MARKET OVERVIEW

The global ceramic membrane market is specific in the technical field and broad in its applications. Ceramic membranes afford high precision in separation, thus enabling the separation of submicron particles, microorganisms, and macromolecules very efficiently in a host of applications. The very fact that ceramic membranes can be highly intensified where severe situations of high temperature and aggressive chemical environment are standard is an advantage to industrial applications where traditional filtration systems cease to work. Additionally, these membranes also have an extended service life which makes their maintenance cost and downtimes low; thus, lowering the cost aspect even more for industries. Such durability and efficiency render them fit for innumerable applications, starting from water purification to pharmaceutical production.

Ceramic membranes act to safeguard product quality and safety in the food-and-beverage industry. In processes like milk clarification, the juice filtration, and stabilization, they protect flavor and nutritional integrity. They also have a great role to play in the pharmaceutical industry for drug formulation and sterile filtration applications when product purity is vital. Water treatment is yet another area of application for these membranes in removing contaminants, enabling them to achieve their recycling targets. Thus, the greener industries will be the suitable abode for ceramic membranes.

With a widely spread geographical and industrial scope, the global ceramic membrane market is characterized by North America, Europe, and Asia-Pacific leading the chart. Technological innovations and environmental regulations are driving this market. With emerging economies catching onto the advantage of ceramic membranes, investments in water infrastructure and industrial developments have also seen a rise. Given the demand for addressing the documentations of water quality and the effective functioning of industries in these regions, there might be an increase in demand for filtration solutions such as ceramic membranes.

Emerging advancements in membrane technology form features that shall dictate the future of the global ceramic membrane market, whether in research to improve performance or to bring down costs of production. Emerging hybrid membranes, which embody ceramic and polymeric properties, will offer alternative pathways to application and efficiency. Membrane coating and fabrication process improvements will enhance permeability and selectivity, optimize performance for intricate filtration tasks, and widen the application area for ceramic membrane products.

Giant global ceramic membrane markets are made up of players already well established and others just coming into the field, with both fighting for space by developing innovative products. With investments made in R&D, firms are currently solidifying their market presence with strategic collaborations and expanded manufacturing capacity. Collaboration and product innovation will be the new emerging trends, as technological advancement continues. However, these innovations will also push the demand for better filtration performance.

Imminent changes are to occur in the near future for the global ceramic membrane market due to emerging technologies and widening application areas. Because of its unmatched strength and effectiveness, the ceramic membrane is expected to remain the heart of industries searching for advanced filtration solutions. Tightening of environmental and industrial parameters across the globe will certainly have an impact on the growth potentials and innovations in this market in the coming years.

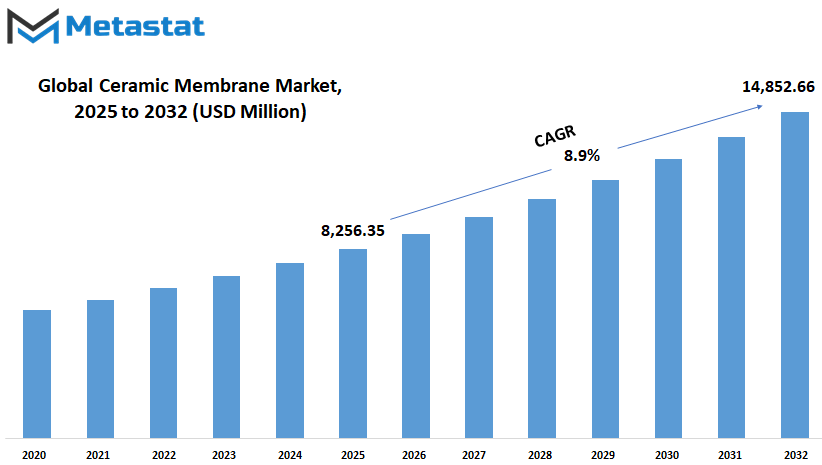

global ceramic membrane market is estimated to reach $14,852.66 Million by 2032; growing at a CAGR of 8.9% from 2025 to 2032.

GROWTH FACTORS

The global ceramic membrane market will be propelling upward in the years ahead. This growth is due to several compelling factors that will shape this market in the future. One of the primary reasons for adoption results from being found in different branches of industries that demand advanced filtration technologies. Compared to conventional polymer membranes, ceramic membranes are preferred because they best demonstrate durability, efficiency, and endurance for rough conditions. Their exceptional chemical and thermal stability make them suited for application areas like water treatment, pharmaceuticals, food and beverage processing, and biotechnology. Increasingly, industries are concerned about attaining quality filtration systems; therefore, the adoption of ceramic membranes is expected to become standard practice.

Another boost to the increased market for ceramic membranes is that most industries are turning toward emphasizing the sustainable and eco-friendly technologies. Such environmental awareness has necessitated energy-saving and long-lasting solutions from the industries. Hence, ceramic membranes fit perfectly, considering their lifespan and maintenance costs that are lower than average. With the impetus of governments and organizations around the world for stricter environmental regulations and sustainability in the days to come, it is right to assume that there will be an increasing demand for these membranes. This is not forgotten; it is yet another way in which moving towards greener technologies has happened over and above how it will influence the future of the global ceramic membrane market.

All the growth factors have their challenges due to which the market may slow down. One such would be initial high costs of ceramic membranes. They prove to be expensive compared to other filtration modalities; thus, they might discourage adoption among small and medium enterprises. Complicated nature of manufacturing coupled with requirements for specialized installation and maintenance services adds to the overall cost even more and these factors discourage high adoption rates, especially in budget constraint regions, towards cost-effective adoption of ceramic membranes.

Another possible drawback to market growth is the unawareness and technical know-how regarding ceramic membranes technology in certain sectors. Only a few companies have automated in their filtration processes; this is usually because of familiarity and the relative ease of use. Few companies, however, might only see the adoption of the membranes as an additional burden due to not understanding the long-term benefits and efficiency of these membranes. Filling this gap through education and train-the-trainer programs will be the primary means to get technology into broad acceptance.

No doubt, the future for the global ceramic membrane market seems to have highly promising opportunities that might well drive it into phenomenal growth. Development in manufacturing techniques and innovations in materials are expected to drive the cost of producing these membranes low enough to make them inexpensive and thus widely used. Increasing research and development activity is expected to add to performance improvements, hence larger opportunities of applications.

MARKET SEGMENTATION

By Material

The numerous materials used for the preparation of ceramic membranes are majorly facilitating the growth of this market. These materials include alumina, titania, zirconia, silica, to name a few, each with specialized advantages. Alumina-based ceramic membranes are well characterized for their sturdy mechanical properties and thermal stability, which makes them particularly applicable to extreme temperature and pressure scenarios.

In contrast, titania membranes are characterized by high resistance to chemical attacks and photocatalytic properties, which are useful in advanced water purification processes. Zirconia membranes have great strength and resistance to acids and alkalis. During industrial filtration, this makes them extremely efficient. Silica membranes demonstrate high selectivity and are mostly used for the separation of gases and vapors. Other ceramic membranes exhibit specialized characteristics relevant to a given application.

Innovation and development within the market will likely increase in the years ahead, as researchers and manufacturers work towards enhancing, among others, performance and efficiencies. Developments in nanotechnology and material science might lead to the manufacture of ceramic membranes with possibly enhanced porosity, further permeation rate, and still higher resistance to fouling, thereby gaining them a lot more popularity with industries that demand stringent and high-standard filtration processes. Last but not least, the sustainability aspect evident today will leverage industries to improve their environmental perspective. Thanks to the long service life associated with ceramic membranes, they require lower maintenance, which helps keep their environment's impact on a lower end.

This great demand of pure water and well-arranged waste disposal systems almost globally shall contribute very much to the growth of this market. Around the world, governments and organizations are expected to sink more funds into advanced filtration technologies capable of addressing water scarcity and pollution concerns. In these endeavors, the ceramic membrane, known for reliability and excellent performance, shall arguably bear the brunt.

As industries expand and confront new challenges, the global ceramic membrane market will offer reliable and innovative filtration solutions that stand ever closer to the emerging industrial challenges. The extension of the ceramics field hence induced by materials like alumina, titania, zirconia, silica, and others will further guarantee redirection of the asymmetric industrial flow towards a more entertaining and promising scientific challenge.

By Application

With respect to end-use industries, this newest trend in the application of ceramic membranes concerns the advancement of resistance in harsh environment conditions with the introduction of high temperature, chemicals, and mechanical pressures. It shall take place because, common before its current application in industries, these factors triggered their demand with properties of durability and functional operational efficiency in extreme environments. This technology is expected to further advance and develop more future filtration and purification industrial applications.

The activities being concentrated under the market were largely water and wastewater treatments. Population increases have necessitated that potable water supplies be complemented with more effective waste management systems, which now are causing industries and municipalities alike to explore filtration systems where ceramic membranes excel in lifetime performance over polymer-based membranes. It is best known as processes that remove contaminants, particles, and microorganisms from water, producing it fit for drinking and reuse. As the pressures for solutions to water scarcity and pollution increase, the scope of contributions from ceramic membranes toward water treatment will soon surpass even the great heights they achieve today.

The largest scope among the applications of ceramic membranes in food and beverage will involve clarity, concentration, purification, and holding up to high temperatures against severe cleaners using high temperatures without compromising performance. These all will be required for delivering product quality and safety by eliminating the chance of contamination whilst retaining its original flavor and nutrients. Given the demand for high-quality processed food and beverages, one anticipates their increased use in this industry.

These membranes would also serve the pharmaceutical and biotechnology industries, and here it might not be uncommon to have a requirement for the purest of purity ever required. Ceramic membranes would provide specific advantages by maintaining a low contamination level with the most specialized filtration, which includes that from fermentation to other processes of drug-making purposes. Their superb integrity and even performance allow extrapolation in trust for formulating safety and efficacy in pharmaceutical products. Here growth has been coinciding with research and innovation, and the growing demands on these sectors. This builds up for demand for filtration more superior and efficient and fuels the growth of ceramic membranes.

This is another major arena where these membranes find wide application: the chemical processing environment, in which they can easily separate and purify a variety of chemical compounds and even withstand really aggressive chemicals and high pressures. They assure product consistency and quality during the processing stage using these membranes.

By Technology

With progressively growing applications and technological advancement, the global ceramic membrane market is expected to witness considerable growth in the near future. Ceramic membranes are durable, can work under severe conditions, and are efficient, so they are a preferred choice for various industries, such as water treatment, pharmaceuticals, food and beverage, and biotechnology. As industries change and the demand for reliable filtration systems increases, it is ceramic membranes that are going to be of even greater importance to cater to such needs.

One of the factors fueling the demand for ceramic membranes is their suction performance when compared with standard polymeric membranes. Ceramic membranes are more complex filtration owing to their greater resistance to chemical, heat, and pressure. As industries are focused on increasing efficiency and sustainability in their operations, ceramic membranes will appeal even more as they fit in this bracket: longer lifespan, and lower maintenance. All these advantages make it a viable long-term option despite a slightly higher initial investment cost.

In technology, the global ceramic membrane market is segmented into various sorts based on the filtration methods. Ultrafiltration emerges as another of the most popular technologies to date, given its capacity to remove small particles and microorganisms suspended in liquid. These features make it very useful in the water treatment and pharmaceutical industry, where high purity levels are required. Microfiltration, on the other hand, has its application in the food and beverage industry for separating larger particles and thus keeping the quality and safety of its products.

Nanofiltration technology finds growing attention owing to its high performance in finer filtration and the removal of dissolved salts and organic matter in liquids. With increased application of nanofiltration in targeted and efficient filtration approaches, it is most likely to observe high acceptance rates in the coming years. Besides the mentioned techniques, there are other processes which develop ceramic membrane technologies to meet specialized needs and emerging industrial applications.

Going forward, the market would witness considerable growth through research and innovations, as the performance and cost of ceramic membranes are likely to be enhanced with the new materials and production techniques being explored. The increased awareness about environmental protection and strict regulations on waste disposal and water quality would work in favor of implementing advanced filtration systems. Thus, the consistent growth of urbanization and industrialization all around the world will exponentially increase the demand for reliable filtration and good purification technologies.

The future for the global ceramic membrane market is very bright, with the technology being one of the core driving forces behind its development. As industries will continue searching for improved performance and sustainability, ceramic membranes will continue to be a great solution and thus be an essential element of modern filtration systems.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$8,256.35 million |

|

Market Size by 2032 |

$96,183.92 Million |

|

Growth Rate from 2025 to 2032 |

8.9% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

Ceramic membranes offer a wide range of applications in bio-filtration, industrial filtration of chemicals, pharmaceutical products, waste treatment, advanced water treatment, food processing, and much more-all with unique capabilities in their strengths and weaknesses. With their long life span, resistance to temperature and chemical environments, ceramic membranes are becoming indispensable in filtration systems globally.

North America forms an important region for the global ceramic membrane market. The US, Canada, and Mexico are heavily investing in the sector of advanced filtration technologies due to stringent environmental laws and a need for effective management solutions for water. In the coming years, With heavy adoption of ceramic membranes in treatment of water and waste waters.

The European countries mostly define the global ceramic membrane market as market leaders in technological development and sustainability. The UK iron, Germany, France, and Italy's demand for energy-efficient and reliable filtration systems translates into wider appreciation of ceramic membranes across multiple sectors. The growing environmental consciousness and a push for sustainable solutions mean that Europe's impact on market growth will continue.

The industrial and urban boom continues to offer the necessary impetus for the budding market in the Asia Pacific region. Rising demand for advanced filtration systems in China, India, Japan, and South Korea stems from an increasing population and growing awareness about drinking water quality. Keeping in mind that the region's government enforces stricter environmental laws, conversely, the industries are rapidly adopting new technologies, which create a demand for high-performance filtration solutions, namely ceramic membranes.

In South America, some gradual adoption of ceramic membranes is beginning, with Brazil and Argentina leading in that perspective. Demand is growing for robust and effective filtration systems, as industries in the region strive to attain operational efficiency and fulfill environmental standards. Likewise, countries in the Middle East and Africa could also present the growth potential of the market, particularly in Saudi Arabia, Egypt, and South Africa. Water scarcity and industrial development are the forces driving advanced filtration technological needs in these regions, thus pushing ceramic membranes increasingly.

COMPETITIVE PLAYERS

The global ceramic membrane market is developing towards assuming an increasingly vital role in the future of advanced filtration and separation technologies. Industries have turned their attention to ceramic membranes for their significance due to their attributes of being most efficient, durable, and sustainable solutions. These membranes are said to provide high resistance and stability at elevated temperatures, harsh chemicals, and mechanical stress, thereby making them for applications requiring stringent water treatment, pharma and food processing, biotechnology, etc. Such membranes assure consistent behavior over a long product life and hence are viewed as a wise investment for industries focusing on efficient operations and cost savings in the long run.

In the coming years, demand for ceramic membranes will be at a greater height as there will be a global drive for cleaner water and modern industrial processes. Innovativeness in filtration will have to be adopted by most the establishments using newer methods of wastewater treatment owing to environmental constraints and tougher regulations affiliated with it. Most probably, ceramic membranes will be in demand by industries aimed at achieving these standards since they are known for operating at the extremes while still maintaining fine filtration accuracy. New advances in materials science and manufacturing methods will also be established to yield better and cheaper ceramic membrane products, increasing their reach to fresh markets.

Therefore, after the market has expanded, competition among leading companies will heighten. This includes Pall Corporation, Veolia Water Technologies, Saint-Gobain-Holand, and others who will continuously innovate and raise the performance standards within the framework of Global Ceramic Membrane industry competition. Companies such as Atech Innovations GmbH, TAMI Industries, and Nanostone Water, Inc. could be counted in the future on pushing their cutting-edge technologies focusing on innovations for filtration efficiency and durability. Meanwhile, companies such as Jiangsu Jiuwu Hi-Tech Co. Ltd., METAWATER Co. Ltd. Guochu Technology (Xiamen) Co. will only strengthen their positions with higher production capacities and extended global networks of distribution. This competitive landscape means that partnerships and joint endeavors will be fostered and pursued with a view toward maximizing applications of ceramic membrane technologies.

In the future, the global ceramic membrane market may further witness investment trends patronizing the construction of more sustainable manufacturing processes and environment-friendly materials. Investment in research and development will be made in order to optimize production and require less energy and waste. With digitalization and automation growing in the industry, industries can soon take advantage of "smart" filtration systems integrated with advanced sensors and real-time monitoring capabilities for greater control and efficiency.

Ceramic Membrane Market Key Segments:

By Material

- Alumina

- Titania

- Zirconia

- Silica

- Others

By Application

- Water & Wastewater Treatment

- Food & Beverage

- Pharmaceuticals

- Biotechnology

- Chemical Processing

- Others

By Technology

- Ultrafiltration

- Microfiltration

- Nanofiltration

- Others

Key Global Ceramic Membrane Industry Players

- Pall Corporation

- Veolia Water Technologies

- Atech Innovations GmbH

- TAMI Industries

- Hyflux Ltd

- MEIDEN America, Inc.

- Nanostone Water, Inc.

- Lishun Technology (Shanghai) Co., Ltd.

- Novasep

- Jiangsu Jiuwu Hi-Tech Co., Ltd.

- METAWATER Co., Ltd.

- ItN Nanovation AG

- Qua-Vac

- Saint-Gobain

- TAMI Industries

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383