Global Automotive Suspension Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global automotive suspension market and industry came into existence in the early twentieth century with the production of automobiles on a mass scale creating a pressing demand for systems that would balance stability and comfort. Most vehicles during this period used primitive leaf springs, which only offered basic load-carrying capacity. As mobility for the individual became the focus of contemporary life, engineers began tinkering with coil springs, hydraulic dampers, and ultimately independent suspension designs that would revolutionize how automobiles navigated roads of all types. Such innovations were more than mere mechanical advancements but milestones that marked how the business would grow with every decade.

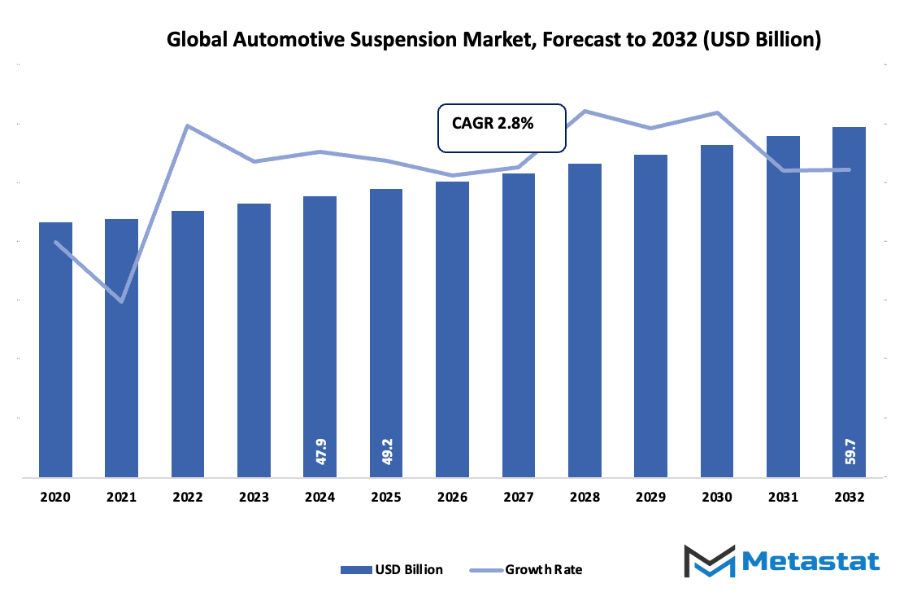

- Global automotive suspension market worth about USD 49.2 Billion in the year 2025, advancing at a CAGR of about 2.8% during 2032, with potential of surpassing USD 59.7 Billion.

- Passive System holds about 66.8% market share, spearheading innovation and broadening applications through aggressive research.

- Top trends fueling growth: Increasing uptake of electric and autonomous vehicles

- Opportunities: Integration of smart suspension with IoT and AI technologies

- Key insight: The market will increase exponentially in value over the next decade, with key growth opportunities.

By mid-century, the popularity of performance cars spurred builders to experiment with double wishbones and air suspension, ushering in a new age of ride quality and handle precision. Safety regulations in the 1970s and 1980s provided another level of complexity, compelling manufacturers to optimize suspension not just for driver comfort but also vehicle stability in emergency maneuvers. This was an era when international trade and competition accelerated innovation, and consumer expectations started heading towards cars that could provide both smooth travel as well as durability over the years. The last few decades have seen the international automotive suspension market influenced by requirements of fuel efficiency, light weightness, and computer-controlled systems. The advent of electronic stability programs and adaptive damping demonstrated how far suspension technology could extend from its mechanical roots.

As electric cars and autonomous vehicles gain prominence, suspension systems will not only be there to take shocks but will be actively talking to digital networks to optimize passenger comfort and security. This means that the market will persist in moving away from conventional engineering, led by new parameters like sustainability and smart mobility.

Market Segments

The global automotive suspension market is mainly classified based on System, Component, Vehicle Type, Suspension Type.

By System is further segmented into:

- Passive System: global automotive suspension market passive systems will continue to be standard in most vehicles because of simplicity and reliability. Passive systems do not change to absorb shock, giving basic comfort. Though not as responsive as newer systems, they will still find use in value-oriented models and some commercial vehicles that emphasize longevity over responsiveness.

- Semi Active/Active System: Active and semi-active suspension systems will lead technological innovation in the global automotive suspension market. These systems dynamically adjust damping forces to enhance handling, stability, and comfort. Future technological advancements will include integrating smart sensors and AI controls to provide real-time response to road conditions and driving behavior, revolutionizing overall vehicle performance.

By Component the market is divided into:

- Spring: Springs will remain a primary element in the global automotive suspension market. Material and design advancements will be targeted to enhance load control, vibration damping, and ride comfort. Lighter weight and corrosion-resistant configurations will become more in favour, promoting energy efficiency and longer life without compromising the performance requirements of future vehicles.

- Shock Dampener: Shock dampeners will be essential to enhanced vehicle stability in the market. Increasing responsiveness, durability, and accuracy are the promising areas of future innovation. Adoption of electronic controls will enable adaptive damping, with smoother rides over diverse road conditions, minimized wear, and aiding semi-active and active suspension systems.

- Struts: Struts will continue to be a key element in the market. Designs will be more compact, while strength and shock absorption will be enhanced. Technological advancements will allow struts to function harmoniously with electronic control systems, providing better handling for vehicles and contributing to improved safety standards in future vehicle models.

- Control Arms: Control arms in the market will develop to impart more stability and accurate wheel alignment. Stress will be lessened and maneuverability enhanced through the use of lightweight materials and creative designs. Better compatibility with active suspension systems will reinforce vehicle handling and response further, providing a smoother and controlled ride

- Ball Joint: Ball joints in the market will evolve to support increased stress and motion with reduced friction. Innovative materials and design will enhance safety and reliability, both for passenger vehicles and trucks. Integration with adaptive systems will enable real-time adjustment for improved ride performance.

- Air Compressor: Air compressors will continue to play a critical role in the market, particularly for air suspension systems. Future innovations will emphasize efficiency, space-saving design, and quicker response times. These compressors will enable automated height control and ride optimization, which will enhance comfort, fuel efficiency, and responsiveness to diverse driving conditions.

- Leaf Spring: Leaf springs will remain useful for heavier vehicles in the global automotive suspension market. New developments will comprise stronger and lighter material with improved load-carrying capacity and durability. Integration of advanced manufacturing technology will increase flexibility and ride quality, and leaf springs will become more useful in commercial and off-road vehicles.

By Vehicle Type the market is further divided into:

- Two-wheeler: Two-wheelers in the global automotive suspension market will see enhanced suspension designs for better stability and comfort. Compact, lightweight systems will improve handling and reduce vibration, especially in urban environments. Advanced damping technologies will also allow two-wheelers to maintain safety and comfort under varied road conditions.

- Passenger Cars: Passenger cars in the market will increasingly adopt semi-active and active systems. These innovations will improve comfort, stability, and responsiveness. The integration of electronic controls will allow real-time adaptation to road surfaces, ensuring a smoother ride while supporting fuel efficiency and overall vehicle performance.

- Commercial Vehicle: Commercial vehicles in the global automotive suspension market will require robust and durable systems. Suspension components will focus on load management, stability, and safety under heavy cargo conditions. Future trends will include adaptive technologies to improve comfort, reduce maintenance, and enhance efficiency for long-distance and urban transport.

By Suspension Type the global automotive suspension market is divided as:

- Hydraulic Suspension: Hydraulic suspension systems in the global automotive suspension market will offer smoother and more controlled rides. Future improvements will focus on precision control, reduced energy consumption, and enhanced durability. Integration with vehicle electronics will enable adaptive damping, improving handling, comfort, and overall safety across multiple vehicle types.

- Air Suspension: Air suspension systems in the market will lead in adaptability and comfort. Adjustable ride height, enhanced load management, and smoother handling will make these systems increasingly common. Smart control technologies will allow real-time adjustments, providing optimal performance for passenger cars, commercial vehicles, and high-end applications.

- Leaf Spring Suspension: Leaf spring suspension will continue to support heavy-duty vehicles in the global automotive suspension market. Advances will focus on stronger, lighter materials for improved load management and ride quality. Leaf springs will remain a reliable choice for commercial and off-road vehicles, while integration with advanced suspension technologies will enhance their overall performance.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$49.2 Billion |

|

Market Size by 2032 |

$59.7 Billion |

|

Growth Rate from 2025 to 2032 |

2.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

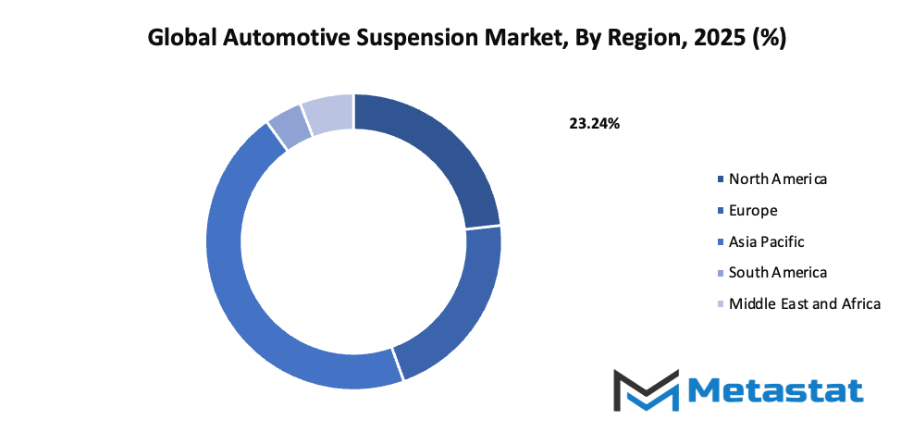

By Region:

- Based on geography, the global automotive suspension market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Rising demand for comfort and ride quality in passenger vehicles: Passenger vehicles will focus on improving ride quality to meet customer expectations. Manufacturers will invest in adaptive suspension systems that adjust in real-time to road conditions. Enhanced comfort will influence vehicle sales, making advanced suspension a key differentiator in the competitive automotive sector.

- Growing adoption of electric and autonomous vehicles: The global automotive suspension market will benefit from the rise of electric and autonomous vehicles. These vehicles require precise suspension systems to handle battery weight and maintain stability at high speeds. Intelligent suspension will support self-driving technologies by improving safety, responsiveness, and overall driving experience.

Challenges and Opportunities

- High cost of advanced suspension systems: Advanced suspension solutions remain expensive due to complex components and materials. High production and maintenance costs slow adoption, especially in cost-sensitive markets. Manufacturers will need to balance affordability with performance while developing systems that can support future vehicle designs, including electric and autonomous models.

- Complex design and maintenance requirements: Suspension systems require precise engineering and specialized knowledge for installation and upkeep. Complexity in design limits widespread implementation, especially in smaller vehicles. Improved manufacturing techniques and simplified maintenance solutions will become essential as the global automotive suspension market expands and evolves.

Opportunities

Integration of smart suspension with IoT and AI technologies: Smart suspension systems connected to IoT platforms will provide real-time performance data, enabling predictive maintenance and customization. AI-driven adjustments will enhance comfort and safety by adapting to driving habits. This technological integration will transform suspension design, offering significant growth potential for the global automotive suspension market.

Competitive Landscape & Strategic Insights

The global automotive suspension market will continue to experience significant growth as the automotive industry adapts to new technologies and changing consumer demands. This market is a mix of established international leaders and emerging regional competitors, all working to meet the increasing expectations for vehicle performance, comfort, and safety. Companies such as KYB Corporation, Hendrickson USA LLC, Sogefi SpA, Continental AG, Tenneco Inc., Gabriel India Ltd (ANAND Group), FOX Factory, Inc., Multimatic Inc., WABCO Holdings Inc., ThyssenKrupp AG, ZF Friedrichshafen AG, Mando Corporation, LORD Corporation, Hitachi Astemo Ltd., BWI Group, Marelli Corporation, Rassini, and Hendrickson International Corporation play a crucial role in shaping the industry. These players focus on innovation, aiming to develop advanced suspension systems that enhance vehicle stability, handling, and energy efficiency.

Future trends in the market will likely include the integration of smart technologies and adaptive systems. Suspension systems that can adjust automatically to road conditions or driver preferences will become more common, offering both comfort and improved vehicle control. Additionally, electric and autonomous vehicles will push the market to develop solutions that support lighter, more energy-efficient designs without compromising performance.

Regional players are expected to gain influence by offering cost-effective and locally optimized solutions, which will create a competitive landscape that balances quality, price, and innovation. Strategic partnerships and technological collaborations will accelerate progress, enabling faster development of advanced materials and intelligent suspension mechanisms. Over time, the focus will shift from simply absorbing shocks to actively improving vehicle dynamics, safety, and fuel efficiency, making the market a critical component of the future automotive industry.

Overall, the market will grow in both scale and complexity, with traditional leaders maintaining their influence while emerging companies drive fresh ideas and technologies. This dynamic environment will result in a market that is more responsive to technological trends and consumer demands, shaping the next generation of automotive suspension systems.

Market size is forecast to rise from USD 49.2 Billion in 2025 to over USD 59.7 Billion by 2032. Automotive Suspension will maintain dominance but face growing competition from emerging formats.

Looking ahead, the global automotive suspension market will not remain a static sector. It will carry forward its century-long tradition of responding to consumer demands, regulatory landscapes, and technological disruptions. From its modest beginnings with simple leaf springs to the promise of sensor-driven, adaptive solutions, it will stand as an example of how innovation continuously reshapes an industry’s trajectory.

Report Coverage

This research report categorizes the global automotive suspension market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global automotive suspension market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global automotive suspension market.

Automotive Suspension Market Key Segments:

By System

- Passive System

- Semi Active/Active System

By Component

- Spring

- Shock Dampener

- Struts

- Control Arms

- Ball Joint

- Air Compressor

- Leaf Spring

By Vehicle Type

- Two-wheeler

- Passenger Cars

- Commercial Vehicle

By Suspension Type

- Hydraulic Suspension

- Air Suspension

- Leaf Spring Suspension

Key Global Automotive Suspension Industry Players

- KYB Corporation

- Hendrickson USA LLC

- Sogefi SpA

- Continental AG

- Tenneco Inc.

- Gabriel India Ltd (ANAND Group)

- FOX Factory, Inc.

- Multimatic Inc.

- WABCO Holdings Inc.

- ThyssenKrupp AG

- ZF Friedrichshafen AG

- LORD Corporation

- Hitachi Astemo Ltd.

- BWI Group

- Marelli Corporation

- Mando Corporation

- Rassini

- Hendrickson International Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252