MARKET OVERVIEW

The Global Contract Packaging market is set for more than just static traditional packaging functions. It will choose to embrace new technologies with sustainable practices. Automation and digitalization to enhance performance will be at the very heart of the market in the future. Such advances in machinery, data-driven systems, and robotics will siphon more employees from manual labor into production, thus improving quality assurance and traceability. The market would moreover see a heightened interest in green packaging materials and methods, largely propelled by regulatory pressures and the growing consumer-awareness drive.

The very fabric of Modern Supply Chain lies with Global Contract Packaging Market and its industry. Bespoke packages are designed and expected to suit individual businesses in all sectors. This market allows contracts for outsourcing packaging operations from third parties that specialize in providing this service efficiently and flexibly. Companies tend to maneuver into hiring contract packaging experts for packaging management, leaving them to concentrate on optimizing their core business processes. The industry serves the particular needs of multiple segments like pharmaceuticals, food and beverages, consumer products, electronics, etc., with custom packaging services enabling those given particular product requirements and regulatory standards.

As industries grow and product life cycles become even more dynamic, the Global Contract Packaging market will keep on transforming according to the demands of the changing businesses. This market has been defined by its propensity to have a wide range of services, including primary and secondary packaging, labeling, assembly, and logistics support. These attributes facilitate scalability and economic viability in terms of production volume fluctuations and intricate supply chain issues. Enhanced efficiency in business operations and, therefore, the optimal handling of products until reaching the hands of final consumers can be brought about through partnered operation between businesses and contract packaging providers.

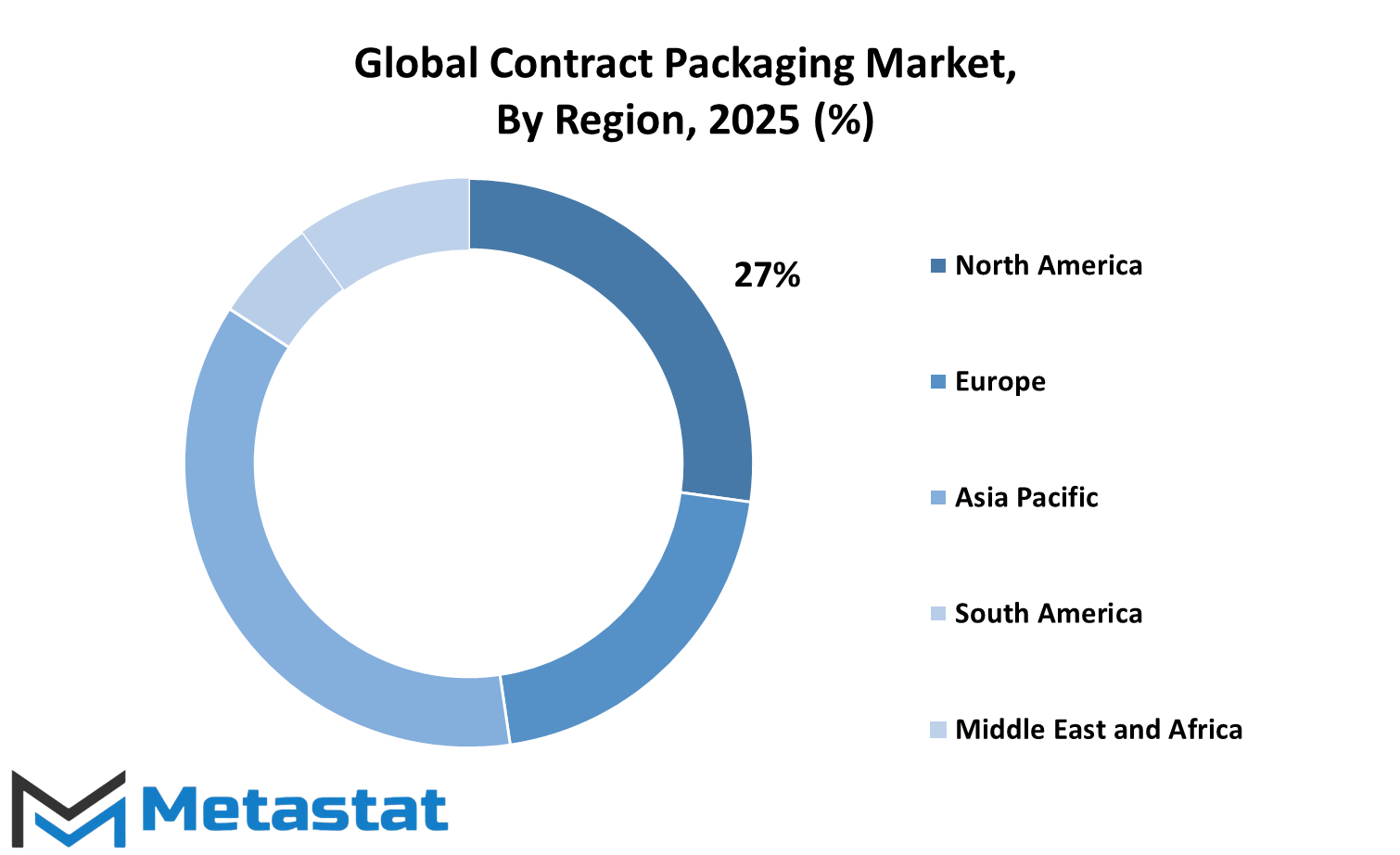

The reach of the Global Contract Packaging market extends across different geographies, ranging from North America to Europe and Asia-Pacific. Each has its internal characteristic pattern shaped by the degree of industrialization, regulatory environments, and consumer preferences. However, North America is expected to continue playing a significant role due to increased technological advancements and well-established supply chains; the expensive manufacturing infrastructure and industrialization in the Asia-Pacific, as well as the constantly evolving e-commerce landscape, would contribute to an increased demand for contract packaging services in this region. Sustainability and increasingly strict quality standards by various regions in Europe would also play a crucial part in shaping how the market plays out.

In the coming years, the market will face challenges pertaining to regulatory compliance, cost containment, and disruptions in the supply chain, but its ability to offer specialized know-how and flexible services will make it resilient. In this way, companies that work with a contract packaging provider could relieve themselves from a burden while devoting time to innovation and market growth. The evolvement of this market will certainly reflect the broader practical evolutions in global manufacturing and distribution, hence demonstrating its importance to the entire web of commerce. .

This global contract packaging market thus increases and continues to change in the industry it represents, ultimately shaping modern business practices. This support will help industries use more consumer-friendly, easier-to-manage packaging solutions to meet the public's expectations for and, in turn, navigate complex supply chains. That future will be driven by technological developments, ecological responsibilities, and the quest for operational performance about a competitive world and, to this end, keeping relevant to the industry.

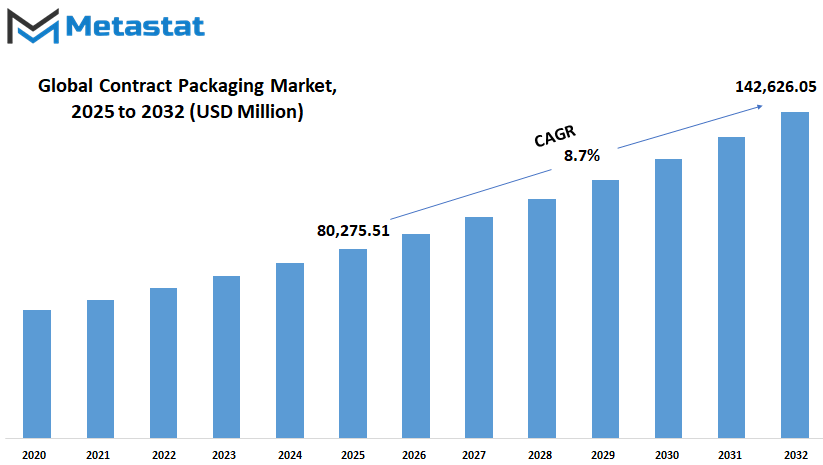

Global Contract Packaging market is estimated to reach $142,626.05 Million by 2032; growing at a CAGR of 8.7% from 2025 to 2032.

GROWTH FACTORS

The Global Contract Packaging market is forecasted to grow tremendously in the coming years. As the operations of companies around the industries keep changing with an ever-increasing pace, the requirement for efficient and cost-effective packaging solutions has come up as very important. Companies have been increasingly activating the contract packaging providers to pack for them so that they may concentrate instead on their core business. One of the major driving factors for the growth of this market, therefore, is this shift toward outsourcing non-core activities. By handing over the packaging job to professionals, companies are able to streamline their internal operations and cost-effective expenditure and make larger productive gains.

A rise in the focus on cost minimization and operational efficiency has become yet another significant aspect contributing to the growth of the Global Contract Packaging market. The huge competition piled with ever-increasing production costs are pushing these companies to seek novel ways to optimize their operations. Using the expertise and advanced technology of contract packaging providers, companies can scale packaging solutions according to production needs and schedules without heavily investing in infrastructure, equipment, and labor. This not only reduces costs, but increases flexibility, enabling businesses to respond rapidly to changing market conditions.

Notwithstanding the positive outlook of the market, some challenges still arise. Quality control remains an issue of major concern, for companies have to inspect the packaging assigned to a third party in order to resolve whether it meets the standards they have set and to project their brand image. On the other hand, irregular quality can damage products, upset customers, and incur losses. Therefore, the enforcement of tougher quality checks and the formation of effective communication between companies and contract packaging providers is integral to the sustained growth of this market.

The other challenge pertaining to the Global Contract Packaging market is regulatory compliance. Various regions apply different packaging regulations, especially in the food, pharmaceutical, and cosmetic industries. Contract packaging providers ought to remain up-to-date on these requirements and guarantee that their practices comport with local and international standards. Inability to comply with regulatory guidelines may lead to legal proceedings, recall of products, and damage to a company's image.

An ensuing trend is the imminent promise of the pharmaceutical contract packaging markets in which growth opportunities arise. The burgeoning demand for drugs, coupled with increasing complexity in pharmaceutical products, has triggered the demand for specialized packaging solutions. Contract packaging companies armed with advanced technology and knowledgeable in the industry will highly be relied upon to fulfill these demands. Their ability to provide customized, safe, and compliant packaging solutions will be critical in supporting the growth of the pharmaceutical sector.

MARKET SEGMENTATION

By Packaging Type

The Global Contract Packaging market is predicted to flourish with more demand from almost every corner of the world. All industries are now setting sights on getting better packaging mechanisms that can function both efficiently and flexibly. In a situation where businesses are looking for ways to cut supply chain costs and meet rising demands for high-quality packaged products, contract packaging offers a practical means for achieving this by outsourcing the packaging needs to specialized external service providers. This method allows businesses to keep their core activities while ensuring that consumers receive their products in professional packaging. The presence of globalization and the expansion of e-commerce will only raise the need for streamlined packaging processes.

The Global Contract Packaging market is expected to grow due to the multiple packaging types it offers. These packaging solutions are generally categorized into three: primary packaging, secondary packaging, and tertiary packaging. Each of these plays a specific role in ensuring that the products are well protected, but most importantly, that they are presented attractive and up to standard with the industry guidelines.

It is the primary packaging that is first contacted by the entity product. As the first stage, such protection is essentially against the item. It preserves the quality of the item. Such packaging is applicable to industries like pharmaceuticals, food, and personal care. Safety and hygiene are prioritized in such packaging. With the emergence of consumers' awareness and norms, innovative and sustainable primary packaging will have a growing demand.

On the other hand, secondary packaging is intended to bundle single products for more convenient handling or conveyance. This includes boxes, cartons, and wraps that tie up numerous units of a product together. It is most useful for product branding and information, as it gives space for labels, instructions, and promotional details. The basis for secondary packaging design and functionality becomes even more important, as businesses look for ways to stand out in competition.

Tertiary packaging is meant for the securing, economical, or good transportation of huge quantities of products. It includes bulk containers, pallets, and shrink wraps, which all go according to shipping and storage. The tertiary packaging will continue being important in protecting goods during transit as global trade increases and logistics become more complicated. Most likely, new packaging technologies and materials will lead this segment in innovation, robustness, and sustainability.

The global contract packaging industry, though, will continue to evolve toward becoming more rapid and least expensive. Automation, smart packaging, and ecological fabric will be the industry drivers to shape the capabilities of future packaging. Those who embrace these renewals will prove to have a better standing in the next global-changing markets.

By Service Type

The Global Contract Packaging market has a bright future, with a highly promising growth factor expected to be related to the diversified demand for efficient, flexible, and cost-effective packaging solutions. Businesses are work toward such increased expansion worldwide, making packaging service an even more important aspect of their offerings. Companies are looking for those that can specifically ensure that their packaging processes are well done, allowing the products to reach consumers in perfect condition. With this, the market is pushed towards innovation and better delivery.

Among the major attributes covered within the Global Contract Packaging market is another aspect that mentions the packaging design concept. Consumer preferences usually change with time, hence requiring businesses to adopt unique and functional packaging design ideas to counter competition on the shelves. The right design does not only tangibly catch the eye, but also plays a part in product protection and usability.

The companies that will then have contract designs the packaging will probably have employed advanced design instruments and technology, working hand-in-hand with brands in developing customized and functional packaging ideas. Clearly, these designs will also carry the trends of sustainability, using eco-friendly materials and reducing the use of excess packaging to entice environmentally conscious consumers.

Material sourcing is yet another crucial component that would mold the and shape future of the market. More complex the supply chains become, easy procurement of quality materials for competitive pricing will place packing companies at a better advantage. Years to come probably will witness a shift toward more sustainable materials, like biodegradable plastics and recyclable paper. By this ensured reliable material sourcing contract packaging firms will enable businesses to maintain quality on a constant flow while meeting regulatory standards and environmental goals.

The assembly and Packaging services will, therefore, keep dominating the growths of the market. Efficient assembly processes always lead products to package them at the right speeds without hampering demand. Increasing deployment of machinery-assisted automatic assembly will speed up production and maintain high quality. This concept will suit the flexibility and scalability that contract packaging companies will achieve to meet different products and volumes.

Labeling and branding will capture the major share of the profit creating areas where businesses work to make brand identities strong and recognizable. Attractive and responsive labels will significantly create awareness among consumers by standing out from others and offering critical information about the product. The future may likely witness a more integrated mobile penetration into the Global Contract Packaging market through smart labels carrying QR codes or known as Near Field Communication (NFC) technology, thus enabling the product to be interactive and more transparent. This initiation would also go a long way to strengthen connecting brands with consumers by increasing trust and engagement.

By Material

As the contract packaging market plays a significant role in shaping the future of industries across the globe, demand for specialized packaging solutions will only set to grow. Packaging services have been contracted out to experts providing tailored solutions and helping companies save time, money, and retain quality. Flexibility, sustainability, and cutting-edge technology in packing methodologies will become major growth drivers for this subset.

Raw materials, i.e., the variety of materials used for packaging, will be a key factor in determining the industry's future. Meshed in materials, the market will be sub-divided into plastic, metal, glass, paper, and paperboard. Each of these materials has different merits, thus continues to weigh in on the evolution of packaging in varied ways. Plastic has long been a versatile contender owing to its durability and light weight whilst maintaining cost-effectiveness.

With advancements in technology, the emergence of environmentally safe and biodegradable plastic will instead address the foremost environmental concerns and therefore foster the sustainability of plastic packaging. The further enhancement of the recycling abilities and the safety of plastic packaging may be an investment that companies are interested in, thus branding renown sectors with plastics.

Metal packaging with strength for product preservation will remain the key to the market, especially for food and pharmaceutical applications. Metal containers are generally not only great for preventing interruptive contaminants from reaching products but also serve to prolong shelf life, which will also keep them in demand. Lightweight metals and recyclable innovations will also drive the future of metal packaging along with sustainability.

Glass packaging will continue to prove alluring for marketers due to its premium views and also its non-reactive properties. Glass is associated with high-end products, therefore quite preferred in the beverage, cosmetics, and pharmaceutical industries. These challenges will nevertheless be met through innovations in lightweight glass as well as production technologies. Increasingly environmentally friendlier packaging requirements will also solifiy the impect of glass due to its recyclability.

Paper and paperboard are on the rise as they fit perfectly with the global shift towards sustainable packaging. They stand as environmentally responsible offerings due to their biodegradable characteristics and easiness of recycling. The industry will explore innovative designs for paper-based packaging that retain strength and durability while lessening environmental life cycle impacts. Paper and paperboard are poised to play an even greater role in the future of contract packaging due to their cost-competitive and environmentally friendly characteristics.

By End-User

The Global Contract Packaging market is expected to witness a monumental increase over the next few years; the factors that will lead to this market growth are the need for better efficiency, cost-effective packaging solutions from all industries acting towards production. Companies across the world now opt for contract packaging services to reduce their packaging costs and instead focus on the core processes of production. Contract packing helps a company operate on a leaner basis and removes redundancy in their operations by streamlining supply chains.

This, ultimately, helps make the company more flexible to market changes and customer demands. With technology rapidly advancing and the need for innovation in packaging solutions, the Global Contract Packaging market is going to be seen as an industry preparing for expansion and transformation.

The food and beverage industry is primarily responsible for the growth of this market. As people become more and more comfortable and environmentally aware, packaging would need to be in accordance with their new needs. For example, contract packers are starting to hospitalize the use of green materials, seals, and attractive designs that help maintain the quality of the product and add more value to customers' experiences. These include the rise of online food delivery services as well as e-commerce, which call for strong and efficient packaging so that the products reach fresh and undamaged during their travel.

The Global Contract Packaging market also depends on one of the most significant health care sectors whereby the demand for medical products is rising; very strict rules are laying down the fast stringent delivery standards necessary for precise and safe packaging. Contract packaging companies spend millions of dollars on the latest technologies to ensure that their products comply with industry standards for safety and application. Some examples of innovations that are gaining importance in this area are child protection, tamper-proof, and temperature-sensitive packaging.

Packaged household goods, automotive and industrial production, personal care and cosmetics: packaging for them goes beyond merely preventing their damage. With growing demands for unique and aesthetically pleasing packages, contract packers come to the aid of companies through imaginative designs, custom shapes, and state-of-the-art materials, enabling the brand to be recognized in the market. High traction is also received due to the demand for recyclable and sustainable forms of packaging that drives the innovation of selection and production processes within the industry.

Household goods, together with the automotive and industries, have contributed towards the market in growth. These market segments have different packaging designs that can be used under very harsh conditions for preserving or maintaining product integrity. Right from the product development state, contract packaging services develop tailor made solutions along the entire life cycle of the product, thus providing efficient handling and logistics support to improve supply chain efficiency.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$80,275.51 million |

|

Market Size by 2032 |

$142,626.05 Million |

|

Growth Rate from 2025 to 2032 |

8.7% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The worldwide market for contract packaging has a lot in store for the years to come, as it will be mainly affected by changing consumer behaviors, innovation, and increased efficiency in supply chains. The call for specialized contract packaging will keep growing as most industries across the globe are optimizing their packaging processes. The industry will also grow in response to the emergent sectors, such as food and beverages, pharmaceuticals, cosmetics, and fast-moving consumer goods, wherein the role of reliable, state-of-the-art packaging solutions remains paramount.

Continents in the world represent the global contract packaging market as a share of growing regions. The market dynamics of each region contribute to the global level in a myriad of ways. Benefiting from strong industrial infrastructures and high consumer demands, North America houses countries such as the U.S., Canada, and Mexico. The U.S. clearly dominates because of its advanced manufacturing capacity coupled with the number of companies that majorly depend on third-party services to streamline operations. Both Canada and Mexico are expected to experience the same kind of growth, bolstered by increasing cross-border commerce and need for efficient packaging solutions to facilitate logistics and distribution networks.

Europe remains a crucial region in the global contract packaging market, characterized by innovation and strict quality standards. The UK, Germany, France, and Italy rank high among those forward with their well-established industries and a great concern with more sustainable packaging practices. Consumer demands for and incentives toward eco-friendly, specialized packaging solutions compel companies in that region toward advanced technologies and collaborations with contract packaging providers with niche expertise. It will likely go on to shape the growth of this market in Europe, thus creating avenues for businesses to improve their product presentation and efficiency along the supply chain.

Asia-Pacific will be the fastest-growing area, according to this report. This growth will be the effect of India's, China's, Japan's, and South Korea's quick expansion in the manufacturing sectors. Population and disposable income growth have pushed demand for packaged goods, fueling businessmen's quest for cheaper, high-quality packaging services. China and India are significant because they have large-scale production and, of course, a large number of small and medium enterprises that pursue efficient packaging solutions to be competitive.

Industrial growth and exports take place predominantly in Brazil and Argentina-based contract packagers, which are crucial to the global contract packaging market. This is increasingly evident from the demand for flexible packaging solutions across several product categories guided by shifting consumer trends. Likewise, the Middle East and Africa, including GCC countries, Egypt, and South Africa, are being established as fast-growing markets, where the increasing demand for packed goods and enhancement of manufacturing capabilities are expected to contribute toward growth.

The focus of companies around the world has been on innovation, efficiency, and sustainability, each of which will create opportunities for expansion in the global contract packaging market across various regions. The evolution of the market will be governed by the peculiar strengths and demand of the geographical area, and consequently, regionalism will assume considerable importance in understanding the future course of the market.

COMPETITIVE PLAYERS

The increasing demand for efficient, flexible, and cost-effective packaging solutions in various industries will lead to rapid growth in the Global Contract Packaging market in the next few years. Companies are focusing on streamlining their supply chains and core competencies, so they are seeking the help of third-party packaging providers. This allows businesses to save on operational costs while also ensuring quality packaging that has rapidly responded to changing consumer demands and regulatory standards. The industry promises hope for the future as it is being driven by technology and innovative strategic partnerships due to evolving market requirements.

A crucial determinant of the future of the Global Contract Packaging market will be the competitive actions of its players. These companies are investing tremendously in advanced packaging technologies, automation, and sustainable practices to meet the growing demands of businesses anywhere around the world. Players such as Sonoco Products Company, the Packaging Corporation of America (PCA), and WestRock Company are setting the industry-level benchmarks through their long-established expertise and broad service offerings. Their engineering capabilities to offer customized, high-quality packaging solutions have placed them among the very few movers and shakers in the market.

In parallel, companies like DHL Supply Chain, CEVA Logistics, and Kuehne + Nagel Logistics are leveraging their global networks and logistical capabilities to offer end-to-end packaging and distribution services. This unison of packaging and supply chain management allows entities to achieve faster turnaround times and increased efficiency, which is necessary in today's rapidly changing market. Smaller but equally innovative companies like Multipack Solutions LLC, SilganUnicep, and AmeriPac, Inc. are ensuring their voices are heard in the packing industry by providing specialized services and customized solutions. Many of these companies operate within niche markets, offering a very flexible and personalized approach to packing solutions that bigger companies cannot always provide.

Another facet of competition concerns companies that specialize in pharmaceutical and healthcare packaging, such as Sharp Services, LLC, Reed-Lane, Inc., and Tjoapack. These companies play a crucial role in ensuring that products in these most critical sectors are packaged properly and in accordance with stringent safety regulations. Their skill set in dealing with sensitive materials gives them a significant role in a marketplace where quality and safety are irrefutable.

As the Global Contract Packaging market keeps growing, the competition among these companies can be expected to fuel advances and improvements in packaging services. With innovation, efficiency, and sustainability at the forefront, the established players of the industry are paving a road towards the future-a future where quality, adaptable packaging solutions will be there to help clients to grow and prosper.

Contract Packaging Market Key Segments:

By Packaging Type

- Primary Packaging

- Secondary Packaging

- Tertiary Packaging

By Service Type

- Packaging Design

- Material Sourcing

- Assembly and Packaging

- Labeling and Branding

- Warehousing and Distribution

By Material

- Plastic

- Metal

- Glass

- Paper and Paperboard

By End-User Industry

- Food and Beverage

- Pharmaceuticals and Healthcare

- Cosmetics and Personal Care

- Household Products

- Automotive and Industrial

- Other

Key Global Contract Packaging Industry Players

- Sonoco Products Company

- Packaging Corporation of America (PCA)

- DHL Supply Chain

- WestRock Company

- Multipack Solutions LLC

- SilganUnicep

- Aaron Thomas Company, Inc.

- AmeriPac, Inc.

- Consolidated Strategy Group (CSG)

- Reed-Lane, Inc.

- FM Logistics

- Deufol SE.

- Tjoapack

- Sharp Services, LLC

- CEVA Logistics

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252