MARKET OVERVIEW

The global family offices market belongs to the wealth management sector and serves ultra-high-net-worth families and individuals who require custom financial solutions. The market stands on the basis of offering sophisticated investment management, estate planning, tax optimization, and philanthropy advisory services with a focus on long-term financial preservation and smart wealth distribution. As more and more emphasis is being laid on customized financial approaches, family offices serve as focused units meant for managing intricate financial matters with guaranteed continuity over generations.

As opposed to traditional financial institutions, the global family offices market is a niche segment that provides an extremely tailored approach to wealth management. These offices will continue to grow, incorporating cutting-edge financial technologies, responsible investment approaches, and multi-generational wealth planning to address the advanced requirements of high-net-worth families. Private investment arrangements will be at the core of this market, enabling families to retain more control over their wealth while achieving maximum financial performance via diversified portfolios. The imperative for confidentiality, exclusivity, and tactical asset protection will prompt families to approach the market for tailor-made financial products that situate them in conformity with their long-term goals. The global family offices market is broader than the usual advisory services for investments.

These offices oversee philanthropic activities, legal structures, succession planning, and risk management strategies, keeping family legacies preserved. As financial environments change, there will be increasing focus on sustainable investing and socially responsible financial planning, leading family offices to adopt environmental, social, and governance (ESG) principles into investment systems. The rising sophistication of international tax rules and international wealth management will continue to influence the approaches utilized in this market. Technology will continue to influence the global family offices market, streamlining operations through automated portfolio management, advanced data analytics, and artificial intelligence-driven financial insights. Digital transformation will enhance transparency, risk assessment, and decision-making capabilities, allowing family offices to navigate economic fluctuations with greater agility.

As cybersecurity concerns rise, protecting sensitive financial data will become a critical component, leading to the implementation of advanced security measures and regulatory compliance frameworks. The organization of family offices in this market is diverse, with some being single-family offices committed to administering the wealth of a single family and others being multi-family offices offering knowledge to multiple high-net-worth households. Whether or not to have a family office will be based on size of assets, complexity of investments, and long-term financial objectives.

As economic conditions fluctuate, the demand for strategic financial guidance will continue to expand, and therefore reinforce the importance of family offices in wealth preservation. Globalization will continue to influence the global family offices market, as international assets and investments held by families necessitate expert advice on cross-border financial planning. Regulatory changes, currency movements, and geopolitical considerations will influence the way family offices organize their investment portfolios and asset allocations. Inter-generational wealth transfer will also continue to be a priority, with estate planning strategies evolving in response to changing legal and financial environments.

The global family offices market will be a pillar of high-net-worth financial management, responding to technological innovation, regulatory changes, and shifting economic circumstances. With rising complexities in preserving wealth and legacy planning, family offices will evolve their strategies further, so that high-net-worth families receive customized financial solutions that are consistent with their changing needs and long-term goals.

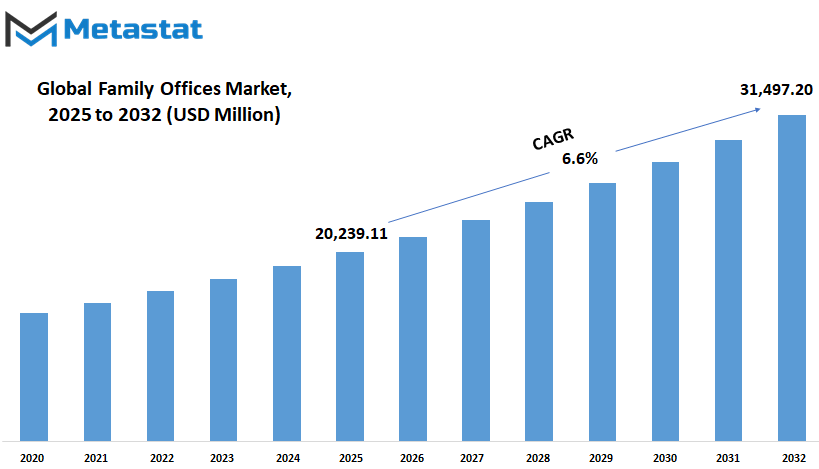

Global family offices market is estimated to reach $31,497.20 Million by 2032; growing at a CAGR of 6.6% from 2025 to 2032.

GROWTH FACTORS

The global family offices market will witness great change due to many influencing factors concerning its growth and direction. The enormous increase in high-net-worth individuals actively seeking structured and customized wealth management solutions is one of the primary drivers for this change. With the increase in financial assets, the demand for specialized services dealing with estate planning, tax management, and philanthropy is on the rise. Conventional investment strategies are no longer valid, as wealthy families require that investments and the whole family office be oriented toward long-term financial goals. This transition, therefore, has necessitated the growth in the need for family offices that incorporate wealth transfer strategy, risk assessment, and wealth retention over generations.

The more financial markets inter-link, the greater is the in-depth understanding needed of world markets, varied investment opportunities, and economic ebbs and flows for wealth management. Hight-net-worth families are diversifying their investment portfolios by not restricting themselves to specific domestic markets. This evolution has contributed to the birth of global multi-family offices serving a large pool of clients through global comprehensive financial services. Cross-border investment, regulatory environment, and currency fluctuations have, therefore, created a growing demand for professional skills to deal with these.

Nevertheless, the global family offices market stands to face some challenges that may counter its growth momentum. Regulatory compliance is one major concern. Various countries imposed distinct legal and tax regulations, rendering family offices incapable of operating smoothly across jurisdictions. Keeping track of, and gradually adapting to, emerging changes becomes tedious and very expensive day-to-day. Another area of concern is the acute shortage of experienced professionals in this field. This is a high-skilled environment, which presents challenges to firms trying to ramp up their operations when the pool of skilled labour is so thin.

Enormous growth potential therefore exists for providing family office services beyond wealth management in the future. Impact investing, sustainable finance, and technology-assisted investment solutions are being embraced by growing pools of family capital. The incorporation of artificial intelligence and advanced analytics should improve the whole decision-making process of family office services in providing more accurate financial solutions. In addition, with the growing recognition of structured wealth management in many areas, new markets for service delivery are likely to open up.

MARKET SEGMENTATION

By Product Type

The global family offices market is currently seeing a dramatic transformation, something that is now necessary due to changing needs among rich families and individuals. Family offices are now private organizations dealing with the much more varied and personalized wealth and affair services for rich families: all of these changes are especially noticeable among different types of family offices: Single Family Offices, Multi-Family Offices, and Virtual Family Offices.

Single Family Offices specialize in the financial needs of a single family and thus affords highly individualized approaches according much closer congruence along the lines of vision and values of the family themselves. Investment management, estate planning, and philanthropy are all encompassed in the multitude of portfolio activities provided by such an office. More and more, wealthy families have opted to set up their own Single Family Offices to have increased control and confidentiality. In Spain, for example, such "offices" have been instituted by the 'Ortegas', 'Roigs,' and others to regulate their vast fortunes and investments.

Multi-Family Offices serve multiple families pooling resources to provide cost-effective and diversified wealth management services. Sharing skills and infrastructures allows these branches to offer a broader range of services than Single Family Offices. Hence, it becomes feasible for a family to utilize professional management without the burden of setting up a dedicated office. Some examples of firms that fall into this category are Pennington Partners, whereby pooled assets for several families are used to construct personalized financial strategies.

The virtual family office is progressive, thus mobilizes the technology of today to provide flexible, effective wealth management vehicle services. Online channels were utilized to bundle services so that families can have easy access or remote management of their wealth. It would typically appeal to the younger generation of financially astute families for whom flexibility and convenience in their financial matters are essential.

Family offices are setting up strong systems for risk and cyber security management, as an increasing number of households makes risky investments in markets that are becoming more complicated and loaded. Since family offices act as custodians for some of the most sensitive information regarding the finances of clients, client data and assets face really stiff safeguards. On top of that, such houses have been reengineering strategies to deal with uncertainties in the global family offices market due to developments in geopolitics that might affect their clients' financial well-being.

The figures are testimony to the way family offices are increasingly proliferating around the world, as indeed their numbers are multiplying with the swelling fortunes of ultra-high-net-worth individuals and families. This trend signifies how family offices are emerging across the globe as increasingly important entities managing the affairs of the mega-wealthy.

By Service Type

Little by little, the global family offices market is set for a major transformation according to the needs of ultra-high-net-worth individuals and families in their search for more complete and personalized wealth management solutions. Such developments will likely bring forth increased demands for specialized services. The global family offices market includes primary areas of segmentation like Investment Management, Estate Planning, Tax Services, and Other ancillary services, all reaching different yet crucial spheres of affluent families' multi-faceted needs.

Investment Management holds the first place among services provided, with family offices going much further in diversifying their portfolio with alternative assets such as private equity, venture capital, or real estate to secure higher returns and avoid volatile traditional investments, adding direct investments to their portfolio for family control and enhanced returns. Highly sophisticated means, like artificial intelligence and machine learning, are being used for refining investment strategies and improved decision making in processing.

The requirement of estate planning becomes complex with families taking interest in ensuring that there are smooth flows of wealth through generations. It is gearing towards developing strong governance mechanisms and educating heirs to manage and preserve wealth properly. Resources are hence committed by family offices to devising education programs and succession plans that would fit as per the family's values, or long-term objectives.

All these are the dominant factors affecting Tax Services in view of a most complicated and fastest-changing global tax environment. Family offices are preemptively trying to tap capability sources to deal with international tax laws, minimize tax liabilities, and ensure compliance. Approach these in developing strategies as efficient and adaptable to legislative changes as possible to guard the family's fortunes from unforeseen tax ramifications.

Family offices are extending their scope beyond the above basic service offerings to include philanthropic advisory, lifestyle management, and personal security among other things. This eclecticism in scope is intended to cover what an affluent family may really want in a single touchpoint instead of personalization driven by specific needs. For technology enables a lot within these services, providing secure and efficient platforms for communication and management.

In the years to come, the global family offices market is poised to witness substantial growth owing to the mushroom growth of rich people and sophisticated wealth management solutions. Certainly, areas such as embracing technology innovations, scale-up of services, and improved governance frameworks will be on focus as changing needs evolve among affluent families.

By Application

The global family offices market is poised to undergo some transformations with an upward rise in personalized wealth management demands. These offices are structured to tackle the financial, strategic, governance, and advisory needs of wealthy families to ensure their assets are adequately protected and efficiently managed. With continuouslychanging economic scenarios and new technology on the rise, the operating atmosphere for such offices will soon change with new challenges and opportunities.

Finance management is one sphere that will witness its share of future focus. The complexities of investments will allow a new breed of wealth managers to offer myriad diversification alternatives with concomitant risk mitigation strategies. Traditional means may not suffice anymore; instead, dependence on a more data-driven approach and advanced analytic tools will multiply. Artificial Intelligence will probably play an even more prominent role, offering intelligence input toward anticipating market behavior and optimizing its strategization for investments. Another scenario is that a family office will have to integrate into their financial planning cryptocurrency and blockchain technology just because digital assets are becoming more discussed and utilized.

Strategic planning will be yet another important pillar that will help families remain stable across generations. In this era of economic uncertainties and geopolitical upheavals, a strong path toward wealth preservation will be rather handy. From traditional modes of finance management, family offices must therefore develop new trajectories toward sustainable investing that are aligned with long-term goals. This could mean promoting environmentally sustainable businesses, modern technologies, and industries that foster a sustainable future. This way, they will not only qualm their own assets but also possibly engender a durable impact on the global family offices market.

As family offices mature by size and complexity, the governance frameworks will have a corresponding refiner. Greater expectations for transparency and ethical decision-making will require family offices to comply with stronger principles that align with increased regulatory service. Structured wealth leadership transitions will also be necessary to ensure readiness for future generations. A stronger framework will mitigate sources of conflicts by providing parameters within which to operate in decision-making. Although younger family members are demanding input with increasing strength, governance models may become more participatory, using technology-based approaches.

Advisory services will expand as families seek guidance from experts in areas extending beyond finances. The very same demand in legal, philanthropic, and lifestyle management advice will find wider acceptance for brands of service. Family offices will work with specialized advisors that have an expertise in foreign markets, cross-border investments, and regulatory requirements, all the while building up strong worldwide networks. This shift will lead towards stronger interconnectivity, where knowledge will play a pivotal role in decision-making.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$20,239.11 million |

|

Market Size by 2032 |

$31,497.20 Million |

|

Growth Rate from 2025 to 2032 |

6.6% |

|

Base Year |

2024 |

|

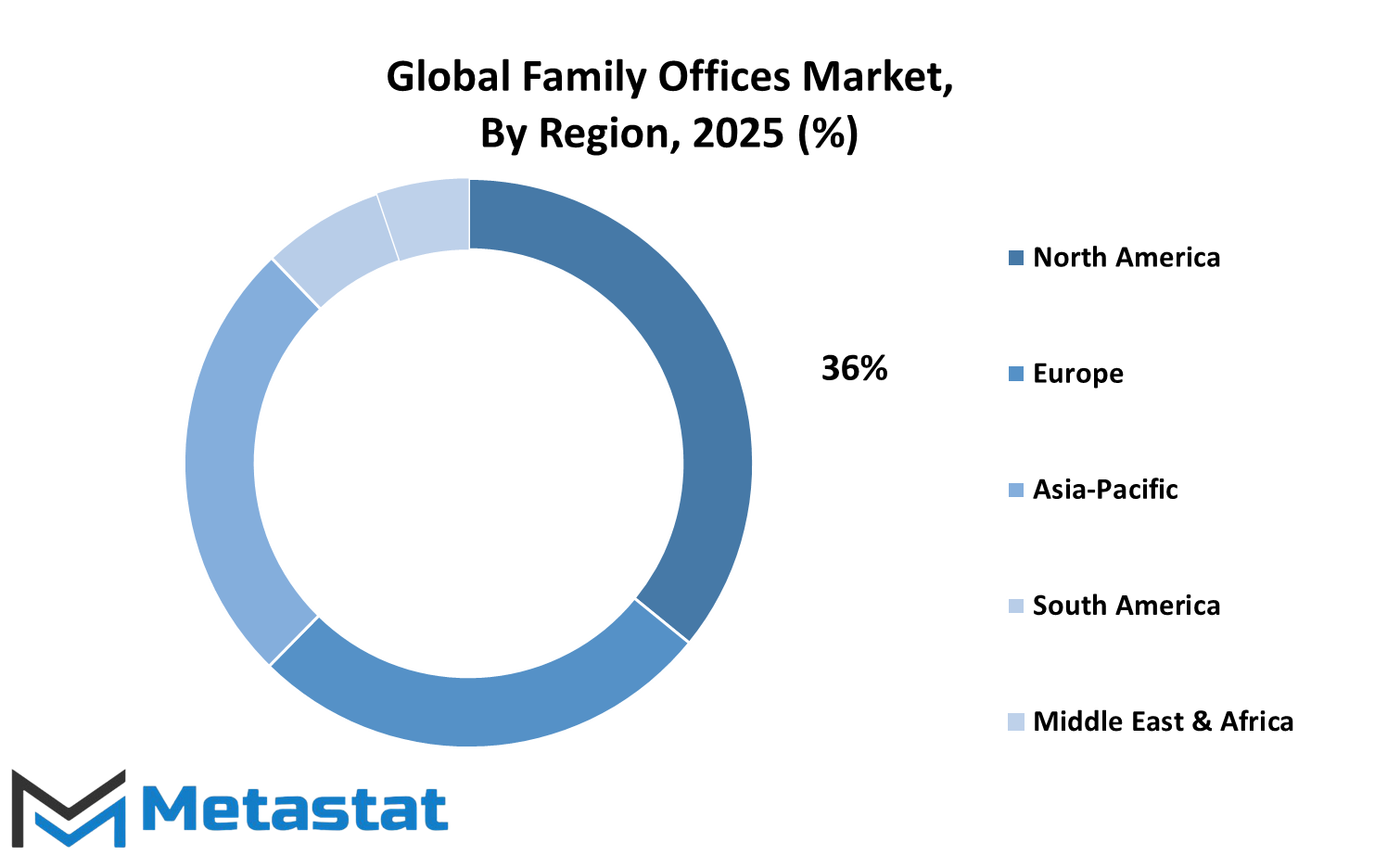

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

A number of factors, therefore, do contribute to shaping the global family offices market from different regions. Such factors have resulted in the growth and evolution of the global family offices market. The change in wealth management is highly influenced by regional factors on strategies, investment preferences, and regulatory frameworks. This gives insight into each region's change in the adaptation of global change with an understanding of how family offices will develop in the future and the expansion of their roles within financial landscapes.

The major presence in the global family offices market consumes North America as it is backed up by a well-established wealth management sector and a firm financial infrastructure. The United States primarily remains a global hub where its private wealth is actively managed through highly advanced financial services. There is also a rising trend of family offices in Canada and Mexico owing to increasing wealth and inclination toward structured methods of investment. Most trends in this region also lean in strategy toward a more digitalized and sustainable investment approach, mirroring the transformation of global financial priorities.

Europe is almost on par and continues to develop a mature environment for family offices. The UK, Germany, France, and Italy have established legacies in estate and wealth management over the generations; hence, many family offices are almost generations old. Most of them are gravitating toward technology-aligned asset management, impact investing, and alternative assets. The effect of the changing regulations on financial decisions has made family offices in this region reshape their focus toward transparency, governance, and diversification. This is also one major priority-to keep those family values intact in a complex ecology while ever protecting them from the generational asset losses.

This region, which is so composed of South Asian countries that now have China, India, and Japan and perhaps South Korea, is going to make quite an impact on the landscape-the oceans and shores of which will grow rapidly in total private wealth. The total number of high-net-worth individuals is going to lead to an empowering demand on financial solutions, bringing more family offices tailored to wealthy families' particular needs into existence until the region begins to geared towards supporting the rising number of first-generation family offices where new wealth gets into structural long-term financial plans-ambit of investment is enveloping traditional investments in new-age digital assets.

The family wealth management approaches here differ due to significant economic fluctuations that occur. Brazil and Argentina, along with other parts of the region, are among the countries that are generating more and more family offices. These developments are due to increased establishments among the wealthy seeking protective or growth strategies under new financial conditions. The global family offices market is slowly but surely adopting global trends, for example, impact investing, cross-border diversification, as families will seek stable opportunities for growing wealth in a new economic environment.

The Middle East and Africa region is currently influencing the future of the global family offices market, particularly through wealth emanating from energy sources and newly developed industries. The Gulf Cooperation Council (GCC) countries along with Egypt and South Africa have recently begun to tilt toward structured wealth management strategies. With an increasing emphasis on sustainable investments and diversification outside traditional domains, these family offices begin to combine global financial strategies with regional economic strengths.

In a fast-evolving world, regional trends will greatly determine the investment strategies, regulatory frameworks, and technological advancements of the regional family offices. The paradigm looks toward more digital transformation, global interconnectedness, and an increasing pivot toward sustainability in preparation for family offices' adaptability amid an ever-changing financial landscape.

COMPETITIVE PLAYERS

The global family offices market is undergoing a major transformation, fueled by the increasing number of ultra-high-net-worth individuals and the increasing complexity of managing huge wealth. Family offices, which are specialized entities that manage financial and personal affairs of affluent families, have become the vehicles for the sustenance and enhancement of familial wealth across generations. The changing terrain has seen several prominent organizations taking charge of the comprehensive service offering for wealthy families with specialized demands.

For instance, Cascade Investment, established by Bill Gates, illustrates a family office managing a diversified investment portfolio comprising technology, real estate, and public equities. Likewise, Bezos Expeditions associated with Jeff Bezos invests in varied sectors of activity, thus reflecting the tactical approach to wealth management. The Ballmer Group, initiated by Steve Ballmer, relies on philanthropy-thus, investing huge chunks of resources into initiatives that enhance economic mobility.

Traditionary institutions have now woken up to the demand for specific family office services. The UBS Group AG and J.P. Morgan Private Bank set up their specialized divisions to cater to the unique demands of these wealthy families offering services covering investment management to estate administration. Goldman Sachs Family Office and Credit Suisse Group AG provide a selection of tailored solutions grounded in their time-tested financial experience for serving this segment. Indeed, BNY Mellon Wealth Management and Northern Trust have similarly expanded their suite of offerings to focus on personalized wealth preservation plans.

In the UK, Stonehage Fleming has become a settling name in the multi-family office, managing assets. Bessemer Trust, established in 1907, was founded by Henry Phipps Jr. and offers a full range of services from investment management to estate planning.

Rockefeller Capital Management has made several advances into the family office sector. Recently, Meyer DeMartini Wealth Partners was added, enhancing Rockefeller's presence in San Francisco.

Traditional Swiss wealth management, long considered ostentatiously discrete and stable, is currently in landslide shifts under pressure and challenge from global firms setting up outside Switzerland. Wealth managers are grappling with Asian financial centres such as Hong Kong and Singapore, predicted to dethrone Switzerland as the preferred offshore wealth management centre in 2028.

Family Offices Market Key Segments:

By Product Type

- Single Family Office

- Multi Family Office

- Virtual Family Office

By Service Type

- Investment Management

- Estate Planning

- Tax Services

- Other

By Application

- Financial

- Strategy

- Governance

- Advisory

Key Global Family Offices Industry Players

- Cascade Investment

- Bezos Expeditions

- Ballmer Group

- UBS Group AG

- J.P. Morgan Private Bank

- Goldman Sachs Family Office

- Credit Suisse Group AG

- BNY Mellon Wealth Management

- Northern Trust

- BMO Harris

- HSBC Private Bank

- Rockefeller Capital Management

- Wilmington Trust

- Glenmede Trust Company

- Stonehage Fleming Family & Partners

- Bessemer Trust

- Pictet

- Citi Private Bank

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383