Global Shrimp Feed Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global shrimp feed market along with its industry has been around for a longer time than it was initially seen by the world, getting established through the coastal operations that were made up of fish waste and local grains. The aquaculture organized expansion in the '70s led to the realization of farmers that if there is no nutrition consistency, the survival rates and growth patterns will not improve. It was the Hac Minh and Huong Loi farms in Southeast Asia and Latin America that first paved the way for the more consistent nutrition by layering different protein sources and so on. The development of the feed mills in these regions marked one of the major turning points in this area. The 1990s saw a spike in production of shrimp from aquaculture leading manufacturers to refine their formulas even more and to introduce processed soy protein, stabilized lipids and multimineral supplementation to help companies grow faster and be more resistant.

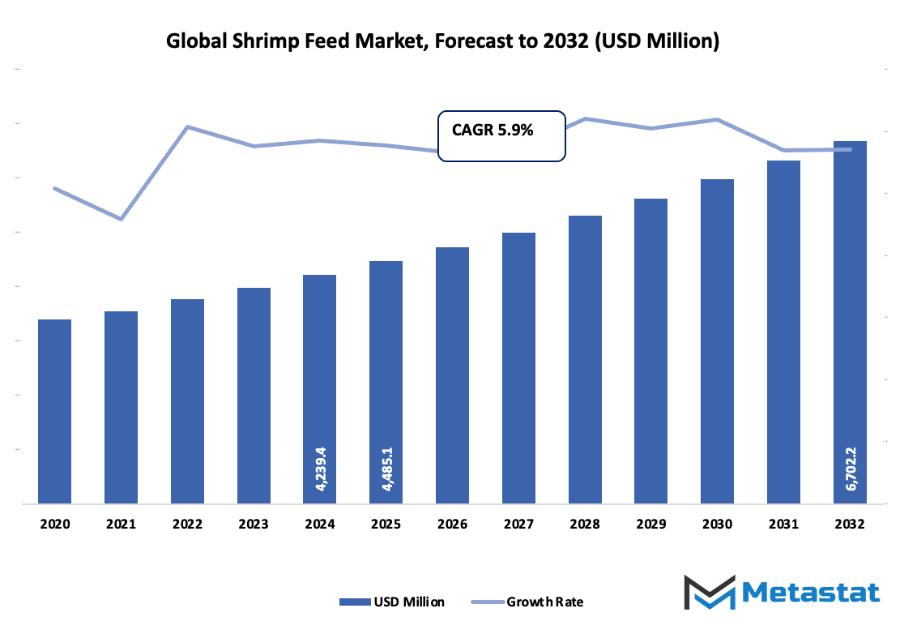

- The global shrimp feed market is predicted to be worth around USD 4485.1 million by 2025, with a CAGR of about 5.9% through 2032, and possibly more than USD 6702.2 million.

- Starter Feed is projected to hold approximately 22.4% of the total market, pushing the research massively and therefore the applications of the product are wide open.

- Among the major trends that are contributing to the growth are: the increase in seafood demand and also the shrimp aquaculture industries' expansion, and the use of high-quality feed formulations that are balanced nutritionally and are called to improve shrimp health and yield.

- The opportunities consist of the creation of sustainable and alternative protein sources, such as insect meal and microalgae that are going to be the raw materials for eco-friendly shrimp feed.

- The market is set to experience rapid growth in value over the next decade which means that there will be more and more significant growth opportunities.

The situation of feed requirements has continuously altered over the years due to the demands of buyers from North America, Europe, and East Asia. The importers began to demand the ingredients that were traceable and responsibly sourced which, in turn, forced the producers to do away with fishmeal and use plant-based proteins along with microbial additives instead. This exchange was quickened after a few governments imposed restrictions on the fishing of wild forage fish to reduce the pressure on the marine ecosystems. For example, the Food and Agriculture Organization's data indicated that the global fishmeal output had been experiencing a steady decline since the year 2010 which prompted the feed manufacturers to look for alternatives like fermented soybean concentrate and insect-based protein. On the other hand, epizootic outbreaks like EMS and WSSV compelled the farms to use immune-support supplements-enriched feed thus creating a trend that was noted in many technical bulletins issued by national aquaculture agencies.

Moreover, technology was a significant factor that influenced the industry's direction. The extrusion systems were made so accurate that they were able to produce pellets that could retain their nutrients for a longer time even in tropical waters with high temperatures. The research conducted by aquaculture research centers of different countries indicated that pellet stability saw an increase of over 25% from 2005 to 2020 thus resulting in less wastage and better feeding conversion ratios. The digital monitoring of farms is going to be a constant factor in the development of feeds since the real-time water-quality data will be the guiding factor in the most suitable feeding practices.

The present-day market is the result of such a long process of adaptation over decades that was influenced by changes in diets, environmental expectations, and scientific advancements. The feed producers will inevitably have to keep altering their formulations, sourcing strategies, and manufacturing methods to accommodate a sector that is still expanding its presence in the main producing regions even though the global consumption of farmed shrimp is on the rise.

Market Segments

The global shrimp feed market is mainly classified based on Feed Type, Ingredient, Form, Shrimp Species.

By Feed Type is further segmented into:

- Starter Feed: Early-stage nourishment in the global shrimp feed market supports steady growth during initial development. Balanced nutrients in this feed encourage healthy structure formation and consistent intake. Careful mixing of proteins and supportive elements helps maintain uniform quality, allowing young shrimp to adapt to controlled farming environments without stress from sudden dietary changes.

- Grower Feed: Mid-stage nourishment focuses on steady weight gain and balanced conditioning. Ingredient selection supports stable energy levels and dependable metabolism, allowing steady progress from juvenile to mature stages. Consistent texture and measured nutrient flow encourage predictable feeding habits, helping farms achieve reliable output and better management of farming cycles.

- Finisher Feed: Late-stage nourishment offers targeted support before harvest, delivering steady energy and controlled protein levels. This feed helps maintain uniform size and dependable meat texture. Thoughtful ingredient blending supports balanced development, allowing farms to meet market expectations while maintaining consistency in final crop quality and reducing waste during the final growth period.

- Functional/Medicated Feed: Special-purpose nourishment addresses specific health or environmental challenges through added supportive elements. Controlled formulas assist with resistance and stability during stressful conditions. Targeted additives help maintain wellness and steady growth, giving farming operations a dependable option during seasons of higher risk or when enhanced support becomes necessary.

By Ingredient the market is divided into:

- Fish Meal-based Feeds: Marine-derived protein sources offer strong digestibility and steady amino acid levels. This option supports firm structure formation and efficient nutrient absorption. Reliable supply of essential components encourages dependable growth patterns and is often used when farms require high-performance nourishment tailored for faster development and strong physical conditioning.

- Plant-based Feeds: Plant-derived ingredients support cost-effective nourishment with balanced energy content. Controlled blending provides steady fiber, moderate protein, and essential minerals. This option helps reduce dependence on marine sources while maintaining stable feeding activity, offering farms a practical alternative that supports sustainable resource planning and predictable production outcomes.

- Soybean Meal-based Feeds: Soy-based formulas deliver consistent protein and easily absorbed nutrients. Measured processing helps reduce unwanted elements while improving overall digestibility. Affordable sourcing supports stable farm planning, offering dependable nourishment that fits well into long-term feeding strategies focused on predictable crop performance and balanced operational budgets.

- Wheat-based Feeds: Wheat-derived components offer steady carbohydrate supply and reliable binding properties for structured feed formats. This option supports uniform texture and controlled energy levels, helping maintain steady feeding habits. Balanced nutrient flow encourages consistent digestive performance and is often used to support overall feed stability in various farming environments.

- Corn-based Feeds: Corn-focused formulas give stable energy and moderate protein levels, supporting growth through dependable caloric intake. Controlled processing ensures consistent quality, encouraging predictable feeding behaviour. This ingredient is often selected for its affordability and compatibility with blended feeds designed to maintain stable performance across different farming conditions.

- Others: Additional feed varieties include alternative proteins and mineral-rich components that support flexible planning. These options help farms adjust to supply shifts or meet specific dietary needs. Varied ingredient profiles support balanced development, offering adaptability when standard feed types require supplementation or adjustment to maintain steady production outcomes.

By Form the market is further divided into:

- Pellets: Solid feed units support controlled intake and reduce waste through firm structure and slow disintegration. Uniform shaping helps maintain steady feeding patterns and simplifies distribution. Reliable nutrient retention ensures consistent nourishment, making pellets suitable for farms aiming for efficiency and manageable feeding routines across different production scales.

- Crumbles: Fragmented feed pieces deliver gentle feeding support for smaller shrimp or transitional stages. Even particle size encourages smooth digestion and stable nutrient flow. This format allows gradual adaptation toward larger feed types while maintaining steady energy levels and supporting orderly growth during sensitive developmental periods.

- Powder: Fine-textured feed supports early-stage feeding or specialized applications requiring rapid dispersion. Controlled particle size helps ensure even distribution and smooth consumption. This format offers flexibility for mixing with other elements, supporting precise feeding strategies that require close control over nutrient concentration and delivery.

- Liquid Feed: Fluid nourishment enables fast absorption and even coating of other feed types when needed. This option supports specialized farming situations requiring enhanced nutrient delivery. Smooth distribution across tanks or ponds allows consistent exposure, making liquid feed suitable for targeted supplementation or environments needing easily absorbed support.

By Shrimp Species the global shrimp feed market is divided as:

- Pacific White: This species benefits from feeds offering balanced proteins, steady energy, and controlled nutrient flow. Consistent feeding strategies help maintain stable growth and predictable harvest cycles. Reliable adaptation to farming systems makes this species dependent on feeds that support uniform size development and dependable overall performance.

- Black Tiger: Stronger nutrient demands require feed with richer protein and energy levels to support robust growth. Controlled formulas help maintain muscle development and steady metabolism. Feeding consistency is important for this species, encouraging farms to choose options that deliver dependable nourishment and stable support throughout longer growth cycles.

- Other Species: Diverse species groups require adaptable feed strategies that match varied dietary needs. Flexible ingredient combinations support steady development across different environments. Balanced formulations help maintain reliable growth patterns, allowing farms to manage mixed-species operations while maintaining predictable performance and meeting varied market expectations.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$4485.1 Million |

|

Market Size by 2032 |

$6702.2 Million |

|

Growth Rate from 2025 to 2032 |

5.9% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

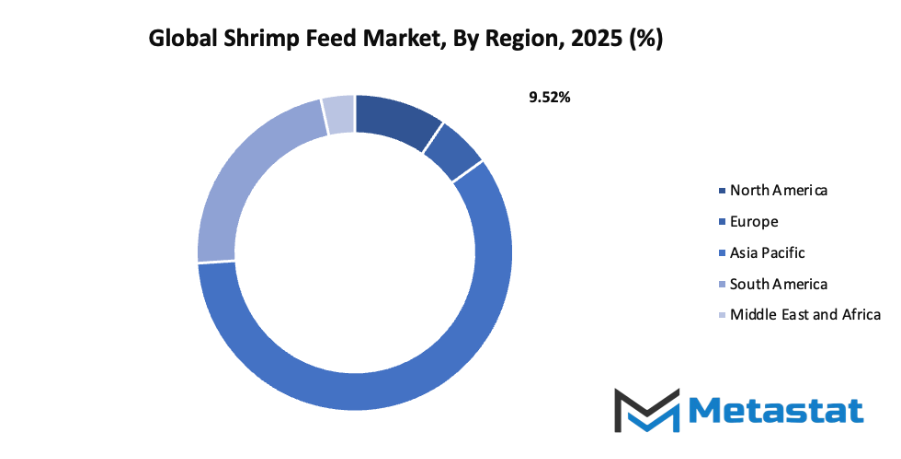

By Region:

- Based on geography, the global shrimp feed market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

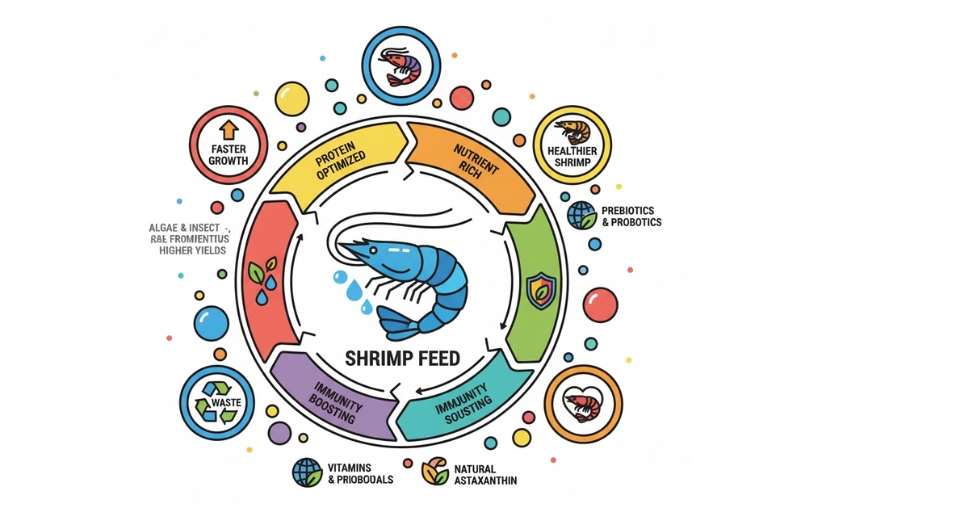

Increasing demand for seafood and expansion of shrimp aquaculture industries: Growing seafood consumption encourages steady expansion of shrimp farming, creating stronger need for reliable feed solutions. Expansion of farming activities supports steady production levels, helping maintain supply stability. Rising interest from various markets adds steady momentum, allowing the global shrimp feed market to grow through consistent commercial activity and wider farming adoption.

Rising adoption of high-quality, nutritionally balanced feed formulations to improve shrimp health and yield: Use of better feed formulations supports stronger shrimp growth, steady survival rates, and dependable harvest results. High-quality ingredients help maintain healthier stock, leading to improved output and reduced loss. Such balanced feed solutions encourage farms to maintain efficient operations, supporting wider acceptance within the global shrimp feed market.

Challenges and Opportunities

High cost of raw materials such as fishmeal and soybean meal: Fishmeal and soybean meal prices continue to rise, placing pressure on feed producers and farming operations. Cost fluctuations reduce budget flexibility, making production planning harder. Limited supply and strong demand from multiple sectors add more strain, creating ongoing challenges for stable feed pricing across the global shrimp feed market.

Environmental concerns and regulatory restrictions related to aquaculture practices: Stricter environmental rules guide farming activity toward cleaner methods, increasing compliance demands. Waste control, water quality standards, and habitat protection shape production decisions. These requirements raise operational costs but also push the industry toward safer procedures, influencing future development across the global shrimp feed market.

Opportunities

Development of sustainable and alternative protein sources, such as insect meal and microalgae, for eco-friendly shrimp feed production:

Growing interest in alternative protein sources encourages new feed solutions that reduce pressure on traditional raw materials. Insect meal and microalgae offer steady nutrient value with lighter environmental impact. Adoption of such options supports long-term sustainability and strengthens future growth prospects for the global shrimp feed market.

Competitive Landscape & Strategic Insights

The global shrimp feed market brings together established international corporations and rising regional producers competing to meet the growing demand for high-quality aquaculture nutrition. Each company plays a role in shaping the market through innovation, product development, and sustainability practices. The industry’s progress depends on maintaining a balance between efficient production and environmental responsibility, as shrimp farming requires carefully formulated feed that promotes growth and disease resistance while minimizing ecological impact.

Among the major participants, Charoen Pokphand Foods PCL continues to influence global feed production with extensive research and a wide distribution network. Cargill, Incorporated focuses on improving feed efficiency and sustainability through advanced nutritional solutions. Nutreco, operating under its Skretting brand, emphasizes science-based feed formulations that enhance shrimp health and support responsible aquaculture. Schouw & Co. and its subsidiaries contribute to the expansion of modern feed manufacturing, integrating technology to maintain consistent quality. Guangdong HAID Group Co., Ltd highlights innovation and large-scale production, serving as one of Asia’s leading feed suppliers.

Other important contributors include Adisseo Group, which provides nutritional additives that strengthen feed performance, and Alltech, known for its focus on natural feed ingredients that promote sustainable growth. Avanti Feeds Ltd. plays a significant role in South Asia, supporting farmers with region-specific solutions, while BioMar Group continues to invest in research aimed at improving feed digestibility and environmental performance. Biomin Holding GmbH advances the use of probiotics and natural ingredients, and Cermaq Group AS works to maintain feed safety standards that align with responsible farming practices.

Market size is forecast to rise from USD 4485.1 million in 2025 to over USD 6702.2 million by 2032. Shrimp Feed will maintain dominance but face growing competition from emerging formats.

The global shrimp feed market continues to develop through technological advancement, investment in sustainable farming, and collaboration across international and local producers. The industry’s direction reflects a collective commitment to meeting global seafood demand while ensuring ecological balance and long-term growth.

Report Coverage

This research report categorizes the global shrimp feed market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global shrimp feed market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global shrimp feed market.

Shrimp Feed Market Key Segments:

By Feed Type

- Starter Feed

- Grower Feed

- Finisher Feed

- Functional/Medicated Feed

By Ingredient

- Fish Meal-based Feeds

- Plant-based Feeds

- Soybean Meal-based Feeds

- Wheat-based Feeds

- Corn-based Feeds

- Others

By Form

- Pellets

- Crumbles

- Powder

- Liquid Feed

By Shrimp Species

- Pacific White

- Black Tiger

- Other Species

Key Global Shrimp Feed Industry Players

- Charoen Pokphand Foods PCL

- Cargill, Incorporated

- Nutreco (Skretting)

- Schouw & Co.

- Guangdong HAID Group Co., Ltd

- Adisseo Group

- Alltech

- Avanti Feeds Ltd.

- BioMar Group

- Biomin Holding GmbH

- Cermaq Group AS

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252