MARKET OVERVIEW

The global sanitary valves market is at a significant turn where technology, hygiene rules, and design success are found to shape a comprehensive industrial environment. It is unbreakable with industries such as markets, food processing, pharmaceuticals, biotechnology and personal care, it will go a long way from its utilitarian roots. Instead of being seen only as machinery parts, sanitary valves will emerge as strategic tools that ensure safety, regulatory compliance and efficiency in the production environment.

Soon, the global sanitary valves market will begin to take a close route towards market stability objectives and digitization. With industries striving for greenery processes, the need for valves that facilitate energy-efficient and low-illuminated operation will increase. Such valves will not only complete mechanical functions, but will also be equipped with smart techniques that gather and move information. This transformation will enable businesses to track fluid dynamics in real time, forecast maintenance requirements, and cut unwarranted downtime. With this trend going deeper, data-driven decision making will become industry norm across hygienic processing-dependent industries.

The global sanitary valves market will also see structure changes induced by changing global manufacturing norms. Nations in various parts of the world are already imposing stricter safety standards and quality certifications on materials that touch consumables. As a response, the sanitary valve will be designed with greater accuracy and formulated with sterilization-resistant, temperature-resistant and chemical resistant materials that do not face decline. These progress will revolutionize the production methods of all progress valve manufacturers, which will motivate them to embrace cleaner and new techniques to deal with international demand.

Nevertheless, another defined characteristic of the upcoming global sanitary valve market will be adaptation. Instead of providing universal products, suppliers will focus on modular designs that respond to special operational conditions. From ultra-hygiene pharmaceutical features to pressure-sensitive food processing equipment, the valve will be designed to address unique demands of each industry. Doing so will promote compatibility and operational symbiosis between complex systems, which will enable the corporations to maintain product integrity by increasing throopoot.

In addition, the market will further expand its reach into collaborative ecosystems. With businesses looking for partnerships to spur innovation, valve manufacturers will work more closely with automation companies, software engineers, and materials researchers. Collectively, they will create integrated solutions that not only pass hygiene standards but also enhance overall process intelligence. These synergies will enable companies to gain greater production agility, which will be essential in a future where consumer demand trends change quickly and regulatory regimes keep tightening.

Eventually, the global sanitary valves market will not be limited to its historic function. It will become an industry where engineering perfection meets sustainability, compliance, and digital transformation. With smart systems, new materials, and highly customized designs set to become the standard, the industry will be at the forefront of determining the way modern production lines operate. This future-proof path will enable sanitary valves to not only be passive tools, but to become central facilitators of industrial strength and innovation.

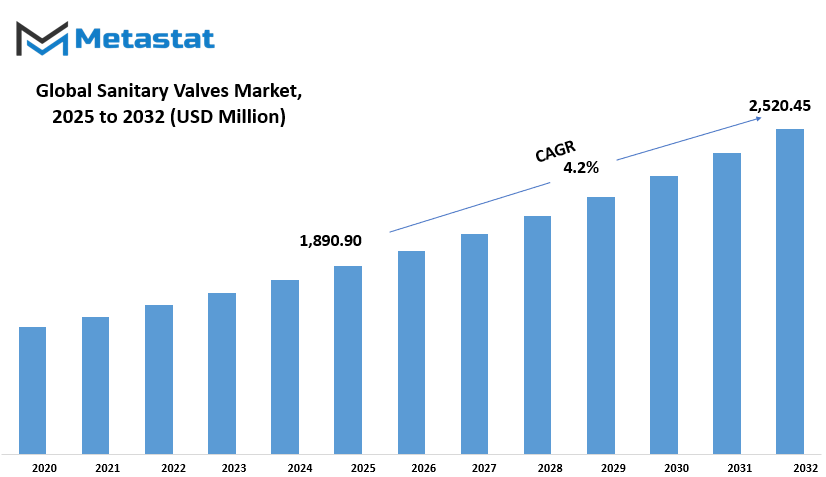

Global sanitary valves market is estimated to reach $2,520.45 Million by 2032; growing at a CAGR of 4.2% from 2025 to 2032.

GROWTH FACTORS

The global sanitary valves market will see significant alteration as industries react to increased hygiene requirements and stronger regulations. One of the main reasons for this change is the increasing emphasis on clean and contamination-free manufacturing in industries such as food and pharmaceuticals. These sectors pressurize themselves to follow safety and quality standards, forcing firms to apply sanitary valves, especially to ensure hygiene in processing. This trend is only likely to grow, especially the regulatory commissions continue to make sanitary practices worldwide more rigid.

Concurrently, the increasing levels of expectations related to sanitary compliance are not without their difficulties. Most small features feel that the cost of installing and maintaining sanitary valves is highly prohibited, which prevents them from modernizing their system. These valves have a level of maintenance that requires both time and expertise, which makes the cost more difficult for companies with strapped budget to justify the cost. Secondly, compatibility remains an issue. Much of the current industrial infrastructure still uses older equipment that is not compatible with newer valve technologies. This causes integration problems and slows the rate at which these sophisticated systems gain traction.

But there are definite indications that growth is on the horizon. Rapidly, more and more companies are converting into automated processing, and sanitary valves play an important role in doing automation work and working firmly. Valves help maintain stability in the production line and prevent contamination risk, which is paramount for companies handling sensitive materials. Infection for automation is not just an option - it becomes a matter of requirement if companies want to work efficiently and meet regulation requirements. This growing dependence on smart and interconnected systems makes more space for sanitary valves to play its role in future production lines.

Another direction of potential growth is in biopharmaceuticals. With growing investments in drug manufacturing and healthcare infrastructure by emerging nations, the demand for sanitary and precise equipment is increasing rapidly. Former importers of pharmaceutical products are now establishing indigenous manufacturing capacities. This expansion generates a high demand for specialist valves capable of sterile processing, presenting companies with new prospects to expand their share and address such requirements.

In brief, although the global sanitary valves market does have some challenges, namely in cost and integration, it has much to gain from large trends such as automation and biopharmaceutical production globally. As cleaner and more efficient systems become increasingly in demand, the market will keep looking for new means of growth and innovation.

MARKET SEGMENTATION

By Valve Type

The global sanitary valves market should experience a continuous increase in demand owing to its critical contribution towards hygiene standards in numerous industries. Sanitary valves find special use in sectors such as food and beverage, drugs, and personal care, where cleanliness and contamination control are a must. These valves are fabricated to provide easy cleaning, minimal fluid entrapment, and corrosion resistance, making them perfectly suited to processes that demand strict compliance with hygiene. Their ongoing usage will be significantly fueled by the increasing focus industries are placing on safety and product quality.

Of the various types they come in, Ball Valves lead the global sanitary valves market with a value of around \$653.50 million. Their compactness and resistance to wear and tear make them a choice in systems that require precision along with cleanliness. Single-Seat Valves share a substantial market space because of their minimalistic design and effectiveness in flow control, mainly for small-sized piping systems. Butterfly Valves are appreciated due to their low-profile design and performance suitability for large-diameter pipes, where light handling is critical. While that is happening, Other valve types cater to more specialized requirements and will continue to plug gaps where off-the-shelf solutions are inadequate.

When demand increases, the trend will be towards innovation in valve material and design. Manufacturers will look for possibilities that not only satisfy sanitary conditions but also accommodate automated and intelligent systems. Such a change is likely to enable industries to minimize waste, reduce energy consumption, and ensure consistent product quality. With business houses under the pressure to comply with stringent regulatory demands, the use of sanitary valves will continue to become increasingly important in production lines all over the world.

The destiny of the global sanitary valves market will be influenced not only by technology, but by shifting customer expectations. As customers themselves develop greater health and safety consciousness, the demand for contamination-free manufacturing will compel industries to enhance their systems. Valves that support quicker cleaning and minimize downtime will become the preferred choice. This will direct procurement choices, turning sanitary valves into not merely a mechanical device, but an investment in trust and reliability.

With all these transformations in progress, every valve type—whether Ball, Single-Seat, Butterfly, or Others—is going to continue to occupy their position in systems designed for safe and clean operations. They may perform differently, but their mission will still be the same: to assist industries in providing secure, quality products while remaining efficient and compliant.

By Material

The global sanitary valves market is influenced by the requirements of a number of basic industries. Food processing industry is one of the largest areas with sanitary valves apply. In this area, hygiene is necessary to prevent contamination and maintain product safety. Sanitary valves do not abandon hygiene and make procedures easier by regulating liquid flow, making them a reliable option for food producers. Likewise, in beverage production, these valves are involved in protecting taste and quality. From soft drinks to bottled water, the fluid flow during production needs to be clean and consistent, and sanitary valves are designed to do that.

In the dairy market, the equipment employed must be of strict safety standards as a result of milk-based products' sensitivity. Sanitary valves are made to address such issues by supporting CIP systems and keeping all parts of the production line free from infectious bacteria. Manufacturers are hence able to adhere to regulations while eliminating waste and downtime. The pharmaceutical market also uses these valves for the same purposes. Drugs and wellness products need to be manufactured in a controlled environment where there is no risk of contamination. The sanitary valves help to control the flow through pipelines by improving efficiency in cleaning processes in this highly regulated environment.

Each of these regions has its own demands, but shared demand for high degrees of hygiene and stability units them. The sanitary valves, with ease of their accurate construction and cleanliness, will continue to help the production levels and safety requirements of these areas. With expanding and streamlining its methods of building these areas, the role of sanitary valve will all become more important.

By End Use

The global sanitary valves market by material indicates a distinct trend towards choices that promote hygiene, longevity, and convenience of maintenance. Of these, stainless steel remains the first choice in food and industries such as drinks, medicines, and dairy. This is mainly due to its corrosion resistance, the ability to withstand high temperatures and the lack of reaction with sensitive materials. Its high life and health safety rules make it a reliable option, especially where strict hygiene is required. Since companies seek more consistent and reliable performance in fluid control systems, the demand for stainless steel sanitary valves will be strong.

However, there is a middle ground in the brass sanitary valves market. Although they are cheaper than stainless steel, they have some shortcomings. Brass will slip over time, especially when it is subject to special chemicals or water conditions. Nevertheless, they continue to be used in applications where temperature and pressure levels are within control and where the material compatibility is within functional requirements. Few small-sized industries and business establishments still use brass valves to save money, even at the cost of slightly reduced longevity.

Sanitary valves made of plastic are a low-weight, low-cost option. These are used in non-critical or less stringent conditions where heavy heat and heavy pressure aren't issues of prime concern. In industries such as cosmetics, bottled water, or laboratory applications, plastic valves are usually sufficient. However, they are rapidly wear out and are more likely to be affected by chemical risk or structural stress. He said, innovation in plastic engineering can open new possibilities, especially in markets in search of more durable or recycled materials.

The "other" category includes niche materials or valves of custom yogas for specific operational conditions. They can include special mixes or coated pieces for corrosive chemical chemicals or excessive temperature. Although usually used, these options meet specific industries with specific demands. Their market entry is low, but they are important for organizations that may not be organized for performance due to the type of product or procedure.

Overall, the global sanitary valves market reflects material options based on the market cost, performance, and safety. Stainless steel remains in the lead, affected by reliability and installed benefits, with plastic and brass cover where flexibility or value is priority. As technology advances and stability are required at any time, even sanitary valve materials can change, leading to new opportunities for industries and manufacturers.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,890.90 million |

|

Market Size by 2032 |

$2,520.45 Million |

|

Growth Rate from 2025 to 2032 |

4.2% |

|

Base Year |

2024 |

|

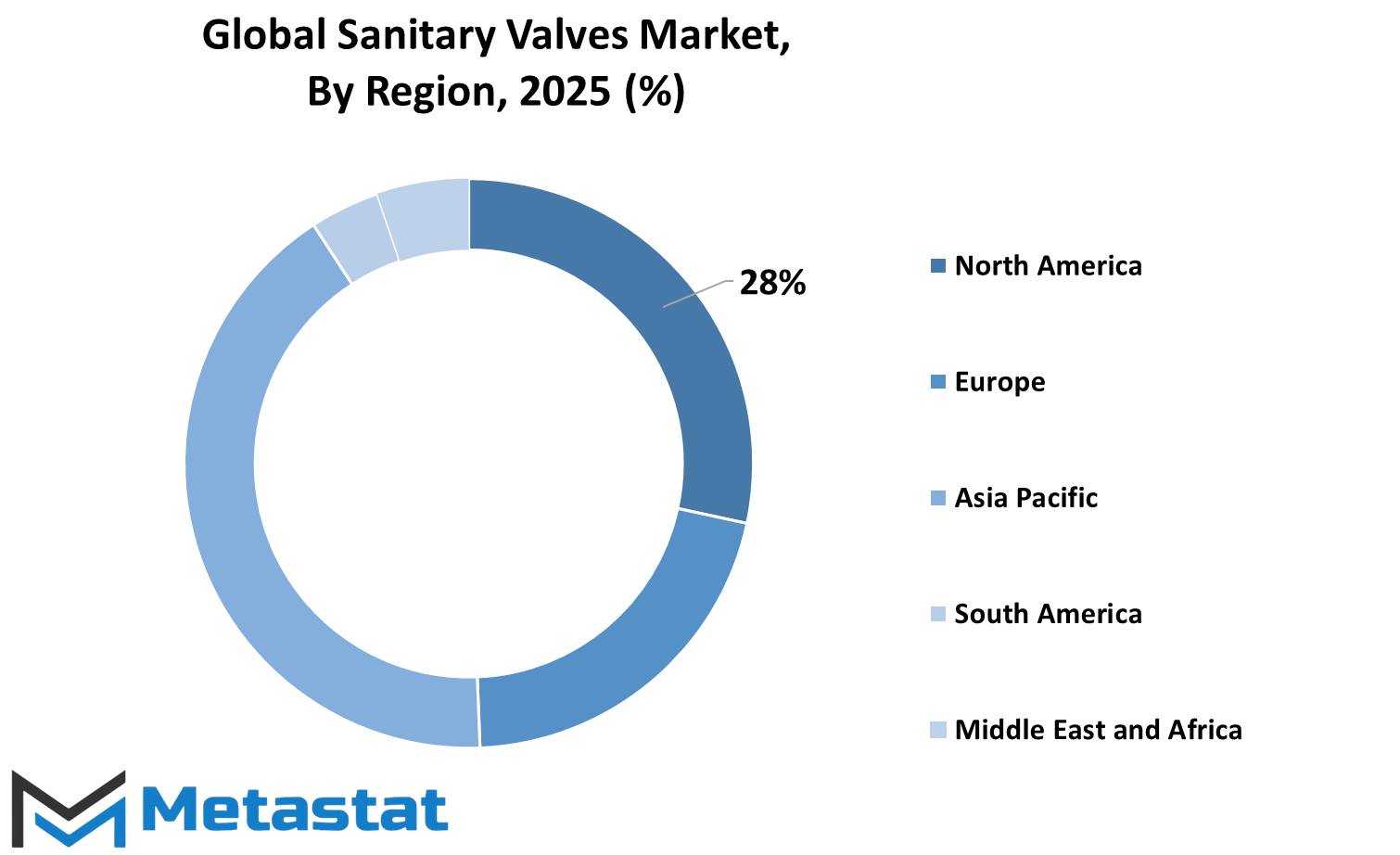

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global sanitary valves market has been divided into many geographical regions to better understand market behavior, growth and demand pattern worldwide. Each region indicates unique characteristics of local industries, development of infrastructure and regulatory structure. North America includes countries such as the United States, Canada and Mexico. The region often leads to technical integration and hygiene standards in food, drinks and pharmaceutical industries, which heavy use of sanitary valves. Along with countries such as Europe, UK, Germany, France and Italy, with the rest of the continent, strict quality and safety regulations indicate the constant demand for focusing strong focus on maintaining the rules.

In the Asia-Pacific, India, China, Japan, South Korea, and other sanitary valves play a major role in the market. This sector will continue to grow due to rapid industrialization, increase in food processing activities and increasing public health awareness. The South American section, including Brazil, Argentina and neighboring countries, is gradually increasing its presence in the global sanitary valves market. The increase in this sector will be affected by investment in local manufacturing and improvement in public utility.

Finally, the Middle East and Africa include a diverse group of regions such as GCC countries, Egypt and South Africa. These places reflect different levels of market development. While some countries are focusing on advancing healthcare and water treatment systems, others are beginning to adapt to modern sanitary infrastructure. This geographical rupture helps to expose the ability of analog strategies and future expansion opportunities in each part of the world.

COMPETITIVE PLAYERS

The global sanitary valves market is influenced by the requirements of a number of basic industries. The food processing industry is one of the biggest sectors in which sanitary valves are applied. In this field, hygiene is essential to prevent contamination and maintain product safety. Sanitary valves make processes easier by regulating liquid flow while not sacrificing cleanliness, making them a trusted option for food producers. Likewise, in beverage production, these valves are involved in protecting taste and quality. From soft drinks to bottled water, the fluid flow during production needs to be clean and consistent, and sanitary valves are designed to do that.

In the dairy market, the equipment employed must be of strict safety standards as a result of milk-based products' sensitivity. Sanitary valves are made to address such issues by supporting CIP systems and keeping all parts of the production line free from infectious bacteria. Manufacturers are hence able to adhere to regulations while eliminating waste and downtime. The pharmaceutical market also uses these valves for the same purposes. Drugs and wellness products need to be manufactured in controlled environments where there is little to no risk of contamination. Sanitary valves assist in controlling flow through pipelines while improving efficiency in cleaning procedures, a crucial element in this highly regulated environment.

Each of these sectors has its own demands, but the shared demand for high degrees of hygiene and consistency unites them. Sanitary valves, with their precise construction and ease of cleaning, will continue to aid in the production levels and safety requirements of these sectors. With these sectors expanding and streamlining their methods of manufacture, the role of sanitary valves will become all the more important.

Sanitary Valves Market Key Segments:

By Valve Type

- Ball Valves

- Single-Seat Valves

- Butterfly Valves

- Other

By Material

- Stainless Steel

- Brass

- Plastic

- Other

By End Use

- Processed Food Industry

- Beverage Industry

- Dairy Industry

- Pharmaceutical Industry

Key Global Sanitary Valves Industry Players

- Alfa Laval

- GEA Group

- SPX FLOW

- ITT Inc.

- Emerson Electric Co.

- Pentair Plc

- Burkert Fluid Control Systems

- Adamant Valves

- Ampco Pumps Company

- Dixon Valve & Coupling Company

- DEFINOX

- Waukesha Cherry-Burrell

- Schubert & Salzer Control Systems

- Kieselmann GmbH

- APV (Part of SPX FLOW)

- INOXPA Group

- GEMÜ Group

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252