Global Asphalt Concrete Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global asphalt concrete market has gone through quite a transformation and now it is a major contributor to modern infrastructure and transportation systems in a big way. Its industry roots go back to the late 1800s when asphalt concrete was first invented by mixing bitumen and aggregates for making roads. Builders at that time faced the problem of having to replace roads often due to wear and tear caused by heavy vehicles and heat. They found out that asphalt together with crushed rock was the best solution for these problems. This discovery helped in building the road for what later turned out to be an indispensable material for highways, airports, and urban development projects.

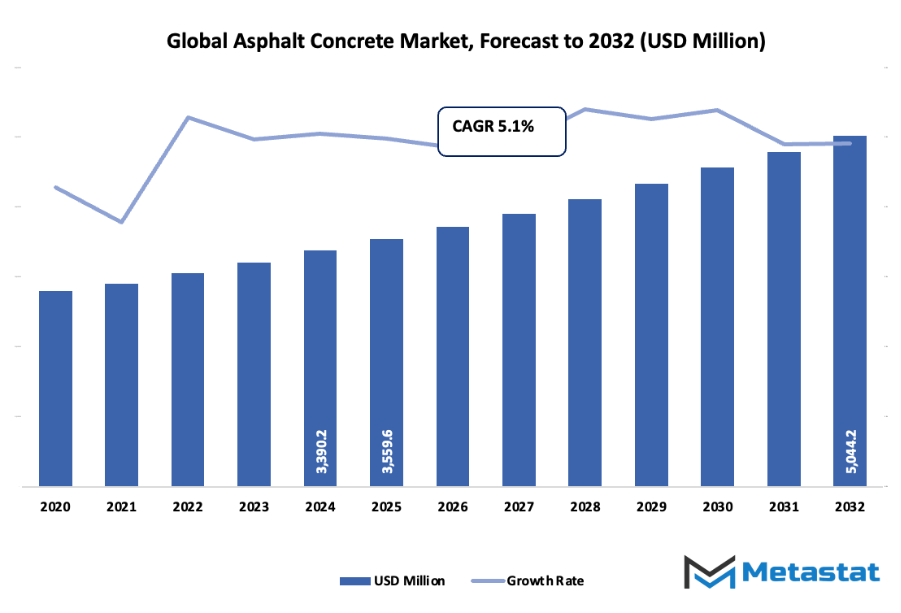

- Global asphalt concrete market valued at approximately USD 3559.6 Million in 2025, growing at a CAGR of around 5.1% through 2032, with potential to exceed USD 5044.2 Million.

- Hot Mix Asphalt (HMA) account for nearly 42.3% market share, driving innovation and expanding applications through intense research.

- Key trends driving growth: Increasing investment in road infrastructure and urban development, Growing demand for durable and low-maintenance paving materials

- Opportunities include: Development of sustainable and recycled asphalt solutions for eco-friendly construction

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

By the end of the last century, the continuous rise of vehicles and the push for global connectivity led to constant innovation in asphalt production. The use of mechanical mixing plants and the refining of petroleum products changed not only the quality but also the scale of production. The government of the developed countries started to set up standardized rules for road building, which created a steady demand and at the same time, encouraged the large-scale producers of asphalt. These regulations would later dictate how quality and sustainability were dealt within the global asphalt concrete market by placing strong emphasis on performance standards and safety while discouraging low-cost production through gradual extinction of the players who rely on it.

The past few years have seen the market shift to a new paradigm in which sustainability and digitalisation are the main drivers. Once considered impractical, recycling technologies are now creating a routine allowing the reuse of old pavements with the least possible loss of resources. Moreover, the innovative temperature control techniques have come into play which lowers the emissions during asphalt mixing and laying operations.

The story of the global asphalt concrete market is ultimately one of adaptation from rudimentary mixtures of stone and tar to intelligent, sustainable solutions that will shape the future of urban mobility and infrastructure resilience across continents.

Market Segments

The global asphalt concrete market is mainly classified based on Product, Product Form, Application.

By Product is further segmented into:

- Hot Mix Asphalt (HMA): Hot Mix Asphalt is the most commonly used form in road construction and repair. It is produced at high temperatures, providing strong durability and resistance to deformation. The mixture ensures smooth surface finishes and supports heavy traffic loads, making it suitable for highways and large-scale infrastructure projects.

- Warm Mix Asphalt (WMA): Warm Mix Asphalt uses lower production temperatures compared to hot mix asphalt, helping to reduce fuel consumption and emissions. It offers better workability, even in cooler conditions, and enhances worker safety. This method is gaining popularity as construction industries adopt more sustainable and energy-efficient practices.

- Cold Mix Asphalt: Cold Mix Asphalt is mainly used for temporary repairs and small maintenance tasks. It is easy to apply without heating, making it ideal for quick road repairs and remote areas. Its flexibility and convenience make it cost-effective, although it may not provide the same strength as hot mix options.

- Recycled Asphalt Pavement (RAP): Recycled Asphalt Pavement is made by reusing old asphalt materials, reducing waste and conserving resources. It lowers overall construction costs while maintaining strength and durability. This eco-friendly option supports sustainable construction practices and is increasingly being adopted by both private and public sectors.

- Other: Other asphalt types include specialized blends designed for unique environmental or structural needs. These variations often contain additives to enhance performance, durability, or weather resistance. Their use depends on project requirements, ensuring the right balance between quality, cost, and environmental responsibility.

By Product Form the market is divided into:

- Liquid: Liquid asphalt is widely used for surface coatings, sealing, and maintenance work. Its adhesive properties make it effective for binding aggregates and preventing water damage. Easy application and versatility make it a preferred choice for both small and large-scale infrastructure projects.

- Solid: Solid asphalt is mainly used in large paving projects that require high strength and stability. It provides long-lasting surfaces capable of withstanding heavy loads and frequent traffic. Its solid form ensures greater resistance to weather conditions, making it suitable for demanding construction environments.

By Application the market is further divided into:

- Roadways: Roadways represent the largest application area for asphalt concrete. Continuous growth in transportation infrastructure and highway construction projects drives demand. The material’s durability, smooth finish, and cost efficiency make it essential for both urban and rural road development.

- Railway Beds: Asphalt concrete in railway beds improves load-bearing capacity and drainage. It provides stability for tracks and reduces maintenance needs. The use of asphalt helps maintain consistent alignment, enhancing safety and efficiency in railway operations.

- Airport Runways: Airport runways require materials that can handle heavy loads and temperature changes. Asphalt concrete offers a smooth and durable surface for aircraft operations. Its flexibility and quick maintenance make it an ideal choice for busy airports that demand minimal downtime.

- Parking Lots: Parking lots benefit from asphalt’s smooth texture and easy maintenance. Its cost-effective application and quick installation process make it ideal for commercial and residential use. The material’s strength supports frequent vehicle movement while maintaining an attractive appearance.

- Embankment Dams: Asphalt concrete is used in embankment dams to ensure water tightness and structural integrity. Its impermeable nature prevents leakage and provides long-term durability. It also adapts well to various environmental conditions, making it a reliable option for water containment projects.

- Tunnels: In tunnel construction, asphalt concrete provides effective waterproofing and structural reinforcement. It helps reduce maintenance costs and extends the lifespan of tunnel surfaces. The material’s flexibility allows it to withstand ground pressure and temperature variations.

- Other: Other applications include pavements for industrial areas, sports grounds, and specialized infrastructure projects. These uses highlight the adaptability and reliability of asphalt concrete in different construction scenarios. Its performance and longevity make it a preferred choice across multiple sectors.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$3559.6 Million |

|

Market Size by 2032 |

$5044.2 Million |

|

Growth Rate from 2025 to 2032 |

5.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

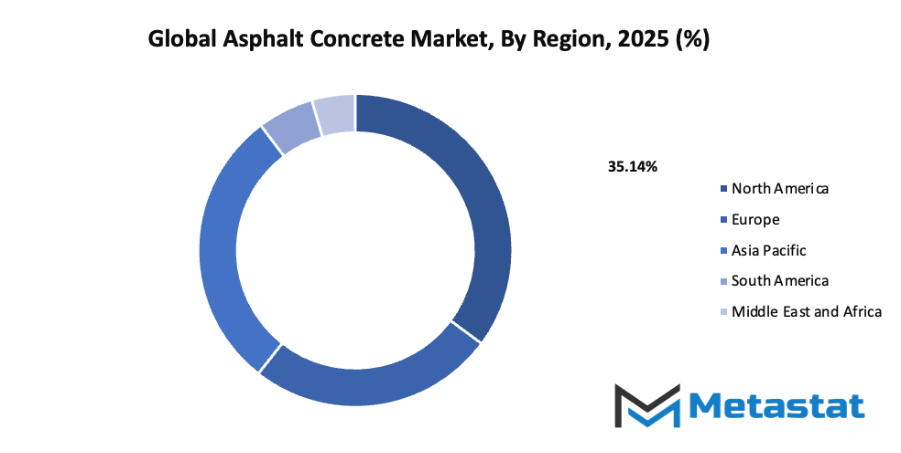

By Region:

- Based on geography, the global asphalt concrete market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Increasing investment in road infrastructure and urban development: The global asphalt concrete market is witnessing steady growth due to rising investments in road infrastructure and expanding urban areas. Governments and private sectors are focusing on improving transport connectivity, highways, and city roads to support economic development. Continuous urban expansion is increasing demand for asphalt concrete as a reliable material for constructing strong and smooth pavements that ensure long-lasting performance and reduced maintenance needs.

- Growing demand for durable and low-maintenance paving materials: The global asphalt concrete market is growing as construction sectors seek materials offering strength and cost efficiency. Asphalt concrete provides durability, flexibility, and resistance to wear, making it suitable for high-traffic areas and harsh weather conditions. The ability to deliver long service life with minimal repairs encourages widespread use across commercial, residential, and industrial projects, supporting consistent market expansion.

Challenges and Opportunities

- High dependence on petroleum-based asphalt leading to price volatility: The global asphalt concrete market faces challenges due to reliance on petroleum products, which directly influence asphalt pricing. Fluctuations in crude oil costs create instability in production expenses and project budgets. Manufacturers and contractors often face difficulties in cost management, especially during sudden spikes in oil prices, affecting overall market balance and profitability.

- Environmental concerns related to production and recycling processes: The global asphalt concrete market encounters environmental challenges from energy-intensive production and emission generation. Traditional asphalt manufacturing releases greenhouse gases and contributes to resource depletion. Recycling processes, though beneficial, sometimes face limitations in maintaining material quality. Stricter environmental regulations are pushing producers to adopt cleaner technologies and improve recycling efficiency to reduce negative ecological impacts.

Opportunities

- Development of sustainable and recycled asphalt solutions for eco-friendly construction: The global asphalt concrete market presents significant opportunities through innovation in sustainable materials. Use of recycled asphalt pavement and bio-based binders is gaining attention for reducing carbon footprint and conserving resources. Advancements in technology support the creation of eco-friendly mixtures that maintain performance standards while promoting circular economy practices, aligning with global sustainability goals.

Competitive Landscape & Strategic Insights

The global asphalt concrete market is undergoing a steady transformation driven by innovation, sustainability goals, and growing infrastructure demands. The industry is a mix of both international industry leaders and emerging regional competitors, creating a competitive yet cooperative environment that shapes the future of construction materials. Important competitors include Anglo American Plc, Lafarge, Tiki Tar Industries, Jurgensen Companies, Associated Asphalt, SBORNE Companies Inc., Roadstone Ltd., Aggregate Industries Ltd., Cemex, Owens Corning, King Asphalt Inc., Atlas Roofing Corporation, American Asphalt Company, Eastern Asphalt & Mixed Concrete Company W.L.L, and Croell. Each of these companies plays a vital role in setting new standards for product quality, durability, and environmental responsibility.

As urbanization continues and transportation networks expand, the demand for high-performance asphalt concrete is expected to rise. Governments and private investors are focusing more on sustainable infrastructure that can endure harsh weather and heavy traffic conditions. This growing emphasis on long-lasting and eco-friendly materials has encouraged companies to adopt advanced production techniques and explore the use of recycled materials. The move toward greener construction practices is becoming a defining factor for long-term success in this market.

Technological progress is also reshaping how asphalt concrete is produced and applied. Automation, digital monitoring, and data-driven project management are improving efficiency and reducing waste during production and laying processes. These advancements not only lower operational costs but also improve the quality and consistency of the final product. The integration of smart technologies allows manufacturers to monitor temperature, density, and compaction levels in real time, ensuring that every project meets strict safety and quality standards.

Future trends suggest that research and development will focus on creating asphalt mixtures that are more resistant to temperature fluctuations, cracking, and water damage. Nanotechnology, bio-based additives, and polymer-modified binders are gaining attention as ways to enhance performance while minimizing environmental impact. With the global shift toward reducing carbon emissions, asphalt concrete producers are also exploring methods to decrease energy consumption during manufacturing and to capture or reuse greenhouse gases.

Regional players are expected to continue gaining ground as they adapt quickly to local market needs and environmental regulations. While international leaders maintain their dominance through scale and innovation, smaller companies bring flexibility and localized expertise that make them valuable contributors to regional infrastructure projects. This balance between large and smaller competitors fosters healthy competition, encouraging continuous improvement and adaptation to global and local demands.

Market size is forecast to rise from USD 3559.6 Million in 2025 to over USD 5044.2 Million by 2032. Asphalt Concrete will maintain dominance but face growing competition from emerging formats.

Looking ahead, the global asphalt concrete market is positioned to become more sustainable, technology-driven, and collaborative. The combined efforts of international leaders and regional innovators will define how future cities, roads, and industrial spaces are built. With an emphasis on durability, safety, and reduced environmental impact, the industry will continue to evolve toward smarter, cleaner, and more efficient solutions that meet the infrastructure needs of the next generation.

Report Coverage

This research report categorizes the global asphalt concrete market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global asphalt concrete market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global asphalt concrete market.

Asphalt Concrete Market Key Segments:

By Product

- Hot Mix Asphalt (HMA)

- Warm Mix Asphalt (WMA)

- Cold Mix Asphalt

- Recycled Asphalt Pavement (RAP)

- Other

By Product Form

- Liquid

- Solid

By Application

- Roadways

- Railway Beds

- Airport Runways

- Parking Lots

- Embankment Dams

- Tunnels

- Other

Key Global Asphalt Concrete Industry Players

- Anglo American Plc

- Lafarge

- Tiki Tar Industries

- Jurgensen Companies

- Associated Asphalt

- SBORNE Companies Inc.

- Roadstone Ltd.

- Aggregate Industries Ltd.

- Cemex

- Owens Corning

- King Asphalt Inc.

- Atlas Roofing Corporation

- American Asphalt Company

- Eastern Asphalt & Mixed Concrete Company W.L.L

- Croell

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252