Global Building Information Modeling (BIM) Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global building information modeling (BIM) market grew into the most disruptive sector of the design and construction industry. The concept began as a niche towards the end of the 20th century when architects and engineers experimented with computer drafting tools that went beyond the basics of two-dimensional drawings. Initial efforts in the 1970s and 1980s brought forward software that could model building components in three dimensions, but it wasn't until the 1990s that structured modeling tools began to gather speed. This was the beginning of what would subsequently come to be known as a new paradigm for thinking about the entire lifecycle of a building.

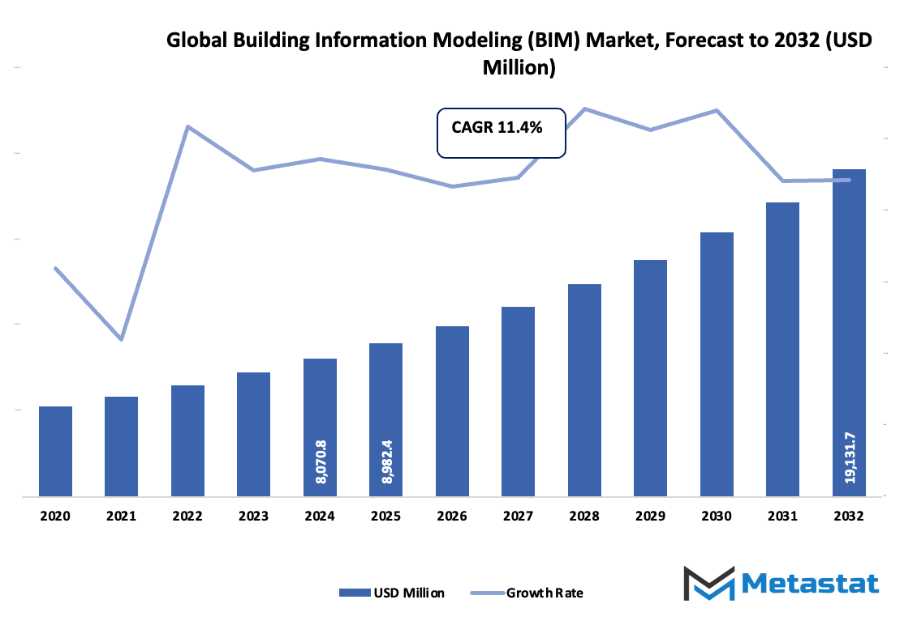

- Global building information modeling (BIM) market of approximately USD 8982.4 million in 2025 and will grow at approximately 11.4% CAGR in 2032, and it can grow higher than USD 19131.7 million.

- On-Premises Deployment hold approximately 37.2% market share, driving innovation and expanding applications by carrying out thorough research.

- Key trends driving growth: Increased need for efficient construction processes, More emphasis on sustainability in construction projects

- Opportunities: Implementation of BIM in infrastructure development projects

- Key insight: The market is expected to grow exponentially in value over the next decade, suggesting unprecedented opportunities for growth.

- Since its inception, the path of the global building information modeling (BIM) market has been marked by several dramatic milestones.

Object-based parametric modeling brought about the possibility for designers not just to visualize, but also to manage data linked to each building component. This was a milestone that paved the way towards wider acceptance. At the beginning of the 2000s, North American and European administrations began promoting digital modeling to improve transparency of public infrastructure projects. As these regulatory pressures rolled out across different areas, the market started to shift from voluntary uptake to an accepted standard for efficiency and accountability. The distinction that differentiates today's environment is the way consumer expectations have altered. Owners and builders today demand projects to be faster to provide, environmentally sustainable, and value-effective in the long term.

This pressure has motivated software developers to continue advancing their platforms with technologies like real-time collaboration, cloud access, and integration with smart technologies. With the shift in construction practices towards sustainability and net-zero goals, the global building information modeling (BIM) market will increasingly emerge as a technical and strategic tool. Looking ahead, the industry will be that much more mature as digital twins, automation, and AI become the norm in construction processes. The path from its modest start to where it is now demonstrates not just a technological shift, but a cultural shift as well in terms of how the business imagines, builds, and sustains the places human beings will call home and work in tomorrow.

Market Segments

The global building information modeling (BIM) market is mainly classified based on Deployment Mode, Project Lifecycle, Application, End User.

By Deployment Mode is further segmented into:

- On-Premises Deployment: On-premises deployment within the global building information modeling (BIM) market will still be appropriate for those companies who are concerned about data security and immediate control. It offers tailored solutions with self-managing internal IT. It will continue to be appropriate for sectors requiring stringent compliance and full ownership of systems without depending on external providers of services.

- Cloud Deployment: Cloud deployment in the global building information modeling (BIM) market will allow flexibility and collaboration region-wise. More digital transformation will be enabled by cloud-based models that allow real-time updates, scalable storage, and reduced infrastructure costs. This approach will allow easier coordination for large projects and connect different teams with more efficiency.

By Project Lifecycle the market is divided into:

- Preconstruction: The preconstruction phase of the global building information modeling (BIM) market will be driven by extremely sophisticated planning and forecasting methods. Virtual modeling will be employed to identify potential dangers, reduce errors, and optimize resource allocation before actual work is started. This will help minimize waste and enhance decision-making for better results in the project.

- Construction: Construction stages of the global building information modeling (BIM) market will focus on live monitoring and error-free execution. With accurate digital models, project managers will reduce delays and keep costs in check. Integration of data from throughout teams will increase productivity in combination with providing transparency, the construction process becoming faster and more reliable.

- Operation: Operation in the global building information modeling (BIM) market will change to predictive maintenance and green building management. Smart use of data will track performance, improve energy efficiency, and achieve long-term asset value. Cost savings will be made possible while extending the life of buildings through effective management.

By Application the market is further divided into:

- Planning and Modelling: Planning and modeling in the global building information modeling (BIM) market will allow for effective visualization of projects before their implementation. 3D models and digital twins will provide better planning of layout, material, and schedule. This method will simplify the communication between stakeholders and reduce expensive revisions in later stages.

- Design and construction: Design and construction in the global building information modeling (BIM) market will involve more integration of ideas and actual implementation. Data models will construct more efficient and responsive buildings. More interaction among builders and designers will produce new designs while creating harmony with project goals.

- Asset Management: World-wide Building Information Modeling (BIM) Market asset management will pay dividends in the long term for facility owners. Computerized systems will track maintenance, upgrades, and asset performance in real time. This will extend service life, reduce repair costs, and provide sound data to inform future infrastructure investment.

- Building System Analysis and Maintenance Scheduling: Building systems analysis and scheduling maintenance will be predictive in the global building information modeling (BIM) market. Computerization of the systems will aid pre-emptive comprehension of issues before they occur. Scheduling automatically will reduce downtime and save energy costs, enabling sustainable and cost-effective operations.

By End User the global building information modeling (BIM) market is divided as:

- Architects/Engineers: Architects and engineers in the global building information modeling (BIM) market will be equipped with more advanced design accuracy and visualization capabilities. Team coordination will be streamlined using collaborative platforms, with added creativity and technical performance. Digital innovation will produce more sustainable and efficient buildings to meet future urban development needs.

- Contractors: Contractors operating in the global building information modeling (BIM) market will benefit from accurate scheduling, material planning, and resource allocation. Improved integration of data will allow for faster decision-making and minimized delays. This will translate into enhanced project efficiency with reduced risks and seamless completion of projects.

- Others: Government departments, consultants, and building managers shall be among the other participants in the global building information modeling (BIM) market. Their uses of digital modeling shall be on compliance, cost control, and long-term sustainability of assets. Such users shall rely on BIM for monitoring quality, safety, and regulatory compliance during infrastructure projects.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$8982.4 Million |

|

Market Size by 2032 |

$19131.7 Million |

|

Growth Rate from 2025 to 2032 |

11.4% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

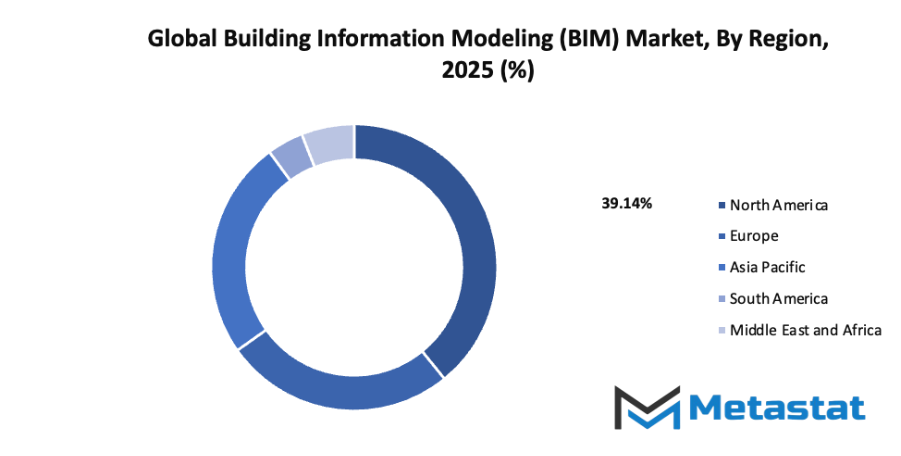

- Based on geography, the global building information modeling (BIM) market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

Increased demand for efficient construction processes: The global building information modeling (BIM) market will expand due to the rising need for efficient construction methods. BIM enables accurate planning, real-time data access, and smoother coordination across project stages. Faster decision-making, reduced delays, and better use of resources make BIM essential for firms aiming to deliver projects within budget and on schedule.

Growing emphasis on sustainability in construction projects: The global building information modeling (BIM) market will benefit from the increasing demand for sustainable construction. BIM supports eco-friendly design by optimizing energy efficiency, reducing waste, and lowering environmental impact. With regulations encouraging greener practices, BIM becomes an essential tool for integrating sustainability goals into projects and improving long-term building performance.

Challenges and Opportunities

High initial investment costs: The global building information modeling (BIM) market is slowed by high initial costs required for technology adoption. Software, training, and system integration demand significant spending, which can discourage smaller firms. Although upfront expenses are high, long-term benefits such as reduced rework, greater efficiency, and improved project outcomes justify the investment.

Resistance to change in traditional construction practices: The global building information modeling (BIM) market faces barriers due to reluctance in shifting from conventional methods. Many firms rely on familiar approaches and hesitate to adopt digital platforms. Limited technical knowledge and fear of workflow disruption add to the resistance. However, growing industry pressure highlights the need for change.

Opportunities

Adoption of BIM in infrastructure development projects: The global building information modeling (BIM) market will grow significantly with increasing use in infrastructure projects. Governments and private sectors are adopting BIM for transport, utilities, and urban development. Its ability to improve cost management, enhance design accuracy, and strengthen collaboration ensures BIM remains vital for large-scale future infrastructure.

Competitive Landscape & Strategic Insights

The global building information modeling (BIM) market reflects a dynamic competitive landscape shaped by both established multinational corporations and ambitious regional players striving for recognition. Major names such as Autodesk, Inc., Nemetschek Group, Trimble Inc., Bentley Systems, Incorporated, Dassault Systèmes, Asite Solutions Ltd., Archidata Inc., Beck Technology Ltd., Computers and Structures, Inc., Schneider Electric, Hexagon, 4M Company, Procore Technologies, Inc., CYPE Ingenieros, S.A., Siemens AG, IES Ltd., and Newforma, Inc. continue to influence the industry through technological innovation, mergers, and strategic alliances. Each competitor brings distinct strengths, from software expertise to integrated hardware solutions, ensuring that competition does not stagnate but pushes the industry forward at an accelerated pace.

Future development in this market will be defined by how these competitors adapt to changing demands in construction, infrastructure, and design. Automation, cloud-based platforms, artificial intelligence, and digital twins are expected to shift how projects are planned, executed, and maintained. Strategic insights from observing current trends suggest that integration between software and real-time data analytics will play a central role in market differentiation. Companies that successfully align their products with sustainability requirements, energy efficiency standards, and smart city initiatives are likely to establish stronger positions.

Competition will intensify as regional companies introduce localized solutions tailored to specific regulatory and cultural contexts. While international leaders hold extensive resources and established client networks, smaller competitors can act more flexibly, adapting quickly to market changes and offering specialized services that may not be immediately available through larger corporations. This balance between scale and adaptability creates an environment where innovation is not optional but essential for survival.

The strategic future of the BIM market lies in partnerships that cross traditional industry boundaries. Collaborations with governments, urban planners, and technology providers outside the construction sector will expand the influence of BIM beyond architecture and engineering. The rise of smart infrastructure, powered by IoT and predictive modeling, opens opportunities for companies that position themselves at the intersection of digital technology and physical construction.

Market size is forecast to rise from USD 8982.4 million in 2025 to over USD 19131.7 million by 2032. Building Information Modeling (BIM) will maintain dominance but face growing competition from emerging formats.

Long-term competitiveness will be shaped by how well these companies invest in research and development while maintaining customer accessibility. Cost efficiency, user-friendly platforms, and seamless integration with existing tools will remain decisive factors. Looking ahead, the global BIM landscape is likely to be less about dominance by a few and more about dynamic cooperation and healthy rivalry, ensuring that innovation and efficiency continue to define the industry’s trajectory.

Report Coverage

This research report categorizes the Building Information Modeling (BIM) market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Building Information Modeling (BIM) market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Building Information Modeling (BIM) market.

Building Information Modeling (BIM) Market Key Segments:

By Deployment Mode

- On-Premises Deployment

- Cloud Deployment

By Project Lifecycle

- Preconstruction

- Construction

- Operation

By Application

- Planning and Modelling

- Construction and Design

- Asset Management

- Building System Analysis and Maintenance Scheduling

By End User

- Architects/Engineers

- Contractors

- Others

Key Global Building Information Modeling (BIM) Industry Players

- Autodesk, Inc.

- Nemetschek Group

- Trimble Inc.

- Bentley Systems, Incorporated

- Dassault Systèmes

- Asite Solutions Ltd.

- Archidata Inc.

- Beck Technology Ltd.

- Computers and Structures, Inc.

- Schneider Electric

- Hexagon

- 4M Company

- Procore Technologies, Inc.

- CYPE Ingenieros, S.A.

- Siemens AG

- IES Ltd.

- Newforma, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252