Global Customs Brokerage Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global customs brokerage market will keep defining the future of global trade by filling the difference between intricate regulatory environments and flawless cross-border trade. Working inside the international logistics and supply chain sector, it will be an essential facilitator for agencies seeking to grow their presence throughout diverse markets. With the ongoing globalization of exchange, agencies will be increasingly depending on powerful customs brokerage offerings to help compliance, timely documentation, and stable passage of goods throughout borders.

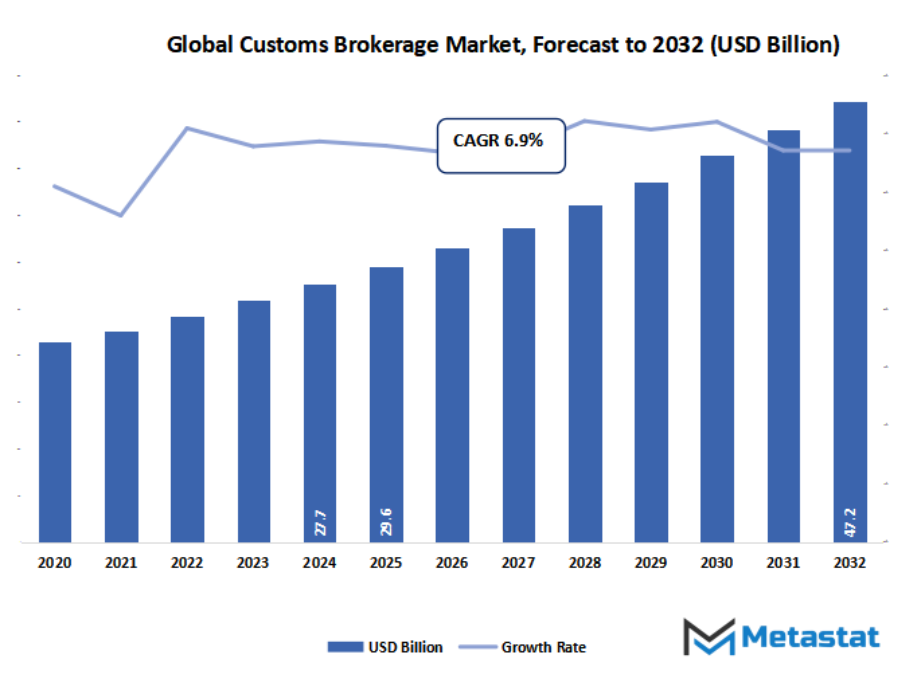

- Global customs brokerage market valued at approximately USD 29.6 Billion in 2025, growing at a CAGR of around 6.9% through 2032, with potential to exceed USD 47.2 Billion.

- Import Customs Brokerage account for nearly 33.4% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising international trade and cross-border e-commerce activities., Increasing demand for efficient and compliant global supply chain operations.

- Opportunities include Integration of digital technologies and automation in customs clearance processes.

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

How is the growing complexity of international exchange rules reshaping the future of the market? Could the upward thrust of automation and digital systems disrupt conventional brokerage fashions, creating new opportunities for innovation? As worldwide supply chains face uncertainty, will customs brokers evolve rapid sufficient to fulfill the developing call for for performance and transparency?

Over the next few years, the enterprise will transition far from traditional customs clearance into virtual transformation and complex change control services. The mixture of automation and AI will reduce human errors and simplify clearance methods, assisting importers and exporters in maneuvering the an increasing number of strict customs policies with precision. As worldwide trade regulations evolve, brokerage organizations will adjust themselves through imparting greater personalised services tailored to the various industries, from production and retail to prescription drugs and era.

The global customs brokerage market can even see a trend towards transparency and sustainability. As consciousness of ethical alternate practice will increase, companies will be specializing in companions who help them power responsible sourcing and adherence to inexperienced standards. The use of data-driven structures will permit real-time monitoring and analytics, giving customers better control over their cargo and supply chain choice-making.

Market Segmentation Analysis

The global customs brokerage market is mainly classified based on Service Type, Mode of Transport, End-User.

By Service Type is further segmented into:

- Import Customs Brokerage: The global customs brokerage market can be characterized by means of extensive advancement in import customs brokerage as international locations beef up exchange family members. Sophisticated documentation systems and electronic filing mechanisms will make imports less complicated, less time-ingesting. Increasing trade alliances amongst geographical zones will in addition boom transparency and efficiency in worldwide import control, making sure smoother go-border items movement.

- Export Customs Brokerage: The market will grow its export customs brokerage business with the growth in global alternate agreements and electronic compliance systems. Automation and blockchain era will make export documentation smoother, bearing in mind faster customs clearance. Growing volumes of exports of patron and business merchandise will drive the adoption of trusted brokerage offerings globally.

- Consulting Services: In the market, consultative services will play a essential position in navigating agencies via tricky trade policies. Enterprises will depend upon professional experts for risk management, documentation, and tariff classification. This will assist worldwide entities in adapting to transferring customs legal guidelines and optimizing deliver chain prices and compliance tactics.

- Trade Management & Compliance: The market will expand its exchange management and compliance phase as governments implement stricter regulations and digital tracking measures. Businesses will use clever compliance software to reduce the danger of non-compliance. Integrated trade control answer call for will upward push, making sure transparency in go-border transactions.

- Customs Clearance Services: In the market, customs clearance services will broaden at a excessive rate as there are extra global cargo volumes. Customs inspection and clearance pace will enhance with the usage of synthetic intelligence and predictive analytics. Global companies may be able to control goods movement efficaciously even as following international trade standards through such innovation.

- Others: Auxiliary service types inside the global customs brokerage market will also encompass shipment monitoring, regulatory advisory, and freight documentation. Future improvement will rely upon combining these auxiliary services with digital exchange platforms. Companies will respect technology-based totally bendy solutions that decorate visibility and coordination across global logistics operations.

By Mode of Transport the market is divided into:

- Air: The air delivery thing of the global customs brokerage market will grow with growing call for for immediate pass-border shipping. Sophisticated customs automation and electronic airway bill structures will limit clearance time. Global freight forwarders will rely notably on air brokerage answers to deal successfully with high-price shipments and time-sensitive shipments.

- Sea: In the market, maritime delivery will remain essential on the back of value savings for bulk shipments. Enhanced port facilities and automated customs documentation systems will enable swifter clearance. Bundling of maritime logistics information with brokerage structures will improve worldwide change drift predictability and accuracy.

- Land (Truck/Rail): The market will solidify its land delivery section because of growing alternate amongst neighboring international locations. Electronic statistics interchange (EDI) structures will allow actual-time border clearance for rail and truck shipments. Regional cooperation will decorate logistics synchronization and facilitate easy alternate motion between continents.

- Others (Pipelines, Multimodal, Inland Waterways): In the global customs brokerage market, pipelines, multimodal, and inland waterways will see gradual advancement. Multimodal logistics facilities may be greater investment-pleasant, using incorporated solutions for customs. Blockchain and automation will force multiplied transparency and traceability for those alternative modes of delivery.

By End-User the market is further divided into:

- Manufacturing: The global customs brokerage market will enlarge inside the production industry as companies growth global manufacturing bases. Simplified customs approaches will reduce delays on raw cloth imports and finished goods exports. Automation will increase performance in coping with move-border change documentation for manufacturing supply chains.

- Retail & E-trade: Retail and e-trade could be widespread drivers of the market as a result of online buying growth globally. Customs agents will put into effect real-time monitoring techniques and automated compliance verification to address extended parcel volumes. Streamlined brokerage solutions will make certain quicker shipping schedules and customer pleasure.

- Automotive: The car industry in the market will trade as international car change expands. Advanced electronic customs systems will enable the flow of additives and completed motors among regions. The emphasis will be placed on minimizing clearance put off and facilitating consistent compliance with worldwide automobile alternate policies.

- Chemicals & Materials: In the market, the chemical compounds and substances industry will look to brokerage competence to manipulate safety regulation and export rules. Computerized compliance systems will help in imparting the secure and well timed movement of dangerous commodities. These types of solutions will maintain global trade effectiveness whilst adhering to environmental and protection needs.

- Food & Beverage: The market will witness huge tendencies within the meals and drinks enterprise with growing call for for international meals exchange. Simplified customs documentation for perishable products will reduce risks of spoilage. Sophisticated bloodless-chain tracking and digital clearance mechanisms will further augment operational performance in global meals deliver chains.

- Pharmaceuticals & Healthcare: The market will evolve within the healthcare and pharmaceuticals enterprise with quick clearance mechanisms for sensitive to heat objects and high-cost merchandise. Digital customs solutions will provide safety and accuracy. Global cooperation will facilitate greater handy exchange of clinical gadgets, vaccines, and device throughout worldwide borders.

- Aerospace: In the market, the aerospace enterprise will depend upon powerful brokerage offerings for defense-associated and high-price issue shipments. Accuracy in documentation and regulatory compliance may be crucial. Blockchain and AI-pushed customs tracking adoption will decorate global aerospace deliver chain visibility.

- Consumer Electronics: The customer electronics market in the market will grow with growing international trade in devices and digital gear. Automated brokerage systems will enable faster processing of imports and exports. Improved virtual integration will offer assured compliance with tariff systems and customs requirements across various areas.

- Others: Other give up-customers for the global customs brokerage market will be industries like textiles, power, and logistics provider providers. The emphasis will be on optimizing data-driven customs operations for enhancing trade visibility. Smart brokerage solutions integration will enable these industries to survive changing global trade environments effectively.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$29.6 Billion |

|

Market Size by 2032 |

$47.2 Billion |

|

Growth Rate from 2025 to 2032 |

6.9% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

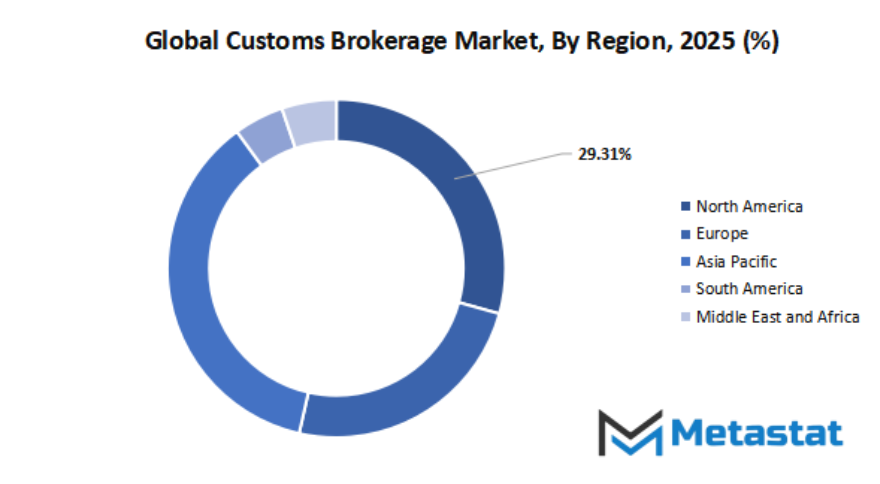

Geographic Dynamics

Based on geography, the global customs brokerage market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Competitive Landscape & Strategic Insights

The global customs brokerage market is also responsible for facilitating the free flow of international trade by assisting businesses in dealing with intricate customs procedures and regulatory compliance around the world. With global trade growing larger, there will be increasing demand for third-party customs brokerage services that can assist companies in streamlining documentation, duties, and compliance. The economy is being affected by the rising cross-border movement of products, growing online trade, and tougher government regulations that demand professional help to prevent delays and fines. Companies globally rely on experienced customs brokers that ensure goods pass through multiple customs platforms with ease while reducing risks.

This market is characterized by the presence of both established global operators and emergent regional players competing to offer effective, technology-based, and compliant solutions. A few of the pinnacle corporations driving the industry are A.N. Deringer, Inc., A.P. Moller – Maersk (Maersk Customs/Trade Services), Agility, AIT Worldwide Logistics, APL Logistics Ltd., BDP International, Bolloré Logistics, and C.H. Robinson Worldwide, Inc. These companies have set up amazing reputations for imparting complete customs management services that cater to small organizations as well as mass producers. Their proficiency now not handiest encompasses clearing products thru customs however also advisory services to assist customers comply with evolving alternate guidelines and tariffs across diverse countries.

Meanwhile, some of the agencies which include CEVA Logistics, CJ Logistics Corporation, DB Schenker, Deutsche Post DHL Group, Expeditors International of Washington, Inc., FedEx Trade Networks (FedEx), Flexport, and Geodis are still improving their presence by way of enforcing era of their operations. Automation, actual-time tracking, and virtual documentation are revolutionizing the way customs methods are controlled, allowing businesses to import-export easily. These tendencies imply a pass towards faster, greater transparent trade operations wherein virtual offerings limit errors and human delays. As logistics networks emerge as extra intelligent, the function of customs agents turns into ever extra crucial to assist corporations in adjusting to increasingly complex global exchange environments.

In addition, regional and global leaders like Hellmann Worldwide Logistics, Kerry Logistics, Kintetsu World Express, Kuehne + Nagel, Livingston International, Nippon Express Holdings, Rhenus Logistics, Sinotrans, United Parcel Service (UPS) / UPS Supply Chain Solutions, XPO Logistics, and Yusen Logistics are also enhancing their abilities by collaborating with others and by innovation. Their solutions tend to center around efficiency gains, cost savings, and the value-added provision of activities like compliance training, tariff optimisation, and customs consulting. Through the provision of combined logistics and brokerage services, these companies try to streamline the transportation of goods while enhancing client satisfaction and confidence.

In the forthcoming years, the global customs brokerage market will keep on playing a critical role in facilitating international trade and supply chain processes. With globalisation reinforcing relationships amongst nations, and digitization transforming logistics strategies, the marketplace shall witness extra interplay amongst governments, brokers, and generation providers. As trade routes increase and regulations emerge as greater complicated, customs agents shall keep to play the pivotal function in ensuring that merchandise float easily and lawfully throughout borders, promoting worldwide commercial enterprise improvement and monetary balance.

Market Risks & Opportunities

Restraints & Challenges:

- Complex and varying customs regulations across different countries. - The global customs brokerage market will have to persevere against a variety of different regulatory systems in different countries. Countries have different import and export processes, which make it complicated to manage global trade. Such discrepancies tend to lead to delays, compliance, and more documentation work. Future development will rely on harmonizing policy and streamlining global trade laws.

- High operational costs and administrative burden for small businesses. - A second significant restraint across the market will come from the administrative and financial burden imposed on small businesses. Subscribing to compliance with customs paperwork, tariffs, and inspections often calls for most important capital expenditure in generation and information. This acts as a barrier to entry for smaller organizations, who are unable to compete internationally. Affordable virtual solutions and shared service structures could be crucial to overcoming these troubles.

Opportunities:

Integration of digital technologies and automation in customs clearance processes. - The destiny of the global customs brokerage market will depend plenty on the usage of automation, artificial intelligence, and blockchain technology. These technology will automate customs approaches, reduce mistakes, and speed up clearance times. Better information analysis and virtual tracing will further beautify transparency and security in global alternate networks. The intermingling of such improvements will propel traditional brokerage groups into powerful, technology-based totally ecosystems that facilitate smoother pass-border exchange.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 29.6 Billion in 2025 to over USD 47.2 Billion by 2032. Customs Brokerage will maintain dominance but face growing competition from emerging formats.

In the larger view, the market will be more than an intermediary for trade—it will become a strategic ally that allows countries and businesses to engage productively in international commerce. The global customs brokerage market will therefore reimagine its future horizon by combining technology, rule of law, and trust to build a more integrated and streamlined trading platform.

Report Coverage

This research report categorizes the global customs brokerage market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global customs brokerage market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global customs brokerage market.

Customs Brokerage Market Key Segments:

By Service Type

- Import Customs Brokerage

- Export Customs Brokerage

- Consulting Services

- Trade Management & Compliance

- Customs Clearance Services

- Others

By Mode of Transport

- Air

- Sea

- Land (Truck/Rail)

- Others (Pipelines, Multimodal, Inland Waterways)

By End-User

- Manufacturing

- Retail & E-commerce

- Automotive

- Chemicals & Materials

- Food & Beverage

- Pharmaceuticals & Healthcare

- Aerospace

- Consumer Electronics

- Others

Key Global Customs Brokerage Industry Players

- A.N. Deringer, Inc.

- A.P. Moller – Maersk (Maersk Customs/Trade Services)

- Agility

- AIT Worldwide Logistics

- APL Logistics Ltd.

- BDP International

- Bolloré Logistics

- C.H. Robinson Worldwide, Inc.

- CEVA Logistics

- CJ Logistics Corporation

- DB Schenker

- Deutsche Post DHL Group

- DHL Global Forwarding (Deutsche Post DHL Group)

- Expeditors International of Washington, Inc.

- FedEx Trade Networks (FedEx)

- Flexport

- Geodis

- Hellmann Worldwide Logistics

- Kerry Logistics

- Kintetsu World Express

- Kuehne + Nagel

- Livingston International

- Nippon Express Holdings

- Rhenus Logistics

- Sinotrans

- United Parcel Service (UPS) / UPS Supply Chain Solutions

- XPO Logistics

- Yusen Logistics

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383