Global Battery Materials Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global battery materials market is far removed from it being a specialized sector within the chemical and mining sectors to it being one of the worlds most asked-about industries. It started evolving mid-last century when lead-acid batteries dominated vehicles and early electric installations. Dependability was the priority at that time. The real metamorphosis occurred in the 1990s with mass-marketing of the lithium-ion battery when the world discovered mobile power on a scale never previously witnessed. That revolution rewrote material definitions such as lithium, nickel, cobalt, and graphite that would characterise the energy storage of the future.

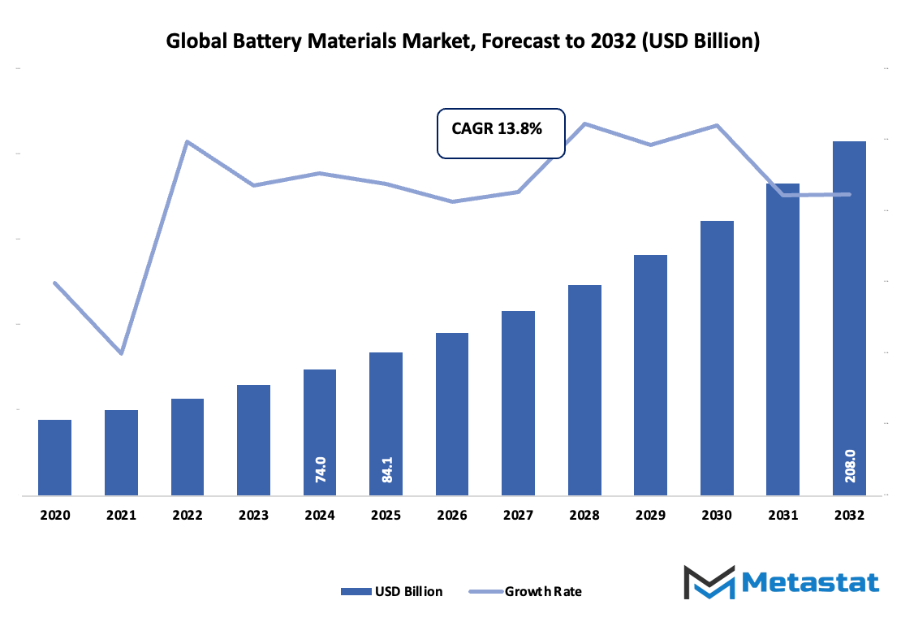

- Global battery materials market size of approximately USD 84.1 billion in 2025 to the CAGR of approximately 13.8% until 2032 and with potential for further growth beyond USD 208 billion.

- Lithium-Ion cover approximately 60.3% market share, driving innovation and expanding application through extensive research.

- Driving factors: Use of Electric Vehicles, Interfacing of Renewable Energy

- Market opportunities are: Energy Storage Systems for use in Grid

- Key takeout: The market will grow exponentially in value over the next decade, offering vast opportunities for growth.

The change prompted work on boosting energy density, reducing degradation, and reducing the use of rare materials. Firms started engineering next-generation cathode and anode materials that were capable of supporting more charge cycles, and R&D facilities worked on solid-state technology that can potentially substitute liquid electrolytes altogether. Each decade was a milestone thin battery in cell phones in the 2000s, efficient cells for electric vehicles in the 2010s, and now the quest for green manufacturing and recyclability. Consumerism has been the driving force behind the path of this industry. Growing fears of environmental sustainability prompted manufacturers to monitor supply chains more transparently and make investments in environmentally friendly extraction.

Governments across various continents started regulating in terms of waste management and recycling efficiency, compelling manufacturers to clean up extraction and circular reusing of Battery Materials. The inclusion of global safety and sustainability regulations brought another dimension of responsibility, modifying the manner in which the industry will function in the forthcoming years. The global battery materials market will continue to reinvent itself with chemistry and design innovation in the future. New entrants will disrupt conventional supply chains as automation and data-driven analysis will enhance manufacturing precision. What started as modest probing of captive energy has now expanded into a foundation for a cleaner, more connected world one that will continue to expand as society and technology push the limits of what batteries can do.

Market Segments

The global battery materials market is mainly classified based on Battery Type, Material, Application, .

By Battery Type is further segmented into:

- Lithium Ion: A major shift towards lithium-ion technology will be driven by rising demand for new energy storage capacity in the global battery materials market. Lithium-ion batteries will possess higher energy density, longer lifespan, and better charging, enabling expansion in portable consumer electronics, electrically powered vehicles, and industrial applications along with technological innovation.

- Lead Acid: Lead-acid batteries will maintain a considerable share percentage of the global global battery materials market, mainly automotive and industrial. This segment will provide effective and cost-effective energy storage, especially for standby power systems, and material efficiency technologies to enable them to be used for future energy storage applications

- Others: Other battery types will be in vogue in the global battery materials market as innovation focuses on cost, safety, and performance. These are sodium-ion, solid-state, and hybrid batteries that will meet niche energy storage needs, become more sustainable, and meet rising demand in new uses in energy and transport markets.

By Material the market is divided into:

- Cathode: Cathode will remain a critical component of the global battery materials market, determining energy capacity and stability. Cathode chemistry will maximize performance and safety, and R&D will center on reducing environmental impact, enabling batteries to keep pace with increasing needs of electric vehicles, industrial equipment, and mobile electronics.

- Anode: Anode materials will dictate the performance and battery life of the market. Silicon-based and other next-generation high-capacity anodes will increase energy density and reduce recharging time, allowing future batteries to provide enhanced performance for handheld devices, electric vehicles, and industrial storage devices.

- Electrolyte: Electrolytes will be the leading force in battery performance, safety, and efficiency in the market. Liquid, gel, and solid electrolyte developments will provide enhanced conductivity, stability, and less overheating risk, allowing the development of next-generation batteries for numerous applications such as automotive, industrial, and portable.

- Other: Other Battery Materials will fill performance gaps in global battery materials market, including separators, binders, and additives. Their development will translate into enhanced safety, improved energy efficiency, and longer battery life, enabling batteries to keep pace with rising demands from emerging technologies and clean energy solutions across industries.

By Application the market is further divided into:

- Portable Device: Batteries for portable devices will continue to be the driving force for the global battery materials market, calling for light, long-life, and quick-charging devices. Material innovation will focus on maximizing energy density without compromising safety, which will allow growth in consumer electronics, wearable electronics, and other mobile technologies demanding reliable and stable power supplies.

- Electric Vehicle: Electric vehicles will remain one of the main drivers of growth for the market. Next-generation materials battery technology will improve range, reduce charge time, and extend lifespan. Such innovations will allow higher roll-out of electric mobility and clean up the transport sector by reducing fossil fuel reliance.

- Industrial: Industrial applications will require scalable and robust batteries, which will define the market. High-capacity production storage systems, energy management, and backup power will rely on high-end materials to ensure maximum efficiency, lifespan, and reliability, compelling the industrial industry toward sustainable and constant energy uses.

- Automotive: Apart from electric vehicles, traditional automotive applications will still be shaping the global battery materials market. Advanced materials will be employed to optimize performance, security, and energy efficiency in automobiles such as hybrids, and technologies of the future will focus on providing cost-effectiveness and sustainability better in response to evolving regulative needs and customer demands.

- Others: Other applications in the global battery materials market will be renewable energy storage systems, medical devices, and grid storage. Future material innovation will give safe, long-lasting, and resilient energy storage systems that are adapted to rising demand for sustainable and multi-functional batteries for new technologies and critical infrastructure sectors.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$84.1 Billion |

|

Market Size by 2032 |

$208 Billion |

|

Growth Rate from 2025 to 2032 |

13.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

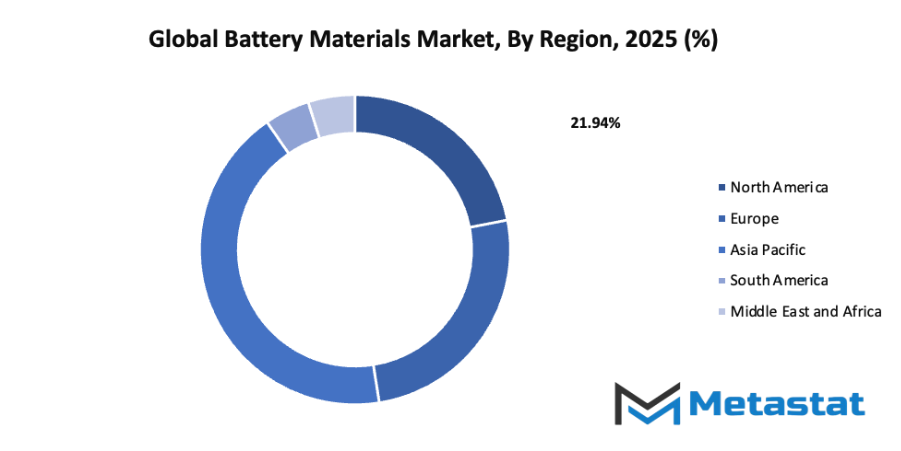

By Region:

- Based on geography, the global battery materials market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Electric Vehicle Adoption: Rapid adoption of electric vehicles will boost the global battery materials market. As more countries enforce stricter emission standards, automakers will increase production of EVs. Advanced Battery Materials will be essential to provide longer driving ranges, faster charging, and improved vehicle performance, making the market more critical to the automotive transition.

- Renewable Energy Integration: The integration of renewable energy sources will play a key role in the global battery materials market. Solar and wind energy systems will rely heavily on efficient storage solutions. Advanced Battery Materials will enable stable energy supply, smooth power distribution, and reliable storage, making renewable sources more practical and accessible for widespread use.

Challenges and Opportunities

- Supply Chain Constraints: Supply chain constraints will affect the market by creating delays and increasing costs. Limited availability of lithium, cobalt, and nickel will put pressure on manufacturers. Developing local supply sources, improving logistics, and adopting recycling initiatives will help reduce dependency on constrained supply chains.

- Environmental Regulations: Strict environmental regulations will shape the global battery materials market. Compliance with emission standards and proper disposal of battery waste will become mandatory. Companies will invest in eco-friendly materials and sustainable manufacturing processes, which will align with government policies and encourage responsible growth in the market.

Opportunities

- Energy Storage Systems for Grid Applications: Energy storage systems for grid applications will expand the global battery materials market. These systems will stabilize electricity supply, manage peak demand, and support renewable integration. Advanced materials will enhance storage efficiency and lifespan, making grid energy storage a critical component for future energy infrastructure.

Competitive Landscape & Strategic Insights

The global battery materials market is set to transform significantly as demand for energy storage and sustainable technologies continues to rise. This industry is a mix of both international industry leaders and emerging regional competitors. Important competitors include Umicore, Samsung SDI Co., Ltd., LG Chem Ltd., Asahi Kasei, Mitsubishi Chemical Holdings, Posco, Johnson Matthey, NICHIA CORPORATION, NEI Corporation, TCI Chemicals (India) Pvt. Ltd., Hitachi Chemical Co., Ltd., Solvay S.A., Tanaka Chemical Corporation, Targray Technology International Inc., BASF SE, Sumitomo Chemical Co., Ltd., Albemarle Corporation, and Arkema Group. These companies will play a critical role in shaping the market’s future, as innovation and efficiency become central to meeting global energy needs.

Technological advancements in Battery Materials will redefine performance standards. Companies will focus on developing materials that provide higher energy density, longer life cycles, and improved safety, which will become increasingly important as electric mobility and renewable energy storage expand worldwide. Research and development efforts will push boundaries in material science, creating more efficient and cost-effective solutions that will attract both automotive and electronics manufacturers.

The presence of regional competitors will encourage global leaders to adapt faster and explore collaborations or strategic partnerships. These emerging players will challenge conventional methods, offering competitive pricing or innovative products that could reshape supply chains. As the industry grows, geographical diversity will ensure that production and development are not limited to a few dominant countries, allowing more flexible and resilient manufacturing networks.

Environmental sustainability will also guide the direction of the industry. Companies will focus on materials that reduce ecological impact and improve recyclability, responding to increasing regulatory pressure and consumer expectations. By integrating sustainable practices, battery material producers will not only meet global standards but also set new benchmarks for responsible production.

Market size is forecast to rise from USD 84.1 billion in 2025 to over USD 208 billion by 2032. Battery Materials will maintain dominance but face growing competition from emerging formats.

Looking ahead, the global Battery Materials industry will continue to be driven by a combination of technological breakthroughs, competitive dynamics, and sustainability initiatives. Leaders like Umicore, Samsung SDI Co., Ltd., and LG Chem Ltd. will continue to set trends, while regional competitors will contribute with innovative approaches that keep the market dynamic and forward-looking. The combined effort of these companies will ensure that energy storage solutions are more efficient, affordable, and environmentally conscious, paving the way for a future powered by advanced Battery Materials.

Report Coverage

This research report categorizes the global battery materials market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global battery materials market.

Battery Materials Market Key Segments:

By Battery Type

- Lithium Ion

- Lead Acid

- Others

By Material

- Cathode

- Anode

- Eectrolyte

- Other

By Application

- Portable device

- Electric vehicle

- Industrial

- Automotive

- Others

Key Global Battery Materials Industry Players

- Umicore

- Samsung SDI Co., Ltd.

- LG Chem Ltd.

- Asahi Kasei

- Mitsubishi Chemical Holdings

- Posco

- Johnson Matthey

- NICHIA CORPORATION

- NEI Corporation

- TCI Chemicals (India) Pvt. Ltd.

- Hitachi Chemical Co., Ltd.

- Solvay S.A.

- Tanaka Chemical Corporation

- Targray Technology International Inc.

- BASF SE

- Sumitomo Chemical Co., Ltd.

- Albemarle Corporation

- Arkema Group

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383