MARKET OVERVIEW

The global cargo transportation insurance market is an integral part of the global trade and logistics industry. It shapes the way goods are moved from one continent to another, giving effect to the almost absolute reliance of a world supply chain on movement. Cargo insurance protects businesses and consumers against the possibility of loss through transportation. The further expansion of trade routes coupled with the constant growth in the volume of international trade creates a demand for an ever-increasing need for insurance coverage, making this sector important across organizations and across borders.

The market will see some revolutionary changes in the near future due to advancement in technologies and changes in global trade patterns. As logistics embraces automation and digitization, the global cargo transportation insurance market will adapt to these trends for real-time tracking and claim management. Moreover, there will be a wider adoption of Artificial Intelligence (AI) and blockchain technology to enable a more refined risk assessment, which would improve transparency in the insurance processes. These advancements will simplify the entire operation, mak

Through this approach, customers' expectations will understand in what segments and how services are provided. Companies will be moving closer to having the personalized and cheaper solutions they demand, while insurers will narrow their tenders to cover specific threats while focusing on different types of cargo. Heavy electronics and perishables will warrant different cover spells, and tailored insurance coverage would ensure the most extensive possible representation of the business without stretching coverage costs.

The challenges facing traditional liability insurers will certainly be extensive in future years along with the increasing sustainability fell in their arms. The true core of this argument involves climate change and environmental concerns, and as the days go by, the more intense will be the pressure for integration into this direction of sustainability under the offers of Global Cargo Transportation Insurance. It could involve something like insurance for electric-powered vessels, or it could simply be an incentive for following sustainability standards. The paradigm shift toward sustainability will change how insurance policies are developed and marketed.

Cargo transportation insurance is likely to become increasingly important, in line with increased linkages and the growing vulnerabilities in global supply chains. Businesses will be using such insurance more often to financially hedge their activities against unpredictable events. Innovation and the evolution of risks will shape the future of the global cargo transportation insurance market, along with changing market demands. Indeed, this will continue to serve as the backbone of the supply chain for the world by securing the necessary protection against the unknown for businesses that do international trade.

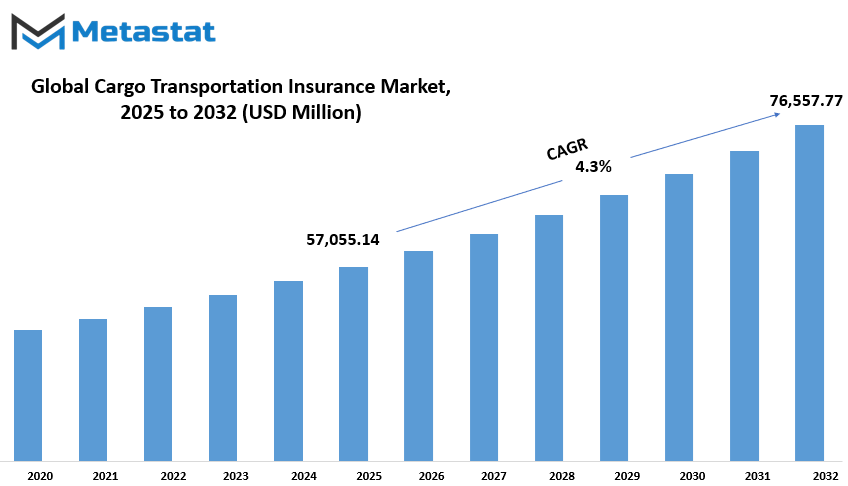

Global cargo transportation insurance market is estimated to reach $76,557.77 Million by 2032; growing at a CAGR of 4.3% from 2025 to 2032.

GROWTH FACTORS

Several factors have been contributing to the expanding growth dimension of the cargo transportation insurance market on a global scale. One big factor triggering this growth is the increasing demand for insured shipments brought about by the burgeoning growth of global trade and e-commerce. As businesses continue trading goods across borders and consumers purchase more and more products online, the demand for reliable shipping insurance becomes thicker than ever. Protecting shipments from probable risks such as theft, damage, or loss now stands as a cardinal consideration both for businesses and consumers.

Moreover, the necessity of stringent regulations for ensuring cargo protection in international supply chains mandates more demand for cargo insurance. Regulations have been put in place by the governments and international authorities in order to protect all shipments, especially when goods are being transported across many countries. Such regulations seek to protect both the businesses and consumers from incurring financial losses because of unforeseen situations. Thus, companies engaged in international trade are often mandated to secure insurance coverage for their goods during transit, much to the general growth of the market.

Nevertheless, positive trends notwithstanding, there are some challenges that might hinder the growth of the cargo transportation insurance market. One major concern involves cargo premiums that are terribly expensive and thus could deter sole traders from being able to take out an adequate insurance policy. Small and medium-sized enterprises (SMEs) are often resource-strapped, and the additional financial burden imposed upon them by premiums could hinder their access to the protection they really need. This affordability problem might slow down growth in the market, especially in scenarios where small businesses are vital to the economy.

Furthermore, the complexity of the claims process may also pose a hindrance to the market. Many businesses face delays in compensation, as the claim-filing and processing exercise is highly complicated and sometimes cumbersome. Lack of transparency and drawn-out procedures may not only irritate firms in instances involving unanticipated losses but may also lead to detestment towards the insurance in general and discouragement for companies to purchase insurance from the beginning.

In the future, opportunities await the cargo transportation insurance market with the advancement of digital platforms and the utilization of blockchain technology. These new enhancements ought to facilitate better policy management, bear features of transparency, substantiate fraud prevention, and have the foundation for a smooth insurance process. Therefore, as technologies will grow further, they will give a new opportunity towards the growth of the market by making it easy and economic for businesses alike to secure their shipments. The future for cargo insurance market growth prospects appears bright, glorified by digital transformation with great expected changes in service delivery and customer satisfaction.

MARKET SEGMENTATION

By Product Type

The global cargo transportation insurance market is a vast area of services meant to protect goods while they are in transit. One aspect of this market is product type segmentation, flexibility in category, level of coverage, etc. A few of the product types are Single Trip Insurance, Open Policy Insurance, and Contingency Insurance.

Single Trip Insurance consists primarily of a sizeable segment of the $17,023.43 million market, to be bought specifically for a one-time trip or shipment, as the name suggests. This product type is best suited for businesses or people who look forward to using it on a specific journey as it is for getting protection from financial losses associated with items in transit, following risks including theft or damage to goods, or loss of the goods themselves. Its value in the market reflects the independent demand for single-coverage options by people who infrequently ship items and need protection for individual shipments.

On the contrary, Open Policy Insurance is specially built for a business that requires movement of goods on a continuous basis. The shipping need is determined by the number of shipments in this policy, to which the bulk of the shipments referred to as those under the policy umbrella are covered over an extended period- one year generally. In addition, the policy remains open. That means it automatically applies to each of the shipments made during the term of the policy, in conformity with a surefire convenience and cost-effectiveness for companies that require continuous coverage. Most companies that engage in international trade or logistics would prefer this type of insurance rather than buying an individual insurance policy for every shipment.

Contingency Insurance is yet another segment in this market, which acts as backup or supplementary insurance. It is usually adopted in those cases where primary insurance policies do not often cover major risks, thus providing a safety net if the main insurance would otherwise fail. Sometimes called Back-to-back Insurance, this covers unforeseen events or provides more insurance in cases of shipments at high risk. It has a great place in shipping businesses as it covers goods which may be considered most fragile or extremely high value, where standards may not cover all types of risks.

Ultimately, all global cargo transportation insurance market quite a range in fulfilling those varied shipping needs, with everything from single-trip, continuous shipping, or separately purchased extra coverage. The variety of product types allows a business or an individual to select the most appropriate insurance for their needs. The growth of the market reflects and highlights the importance of protecting goods during transit and shows the need for reliable, flexible insurance options in the global transportation industry.

By Cargo Type

International trade, in terms of cargo transportation insurance, constitutes one of the main pillars supporting world trade with respect to keeping goods safe in transit from one country to the other. It thus requires sub-segmentation along the lines of risk under different categories of goods and insurance needs. Major types of goods will include dry cargo, liquid cargo, perishable goods, hazardous materials, and valuables and special cargo.

Dry cargo is goods not affected by moisture, such as textiles, machinery, or consumer products. Dry cargo is relatively less affected by environmental factors than other cargoes; therefore, it is regarded as a lower-risk category. However, there still exist situations whereby the cargo can sustain damage due to rough handling, accidents, or even theft, thereby necessitating insurance coverage to protect these goods in transit.

Liquid cargo includes chemicals, oils, or alike liquids, which require great care in transit. Higher risks are entailed regarding the spillage, leakage, or contamination of liquid cargo while being transported. Thus, insuring liquid cargo against this risk becomes important merely to compensate for loss against any damage to the cargo itself or the environment in case of an accident. Part of the logistics of transporting liquids may have specialized equipment and precautionary measures necessary to ensure the safe arrival of such goods. Consequently, liquid cargo insurance will most often cover greater facets.

Perishables, such as fruits, vegetables, and other food items, are extremely time-and-temperature-sensitive goods. These goods require prompt transportation, and in the event that favorable conditions are not maintained, they are not so easily putrefied, contaminated, or damaged; hence they are more demanding in terms of insurance. Insurance serves the purpose of compensating for losses incurred by these items due to delays, temperature changes, or mishandling to ensure that the goods reach their destination in perfect condition.

Hazardous material includes all substances that can cause harm to the health, safety, or environment. Such hazardous materials can take the form of explosives, chemicals, or radioactive materials and are characterized by very stringent governmental regulations regarding transportation safety standards and handling procedures. Insurance for hazardous materials warrants compensation of any damages to the goods involved and to any people or environment, caused by accidents. The insurance of such a commodity becomes vital to the whole shipping process, as it calls for acute knowledge and safety measures.

Valuables and specialty cargo constitute precious goods like electronics, jewelry, and artwork. These goods are increasingly exposed to theft, damage, or loss while in transit and hence require very wide-ranging insurance policies to cover that risk. The high values of these items mean that the costs taken out for insurance for valuables and specialty cargo would quite often be high due to the underlying need for addition precautions and coverage.

The global cargo transportation insurance market, therefore, is indeed diverse, with different types of cargo requiring custom insurance coverage to deal with the specific risks it has to offer. Dry cargo, liquid cargo, perishable goods, hazardous materials, valuables: the importance of having insurance for these goods during transit cannot be overemphasized.

By Policy Type

Around the globe, cargo transportation insurance deals with protection in transporting goods, including financial protection against loss and damage. This market segment is further divided into types of coverage that address the varied requirements of different personalities and organzations involved in shipping and transport. The global cargo transportation insurance market has three major types of coverage: (1) All Risk Coverage; (2) Named Perils Coverage; and (3) Total Loss Coverage.

All Risk Coverage is a comprehensive amount of protection for almost any damage or loss during transit. It provides coverage for a wide range of risks including damages arising from accidents, acts of nature, or theft, etc. It provides for a greater range of coverage and is, therefore, highly sought after with respect to others since businesses are willing to pay just to have peace of mind whilst shipping their valuable or brittle materials.

This named peril insurance is very much like the All Risks policies, except that it normally covers just particular risks clearly mentioned in the insurance policy. This means it does not cover every possible risk but does protect against specific perils like fire, collision, or theft. Such coverage is usually less expensive than All Risk Coverage. But it is incumbent upon the business to evaluate carefully its transport requirements to ascertain whether it provides enough cover for the company's goods.

Total Loss Coverage is concerned only with the total destruction of the cargo. It kicks in when goods are either totally destroyed when being transported or lost in transit such that no opportunity for recovery or partial salvaging is afforded. While this class of coverage could provide significant monetary relief in cases involving serious accidents or great catastrophes, it hardly covers damages less than absolute destruction of the cargo.

Each of these policy types has additional merit based on coverage types that are needed, values of the shipping goods, and specific risks arising from the market. In that way, organizations engaged in global cargo transportation must put thorough consideration into their need and nature of the shipment before taking a specific type of insurance out. Being aware of the differences between the spread of work ensures that businesses wholly secure themselves in the time of transit, thereby diminishing the financial effects of any unforeseen issues that may arise along the way in the transportations of goods.

By End-User

The global cargo transport insurance market is on the upswing because businesses are increasingly coming to realize the need for protection during the transit of goods. This insurance market assumes a prominent position mostly in securing shipments against damage, disappearance, or theft, which may occur at various points of the transportation chain. The market for cargo transportation insurance has gradually grown in demand as the industries become interconnected and global trade flourishes. The market is segmented across various end-user subsegments, each with its own functional requirements and motivations to acquire cargo transportation insurance.

E-commerce companies have become an increasingly large segment of the global cargo transportation insurance market, given the rise of online shopping. These companies depend on timely deliveries and safe transport for high customer satisfaction. Any delay in the delivery process-whether damage during transit or delay-could hurt their reputation. Insurance helps to mitigate these risks so that both the company and its clientele are protected.

Importers and exporters are two major groups that rely on cargo transportation insurance. This insurance is very important for importers because it ensures the protection of goods coming from other countries against all sorts of risks during transit. An eventuality could cause damage to the goods, from an accident to unforeseen delays that affect delivery schedules. On the other hand, exporters are concerned with the reverse scenario: they have to be sure that the goods they are sending overseas go to the rightful buyer in good condition especially when dealing with long transportation routes across different countries.

Logistics companies along with freight forwarders make up another important group of participants in the global cargo transportation insurance market. These companies altogether are instrumental in the movement of goods and ensure that these are transported in an efficient manner and safely. Nevertheless, with the logistics world being a multitude of variables-from changing weather patterns to machinery breakdowns to human errors-it is evident that need for cargo insurance must exist. This insurance provides the cushion for these companies against unanticipated financial crisis; hence they can comfortably offer their services.

Manufacturers and distributors, who are responsible for producing and delivering the goods, also require cargo transportation insurance in the protection of their shipments. From an insurance viewpoint, manufacturers would consider their shipment since the goods would most likely form a big part of their financial investment, which under the worst circumstances would lead to an eventual loss if damaged or lost in transit. Distributors transporting goods from manufacturers to retailers or towards the end-user also need protection in the course of accomplishing their operations.

In summary, the global cargo transportation insurance market is an essential market for various industries: importers and exporters, logistics companies, e-commerce businesses, manufacturers, and distributors all depend on cargo insurance to protect their goods and guarantee smooth operation. As global trade scales up and supply chain become more complicated, the need for such insurance will continue to grow.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$57,055.14 million |

|

Market Size by 2032 |

$76,557.77 Million |

|

Growth Rate from 2024 to 2031 |

4.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

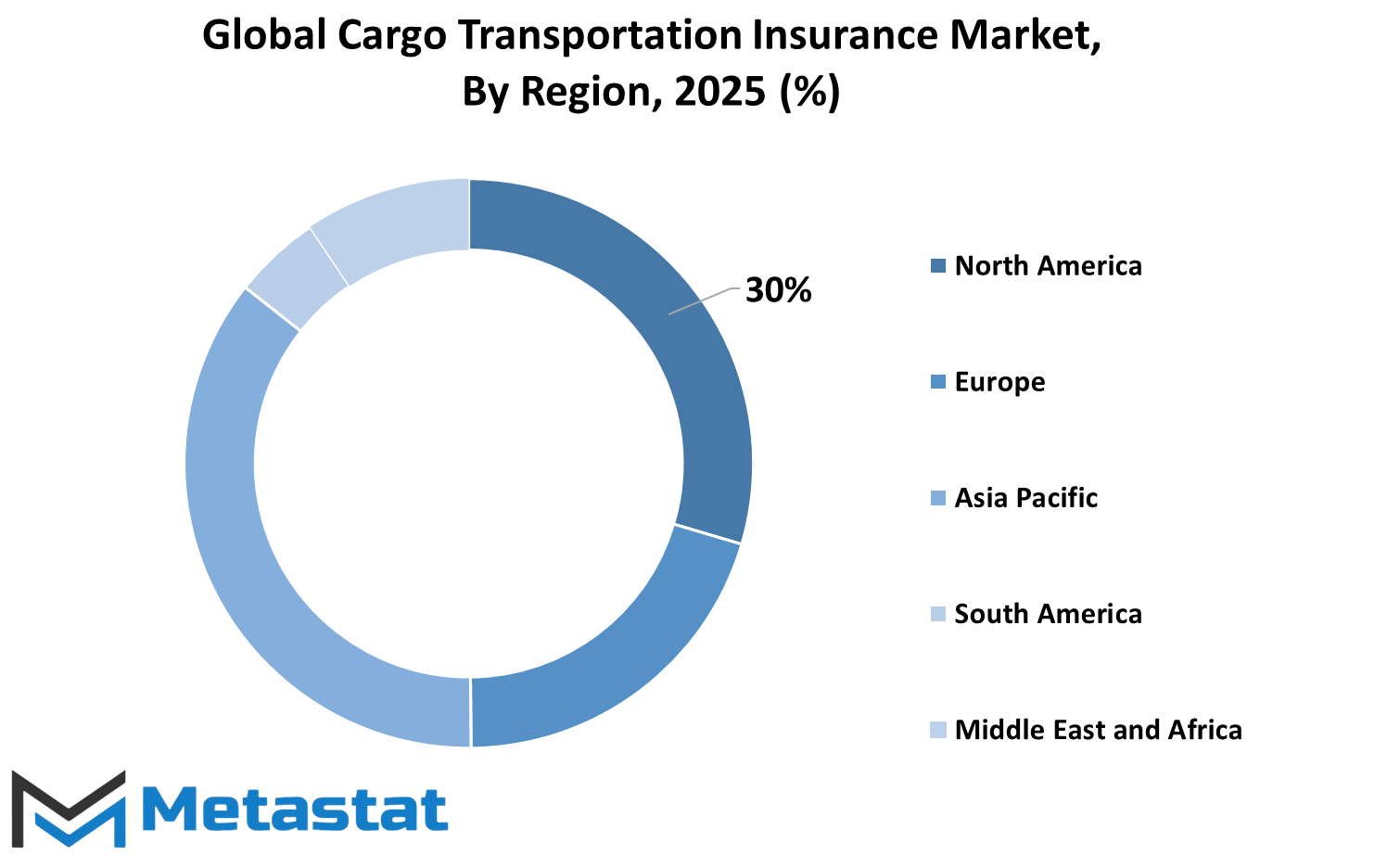

The global cargo transportation insurance market has been divided among geographies into regions, such as North America; there are smaller regions generally called the U.S., Canada, and Mexico. Each country has its own specific regulatory environment and demand for cargo transportation insurance that, in turn, have influenced the market distinctively.

The other major region in the global cargo transportation insurance market is the Europe Region. It includes major countries, including the UK, Germany, France, and Italy, along with other countries grouped as "Rest of Europe". Besides, these insurance needs differ due to the volume of international trade, the economic conditions, and the level of development of the infrastructure in these countries.

Asia-Pacific is a vast and diverse region that accommodates important countries, namely India, China, Japan, and South Korea. The increase in trade and transportation in these countries has given rise to an upsurge in demand for cargo transportation insurance. Several other countries in the eastern region fall within the category "Rest of Asia-Pacific" and are now also experiencing a huge demand for insurance solutions due to the growth of their economies.

South America, despite not being as large a country as North America or Europe, still has a special place in the global cargo transportation insurance market. Comprised of Brazil, Argentina, and other countries, it forms the "rest of South America." The increase in trade in this region has caused a continuous influx in dollars spent on transportation insurance products.

A region such as the Middle East & Africa looks very promising, due to the conditions in countries such as the GCC countries, Egypt, South Africa, and other remaining nations within the "Rest of Middle East & Africa" category. The demand in these countries depends on their strategic location as trade hubs, and the increase in the amount of exports and imports.

Each of these regions uniquely shapes the global cargo transportation insurance market. To navigate the complexities of this industry, it is important for businesses to understand the market dynamics in each area.

COMPETITIVE PLAYERS

The global cargo transportation insurance market is a significant area of trade and logistics. It is set up so that the goods in transit are covered, permitting protection for businesses against losses resulting from accidents, natural disasters, thefts, and other unforeseeable events. A handful of leading players in the global cargo transportation insurance market are doing quite a fair share of work and contributing to its growth.

Some of the major players in the cargo transportation insurance field include Allianz SE, AXA XL, Zurich Insurance Group, and Tokio Marine Holdings, Inc. These are household names and are highly regarded for their well-rounded experience and range of services, providing tailored solutions for businesses engaged in international trade. Allianz SE is especially well regarded for its prompt and reliable services, while AXA XL and Zurich Insurance Group are both considered leaders in risk management.

Not to be left behind in the industry are other major companies, namely, Chubb Limited and American International Group, Inc. (AIG). Both companies have years of experience in the area of cargo insurance, offering a variety of programs to meet the needs of enterprises, ranging from small importers to large multinational corporations. The AIG has built a reputation for backing global coverage of cargo operations while Chubb decidedly leans toward providing customizable insurance solutions.

A major industry player in cargo insurance is Lloyd's of London, with also Atradius N.V. and Marsh McLennan. Lloyd's, in itself, is a global cargo transportation insurance market of sorts and presents some very innovative solutions for risk-sharing among participating insurers and reinsurers. Atradius N.V. focuses on credit insurance, while Marsh McLennan is more of a brokerage giant on its own, helping businesses find the right coverage.

Other key players include QBE Insurance Group Limited, RSA Insurance Group Limited, and Sompo International Holdings Ltd. These companies offer global solutions for businesses engaged in cargo transportation, providing peace of mind to those dealing with the complexities of international trade. Swiss Re Group, HDI Global SE, and Generali Group share a place on the global cargo transportation insurance market for their long-standing experience and ability to underwrite in different areas, thereby ensuring complete protection to ensure their goods are covered while in transit.

These players act as the growth engine for the global cargo transportation insurance market, providing necessary protection to be able to confront risks accompanying international trade. These companies will continue to be the future of cargo transportation insurance that will grow on further.

Cargo Transportation Insurance Market Key Segments:

By Product Type

- Single Trip Insurance

- Open Policy Insurance

- Contingency Insurance

By Cargo Type

- Dry Cargo

- Liquid Cargo

- Perishable Goods

- Hazardous Materials

- Valuables and Specialty Cargo

By Policy Type

- All Risk Coverage

- Named Perils Coverage

- Total Loss Coverage

By End-User

- Importers and Exporters

- Logistics and Freight Forwarding Companies

- E-commerce Companies

- Manufacturers

- Distributors

Key Global Cargo Transportation Insurance Industry Players

- Allianz SE

- AXA XL

- Zurich Insurance Group

- Tokio Marine Holdings, Inc.

- Chubb Limited

- American International Group, Inc.

- Lloyd’s of London

- Atradius N.V.

- Marsh McLennan

- QBE Insurance Group Limited

- RSA Insurance Group Limited

- Sompo International Holdings Ltd.

- Swiss Re Group

- HDI Global SE

- Generali Group

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252