MARKET OVERVIEW

The global airport surveillance radar market is a niche division of the aviation and defense technology sector, dedicated to providing radar-based surveillance solutions for civilian and military airfields. The market will play a vital support role in providing aircraft safety, runway integrity, and air traffic coordination. As airports increasingly embrace more sophisticated technologies to manage traffic with accuracy, demand for radar systems designed for surveillance purposes will be ready for strategic positioning in line with the operational requirements of domestic and international airports. Airport surveillance radar systems operate by monitoring and tracking aircraft both within controlled airspaces and on the ground.

The systems fall under the primary and secondary radar categories, with the technologies providing varying amounts of accuracy, range, and detectability. Primary surveillance radar detects an object by transmitting radio waves and processing their echoes, while secondary radar will use the onboard transponder of the aircraft to identify it. The two systems will collaborate for smooth air traffic surveillance. The global airport surveillance radar market will expand its reach across several verticals. In addition to major commercial centers, regional airports, military airfields, and cargo terminals will embrace surveillance radar systems.

These technologies will not be restricted to metropolitan areas but will be incorporated into locations that need sophisticated airspace management because of environmental or logistical complexity. These systems' use will go beyond aircraft location, such as weather observation and obstacle detection. Their multi-functionality will add to their worth in airport operations. Technology suppliers in this market will aim to provide modular, interoperable systems that will fit into wider airport infrastructure platforms. These systems must adopt global aviation safety standards while remaining flexible to meet local airspace issues.

The radar systems will also interface with control tower software and real-time data analysis platforms to facilitate decision-making processes. Innovations will also propel the market further into automation, with systems that will provide improved detection of non-cooperative targets, such as drones and other unidentified aerial objects. The global airport surveillance radar market will be influenced by regulations imposed by aviation authorities like the International Civil Aviation Organization (ICAO) and regional authorities in North America, Europe, Asia-Pacific, and the Middle East. Such organizations will define the technical and operational standards to be adhered to by manufacturers and service providers. As airports globally grapple with the dual pressures of efficiency and safety, surveillance radar will be implemented not only as a measure of compliance but also as an aid to optimize operational flow.

This market will also find application in the modernization of legacy infrastructure. Most nations will spend funds on replacing ageing radar systems with next-generation digital platforms. These upgrades will not only cater to existing requirements but also future-proof airport operations for expected airspace modernization programs. As increased focus is given to airside safety, incident prevention, and smart transport integration, the deployment scope will progressively evolve outside classical boundaries. In brief, the global airport surveillance radar market will establish itself as a critical aviation and air traffic system segment. Its expansion will be propelled by demand for precision, security, and readiness for operation in both international and domestic airports.

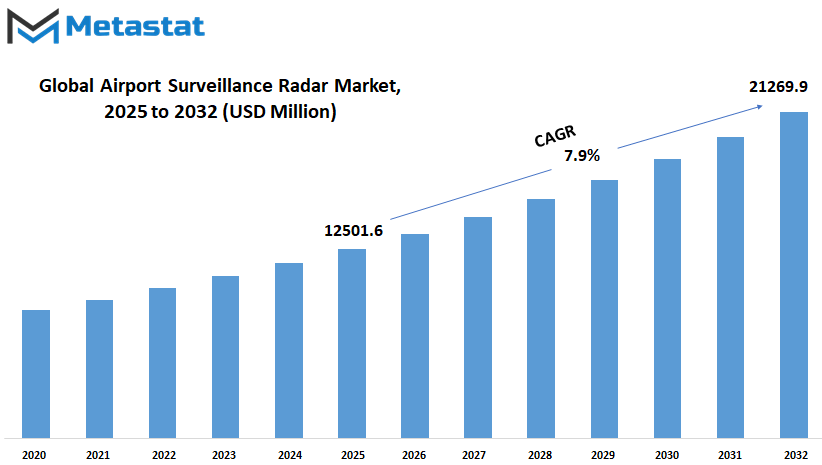

Global airport surveillance radar market is estimated to reach $21269.9 Million by 2032; growing at a CAGR of 7.9% from 2025 to 2032.

GROWTH FACTORS

The global airport surveillance radar market will experience steady expansion in the coming years as air traffic expands and security needs heighten. With airports aiming to enhance safety for passengers and aircraft alike, radar systems are improving and spreading. As global travel continues to expand, demand for dependable and accurate tracking technology will continue to expand. Governments and aviation authorities are also putting emphasis on investment in surveillance systems to ensure airspace control and cost-effective monitoring, which is one of the determinants that will propel the market forward. Also, other countries are currently replacing old radar equipment with new, sophisticated systems that can accommodate more aircraft while reducing the chances of technical failure. One of the most significant push factors for the global airport surveillance radar market is the growing focus on national security. As threats to airport security increase, from both physical and also virtual sources, there is a need for increased surveillance activity.

Radar technologies play an important role in this, helping controllers to identify suspicious behavior or unauthorised intrusion in and around airports. Technological development is a second push factor. Newer radar technologies are more precise and perform well with changing weather, thus being more valuable and trustworthy. As the technology in radars becomes smarter and more capable of fitting into other airport mechanisms, more airports will be willing to buy them. Certain problems could, however, hamper global airport surveillance radar market growth. Exorbitant maintenance and installation costs are a concern, especially for smaller or developing countries. Such systems require ongoing support, skilled staff, and regular upgrades, which may be costly. Interference by nearby communication signals or natural obstacles that may reduce the accuracy of radar systems, particularly in difficult environments, is also an issue. Despite such challenges, there are numerous opportunities ahead. One is the possibility of collaboration between private industries and governments to make the technologies more affordable and accessible.

As artificial intelligence becomes increasingly used in aviation, integrating it with radar systems might provide better data analysis and faster decision-making. Remote and automated air traffic control systems also have promise, particularly for airports in less populated regions. With new smart city projects and growing urban air mobility advancements on the horizon, the global airport surveillance radar market may find new uses in unexpected ways and offer growth opportunities into new markets beyond typical airport operations.

MARKET SEGMENTATION

By Type

The global airport surveillance radar market by type is taking an interesting trend with Primary Surveillance Radar (PSR) providing fundamental but significant functionality by being able to detect objects without requiring cooperation from the aircraft. It will still be present because of its independent nature. Nevertheless, there is an increasing tendency towards more integrated systems. Secondary Surveillance Radar (SSR) is dependent on the aircraft's transponder to reply, providing more accurate information. As planes keep on becoming increasingly digital, SSR systems will probably see more use for providing more accurate tracking. On the ground, Surface Movement Radar (SMR) tracks cars and planes on taxiways and runways. With airports seeking to prevent accidents and delays during heavy traffic, SMR will become more sophisticated and capable of managing intricate ground movements.

It will be particularly useful in weather conditions that limit visibility. Monopulse Secondary Surveillance Radar (MSSR) also provides even greater accuracy and quicker updates. This type of radar operates in a technique that rapidly homes in on the target and has a reliable signal, allowing air traffic controllers to respond immediately. MSSR usage will most probably increase as airports make investments in advanced systems capable of coping with congested skies and tight safety regulations. The global airport surveillance radar market will be driven by both regulatory needs and the demand for increasingly efficient air transport. Airports will keep investing in technology that holds the promise of smoother management and fewer dangers. These types of radar will not only coexist but complement each other to create an increasingly integrated, dependable, and responsive air traffic landscape that serves the demands of tomorrow.

By Application

The global airport surveillance radar market will remain central to enhancing security and efficiency in civilian as well as military airports. With rising air travel and increased reliance of more areas on air transport for economic and social growth, demand for more efficient radar systems will expand. The systems are employed to monitor aircraft activity on the ground and in the airspaces surrounding airports. They assist air traffic controllers in tracking planes and offering guidance to prevent accidents or delays. In the years to come, these technologies will be called upon to perform even more functions, including facilitating advanced automation and responding to changing flight patterns. Civilian airports will probably depend to a large extent on advances in radar technology.

With regular increases in flights and passengers, airports need to ensure that planes land and take off safely, even in bad weather or technical issues. Surveillance radar assists by providing precise, real-time monitoring of plane positions. As the world shifts towards intelligent infrastructure, most airports will start upgrading to advanced systems that not only monitor movement but also forecast and avoid potential risks. These improvements will not only slow down delays but also enhance the efficiency with which airport space is utilized. New radar systems will also have to interface with other equipment and sensors employed in airport operations, providing a more integrated and intelligent manner of traffic management. Military airports, however, have various requirements but are subject to similar pressure to be efficient and safe. The radar devices employed in the areas tend to require more sophisticated and ruggedized devices.

They are required to identify both civilian and military aircraft and react to potential threats. With the ongoing improvement of technology employed by various nations, military airports will require devices that can support complicated flight conditions and respond to drastic changes quickly. The future will see radar equipment with improved range, clearer data, and more secure communications. Military devices will have to be ahead of potential threats as they cooperate with allied forces in combined operations or missions. Overall, the global airport surveillance radar market will continue to advance as the need for smarter and safer air traffic control continues to grow. Whether for commercial travel or defense purposes, airports will rely on radar systems that are fast, accurate, and reliable. These systems will become the backbone of air traffic management in the future, ensuring that the skies remain safe and airports function efficiently.

By End User

The global airport surveillance radar market will keep evolving steadily as air traffic rises and security requirements grow globally. Both military and civilian sectors are endeavoring to enhance airport safety, which generates demand for improved surveillance systems. These radars have a significant part in tracking aircraft movements on runways and in airport surrounding airspace. With flights on the rise and more individuals dependent on air transport, reliable radar systems are becoming essential and not just an auxiliary system. They assist in streamlining traffic, minimizing the possibilities of accidents, and providing smoother coordination between airport officials and aircraft. In the future, this industry will be influenced by the various needs of its users.

Airport authorities and civil aviation organizations desire systems that assist in the safe management of commercial air traffic. Their interest will continue to be in preventing collisions, enhancing aircraft detection irrespective of weather conditions, and directing planes during takeoff and landing. Such organizations also require steady radar assistance in handling emergency conditions and sudden changes in air traffic. In contrast, military organizations tend to seek more sophisticated capabilities. They require radars that are able to identify potential threats, function in harsh environments, and function in every mission type, whether in combat or away from populated areas. Their systems tend to be designed to act fast, providing defense teams with time to react. As technology evolves, these users will seek improvements such as enhanced automation, quicker data processing, and more resilient signal accuracy. In the future, the global airport surveillance radar market will turn increasingly towards smarter and more responsive solutions. Artificial intelligence and machine learning will take a bigger role, enabling systems to learn from experiences and improve predictions and detect anomalies.

More radar systems are also likely to become connected to cloud networks, enabling data sharing at a faster rate and enhanced coordination among multiple airports and agencies. Another significant change can be the employment of light, energy-saving equipment that can be quickly installed and utilized in big as well as small airports. When the demands intensify to make aviation safer and better managed, the global airport surveillance radar market will reflect with innovation equal to the speed of world needs. The combination of civilian and military investment will maintain the market dynamic, assisting in driving enhancement that serves air travel in all areas.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$12501.6 million |

|

Market Size by 2032 |

$21269.9 Million |

|

Growth Rate from 2025 to 2032 |

7.9% |

|

Base Year |

2024 |

|

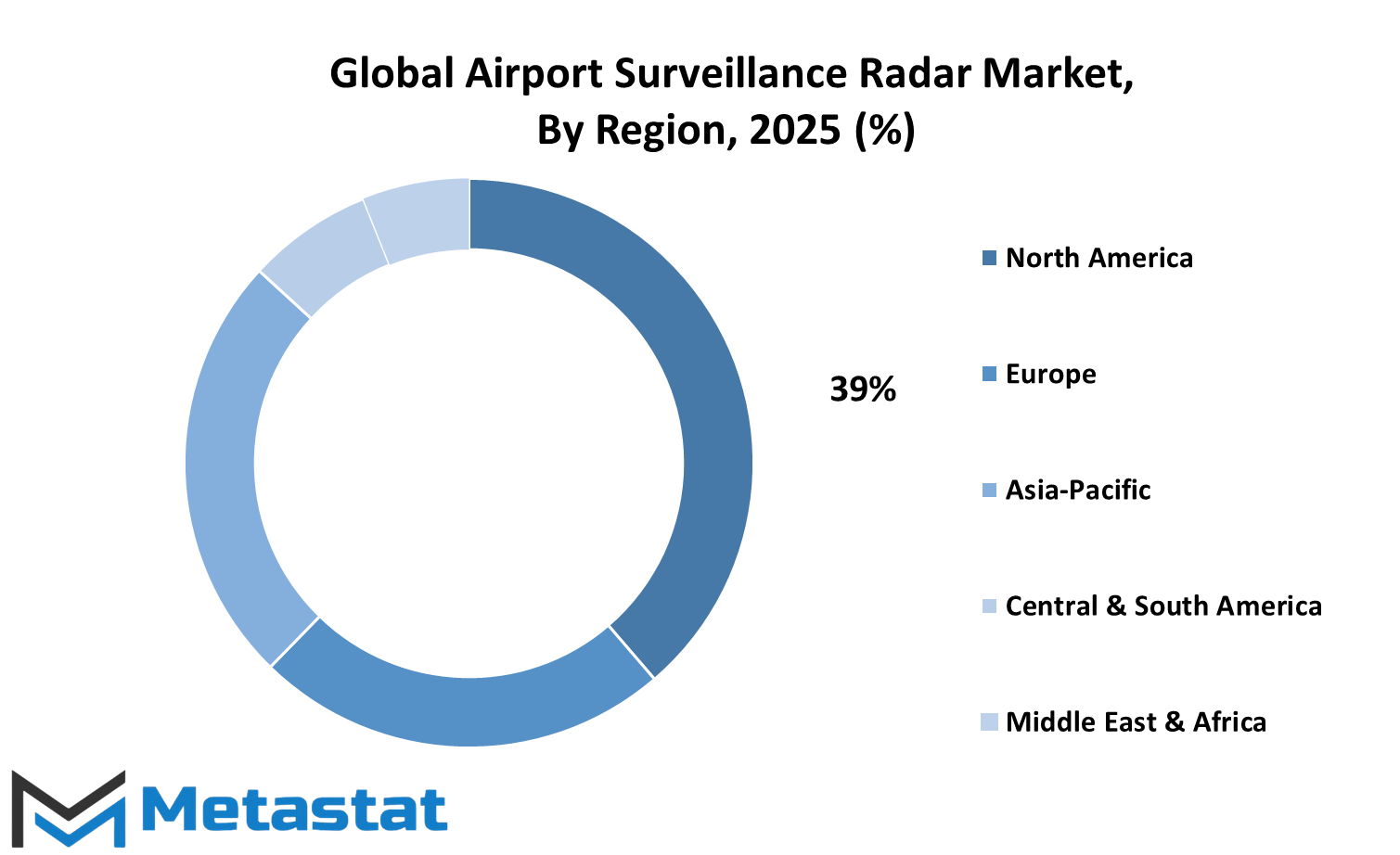

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

With increasing global transportation and continuous growth in air traffic, the value of effective and consistent airport monitoring systems becomes increasingly important. The global airport surveillance radar market is destined to undergo dramatic changes, with different parts of the world having various roles to play in its advancement. Every geographical region has its own set of priorities and issues, which determines the extent to which these radar systems are embraced and enhanced. North America, and especially the U.S., will most probably be the predominant force with leading-edge technologies and robust government support of aviation safety. Canada and Mexico will follow the same trend, albeit at a slower rate, with a concentration on developing infrastructure and air traffic control. In Europe, nations such as Germany, the UK, France, and Italy will also have consistent demand for upgrading their current radar networks. This upgrade is fueled by safety directives and the necessity of supporting both commercial and private flight traffic. Europe is also famous for undertaking eco-friendly projects that support green operations, and this can be in line with the continued evolution of radar systems that consume less power with improved coverage.

The Asia-Pacific region is also demonstrating high growth potential, with nations like China, India, Japan, and South Korea placing greater emphasis on building airport networks. With huge growth in both passenger and cargo flights, the demand for efficient radar systems is quite obvious. These countries are likely to invest heavily in advanced technology that guarantees security and assists in managing increasing air traffic with ease. With infrastructure projects advancing, particularly in developing regions of Asia, the requirement for these systems of radar will keep on increasing. South America, which boasts main players such as Argentina and Brazil, is steadily enhancing its aviation infrastructure. While improvement may not be quite as rapid in other regions, there is still a necessity to enhance airspace surveillance. Investments in radar systems that facilitate regional travel and link smaller airports to big hubs are being made. In the Middle East and Africa, particularly in GCC nations, Egypt, and South Africa, there is evidence of efforts to modernize airport operations. This region wants to establish itself as a key transit point. Enhanced surveillance radar technology will aid this endeavor by making air traffic control safer and more efficient. In the future, the global airport surveillance radar market will also keep on changing as nations will focus on safety, efficiency, and growth in aviation. Regional variations will influence the rate of change, but the common aim is clear: providing safer skies for all.

COMPETITIVE PLAYERS

The global airport surveillance radar market is likely to change substantially in the next few years, driven by increasing requirements for air traffic safety and evolving radar systems. While air travel remains a critical component of global connectivity, airport authorities will increasingly depend on accurate tracking technologies to enhance situational awareness. Surveillance radar systems play an integral role in this aim, providing real-time information on aircraft locations to facilitate smooth and secure operations on the ground and in the skies. With global air traffic steadily rising, the need to replace age-old systems will compel airports and governments to make investments in improved and more efficient radar solutions. In this scenario, most firms are gearing up for the future in which performance and responsiveness will be essential.

Top players like RTX Corporation and Thales Group are developing sophisticated radar systems that can operate in harsh weather and air traffic conditions. Their emphasis on innovation will determine the future of airport radar systems. Meanwhile, Indra Sistemas, S.A. and Shoghi Communications Ltd. are developing solutions that provide not just accuracy but also rapid response times to assist in handling dense traffic efficiently. More recent innovations by Leonardo S.p.A. and Terma A/S will improve airport efficiency by cutting down on blind spots as well as expanding coverage. Their forward-thinking strategy will aid airports in adapting to flight frequency changes and airspace configurations. L3Harris Technologies, Inc. and Hensoldt AG are also creating systems by integrating conventional radar with digital technology, enabling smoother integration with other airport safety systems. The global airport surveillance radar market will probably experience increasing competition, as firms such as Saab AB and NEC Corporation apply their defense and digital infrastructure expertise to civil aviation.

Easat Radar Systems Limited and ASELSAN A.Ş. are also investigating compact, modular configurations for deployment at smaller airports or for transient operations and are demonstrating how flexible configurations might be used to address regional requirements. Lockheed Martin Corporation continues to leverage its extensive radar heritage to produce systems that are hardy and forward-looking. In the years to come, these firms will not just compete on technology but also on their comprehension of airport-specific needs. Whether one can provide stable, secure, and dynamic systems will decide who is the leading player in the global airport surveillance radar market in the future.

Airport Surveillance Radar Market Key Segments:

By Type

- Primary Surveillance Radar (PSR)

- Secondary Surveillance Radar (SSR)

- Surface Movement Radar (SMR)

- Monopulse Secondary Surveillance Radar (MSSR)

By Application

- Civilian Airports

- Military Airports

By End User

- Airport Operators and Civil Aviation Authorities

- Military Organizations

Key Global Airport Surveillance Radar Industry Players

- RTX Corporation

- Thales Group

- Indra Sistemas, S.A.

- Shoghi Communications Ltd.

- Terma A/S

- Leonardo S.p.A.

- L3Harris Technologies, Inc.

- Hensoldt AG

- Saab AB

- NEC Corporation

- Easat Radar Systems Limited

- ASELSAN A.Ş.

- Lockheed Martin Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252