MARKET OVERVIEW

The Global Personal Finance Management Market covers a plethora of applications, ranging from mobile apps to software platforms and web-based online tools catering to different financial needs. As increasingly complex decisions are made regarding finances, budgeting, debt management, expense tracking, tax planning, and investment analysis will quickly become necessities. These tools are expected to develop greatly, merging with other financial services such as online banking and investment platforms to provide an all-inclusive approach to personal finance management. Shifting focus thus will allow a future vision toward platforms that enable people to get a more holistic view of their finances while simplifying complicated financial processes.

The Personal Finance Management has become an industry in itself as personal finance management enables the person to manage his or her financial life with greater efficacy. In advancing times, the user has provided several digital platforms that allow budgeting, savings, expenses tracking, and providing an investment plan altogether. The growing importance of financial literacy and citizens' urge to manage finances better means that personal finance management tools will evolve to address these issues. These tools mainly include artificial intelligence and data analytics, allowing end-user financial decisions.

Probably one of the more appealing aspects of the Global Personal Finance Management market is its democratizing role in access to financial tools. Traditionally, financial planning-related solutions were targeted to high-net-worth individuals or through financial advisers. The era of mobile-based applications and cloud-based solutions brings affordable financial tools into the hands of users across all income brackets and geographic boundaries. In the future, users will tend towards personal finance management tools for simple yet advanced features such as real-time budgeting, automatic expense categorization, monitoring of the credit score, and personalized financial advice. These innovations will help individuals better manage income, investments, and expenses, assuring that they can meet their financial goals.

Personal finance management will be extended to the corporate front. Organizations will invest in these individual finance management systems as part of employee wellness programs, allowing employees to provide them with personal finance management capabilities to reduce financial burden in their lives. Such focused attention to employee financial wellness is likely to lead to improved productivity and overall satisfaction since the financial well-being of individuals tends to reflect their performance. These financial management solutions would also incorporate institutions and individual financial advisors into their services, enabling their clients to monitor and manage their financial portfolios digitally.

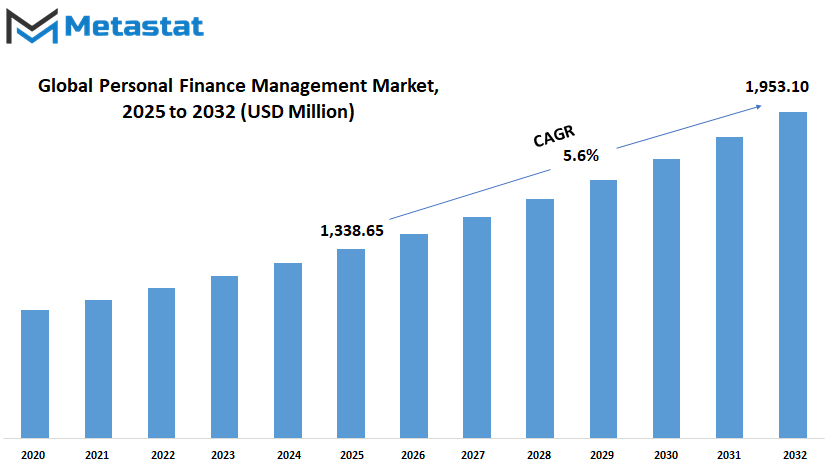

Global Personal Finance Management market is estimated to reach $1,953.10 Million by 2032; growing at a CAGR of 5.6% from 2025 to 2032.

GROWTH FACTORS

The Global Personal Finance Management market is coming into direct competition with efficient and effective ways of managing one's money. Nowadays, financial management is a lot more convenient with the increasing penetration of digital and mobile apps in the lives of many users. Instead of going to the bank, people use expense-tracking apps, savings goal set-ups, and other ways to gain insight into their spending patterns. This shift has happened, mainly credited to convenience, where all these quick hits to one device give users better control of their finances. The market is bound to enjoy more growth as several financial institutions and tech providers bring more innovative offerings to the table.

Among the many factors responsible for growth is increased awareness regarding financial literacy and wealth management. The majority of people now believe that understanding their finances, planning for the future, and making wise investment decisions are extremely important at this point. Educational initiatives that have been provided both by governments and private organizations have played a vital role in encouraging and empowering people to take responsibility for their financial well-being. As far as financial literacy improves, usage will increase among consumers that are willing to embrace digital solutions to help them make smarter decisions in money management.

However, there are some challenges that will restrict the growth of the market. The major concern is 'data privacy and cybersecurity', which have always been potential threats when it comes to finance because the online finance platform will handle sensitive personal as well as financial such information. That is the reason why most users are not ready to use the entire convenience brought by digital means of finance. Companies operating in this sector must continue to keep on increasing security measures to build trust and make users feel secure regarding the safety of their data.

However, limited financial knowledge is another constraint, particularly in some developing regions. They give financial knowledge and skills to people through digital platforms, but many people still do not have the understanding required to use the tools. The absence of this knowledge results in consumers being unable to derive all the benefits they ought to be able to get from these platforms, thereby impeding progress for the market in some areas. It takes years of continuous efforts to ensure that offering financial education enables people to use digital finance solutions confidently for their financial well-being.

Forecasts suggest that AI-based financial advisory services, equipped with personalized budgeting tools, are solutions to create new avenues. Algorithms that are advanced can analyze users' expenditure habits, suggest saving tips tailored to their spending habits, and even project financial trends based on past spending activities. Such intelligent solutions would make personal finance management automatized; therefore, they would assist individuals in optimizing their financial plans with minimum effort.

MARKET SEGMENTATION

By Software Type

The market for personal finance management worldwide is becoming very important and growing rapidly in the financial industry. It is one important aspect in which an individual or organization can easily manage all financial transactions based on different software applications designed for tracking, planning, and managing aspects of finance. Indeed, as technology progresses, personal finance management software has rapidly developed to provide their users with more sophisticated tools to manage their finances easily. It has turned into very open avenues and trends that are likely to remain open to changes in the future of financial management.

Perspective into future view, the global market for the personal finance management software would show how different software came into existence to cater to different needs. The most conventional distribution of the market in software categories for personal finance purposes does create space for different areas of personal finance. Some of the popular types include budgeting software, debt reduction software, investment tracking software, expense tracking software, and retirement planning software. Each type plays a substantial role in letting the users take charge of their financial situations and make informed decisions for their future plans.

These software's allow users to plan expenses, income, and appropriate amounts for various needs. It is likely that with the rapid advances in technology, this software will have an even more personalized approach. This would include the capability of drawing insights on the users' spending, allowing them to customize budgets in real time. The sophistication with which expenses are automatically categorized and accounts are linked will also advance further so that budgeting becomes simply intuitive for all.

Debt reduction programs help individuals manage and cut down their debts over time. In the future, these applications will have more sophisticated algorithms that will furnish users with customized strategies for getting free of debt. Such algorithms would take into consideration individual financial goals and offer step-by-step guides to help achieve those goals. Moreover, such applications would integrate more with the other finance management tools, thus giving a more fluid experience.

Investment tracking will also have significant improvements. It would enable users to keep tabs on their investment portfolios in real-time and furnish a complete analytic on performance. This software might probably apply artificial intelligence and machine learning to provide insight and projections, thus making investment management easier and within the reach of a broader audience.

Expense tracking software is also set for further growth. By directly syncing one's bank accounts as well as those credit cards, it would now be possible for future versions of software to track all one's expenses in real time. With enhanced features, this software would identify trends and provide insights into an individual's spending in order to help adjust one's financial strategies.

By Services Type

The Global Personal Finance Management market continues to expand and develop significantly even in the past few years and will likely continue to do so. As more people try to gain control over their finances, the need for different personal finance services is also increasing day by day. Growth in this area pushes to widen the market in various dimensions towards providing the diversity of services to meet the unique financial needs of the individuals.

One of the important segments in the market is Financial Advisory Services. Such services aim to give personalized financial planning advice for better management of an individual's finances. As consumers look for effective means of spending, saving, and investing, the demand for financial advisory services is increasing. Advice from these professionals offers clients the opportunity to make prudent financial decisions leading to their financial goals in the long run. Future prospects for financial advisory services look bright as favors of technology like AI-powered tools make personalized advice much easier.

Debt counseling services form one crucial aspect of the entire personal finance management market worldwide. An increasing number of individuals worldwide face rising debt levels, which compel many to get professional help from debt counselors. Such services provide expert advice on how to manage, reduce, and possibly eliminate debt to help regaining control over an individual's financial situation. Debt-counseling services are going to evolve into more support for multitudes facing economic challenges. In the future, such services will likely be readily available and cater specifically to different demographics.

Wealth Management Services also form a critical segment in this market. These services are aimed at that privileged segment of society that is looking for wealth growth and safety of its financial future. Wealth management services include investment strategies, retirement plans, and asset management to help individuals gain and accumulate wealth over some period. This segment will keep growing with more and more people acquiring assets through investments and business ventures. Future indications point to such services becoming even more technology-driven, offering sharper, more efficient strategies.

Lastly, Tax Planning Services are all-important to an individual regarding reducing taxes owed. A person may find it really hard to know all the current tax rules and regulations, and it is best to get professional help regarding one's finances so as to be on the safe side of taxation. There is going to be more and more dependency on tax planning services as every government adopts some new tax policy. In time, the very advance of technology will allow for more automated and easily accessible tax planning services to help individuals sort things out in their financial lives.

By Application

The Global Personal Finance Management market is rapidly changing on a global scale, with several current trends influencing its growth patterns and developments. Personal finance management is essential in daily life since it enables individuals to keep a check on their financial status. The increasing demand for instruments that can assist individuals in managing their finances in a more optimal manner is rising. Such increments in demand are primarily due to digital solutions catering to the convenience of the user in tracking, planning, and optimizing financial undertakings.

In terms of an area that could be cited within the Global Personal Finance Management market, budgeting is one of immense significance. The living costs becoming so high and the increasing need for financial discipline have led more people to personal budgeting using digital systems. These digital systems help users establish budget-related goals by classifying income and expenses, establishing saving goals, and, most importantly, tracking the accomplishment of those goals. This way, such applications are helpful in inducing better judgment over expenditures and further help individuals with his or her confidence in meeting their financial goals. Simply put, budgeting management is instrumental, as it serves as the foundation of sound financial planning for those who seek to establish equilibrium between their short-term wants and long-term goals.

Another application that plays a key role in the Global Personal Finance Management sector is investment management. As people discover more ways to grow their wealth, they resort to digital platforms for investment management. These platforms provide easy access to a variety of investment vehicles, whether in stocks, bonds, or mutual funds. They simplify the entire investing phenomenon by providing personalized advisory services, risk assessment, and portfolio tracking. We would suggest that, in the future, advancements in these tools are more likely to integrate AI to discern market trends and provide real-time investment recommendations so that investing can be made a much wider field.

Debt management is yet another realm where personal finance management tools are being greatly beneficial. These tools track and manage loans, credit cards, and other debts of individuals in a world where personal debt levels are soaring. Therefore, these tools allow individuals to visualize their liabilities clearly and develop strategies to pay off debts quicker. Going forward, debt management tools will likely evolve with automated payment reminders and tailored recommendations on faster debt reduction.

More weighting is also being put on retirement planning as persons begin to seek assurance for their financial future. The need for retirement planning is gaining traction as individuals are now aware enough to save adequately for the ability to live luxuriously after leaving the job. Personal finance tools increasingly simplify access to this by engaging calculators, suggesting investment opportunities, and making projections on the basis of existing savings.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,338.65 million |

|

Market Size by 2032 |

$1,953.10 Million |

|

Growth Rate from 2025 to 2032 |

5.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

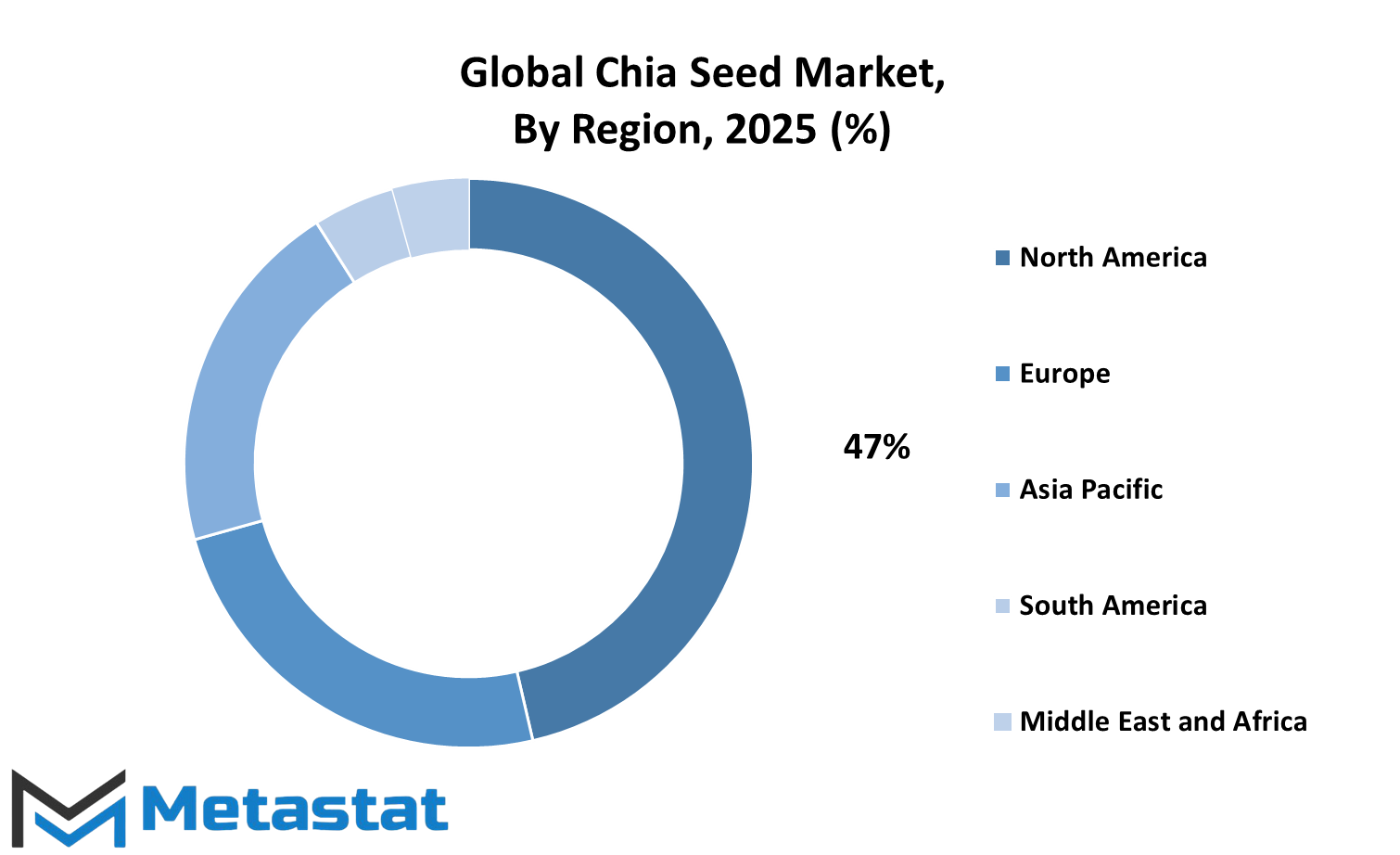

REGIONAL ANALYSIS

The personal financial management market is characterized by the presence of various geographies, each of which has its opportunities and challenges. These define for the specific regions how growth happens within the boundaries of such parameters as technology adoption, consumer behavior, economic conditions, and regulatory frameworks. Personal finance management will therefore be based on the dictates of regional trends and will continue evolving in the future.

The North American personal finance management market (US, Canada, and Mexico) is set to be buoyant regarding the high penetration of users of digital tools and services. Most of these people have become understandably more financially savvy and have been convinced of the value that they attach to such tech-driven solutions. Thus, they are now patronizing sophisticated personal finance management platforms. This trend will probably be propelled further by the increasing tech-savvy market population who are requiring more financial planning and debt management tools. In this area where consumers seek ways of better personal financial management, the importance will become even greater between automation, artificial intelligence, and personalized financial solutions.

European countries such as the UK, Germany, France, and Italy are expected to witness steady growth in the market for personal finance management. The region has been known for financial services over the years; now, its people are moving toward digital platforms for personal finance management at high speed. In addition to increasing regulatory pressure in the region, there is a strong case for growing consumer awareness of data privacy that will force such firms in this region to innovate and develop safe and user-friendly methods. Most likely, the integrated services for the future will have a high degree of integration where they could track and plan finances of consumers across different platforms seamlessly.

Looking at the Asia-Pacific market, it presents vast potential for market growth. In China, India, Japan, and South Korea, the increasing middle-class population and the rapid adoption of smartphones and the internet have contributed substantially to the growing demand for personal finance management solutions. Consumers in these countries will start relying more on digital means regarding budgeting, savings, and investments. The future may prove to be productive for businesses, with businesses providing targeted benefits for this vibrant region while dealing with large-scale financial literacy challenges and enabling affordability to the broadest audience possible.

Although it is still relatively new compared to North America and Europe, the South American market, particularly in Brazil and Argentina, looks extremely promising. As the internet continues to penetrate, more consumers in this region will be looking at ways of managing their finances better.

COMPETITIVE PLAYERS

The market for Global Personal Finance Management is on the rise, and the number of people who will access it in the future will continue to increase. The trend indicates that individual and business spending will be funneled into managing their budgets with digital tools. As a result, personal finance management has also become mainstream, as it's available for and targeted at all sorts of income and financial goals. The competitive space exists mainly around various companies providing different approaches to personal finance management.

In addition to providing their major offerings, several emerging players in this segment are driving up innovation and growth with their distinct capabilities. Mint, a product of Intuit, happens to be among the best-known names with personal finance management. This application lets users see whether their money is being spent wisely and if not, help them create budgets, and even show how a spending habit evolves. All these services provided are easy to understand and therefore accessible to most people. Like wise, The Vanguard Group, Inc. is considered as a provider of investment management services, but it has also developed tools intended to be used by an individual in plans to reach financial targets in the long run, such as retirement.

Another significant player in this space is Yodlee, a provider of financial data aggregation services. Yodlee's tools facilitate the integration of multiple financial accounts into a single view. Increased security concerns prompt Finicity, a Mastercard Company, to provide the proper end-to-end new technology to secure safe financial data management for all its users without omission of service to add an innovative tool for budget tracking and monitoring.

Fidelity Investments Inc. happens to be a well-known company engaged in financial services and further extended its footprint into personal finances management. Fidelity is known for its investment services but has developed digital tools that empower individuals to manage their portfolios and finances much more easily. Acorns Grow Incorporated, in contrast, offers a more passive way of managing personal funds through the encouragement of micro-investments and rounding up purchases to save for the future. This is a contemporary trend, with more and more people preferring to adopt such low-effort alternatives to help grow their wealth over time.

Other companies, such as Quicken Inc., Personal Capital Corporation, and Moneydance (The Infinite Kind), also carve a great portion into this personal finance market, providing software for easily tracking financial data, creating budgets, and better financial decisions. Providing newer software in the market like Moneyhub, Tiller Money, Inc., Buxfer Inc., etc., these companies have recently built their business model on personal finance management by harnessing technology for innovation, including providing automated features and customization options. Fintech has the magic of introducing more innovative ideas to join hands with entrepreneurs across PocketSmith Ltd and Perfios Software Solutions Pvt. to revise the entire aspect of people's financial management, drawing new boundaries in visualization and planning.

Personal Finance Management Market Key Segments:

By Software Type

- Budgeting Software

- Debt Reduction Software

- Investment Tracking Software

- Expense Tracking Software

- Retirement Planning Software

By Services Type

- Financial Advisory Services

- Debt Counseling Services

- Wealth Management Services

- Tax Planning Services

By Application

- Budget Management

- Investment Management

- Debt Management

- Retirement Planning

- Expense Tracking

Key Global Personal Finance Management Industry Players

- Mint (Intuit)

- The Vanguard Group, Inc.

- Yodlee

- Fidelity Investments Inc.

- Acorns Grow Incorporated

- Quicken Inc.

- Personal Capital Corporation

- Finicity, a Mastercard Company

- Moneydance (The Infinite Kind)

- VeriPark

- Moneyhub

- Tiller Money, Inc.

- Perfios Software Solutions Pvt.

- Buxfer Inc.

- Moneyspire Inc.

- Pocket Smith Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252