MARKET OVERVIEW

The global commercial vehicle air filter market will become a business of great significance within the automotive filtration sector. In the years to come, the market will grow as producers and operators move towards more effective and dependable solutions for large and medium-duty vehicles that carry goods or passengers. It will be apparent that conventional filters can no longer meet the demands of stricter regulations or standards for cleaner air processing in engine systems.

Market leaders will invest in developing materials that provide extended service life and improved filtration of airborne contaminants like soot and dust without compromising engine performance. More specifically, composite blend media with enhanced nanofiber layers and activated carbon will be launched, with the promise of removing tiny contaminants while providing better air flow. This technology will be received by operators looking to minimize maintenance expenditure and downtime, particularly in areas where road conditions hasten filter clogging. In the meantime, fleets in emerging nations will gradually move to filters that prioritize strength and low replacement rates. Suppliers will engineer cartridges that withstand high-load damage and harsh environments, such as dusty roads and construction sites. That shift will assist operators in making the move from frequent, manual maintenance to scheduled service intervals enabled by digital systems. Those systems will warn when filters reach their service limit, preventing neglected maintenance that can damage engine health.

In more developed markets, connectivity and sensors will reconfigure the way the market develops. Filters will be shipped with basic chips embedded in them that transmit pressure drop information to fleet management systems. That information will be pushed into predictive models, making predictions of replacement requirements and adjusting procurement schedules. Operators will no longer operate on fixed-interval replacement, but will program replacements based on real-time condition monitoring.

By working together with heavy-duty vehicle and logistics manufacturers, air filter manufacturers will provide modular products that fit on upcoming engine designs without much redesign. They will serve usage cases from long-distance shipping to local delivery and public transportation. Filters will be adapted to traditional diesel, biodiesel, compressed natural gas, and hydrogen fuel engines so as to be universally applicable whether or not propulsion is electric, diesel, or gasoline.

Environmental regulations will continue to get stricter, and emissions testing procedures will need more stringent particle trapping. Operators will implement filters with multilayered media that cut down particulate matter entry into the engine intake. That change will decrease engine wear, improve fuel economy, and decrease particulate emissions—all becoming priority issues as regulators make performance standards tighter.

Service networks will expand to offer filter recycling programs. Used filters will be gathered and processed, metal components recovered and filter media treated or recycled where feasible. That initiative will enable a circular-economy mentality and lower disposal expense for big fleets.

Overall, the global commercial vehicle air filter market will evolve into a reliable, smart system. It will enable maintenance automation, respond to diverse operating conditions globally, and be compatible with next-generation propulsion technologies. Operators will enjoy increased service life between overhauls, more intelligent replacement planning, and better engine health. As the industry matures, it will be simpler for stakeholders to count on air filtration as a consumable, but also as a built-in part of fleet efficiency and sustainability.

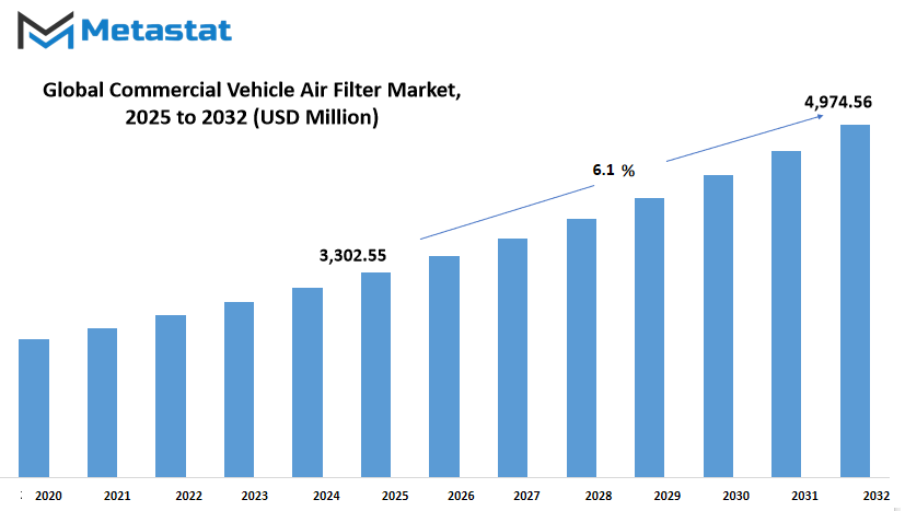

Global commercial vehicle air filter market is estimated to reach $4,974.56 Million by 2032; growing at a CAGR of 6.1% from 2025 to 2032.

GROWTH FACTORS

The global commercial vehicle air filter market is set to witness significant changes in the coming years as the transportation industry continues to focus on efficiency, performance, and sustainability. One of the major factors driving growth is the rising demand for fuel-efficient and low-emission commercial vehicles. With stricter environmental regulations and the need to reduce operational costs, fleet operators are increasingly relying on high-quality air filters that improve engine performance and optimize fuel consumption. This shift is creating a steady demand for advanced air filtration solutions that not only enhance efficiency but also extend the life of engines in heavy-duty vehicles.

Another key factor shaping the global commercial vehicle air filter market is the growing adoption of aftermarket filters. The frequent need for replacements, due to wear and tear from heavy usage, keeps the aftermarket segment active and competitive. Many fleet owners prefer aftermarket filters because they are cost-effective and widely available, making them a practical choice for regular maintenance. This trend is expected to continue, with aftermarket suppliers expanding their product lines to meet evolving industry standards.

However, there are certain challenges that could affect market growth. The gradual shift toward electric commercial vehicles is one such challenge. Since electric vehicles do not require traditional engine air filters, the demand for these products may see a decline over time as adoption rates of electric models increase. In addition, price sensitivity among buyers and strong competition from low-cost filter manufacturers are putting pressure on established brands to deliver high-quality products at competitive prices.

Despite these hurdles, the global commercial vehicle air filter market holds promising opportunities for innovation and advancement. The development of high-efficiency air filters with longer service life is emerging as a key growth area. Modern vehicles demand filters that can handle increased performance levels while ensuring optimal airflow and protection. Manufacturers investing in research and development to create durable, technologically advanced filters are likely to gain a strong position in the market.

Looking ahead, continued emphasis on environmental standards, combined with advancements in filtration technology, will reshape the landscape of the global commercial vehicle air filter market. From supporting cleaner engine operations to reducing maintenance downtime, the evolution of air filters is expected to meet the needs of a more demanding and eco-conscious transportation sector. While competition and market shifts present challenges, the ability to innovate and adapt will determine the long-term success of stakeholders in this dynamic market.

MARKET SEGMENTATION

BY Product Type

The global commercial vehicle air filter market growing strongly as demand climbs for cleaner and smarter solutions. The segment labeled Engine Air Filters leads today, as those keep engines safe from dust and soot, boosting efficiency and lowering emissions. Innovation will shape the future here, with filters built from nanofiber or synthetic media that trap ultra-fine particles while letting air flow easily. Connected filters could warn operators when change is due, cutting downtime and waste.

Meanwhile, Cabin Air Filters are emerging as fast-growing because drivers want clean air inside the vehicle. Filters featuring activated carbon or electrostatic layers will become common, blocking allergens, odors, even microbes. An emphasis on health means filters may add antimicrobial coatings or replaceable modules to let cleaning happen more often without full swaps.

Fuel Filters will not be left behind. Advances may see filters able to handle biofuels or hydrogen blends without breaking down. Smart sensors could check fuel quality in real time, warning of contamination or wear before breakdowns happen. This kind of predictive care will save money and help fleets keep moving smoothly.

Transmission Filters also have room to advance. As transmissions grow more complex, these filters will need to filter smaller particles while resisting higher heat. Materials may shift toward recyclable polymers or ceramics so filters last longer and meet green standards. Real-time monitoring might spot when a transmission is struggling, triggering filter service before damage occurs.

Together, the four product types will reshape how the global commercial vehicle air filter market evolves. Engine Air Filters remain dominant, but Cabin Air Filters will grow fast due to health and comfort concerns. Fuel and Transmission Filters could gain a new spotlight as smart, durable choices. Across all types, the future will bring filters that talk, that last longer, and that fit eco-friendly goals. Demand will come from stricter emissions rules, rising health awareness, and fleets that value uptime. In this way, the global commercial vehicle air filter market will become more efficient, more responsive, and more sustainable.

By Filtration Media

The global commercial vehicle air filter market offers a glimpse into a future where cleaner engines and better air quality will matter more than ever. A range of filtration media will shape that evolution. Paper Filters, Foam Filters, Metal Filters, and Composite Filters will each play a distinct role in meeting growing demands from transport industries around the world. Advances in materials science will drive improvements in efficiency and durability, helping filters to perform better under tough conditions.

Paper Filters will continue to be widely used thanks to low cost and ease of replacement. Designs will evolve to capture finer particles without sacrificing airflow. Upgrades in pore structure and fibers will allow better filtration with minimal pressure drop, supporting engines to last longer and burn cleaner.

Foam Filters will gain popularity in applications needing repeated cleaning. A focus on washable, reusable designs will lower waste and reduce operating costs. Future foams will be more resistant to oils and chemicals, which will make maintenance more forgiving. Flexibility in shape will help fit into tighter spaces, expanding options for designers in next-generation vehicles.

Metal Filters will become more common in environments where high temperatures or harsh conditions will be routine. Stronger alloys and surface treatments will boost durability and resist corrosion. Metal Filters will support vehicles used in heavy-duty or off-road settings where rugged performance matters most. Reusable metal units will lower total cost of ownership while staying reliable.

Composite Filters will blend strengths from multiple media types. Layered structures will combine paper’s fine capture, foam’s flexibility, and metal’s durability. Composite designs will allow customization for specific needs, like dust storms, urban smog, or long-distance hauling. Integration of smart sensors into composite structures will help monitor filter health and trigger maintenance reminders.

Growth in the global commercial vehicle air filter market will also be driven by tightening emissions regulations and rising environmental awareness. Transport operators will prioritize filters that reduce particulate output and improve engine breathing, aligning with sustainability goals. Partnerships between filter manufacturers and vehicle OEMs will support tailored solutions for electric hybrids or alternative-fuel vehicles, where air intake conditions will differ from traditional engines.

Innovations such as biodegradable media or nanofiber layers will push filter performance further. Add-on modules that self-clean or adjust filtering based on conditions will become standard in some fleets. The market will shift toward smart, adaptable filters that respond in real time to air quality and engine load.

A future where cleaner air, longer engine life, and smarter trucks all link back to thoughtful filter design is within reach. The global commercial vehicle air filter market will drive progress toward that vision, with Paper, Foam, Metal, and Composite Filters all playing a role in shaping tomorrow’s cleaner roads.

By Application

The global commercial vehicle air filter market will reflect a future shaped by smarter vehicles, cleaner conditions, and tighter standards. Demand for filters that keep engines clean and air pure will rise as urban areas adopt stricter rules. A landscape where vehicles from city trucks to farming machines must meet tougher norms will push developers to craft filters that last longer, trap smaller particles, and cost less to keep up. Technology for advanced materials and smart sensors that track filter life will come into play, letting service be predicted before problems arise.

Expect significant progress in the global commercial vehicle air filter market across various applications. On-Road Applications such as delivery trucks and buses will demand filters engineered for varied speeds, stop-go traffic, and polluted streets. Durability and low resistance will matter most, helping engines breathe free while saving fuel. Off-Road Applications like mining and forestry equipment will push filters to withstand dust storms, heavy debris, and rough terrain. Tougher housing and self-cleaning features may show up first in that segment.

Agricultural Applications will need filters that handle pollen, soil dust, and field spray. Filters designed for tractors, harvesters, and sprayers may include coatings to repel moisture and clogging particles. More attention will go to maintenance ease because uptime during planting and harvest seasons will be critical. Construction Applications will feature filters that resist cement dust, silica, and other fine powders kicked up on sites. Filters with replaceable cores and reinforced frames will likely become standard for that segment so work can continue without long downtime.

A shift toward electric commercial vehicles may also influence the global commercial vehicle air filter market. Even battery-powered trucks may keep cabin air clean and protect auxiliary systems. Hybrid systems with small internal combustion engines will still need air filters for efficient operation. Smart filters that warn when airflow drops or capture more harmful pollutants might become common.

A future view of the global commercial vehicle air filter market presents opportunities for product makers. Advanced media, predictive maintenance, eco-friendly disposal, and modular design will all help meet rising needs. Growth across On-Road, Off-Road, Agricultural, and Construction Applications will push filter design toward smarter, tougher, and greener solutions. There will be space for innovation that keeps vehicles healthy, environments cleaner, and users satisfied.

By Vehicle Type

The global commercial vehicle air filter market will continue to grow as demand for efficient and durable filtration solutions increases across industries. Rising transportation needs, combined with stricter emission standards, will drive consistent advancements in air filter technology. By vehicle type, the market is divided into Light-Duty Commercial Vehicles, Medium-Duty Commercial Vehicles, Heavy-Duty Commercial Vehicles, and Specialty Vehicles, each contributing to the overall expansion in unique ways.

Light-Duty Commercial Vehicles will play a major role in driving demand. Urban logistics, e-commerce deliveries, and small-scale transportation will require reliable and cost-effective air filters to maintain engine performance and reduce environmental impact. Medium-Duty Commercial Vehicles will also maintain steady growth as regional transportation networks expand and demand for fleet efficiency rises. These vehicles will need air filters that not only handle frequent use but also adapt to diverse operating conditions, ensuring performance remains consistent over time.

The segment for Heavy-Duty Commercial Vehicles will remain a significant contributor, fueled by the growth of construction, mining, and cross-border logistics. These vehicles will demand high-capacity air filters designed to withstand heavy workloads and challenging environments. As industries push for longer maintenance cycles and lower downtime, manufacturers will invest in durable materials and advanced designs to meet operational requirements.

Specialty Vehicles, including those used in agriculture, defense, and emergency services, will also shape the future of the global commercial vehicle air filter market. Unique usage patterns and extreme conditions will create the need for specialized air filters with higher resistance to dust, debris, and temperature changes. This focus on customization will lead to more tailored solutions, supporting the unique needs of each sector.

The adoption of advanced technologies, such as nanofiber materials and smart filtration systems, will drive further innovation. Air filters with sensors capable of monitoring airflow and contamination levels will become more common, allowing for predictive maintenance and improved efficiency. This shift will help operators reduce operational costs while meeting environmental regulations that continue to tighten worldwide.

With ongoing urbanization and industrial growth, the global commercial vehicle air filter market will see rising demand across all vehicle types. Regions with expanding transportation and logistics networks will create significant opportunities, while established markets will invest in upgrades and replacements to meet stricter performance and environmental standards. Manufacturers that focus on innovation, durability, and cost-effectiveness will lead the way in meeting these evolving demands, ensuring that the market maintains strong momentum well into the future.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$3,302.55 million |

|

Market Size by 2032 |

$4,974.56 Million |

|

Growth Rate from 2025 to 2032 |

6.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global commercial vehicle air filter market is expected to witness steady growth in the coming years, driven by rising demand for cleaner engines, stricter emission standards, and the continuous expansion of the transportation and logistics industries. As commercial vehicles become more advanced, the need for efficient air filtration systems will remain essential to ensure better engine performance and longer operational life. This growth will also be supported by the shift toward smart and energy-efficient technologies that enhance durability and performance while reducing overall maintenance costs.

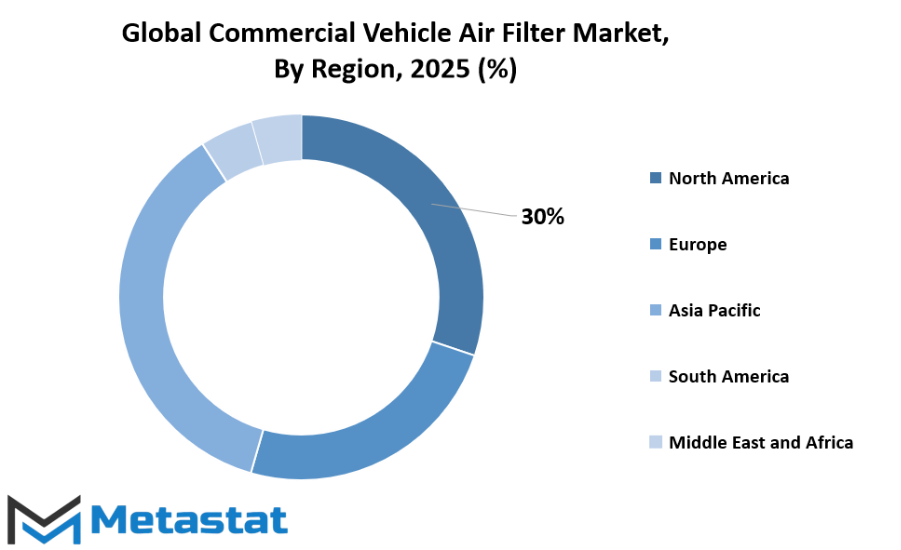

Based on geography, the global commercial vehicle air filter market is segmented into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. In North America, markets such as the U.S., Canada, and Mexico are expected to show consistent demand, fueled by the modernization of fleets and the need for improved air filter solutions to meet high operational standards. Europe, with key regions including the UK, Germany, France, Italy, and the Rest of Europe, will see a rise in adoption driven by strict emission regulations and the steady push for sustainable solutions within the transportation sector.

The Asia-Pacific region, including India, China, Japan, South Korea, and the Rest of Asia-Pacific, will likely dominate the market share over the forecast period. Rapid industrial growth, expanding logistics operations, and increasing commercial vehicle production will be major factors shaping demand in this region. Additionally, government initiatives to control pollution levels will encourage manufacturers to introduce innovative and efficient air filtration systems to meet regional needs.

South America, led by Brazil, Argentina, and other countries in the Rest of South America, is expected to experience gradual but steady growth. The region’s commercial transportation sector is expanding, creating opportunities for the development and integration of advanced air filter technologies. In the Middle East & Africa, including GCC Countries, Egypt, South Africa, and the Rest of the region, growth will be supported by infrastructure development projects, increased freight movement, and the modernization of existing vehicle fleets.

Future advancements in the global commercial vehicle air filter market will likely include smart monitoring systems, longer-lasting filter materials, and sustainable production methods. As industries move toward greener operations, demand for eco-friendly and high-performance air filters will continue to rise. The ongoing shift to electric and hybrid commercial vehicles will also create opportunities for specialized air filtration solutions designed for next-generation engines, ensuring that the market remains dynamic and competitive in the years ahead.

COMPETITIVE PLAYERS

The global commercial vehicle air filter market unfolds with a clear focus on how vehicle parts keep engines working cleanly and efficiently. Observing how filters serve a key purpose in the operation of heavy trucks, buses, and other commercial units, attention centers on how this market will shape future innovations. One will see how top names such as DENSO Corporation, Cummins Inc., MANN+HUMMEL, K&N Engineering, Robert Bosch LLC, ACDelco, Ahlstrom, ALCO Filters, Donaldson Company, Inc., Freudenberg Filtration Technologies GmbH & Co. KG, Hastings Premium Filters, Hengst SE, Champion Laboratories, Inc. (Luber-Finer), Lyndall, Inc., and MAHLE GmbH are bringing ideas ahead.

Advances in filter materials will create a path for designs to trap finer particles while letting air flow smoothly. Every brand listed will aim to deliver filters that last longer and cut maintenance time. New fibers and media will find a place in upcoming products that promise better protection for diesel and gasoline engines that face tough road conditions. Future filters will target lower emissions and improved fuel economy, helping fleets meet stricter regulations while keeping operational costs low. Companies such as MANN+HUMMEL or Donaldson Company, Inc. will likely test new coatings or structures that block dust and contaminants economically.

The global commercial vehicle air filter market will benefit from sensors becoming common inside air filters so that systems can warn when a filter is clogged or nearing the end of life. Smart tracking will help fleet operators plan filter changes effectively. ACDelco, Robert Bosch LLC, and DENSO Corporation may push devices that connect to dashboards or maintenance systems to signal filter health in real time. This new approach will reduce downtime and keep commercial vehicles on the road longer.

Focus stays on how filters will not just remove dirt but will also help vehicles meet future emission goals. As part of this progression, companies like Freudenberg Filtration Technologies GmbH & Co. KG and Cummins Inc. will supply parts that go into hybrid or alternative fuel vehicles, raising the role of air filters in those systems. Wider acceptance of electric or hybrid commercial vehicles will shift filter design toward new demands, like managing cabin air or integrating with battery cooling paths.

Current names in the global commercial vehicle air filter market look ahead to creating filters that are smarter, cleaner, and more efficient. Future thinking centers on long service intervals, lower emissions, digital connection, and adaption to new fuel types, with all key players ready to bring those changes forward.

Commercial Vehicle Air Filter Market Key Segments:

By Product Type

- Engine Air Filters

- Cabin Air Filters

- Fuel Filters

- Transmission Filters

By Filtration Media

- Paper Filters

- Foam Filters

- Metal Filters

- Composite Filters

By Application

- On-Road Applications

- Off-Road Applications

- Agricultural Applications

- Construction Applications

By Vehicle Type

- Light-Duty Commercial Vehicles

- Medium-Duty Commercial Vehicles

- Heavy-Duty Commercial Vehicles

- Specialty Vehicles

Key Global Commercial Vehicle Air Filter Industry Players

- DENSO Corporation

- Cummins Inc.

- MANN+HUMMEL

- K&N Engineering

- Robert Bosch LLC

- ACDelco

- Ahlstrom

- ALCO Filters

- Donaldson Company, Inc.

- Freudenberg Filtration Technologies GmbH & Co. KG

- Hastings Premium Filters

- Hengst SE

- Champion Laboratories, Inc. (Luber-Finer)

- Lyndall, Inc.

- MAHLE GmbH

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383