MARKET OVERVIEW

The Europe surety market is among the most important contributors to the insurance and financial sector in the continent. The market is based on the issuance of surety bonds, which are financial instruments that are utilized to guarantee contract and obligation fulfillment. The bonds guarantee that one person will complete contractual obligations to another, insuring the obligation against default risk by the principal. With businesses in Europe involved in diverse commercial and building transactions, there will be even greater demand for surety bonds, further strengthening the role of the market as a guaranteed vehicle and trust establishment in financial undertakings. The Europe surety market is influenced by intricate interplay among legal frameworks, business environment, and economic forces.

Surety bonds can be applied in various activities, such as construction contracts, court bonds, and other commercial transactions, where financial suretyship and performance guarantee are required. The market usually comprises bond providers, who take the risk, and the companies or individuals buying the bonds as a safeguard against possible contract breaches. With the passage of time, this market has changed due to changes in the regulatory regime of obligations and growing business complexities, requiring more security and assurance. With the building construction industry still on the growth track in Europe, the demand for surety bonds will continue to be strong.

These are usually required to be provided by contractors and subcontractors so that their work is completed within standards acceptable and in a timely fashion. Moreover, the growing dependence of the construction sector on behemothic infrastructure projects will generate additional demand for these tools. Insurers, financial institutions, and bond experts will use their services to address the expanding needs of this thriving industry. The European Surety market landscape is also driven by the economy of nations. The stability of the construction industry, the regulatory framework, and the level of faith among enterprises in an area are some of the factors that can influence market activity considerably. For example, where there is vigorous construction growth and stringent regulatory requirements, demand for surety bonds will keep increasing as companies attempt to ensure their contracts and safeguard themselves from financial exposure.

Digitalization shall bring a revolutionary impact on the future of the Europe surety market. Improved data analysis and risk management technology shall enable bond providers to measure risk more accurately and effectively. With the market increasingly using automated alternatives, firms shall enjoy faster processing speeds and lower fees. Additionally, internet-based platforms would facilitate easier purchasing and administration of surety bonds, enabling European firms to find such products more conveniently.

The future years will see further developments in the Europe surety market as insurance carriers and financial institutions prepare for regulatory change and changing business demands. The increased European market emphasis on corporate social responsibility and sustainability will likely create more stringent standards for issuing surety bonds. These shifts have the capacity to propel the size of the overall market higher because firms will move to achieve compliance and financial standards. The Europe surety market in the future will remain a significant influence in facilitating various industries with its critical services, further reinforcing the credibility and security of commercial and construction transactions. The ongoing evolution of risk assessment products, combined with increasing demand for surety bonds, will further place the market on the foundation for European business operations.

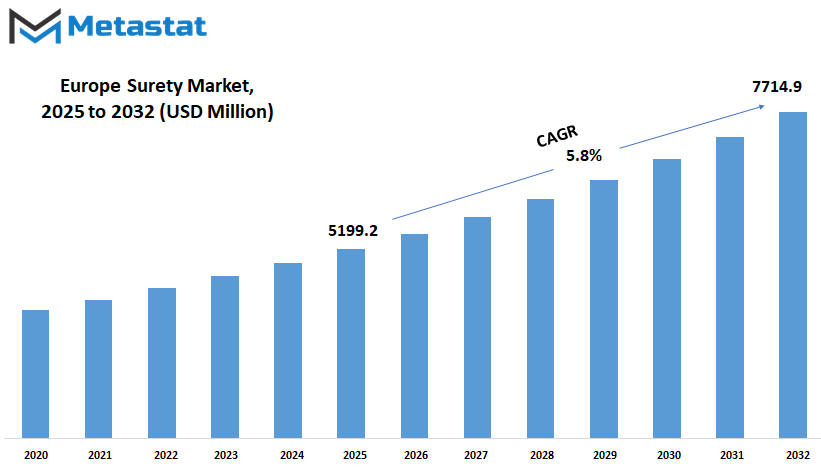

Europe surety market is estimated to reach $7714.9 Million by 2032; growing at a CAGR of 5.8% from 2025 to 2032.

GROWTH FACTORS

The Europe surety market is to witness extensive growth in coming years, which will be propelled by the aggregation of a multitude of key driving factors to its destiny. Such a key propellant in the market is growing demand for managing financial security and risk solutions, mainly in areas like construction, real estate, and finance. Companies care more about risks involved in transactions, particularly cross-border transactions, where financial obligations are fulfilled through surety bonds. With increasing interest in project completion, financial responsibility, and being law-abiding, the European surety bond market will also increase further. The market is also affected by changing regulations and industry practices. As companies in all industries are faced with the obligation to comply with some regulatory conditions, they are resorting to surety bonds as a means of ensuring compliance.

The construction industry, for instance, has experienced increased demands for surety bonds as a result of stricter legal conditions and the necessity to have projects executed successfully and within schedule and without loss of money. Likewise, real estate and the finance industry are increasingly depending on surety bonds to guarantee transactions and shield themselves from defaults. Technological innovation is also doing its part in defining the future of the Europe surety business. The use of online bond platforms and digital bonding services has created more straightforward channels for businesses to obtain surety bonds with greater efficiency and less paperwork. With the use of technology increasing, businesses will find it simpler to process bond requests and oversee their portfolios, further increasing the market's growth prospects. Yet, there are certain problems which can put the market's onward march in its tracks. One such challenge is the ambiguity that exists in the international economy, which may affect the willingness of the business to invest in risk management tools such as surety bonds. Also, the growing competition among surety providers may exert downward pressure on price, thereby reducing the profit margins of companies in the market.

These pressures may be a serious threat to market growth, and thus companies have to innovate and develop new solutions in order to remain competitive. In spite of these pressures, the future for the Europe surety market remains bright. The ongoing demand for financial stability as well as increasing focus on regulatory compliance will present many opportunities for the market participants. The increased use of technology and online services will also create new opportunities for expansion, allowing companies to access more customers and optimize their operations. As the market continues to grow further, demand for surety bonds will continue to be high and offer enormous opportunities for providers to expand their coverage and cater to a broader range of industries.

MARKET SEGMENTATION

By Type

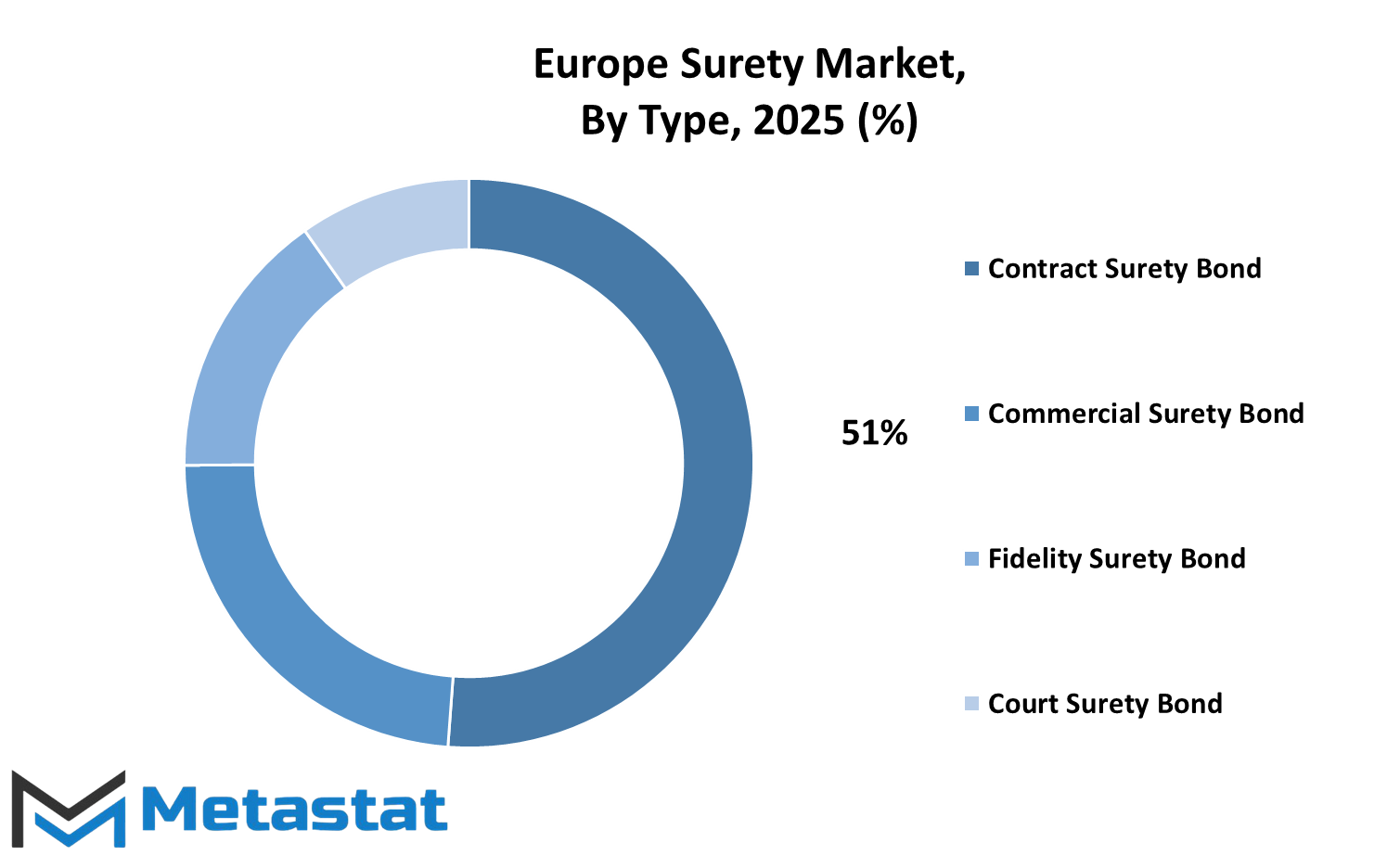

The Europe surety market will continue to exhibit evidence of steady enhancement as companies and sectors put value on financial soundness and reliability. Trust is an enormous burden in business transactions, especially where large amounts or intricate projects are involved. Surety bonds are not just the regulation guarantee bonds create trust among parties, ensuring promises made are kept. Europe Surety is driven by such a need for security and confidence in business relations, and it will become even more critical as private and public sectors undertake complex projects and more rigorous regulations. Different surety bonds are utilized depending on the contract or agreement.

Contract Surety Bonds operate in construction and other similar fields. These bonds ensure the contractors complete work according to the agreement. Governments and individual investors starting new projects want to be sure that there is a fallback arrangement in the event of any accidents. This is where Contract Surety Bonds are involved, and the market for such bonds is expected to expand as construction methods become better and more public projects are funded. Commercial Surety Bonds assist businesses that are mandated to comply with some laws or regulations. These bonds are used for licensing, permits, and other legal contracts.

As rules become tighter and more businesses are subjected to tighter checks, businesses will use Commercial Surety Bonds to prove that they are compliant and are reliable businesses. These bonds help in evading risks and building a good reputation, a resource more valuable than ever in a time where trust is as valuable as performance. Fidelity Surety Bonds protect companies from loss caused by employee actions, such as theft or dishonesty. As the workplace changes and technology offers new ways for fraud to take place, these bonds offer a sense of security that companies will need more and more. Employee-related security will be in greater demand, especially as hybrid and remote workspaces remain popular. Court Surety Bonds are used in court proceedings.

These bonds are invoked in court proceedings to ensure someone will abide by the judicial decision. As legal institutions continue to change as new technologies emerge and international cooperation increases, requirements for bonds that guarantee the outcome of court decisions will also increase. In the coming years, the Europe surety market will see steady demand in these categories, driven by confidence, legal requirement, and risk management. These bonds are not pieces of paper forms—these are assurances that there will be compliance with rules and there will be success in achieving goals.

By Provider Type

The Europe surety market will experience stable shifts in the years to come as various industries look for financial protection for their partnerships and projects. This market enables companies to proceed with assurance, knowing there is a financial safety net if agreements are not adhered to. Although the overall concept of surety is not new, the manner in which companies address it today is influenced by changing business requirements, technological solutions, and increasing risk and trust concerns. One significant driver in this market is the type of provider firms select.

Three dominant provider types influence the Europe surety market: Specialized Surety Firms, Banks, and Insurance Companies. Each of these providers has a different role, and businesses tend to select based on what is best for them. Specialized Surety Firms only deal with providing bonds and their associated services, so they tend to be more knowledgeable about the process. They tend to work with clients intimately to understand the risks of each agreement and offer bonds that are suitable for the situation. Their specialization in one field enables them to act fast and provide flexible solutions, particularly in intricate projects where seeing the complete picture matters. Banks also participate in this market, but their strategy is slightly different. Their advantage is that they have long-term relationships with customers and can package bond offerings with other financial products.

Some companies like to deal with banks because they keep all financial services in one place. Banks, however, might not always be as flexible as specialist firms, particularly when handling non-standard projects. Insurance firms are also present in the Europe surety market. They usually step in after companies already utilize their other products. With their wide scope and deep pockets, insurance companies can provide steady bonds. Their speed and customization may not always be the same as companies specializing solely in surety, but their stability usually tips the balance for many customers.

In the future, the market will trend towards more digital and data-based services. Providers that leverage technology to make it quicker, simpler, and more transparent will be likely to stand out. As businesses expand and regulations evolve, the Europe surety market will continue to adapt. Companies will seek providers who realize the importance of both safety and speed, and who can facilitate growth while maintaining trust.

By End User

The Europe surety market will witness consistent growth in the times to come as several industries are gradually depending on financial guarantees for covering operations, controlling risk, and securing deals. Surety bonds serve as an insurance system whereby obligations are fulfilled, primarily in sectors where projects involve considerable stakes. In Europe as a whole, the market is fundamental to sustaining trust between businesses, governmental agencies, and project parties. The future of the Europe surety market will most probably be defined by the extent to which various industries respond to increasing needs for transparency, accountability, and fiscal stability. Major companies, specifically, will remain at the center of much activity in this market.

These institutions tend to engage in industries like construction, energy, and infrastructure, where surety bonds are an integral part of project development and implementation. As these sectors invest in long-term ventures and are subject to greater regulation, the demand for surety bonds will only increase. Further, shifts in the global economy and stricter compliance regulations will ensure that large companies demonstrate financial responsibility, increasing the adoption of surety solutions. It will also make SMEs more dynamic players in the Europe surety marketplace. As digital access continues to enhance and as insurers become proficient at creating specialized tools for smaller businesses, acquiring surety bonds will become less difficult for SMEs.

It is critical, as it grows more prevalent, that governments and private clients begin to require financial guarantees prior to contracting. Facilitating SMEs with more easily accessible products will enable greater access to emerging opportunities as well as stimulate growth across other industries. Government institutions will remain a significant force in molding the Europe surety market. Public construction projects, environmental projects, and big-ticket service contracts all find it advantageous to utilize surety bonds to mitigate risk and ensure adherence to rules. As governments in Europe look to enhance infrastructure, achieve environmental targets, and execute public projects within deadlines, the job of surety providers will only become that much more crucial.

Such players are expected to resort more heavily to surety bonds to facilitate accountability and fiscal safety in every step of a project. In the future, the Europe surety market will expand through innovation, improved access to financial instruments, and a common emphasis on risk mitigation. Through public works, private agreements, or increased backing of SMEs, surety bonds will continue to be a source of trust and dependability throughout Europe.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$5199.2 million |

|

Market Size by 2032 |

$7714.9 Million |

|

Growth Rate from 2025 to 2032 |

5.8% |

|

Base Year |

2024 |

|

Regions Covered |

Germany, France, UK, Italy, Spain, Rest of Europe |

REGIONAL ANALYSIS

The Europe surety market will experience dramatic changes and growth over the next few years, with much of this being driven by continued changes in regulations, economic conditions, and demand for financial assurance. This market offers financial guarantees that hold businesses and individuals accountable for their obligations, particularly in sectors such as construction, infrastructure, and public projects. As more businesses look for ways to manage risk and build trust with governments and partners, the demand for surety products will grow. In the future, one of the biggest drivers of the future of the market is regional differences.

Europe is notable not only due to its mature economies such as the UK, France, and Germany, but also due to the growing significance of smaller markets. These nations, while varying in financial and legal systems, are all moving toward better infrastructure, digitalization, and sustainability. This change presents new opportunities for surety providers who are ready to evolve and address the expanding needs of these emerging regions. What makes this even more critical is the growing emphasis on cross-border projects and collaboration among nations. As the European Union continues to encourage combined infrastructure and energy networks, companies that participate in such endeavors require solid assurances.

This will challenge the Europe surety market to expand in a way that favors more flexible and responsive products, allowing companies to conduct business across borders with ease and without delay or additional risk. And, the UK's post-Brexit position lends a distinctive aspect to the way the market will develop. Though divorced from EU regulations, the UK remains tightly connected to European business, with a need for specialized surety solutions that will satisfy both international and domestic demands. On the regional comparison, other regions such as Asia-Pacific and North America are also developing, but Europe has its own trajectory owing to historical depth, regulatory framework, and political cohesion. Nations such as France and Germany will continue to be important players with stable economies and robust construction industries. Meanwhile, southern and eastern regions of Europe can exhibit faster growth rates owing to continuous investment and modernization. With increasing numbers of nations adopting stricter compliance requirements, the demand for strong financial support using surety bonds will increase. This is particularly so with projects having long durations and multiple parties involved. The Europe surety market, though based in tradition, is evidently gearing up for a future that calls for adaptability, dependability, and the capacity to facilitate complex contracts across borders.

COMPETITIVE PLAYERS

The Europe surety market will experience dramatic changes and growth over the next few years, with much of this being driven by continued changes in regulations, economic conditions, and demand for financial assurance. This market offers financial guarantees that hold businesses and individuals accountable for their obligations, particularly in sectors such as construction, infrastructure, and public projects. As more businesses look for ways to manage risk and build trust with governments and partners, the demand for surety products will grow. In the future, one of the biggest drivers of the future of the market is regional differences.

Europe is notable not only due to its mature economies such as the UK, France, and Germany, but also due to the growing significance of smaller markets. These nations, while varying in financial and legal systems, are all moving toward better infrastructure, digitalization, and sustainability. This change presents new opportunities for surety providers who are ready to evolve and address the expanding needs of these emerging regions. What makes this even more critical is the growing emphasis on cross-border projects and collaboration among nations. As the European Union continues to encourage combined infrastructure and energy networks, companies that participate in such endeavors require solid assurances.

This will challenge the Europe surety market to expand in a way that favors more flexible and responsive products, allowing companies to conduct business across borders with ease and without delay or additional risk. And, the UK's post-Brexit position lends a distinctive aspect to the way the market will develop. Though divorced from EU regulations, the UK remains tightly connected to European business, with a need for specialized surety solutions that will satisfy both international and domestic demands. On the regional comparison, other regions such as Asia-Pacific and North America are also developing, but Europe has its own trajectory owing to historical depth, regulatory framework, and political cohesion.

Nations such as France and Germany will continue to be important players with stable economies and robust construction industries. Meanwhile, southern and eastern regions of Europe can exhibit faster growth rates owing to continuous investment and modernization. With increasing numbers of nations adopting stricter compliance requirements, the demand for strong financial support using surety bonds will increase. This is particularly so with projects having long durations and multiple parties involved. The Europe surety market, though based in tradition, is evidently gearing up for a future that calls for adaptability, dependability, and the capacity to facilitate complex contracts across borders.

Europe surety market Key Segments:

By Type

- Contract Surety Bond

- Commercial Surety Bond

- Fidelity Surety Bond

- Court Surety Bond

By Provider Type

- Specialized Surety Firms

- Banks

- Insurance Companies

By End User

- Large Enterprises

- Small and Medium Enterprises (SMEs)

- Government Entities

Key Europe Surety Industry Players

- Zurich Insurance Group

- Allianz SE

- Atradius N.V.

- Coface

- London Surety & Financial Risks

- Swiss Re Corporate Solutions

- Chubb Limited

- Munich Re Group

- Tokio Marine HCC

- Liberty Mutual Insurance Company

- QBE Insurance Group Plc

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252