MARKET OVERVIEW

The global battery management system market will stretch across the changing terrain of energy storage and electrified transport, merging into the wider battery industry as it evolves. The conversation will lay out the developing scene, without relying on clichés or overly elaborate language, and staying as natural as possible.

Players in the battery industry in the coming years will be walking a tight rope between growing demand for safety, reliability, and efficiency. They will be addressing challenges in battery chemistry, cell balancing technologies and thermal management. Vehicle and storage solution providers, manufacturers and engineers will be striving towards harmonious integration of management systems with future-generation cells. Research groups will be testing innovative sensors and algorithms that track state of charge, health and temperature with increased accuracy. Producers will understand that as cells advance reaching greater energy densities, quicker charging and longer life the systems managing them will also have to advance. Focus will turn to data-driven diagnostics, predictive maintenance and cloud monitoring. Remote monitoring will be the norm in mass storage parks or fleet deployments. Users will be dependent on alerts and performance insights transmitted in real time, minimizing downtime and avoiding surprise failures.

At the same time, software platforms will increase in sophistication. Developers will create interfaces that convert intricate battery data into usable metrics for plant operators or auto users. Application programming interfaces could integrate management systems with enterprise software or grid management tools. This integration will allow for performance optimization on multiple battery units, linking them into cohesive systems capable of reacting to changing power demands.

On the production side, component suppliers of the likes of current sensors, balancing resistors and thermal switches will be going further toward collaboration with system integrators. Tailoring will become the norm; battery packs for particular applications electric vehicles, home storage, utility-scale energy buffers will feature management systems optimized to their usage profiles. This will ensure each installation will realize its optimal cost, performance and safety balance.

Integration with renewable power generation will become even smoother as well. The systems will be planned in such a manner that management systems will balance solar or wind charging based on grid signals, forecasts of demand and state of charge. They will enable batteries to respond more dynamically, storing power when production is peak and delivering it when required, thereby stabilizing electrical networks.

Beyond present technology, advances in solid-state and lithium-sulfur batteries will redefine the design of management systems. The future could provide systems that have inherent fault-tolerance, self-healing circuits or streamlined module architectures that minimize wiring complexity. Advances such as these will make systems lighter and less expensive yet more reliable.

Regulatory trends will promote use of more open monitoring features. There will be standards for interoperability, data format and safety levels, so that systems from multiple suppliers are compatible. In that environment, ecosystem partners will develop plug-and-play modules that will simplify installation and maintenance.

Overall, the world Battery Management System market will be one in which hardware and software combine with intelligence and connectivity. The industry will provide solutions that will enable batteries to last longer, withstand harsh conditions and integrate easily into cars or power grids. All this will make it smarter, safer and easier to use than ever before.

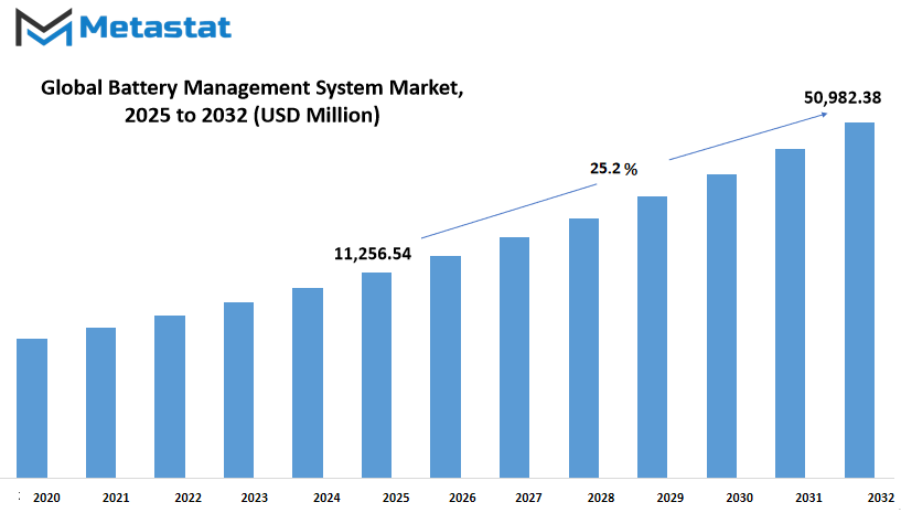

Global battery management system market is estimated to reach $50,982.38 Million by 2032; growing at a CAGR of 25.2% from 2025 to 2032.

GROWTH FACTORS

The global battery management system market growth drivers are quick uptake of electric vehicles and the demand for renewable energy storage. Both these drivers will fuel growth. Nevertheless, high upfront expenditure and low charging infrastructure may deter market growth. Urbanization and government subsidies would offer high-value opportunities for the market during future years.

The global battery management system market will keep picking up as the demand for electric mobility increases and energy storage systems become standard. Electric vehicle manufacturers are spending big to enhance range and safety with battery management systems. Solar and wind energy as a source of power require efficient energy storage to manage fluctuations. Battery management systems are important in ensuring battery health, temperature and voltage monitoring, and avoidance of overcharging and deep discharge. All that support adoption across most industries.

Challenges still exist. A high upfront cost of battery management systems, such as sensors and sophisticated software, can increase the cost of installation compared to traditional systems. Sparse charging infrastructure also is an obstacle. Without sufficient locations to charge, users of electric vehicles might shy away from using battery systems that require regular charging. The reluctance slows down development of markets that rely upon those systems. Cost and infrastructure must be addressed to increase adoption.

On the positive side, there are a number of trends that would create opportunities. Exponential urban population expansion in much of the world will drive demand for clean energy and transport, and hence for battery management systems. Governmental subsidies for purchasing electric vehicles and backing for renewable energy schemes would reduce obstacles and stimulate utilization of those systems. As the process of digitalization advances, smart grid and Internet of Things integration will enable battery management systems to deliver useful information, optimize efficiency, and facilitate predictive maintenance. That would add even greater value to end users as well as system operators. Artificial intelligence and machine learning integration into battery control will enable systems to become intelligent, responding to usage patterns in order to maximize battery life. That would enable new service models and business opportunities. In short, global battery management system market development will be driven by the growth in adoption of electric vehicles and renewable energy storage. High initial cost and limited charging infrastructure could moderate progress. Nevertheless, urban growth, incentives, and connectivity and smart control breakthroughs would provide excellent opportunities. Emphasis on reducing cost, increasing infrastructure, and adopting digital tools will serve to create a prosperous future for this market.

MARKET SEGMENTATION

By Battery Type

The global battery management system market shows how innovations will shape energy control and efficiency. Growth in this field will reflect advances in battery technology, smarter controls, and expanding applications. Forecasts point to a future where system designs will adapt quickly as energy storage needs change.

The global battery management system market development will follow trends in battery chemistry. Lithium-Ion Based batteries offer high energy density and faster charging, so management systems for these types will become more precise and adaptive. That will help deliver longer range, better safety, and smoother performance. Lead-Acid Based batteries remain common in cost-sensitive and heavy-duty applications, so management systems will focus on durability and straightforward maintenance, ensuring reliability where simplicity matters most. Nickel Based batteries bring robustness and longer life cycles, so management systems targeting those cells will deliver optimized balancing and state detection to support extended use. Flow Batteries offer unique benefits such as scalable capacity and safe operation. Management systems for flow batteries will emphasize fluid handling coordination, state tracking, and effective system integration to enable large-scale energy storage services.

Advances in sensor technology, microcontrollers, and communication systems will shape how management systems respond. Future designs will integrate cloud connectivity and predictive analytics to foresee faults before failure, enhancing safety, reducing downtime, and improving lifespan. Smart algorithms will learn from usage patterns and environmental conditions to adjust charging cycles, thermal profiles, and balancing strategies. That will reduce energy waste and extend service periods.

Growth in electric mobility, renewable integration, and grid stabilization will push demand for advanced Battery Management System solutions. Electric vehicle fleets, solar or wind storage arrays, and micro-grid systems will rely on battery control units that manage packs safely and efficiently. The role of global battery management system market will become central in coordinating energy supply and demand with greater intelligence. Regulations and standards will drive further refinement in safety features, communication protocols, and interoperability. That will make management systems more robust and easier to integrate across platforms and industries.

A future-focused view suggests that next-generation modules will work closely with energy networks and even user interfaces to offer real-time reporting, customizable alerts, and seamless maintenance scheduling. Adaptive firmware updates and secure architectures will protect against cyber threats while keeping performance sharp. Strong collaboration between battery producers, system integrators, and energy users will bring management units that evolve alongside energy needs.

In summary, the global battery management system market will grow by Battery Type categories Lithium-Ion Based, Lead-Acid Based, Nickel Based, Flow Batteries through technological enhancements and application expansion. Connectivity, intelligence, and flexibility will drive progress toward safer and more efficient energy systems.

By Topology

The global battery management system market will continue to grow as energy storage needs expand across different industries. By topology, the market is divided into Centralized, Distributed, and Modular systems, each offering unique benefits for future applications. Centralized systems will remain important where cost efficiency and straightforward design are priorities. These systems use a single controller to manage battery packs, making them suitable for smaller setups or where complexity needs to be kept low. However, as energy demands rise and technology advances, Distributed systems will gain momentum. These systems use multiple controllers, giving better control, safety, and scalability, which will be critical for large-scale energy storage solutions, electric transportation, and smart grid applications.

The Modular approach in the global battery management system market will attract significant attention in the coming years. Modular systems combine the advantages of both centralized and distributed designs, allowing for flexibility and easy expansion. This adaptability will support industries where energy requirements are unpredictable or grow rapidly, such as renewable energy projects and electric vehicle infrastructure. The ability to add or remove modules without redesigning the entire system will save costs and time, making modular systems a preferred choice for dynamic markets.

Technological advancements will drive innovation across all three topologies. Integration of artificial intelligence and advanced sensors will improve real-time monitoring, fault detection, and energy optimization. As battery technologies evolve toward higher capacity and faster charging, management systems will need to keep pace to ensure safety, efficiency, and longer battery life. Regulatory standards focusing on sustainability and safety will further influence design improvements, pushing companies to develop smarter and more reliable solutions.

The global battery management system market growth will also benefit from the rising focus on renewable energy storage and electric mobility. Solar and wind projects will require advanced battery systems to store and distribute power efficiently, while electric cars, buses, and trucks will depend on reliable management systems for performance and safety. With increasing investments in clean energy and transportation, demand for centralized, distributed, and modular battery management solutions will expand, shaping the energy landscape of the future.

By Application

The global battery management system market will continue to expand as technology advances and the demand for efficient energy storage grows. Across various industries, the need for reliable systems that monitor, control, and optimize battery performance will drive significant development. By application, the market is divided into automotive, consumer electronics, energy, defense, and others, with each segment showing unique growth potential influenced by innovation and future demand.

In the automotive sector, the shift toward electric and hybrid vehicles will remain a strong driver. As vehicles become more dependent on high-performance batteries, advanced management systems will be essential for extending battery life, improving efficiency, and ensuring safety. Continuous improvements in vehicle technology will lead to more precise monitoring systems, supporting longer ranges and faster charging times, which will directly impact market growth.

The consumer electronics segment will also maintain steady progress. Portable devices, including smartphones, laptops, and wearable technology, will increasingly rely on compact and efficient battery systems. With the rise of connected devices and the growth of smart home products, the demand for smaller yet more powerful management systems will grow. Manufacturers will focus on creating lighter and more adaptable solutions to meet the requirements of next-generation gadgets.

In the energy sector, the need for reliable storage solutions will grow due to the rising use of renewable energy. Solar and wind power installations will benefit from advanced battery systems that manage energy flow efficiently, ensuring stable and consistent delivery. Utility providers will invest heavily in technologies that enhance storage capacity while reducing operational costs, allowing for better grid stability and energy distribution.

The defense segment will continue to prioritize durability and reliability in challenging environments. Battery systems used in this sector will need to withstand extreme conditions while offering consistent performance for equipment and vehicles. As military technology advances, the demand for systems that provide secure and efficient power management will rise steadily.

Other applications will see steady adoption as industries such as healthcare, industrial automation, and logistics integrate battery-powered systems into daily operations. Equipment ranging from medical devices to warehouse automation tools will benefit from precise monitoring and control, ensuring uninterrupted performance and safety.

Future developments in artificial intelligence and data analytics will support the evolution of the global battery management system market. Smarter systems will predict performance needs, reduce downtime, and enhance safety across all applications. This forward-looking progress, supported by ongoing research and innovation, will ensure consistent market growth and adaptation to changing technological demands.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$11,256.54 million |

|

Market Size by 2032 |

$50,982.38 Million |

|

Growth Rate from 2025 to 2032 |

25.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

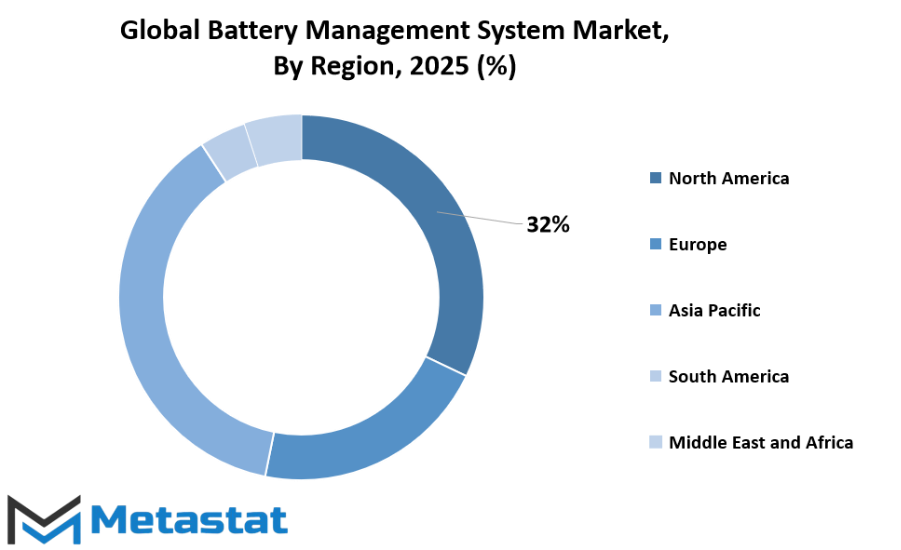

The global battery management system market is on a steady path of growth, driven by rising demand for efficient energy storage solutions across multiple industries. Rapid advancements in electric vehicles, renewable energy storage, and portable electronic devices are shaping the future of this market. With technology moving toward higher efficiency and safety standards, the market will continue to evolve as new applications and innovations are introduced.

Based on geography, the global battery management system market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. North America is further segmented into the U.S., Canada, and Mexico, where strong adoption of electric vehicles and government incentives for clean energy are fueling steady growth. Europe, which includes the UK, Germany, France, Italy, and the Rest of Europe, is focusing on policies that promote sustainability and reduce carbon emissions, making the region a strong contributor to market expansion.

Asia-Pacific, segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific, is expected to experience the fastest growth in the coming years. Increasing investments in electric mobility and rapid industrialization will strengthen the region’s role in shaping future advancements. South America, with Brazil, Argentina, and the Rest of South America, is gradually entering the market as awareness of clean energy technologies spreads and investments in infrastructure improve. In the Middle East & Africa, which includes GCC Countries, Egypt, South Africa, and the Rest of the region, the focus is on energy diversification and the adoption of technologies that support sustainable energy use, which will drive moderate but consistent growth.

Future developments will bring smarter systems with improved data management and predictive analytics, enhancing battery safety and performance. Integration with artificial intelligence and cloud platforms will allow better monitoring and maintenance, helping industries achieve efficiency and reliability. The market will also benefit from increasing demand for renewable energy storage, where reliable battery systems are essential to balance energy supply and demand.

Continuous research and development will lead to systems that are lighter, more cost-efficient, and capable of managing higher energy capacities. As industries worldwide transition toward greener solutions, the demand for advanced battery management systems will remain strong. With collaborative efforts between governments, manufacturers, and technology developers, the global battery management system market will move toward a future defined by innovation, scalability, and widespread adoption, shaping energy solutions for the decades ahead.

COMPETITIVE PLAYERS

The global battery management system market will shape the way energy storage systems operate in coming decades. A view into that market shows how technologies, companies, and innovations will transform energy reliability and efficiency. Growth will come from increasing demand for electric vehicles, renewable energy integration, and smart grid applications. Future developments in the global battery management system market will focus on better safety, longer lifespan, and smarter monitoring across all battery types.

Key players in the global battery management system market will include many familiar names already linked with electronics, automotive systems, and energy storage. A123 Systems LLC, Analog Devices, Inc., AVL List GmbH, BMS Powersafe, BYD Company Ltd., Dana Inc., Dober, Eberspaecher Vecture Inc., Ecobalt Solutions, Elithion Inc., Gentherm Inc., GS Yuasa Corp, Hitachi Chemical, Infineon Technologies AG, Johnson Matthey Plc, Leclanché SA, LG Chem Ltd., Lithium Balance AS, Nuvation, NXP Semiconductor N.V., Panasonic Holdings Corp., Renesas Electronics Corp., Samsung SDI, Tesla Inc., Texas Instruments Inc., and Toshiba Corp. will each play a role in advancing technology, forming partnerships, and shaping standards.

That market will benefit from tighter integration between battery hardware and artificial intelligence, creating systems able to predict failures before they happen and optimize charging cycles for real-time conditions. Future control systems in that market will adapt their behavior based on usage patterns, environmental data, and grid demands. Manufacturing methods will incorporate digital twins, making testing and quality control faster and less expensive.

The global battery management system market will also be influenced by regulations around safety and recycling. Standards requiring monitoring of cell voltages, temperatures, and state of health will push companies to design more robust systems. Recycling incentives and circular economy policies will drive systems that track battery components and simplify end-of-life handling.

Cities will benefit from deployment in public transit, where monitoring systems will ensure buses and trains operate safely for longer periods. Industrial installations will rely on those systems to manage large-scale storage paired with solar and wind farms. Homes will gain from smart home integration, where energy storage and management will reduce costs and support backup power during outages.

Overall, the global battery management system market will grow steadily as innovation keeps pace with demand. Systems that learn and adapt, companies collaborating across fields, and a push toward sustainability will guide progress. Change will come fast, and that market will stand at the center of cleaner, safer, more dependable energy systems for decades ahead.

Battery Management System Market Key Segments:

By Battery Type

- Lithium-Ion Based

- Lead-Acid Based

- Nickel Based

- Flow Batteries

By Topology

- Centralized

- Distributed

- Modular

By Application

- Automotive

- Consumer Electronics

- Energy

- Defense

- Others

Key Global Battery Management System Industry Players

- A123 Systems LLC

- Analog Devices, Inc.

- AVL List GmbH

- BMS Powersafe

- BYD Company Ltd.

- Dana Inc.

- Dober

- Eberspaecher Vecture Inc.

- Ecobalt Solutions

- Elithion Inc.

- Gentherm Inc.

- GS Yuasa Corp

- Hitachi Chemical

- Infineon Technologies AG

- Johnson Matthey Plc

- Leclanché SA

- LG Chem Ltd.

- Lithium Balance AS

- Nuvation

- NXP Semiconductor N.V.

- Panasonic Holdings Corp.

- Renesas Electronics Corp.

- Samsung SDI

- Tesla Inc.

- Texas Instruments Inc.

- Toshiba Corp.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383