Market Overview

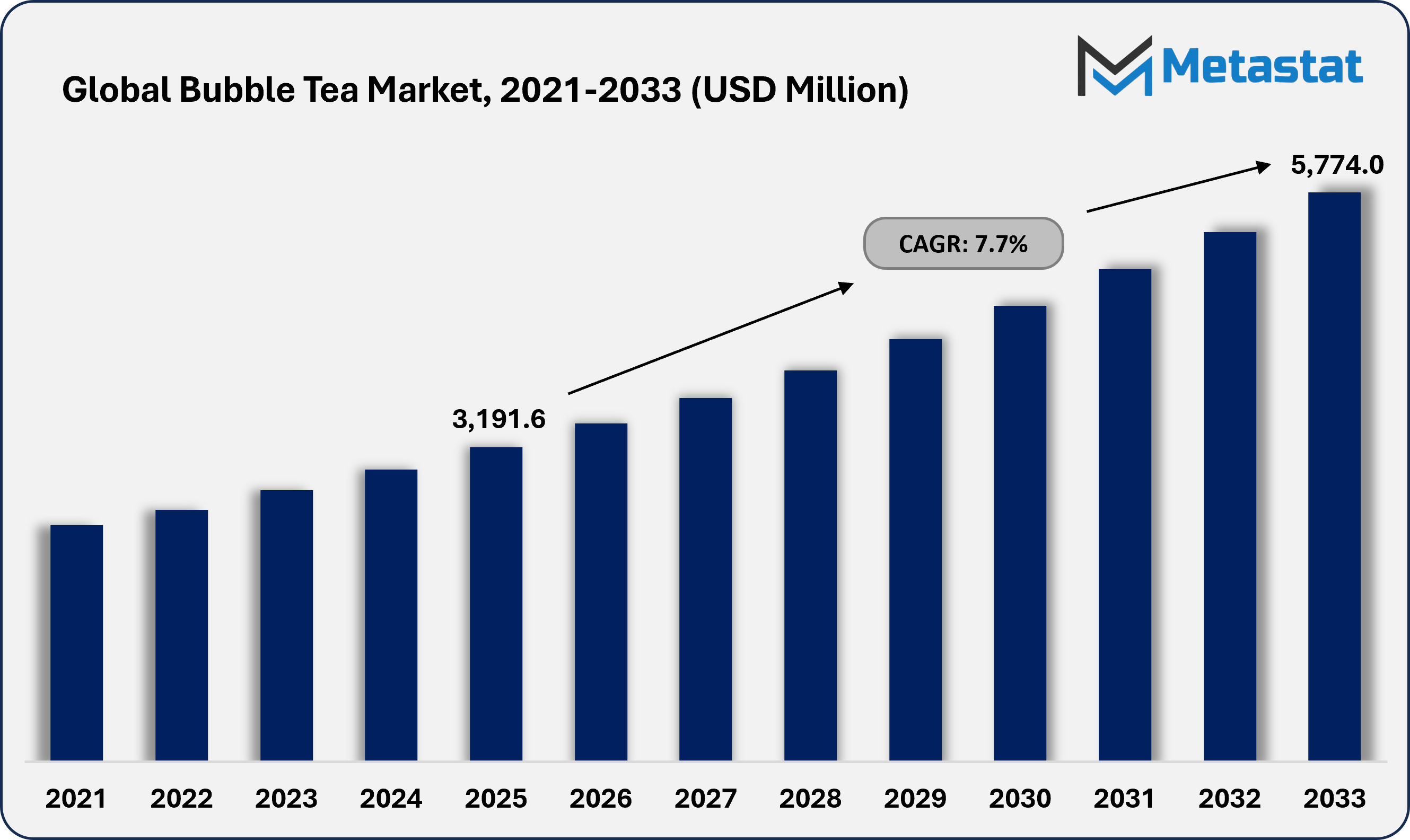

The global Bubble Tea market size was valued at USD 3,191.6 million in 2025. The market is projected to grow from USD 3,434 million in 2026 to USD 5,774 million by 2033, exhibiting a CAGR of 7.7% during the forecast period.

The bubble tea market has rapidly evolved from a niche Asian beverage market into a global, highly branded category characterised by dense franchise networks, high-frequency consumption, and accelerating product innovation. Platform data cited by Grab show consumers drink an average of four cups of bubble tea per person per month Southeast Asia, with Thailand reaching about six cups and the Philippines five cups, underlining the drink's role as an everyday refreshment rather than an occasional treat. Chatime corporate briefing noted that regional demand in Southeast Asia was surged by about 3,000% in 2018, highlighting how quickly new formats, toppings, and digital ordering can scale once the category gains social media traction. On the supply side, leading specialist chains are building global footprints. For instance, Gong Cha reported record system sales of around USD 600 million in 2024 and closed the year with 2,162 outlets across 28 markets, with plans to expand further in Europe and target 10,000 stores globally by 2032.

Chatime's network similarly spans more than 30 countries across four continents, illustrating how Taiwanese-born brands now anchor a globalised "boba" ecosystem. At the same time, China's low-cost chains are reshaping competitive dynamics. For instance, Mixue Group has grown to over 45,000 outlets worldwide, around 40,000 in China, making it the world's largest food-and-beverage chain by store count and intensifying price competition in emerging markets such as Indonesia and Vietnam. Beyond dedicated teahouses, large beverage multinationals are using bubble tea to refresh their portfolios and target younger consumers. This ecosystem is increasingly diversified by format such as speciality cafés, kiosks, QSR tie-ups, convenience stores, RTD bottled or canned boba drinks. Moreover, the product extensions such as bubble-tea-flavoured bakery items and desserts reflecting the drink's migration from trend to lifestyle and reinforcing its position as one of the most dynamic segments in the contemporary non-alcoholic beverages industry.

Global Bubble Tea Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

- Global bubble tea market is valued at USD 3,191.6 million in 2025, growing at a CAGR of around 7.7% through 2033, with potential to exceed USD 5,774 million.

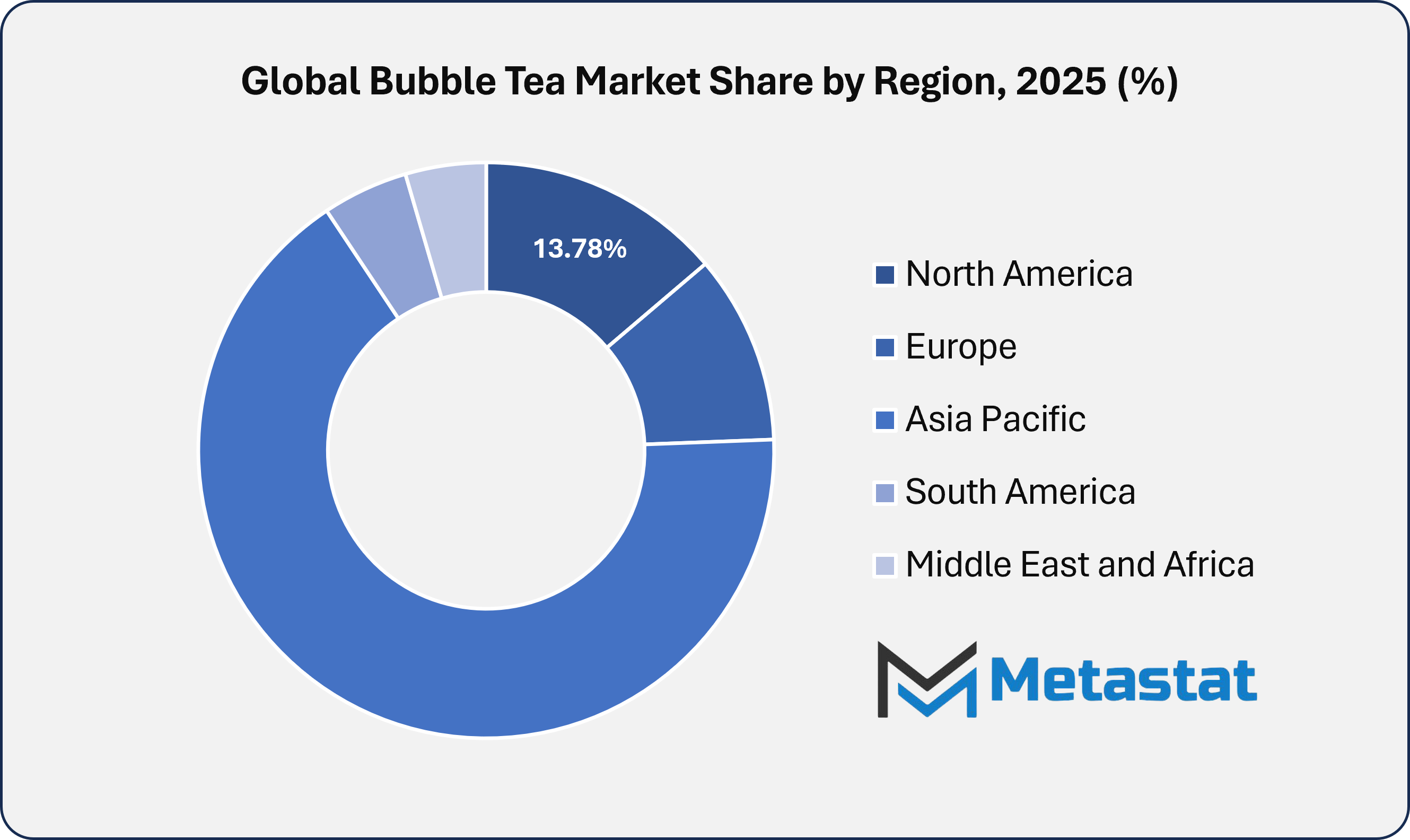

- Asia Pacific holds 66.25% in 2025 with Taiwan leading the market share in 2026.

- Black Tea segment accounts for a market share of 40.26% in 2025 driving the market growth.

- Key trends driving growth: Global popularity of Asian cuisine and experiential beverage trends and social media appeal driving younger consumer adoption.

- Innovation in healthier ingredients, functional add-ins, and premiumization are key market opportunities within forecast period.

- Key insight: Expanding beyond the traditional drink cup into adjacent categories like snacks, ice cream, and desserts leverages the brand's popularity to capture new spending occasions.

Market Dynamics

Growth Drivers:

Global popularity of Asian cuisine and experiential beverage trends.

The growing popularity of Asian cuisine culture is a vital factor in bubble tea's growth outside of Asia. Bubble tea has gone from being a niche ethnic drink to a popular drink choice globally.

Social media appeal driving younger consumer adoption.

Social media is a key aspect in getting new customers, especially for Gen Z and Millennials. Viral visual trends and user-generated content on platforms is al lending factor for product trial, brand discovery, and long-term consumer engagement.

Restraints & Challenges:

High sugar content leading to health-conscious consumer backlash.

Sugar concentration and health effects are a major obstacle and problem in adoption of bubble tea. As more people become aware of the health risks of sugar and the government looks more closely at how much sugar people eat, traditional recipes may become less popular with health-conscious clients. This could lead to stricter labeling, higher taxes, and market limitation for bubble tea market.

Market saturation and intense competition among brands.

Intense competition is a key factor for restricted market growth in bubble tea industry. The low entry barrier, growing independent stores & chains, pricing competition is hindering the market growth and potential.

Opportunities:

Innovation in healthier ingredients, functional add-ins, and premiumization.

Healthy innovations and premiumization is a critical opportunity encashed by market leaders. Reformulating products with low-sugar recipes, natural sweeteners, and functional add-ins such as protein or adaptogens is directly addresses the main health restraint and opens new premium market segments. Whereas, moving beyond basic drinks through high-quality ingredients, artisanal preparations, and limited-edition collaborations allows brands to differentiate in a saturated market and command higher price points.

Market Segmentation Analysis

The global Bubble Tea market is mainly classified based on Type, Flavor, Distribution Channel, and undefined.

By Type, the market is further segmented into:

- Black Tea

Black Tea is the leading market segment and cash cow in bubble tea market. With the biggest share of the market owing to its strong flavor that goes well with milk and sweets, making it the classic profile buddle tea category.

- Green Tea

Green tea is an important growth segment owing to global health and wellness trends. Its purported antioxidant benefits and lighter taste appeal to health-conscious customers, allows for premium positioning. The premium market position will help the segment to contribute a major CAGR for buddle tea market.

- Oolong Tea

Oolong Tea is a premium and unique niche market that appeals to connoisseurs and older people owing to its complex, subtle flavor profile. It supports higher price points and is commonly utilized in artisanal or luxury product lines.

- White Tea

White Tea is a new and high-end niche market that is used for its delicate flavor and strong antioxidant content. It is usually available in small amounts to appeal to the most health-conscious customers and with a high price point.

- Others

Others such as fruit teas, coffee, and non-tea bases, are the most important area for new ideas and growth. They are important for getting new customers to try tea, meeting dietary needs, and reaching a wider range of drinkers than just tea lovers.

By Flavor, the market is divided into:

- Fruit

Fruit flavors are the key area of development and innovation, with new seasonal and exotic types coming out all the time. This segment appeals to a wide range of customers looking for refreshing, colorful, and frequently lower-calorie options. Moreover, the increasing social media posting within this category will also push the market further.

- Original

Original flavors, like classic milk tea and taro, are the basic and most important part of the menu for most firms. This category generates consumer loyalty through familiar taste and are essential for building brand identification and operational consistency.

- Chocolate

Chocolate tastes are a popular treat and crossover category owing to mass sweet desire and blur the distinctions between dessert drinks. This segment also helps to generate new customers during the colder months.

- Coffee

Coffee flavors are a strategic competitive segment that directly targets customers from the premium coffee shop occasion. This category utilizes the current coffee culture to entice people to try them and come back more often by delivering a familiar caffeine base with fun bubble tea textures.

- Others

The Others segment covers flowery, nutty, and hybrid flavors which are part of the experimental and premiumization group. Brands employ them to make trademark products, create buzz in the media with limited editions, and appeal to adventurous customers who want to try new flavors.

By Distribution Channel, the market is further divided into:

- B2B Sales

B2B sales are the most important part of the upstream supply and franchising market. The segment includes all wholesale transactions in which firms sell to other businesses. This category involves providing store owners with raw materials such as tea, tapioca, and syrups, equipment, and the rights to use franchising models. This segment is one of key driving factor of the bubble tea market.

- B2C Sales

B2C sales category is expected to push the market into growth phase in the forecast period. The segment includes all direct sales to the end customer. This channel is made up of physical stores for the experiential core, online food delivery services for growth driven by convenience, retail supermarkets for ready-to-drink product expansion, and other direct channels. Together, these channels increase brand awareness, market penetration, and contribute a major share of the industry's total revenue.

By Region:

- Based on geography, the global bubble tea market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America Bubble Tea Market is set to expand at a CAGR of 7.7% within the forecast period, reaching a market size (TAM) of USD 786.4 million by the end of 2033.

- The Health and Wellness Megatrend is a major force in the North America market, with a majority of people opting for healthier drink options. People who care about their health, especially Millennials and Gen Z, have begun to shift from sugary drinks. The result has led to a rise in reformulated and healthier products. This factor has led to a rise in reformulated products within North America region. It also shows up in the widespread use of low-calorie and low-sugar foods, sugar-free natural sweeteners like stevia, and plant-based milk substitutes like oat and almond milk.

- Brands like Gong Cha have taken advantage of this trend by providing bubble teas that are ready to drink and sugar level options like less sweet or no sugar. The movement is also making green and black tea bases more popular owing to the health benefits perception such as increased metabolism and reduced free radicals.

- The North American market is growing through social media marketing and experienced based growth. The deeply rooted in digital social networks and beverage culture has leads to discovery and repeat purchases in bubble tea market.

- Bright colors, customizable toppings, and photogenic presentation is the primary aspect that makes the bubble tea products social media worthy in US. The increased appeal on sites like TikTok and Instagram, where #bubbletea has millions of posts, drives viral trends and peer-to-peer marketing. The Younger customers are increasingly driving the purchases in bubble tea. As per Metastat analysis, around 94% of U.S. consumers aged 20 to 29 had recently bought buddle tea and related products. As a result, brands are shifting towards influencer marketing and digital campaigns to reach younger audience.

- The product diversification and premiumization lead opportunity focuses on growing the bubble tea brand and flavor profile beyond the usual drink cup into new product categories and high-end experiences. The strategy is to use the drink's famous flavors to make snacks, desserts, and retail items which have been inspired by bubble tea. These product range includes ice cream, mochi, instant noodles, and beauty products.

- The room for premiumization in the beverage segment through limited-edition flavors, high-quality artisanal ingredients, and unique culinary collaborations such as cheese foam toppings, seasonal fruit infusions is providing key expansion opportunities across the globe.

- Digital integration and hyper-local franchise growth by using technology and flexible business models to reach a large number of customers in a wide range of bubble tea markets. Advanced digital platforms for mobile ordering, delivery app partnerships, and customer loyalty programs is a key factor propelling the market growth within Asia Pacific region.

- The aggressive franchising, especially through flexible formats like kiosks and cloud kitchens, is helping a quick market growth into busy urban and suburban areas. Hyper-localization is the key to success. The master franchises and local partners are innovating flavors such as ube in Philippines or saffron in the Middle East to fit with the tastes of specific cultures. This two-pronged approach of tech-enabled service and localized, asset-light growth is key to getting growth in both mature and new markets.

- The bubble tea is becoming more popular within Middle East, Africa, and South America regions. The growing brands are entering the new market and young people are becoming more interested in bubble tea. The early-stage growth of the market is marked by the planned entry of international franchises like Gong Cha and KOI Thé into major cities like Dubai, São Paulo, and Johannesburg to establish a first-mover presence. Growth is driven by rising cross-cultural food trends, increased cities population, and young, digitally connected consumers with increased disposable income.

Competitive Landscape & Strategic Insights

The global bubble tea market is highly fragmented and regionally concentrated, with Taiwan- and China-origin brands exerting strong influence across Asia-Pacific and increasingly in North America, Europe, and the Middle East. Leading chains such as Gong Cha, Chatime, CoCo Fresh Tea & Juice, Kung Fu Tea, and KOI Thé anchors the organized segment supported by extensive franchise networks, standardized quality systems, and strong brand recall. Heritage players like Chun Shui Tang, TP Tea, and Ten Ren’s Tea Time reinforce the category’s authenticity by leveraging deep roots in Taiwanese tea culture, while newer lifestyle-oriented brands like The Alley, Tiger Sugar, Heytea, and Mixue Ice Cream & Tea compete through experiential retail concepts, social media visibility, and highly differentiated flavor formats.

Competitive intensity is driven by rapid outlet expansion, menu innovation, and localization of products to suit country-specific tastes, price points, and health preferences. Chains such as KOI Thé, Tealive, LiHO TEA, and Mixue Ice Cream & Tea have aggressively grown their footprints in Southeast Asia and beyond, often using master-franchise or regional partnership models supported by structured training and quality-assurance programs documented in corporate and regulatory filings. Furthermore, brands like Boba Guys, Teaspoon, and Happy Lemon focus on premium positioning in Western markets, emphasizing higher-quality ingredients, transparent sourcing, and curated in-store experiences to differentiate against both local independents and imported Asian chains.

Product strategies across competitors increasingly converge around three themes, which are authenticity of tea, indulgent signatures, and health-oriented customisation. Established tea companies such as Ten Ren’s Tea Time and Chun Shui Tang build on their expertise in loose-leaf tea and traditional recipes, while trend-led chains like Tiger Sugar, Xing Fu Tang, Truedan, and OneZo compete on visually distinctive brown-sugar or handmade toppings that command premium pricing and drive viral demand.

Barriers to entry at scale are rising as leading players invest in upstream sourcing, proprietary recipes, digital ordering ecosystems, and brand-led communities. Larger groups rely on centralized procurement and, in some cases, dedicated manufacturing plants for tea, toppings, and syrups which will support consistency and cost control across hundreds of global outlets. However, competition from local specialty cafés and emerging regional brands remains intense, forcing the major chains such as Kung Fu Tea, Sharetea, Royaltea, Presotea, Wushiland Boba, and others to continuously refresh menus, collaborate with delivery platforms, and adopt loyalty programs to sustain traffic and defend market share.

Forecast & Future Outlook

Market size is forecast to rise from USD 3,191.6 million in 2025 to over USD 5,774.0 million by 2033.

The bubble tea market is expected to grow steadily over the decade that follows overall rise in global tea consumption. The rising incomes in developing countries, a continued shift toward flavored and specialty teas, and the rapid spread of Asian beverage formats around the world is propelling the market growth by 2033. Format innovation such ready-to-drink, retail kits, and home-preparation packs combined with digital ordering and delivery integration will all help the market to grow in the future. Stricter sugar-reduction policies and public health concerns in places like Singapore, Malaysia, the EU, and North America are likely to push operators toward lower-sugar formulations, portion control, and clear nutritional labeling. These factors will favor brands that can change their recipes without losing taste and texture. Bubble tea is likely to grow from a niche treat into a more diverse category that includes high-end artisanal brands, mass-market franchises, and products sold in stores. The competitive edge will go to companies that can find a balance between indulgence, health, and sustainability in their sourcing and store networks.

Bubble Tea Market Key Segments:

By Type:

- Black Tea

- Green Tea

- Oolong Tea

- White Tea

- Others

By Flavor:

- Fruit

- Original

- Chocolate

- Coffee

By Distribution Channel:

- B2B Sales

- B2C Sales

Key Market Players:

- Gong Cha

- Chatime

- CoCo Fresh Tea & Juice

- Kung Fu Tea

- Sharetea

- The Alley

- Tiger Sugar

- Heytea

- Mixue Ice Cream & Tea

- Xing Fu Tang

- YiFang Taiwan Fruit Tea

- Chi Cha San Chen

- Boba Guys

- Happy Lemon

- Quickly

- Royaltea

- OneZo

- Tealive

- Presotea

- Comebuy Tea

- KOI Thé

- Wushiland Boba

- Teaspoon

- Chun Shui Tang

- TP Tea

- Ten Ren's Tea Time

- Moge Tee

- Mr. Wish

- Truedan

- LiHO TEA

Report Coverage

This research report categorizes the Bubble Tea market based on key segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Bubble Tea market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market.

The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Bubble Tea market.

|

Report Attributes |

Details |

|

Study Period |

2021-2033 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2033 |

|

Historical Period |

2021-2025 |

|

Growth Rate |

CAGR 7.7% from 2026 to 2033 |

|

Revenue Unit |

USD Million |

|

Segmentation |

By Type, Flavor, Distribution Channel, undefined, and Region |

|

By Type |

Black Tea |

|

Green Tea |

|

|

Oolong Tea |

|

|

White Tea |

|

|

Others |

|

|

By Flavor |

Fruit |

|

Original |

|

|

Chocolate |

|

|

Coffee |

|

|

Others |

|

|

By Distribution Channel |

B2B Sales |

|

B2C Sales |

|

|

By Region |

North America (By Type, Flavor, Distribution Channel, undefined, and Country) |

|

|

|

|

|

|

|

Europe (By Type, Flavor, Distribution Channel, undefined, and Country) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asia Pacific (By Type, Flavor, Distribution Channel, undefined, and Country) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

South America (By Type, Flavor, Distribution Channel, undefined, and Country) |

|

|

|

|

|

|

|

|

Middle East and Africa (By Type, Flavor, Distribution Channel, undefined, and Country) |

|

|

|

|

|

|

|

|

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252