Global Debt Financing Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

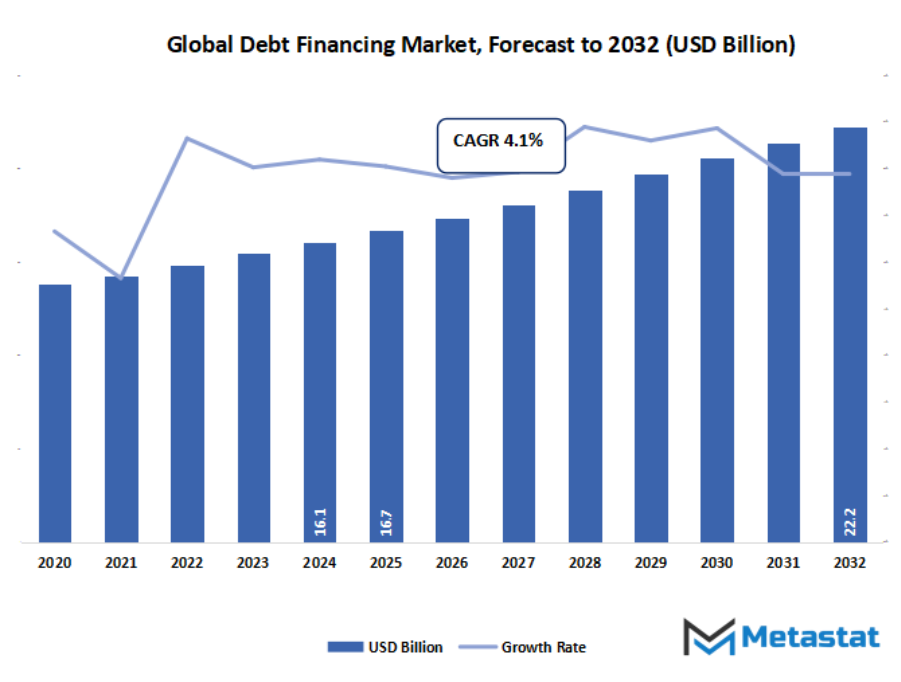

- The global debt financing market valued at approximately USD 16.7 Billion in 2025, growing at a CAGR of around 4.1% through 2032, with potential to exceed USD 22.2 Billion.

- Private account for a market share of 55.9% in 2024, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising infrastructure and corporate investment projects fueling demand for leveraged funding., Low global interest rate environment making debt more attractive for issuers.

- Opportunities include: Growing opportunity in green and sustainable debt instruments (green bonds, sustainability-linked loans) attracting ESG-focused investors.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Market Background & Overview

The global debt financing market and its industry will stand at a stage where financial decisions will carry deeper meaning than simple lending and borrowing. As organisations move through the economic uncertainty, debt won't be seen just as a way of satisfying short-term needs but as a structured approach that could shape long-term direction. Companies across numerous sectors will search for investment techniques a good way to assist them safeguard stability whilst permitting room for progress. This will pressure each lenders and debtors to negotiate with a lot extra warning, developing an surroundings in which clarity, accept as true with, and responsibility will suggest more than ever.

The structure of financing will shift as markets stretch across borders, inviting new participants who will bring their own expectations and standards in its wake. With such expansion, transparency will become a necessary premise, not only due to regulation but also because business will want to secure partners who understand the pressures they face. Tailored lending patterns will also rise in the industry, as firms will seek solutions mirroring their unique situations rather than accept uniform agreements.

Market Segmentation Analysis

The global debt financing market is mainly classified based on Sources, Type, Duration.

By Sources is further segmented into:

- Private

The future demand for private funding channels in the global debt financing market will represent the rise in interest from corporate borrowers for flexible structures and negotiated terms. Private deals will facilitate customized solutions molded around project scale, risk tolerance, and patterns of repayment, enabling broader financial flows across regional and international investment landscapes without rigid regulatory boundaries.

- Public

Public financing routes will be strengthened as governments and major institutions facilitate the need for more transparent debt structures based on well-established regimes of regulation. Public debt routes will widen participation from a broader set of investor segments, while stability will be facilitated in the global debt financing market based on process standardization, predictable regulation, and widely available information leading to long-term confidence in structured borrowing.

By Type the market is divided into:

- Bank loans

Bank-based lending in the global debt financing market will continue to play its role as a base credit channel for companies seeking structured borrowings underpinned by institutional evaluations, schedules for repayment, and collateral agreements. Conventional credit instruments would continue to be core for companies needing reliable finance backed by regulated mechanisms and predictable contractual arrangements.

- Bonds

The issuance of bonds will attract corporate and sovereign borrowers seeking large financing at market-driven pricing and through diversified investor pools. Bond activity in the global debt financing market will be beneficial in infrastructure expansion, strategic development goals, and capital-intensive programs with standardized instruments recognized across global exchanges and institutional platforms.

- Debenture

Debenture issuances will be extended to companies that need to source long-term capital without offering any tangible collateral. These instruments in the global debt financing market will enable companies to enhance their financial strength by attracting those types of investors who can rely on creditworthiness, operational strengths, and market reputation rather than asset-based guarantees.

- Bearer Bond

Bearer bond circulation will appeal to investors seeking transferable instruments with simplified ownership transfer. Future use within the global debt financing market will reflect selective demand from participants prioritizing mobility and discretion in financial dealings, while regulatory bodies maintain structured compliance requirements for safe and transparent handling of these instruments.

- Others

Other financing instruments, including hybrid notes, structured debt products, and region-specific lending tools, will add to market diversity. These solutions in the global debt financing market will help meet very specific borrower requirements via alternative structures that can enhance financial access, accommodate unconventional projects, and increase funding opportunities across different economic environments.

By Duration the market is further divided into:

- Short-Term

Short-term borrowings will underpin operational liquidity, working capital cycles, and time-sensitive financial undertakings. In the global debt financing market, short-duration instruments will attract those entities looking for rapid funding responses to seasonal demands, procurement needs, or immediate business activities that require rapid access to structured financial support with defined repayment expectations.

- Long-Term

Long-term debt alternatives will facilitate infrastructural establishment, expansion initiatives, and elaborate development proposals needing longer repayment periods. The global debt financing market will provide long tenure structures matched with multiyear goals, giving the borrower stability, predictable interest obligations, and continued financial support for strategic growth in regional and international sectors.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$16.7 Billion |

|

Market Size by 2032 |

$22.2 Billion |

|

Growth Rate from 2025 to 2032 |

4.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

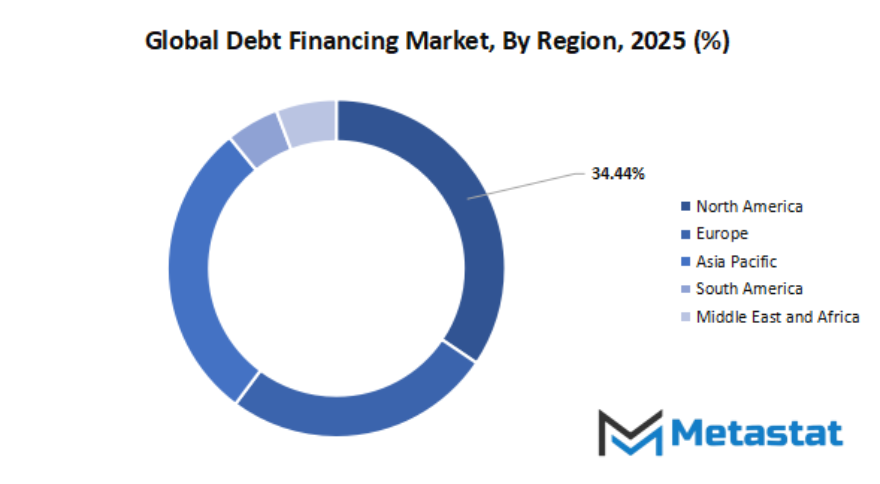

- Based on geography, the global debt financing market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Market Dynamics

Growth Drivers:

Rising infrastructure and corporate investment projects fuel demand for leveraged funding.

Large-scale construction, transport upgrades, and business expansion are in a phase of steady expansion and will continue to push borrowers toward structured lending solutions. The increased adoption of sophisticated financing models will facilitate access to long-term capital, which will persuade developers and companies toward reliance on the global debt financing market for faster project movement and greater economic activity.

Low global interest rate environment making debt more attractive for issuers.

A favourable rate cycle would support long-term venture plans of companies by lowering borrowing costs and widening access to flexible funding. Easier capital flow will encourage issuers to extend debt portfolios and secure future liquidity, thereby allowing the global debt financing market to support growth plans across diverse economic sectors.

Restraints & Challenges:

High default risk and credit pressure in volatile economic conditions.

Turbulent financial conditions will spark concern for repayment, calling for re-evaluation of lender strength and stability of future cash flows. Greater uncertainty requires extra stringent lending requirements, including caution to the global debt financing market and shaping how institutions measure ability to repay in unpredictable enterprise cycles.

Regulatory modifications and increased scrutiny on corporate leverage/debt servicing.

Future coverage changes will similarly compel economic establishments to more carefully monitor leverage, risk exposure, and long-time period debt structures. Stricter compliance requirements will effect how funding is structured and, over the years, reshape the global debt financing market as agencies conform their reporting practices and ensure transparency to fulfill the improved governance necessities.

Opportunities:

Growing opportunity in green and sustainable debt devices: inexperienced bonds and sustainability-related loans which might be attracting ESG-focused traders.

Future transition plans will propel organizations closer to making clean-energy commitments that are turning into more and more aided with the aid of sustainable financing gear. Growing interest from responsible traders will open up avenues for funding models connected to environmental targets and long-term social effect initiatives by using transferring the global debt financing market toward climate-aligned tasks.

Competitive Landscape & Strategic Insights

The industry represents a broad dispersion of well-established international institutions operating amidst rising regional players who catch attention with sustained activity. The presence of long-standing financial groups will continue to mold the way funds will flow, the way risks are managed, and the way new techniques of raising capital will emerge in the global debt financing market. Each of the participants will strive to establish a stronger position by enhancing the services, expanding the network, and responding to the changing borrowing requirements across different sectors. This combination of mature and new participants will keep the market active and driven by continuous adjustments in lending behaviour.

Major names consist of JPMorgan Chase & Co. (J.P. Morgan), Bank of America Corporation (BofA Securities), Citigroup Inc. (Citi), The Goldman Sachs Group, Inc., Morgan Stanley, Barclays PLC, HSBC Holdings p.C, BNP Paribas SA, Deutsche Bank AG, UBS Group AG, and Wells Fargo & Company, so that it will continue to shape the course that debt activities round the world take. These agencies will leverage tremendous enjoy, access to a big client base, and strong analytical preparations to provide financing solutions that higher meet the shifting desires of companies and establishments. Their scale permits them to handle huge projects, move-border deals, and long-time period lending desires.

In addition to these traditional entities, investment and asset management groups like Blackstone Inc. (Blackstone Credit & Insurance), Ares Management Corporation, and Apollo Global Management Inc. will continue to add depth to the global debt financing market. These groups will introduce a different dimension with structured credit products, private lending alternatives, and bespoke debt solutions for companies looking beyond conventional banking channels. Their activity will introduce flexibility into the market and give borrowers other ways of raising funds without reliance solely on mainstream lenders.

This mix of solid, global banks and active investment managers will determine how competition progresses in the global debt financing market. The greater exposure to different sources of funds will facilitate borrowers of diverse sizes, drive innovation in lending practices, and challenge market participants to develop strategies for long-term success. As the financial requirements increase due to expansion in all sectors, each participant will strive to achieve better placement by enhancing services, thoroughly analyzing risks, and adjusting to changes in demand, thus enabling the continuity of the market with balanced participation.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 16.7 Billion in 2025 to over USD 22.2 Billion by 2032. Debt Financing will maintain dominance but face growing competition from emerging formats.

At the same time, investors will look beyond short-term advantages. They will measure the strength of a company by its behaviour under stress and by its commitment to honour obligations even when external conditions may turn unpredictable. In the coming years, decision-makers will not simply raise funds; they will build financial narratives that speak of responsibility and foresight.

Report Coverage

This research report categorizes the Debt Financing market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Debt Financing market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Debt Financing market.

Debt Financing Market Key Segments:

By Sources

- Private

- Public

By Type

- Bank loans

- Bonds

- Debenture

- Bearer bond

- Others

By Duration

- Short-Term

- Long-Term

Key Global Debt Financing Industry Players

- JPMorgan Chase & Co. (J.P. Morgan)

- Bank of America Corporation (BofA Securities)

- Citigroup Inc. (Citi)

- The Goldman Sachs Group, Inc.

- Morgan Stanley

- Barclays PLC

- HSBC Holdings plc

- BNP Paribas SA

- Deutsche Bank AG

- UBS Group AG

- Wells Fargo & Company

- Blackstone Inc. (Blackstone Credit & Insurance)

- Ares Management Corporation

- Apollo Global Management Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383