Global Electric Sub-Meter Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

What if the growing focus on electricity efficiency transforms the manner purchasers display and manage energy utilization globally? Could emerging smart technologies and IoT integration redefine the conventional sub-metering landscape? And as regulatory frameworks tighten, will innovation or compliance force the next segment of increase within the global electric sub-meter market?

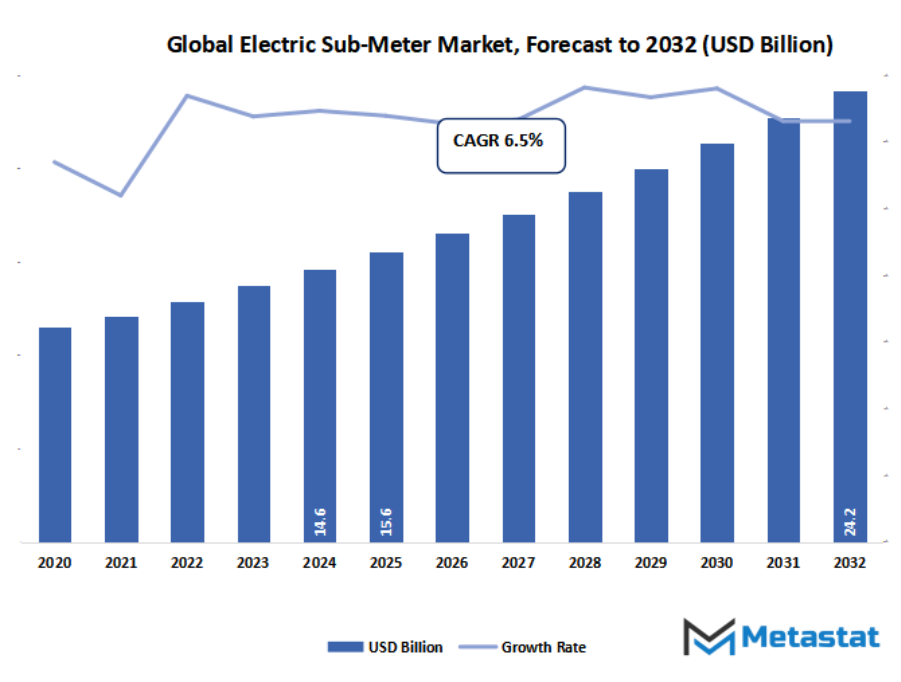

- The global electric sub-meter market valued at approximately USD 15.6 Billion in 2025, growing at a CAGR of around 6.5% through 2032, with potential to exceed USD 24.2 Billion.

- Single Phase account for nearly 42.8% market revenues, driving innovation and expanding applications through intense research.

- Key trends driving growth: Growing demand for energy efficiency and real-time power monitoring., Rising adoption of smart building and IoT-based energy management systems.

- Opportunities include Increasing implementation of smart grids and advanced metering infrastructure (AMI).

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

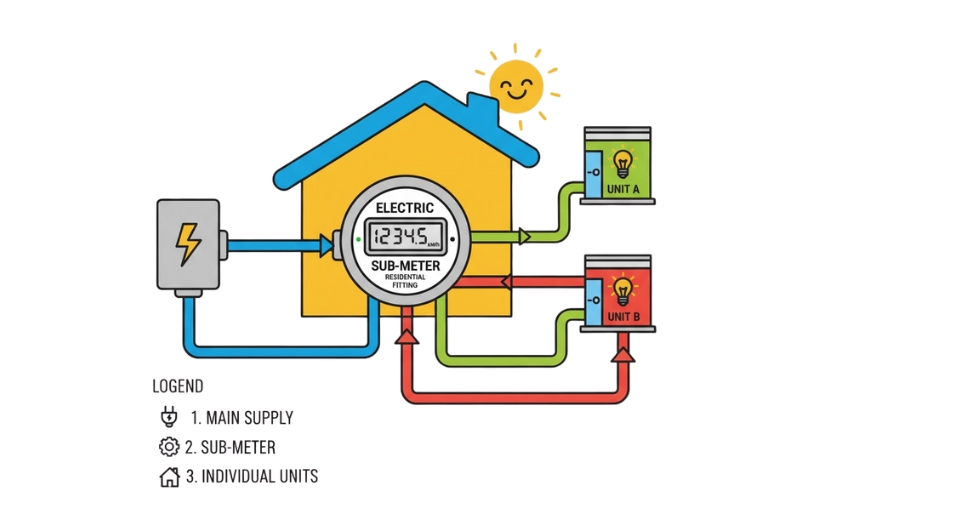

The global electric sub-meter market is shaping the future of strength management regularly, with the developing consciousness on precision monitoring and sustainability across business, commercial, and home sectors. This market sits in the broader electric and strength efficiency enterprise, where the want to reveal and manage strength consumption at granular degrees can be more and more essential. This shall create a scenario where electric sub-metering moves from being a niche practice to a mainstay application for smart energy infrastructure, driven by increased urbanization and automation of industries. Governments of several countries have already started integrating sub-metering mandates into their energy conservation framework, especially to drive transparency in consumption and accuracy in billing.

Similarly, reports from the U.S. Department of Energy identify that advanced metering and sub-metering can reduce building energy use up to 15%, underlining their efficiency-driven role in future energy management. The International Electrotechnical Commission and national energy boards are also working toward setting up better-defined technical standards for sub-meters, which will bring greater accuracy and interoperability in a wide range of electrical systems.

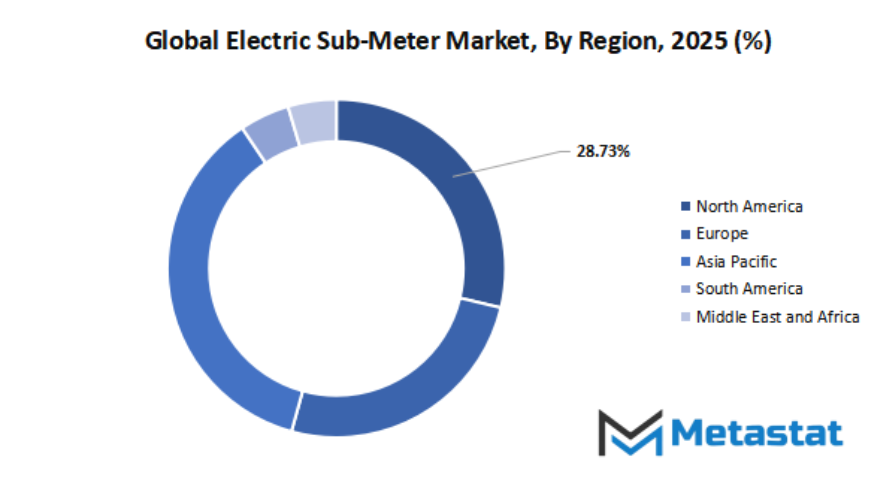

Geographic Dynamics

Based on geography, the global electric sub-meter market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. North America is further divided in the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and Rest of Europe. Asia-Pacific is segmented into India, China, Japan, South Korea, and Rest of Asia-Pacific. The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and Rest of Middle East & Africa.

Market Segmentation Analysis

The global electric sub-meter market is mainly classified based on Phase, Type, Connectivity, End Use.

By Phase is further segmented into:

- Single Phase

The call for single-segment systems is expected to upward thrust within the global electric sub-meter market, as they may be best for residential and small-scale industrial uses. These meters make sure correct power monitoring of constrained electricity loads, helping customers monitor efficaciously. Growing cognizance of energy conservation will in addition force the combination of those systems.

- Three Phase

The market may even see elevated adoption of three-segment systems in industries and big business set-ups, as they form an imperative part of production gadgets and huge facilities with heavy electric load requirements. Enhanced strength optimization and real-time monitoring will make these meters an essential a part of destiny power management solutions.

By Type the market is divided into:

- Electronic Sub-Meters

Because in their affordability and user-friendly thing, digital sub-meters are set to hold gaining momentum in the global electric sub-meter market. Their capability to file accurate strength statistics in smaller installations lets in for extra transparency in billing. A focus on changing previous gadget will force lengthy-term growth in this section.

- Digital Sub-Meters

In the market, rapid boom in digital sub-meters might be observed because of improvements in technology closer to automation and the functionality for remote analyzing. Digital models are perfect for brand new installations, as well as for retrofits of old structures in residential and business regions, considering that they make sure better data accuracy and fault detection.

- Smart Sub-Meters

The future of the market is smart sub-meters, with a developing need for sensible tracking and IoT-based totally manipulate. These meters permit for real-time monitoring, predictive renovation, and optimization of power. Integration with smart grids and records analytics will mark the imminent technology of energy management.

- Analog/Conventional Sub-Meters

In the market, analog sub-meters nevertheless cater to regions with much less get admission to to advanced generation. Though their adoptions are declining, their affordability and simplicity preserve them in regular use in certain applications. However, this section will see sluggish alternative by using virtual and smart editions over the course of time.

- Other

The "different" category within the global electric sub-meter market incorporates hybrid and bespoke sub-metering solutions, which also can be applied to fulfill unique enterprise necessities. Growing innovation and product diversification are expected to aid unique operational demands, helping overall market growth.

By Connectivity the market is further divided into:

- Wired

Wired connectivity remains dominating in the global electric sub-meter market, where a high degree of reliability and data security is required. These systems are preferred in industrial settings where stable communication is crucial. However, integration with digital platforms and centralized monitoring will redefine their usage scope in upcoming years.

- Wireless

Wireless technology is transforming the global electric sub-meter market by providing the need for flexibility and scalability for remote energy monitoring. These meters reduce the complexity in the installation and easily connect with cloud-based systems. Growing interest in smart infrastructure and automated energy networks will significantly improve this segment's growth.

By End Use the global electric sub-meter market is divided as:

- Industrial

The industrial segment will remain one of the most significant contributors to the global electric sub-meter market, owing to growing demands for power distribution efficiency and a reduction in operational costs. Sub-metering provides accurate insights on usage, which allows industries to optimize energy consumption in harmony with the goal of sustainability.

- Commercial

Commercial applications are growing in the market based on the increasing demand for office complexes, malls, and retail locations. Sub-meters enable energy accountability among tenants, thereby improving billing accuracy. As sustainability standards become stricter, more businesses will venture into sub-metering with the goal of efficiently managing their facilities.

- Residential

In the market, the residential segment is expected to grow due to increasing awareness among households towards smart energy management solutions. Rising electricity costs and urban housing development promote the installation of sub-meters. Increasing awareness of consumption patterns will motivate homeowners to employ efficient monitoring technologies.

- Others

This segment includes public institutions, healthcare facilities, and educational establishments that are grouped together under "others" in the global electric sub-meter market. These sectors are increasingly recognizing their needs for precise energy tracking to enable cost control. Interest in sustainable infrastructure and efficiency in budget use will lead to further stimulation in this category.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$15.6 Billion |

|

Market Size by 2032 |

$24.2 Billion |

|

Growth Rate from 2025 to 2032 |

6.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

Competitive Landscape & Strategic Insights

The global electric sub-meter market is seeing a steady growth curve owing to industries, businesses, and residential sectors moving toward efficient energy management. Electric sub-meters are handy tools that measure and reveal the consumption of energy in character gadgets or departments in a big system, which permits users to music their consumption more correctly and decrease useless electricity wastage. With the growing awareness of sustainability and fee manage, their demand will growth in each evolved and developing areas. The marketplace is stimulated with the aid of improvements in clever metering technologies and the worldwide push closer to virtual infrastructure, as electricity efficiency is turning into an integral part of corporate and family practices.

It is an industry comprising international players, along with several regional challengers, each contributing to its growth in their own special manner. Established companies like ABB, Eaton, Schneider Electric, Siemens AG, and Honeywell International Inc. maintain their dominance through continuous technological know-how and broad networks of product distribution. These companies continue to invest in making systems smarter with connectivity that enables real-time data monitoring, seamless integration with building management software, and easy integration with other systems. Regional players such as BENTEC India Ltd, HPL Electric & Power Limited, and Genus Power Infrastructures Ltd solidify their positions by offering cost-effective solutions suited to meet the needs of their local markets. The right balance between innovation at a global level and adaptation at a regional level generates the competition diversity for this market.

With increasing city adoptions of smart grid systems, the role of electric sub-meters will continue to become even more important. Leading companies in this area include Itron, Inc., Kamstrup AS, and Landis+Gyr, which are driving the transition towards advanced metering infrastructure that enables automated readings and analytics. This, in turn, helps both utilities and consumers identify consumption patterns, distribute the load in a better manner, and plan energy use accordingly. The integration of digital technologies with IoT-based platforms will facilitate the industry's move towards transparency and accountability for energy usage-a factor that will be beneficial for governments, organizations, and consumers in the long run.

Apart from the giant companies, other innovative firms such as Socomec, Mitsubishi Electric Corporation, Osaki Electric Co. Ltd, and Xylem Inc are contributing by product diversification and sustainable design. Their emphasis on user-friendly systems and accuracy reflects the growing demand for reliable energy tracking in commercial and residential buildings. Zhejiang Chint Instrument & Meter Co., Ltd has also played a major role in cost-effective sub-metering solutions that have opened energy management to smaller players. This wide range of players ensures the dynamism in this market, with continuous developments dictating the present and future of electricity consumption recording and analysis worldwide. In all, the global electric sub-meter market is progressing toward smarter and more sustainable practices due to innovation and competition. The joint effort of international giants and local enterprises keeps the solutions advanced yet adaptable to different economic environments. As technology continues to evolve an awareness of energy conservation deepens, sub-meters will remain central to global goals on efficiency, creating a marketplace of precision, innovation, and responsible energy use.

Market Risks & Opportunities

Restraints & Challenges:

High installation and integration costs in existing infrastructure:

In the global electric sub-meter market, however, the high investment required for the installation and integration of a sub-metering device into already present infrastructure poses an undertaking. Installation in vintage homes is quite complicated, with higher labour and gadget expenses, at the same time as upgrading the out of date electric distribution network will increase the cost even similarly. With time, this obstacle must step by step disappear as new approaches of price-powerful installation are evolved so as to make it less complicated to adopt across residential, business, and commercial sectors.

Inadequate attention and technical information of stop-users:

Another constraint that affects the course of development inside the global electric sub-meter market is lack of awareness and sufficient technical acumen on the a part of the customers. Many facility proprietors and operators are still now not privy to operational advantages, statistics accuracy, and electricity efficiency offered by means of sub-metering answers. Without right know-how and training, powerful usage becomes tough; this results in underperformance and wastes tons potential. Thus, with developing schooling and specialized schooling, this hole will likely be bridged as global initiatives sell virtual transformation and electricity conservation, enhancing market penetration and person competence in the future.

Opportunities:

Increased installation of clever grids and advanced metering infrastructure (AMI):

The global electric sub-meter market has promising opportunities because of the growing usage of smart grids and superior metering infrastructure. These are changing the way strength is controlled, as they permit for actual-time information collection, predictive evaluation, and higher performance in the distribution of electricity. This trend toward intelligent systems will form an enabling environment for sub-metering devices, accelerating innovation and demand for the device across many industries. The future is toward a more connected, data-driven energy ecosystem where sub-meters form a critical part of consumption optimization and grid stability maintenance.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 15.6 Billion in 2025 to over USD 24.2 Billion by 2032. Electric Sub-Meter will maintain dominance but face growing competition from emerging formats.

The market applications are set to go beyond mere consumption tracking in the coming years, with the amalgamation of smart technologies, such as IoT-based metering, predictive analytics, and cloud-based monitoring. Sub-meters will have an essential role in various fields like distributed generation systems, electric vehicle charging networks, and multi-tenant properties where shared accountability for energy will be paramount. The global electric sub-meter market would be positioned at an interesting juncture between technology and sustainability in redefining the way individuals, corporations, and utilities recognize and have control over power consumption as part of the massive momentum toward renewable energy and net-zero goals.

Report Coverage

This research report categorizes the global electric sub-meter market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global electric sub-meter market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global electric sub-meter market.

Electric Sub-Meter Market Key Segments:

By Phase

- Single Phase

- Three Phase

By Type

- Electronic Sub-Meters

- Digital Sub-Meters

- Smart Sub-Meters

- Analog/Conventional Sub-Meters

- Other

By Connectivity

- Wired

- Wireless

By End Use

- Industrial

- Commercial

- Residential

- Others

Key Global Electric Sub-Meter Industry Players

- ABB

- BENTEC India Ltd

- Eaton

- Elster Group

- GE Digital Energy

- General Electric Company

- Genus Power Infrastructures Ltd

- Honeywell International Inc.

- HPL Electric & Power Limited

- Itron, Inc.

- Kamstrup AS

- Landis+Gyr

- Leviton Manufacturing Company

- Mitsubishi Electric Corporation

- Osaki Electric Co. Ltd

- Schneider Electric

- Siemens AG

- Socomec

- Xylem Inc

- Zhejiang Chint Instrument & Meter Co., Ltd

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252