MARKET OVERVIEW

The global banking market is poised to be at the center of economic change, defining how money is interacted with by people and organizations over the next few decades. With the business heading into a new era of modernization, it will not only be a finance provider but will become an integrated platform that affects commerce, technology, and consumer experience. What's next for traditional banking is a vision of interconnected systems wherein geographic constraints no longer limit financial access.

In the future, the business will adopt technologies that redefine transaction speed and security to far exceed the concept of mere monetary storage and lending. Artificial intelligence, digital identity systems, and advanced analytics will enable custom solutions that anticipate consumer needs even before they emerge. These innovations shall not be limited to developed economies alone but shall provide doors of opportunity for inclusive growth in previously underserved regions. This change will allow banking organizations to emerge as global facilitators instead of localized players.

The notion of trust shall assume a different dimension in the global banking market as transparency and observance of international norms become indispensable. Banks will institute practices in which accountability becomes an integral part of each operation level. This shift will facilitate the restoration of consumer trust, especially after times when financial institutions were under fire for governance methods. In addition, sustainability will no longer be an empty corporate phrase. It will guide policies on lending, investment, and product innovation to ensure economic advancement is achieved without costing nature or social cohesion.

A further aspect that will determine the future is the integration of banking with other industries like retail, health, and mobility. Transactions will no longer be seen as discrete occurrences; they will be part of experiences in everyday life through interlinked ecosystems. Envision a world where a single digital platform controls lifestyle, saving, insurance, and investments without multiple login processes or different providers of services. Such ease will be what competitiveness will mean in the future.

Cross-border financial interaction will also see unprecedented change. The obstacles of currency exchange and delays in time in international transfers will recede with the use of cutting-edge digital currencies and secure blockchain networks. These technologies will not only underpin world trade but will enable small business enterprises and individual entrepreneurs to reach markets that were hitherto out of reach.

Going forward, the global banking market will transition towards being a vibrant infrastructure and not a static institution. It will set up hyperlinks that move past finance and effect innovation, governance, and client empowerment at a global degree. Although banking's roots will nonetheless be in consider and protection, its destiny might be characterized by means of flexibility, integration, and the potential to expect want in an efficiency-pushed world with out sacrificing reliability.

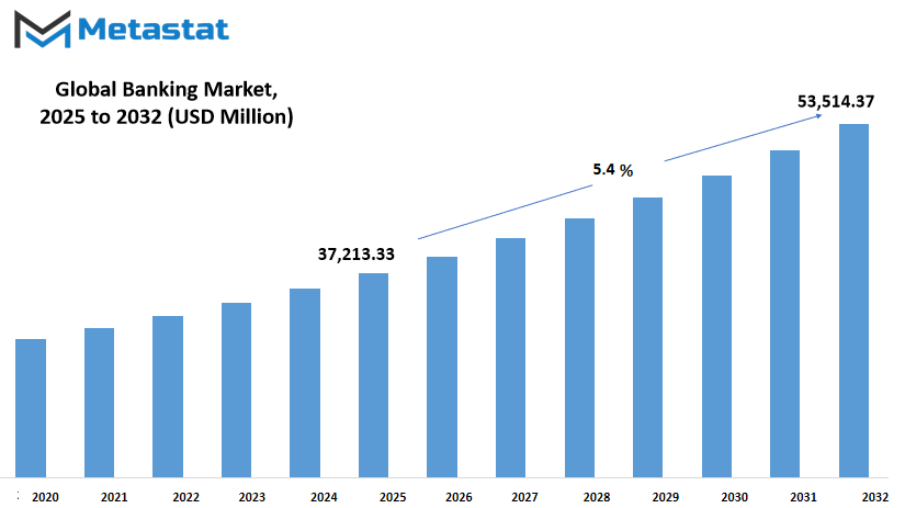

Global banking market is estimated to reach $53,514.37 Million by 2032; growing at a CAGR of 5.4% from 2025 to 2032.

GROWTH FACTORS

The global banking market is experiencing wonderful exchange as extra customers and businesses turn to digital systems for their banking necessities. Increasing demand for on-line and cell banking offerings is altering the operations of traditional banks. Customers more and more expect smooth digital experiences, ranging from truthful account management to sophisticated financial transactions. This move towards digitalization is not merely convenience but also coping with the pressure of a fast life where accessibility and efficiency take precedence. Banks that are able to provide easy-to-use digital solutions are gaining an advantage in this competitive environment.

In addition to this digital drive, the growth in international trade and economic activity is driving the need for financial services. Firms that transact business across borders require efficient banking services for payment, foreign exchange, and credit facilities. The growth in cross-border trade leads to banks extending innovative merchandise in support of change finance, deliver chain answers, and pass-border payments. This trend reinforces the position of banks as imperative enablers of economic development because it opens up possibilities to interact with a much broader spectrum of clients.

The global banking market is not without its demanding situations, however. A key concern is the price of regulatory compliance, which maintains growing as governments and regulators impose extra stringent tips to ensure stability in the monetary quarter. Compliance with such necessities tends to be pricey for banks, influencing profitability and aid allocation. Along with compliance, a key threat is likewise cybersecurity threats. The dependence on digital structures puts banks at hazard for cyberattack, which would interrupt commercial enterprise and erode patron accept as true with. Safeguarding confidential monetary statistics is a top subject for the arena.

In spite of such weaknesses, the increase of fintech corporations and the high fee of acceptance of digital banking products provide considerable growth potentialities. Fintech technologies such as virtual wallets, price applications, and artificial intelligence-primarily based monetary gear are transforming customer expectancies and creating opportunities for co-operation between conventional banks and technology carriers. These co-operations permit banks to upgrade their offerings while preserving with the pace of technological trends. As customers more and more undertake digital finance, the global banking marketplace will revel in giant boom fuelled through innovation, strategic partnerships, and a high emphasis on protection and compliance.

MARKET SEGMENTATION

By Type

The global banking market remains a critical driver of economic interest globally, linking corporations, humans, and establishments to an prepared economic network. Through evolution in generation and a regular growth in international change, banking has transcended into extra than just conventional roles, becoming an integral part of people' and companies' daily operations. This marketplace is fueled by means of increasing call for secure financial transactions, online banking improvements, and consumer-oriented services that render banking more handy than ever.

Retail banking accounts for the highest share, with an estimation of $24,851.38 million. This sector is aimed at catering to individuals with services ranging from saving accounts, loans, credit facilities, and online banking solutions. The move towards mobile and internet-based platforms has contributed a great deal to this sector, enabling customers to conduct transactions from the comfort of their homes or while on the move. The increase in the utilization of mobile payment applications and electronic wallets has also widened the horizon of retail banking, making it a competitive industry with customer experience as the chief discriminator.

Corporate banking is yet another crucial division, serving businesses through working capital, trade finance, treasury facilities, and credit facilities. Internationalization and the growth of multinational corporations have raised the demand for advanced financial assistance, and corporate banking has emerged as a pillar in the development of the economy. As businesses look to maximize cash flows and efficiently manage risks, this division will keep growing steadily. Apart from this, corporate banking services are also being incorporated in digital platforms in order to increase efficiency and lower the time taken for transactions.

Investment banking continues to be important to companies and governments requiring support for financing large-scale planning, mergers and acquisitions, and raising capital. This zone is responsible for generating financial increase by way of providing get admission to financing for boom and innovation. Likewise, private banking caters to excessive-net-really worth customers who want individualized economic techniques and wealth control solutions. Both those areas are probable to increase as worldwide wealth keeps to upward thrust and greater clients pursue specialized financial recommend in an effort to manipulate assets and investments.

Overall, the global banking market is a vibrant and purchaser-orientated panorama where technology, comfort, and trust are what make a business successful. From character saving to sophisticated company transactions, banking is concerned in all walks of present day existence. With innovations consisting of artificial intelligence, blockchain, and next-era analytics going mainstream, the market will continue to evolve to bring faster, more secure, and tailored economic answers to individuals and organizations across the globe.

By Platform

The global banking market is present process dramatic change as generation transforms how economic offerings are supplied and accessed. Banking is no longer confined to the physical branch; it has moved onto diverse platforms that are convenient and flexible for clients. This exchange is inspired by means of the increasing need for faster, safer, and convenient economic solutions. Every platform within the marketplace performs a particular role, assembly the distinctive tastes and necessities of customers at the same time as pursuing the not unusual goal of enhancing financial get admission to and performance.

Conventional banking continues to be a extensive quarter of the enterprise, supplying customers with face-to-face services in bricks-and-mortar outlets. Numerous individuals continue to choose to meet their wishes face-to-face, inclusive of establishing accounts, putting off loans, or handling complex issues. These branches provide customers a sense of consider and one-on-one service that can not be absolutely replicated by way of virtual channels. Although technology has brought new approach to financial institution, bodily banking still exists, specially for those less comfortable with virtual generation or need help that necessitates documentation.

Digital banking, but, has turn out to be extraordinarily popular as clients search for comfort and velocity. Digital banking platforms permit users to control their price range through websites and packages without traveling a branch. They offer offerings which include account control, fund transfers, and bill payments with only some clicks. The appeal lies in accessibility and spherical-the-clock availability, making it perfect for people with busy lifestyles. With advanced security structures used, digital banking has gained plenty of self assurance from customers who want comfort along protection.

Mobile banking has taken convenience to a new level by placing banking services in customers' pockets. Using mobile applications, users can do transactions, deposit checks, and even take out credit while they are in transit. This channel is particularly popular with the younger generations and in countries where mobile phone penetration is high. Mobile banking has speed and flexibility built into it, making services more available in low-branch areas. It also has an important function in financial inclusion by reaching out to populations that were not being served.

Online banking, though a parallel concept with digital banking, is more specifically aimed at offering services via web channels. It offers a simple approach for clients to control normal chores like balancing, money transfer, and paying bills. Online banking is a robust alternative for users who need to manage their finances via a laptop surroundings. It fills the center floor among the vintage conventional way and new-age strategies through imparting convenience without completely taking up from the benefit of legacy structures. The extra technology keeps growing, the extra on-line banking embraces new functions that help to streamline the person experience.

The integration of these platforms emphasizes how the global banking market is evolving to respond to specific consumer needs. While believe and private care include conventional banking, velocity, convenience, and accessibility symbolize digital, cell, and online banking. Such a mix of offerings will preserve to shape the future of the market, rendering banking extra flexible and client-focused than ever before.

By Payment Methods

The global banking market has also undergone a huge change with the passing years, and how things are dealt with now is different from what used to be. As technology improves and expectations from the people increase, banking is no longer restricted to the basic ways. Individuals have numerous fee alternatives at their disposal these days, making transactions less complicated, faster, and extra reliable. It's a demonstration of how the enterprise is shifting towards comfort and accessibility without dropping the age-antique ways for those who are used to it.

Cash stays the various oldest and maximum broadly ordinary modes of payment, specifically for minor transactions as well as in regions wherein there's restricted digital infrastructure. Most customers retain to apply coins because of its ease and lack of net or banking requirements. But with the extended use of electronic approach, coins utilization has decreased in a few places, specifically in towns in which individuals pick faster and extra traceable transactions.

Checks, at one time a major approach of payment for companies and consumers alike, have lost reputation but hold to have a place in certain instances. Checks are frequently employed for large-price tag purchases, official payments, or wherein electronic structures have no longer been completely embraced. Though exams provide a feeling of security and documentation, their slow processing as compared to the opportunity of electronics has helped lead the manner to faster methods inclusive of playing cards and cell bills.

Debit and credit cards are now a powerful presence in the banking sector. Credit cards give the choice of borrowing with extra perks such as rewards and fraud protection, and debit cards provide immediate access to funds without the threat of borrowing. Both practices have earned consumers' confidence through their convenience and security. They are widely accepted for both online and offline transactions, and are a necessity in the current economy.

Mobile payment platforms have been a game-changer with the convenience of allowing individuals to transact using smartphones through a few taps. This is very common among the young generation and tech-users who require speed and convenience. Mobile charge packages additionally have the brought functions of paying payments, moving finances, and the usage of contactless techniques, which lead them to have among many. With more and more areas improving their online infrastructure, cell bills will retain to extend even greater, defining the destiny of people' interactions with banking offerings.

By Customer

The global banking market stays an quintessential factor inside the facilitation of financial interest, with its services catering to a varied customer base of different monetary needs. Its company has expanded to cater to people, corporations, and excessive-net-well worth clients, with each zone capable of receive specialized services that in shape their desires. From man or woman savings money owed to corporate financing on a huge scale, monetary institutions offer critical solutions that shape neighborhood and worldwide economies. With increasingly interconnected financial structures, banks need to offer accessible, steady, and innovative offerings with a view to keep customers' consider.

Individual consumers form a majority of the banking sector as they use financial agencies for each day necessities like saving debts, loans, credit playing cards, and electronic charge schemes. For them, comfort and safety are nonetheless the best precedence. Banks are focusing on person-friendly cell applications, quick fund transfers, and 24/7 get entry to make certain that clients can manage their finances without difficulty. The call for personal loans and housing finance continues to rise, driven by way of converting life and aspirations. This segment is distinctly aggressive, pushing banks to provide appealing hobby quotes and rewards to maintain loyalty.

Small and Medium-Sized Enterprises (SMEs) represent another vital phase of the global banking market. These companies need funding to cover working capital, increase operations, and ride market volatilities. Banks serve SMEs by offering credit lines, trade financing, and advisory to enable them to grow and compete efficiently. As most SMEs turn to digital platforms, banks are developing solutions that make payment collection easier, payroll management easier, and tax compliance simpler. This collaboration between banks and SMEs not only leads to business success but also ensures employment generation and economic stability.

High-Net-Worth Individuals and Corporates are segments that necessitate state-of-the-art financial services in addition to conventional banking. Corporate giants need capital for mergers, acquisitions, and enlargement globally, which compels banks to create in-intensity answers like dependent loans, cash management solutions, and forex. High-Net-Worth Individuals, however, search for custom designed wealth management, funding recommendation, and property planning to manage and enhance their wealth. This segment is primarily based on trust and near relationships, so customer service and restraint are key parameters for banks serving those clients.

As the global banking market keeps evolving, every customer segment will define future product and service trends. Banks will engage in digital transformation, security upgrade, and customized experiences to satisfy the needs of these diverse segments. It could be an individual wanting convenience, an SME looking for growth, or a company dealing with huge operations, the banking sector will remain a key driver of financial stability and advancement.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$37,213.33 million |

|

Market Size by 2032 |

$53,514.37 Million |

|

Growth Rate from 2025 to 2032 |

5.4% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

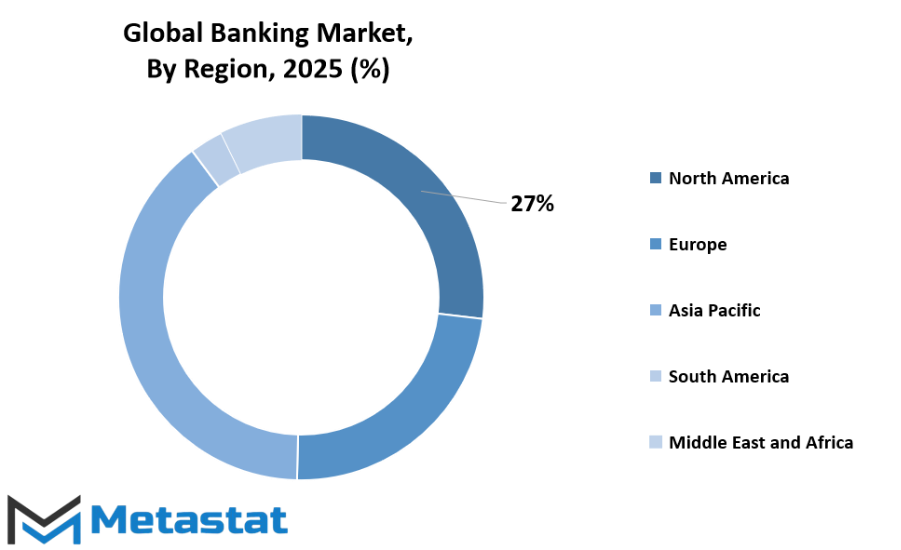

REGIONAL ANALYSIS

The global banking market is organized geographically in diverse regions according to economic heterogeneity and financial infrastructures that prevail globally. Geographically, the market is divided into North America, Europe, Asia-Pacific, South America, and Middle East & Africa. Each geographic region contributes uniquely towards formulating international trends in finance by being subject to local economies, laws, and customer needs. This segmentation assists us in knowing the adoption, growth, and diversification of banking services in various regions of the world.

North America remains a key player in the global banking market, fueled primarily by developed economies and solid financial structures in nations such as the U.S., Canada, and Mexico. The United States is at the forefront with its established banking sectors, high rate of adoption of digital banking services, and ongoing innovation in financial products. Canada and Mexico both have a contribution towards the regional market via stable banking operations as well as increasing applications of advanced banking technologies, for which the region stands among the most powerful players in the worldwide financial arena.

Europe is also another significant region with nations like the UK, Germany, France, and Italy, as well as the Rest of Europe. The area is supported by mature banking systems and robust regulatory environments that ensure transparency and financial stability. The UK and Germany are renowned for their global financial centers, while France and Italy are focusing on developing their bank business through digital transformation and customer orientation. Economic problems notwithstanding, the European banking industry remains robust through innovative spirits and compliance with international norms.

Asia-Pacific is a rapidly developing and fast-expanding market within the global banking sector, with significant contributors being India, China, Japan, South Korea, and the Rest of Asia-Pacific. The region witnesses quick digitization of banking activities due to high populations, growing internet penetration, and growing needs for ease in financial transactions. China and India dominate this growth through burgeoning digital payment systems and mobile banking platforms, while Japan and South Korea concentrate on incorporating superior technologies in conventional banking systems. This fast development places Asia-Pacific as a focal power in the making of the future of international banking.

South America and the Middle East & Africa provide additional diversity to the banking market. In South America, Brazil and Argentina are consistently growing their banking ability, with an emphasis on financial inclusion and access to online banking services. The Middle East & Africa region, which includes GCC nations, Egypt, and South Africa, is experiencing major advances in bank infrastructure. These markets are embracing digital solutions and enhancing regulatory policies for investment attraction and financial growth. Combined, these areas make up a global banking system that evolves and expands with the shifting economic and technological realities.

COMPETITIVE PLAYERS

The global banking market is at the heart of defining the financial architecture of the global economy. It is the backbone that supports both individual and business financial transactions, from savings and credit to investment and massive financial transactions. Banking has evolved over time from the conventional bricks-and-mortar setup to a digital-first strategy, fueled by evolving customer needs and technological advancement. This change is not just enhancing accessibility but also promoting competition among large institutions. Irrespective of local variations in regulations and economic environments, the market will remain an underpinning for international trade, investment, and wealth management.

The global banking market is dominated by a few of the largest and most powerful financial institutions globally, and each has a major contribution to make to global economic growth. Major participants are Mitsubishi UFJ Financial Group, Inc., Citigroup Inc., JPMorgan Chase & Co., China Construction Bank Corporation, Wells Fargo & Company, BNP Paribas SA, UBS Group AG, Deutsche Bank AG, Crédit Agricole SA, Industrial and Commercial Bank of China Limited, HSBC Holdings plc, Agricultural Bank of China Limited, Bank of America Corporation, Morgan Stanley, and The Goldman Sachs Group, Inc. These organizations have established excellent reputations due to their financial stability, large client bases, and capacity for responding to shifts in global financial landscapes. They have operations in many regions, providing services that vary from retail banking to wealth management and investment banking.

The global banking market is increasing cross-border transactions, online banking solutions, and new financial products that render banking more efficient and faster. Major banks are spending significantly on technology like artificial intelligence, blockchain, and cloud services in order to enhance security, customer experience, and operational efficiency. Digital payment platforms, mobile banking applications, and automated advisory platforms have brought banking within reach for a larger population, even in areas that previously did not have the infrastructure for traditional banking. This is a trend that will persist as customers increasingly require convenience and companies search for speed and safety when transferring money across borders.

The global banking market has challenges, though, including regulatory pressure, cybersecurity risks, and economic instability brought about by global events. Banks will have to remain in compliance with stringent financial regulations while being innovative and competitive. Furthermore, the emergence of fintech firms is compelling mainstream banks to reassess their strategies and develop more customer-centric models. Despite the challenges, the global banking industry will continue to be one of the solid foundation pillars of the global economy, delivering essential services that facilitate trade, investments, and personal financial security. With its blend of long-established institutions and emerging technological drivers, the global banking market will keep defining the financial future of businesses and consumers.

Banking Market Key Segments:

By Type

- Retail Banking

- Corporate Banking

- Investment Banking

- Private Banking

By Platform

- Traditional Banking

- Digital Banking

- Mobile Banking

- Online Banking

By Payment Methods

- Cash

- Checks

- Credit Cards

- Debit Cards

- Mobile Payment

By Customer

- Individual Customers

- Small and Medium-Sized Enterprises (SMEs)

- Corporations

- High-Net-Worth Individuals

Key Global Banking Industry Players

- Mitsubishi UFJ Financial Group, Inc.

- Citigroup Inc.

- JPMorgan Chase Co.

- China Construction Bank Corporation

- Wells Fargo Company

- BNP Paribas SA

- UBS Group AG

- Deutsche Bank AG

- Crédit Agricole SA

- Industrial and Commercial Bank of China Limited

- HSBC Holdings plc

- Agricultural Bank of China Limited

- Bank of America Corporation

- Morgan Stanley

- The Goldman Sachs Group, Inc.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252