Global Aviation Fuel Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

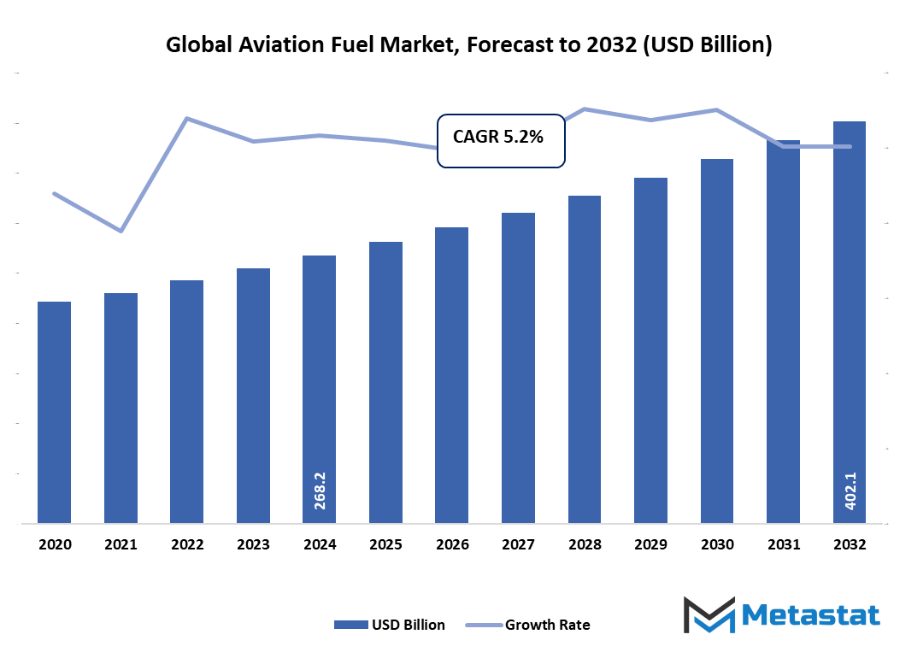

- Global aviation fuel market valued at approximately USD 281.8 billion in 2025, growing at a CAGR of around 5.2% through 2032, with potential to exceed USD 402.1 billion.

- Jet A account for a market share of 7.1% in 2024, driving innovation and expanding applications through intense research.

- Key trends driving growth: Rising air passenger traffic and expansion of global airline fleets, Growing demand for fuel-efficient and high-performance aviation operations

- Opportunities include: Development of sustainable aviation fuels (SAF) offers significant growth opportunities

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Market Background & Overview

The global aviation fuel market will be the backbone of global air travel, providing the fuel that will propel commercial airliners, private aircraft, cargo carriers, and military fleets. The market will not be merely about fuel production but will encompass a vast system of refining, blending, quality assurance, and international distribution that will govern safe and effective flight operations. It will comprise a variety of fuel types, from traditional jet fuel to newer environmentally friendly aviation fuels, each crafted to satisfy rigorous international specifications and performance criteria for current airplane engines.

This business will be at the crossroads of energy and aviation, with refiners, majors in the oil industry, and logistics operators collaborating to supply airports globally in perpetuity. The market will be driven by the evolution of sophisticated refining processes, international trade patterns, and investments in infrastructure that will ensure assured availability. Industry leaders will invest further in R&D, exploring new feedstocks and cleaner production methods to meet plans for emission cuts by regulators and airline associations.

Market Segmentation Analysis

The global aviation fuel market is mainly classified based on Fuel Type, Application.

By Fuel Type is further segmented into:

- Jet A

The global aviation fuel market will persist in utilising Jet A as an ordinary fuel for turbine engines in many different regions. That it is present in domestic airports will guarantee stable demand. Future improvements will be towards streamlining processes to yield increased efficiency and lessen emissions, in accordance with stringent aviation safety and quality standards globally. - Jet A-1

The global aviation fuel market will prefer Jet A-1 because it has a broader freezing point range and is accepted around the world. This grade will still be the preferred one for long-haul flights. Supply chains will adjust to maintain steady supplies at world hubs, supporting passenger and freight aircraft operations in various climates. - Jet B

The global aviation fuel market will contain Jet B for cold-weather operations in extreme conditions where increased volatility is needed. Its application will be restricted to specialized operations like northern routes and remote operations. Technological advancements will improve production to become safer and more efficient while still adhering to aviation standards. - Aviation Biofuel

Airlines will utilize blended fuels to cut carbon footprints with no compromise on performance. Infrastructure investment in producing biofuels will rise, remaining cost-competitive and placing bio-based solutions at the core of future aviation energy solutions. - AVGAS

The global aviation fuel market will continue AVGAS for piston-engine aircraft in training and recreational flight. Flight schools and general aviation operators will provide steady demand. Development work will be aimed at creating unleaded AVGAS variants to comply with environmental regulations and reducing the effect of lead emissions on local communities.

By Application the market is divided into:

- Commercial Aviation

The global aviation fuel market will observe commercial aviation holding the biggest share because of demand for passengers and freight. The airlines will focus on fuel efficiency through fleet modernization and best routes. Collaborations with fuel suppliers will be strengthened to provide a dependable supply for local and international operations at a reasonable price. - Defense Aviation

The global aviation fuel market will be based on defense aviation with governments investing to sustain air capabilities. Military training, military operations, and humanitarian operations will continue fuel demand. Creation of energy-dense fuels and logistical systems will provide readiness and continuous operations in strategic and difficult places. - General Aviation

The global aviation fuel market will grow with overall aviation activity in the form of general aviation activity such as business jets, private charter, and recreational flight. Consumption will accelerate with more air taxi operations and pilot training programs. Upgrades to infrastructure in smaller airports will enhance accessibility, with steady consumption of conventional and alternative aviation fuels.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$218.8 Billion |

|

Market Size by 2032 |

$402.1 Billion |

|

Growth Rate from 2025 to 2032 |

5.2% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

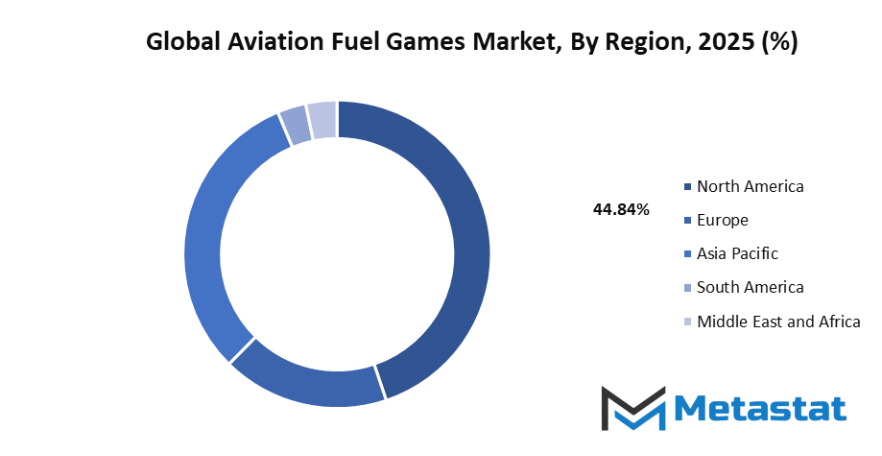

By Region:

The global aviation fuel market will be divided across different main region(s) in which it will supply major airports and airlines globally and repeatedly. The US will be the largest consumer in the region due to is enormous commercial and defense air operations, but Canada and Mexico will continue to grow in importance in relation to cross-border connectivity and cargo traffic across the broader continent. Fuel consumption in Europe will still be concentrated in the four biggest countries of the EU, U.K., Germany, France, and Italy, using advanced refining and regulatory effort to maintain air service continuity.

It is anticipated that Asia-Pacific will emerge as the fastest-growing regional market, and as such, the four countries, India, China, Japan and South Korea will be the contributing factor to the expansion of the passenger and freight networks. These four countries will soon start building new storage and distribution centers to accommodate their airline fleets and leisure travel, which is resuming slowly. As far as South America is concerned, the fuel requirement should remain stable, with the main contributors being Brazil and Argentina; regional airlines will be concentrating on domestic route consolidation and on points that are now unserved. The Middle East and Africa will always have major strategic significance; the six nations of the Gulf Cooperation Council will become key fuel points for long-haul flights leaving the continent, while Egypt and South Africa will be the central departure and destination points for airport arrivals and departures for both passengers and freight throughout the region.

Such regional distribution will make sure that the global aviation fuel market remains capable of fulfilling the energy needs of airlines, balancing production capacity, investments in infrastructure, and adherence to regulation across geographies and enabling the free flow of global air transportation networks.

Market Dynamics

Growth Drivers:

- Rising air passenger traffic and expansion of global airline fleets

The global aviation fuel market will expand due to the increase in passenger air travel globally, which encourages the expansion of fleets and schedules by airlines. New routes will be put in place to connect with emerging markets and maintain a consistent demand for fuel. As passenger air travel expands, this will continue to grow consumption of aviation fuel for domestic, regional, and international flights. There remains a positive outlook for the supplier community as a result. - Growing demand for fuel-efficient and high-performance aviation operations

The global aviation fuel market will grow as operators seek to procure high-performance fuel that allows them to fly longer ranges and require fewer maintenance intervals. Airlines will act to reduce costs by employing optimized fuel blends to reduce the maintenance interval while also improving engine efficiency. Advancements in the refining process will allow supply of consistent quality and support reductions in our global greenhouse gas emissions inventory.

Restraints & Challenges:

- Volatility in crude oil prices impacts cost stability for airlines

The global aviation fuel market will face adverse volatility from crude oil prices that are responsible for a large share of aviation fuel costs. Spikes in crude oil prices will increase pressure on profit margins and ticket prices. Airlines will continue to employ hedging and fixed price contracts to stabilize budgets, but volatility will remain a major source of operating risk. - Environmental concerns and emission regulations limit conventional fuel use

The global aviation fuel market will be constrained from greater aviation fuel adoption rates by stricter emissions regulations imposed by international aviation governing authorities. Traditional fuels will be heavily regulated to achieve unit reductions (to lower carbon emissions), increasing costs to airlines as they achieve compliance, while accelerating research and deployment of cleaner alternatives, such as biofuels.

Opportunities:

Development of sustainable aviation fuels (SAF) offers significant growth opportunities

The global aviation fuel market will benefit from the increased adoption of sustainable aviation fuels. Sustainable Aviation Fuel production will benefit from partnerships with fuel companies, research and technology companies transitioning to SAF, and commercial aviation (airlines). Usage of SAF will decrease lifecycle emissions, allowing aviation to reduce their externalities and achieve climate goals, while developing a new and profitable sector of aviation energy.

Competitive Landscape & Strategic Insights

The global aviation fuel market looks like it's shaping up to be a really interesting place for competition. You've got the big energy companies we all know, plus some smaller, specialized outfits. These smaller companies are looking to serve the tricky fuel demands of commercial, private, and military planes.

The main energy players, who will likely stay in charge, include Exxon Mobil Corporation, Chevron Corporation, Shell Plc, TotalEnergies SE, BP Plc, Gazprom Neft, and Neste Oyj. They're in a strong position because of their huge refining capabilities, their knack for new ideas, and their working relationships with airlines and airport folks. Swedish Biofuels AB, Next Renewable Fuels LLC, Abu Dhabi National Oil Company, Bharat Petroleum Corp Ltd, Indian Oil Corporation Ltd, Emirates National Oil Company, and Valero Energy Corporation are also part of this landscape.

These companies will compete not only on production, but also on innovating ways to refine fuel, reliability of global supply chains, and availability of cleaner, greener aviation fuel. Large international energy firms may focus on expansion of infrastructure and investing into sustainable aviation fuel. Smaller regional players may use their proximity to key airports to deliver affordable fuel on demand. This mix of big international dealers and local market players will probably keep making the market stronger. This also helps it meet the growing demand for fuel due to the increase in the number of flights.

In the coming years, the competitive dynamics of the global aviation fuel market will encourage further collaboration between refiners, airlines, and governments, fostering advancements that will improve fuel efficiency and support the transition to low-carbon alternatives, ultimately shaping the next phase of aviation energy solutions.

Forecast & Future Outlook

- Short-Term (1–2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3–5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6–10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 281.8 billion in 2025 to over USD 402.1 billion by 2032. Aviation Fuel will maintain dominance but face growing competition from emerging formats.

Report Coverage

This research report categorizes the global aviation fuel market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global aviation fuel market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global aviation fuel market.

By Fuel Type is further segmented into:

- Jet A

- Jet A-1

- Jet B

- Aviation Biofuel

- AVGAS

By Application the market is divided into:

- Commercial Aviation

- Defense Aviation

- General Aviation

Key Global Aviation Fuel Industry Players

- Exxon Mobil Corporation

- Chevron Corporation

- Shell Plc

- TotalEnergies SE

- BP Plc

- Gazprom Neft

- Neste Oyj

- Swedish Biofuels AB

- Next Renewable Fuels LLC

- Abu Dhabi National Oil Company

- Bharat Petroleum Corp Ltd

- Indian Oil Corporation Ltd

- Emirates National Oil Company

- Valero Energy Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383