MARKET OVERVIEW

The global beverage container market is also important to the larger packaging industry-to provide beverage companies around the world with diverse requirements. This market encompasses a broad range of products designed to contain, transport, and preserve beverages in all shapes-beverages being liquids such as water, carbonated drinks, alcoholic-containing drinks, juices, and functional drinks. The packaging industry Is at the center of convenience, freshness, and safety of beverages moving from the factory to the hands of consumers. With changes in consumer lifestyle and development in new technology, packaging, this industry will witness fascinating trends in the near term. Beverages in this drink category come in containers of a broad selection of different materials, including glass, plastic, metal, and paperboard, each with unique benefits depending on what is being consumed, as well as the intended market.

The aluminum can, for instance, is used most broadly in carbonated items because of its light weight and possible recyclability. Glass bottles however are still the most probable contenders for premium products with the potential to deliver excellence in the form of taste in the product.

Plastic packs, especially PET bottles, are dominating the whole water and non-carbonated drinks segments due to their convenience and economy. Paper cartons seem like green solutions particularly for juice and milk-based beverages. These products are regularly being engineered and enhanced to meet world sustainability targets, reduce waste, and simplify the consumer's life. global beverage container market priorities are function and appearance:. Containers are not only a functional solution to packaging, but a significant branding tool. Design, shape, and labeling on containers have strong impacts on buying behavior by customers. As beverage companies are investing in unique brand identity, demand will rise for creative and aesthetically pleasing packaging.

Sophisticated printing capabilities and potential for customization are already raising the bar for packaging to communicate brand values and attract attention in hectic retail environments. Regulatory requirements are also an important force behind this market, prompting manufacturers to safety, hygiene, and sustainable standards.

Governments and institutions worldwide are imposing tighter regulations to ensure beverage containers comply with health and environmental regulations. The regulatory climate will in turn drive future growth and innovation of the market, encouraging use of biodegradable and eco-friendly materials. The global beverage container market also expects to expand its reach through incorporation of smart technologies. Features like QR codes for traceability, temperature-sensitive packaging, and digital interactions will transform the way individuals interact with beverages. These innovations will redefine packaging's role beyond its traditional function of guarding the product to enhance consumer experience.

With increasing size and complexity, the need for packaging in the beverage industry will be commensurate with complex and environmental needs. This market will harmonize with global efforts to minimize environmental impact while catering to changing consumer demands and embracing all the technology changes. Therefore, the relentless pressure for innovation and adaptability ensures the global beverage container market as the foundation of modern beverage production and distribution.

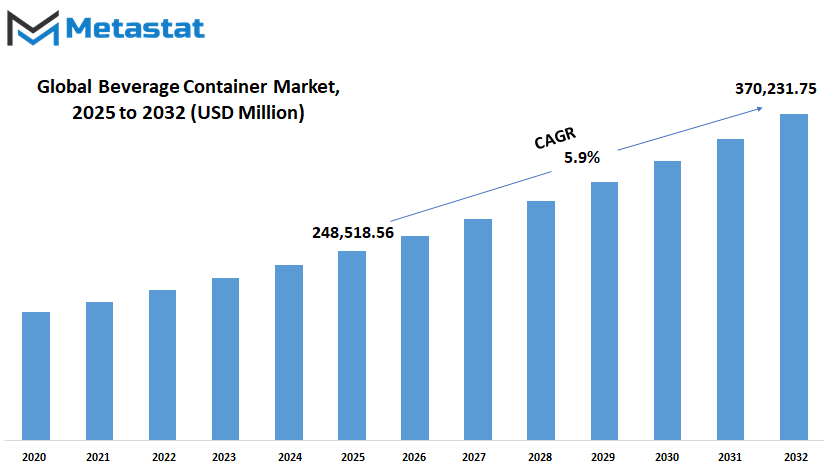

Global beverage container market is estimated to reach $370,231.75 Million by 2032; growing at a CAGR of 5.9% from 2025 to 2032.

GROWTH FACTORS

The global beverage container market is undergoing an era of dramatic transformation. The customers are considering shifts in taste and emerging technological trends, which are reflected in alterations in the beverage container market. The beverage container market is of vital significance to satisfy the growing demand for secure and sustainable packaging solutions throughout the beverage sector. Growth of environmental awareness and innovation drive are going to alter the situation in the market in the next couple of years. Different drivers fuel its growth, and also some challenges and new opportunities shape its path.

Ready-to-drink products and single-serve packaging has increased the demand for the application of lightweight, and at the same time, durable and environmentally friendly containers. Moreover, the move towards minimization of waste and adoption of recyclable material has motivated manufacturers to come up with innovative solutions such as biodegradable containers and reusable containers. These innovations align with the environmental goals but also appeal to a customer who wishes to be eco-friendly. Technological advancement in material science also aids the expansion of the market. Developments like smart packaging and advanced coatings enable beverage packaging to improve shelf life, maintain product integrity, and even enable interactive functions for the consumer.

Not only do such developments add functionality, but they also create a distinctive customer experience, thus stimulating interest and adoption. Increased middle-class population and urbanization in developing markets are also driving demand for differentiated beverages, thus further driving demand for appealing and dependable packaging. That said, the worldwide beverage packaging market is confronted with some challenges that may slow its growth. Plastic usage regulation restrictions and increasing raw material costs are major hurdles. Manufacturers tend to spend more on research and development in order to look for compliant and inexpensive alternatives in response to these challenges. The intensity of competition among producers in responding to strict environmental standards without sacrificing profitability also contributes to the intricacy of market dynamics.

In spite of these difficulties, the market offers ample opportunity for future growth. The growth in green practices across all industries and a surge in demand for premium and functional drinks offers a chance for innovative packaging solutions. Technology suppliers and manufacturers will more than likely team up to create new designs that satisfy both customer expectations and sustainability requirements.

With an emphasis on innovation and taking the environment into account, the world market for beverage containers has promising futures in store, classifying it as mainstream in beverage industry development.

MARKET SEGMENTATION

By Material

The global beverage container industry is being led by trends fueled by advances in materials, emerging environment issues, and consumer preferences. Containers, central to this business, facilitate safe containment and transport of beverages depending on demands for convenience as well as sustainability. Consequently, the differentiated market has appeared in application of materials such as glass, plastic, metal, and paperboard providing various benefits in terms of cost, longevity, or ecological footprint.

Glass remains to be one of the traditional solutions on the beverage container industry. It has been appreciated for its non-reactive characteristic and ability to deliver beverages with a true flavor. It's preferred more particularly in high-end markets like wine, spirits, and craft drinks. Its heaviness and breakability, however have compelled some manufacturers to create other alternatives. Plastic is one of them; particularly PET is dominating based on its light weight and cost.

Types like HDPE, LDPE, and PP also play important roles, serving for certain types of beverages like dairy or juices. However, the ecological footprint of plastic has been a cause of concern, stimulating manufacturers to invest in recycled plastic and biodegradable materials. Metal, mainly aluminum and steel, has become popular due to its ability to be recycled and its strength. Aluminum cans are highly favored in the carbonated beverage category, as they remain fresh for extended lengths of time and are extremely convenient to carry.

While less environmentally popular than aluminum, steel is still utilized for drinks requiring minimal added strength in packaging. Paperboard has recently become extremely trendy as an environmentally friendly option for milk, juice, and plant-based beverages. The absolute best part about paperboard is its light weightiness and negligible footprint on the planet compared to other options. Environmentally conscious consumers opt for paperboard because of these qualities. It is also made up of new materials, including plant-based or hybrid materials, and reflects a growing trend of reducing reliance on conventional packaging.

The future for the global beverage container market is in innovation and sustainability. The firms are bound to center their attention on circular economy models where the material can be recycled or reused with little to no waste. This technology progress will continue to advance packaging functionality within the limitations of tight environmental regulations.

Ethical consumers will push developers to biodegradable or reusable alternatives. Overall, the global beverage container industry is going to continue to evolve through trends, which would respond to changing needs while making strides in addressing very serious environmental challenges. Such advancement is the sum movement towards a better tomorrow.

By Product Type

The global beverage container market is undergoing immense change due to consumer trends and the introduction of new packaging technologies. Due to the growing demand for convenient, eco-friendly, and good-looking packing, companies are trying hard to innovate and attain that. This market encompasses a broad spectrum of product types, i.e., bottles, cans, kegs, cartons, etc., each type being utilized for certain purposes and fulfilling various consumer demands.

Bottles remain the market leader primarily due to the versatility it offers and its application in all kinds of non-alcoholic as well as alcoholic drinks. Glass bottles are preferred by consumers primarily because of the premium touch it has and the maintenance of flavors and quality. Plastic bottles, however, are preferred, primarily in spite of environmental concerns, as they are light in weight and cost-effective in nature. Yet, the future for bottles would probably be in the growing demand for environmental-friendliness, such as those produced from recycled materials or biodegradable materials.

Cans are another critical product segment in the global beverage container industry that is recyclable and portable. Aluminum cans lead the pack in this segment, offering durability and quick cooling advantages. They are especially favorite when it comes to carbonated drinks and energy drinks. In the immediate future, the urge to get environmentally friendly packaging may be a driving force for innovations in can production that will render them more eco-friendly and hence more attractive. Owing to high demand by craft brews, kegs presently have garnered more notice than the utilization of bulk containers such as kegs in situations such as beer or booze packaging.

It's more effective with kegs to spread product in the course of an increasing small scale breweries business future trends would discover the production of kegs up to the level of transport and recyclable. Cartons, being recycled for use with drinks like milk and juice, are becoming increasingly popular due to their renewable material content and small size. The technological innovation in the category of aseptic packaging is increasing the shelf life of drinks packed in cartons, hence turning out to be a convenient choice. With increasing awareness about sustainability, cartons are also likely to be a sought-after choice by green consumers.

The second category is innovation and specialty packaging solutions such as pouches and bag-in-box systems, which are becoming increasingly popular for their convenience and distinctive design. The faster innovation progresses, the wider these alternatives may be adopted.

The global beverage container market has gotten its makeover in order. Every product type would have a unique role to play, and future enhancements would more than likely revolve around consumer convenience and sustainability.

By Beverage Type

And so, the global beverage container market is gradually gaining significance because of evolving trends and environmental issues that are resulting in shifting consumption as well as production patterns.

Such a market is made up of varied types of containers, particularly for different forms of beverages, alcoholic and non-alcoholic alike. They all have various needs based on, among other factors, considerations such as convenience, sustainability, as well as end-users. This ever-changing industry will experience a sea change in the days ahead. Its innovation and changing priorities towards society are some of the most salient features. But frequently there is this need for proprietary containers to drink beer, wine, or spirits in alcohol.

But it makes the product more palatable in the consumer market through its quality. This varies from glass bottles and aluminium cans to occasionally green bottles. The market for premium beverages and premium alcohol will also be on the rise, thus creating the demand for sophisticated and well-branded packaging. This segment will be most crucial to the entire market. Non-carbonated beverages are another ginormous segment of the beverage container industry, which appeals to all ages. The items are soft drinks, juices, energy drinks, and bottled water. Rising health awareness accelerates the demand for healthy and functional beverages; hence, it has brought an impact on trends of packaging. For decades, single-use plastics reign supreme in the industry, with biodegradable products and reusable packaging replacing or complementing them.

The developments range from foldable pouches to plant-based containers, targeting the growing high-water mark of consumers embracing green products. Concurrently, sustainability strategies and technology innovations are likely to overwhelm global beverage container market in the foreseeable future. Intelligent packaging and QR traces and temperature-sensitive labels can potentially spark consumer interest while maintaining food safety.

Governments across the world, along with other organizations, also heighten the demand for much stronger packaging waste regulations. This will once more spur investment in green tech and circular economy practices. The world beverage container industry stands at a crossroads and reacts to the evolving demands in an increasingly aware consumer population.

With everything-being alcohol or non-alcohol, innovation and sustainability, thus, become the core theme of the industry to keep it well in place in the global economy and not only to match the prevailing needs but in place of meeting the future expectations as well.

By Distribution Channel

The global beverage container market is experiencing a great revolution due to shifting trends in the preferences of consumers and developments in packaging technology in addition to the increased emphasis on the concept of sustainability. The trends of the packaging and transportation of beverages have transformed significantly with time, and in the future, this trend is expected to continue dominating. One of the key factors, propelling the market is the variability in the number of distribution channels, that specify how such goods reach their consumers. Retail outlets have been a component of drink container buying for centuries. They offer various products, which are attractive to the customers who want to purchase in person and shop around before making a purchase. These retail outlets have a high presence in urban and suburban areas and are easily accessible. But with more convenient sources of shopping, their power might slowly shift, particularly as other avenues grow even stronger. Supermarkets and hypermarkets also play a significant role equally in the market.

They have rather a wide range of packages of beverages, typically at competitive prices, and are favored in bulk buying by customers who like to purchase in big packs. Their ability to accept diverse customer demands makes the establishments indispensible, particularly where population growth is high.

These companies are most likely not to lose their importance altogether but shall have to consider trends such as automation, digitization, among many others, to continue being viable. Convenience stores, however, are capturing the demand for instant, on-the-go purchases. They've carved a niche by having single-serve portions and packaging perfect for instant consumption. Being close to residential and transportation centers makes them a convenient option for many. While they exist now on impulse purchases, having digital capabilities to automate inventory and provide customized suggestions may influence their future development in the beverage container industry.

The highest-growing channels are online retail. Online platforms alter the manner in which people purchase beverage containers, such as doorstep delivery convenience and greater product assortment. The channel is becoming increasingly popular with the technology-conscious consumer, particularly the young consumers, who seek convenience and personalization. Going forward, with technology advancement, online retailing will most probably overshadow the other channels, perhaps with virtual testing or tailor-made packaging.

The global beverage container market is changing, as seen from a dynamic interaction between the more conventional and the newer modes of distribution. The channels would follow suit accordingly because advancement in technology coupled with changing consumer expectation are fashionable these days. So ahead of the curve it is with innovation by the industry towards changing direction.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$248,518.56 million |

|

Market Size by 2032 |

$370,231.75 Million |

|

Growth Rate from 2025 to 2032 |

5.9% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

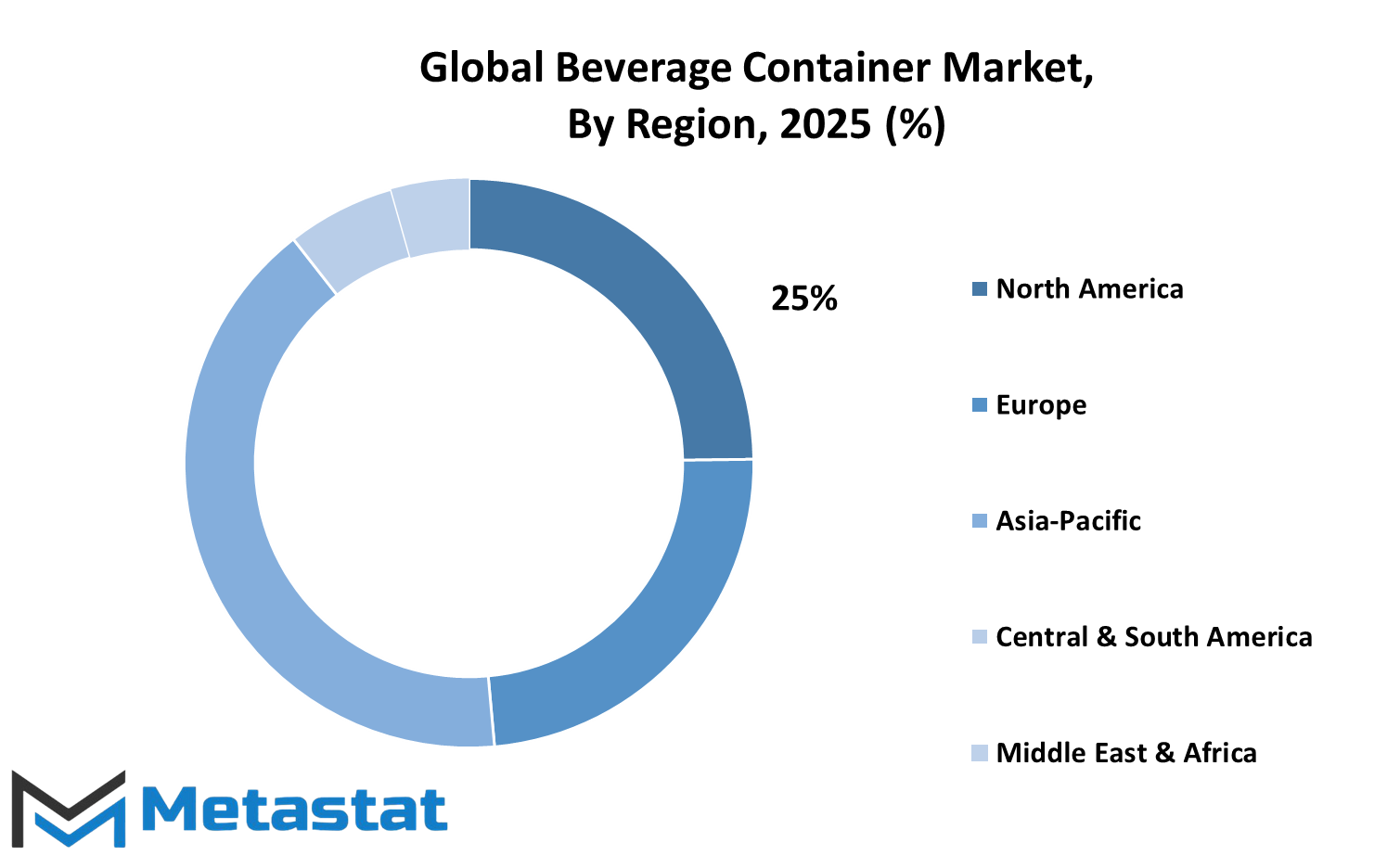

REGIONAL ANALYSIS

The global beverage container industry is part of the global packaging industry and is based on regional consumption patterns, production levels, and tastes. Market development follows from cumulative economic growth, advances in technology, and altering consumer expectations across regions. Regional segmentation assists in better perceiving how all these trends unfold within a given area, illustrating both existing tendencies and possible future trends.

North America is a significant region within the worldwide market that comprises the U.S., Canada, and Mexico. Growing environmental concern has raised the need for sustainable and eco-friendly packaging in this region. Key players are making significant investments in biodegradable and recyclable containers, which is a continuing trend in the near term. The need for convenient, easy, portable drinks has made material innovation and designs impermissible.

Europe, as a significant player with the UK, Germany, France, and Italy in the adoption of green activities in manufacturing of beverage containers, does not fall behind either. The stringent regulations on the utilization of plastics and handling of the waste products compel the growth towards utilization of reusable materials and alternatives. These are predictions anticipated to yield more innovations and changes in the production of containers in the direction of having a lower carbon footprint and a much greener future.

The Asia-Pacific region, comprising India, China, Japan, South Korea, and others, is witnessing accelerated growth because of burgeoning urbanization and burgeoning disposable incomes. As the middle class grows and beverage consumption widens, this region has emerged as a hub for producers. China and India are focusing on large-scale manufacturing while also exploring sustainable initiatives to cater to global aspirations.

Brazil and Argentina are the top dogs of South America, with the remainder of the continent in the process of building its presence in the beverage container industry. Growing investment in local production operations and government efforts to increase recycling operations are assisting the region in aligning itself increasingly with international standards.

The Middle East & Africa holds promising growth potential, particularly in the GCC nations, Egypt, and South Africa. Despite having some regions plagued by poor infrastructure, it is now realized that efforts to support local industries and sustainable approaches are gaining traction.

The global beverage container market is transforming in these markets through environmental issues, technology shifts, and consumers' needs; therefore, it is very innovative and dynamic for the industry's future.

COMPETITIVE PLAYERS

The global beverage container market is going to witness a dramatic transformation in the coming years with the changing requirements of consumers for convenience and sustainability transforming the game. The market, driven by transforming tastes and technological innovations, has major players including Ball Corporation, Crown Holdings, Inc., and Amcor plc, among others. These businesses are striving to align themselves with emerging trends while continuing to develop innovative products that respond to changing consumer habits and yet maintain a competitive position.

One of the most significant drivers of the global beverage container market is sustainability. Governments and consumers are compelling the industry to develop more environmentally sound alternatives to conventional packaging materials. Firms such as O-I Glass, Inc., and DS Smith Plc are exploring biodegradable and recyclable materials that would reduce the footprint on the environment. The trend is also bound to expand further as nations put stronger regulations on single-use plastics, compelling companies to pursue greener solutions.

Moreover, advances in material science and manufacturing processes are increasingly becoming the central focus to overcoming this while not sacrificing quality and affordability. Technological advancement is also the core of what the future has in store for this industry. Firms like Krones AG and Berry Global, Inc., have been developing cutting-edge equipment and production lines aimed at bringing about greater efficiency and reducing losses.

Automation and smart technologies are now part of manufacturing processes, thereby guaranteeing greater speed in terms of production time, as well as quality inspection. This focus on innovation thus guarantees that these companies remain competitive as they respond to the ever-growing need for lightweight, customizable beverage containers. In addition, the growing trend of ready-to-drink products, like energy drinks, flavored waters, and alcoholic drinks, has opened up opportunities for such companies as Mondi Group and Can-Pack S.A.

These companies are developing designs that increase convenience, such as resealable cans and tamper-evident packaging, which resonate with contemporary lifestyles. Concurrently, premium packaging demand is fueling the development of beautiful designs that increase brand recognition and consumer favor. Also on the increase in the beverage container industry are collaborations and acquisitions by market leaders. Other players, such as Silgan Holdings Inc. and Plastipak Holdings, Inc., broaden their capacity as well as share in the marketplace by collaborating with other players or buying out small players to take advantage of common resources and common expertise in the highly competitive market.

This indicates that the future of the global beverage container market will be marked by energetic changes with the company's embracing sustainability, innovation, and strategic expansion. The competitive push by Gerresheimer AG and CKS Packaging, Inc., and other players will continue shaping the market, responding to the needs of consumers as well as the needs of the environment.

Beverage Container Market Key Segments:

By Material

- Glass

- Plastic (PET, HDPE, LDPE, PP)

- Metal (Aluminum, Steel)

- Paperboard

- Other

By Product Type

- Bottles

- Cans

- Kegs

- Cartons

- Other

By Beverage Type

- Alcoholic Beverages

- Non-Alcoholic Beverages

By Distribution Channel

- Retail Stores

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Retail

Key Global Beverage Container Industry Players

- Ball Corporation

- Crown Holdings, Inc.

- Amcor plc

- Comar, LLC

- O-I Glass, Inc.

- Mondi Group

- Toyo Seikan Group Holdings, Ltd.

- Plastipak Holdings, Inc.

- Can-Pack S.A.

- Krones AG

- DS Smith Plc

- Berry Global, Inc.

- CKS Packaging, Inc.

- Gerresheimer AG

- Silgan Holdings Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252