MARKET OVERVIEW

The Global Wellness Beverages market that exists as a section of a larger health market and nutrition industry engulfed into a livelier story than a mere resurfaced consumer narrative. Migration from widespread hydration to more purpose-driven consumption will definitely open new avenues in the field, challenging conventional product categories and redefining how beverages are immersed across cultures.

The Global Wellness Beverages Market has now started moving toward a multipronged experience-not just the functional health aspect but also emotional satisfaction. It will explore traditional herbal science combined with modern science and will not only stick to what one needs in terms of flavor innovations or ingredient swaps. For instance, an adaptogenic infusion and plant-based tonics will be moved from the niche to mainstream shelf spaces to provide a tailored experience to an individual according to the mental and physical state of that individual.

Such is a market that, in future, will not just have drinks classified under low-calorie or vitamin-enriched; in fact, it will even go beyond that through personalization. Brands will dive deeper into biometrics and AI-backed data to create beverage profiles as per an individual’s physiological responses. This course indicates a possible evolution from mass production to precision nutrition: drinks engineered not merely for taste, but for how they communicate with one’s unique body chemistry.

Moreover, storytelling will make an immersive involvement in the defining of wellness beverages. Cultural preservation along the lines of ethical sourcing is expected to expand into the marketplace: products reflecting indigenous ingredients and community harvesting processes will all be dramatized. The Global Wellness Beverages Market is likely to evolve into a conduit for socio-environmental consciousness and act as a catalyst for consumers to make decisions on values rather than benefits. Credibility will be built silently through the transparency of sources and production.

Digital ecosystems are all part of that transformation. No circle just about selling beverages but taking that journey with the customer into wellness-the real-time feedback, sharable community forums, and habit-tracking tools. This is a transformation of brand loyalty from transactional to transformational-building brand loyalty based on shared objectives rather than product performance.

Innovation shall go beyond biodegradable packages and carbon offsets in sustainability. The Global Wellness Beverages Market will develop regenerative agricultural practices, close-loop supply chains, and local ingredient ecosystems that reduce environmental burden while sustaining the community's resilience. This form of sustainability will be internal and not external - it will involve actual changes rather than just superficial green marketing.

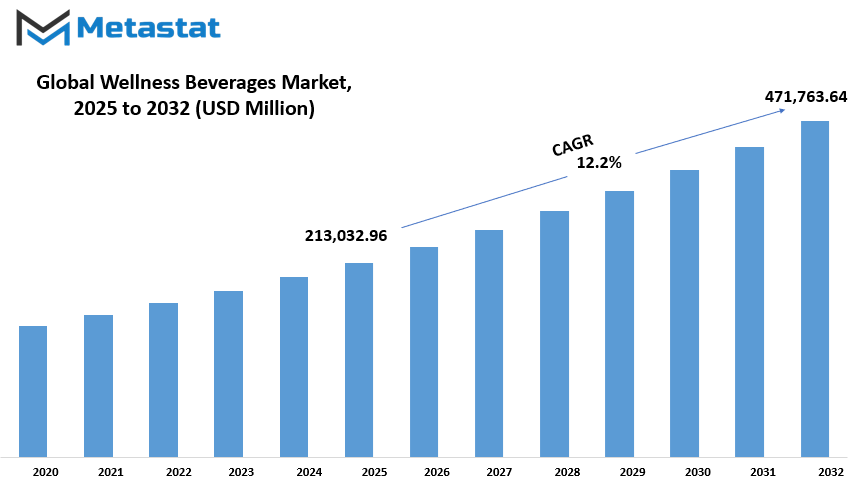

Global Wellness Beverages market is estimated to reach $471,763.64 Million by 2032; growing at a CAGR of 12.2% from 2025 to 2032.

GROWTH FACTORS

The global wellness beverages market, and beyond that, it has grown massively because of a change in consumer behavior that more significantly influenced people today becoming conscious of their own health and taking up drinks that promise health benefits, such as those that boost the immune system and brain functioning or help with digestion. This shift has largely pushed the market forward, with individuals more likely to choose beverages that satisfy more than just thirst as they grow concerned about their overall wellness. Companies see a burgeoning interest in health and wellness that adds impetus to their innovation of new products that will help what people are looking for.

A major factor in this marketplace is the preference of majority natural. Labels are scrutinized because of the presence of ingredients being plant-based or organic and thus, having no artificial additives but instead preferring beverages which are as close to nature as possible. Such preference, however, assures producers that consumers would be quite probable in developing clean-label drinks that attune into said values. This is no longer a concern for taste, but these consumers would also appeal for lifestyle reflection in their drinks.

But there are barriers to entry for companies in this space such as regulatory hurdles. Each country makes its own rules on, among other things, what health claims can be made in product labeling, and which ingredients are approved for use. For companies, that has meant a nightmare in developing products that could be marketed worldwide without facing legal hurdles. Besides that, efficient wellness beverages do not come cheap. The ingredients with a primary importance of functionality are on the higher end of pricing, thereby increasing the entire cost of production. This extra cost when passed onto the consumer will often make it less popular with most who need to stay within a budget.

There are many challenges, but at the same time, many opportunities are ahead. One of the biggest is going to be in personalizing beverages to fit an individual's health needs. Thanks to technology, organizations can collect information about what a person is trying to achieve in their health journey and create a beverage that meets those requirements. This kind of tailoring makes the product more relevant and useful to the consumer. Emerging consumers, whose awareness of health is likely to increase even further as they gain more purchasing power, will also spice things up in terms of market development. This bodes well for the future of wellness beverages.

MARKET SEGMENTATION

By Product Type

Global Wellness Beverages Market maintains steady growth as the understanding of healthier lives spread among the populace. Indeed, in increasing health issues, consumers are consequently looking to buy drinks that are more than just liquid consumption. They desire energy-boosting, digestion-improving and immunity-enhancing drinks, among others, for their wellness purposes. This trend has shifted from mere inclination towards marketing prospects as it will also require companies to come up with products satisfying these changing consumer needs.

Among the most popular categories that spur this growth momentum are the fortified juices of fruits and vegetables. With this drinks, vitamins and mineral are added so as to provide an easier way for consumers to increase the intake of nutrients. A $53,824.04 million market segment is currently testimony to the consumption of these drinks by health-conscious people. It's something that is drunk not only for its flavor but also for the "health" component. Many juices are thus enhanced with vitamin C, calcium, or even antioxidants, appealing to consumers who wanted to boost their immune systems or maintain good bone health.

Energy drinks will be yet another category for consideration in this segment. Generally, these drinks can be defined as containing high ranges of protein, fiber, and other essential nutrients to meet dietary inadequacies. It's more useful for always moving people, who typically have little time to prepare a well-balanced meal, by providing convenient alternatives to better nutrition. It can even be marketed targeting the young gym-goers and busy professionals as a supplement needed for the elderly in keeping strength levels and energy high.

Functional drinks obtain one other aspect of this growing market segment. In these drinks, it is mostly talking about more specific health requirements like focus improvement, stress reduction, or digestive help. Probiotics, adaptogens, and even herbal extracts are the most common types of these kinds of ingredients. As people tend to become more aware of their consumption, they prefer those beverages that are not just thirst-quenching.

These are just some of the main types around which the market has evolved; there are many more other wellness beverages that may not fall into any of these categories. Some may be plant-based beverages, whereas some might concoct innovative combinations with ingredients like turmeric, matcha, or CBD. All these specify the changes that the market undergoes with variations concerning different palates and preferences.

As health continues to become a keen area of awareness, so does the growth of wellness beverages to an even greater extent. There will be many choices for people to feel better and still realize the reality of everyday lives.

By Function

The global wellness beverage industry is voyaging forth steadily with increasing consumer awareness about health. It is driven by a lifestyle change in which many consumers prefer beverages that offer more than just hydration. These drinks are made for a specific purpose that aims to promote one or another aspect of the individual's overall health. The market can be segmented by function into immune-boosting, gut-friendly, heart-friendly, mental focus-and-alertness-boosting, brain-supporting, and other good-for-you functions. Each of these functions is fast gaining recognition with consumers who wish to mindfully attend to their bodies and minds in their daily choices.

Immunity-boosting drinks are among the more popular in this space. Common knowledge around ailments and their prevention, especially after the recent global events on health, has opened people to selecting beverages enriched in vitamins, herbs, and natural ingredients. These drinks encourage a healthy immune response toward fighting off pathogens and sustaining energy levels. The growing demand parallel to this is gut-health-oriented drinks. A healthy gut is known to participate in digestion while also influencing mood. Probiotics and fiber have become the popular constituent choice for those wishing to keep their diet in check.

The drinks also help improve heart health. Heart-friendly beverages typically possess various ingredients that also help maintain cholesterol and blood pressure levels. These drinks are particularly good for older adults or those with a family history of heart issues. At the other end of the spectrum, the younger generation has developed an interest in drinks meant for heightened mental awareness and alertness. These drinks usually combine caffeine, green tea extract, or nootropics and are used to keep students and professionals sharp without the crash that generally accompanies energy drinks.

Supporting brain health is also becoming a legitimate worry along the premise of mental well-being. These beverages help with memory, clarity, and moods. Finally, there are other wellness drinks that might not fall into one single designation but the likes of sleep aid or nutrient plus hydration which would help general well-being.

All in all, though the wellness beverages market shows change in lifestyle habits and values, there is likely to be an upsurge in demand simply because there is an increasing requirement for that product to have some health-related benefit.

By Distribution Channel

Global wellness beverages market has been witnessing continuous growth with more people being health-conscious and seeking great tasting drinks that also have health benefits. This is the market formed with the increasing dimension of society to take healthier lifestyle choices-as water intake-is one of the basic considerations for these beverages in general well-being. Most people today are looking beyond traditional soft drinks and are drawn to products that contain natural ingredients, fewer sugars, and added nutrients such as vitamins, antioxidants, and probiotics. This consumer inclination has motivated the huge beverage companies to develop innovative drinks meeting the demand change.

The important ways in which these products reach customers are through diversified distribution channels. Hypermarkets and supermarkets are the main outlets for wellness beverage purchases. That is why it's convenient to find wellness products, for they offer a larger selection of products all in one place. Most of the time, wellness drinks are promoted through unique displays and promotions, which help boost awareness as well as encourage sales. Specialty outlets are also the most important distribution channels. Most deliverance boasts of high-quality organic or natural products; therefore, draw in consumers whose interests are particularly wellness inclined, in other words looking for wellness products only. That specialty makes them feature a more specific selection, and in some cases carries beverages for wellness that are not compatible with the assortments of great retail chains.

Convenience stores have also their share of market sales. Their limited in sales ranges up to larger stores' offerings, but they boast easy access to wellness drinks appropriate for busy on-the-go consumers. Their location and operation hours would make them a convenient option for busy consumers. Among the places that have witnessed so much growth in recent years are online retail stores especially after the pandemic made a lot of individuals prefer shopping from home. These platforms have made available many products for consumers, complete with descriptions, customer reviews, and sometimes even discount offerings that will go along with their purchase. That's why, in most cases, one makes informed decisions and trying new products within the house.

Hence, last but not least, some other distributions don't really fall within the major categories but still add to the market growth. These could be direct-to-consumer websites run by the beverage brands themselves, vending machines in gyms or wellness centers, or pop-up stores at events. Taken all together, all these channels make available wellness beverages to the broadest audience possible, thereby furthering the growth of this market and fulfilling the demand for healthier drink choices all over the globe.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$213,032.96 million |

|

Market Size by 2032 |

$471,763.64 Million |

|

Growth Rate from 2025 to 2032 |

12.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

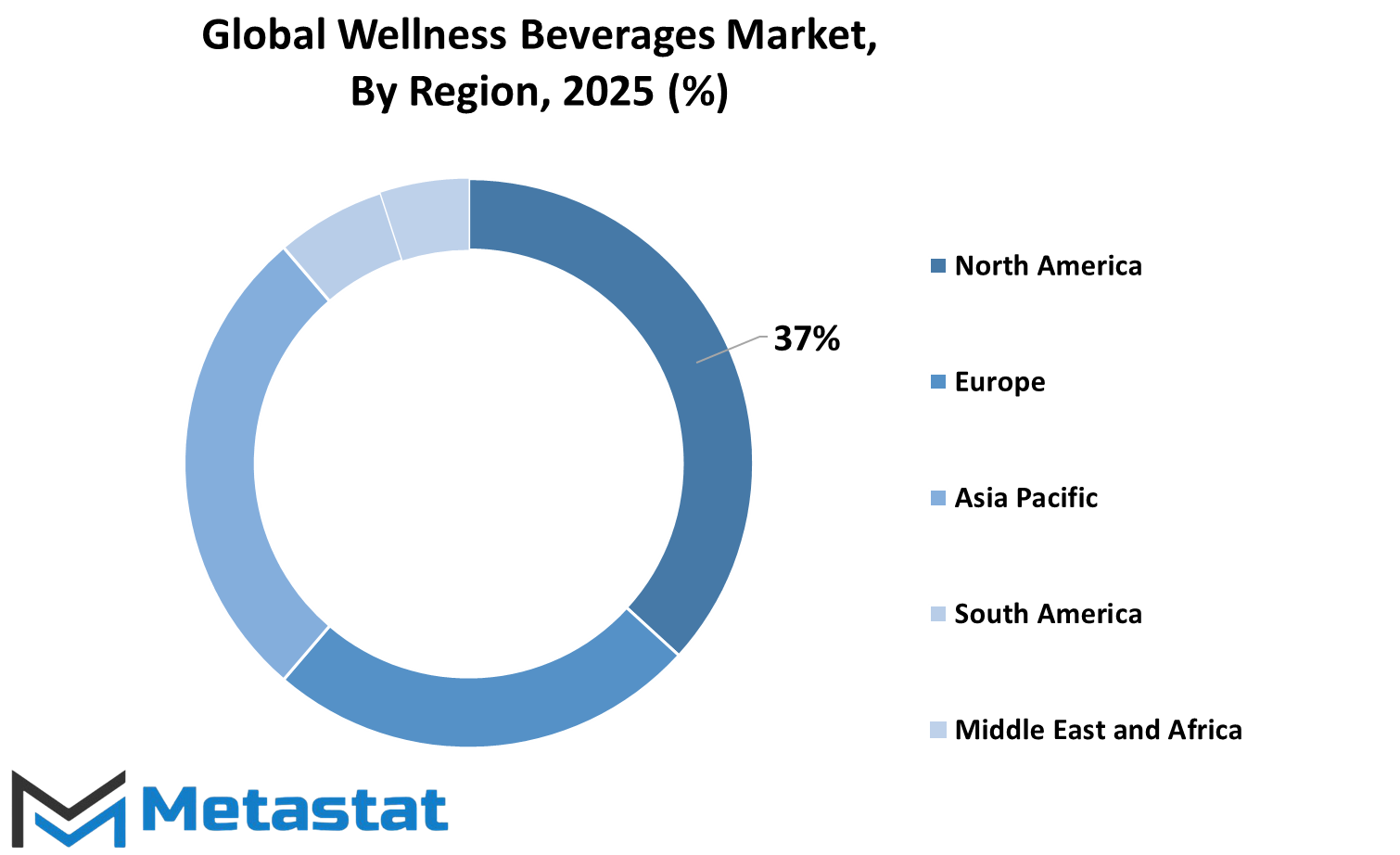

The global wellness beverages market is enjoying a steady and consistent growth as a healthy trend that continues to keep consumers all over the world. The beverage market can be further split geographically into key regions that contribute to its growth in their unique ways; these are North America, Europe, Asia-Pacific, South America, and the Middle East and Africa. Further splitting the North American market would result in the U.S., Canada, and Mexico. Of the three, the U.S. leads in the region along with rapid demand for natural and organic and functional drinks. Consumers want improvable well-being through beverages with vitamins, probiotics, or adaptogens. Mexico and Canada are also showing development in awareness about better health representation.

The market for wellness beverages in Europe includes the entire UK, Germany, France, Italy, and the Rest of Europe. This region exhibits a gradual surge in interest toward plant-based drinks and sugar-free alternatives. There has been an intelligible rise in demand for gut health and mental well-being drinks in countries like Germany and the UK, which is driven mainly by the growing emphasis on fitness and diet-related goals. France and Italy, on the other hand, have traditionally been known for other forms of beverages; however, a shift is slowly taking place, as the youth are interested in food.

Asia Pacific is the other region, with a strong footing in this study that includes India, China, Japan, South Korea, and the Rest of Asia Pacific and within which accelerated growth is expected due to a population so huge and rising disposable income. New-age drinks are being introduced somewhere with the help of old ones in the case of India and China in the hope of attraction towards the youth; however, Japan and South Korea have been the pacesetters in the development of functional beverages infused with an eye toward health but keeping a healthy mixture of tradition and modernity.

South America comprises Brazil, Argentina, and the Rest of South America, where demand is rising very slowly but steadily, as more people become aware of the merits of nutritious drinks. Among these, Brazil is the one who stands tall as a foremost contributor toward this end, with large supplies of raw natural ingredients and a rapidly urbanizing population.

This region comprises GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa. The country is still in its nascent stage as far as the wellness beverages sector goes, but it promises to be really good above others, mainly in the cities, where people are really into tasting these products, which encourage healthy and energy-yielding habits in everyday life.

COMPETITIVE PLAYERS

This improvement has led to the development of new drinks as per advertisements to improve health, refreshment, or just health. Boozers have been created to help with hydration, stimulation, digestion, or the overall health wellness. A number of young consumers-themselves defined in terms of what they consume and use-begins to be quite interested in low-sugar, plant-based, organic, and nutrient-rich drinks. There are many varieties of wellness drinks: kombucha, coconut water, infused water, plant-based milk, and natural energy drinks.

Several players take a huge portion of the wellness beverage market. The following companies are the key players in the wellness beverage industry: PepsiCo Inc., Nestlé S.A., The Coca-Cola Company, Danone S.A., Red Bull GmbH, KeVita, Celsius Holdings, Inc., GT's Living Foods, Suja Life, LLC, The Vita Coco Company, Inc., Health-Ade Kombucha, SAMBAZON, ALOHA, Glanbia PLC, Guru Organic Energy, and Hint Inc. All the abovementioned brands have agility in adjusting to change in need by having a wider drink portfolio to include healthier alternatives such as using natural sweeteners with added vitamins, probiotics, or plant-based ingredients, while making sure that all packaging options are environmentally friendly with clean labeling.

Within the past decade, the overall wellness beverage market has gained increased traction and connectivity for accelerated growth. Different markets have become aware, or are at least trying to become conscious, about their living and health concerns. This has created an evolution where people prefer marketing beverages claiming that these can improve health and refresh or health purposes. Such drinks have also been used as methods for hydration, energy, digestion, or overall health. It indicates the rising interest of youth in low-sugar, plant-based, organic, and nutrient-rich drinks about what they consume. A variety of wellness beverages usually consists of kombucha, coconut water, infused water, plant-based milk, and natural energy drinks.

There are numerous stakeholders that really influence wellness beverages significantly. Major players in wellness beverages include PepsiCo Inc., Nestlé S.A., The Coca-Cola Company, Danone S.A, Red Bull GmbH, KeVita, Celsius Holdings, Inc., GT's Living Foods, Suja Life, LLC, The Vita Coco Company, Inc., Health-Ade Kombucha, SAMBAZON, ALOHA, Glanbia PLC, Guru Organic Energy, Hint Inc. Such agility demonstrated by these brands leaving aside the natural change required adaptation which is provided by excellent production and availability of some healthier drinking alternatives whereby such natural sweeteners come up with vitamins, probiotics, or plant-based ingredients.

What is driving this market is a lifestyle choice, gradually increasing. As more individuals adopt fitness, mental health, and clean eating, they are also establishing rules for what they drink. Social media, health influencers, and outreach programs have helped propagate the message and raise interest in wellness drinks. Getting these drinks into consumers' hands, via supermarkets, health stores, and online shopping platforms, has helped in the acceptance of drinks like these.

Although there is a rise in the market, challenges persist. Awareness in some regions and high prices may slightly slow down the speed at which consumers start accepting new wellness products. Nonetheless, with innovation and massive marketing from the key brands, wellness drinks will stay ay high demand. The future seems bright, where both companies and customers will maintain a healthy and mindful life with better drink options.

Wellness Beverages Market Key Segments:

By Product Type

- Fortified Fruit and Vegetables Juices

- Nutritional Drinks

- Functional Drinks

- Other

By Function

- Boosting Immunity

- Improving Gut Health

- Improving Heart Health

- Boosting Mental Focus & Alertness

- Supporting Brain Health

- Other

By Distribution Channel

- Hypermarkets/Supermarkets

- Specialty Stores

- Convenience Stores

- Online Retail Stores

- Other

Key Global Wellness Beverages Industry Players

- PepsiCo, Inc.

- Nestlé S.A.

- The Coca-Cola Company

- Danone S.A.

- Red Bull GmbH

- KeVita

- Celsius Holdings, Inc.

- GT’s Living Foods

- Suja Life, LLC

- The Vita Coco Company, Inc.

- Health-Ade Kombucha

- SAMBAZON

- ALOHA

- Glanbia PLC

- Guru Organic Energy

- Hint Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383