MARKET OVERVIEW

The global excavator attachments market is shifting towards an era where expectations will go beyond classic industrial standards, defining a new vision of utility, customization, and geography-specific requirements. This market, which was previously constrained by classic digging or demolition capabilities, will become even more impactful through purpose-designed innovations that closely align with given regional requirements, operational difficulties, and environmental factors. As building work evolves to suit distinctive geographies and regulatory regimes, excavator attachments will cease to exist as mere add-ons they will become customized augmentations of operating strategy.

Not the sheer volume of attachments itself, but how they are conceived, integrated, and tailored for multi-duty operations will differentiate this market over the next few years. The generic bucket or breaker will gradually yield to engineered equipment that is used for hybrid functions, substantially cutting down on machine downtime but boosting job-site productivity. From forest to mine work, and from road construction to rescue operations, each industry will need a distinct degree of mechanical versatility. The manufacturer response will be in the form of an advanced emphasis on material durability, weight savings, and improved attachment-change mechanisms that permit machines to assume multiple roles without the need for total equipment revamps.

The future of the global excavator attachments market won't be in developing larger or more powerful tools. Instead, attention will turn to smart, sensor-laden attachments that collect information in real-time, permitting operators to make informed decisions during the task. This change will enable operators to reduce material waste, anticipate maintenance requirements, and maximize performance with minimal intervention. The technology infused in these attachments will drive the global excavator attachments market towards an increasingly connected ecosystem, where attachments, machines, and operators collaborate to ensure smooth execution.

Sustainability objectives will also steer the direction of the global excavator attachments market. In future environments, there will be demands to cut emissions not only from engines, but from the whole machinery life cycle, including attachments. This will lead to an increase in recycled metals, biodegradable hydraulic fluid, and low-carbon manufacturing processes, quietly altering how attachments are manufactured, serviced, and taken out of commission. As regulations by the government become stricter, particularly in urban building areas, this segment of the business will be pushed to design quieter, more powerful tools that do not cause much disturbance.

Personalization will be a characteristic hallmark. Contractors will anticipate attachments that fit the custom scope of a project as opposed to fitting projects into established tools. Suppliers who are able to provide modular attachments that offer scalability in functionality will be the choice of preference. The concept of one-size-fits-all will grow even less appealing, and with it, the conventional method of procurement and inventory handling in the construction industry will also evolve.

As the global excavator attachments market goes through this progressive phase, it will not only see product evolution but also a basic change in user demands and industrial practice. The attachment will never be regarded as ancillary; it will be the definitive asset that ascertains whether a machine is simply running or actually optimized.

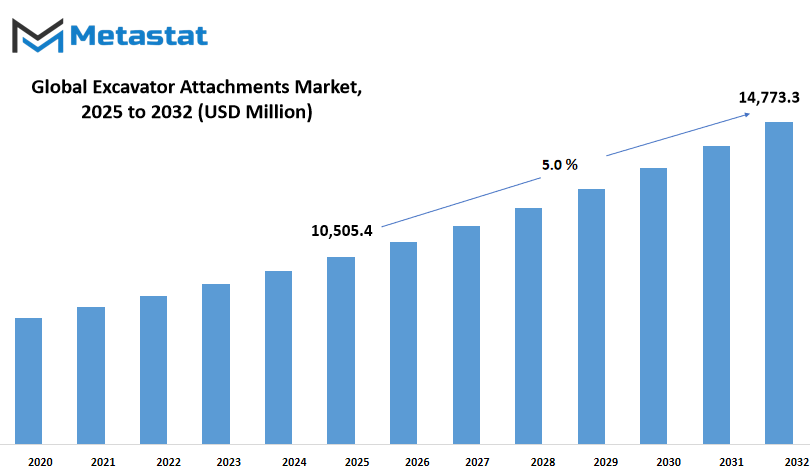

Global excavator attachments market is estimated to reach $14,773.3 Million by 2032; growing at a CAGR of 5.0% from 2025 to 2032.

GROWTH FACTORS

The global excavator attachments market is evolving further with increasing demands fueled by progress and adversity alike. With infrastructure projects at the forefront around the globe, especially in city growth and industrialization, the demand for heavy and versatile machinery is growing. Excavator attachments, through which one machine can perform multiple operations, are increasingly appealing to contractors in a bid to boost on-site efficiency. This increased demand for multi-functional machinery is driven by the necessity to reduce downtime and increase resource utilization. From digging to lifting to demolition, to be able to change tools without having to change machines gives firms an edge in a rapidly moving construction environment.

The using pressure in the back of this growing call for is the worldwide movement to broaden higher infrastructure. Roads, bridges, residential estates, and industrial homes are being constructed or reconstructed, especially in international locations investing much in modernization. Such tasks call for system capable of acting efficaciously beneath pressure and in diverse conditions. Multi-use attachments offer that efficiency, consequently becoming a super desire for contractors seeking to maximize the really worth of their investments. This transition to productivity-driven gear isn't always a flash inside the pan it's the new norm for companies that want to hit tight deadlines whilst balancing lean workforces.

Yet not all contractors have equal access to this degree of technology. Cost is one of the main obstacles. Initial high cost continues to be the drawback, particularly for mid- and small-sized businesses. It's not merely a matter of purchasing the base excavator each attachment contributes to the overall cost. To add insult to injury, keeping this equipment in top shape so it runs at its best is no trivial endeavor. Regular maintenance, replacement of parts, and lost time all cost money. These aspects usually deter smaller operators from making the plunge, even when they perceive the long-term rewards.

Another issue is the volatility of raw materials' prices. Because these attachments mostly include steel and other metals, changes in material prices can quickly affect the manufacturing budget and eventually affect retail prices. This is more difficult for manufacturers to maintain stability in pricing, and it adds greater pressure on both buyers and sellers to adjust the ups and downs in the market. For contractors with already thin benefits margin, this type of instability creates an additional layer of risk.

Nevertheless, with these obstacles, the global excavator attachments market is anything but stable. Rapid rates on which the city are growing in developing economies, they have promising opportunities. Asia, Africa and South America are experiencing high investment in transportation, housing and utilities. These initiatives are creating new demand for construction equipment that meet contemporary requirements. As urban centers move upwards and the infrastructure network increases, the demand for expert excavation attachments will also increase in the forefront. Businesses that can provide long-lasting, cost-effective and simple-use solutions will be the most beneficial.

In addition, there are a concrete effect on the operation of advance attachments in hydraulic systems and intelligent techniques. More recent equipment can provide greater strength with fine control, allowing operators to have a smooth and more accurate experience. Capacity such as real-time tracking, automation support and better security facilities are no longer science fiction-they are becoming standard potential in low order. This progress not only enhances performance, but also increases the attraction of these devices, which provide comfort and reliability to operators.

As a whole, the global excavator attachments market is at a significant turn. It is being influenced by increasing demand and combination of difficult realities. The possibilities are very large, especially for those who are ready to invest in research and development and develop with changing construction requirements. Although issues of high cost and price instability still exist, the picture is bright for manufacturers and consumers who prefer to provide functional, efficient and technology-supported solutions.

MARKET SEGMENTATION

By Attachment Type

The global excavator attachments market is picking up steady pace as construction work picks up and technology continues to aid quicker, more effective work in various industries. Out of all the different categories, attachment types are important in how machinery is adjusted for particular tasks. Every tool contributes functionality, increasing the versatility of an excavator above its initial purpose.

Among the global excavator attachments market, Equipment-Mounted Hydraulic Hammers are most prominent, estimated at $1585.7 million, emphasizing their strategic role in demolition and mining operations. The hammers are designed to handle harsh environments, providing strong blows that accelerate breaking hard rock and concrete. In addition, Handheld Hydraulic Breakers provide more precise application, particularly in areas where large equipment cannot be used. Despite being smaller, they are crucial for repair activities and operations in tight spaces.

Buckets remain among the most universal and essential attachments, utilized for digging, trenching, and material handling. Their uncomplicated design and extensive use render them a standard on construction sites. Compactors tend to be selected for groundwork and infrastructure projects where soil compression is required for stability. They assist in eliminating air pockets and stabilizing the foundation of roads or structures.

Pulverizers are gaining attention as well, especially in recycling and demolition work. They help crush concrete and separate rebar, making site cleanup and material recovery faster and more manageable. Mulching Heads serve a different purpose, often used in land clearing. These attachments can grind vegetation quickly, turning overgrown areas into usable land with less manual labor.

Other specialized attachments help to fuel rising demand in the marketplace. Each has a specific function and indicates how equipment is being modified to address evolving job site requirements. Whether to automate repetitive tasks or enhance performance in tough conditions, the variety of attachments in use today indicates a pragmatic evolution in how heavy equipment helps achieve contemporary infrastructure objectives.

By End Use

The global excavator attachments market will develop steadily over a broad spectrum of end applications, driven by the changing requirements of contemporary infrastructure and development works. Demolition is one of the predominant application fields, in which attachments together with hydraulic breakers and pulverizers assist in accelerating the method of demolishing out of date homes. These attachments provide more efficiency and protection, particularly in high-density city environments. As the cities get large and older systems are cleared away, the need for specialised demolition attachments will persist.

In digging and earthmoving, which can be the core of nearly all production tasks, attachments like augers and buckets are extensively utilized. These enable machines which will exchange consistent with numerous soil situations and operations, inclusive of digging foundations to utilities trenching. The versatility furnished by means of these attachments enables contractors to complete the assignment at hand extra correctly and greater as it should be.

Forestry is every other vast category in which attachments along with grapples, mulchers, and tree shears facilitate the handling of weeds, clearing of land, and log dealing with. Such gadget is important for timber operations and land development packages that want to clean the vicinity cautiously with out destroying the encircling landscape. With greater emphasis being laid on sustainable land use, forestry attachments will continue to evolve.

Construction is still the largest end-user segment for excavator attachments. From urban development to commercial construction, attachments add value to machine functionality, minimize the requirement of multiple machines on the job, and reduce overall operational expenses. Specifically, quick couplers and hydraulic thumbs are widely employed to raise productivity.

Mines and mining require heavy duty attachments that contain rock breakers and repars. These attachments are designed to make heavy use under rough materials and demand for heavy use. With the increasing demand for raw materials and minerals, mining will continue to use high -performance excavations to increase efficiency in industry extraction and reduce downtime.

Landscaping is also made convenient by several attachments, including grading blades, trenches, and compact buckets, which simplify the area to sculpture, install drainage systems and prepare planting areas. These attachments help provide a sophisticated finish with low manpower, which is equally relevant to residential and commercial projects.

Road construction and infrastructure construction enhances various types of functions - from excavation and grading to condensation and floor. Attachments such as vibri compactors, grading beams and concrete crushers are highly important here. Not only do they save time in completing tasks, but also ensure that accurate public work project requirements are met.

Finally, in recycling and waste handling, attachment tools such as grapes, chlameshel buckets, and comparants are employed to sort to sort to handle a series of materials. The tool is favorable for increasing emphasis on stability as it provides the ability to process, transport and recycle waste at construction and demolition sites.

United, these end-use applications suggests how global excavations develop to meet the needs of various industries, providing productivity, safety and economics enhancing solutions under different circumstances.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$10,505.4 million |

|

Market Size by 2032 |

$14,773.3 Million |

|

Growth Rate from 2025 to 2032 |

5.0% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

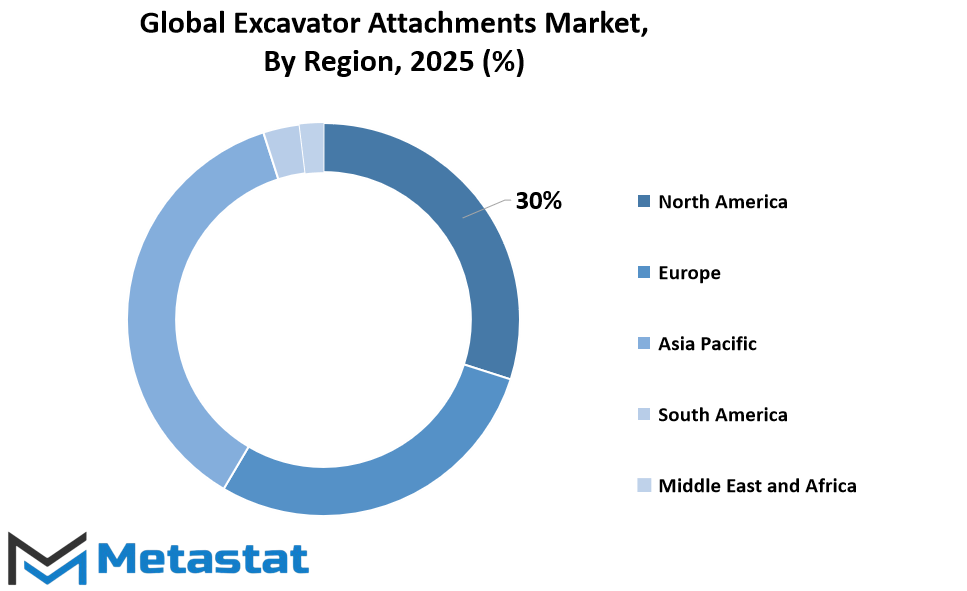

The global excavator attachments market spreads a broad geographical tapestry, which is conducted in primary areas that contribute to each own effect and speed. This division is straightforward: North America, Europe, Asia-Pacific, South America and Middle East and Africa. Each of these regions represents both a previous heritage in construction and heavy machinery industry and the ability to influence its future.

In North America, the excavator attachments market for the United States, Canada, and Mexico is included. The U.S. remains exceptional with steady demand underpinned by continued infrastructure projects and modernization efforts. Canada comes next, where activities in mining and construction have ensured a constant demand for the attachments. Mexico, though still building its heavy equipment sector, is promising as urban growth and transportation improvements continue.

Europe spans the UK, Germany, France, Italy, and other left-over countries on the continent. Germany and France, with their organized industrial economies, provide a solid foundation for development. Italy and the UK introduce a blend of innovation and tradition in construction methods. Although every nation differs in pace, they all support the continent's drive for automation and smart use of machinery.

The Asia-Pacific region is home to some of the region's most dynamic players India, China, Japan, South Korea, and others in the region. China and India remain at the center of growth in construction and urbanization. Their enormous infrastructure schemes and growing emphasis on mechanization make them prime areas for equipment demand. Japan and South Korea, though technology-oriented, favor high-efficiency attachments in line with highly specific operational requirements. The broader Asia-Pacific region also experiences growing interest as nations strive to upgrade building methods.

In South America, Brazil and Argentina hold the greatest sway. Brazil's increasing focus on housing and commercial real estate, coupled with Argentina's rebuilding campaign, propel the demand ahead. The remainder of the continent continues to adjust as economic changes enable greater focus on infrastructure expenditures and machinery improvements.

Finally, the Middle East & Africa covers GCC Countries, Egypt, South Africa, and neighboring countries. The Gulf region, with its mass development plans, ranging from roads to megaprojects, assists in maintaining equipment demand. Egypt and South Africa also contribute significantly because of their active urban projects and mining operations. Throughout the wider zone, increased industrial action and foreign partnerships might underpin the growth of excavator attachment utilization.

Each region contributes its own flair to the big picture. This geographical segmentation does more than simply categorize it illustrates how the potential growth of the global excavator attachments market is being influenced by a combination of economic aspiration, project need, and continued demand for stronger, faster, and smarter machinery solutions.

COMPETITIVE PLAYERS

The global excavator attachments market continues to shape itself as an important section within market construction and mining industries, inspired by urban development, infrastructure expansion and increasing demand for proficiency at job sites. Excaving engagement - from hydraulic breakers and grappers to buckets and years - play an important role in increasing the versatility of machines, allowing a single unit to perform many tasks. As the construction firm equipment wants to reduce the cost and improve productivity, the demand for multicolored attachments has increased, causing these components to become indispensable to modern construction projects. This trend is expected to continue as projects worldwide become more demand and time-sensitive.

A major impact on the global excavator attachments market direction comes from technological progress. Manufacturers are focused on developing rapidly smart, more durable enclosure that can handle acute work status by offering easy compatibility with a wide range of excavation. Adaptation, fuel efficiency, and better hydraulic systems are now among the top characteristics that consider buyers when choosing an attachment. These innovations not only aim to improve operational efficiency, but also ensure safety and operators comfort. With stability with excess traction globally, there is also a push towards developing environmentally friendly equipment that can meet regulatory standards without compromising performance.

The competitive panorama of the global excavator attachments market functions a extensive variety of agencies, from enterprise giants to specialised producers. Leading gamers include Caterpillar Inc., Komatsu Ltd., Hitachi Construction Machinery Co., Ltd., and Volvo Construction Equipment, all of that are known for their full-size product services and commitment to continuous development. Alongside them, companies like Doosan Corporation, Liebherr-International AG, and J C Bamford Excavators Ltd. Keep a robust global presence, often expanding their reach through nearby partnerships and service networks. Others including Sandvik AB, CNH Industrial N.V., Xuzhou Construction Machinery Group Co., Ltd. (XCMG), and Okada America, Inc. Have gained ground by means of providing specialized attachments desirable for mining, demolition, and forestry programs.

Further shaping the global excavator attachments market are manufacturers like Indeco Ind. SpA, NPK Construction Equipment, Inc., Epiroc AB, and AMI Attachments Inc., all of whom cater to precise enterprise demands with area of interest merchandise and custom engineering solutions. Companies including Kinshofer GmbH, Promove SRL, Fecon LLC, Astec Industries, Inc., and Furukawa Rock Drill Co., Ltd. Also play a giant position, mainly in regional markets wherein localized aid and alertness-particular equipment make a awesome distinction.

Overall, the excavator attachments market is ready to move with global construction and mining needs. As more players enter space and existing people refine their offerings, the market will probably be more competitive and innovative-centered, benefiting the last users with better options, better safety and operational flexibility.

Excavator Attachments Market Key Segments:

By Attachment Type

- Equipment-Mounted Hydraulic Hammers

- Handheld Hydraulic Breakers

- Buckets

- Compactors

- Pulverizers

- Mulching Heads

- Others

By End Use

- Demolition

- Earthmoving & Digging

- Forestry

- Construction

- Mining & Quarrying

- Landscaping

- Roadwork & Infrastructure

- Waste Handling & Recycling

Key Global Excavator Attachments Industry Players

- Caterpillar Inc.

- Komatsu Ltd.

- Hitachi Construction Machinery Co., Ltd.

- Volvo Construction Equipment

- Doosan Corporation

- Liebherr-International AG

- J C Bamford Excavators Ltd.

- Sandvik AB

- CNH Industrial N.V.

- Xuzhou Construction Machinery Group Co., Ltd. (XCMG)

- Okada America, Inc.

- Indeco Ind. SpA

- NPK Construction Equipment, Inc.

- Epiroc AB

- AMI Attachments Inc.

- Kinshofer GmbH

- Promove SRL

- Fecon LLC

- Astec Industries, Inc.

- Furukawa Rock Drill Co,Ltd

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252