MARKET OVERVIEW

The Global Electronic Grade Hydrofluoric Acid market is that segment within the electronics industry which in itself represents a major requirement in the form of a chemical that forms an integral part of the manufacture and processing of different kinds of electronic components. It means hydrofluoric acid of high purity that becomes essential in the production of semiconductors, photovoltaic cells, or any other similar devices. It will find its demand because it has the ability to etch silicon wafers and clean electronic parts, which enables the miniaturization and improved performance of modern electronics. The manufacturers in this market keep striving to achieve high purity standards for use in electronic applications. This would include advanced purification techniques for the removal of impurities that hinder the proper functioning of electronic components. With the electronics sector, innovation in the Global Electronic Grade Hydrofluoric Acid market will never come to a close as the needs for higher purity standards increase.

Directly related to this is the growth of the market with advancements in semiconductor technology. Decreasing size and increasing complexity of the semiconductor devices will call for exacting etching and cleaning processes, resulting in increased dependence on electronic grade hydrofluoric acid and hence fueling the market with growth and innovative progress. New semiconductor technologies currently under development for 5G, artificial intelligence, and the Internet of Things will further strengthen demand for this high-purity chemical. Another key growth driver in the market is the photovoltaic industry, which is oriented to producing solar energy.

The manufacturing processes of solar cells require electronic grade hydrofluoric acid for surface texturing and cleaning of these cells to ensure efficiency and longevity. This demand from the photovoltaic sector on the Global Electronic Grade Hydrofluoric Acid market will only continue to increase as the world moves towards adopting renewable sources for energy generation. Geographically, the market will see different trends according to regional progress in technology and industrial development. In the Asia-Pacific region, the rapid growth of semiconductor manufacturing clusters in China, South Korea, and Taiwan is going to play a huge role in shaping the market.

There will be significant demand from these regions since they occupy leading positions in the worldwide electronics supply chain. Similarly, North America and Europe also showed stable growth, driven by its multifarious investments in research and development in the semiconductor sector. However, environmental regulations and dealing with this acid without risks to health and the environment are challenges the market faces. The very corrosive nature entails that various safety measures and environmental regulations in place will be strictly adhered to.

Accordingly, companies shall have to invest in sustainable practices and advanced safety measures that counter such concerns and enable the responsible use and disposal of hydrofluoric acid. The Global Electronic Grade Hydrofluoric Acid market will continue to evolve in response to the dynamic needs of the electronics industry. With its crucial role in semiconductor and photovoltaic manufacturing, it is expected to see continuous demand driven by technological advancement and an increased focus on renewable energy.

Companies in this sector will have to work out challenges in terms of regulatory issues and high purity standards to remain in the competition. The role that electronic grade hydrofluoric acid will play in the next generation of electronic devices and clean energy solutions can only proliferate as the industry advances.

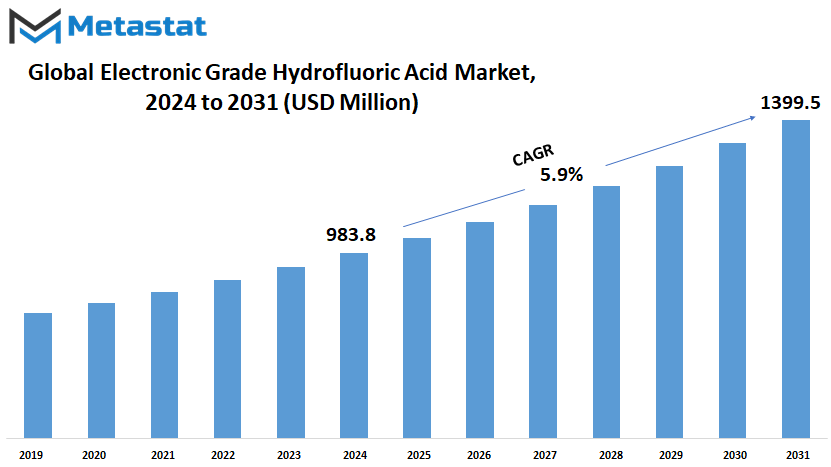

Global Electronic Grade Hydrofluoric Acid market is estimated to reach $1399.5 Million by 2031; growing at a CAGR of 5.9% from 2024 to 2031.

GROWTH FACTORS

A number of factors are driving growth in the global market for Electronic Grade Hydrofluoric Acid. Primary among these is rising demand for electronic devices and semiconductors, whose fabrication processes require high-purity chemicals. Improving technology used for the manufacture of semiconductors, consequently, demands tailored and more reliable etching and cleaning solutions, fueling demand for electronic-grade hydrofluoric acid.

This chemical is indirectly applied in the manufacture of semiconductors, specifically in cleaning and etching silicon wafers. High purity ensures that the produced semiconductors are of high quality, corresponding to the most rigid specifications for modern electronic devices. The need for this acid will only increase with increasing consumer electronics, smartphone varieties, and other gadgets.

However, there are many headwinds that the market faces. The corrosive nature of HF entails that stringent safety and handling measures govern its use. This exposes manufacturers to additional operational costs in terms of compliance. Further, fluctuations in raw material costs and disruptions to the supply chain could affect availability and hence pricing for electronic grade hydrofluoric acid. These might have a dampening effect on market growth.

Even in the face of adversity, promising opportunities are on the horizon. Immense potential has been shown in the development of new purification and recycling technologies. Such developments can bring additional sustainability and cost-effectiveness to the production of electronic grade hydrofluoric acid and make it more attractive to manufacturers. By zeroing in on these improvements in technology, companies will be afforded an opportunity to curtail waste, reduce costs, and optimize overall production efficiency.

The outlook ahead for the electronic grade hydrofluoric acid market remains promising. Increasing dependencies on electronic devices and continuous improvement in semiconductor technology will continue to drive demand for this key chemical. By conquering the problems associated with safety and handling, and supply chain disruptions, embracing innovations for purification and recycling technologies will ensure a stable supply of high-quality hydrofluoric acid for rapidly evolving electronics industries.

The growing demand for electronic devices and innovations in semiconductor technologies are therefore some of the major drivers of the global electronic grade hydrofluoric acid market. Even though there are certain issues regarding safety regulations, operation costs, and supply chain volatility, new technologies in purification and recycling are evolving and present some very promising opportunities in the future. Exploiting these opportunities to sustain the continuous growth of the market shall help ensure continuous evolution of the electronics industry while tackling these challenges.

MARKET SEGMENTATION

By Type

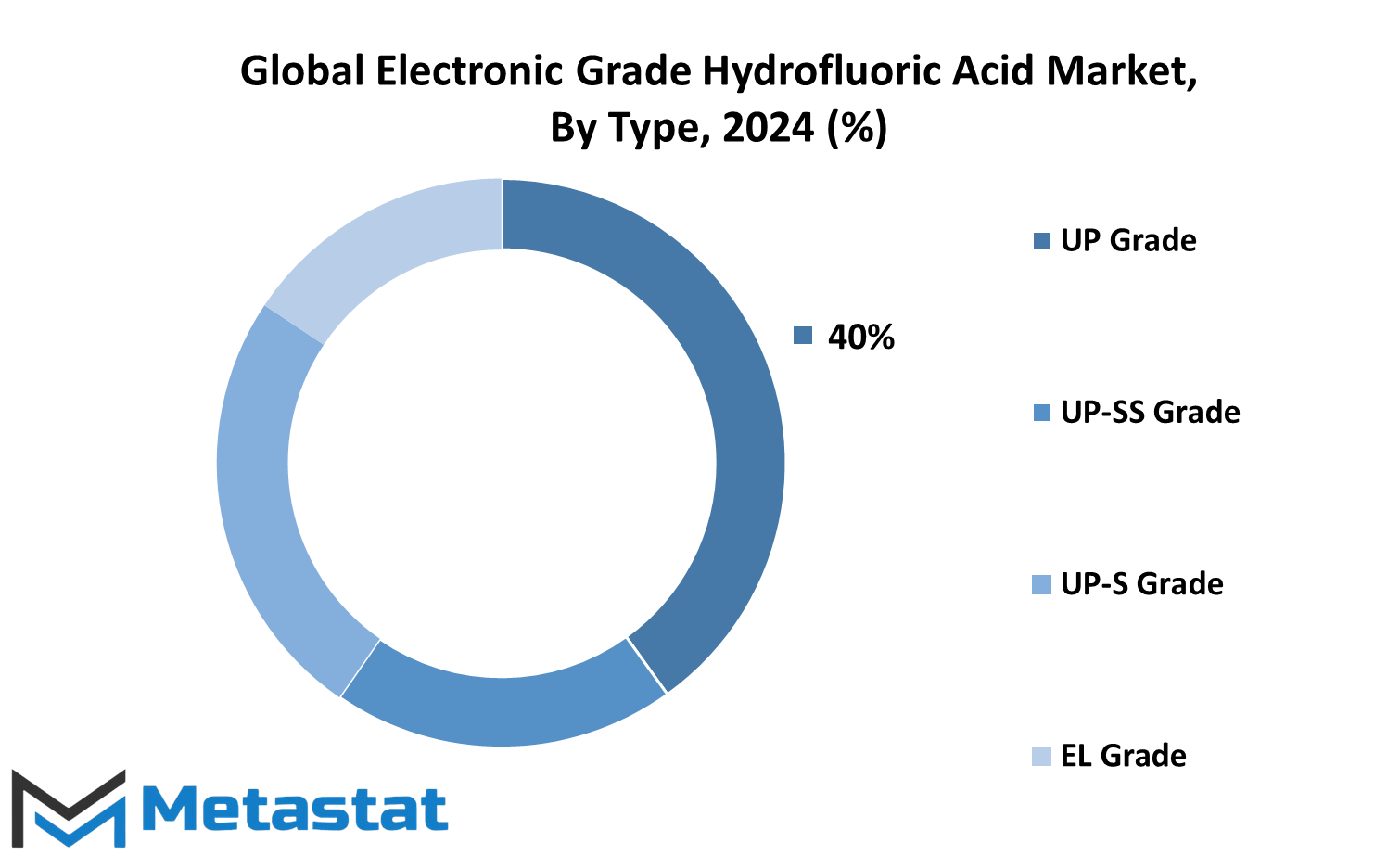

The electronic grade hydrofluoric acid market is set to grow in the global scenario by virtue of the ever-increasing demand from widespread industrial sectors. The electronic grade hydrofluoric acid market is segmented on the basis of type: UP Grade, UP-S Grade, UP-SS Grade, and EL Grade. Each category has unique properties and applications attached to it, eventually surfacing it as different from the others.

Electronic Grade Hydrofluoric Acid has a wide use because it will give all features that are of high purity, thereby suiting semiconductor manufacturing most. The more modern technology is, striving for smaller and more effective electronic components; the more the demand for such requirements using materials of high purity will grow. This trend probably has a lot of years before it is to continue, and therefore UP Grade is one of the necessary building blocks in the production process.

Another important grade is UP-S Grade. The UP-S Grade is highly stable and efficient in silicon wafer etching. The critical property is used in creating microelectronic chips that are a must in any given electronic device. With the digitalization of basically everything and smart technology being a trend worldwide, the demand for electronic UP-S Grade hydrofluoric acid is presumed to grow massively.

The UP-SS Grade bears much importance in the manufacture of solar panels. The solar energy sector is now gaining strength worldwide, as it has become a critical concern with all of the global village; hence, with this, the demand for efficient and cost-effective production is highly required. That need is anticipated to boost the requirement for UP-SS Grade. That specific grade plays an important role in enhancing future energy's sustainable efficiency.

The reason behind the vast usage of EL Grade Electronic Grade Hydrofluoric Acid in the electronic industry is its brilliant cleaning properties. This grade is very much necessary for the performance and durability of the electronic parts or elements. With the rapid increase in complexity and refinement of devices, the needs for cleanliness have increased. This, in turn, will most likely boost the growth of the EL Grade segment in the next few years.

By HF Concentration

The global market for Electronic Grade Hydrofluoric Acid is growing significantly due to the increasing demand for electronics and related technology. This kind of acid is required for etching silicon wafers and cleaning semiconductor devices in the production of various electronic components. In view of evolving technology, the requirement for high-purity chemicals like Electronic Grade Hydrofluoric Acid has become increasingly important.

The market segments based on the HF concentration feature two major segments: less than 49% and more than 49%. Each of the segments avails different uses in the electronics' industry. The lower concentrations solution are most often applied in sensitive cleaning and etching functions. They provide a result that is efficient yet accurate and, at the same time, the likelihood of destruction of sensitive electronics has been reduced. On the other hand, a stronger etching activity may require a more aggressive action of chemicals and thus use solutions of higher concentration levels.

The electronic-grade hydrofluoric acid market, therefore, is envisioned to flourish in the future due to the increasing demand for electronics. The penetration of smart devices into the human lifestyle, the increased growth in IoT, and continuous technological developments in semiconductor technology strongly support this trend. As new innovative products that enter the market are increasingly in demand for quality electronic components, the demand for electronic-grade hydrofluoric acid is subsequently fueled.

Moreover, the growing penetration of electric vehicles (EVs) offers another line of growth. EVs are heavily reliant on advanced electronics, the manufacture of which involves the use of high-purity chemicals. Rising EV adoption is going hand in hand with rising Electronic Grade Hydrofluoric Acid demand, making the electronic chemicals supply chain more robust.

Basically, the Electronic Grade Hydrofluoric Acid has applied huge growth volumes to its main consumption in Integrated Circuit manufacturing, Solar Energy, Glass Products, and Monitor Panels, among other specialized uses. EGHF finds vast demand in the semiconductor fabrication and solar cell production industries, and growth is further fueled by advanced technologies in electronics and renewable energy.

In the electronic manufacturing field, EGHF is used in etching silicon wafers for making complex circuit patterns, which is a very important process in IC manufacture. EGHF will be asked for in the future because with the aggressive downscaling of electronic products and increasing use, the need for decent and reliable etching solution is going to keep increasing.

The other key growth area for EGHF is in solar energy applications. As the search for diversifying into renewable sources of energy continues afoot, EGHF finds application in the manufacturing of solar cells, in texturing and cleaning, the surface of silicon wafers, thereby enhancing its absorption efficiency for light. This application was quite significant in improving the overall performance and cost-effectiveness of solar panels.

Additionally, EGHF is particularly essential in the fabrication of high-quality glass products. It can be applied in glass microstructuring to create microstructures or surface patterning used in the automotive, architectural, and even consumer electronics industries. This is because EGHF is a very crucial and indispensable process for improved functional design and aesthetics of any glass product.

Another significant category includes monitor panels, whereby the use of EGHF is seen to increase the added value in the process of making these panels, especially in the aspect of developing liquid crystal displays (LCDs) and other types of displays. The properties of the chemical offer effective etching and cleaning of glass in order to derive perfect defect-free panels with outstanding optical clarity and robustness.

The global Electronic Grade Hydrofluoric Acid market, going forward, is set to remain bullish backed by manifold advances that can be observed in the electronics space as well as increased adoption of renewable energy and relentless evolution in display technologies. The demand for precision manufacturing remains indomitable, and thus the role of EGHF shall be irreplaceable.

REGIONAL ANALYSIS

The global electronic grade hydrofluoric acid market is getting enormous momentum due to its application in high-tech industries. Geographically, the market is segmented into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. Each region differs in terms of contribution towards the market based on its industrial capacities and technology.

North America subdivides into the U.S., Canada, and Mexico. The dominating market position is captured by the U.S. for several reasons, of which the main is that it houses a very strong industry related to semiconductors where electronic grade hydrofluoric acid has an array of uses during etching and cleaning steps of microelectronics manufacturing. Canada and Mexico also join in, although with less large stakes, and Mexico becomes increasingly an emerging player in electronics manufacturing.

It involves Europe, including the UK, Germany, France, Italy, and the Rest of Europe. Germany and the UK are expected to show high growth because these countries have majorly focused on innovation and technology. The well-established electronics sector in Germany and advanced research and development in the UK make both countries key consumers of Electronic Grade Hydrofluoric Acid. France and Italy also hold important positions, especially in terms of their developing semiconductor industries.

The Asia-Pacific region is further divided into India, China, Japan, South Korea, and the Rest of Asia-Pacific. The dominance of this market segment is completely taken over by China due to its huge electronics manufacturing industry. Japan and South Korea follow it in terms of revenue because of the availability of advanced semiconductor technologies along with high production capacity. India is growing as a key market with heavy investments across its electronics sector.

The rest of Asia-Pacific equally contributes, as countries like Taiwan and Singapore have electronic manufacturing industries that are quite specialized. In South America, the market consists of Brazil, Argentina, and the Rest of South America. Of these, Brazil drives this regional market to a large extent, due mainly to its booming electronics manufacturing industry. Argentina and other South American countries contribute to a smaller extent but have potential to grow with the development of their technological infrastructure.

The Middle East & Africa region is classified into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa. Among these, the GCC Countries, with their rising emphasis on diversifying their respective economies and developing their technology sectors, become one of the major consumers for electronic-grade hydrofluoric acid. Next in line, South Africa performs a vital role with its growing electronics industry. Countries like Egypt and others in this region are slowly growing markets virtue of investing in technological advancement.

The growth in the electronic grade hydrofluoric acid market will be mostly led by technology and an increasing demand from several geographies. Each region has varying technological and industrial strengths, making the outlook for the future quite promising. This diversified and increasing demand thus showcases the importance of electronic grade hydrofluoric acid in the global electronics industry.

COMPETITIVE PLAYERS

The global market for Electronic Grade Hydrofluoric Acid is expected to grow significantly in the near future due to increasing demand for high-quality electronic components and semiconductors. This special chemical is indispensible during the manufacture of semiconductors, which form the backbone of all modern devices in the electronic fields. With improving technology, more and more Electronic Grade Hydrofluoric Acid will be in demand, hence creating a competitive landscape among key players in the industry.

Market leaders in this industry include names such as Stella Chemifa Corp, FDAC, and Honeywell. The aforementioned companies are marked for their new mechanisms and incessant concern towards the quality of services and goods delivered by them. For instance, Stella Chemifa Corp has been continuously engaged in the development of their manufacturing process in order to cater to the ever-growing demand from electronic manufacturers for high-purity chemicals. Their running emphasis on research and development keeps them at the top in this sector.

Another prominent player, Honeywell, contributes its several years of chemical industry experience in manufacturing top-grade Electronic Grade Hydrofluoric Acid. Its global presence, together with high-tech, fully equipped plants, makes it a very formidable competitor. Similarly, Solvay builds trust with customers as a reliable supplier through a focus on green and technology development.

Other major players in this market are Morita and Sunlit Chemical. Morita Company is known for its quality control and has been witnessed to increase new technologies that have built the Company to be more efficient in production and quality of the product. Similarly, Sunlit Chemicals targets specific client needs, offering tailored solutions that guarantee performance in their many and varied applications.

Zhejiang Kaiheng Electronic Materials and Do-Fluoride Chemicals can be considered as major examples of companies that have shown rapid growth and market penetration. The companies mentioned above have rapidly responded to the changes in demand put forward by the electronic industry, thus maintaining the qualitative delivery of Electronic Grade Hydrofluoric Acid to their clients from numerous industries. In this way, they have scaled up operations efficiently to become major competitors in the market.

Other important industry participants include Suzhou Crystal Clear Chemical, Jiangyin Jianghua Microelectronics Materials Co., Ltd., Shaowu Fluoride, Shaowu Huaxin, Yingpeng Group, Sanmei, Otto Chemie Pvt. Ltd., and Lab Alley. What has distinguished the big players in this industry is essentially based on new techniques of production, customer care, or strategic partnerships.

In the future, with more and more companies beginning to realize that electronic-grade hydrofluoric acid has potential for substantial growth, the competition in the Electronic Grade Hydrofluoric Acid market can only rise further. Improving and ever-changing electronic technologies will continue to stimulate demand, thereby pushing key players toward innovation and capacity expansion. Companies focused on quality, sustainability, and customer-centric solution provision are destined to do well in this dynamic environment going forward.

Electronic Grade Hydrofluoric Acid Market Key Segments:

By Type

- UP Grade

- UP-S Grade

- UP-SS Grade

- EL Grade

By HF Concentration

- <49%

- >49%

By Application

- Integrated Circuit

- Solar Energy

- Glass Product

- Monitor Panel

- Other

- Total

Key Global Electronic Grade Hydrofluoric Acid Industry Players

- Stella Chemifa Corp

- FDAC

- Honeywell

- Solvay (Zhejiang Lansol)

- Morita

- Sunlit Chemical

- Zhejiang Kaiheng Electronic Materials

- Do-Fluoride Chemicals

- Suzhou Crystal Clear Chemical

- Jiangyin Jianghua Microelectronics Materials

- Shaowu Fluoride

- Shaowu Huaxin

- Yingpeng Group

- Sanmei

- Otto Chemie Pvt. Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252