MARKET OVERVIEW

The global automotive lubricants market is set to be at the center of the automotive sector as cars and car technologies keep on gaining traction. The market is concerned with the research, development, production, and sales of lubricants required for various types of applications in different systems in vehicles, such as engines, gearboxes, and differential housing. Lubricants serve as an anti-friction agent that contributes to reducing corrosion, enhancing operating performance, and thus increase the efficiency of the vehicle, thus providing a greater probability of its smooth flow.

The global automotive lubricants market will grow with advancements in automotive technologies, including electric and hybrid vehicles, which will transform the nature of lubricant required. Petroleum-based lubricants will continue to dominate most of the market, but EVs will raise the demand for niche lubricants. These lubricants will cater to various needs, such as preserving efficiency in battery cooling systems, lubrication of electric motors, and making sure that the fewer mechanical components in EVs function optimally.

The range of products in the automotive lubricants industry is diversified, including engine oils, transmission fluids, grease, and gear oils. Each of these categories is designed to play a distinct role in the operation of the vehicle and its performance, and their significance must not be ignored. Engine oils dominate market share with its ability to keep lubricating at high temperatures and pressures. Transmission fluids are another vital part of the product, providing smooth gear shifts and the longevity of the transmission system. Gear oils and greases, the lubricants generally applied to bearings and other moving components, provide smoother operating parts that inhibit corrosion and allow vehicles to operate as long and safely as possible.

As the car market moves towards greater efficiency and less damaging environment, synthetic lubricants would dominate, as these are better in performance than the traditional mineral oils. They will be the market leader because they provide improved fuel economy, increased oil change interval, and reduced emissions-a trend that is more commensurate with the increased focus of the world on sustainability.

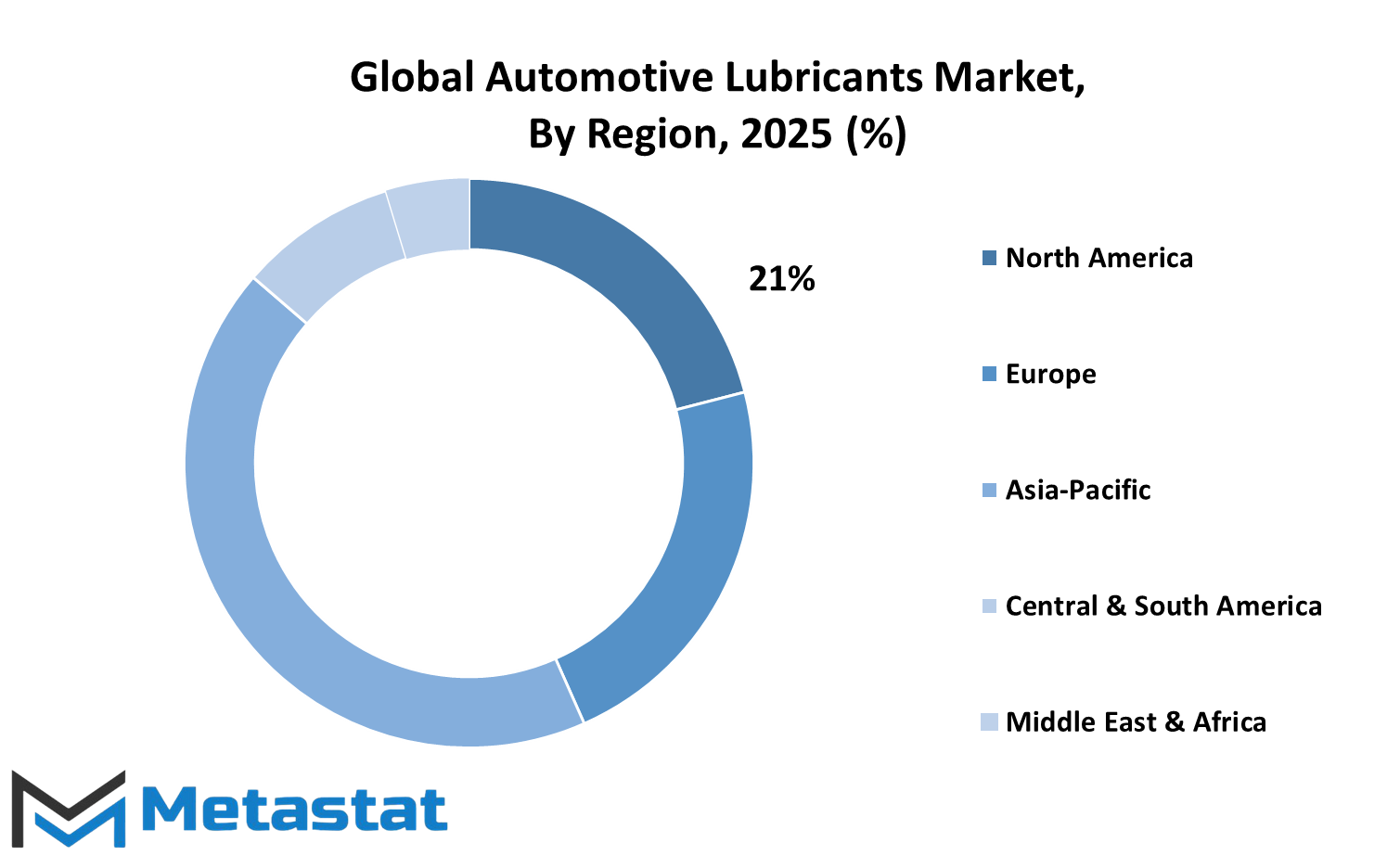

Regional patterns will affect the global automotive lubricants market, with geographies adopting technology faster in some areas compared to others. For instance, North America and Europe are expected to grow in demand for high-performance lubricants as a result of stringent environmental policies mandating cleaner technologies. Contrastingly, developing nations like Asia-Pacific will keep expanding due to rising disposable income and more vehicles on roads.

The global automotive lubricants market will keep pace with the times as will the automobile industry. Since the number of ICE vehicles is so huge, there will always be demand for traditional lubricants; however, penetration of electric vehicles and the requirement to enhance technology will drive the market to the creation of specialized lubricants. Improved performance and sustainability will concentrate the market on a complete variety of auto applications and make sure that any type of vehicle operates in an efficient manner.

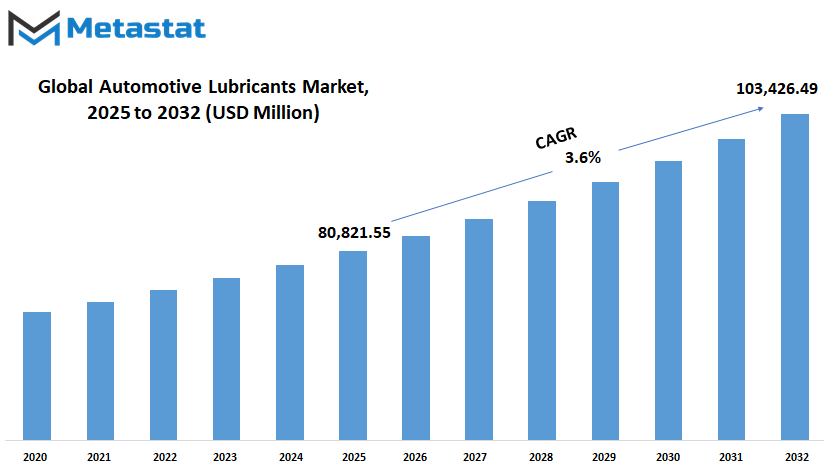

Global automotive lubricants market is estimated to reach $103.4 illion by 2032; growing at a CAGR of 3.6% from 2025 to 2032.

GROWTH FACTORS

This global automotive lubricants market has increased immensely in the last several years and for a variety of reasons. A few of the major reasons for this increase are the car productions. As increasingly more cars are being produced across the globe, more of the demands of improved quality of lubricants to keep an engine operating at its best while extending the lifespan of an engine are present. The car industry is expanding at a very rapid pace, mainly in the developing nations, and is likely to continue for a number of more years and drive further demand for lubricants. Besides this, there is also a greater focus on fuel efficiency. Buyers and producers are focusing on fuel-efficient cars, and the demand for lubricants that would improve the performance of an engine by using less fuel is increasing. This fuel-saving lubricant innovation will be propelling the market more in the future. But on the negative side, there are certain challenges that are faced by global automotive lubricants to possibly restrain its growth.

They include environmental regulations. With the emission and environmental standards increasing pressure on the governments across the globe, higher specification lubricants are highly sought after. Although this is a challenge for lubricant manufacturers, it also provides opportunities to come up with greener alternatives that are sustainable but are capable of fulfilling such specifications. Other challenges that may herald market growth issues in the lubricant industry include crude oil price volatility. Because the petroleum-based lubricants draw their major dependence from crude oil, price volatility of oil worldwide will be likely to increase the price of the lubricants too and make them unavailable, which will affect the overall dynamics of the market. With all this, there are still a number of chances that could propel the world automotive lubricant market. These lubricants, offering superior-performance and more protection to engines, would find much demand as the awareness of premium products filters from customers to manufacturers.

The automotive industry will have a future for synthetic oils as demands for high-performance lubricant markets are on the rise. The technological innovation and evolution of more superior and improved synthetic lubricants in the years to come will be the prime drivers of growth. This automobile lubricants market is supposed to see continual growth; however, in consideration of problems which this segment faces concerning international standards it definitely finds the foundation of development upon increase of motor vehicle production rates along with a rise of demands of lubricants by them towards fuel consumption improvement further development arrives by another set for lub which increases gradually by an unparalleled height while sustaining it only on synthetic-based lubrications formulation.

MARKET SEGMENTATION

By Product Type

The sector holds a highly crucial role for vehicle lubricants to ensure guarantee towards smooth vehicle operation. There is always a certain potential in alterations and growth of the aforementioned sector, provided that technology continues to move forward, and consumer demands start doubling with them. The sector has its fundamental configuration with three broad categories-there's product type, whereby products consist of engine oils, transmission fluids, gear oils, greases, hydraulic fluids, among others. Each product has a significant application, including maintenance of the lifespan and efficiency of cars; thus, this would likely grow over time with automobile technologies. Among the most popularly consumed products in the market are engine oils, which maintain a car's engine in good condition and functioning its overall purpose.

Engine oils can reduce friction, prevent overheat, and even rust parts. Since electric vehicle and hybrid technologies are becoming more and more popular, the engine oils are going to remain as a crucial product in the automotive lubricants sector; however, they will be of more sophisticated formulation focusing on energy efficiency and anticipated environmental norms slated to be implemented in the near future. Transmission fluids also come prominently as a component of the performance aspect of a car, especially one with an automatic transmission. They contribute to the smoothening of actions of the constituents of the transmission system differently located, which is a wear-reducing action.

There will be an increasingly strong need to make transmission systems more efficient and the innovations will be encouraged, and the research will attempt to develop a more sophisticated transmission fluid that would be able to endure even more severe conditions of temperature and operations. As autonomous vehicles use more sophisticated technologies, high-performance transmission fluids will have to be in greater demand.

Another important product within the automotive lubricants industry is gear oils. Gear oils serve to lubricate the vehicle's drivetrain gear as it minimizes friction or wear on the gears. Expansion of electric cars and a change in the design of the drivetrain require that gear oils also adapt. Later, gear oils will be "geared" in the sense that they will be formulated to enhance efficiency but offer improved protection under harsh conditions. Greases and hydraulic fluids are another list where highly critical products also fall within the market.

Both of these are significant because, for many components in an automobile, including bearings and joints greases are essentially necessary in form, and otherwise hydraulic fluids ensure hydraulic fluids in an automobile work perfectly free flow. In other words, increased complexity in the automotives can lead to an increased need for even more complicated greases or hydraulic fluids to manage even more drastic conditions in operating environments.

Technological innovation and changing consumer demand will drive the global automotive lubricants market. All product types-from engine oils to hydraulic fluids-will keep growing as it matures to accommodate new needs for new vehicles. With such patterns, cleaner and more energy-efficient alternatives are showing up, which will probably increase the demand for these lubricants; therefore, it will continue to be one of the most important areas of the automobile market for at least the next two years.

By Oil Type

The global automotive lubricants market are extremely vital in sustaining car performance and efficiency. The most significant driving forces are the rising demand for high-performance lubricants in order to provide smooth engine operations, hence better fuel efficiency. The market in the near future will rise as consumers become more knowledgeable and aware of proper vehicle maintenance. The most important segmentation of the market is based on oil type: synthetic, semi-synthetic, and conventional lubricants. Synthetic oils are gaining popularity due to their superior characteristics. They are designed particularly to deliver more performance as more heat resistance, less volatility, and improved wear protection.

Since recent automobile engine technologies, particularly the development of electric and even hybrid cars, become even better, it would require synthetic oils as part of it. In fact, their capability to withstand longer at hot temperatures without degenerating, which are appropriate for the more potent engines of today, makes these synthetic oils superior to its synthetic equivalent. Synthetic oils in the future will surely be utilized much more predominantly to supply the high-level designs of greater demands from subsequent engine models. Semi-synthetic lubricant is blended from synthetic and standard. They offer a precise combination of cost and performance. The protection offered is more than the standard oil but lower in cost than fully synthetic.

Semi-synthetic lubricants will likely be most popular among most consumers who require a product that performs at a lower cost compared to synthetic lubricants, particularly in markets where price is an essential variable. Advances in the blending technology should cause semi-synthetic lubricants to become even more effective over the near term, and therefore even more desirable to both consumers and manufacturers. The lubricants will be further refined to serve conventional internal combustion engines as well as newer, more fuel-efficient powertrains. Conventional lubricants, made from refined crude oil, are generally the cheapest.

The main cause of such a shift will be the fact that growth in demand for oils providing prolonged protection reduces fluctuations. Commonly, as such a worldwide market of car lubricants develops, there will inevitably be an irreversible drift towards high quality oils, as is indeed the case with semi-synthetic or synthetic lubricants. In particular, additional calls for improved performances, more economical consumption of fuel, and lower environment footprint will keep rolling the ball in such a direction.

By Application

The global automotive lubricants market acts as a driver in keeping the performance and efficiency of the vehicle, irrespective of classes. Since the automobile industry is continually developing, it has created lubricants, which not only are necessary but also ensure smooth operation, reduce friction, and increase the lifespan of all the engine components.

The industry is also impacted by technological developments but by increasing demands for various types of vehicles, ranging from cars to commercial and off-road vehicles. These sectors all contribute in distinct ways to the overall market, dictated by particular needs and innovation. In the passenger vehicle, demand for automotive lubricant is primarily dictated by consumer preferences and increased demands for fuel efficiency and eco-friendly products. As passenger cars become more technologically sophisticated, there exists a demand for lubricants with improved standards of performance.

It is an expectation that motor vehicles, besides lower friction, must exhibit high fuel efficiency, lower emission, and higher engine longevity. With more and more electric vehicles on the roads, there will be a greater demand for specialized lubricants to cater to their specific requirements, and the market will be driven to innovate in formulation and functionality. The commercial vehicle segment is yet another feature of the global automotive lubricants market, which is typified by heavy-duty vehicles that need lubricants that can tolerate long operating hours and harsh working environments.

Such vehicles include trucks, buses, and vans. Lubricants used must be able to handle high temperatures, reduce wear and tear, and be effective in performance over long distances. Other critical segments which fall under the category of motor vehicle lubricants are construction equipment, farm equipment, and recreational vehicles. These types of equipment are generally subjected to harsher conditions, ranging from aggressive terrain to unfriendly climate and even excessive loads.

Off-road cars lubrication therefore must be developed based on these stresses. With every category of vehicle evolving, there is a growing demand for specialized lubricants. Automotive lubricant producers would need to innovate and adapt in order to serve the differences between passenger, commercial, and off-road vehicles, in realizing peak performance and longevity in all types of vehicles to be ahead in the future.

By Distribution Channel

The global automotive lubricants market is a dynamic as well as a critical segment of the automotive business, with a highly significant role in the preservation of the performance of vehicles and their longevity. Looking forward, the overall channel distribution within the automotive lubricant business is projected to alter in a major way, thus reshaping the market in new forms.

There are two primary channels of distribution in this business: OEMs and Aftermarket. They all have a role to play and imply differently to the industry. OEMs are a critical section of the automotive lubricants industry. They are vehicle manufacturers who supply lubricants specially made for new cars to fit the technical standards of auto manufacturers.

Thus, with a new generation of improved technologies by auto manufacturers, lubricant formulation for OEMs will be driven by innovators. A growing electric vehicle and smart automotive systems market will mean that their lubricants will address this new demand and meet the increasing requirements in this industry, including the creation of lubricants that are specific to an electric vehicle battery and drivetrain electric.

These trends will drive growth within the OEM segment, as automobile makers and lubricant companies must collaborate more closely than ever. While the Aftermarket segment of the global automotive lubricants market will increase at a steady rate in the future years. This segment has lubricants sold for use in cars already in traffic, aside from the original manufacturer's service.

Cars need occasional maintenance, such as oil changes, with the passage of time. The Aftermarket channel serves all consumers, from private car owners to commercial vehicle operators, who seek superior lubricants to maintain their vehicles in good health. The count of automobiles on the road is increasing, particularly in emerging markets where automobile ownership is increasing at a fast pace. Further, internet retailing sites enhance the convenience with which individuals can obtain automotive lubricants, thus making it an easier choice for individuals.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

USD 80,821.55 million |

|

Market Size by 2032 |

USD 1103,426.49 million |

|

Growth Rate from 2025 to 2032 |

3.6% |

|

Base Year |

2025 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global automotive lubricants market is distributed over different areas with each adding to the final growth and development in its own segment. Divided into five main regions North America, Europe, Asia Pacific, South America and the Middle East & Africa it makes up an extremely diverse whole that has some unique character, trends and features over itself.

The automotive lubricants market in North America is mainly driven by the high demand in the United States, Canada, and Mexico. The U.S. accounts for a large share of the market due to its large automotive industry and the presence of numerous manufacturing and service facilities. Canada and Mexico also play key roles, with Mexico emerging as an important production hub due to its growing automotive sector. With an increase in vehicle ownership, and demand for efficient fuel and maintenance solutions, the automotive lubricants market is expected to grow steadily in North America.

Europe is the other crucial region for the global automotive lubricants market. This region includes all the key countries of the UK, Germany, France, and Italy, among others, which have well-established automotive industries. Germany is especially a market leader in both the automobile industry and the lubricant manufacturing industry. Major automobile companies have manufacturing facilities here. As the automotive industry of Europe continues to shift towards more environmentally friendly and energy-efficient vehicles, the demand for advanced lubricants will increase, particularly those for electric and hybrid vehicles.

The Asia-Pacific region, including countries like China, India, Japan, and South Korea, is expected to dominate the global automotive lubricants market in the coming years. China is already the largest automotive market globally, and as vehicle ownership continues to increase in India and other countries in the region, the demand for automotive lubricants will likely rise. Also, advances in the automotive industry - that is, in the segment of electric vehicles will introduce new opportunities for regional lubricant manufacturers. Moreover, growth in the region's manufacturing base and increased urbanization will drive the future prospects of the market in the Asia-Pacific region.

The growth in the global automotive lubricants market can also be seen in South America, with countries like Brazil and Argentina. Even though the region's market is smaller compared to others, it is gradually expanding because of an increase in vehicle sales and the adoption of modern automotive technologies. As the region continues to develop its infrastructure and automotive industry, demand for automotive lubricants will increase.

Another such region is the Middle East & Africa, which comprises GCC countries, Egypt, and South Africa. The global automotive lubricants market in this region is also growing. The Middle East, with its major oil reserves, is one of the major producers of automotive lubricants, while the African market is slowly growing, mainly due to the increased sale of vehicles and more emphasis on infrastructure development. As the automotive market in these regions continues to grow, demand for lubricants is likely to increase due to a growing need for higher-quality products and increased usage of vehicles.

Overall, the global automotive lubricants market will grow steadily in the future years of all the regions. Due to the progression of vehicle technology and further attention towards environment sustainability, the trend is expected to differ region-wise and innovations in the field of lubrication technology would be significant in dictating the direction of this market in the future.

COMPETITIVE PLAYERS

The global automotive lubricants market is undergoing drastic transformations in reaction to technological innovations alongside increasing demand for enhanced performing products in the automotive industry. As the vehicles undergo change and encounter sophisticated challenges, lubricants gain greater importance for enhancing engine performance, minimizing wear and tear, and fuel efficiency. A number of multinational companies are leading this market among the dominant players.

Some other dominant industry leaders are Exxon Mobil Corporation, Royal Dutch Shell, Chevron Corporation, and BP plc. They dominate the market with pioneering solutions and a global presence. With enormous production capabilities, extensive product offerings, and ongoing investment in R&D, such corporations hold considerable sway in the industry. Their moves will likely be at the leading edge of defining the future direction of the Global Automotive Lubricants industry.

Total S.A. PetroChina Company Limited and others are pushing the market as well since they are boosting their product portfolios to serve the demands of conventional and electric vehicles. Companies are forced to emphasize bio-based and synthetic alternatives because of increasing demands for sustainable and efficient lubricants. China Petroleum & Chemical Corporation (Sinopec), Lukoil, and Idemitsu Kosan Co., Ltd. also keep making gains with premium lubricants designed to suit different consumer tastes, thus retaining their lead in the international market.

Fuchs Petrolub SE, Valvoline Inc., Gazprom Neft, and Repsol S.A. are also key drivers in the expansion of the automobile lubricants market. They are currently shifting toward evolving market trends by launching products that are compatible with current automobile technologies. With more regulatory pressure on emission cuts and engine efficiency, these companies are going to remain innovative and line up their product offerings according to the needs of contemporary automotive engineering. Indian Oil Corporation Limited, SK Enmove Co., Ltd., and Morris Lubricants are gaining recognition in the market for automotive lubricants due to emphasis on increasing the performance and life of their products, particularly in those markets where vehicle demand is rising.

In the future, Motul, Amsoil Inc., Penrite Oil Company, and ENEOS Corporation will be key players in the further growth of the global automotive lubricants market. High-performance lubricants, particularly in motorsports and heavy-duty trucks, will be the areas of focus for them. The car industry is shifting towards cleaner and more efficient technologies, and the role of lubricants in making them perform best will only increase.

Automotive Lubricants Market Key Segments:

By Product Type

- Engine Oils

- Transmission Fluids

- Gear Oils

- Greases

- Hydraulic Fluids

- Others

By Oil Type

- Synthetic

- Semi-synthetic

- Conventional

By Application

- Passenger Vehicles

- Commercial Vehicles

- Off-road Vehicles

By Distribution Channel

- OEMs

- Aftermarket

Key Global Automotive Lubricants Industry Players

- Exxon Mobil Corporation

- Royal Dutch Shell

- Chevron Corporation

- BP plc

- Total S.A.

- PetroChina Company Limited

- China Petroleum & Chemical Corporation (Sinopec)

- Lukoil

- Idemitsu Kosan Co., Ltd.

- Fuchs Petrolub SE

- Valvoline Inc.

- Gazprom Neft

- Repsol S.A.

- Indian Oil Corporation Limited

- SK Enmove Co., Ltd.

- Morris Lubricants

- Motul

- Amsoil Inc.

- Penrite Oil Company

- ENEOS Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383