Sep 05, 2025

A fresh voice on Global Automotive Electric Actuators for Power Tailgate and Automated Door Systems Market Report from Metastat Insight initiates a narrative indicative of profound familiarity with electric actuator technology used in automobile access systems. Fourteen years of experience in the development of automotive components have fostered subtle sensitivity to how motor-driven latches, sensors, control units, and integration without interruption within automobile architecture develop in operation. This presentation of results conveys more than superficial trends concern for performance requirements, convenience to users, integration complexity, and supply chain latitude occur spontaneously through context. In relating insights, composition flows easily as though shared from experience. Comprehension of actuator design intricacies starts with consideration of how motion control needs to satisfy refinement, quiet operation, responsiveness, and dependability across life-cycle use.

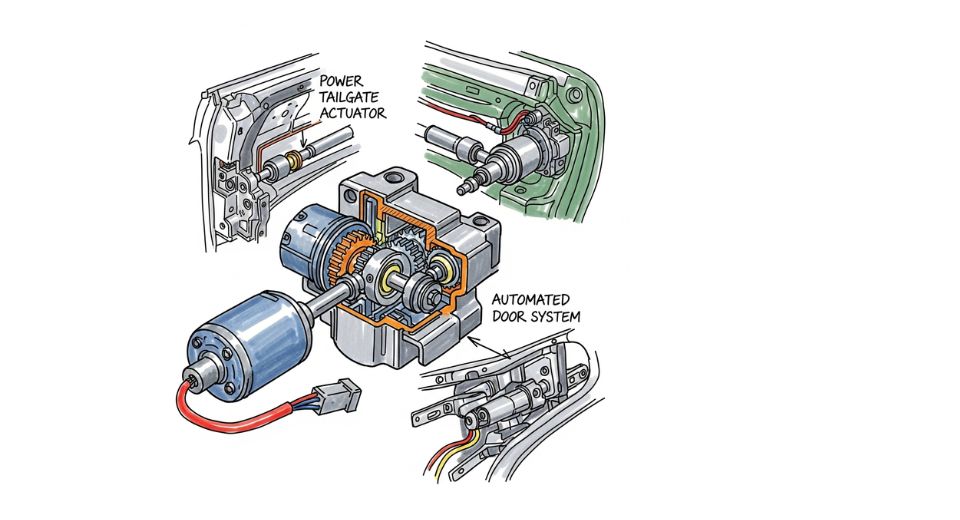

Motor selection, reduction gear, sensor feedback, control logic, and mechanical interface have to all come together in terms of constraints around packaging space, electrical architecture, and safety standards. Specification writing on such systems for years lends credence to a tale that acknowledges how each of these has to respond to temperature fluctuation, corrosion potential, vibration, and large voltage swings. Manufacturing point of view places emphasis on how collaboration with suppliers defines quality and price. Precision machining or injection mold requirements, motor winding quality, lubrication, and seal integrity are needed for actuator units. Freight considerations, border-country sourcing, and contingency planning drive the rhythm of production. Readiness of the facility to respond to small-batch prototyping and ramp-up of large quantities influences time-to-market. Addition of alternative sourcing, validation processes, lot testing, and traceability defines readiness for large order streams.

All of these are captured in that thematic report. End-use behaviors among OEMs and tier-suppliers change as integration into vehicle software stacks becomes more paramount. Programmable motion profiles, force-to-delivery curves, auto-close delay logic and integration with key-fob or smartphone user interface demand collaboration among electronic control unit manufacturers, software domain specialists, and mechanical groups.

Need for diagnostics, fault-detection, emergency manual override and conformity with functional safety standards increasingly defines development requirements. Real-world performance requirements vary widely between premium and mainstream vehicle classes, domestic and export markets, and even within regional climatic zones; work conducted over more than ten years indicates how incremental design refinements arise from repeated field testing and feedback. Design directions have evolved towards modularity pluggable actuator modules with plug-and-play electrical connections, closed-loop limit switch feedbacks, and standardized mounting interface locations that facilitate assembly line integration and aftermarket field replacement.

This trend is aligned with simplification of logistics and responsiveness of service networks. Lieber supply resilience, assembly flexibility, and aftermarket serviceability are recurring themes in various projects. Experience from previous programs highlights how tighter tolerances and alignment procedures decrease noise, provide smoother engagement, and increase useful operating life. Testing scenarios progress from laboratory environment to environmental chamber to in-vehicle integration. Load testing uncovers subtle differences in torque delivery under misalignment and icing conditions. End-of-line functional check routines protect against motor over-current, stall detection, and unwanted latch engagement.

Predictive maintenance options require integration of current sensing or encoder feedback; such options become differentiators for OEM marketers, enabling extended warranties or smart connectivity packages. Those conclusions exist in the cited report in polished language, not broad observation. User preference often leans toward systems that provide near-silence, soft-close motion, and assured latch engagement without sudden motion. Markets differ in their preferences; city-space compact models might need minimal footprint, while luxury sedans and SUVs accept greater force output or programmable options. Accessibility features like programmable opening height or auto-stop on detecting hand indicate consideration of senior citizens or children. Design teams are helped by in-market feedback cycles that inform fine-tuning of movement speed, grip force, self-learning thresholds, and force tuning.

Insights from several programs demonstrate how minor sound-profile shifts impact user perception of quality. On the demand side, raw material price fluctuations and component availability with high precision influence design choices. Copper prices vary with winding selection. Geopolitical shifts influencing availability of semiconductors dictate whether integrated control logic depends on microcontroller integration or is forced to off-board control to body-control modules. Repeated cycles of vendor qualification procedures guarantee technical performance and alignment with corporate responsibility. Factory audit exposure confirms awareness of certification requirements ISO, IATF, or environmental certifications and their effect on design and delivery schedules.

Cooperation among research institutions and industrial designers results in innovations like low-current consumption, less noisy gears, lubricants with good performance over a broad range of temperatures, and impact-absorbing housings. These aspects are important when creating systems for hostile environments like coastal areas, high-altitude, or very cold climates. Development cycles with accelerated life testing, pulley endurance of stress, cycle-count confirmation, and vibration cube tests ensure product strength.

All of these insights combine in the account of the Global Automotive Electric Actuators for Power Tailgate and Automated Door Systems Market Report covered by Metastat Insight as reimagined synopsis. A sense of depth and earthed reality is created, communicating both technology vectors and industry forces with substance instead of abstractions. Credibility is established through text that reflects professional insight instead of armchair observation. This narrative reflects sustained involvement in actuator system creation, validation, manufacturing coordination, and customer-facing delivery.

At conclusion, acknowledgment of the interconnectedness between actuator market advancements, integration complexity, performance requirements, and supply chain relationships enhances the relevance of the outlined findings in the presented report. Consideration of innovation benchmarks, application-driven optimization, supplier ecosystem transformation, and final-user expectations completes the circle of discussion in the final presentation of the Global Automotive Electric Actuators for Power Tailgate and Automated Door Systems Market Report presented by Metastat Insight in new wording.

Drop us an email at:

Call us on:

+1 214 613 5758

+91 73850 57479