Global Aerostructures Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

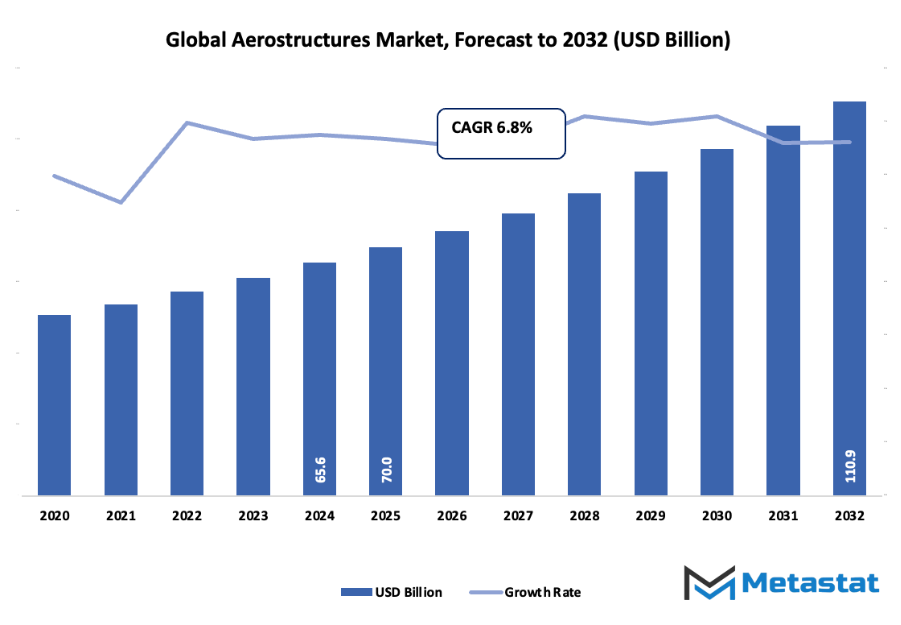

- Global aerostructures market value of approximately USD 70 Billion in 2025, growing at a rate of approximately 6.8% between 2032, with potential growth higher than USD 110.9 Billion.

- Fuselages hold nearly 28.9% market share, leading the way with innovation and expanded uses through aggressive research

- Key growth drivers: Growing Demand for Commercial Airliners, Technological Improvements in Composite Materials

- Opportunities are: Pervasive Use of Advanced Manufacturing Technologies

- Key insight: The industry will expand exponentially in value over the next decade, offering high growth potential.

The global aerostructures market of the aerospace industry will continue to be at center stage as an industry of innovation and engineering sophistication. It goes back to the dawn of the 20th century, when aviation was gradually transitioning from experimental prototypes to commercial and military applications. The evolution initially focused on light airframes and the basic structural components that were able to withstand the stresses of flight. By the 1900s, the market started noticing high-tech advancements in the shape of aluminum alloy launches and riveted assembly techniques that allowed aircraft to grow bigger, faster, and stronger.

In the later years of the 20th century, the global aerostructures market will see a trend toward composite materials as the globe demands more fuel efficiency and load-carrying capability. Old aircraft programs, particularly commercial ones, will establish new precedent in integral wing-body structures and modular fuselage designs. Military applications will also influence trends, as stealth technology, load-bearing enhancement, and adaptive control surfaces will necessitate more sophisticated manufacturing processes.Consumer needs will increasingly be the driving force in shaping the course of the market.

Air carriers seeking improved passenger comfort, less noise in the cabin, and improved efficiency will compel aerostructures suppliers to experiment with new materials, precision-machining, and automation-assisted assembly methods. At the same time, regulatory agencies will place stricter safety and environmental standards, ensuring new designs pass very high standards for durability, performance, and emissions. Such changes will support the utilization of digital twin simulations, additive manufacturing processes, and intelligent monitoring systems to remain compliant while optimizing design cycles.

International collaborations and supply chain diversifications will also determine the direction of the market. Aerospace giants' joint ventures with regional manufacturers and specialized component manufacturers will forge more interconnected networks so that new technologies can be quickly upscaled and innovative solutions incorporated.

By the next decade, the global aerostructures market will further evolve with focus being laid on lightweight materials, predictive maintenance, and flexible structural ideas, reflecting technological ambitions as well as changing requirements of commercial, military, and private air transportation industries.

Market Segments

The global aerostructures market is mainly classified based on Component, Material, Aircraft Type, End Use.

By Component is further segmented into:

- Fuselages: The future of the global aerostructures industry will see the production of fuselages with light-weight materials that reduce the overall weight while being strong. Increased use of composites will yield more fuel-efficient flight. Innovative fuselage structures will also offer greater comfort and safety to passengers and bring in new levels of aviationengineering and manufacturing.

- Empennages: In the global aerostructures market, empennages will evolve to enable greater stability and control of aircraft. Lightweight materials combined with greater aerodynamic performance will ensure commercial and military aviation efficiency. Sophisticated empennages development will be the driver in establishing performance while minimizing operating and maintenance costs.

- Flight Control Surfaces: Flight control surfaces in the market will be enhanced with digitalization and smart technologies. Automated systems will allow for smoother handling and greater safety. Integration of composite materials will further enhance durability while reducing weight, resulting in additional fuel savings and operating performance for various types of aircraft.

- Wings: The wing business in the market will undergo complete transformation with adaptive designs providing greater lift and drag reduction. Wings will be lighter in weight and more flexible through the application of advanced materials, resulting in better fuel economy. Smart sensors embedded in wing structures will facilitate predictive maintenance and increase long-term operational reliability.

- Noses: The market will see aircraft noses which are aerodynamically designed to reduce resistance during flight. Structures will enhance radar facilities and cockpit visibility. New composites will be employed to reduce weight while enhancing strength, thereby ensuring efficiency in commercial as well as defense flying operations worldwide.

- Nacelles & Pylons: Nacelles and pylons will gain prominence in the market due to the growing need for fuel-efficient engines. The designs will be focused on using light but heat-resistant materials to support sophisticated propulsion systems. This change will increase thrust efficiency, reduce carbon emissions, and address the forthcoming goals of sustainable aviation.

- Doors & Skids: Doors and skids in the market will continue with a focus on durability and safety. New materials will allow for lighter, yet stronger, designs that provide better performance and reliability. Helicopter and air mobility vehicle skids will also change based on new standards to facilitate safe landings and operating flexibility worldwide.

- Other: The global aerostructures market will continue to see novel developments in other parts aside from the dominant categories. New landing gear structures, cabin frames, and small assemblies will be made with lighter materials and more intelligent systems. These developments will make way for efficiency, safety, and sustainability goals that define the airline industry's future.

By Material the market is divided into:

- Composites: Composites will be the rulers of the global aerostructures market with their strength and lightness. These will be important in building aircraft that are fuel-efficient and produce less emission. They will enable the shaping of composites into intricate designs, which will provide innovative designs, revolutionizing future aircraft efficiency and operational sustainability.

- Alloys and Superalloys: Alloys and superalloys will remain vital in the market, especially for high-temperature and high-stress applications. The new designs will utilize advanced alloys for maintaining longevity in load structures and engines. They will ensure security and long service life with complementarities with other lightweight materials like metals and composites.

- Metals: Traditional metals will continue to be important in the global aerostructures market for some applications that require high strength and affordability. As developments are achieved in the future, metals will be combined with treatments and coatings to resist corrosion. With this evolution, the application of metals will continue to be effective, staying cost-effective and performing across aviation platforms.

By Aircraft Type the market is further divided into:

- Commercial Aviation: Commercial aviation will remain the largest contributor to the global aerostructures market, driven by increasing passenger travel. Future designs will emphasize fuel efficiency and reduced emissions. Lightweight and aerodynamic structures will help airlines lower operating costs while offering safer, faster, and more sustainable air travel for global populations.

- Business & General Aviation: The market will see rising demand from business and general aviation, with private aircraft owners seeking efficient and reliable designs. Future aerostructures will use composites and alloys to improve performance and comfort. Advanced customization will also drive adoption, meeting the needs of business travelers and leisure flyers.

- Military Aviation: Military aviation will play a major role in shaping the market with demands for strong, durable, and stealth-capable designs. Advanced materials will improve aircraft survivability and maneuverability. Future aerostructures will support next-generation defense aircraft, drones, and combat systems, ensuring national security and operational superiority worldwide.

- Unmanned Aerial Vehicles: Unmanned aerial vehicles will expand rapidly within the market as demand grows for surveillance, delivery, and defense purposes. Lightweight and durable structures will enable longer flight times and higher efficiency. Future innovations will prioritize modular and scalable designs, supporting diverse UAV applications across industries and governments.

- Advanced Air Mobility: The global aerostructures market will see strong growth in advanced air mobility, including air taxis and urban transport aircraft. Structures will focus on lightweight designs, safety, and adaptability for frequent take-offs and landings. Future advancements will support sustainable transport solutions, making urban aerial mobility practical and widely accessible.

By End Use the global aerostructures market is divided as:

- OEM: Original equipment manufacturers will continue driving the market by focusing on advanced production techniques. Integration of automated assembly, robotics, and additive manufacturing will shape future designs. OEMs will be at the forefront of innovation, delivering efficient and sustainable aerostructures for both civil and defense aviation industries.

- Aftermarket: The aftermarket segment of the market will grow steadily due to increasing need for maintenance and replacement. Future services will use predictive analytics and digital monitoring to extend aircraft lifespan. The focus on sustainability will also encourage recycling and reuse of materials, supporting long-term aviation efficiency.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$70.05 Billion |

|

Market Size by 2032 |

$110.9 Billion |

|

Growth Rate from 2025 to 2032 |

6.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

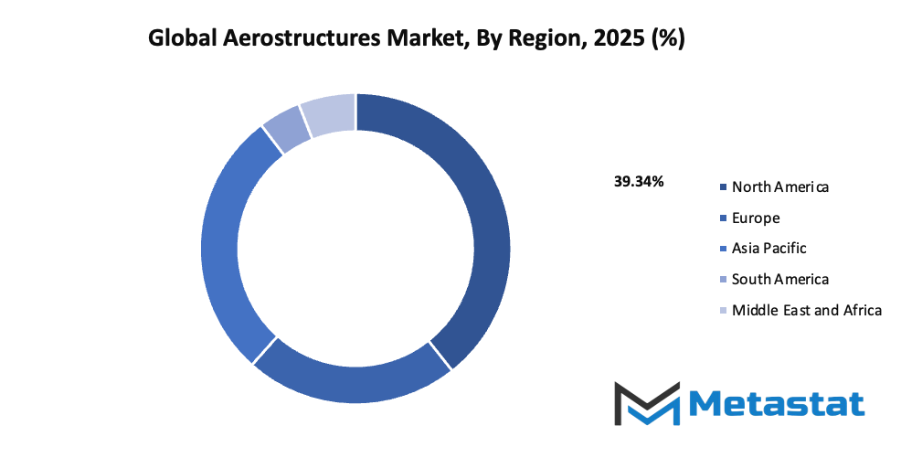

By Region:

- Based on geography, the global aerostructures market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

- Growing Demand for Commercial Aircraft: A steady rise in air passenger numbers will drive orders for new commercial aircraft. Airlines focus on fleet renewal to improve fuel efficiency and reduce operating costs. Emerging economies with growing middle-class populations increase air travel demand, pushing manufacturers to produce more aircraft and support long-term aerostructure development.

- Advancements in Composite Material Technology: The global aerostructures market will benefit from innovations in composite materials. Lightweight yet strong materials reduce fuel consumption and improve aircraft performance. Future breakthroughs will allow faster production, better durability, and reduced maintenance. Improved design flexibility supports more efficient airframes, making composites essential to meet future sustainability and cost-saving targets.

Challenges and Opportunities

- High Manufacturing and Maintenance Costs: Building and maintaining aerostructures requires significant investment in advanced tools, materials, and skilled labour. High production costs limit flexibility for smaller suppliers. Maintenance also adds long-term expenses for operators. Managing these financial challenges while meeting performance expectations will remain a key concern for the market in future.

- Stringent Regulatory and Certification Processes: Strict safety and quality standards increase time and expense for aerostructure development. Certification demands extensive testing and documentation, slowing innovation and raising costs. Meeting these regulations while keeping pace with evolving technologies will remain challenging. Success in navigating compliance will determine growth potential within the global aerostructures market.

Opportunities

Increasing Adoption of Advanced Manufacturing Technologies: Automation, robotics, and additive manufacturing will transform aerostructure production. These technologies lower waste, speed up assembly, and improve precision. Digital tools and smart factories enable faster design changes and cost savings. Adopting these methods will help companies stay competitive, driving future expansion in the global aerostructures market.

Competitive Landscape & Strategic Insights

The global aerostructures market is positioned as a vital segment within the aerospace sector, reflecting both technological advancement and industrial collaboration. The industry will continue to grow as demand for more efficient, lightweight, and durable aircraft structures rises. The market is a mix of established international leaders and emerging regional competitors. Key players such as Airbus SE, Kaman Aerospace Corporation, Northrop Grumman Corporation, Spirit AeroSystems Holdings, Inc., GKN Aerospace, Latécoère, Leonardo S.p.A., ST Engineering, FACC AG, RUAG Group, Saab AB, and Elbit Systems Ltd. play a significant role in shaping industry standards and driving innovation.

The market will witness increasing investment in research and development as companies aim to improve materials and design processes. Advanced composite materials and additive manufacturing techniques are expected to dominate production, allowing lighter and stronger components that improve aircraft performance and fuel efficiency. Collaborations between major corporations and emerging regional players will foster new design solutions and technological breakthroughs, helping to meet rising demands for commercial, military, and specialized aircraft.

Global supply chains will continue to evolve, creating both challenges and opportunities. While established players maintain global networks for manufacturing and assembly, regional competitors will focus on niche solutions and cost-effective innovations to gain market share. Strategic partnerships, mergers, and acquisitions will likely increase, allowing companies to expand their capabilities and reach new markets.

Looking ahead, the market will benefit from growing air travel, defense modernization programs, and advancements in unmanned aerial systems. Sustainability will also shape the future, with materials and manufacturing processes designed to reduce carbon footprints and increase energy efficiency. Companies that successfully combine innovation, adaptability, and operational efficiency will set the pace for market growth.

Market size is forecast to rise from USD 70 Billion in 2025 to over USD 110.9 Billion by 2032. Aerostructures will maintain dominance but face growing competition from emerging formats.

In the coming years, the competitive landscape will remain dynamic, as international leaders leverage their expertise and regional players bring fresh perspectives to the industry. The combination of innovation, strategic collaboration, and growing global demand will ensure that the market continues to expand and play a crucial role in shaping the future of aerospace technology.

Report Coverage

This research report categorizes the global aerostructures market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global aerostructures market.

Aerostructures Market Key Segments:

By Component

- Fuselages

- Empennages

- Flight Control Surfaces

- Wings

- Noses

- Nacelles & Pylons

- Doors & Skids

- Other

By Material

- Composites

- Alloys and Superalloys

- Metals

By Aircraft Type

- Commercial Aviation

- Business & General Aviation

- Military Aviation

- Unmanned Aerial Vehicles

- Advanced Air Mobility

By End Use

- OEM

- Aftermarket

Key Global Aerostructures Industry Players

- Airbus SE

- Kaman Aerospace Corporation

- Northrop Grumman Corporation

- Spirit AeroSystems Holdings, Inc.

- GKN Aerospace

- Latécoère

- Leonardo S.p.A.

- ST Engineering

- FACC AG

- RUAG Group

- Saab AB

- Elbit Systems Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383