MARKET OVERVIEW

The Global Wire & Cable Management Systems market plays a crucial role in ensuring the efficient and organized distribution of electrical power, data, and telecommunications signals across various industries. This industry focuses on the development and implementation of systems designed to manage cables and wires in a manner that enhances safety, functionality, and aesthetic appeal. These systems are essential for maintaining the integrity and reliability of electrical and data networks in both residential and commercial settings.

One of the primary objectives of the Global Wire & Cable Management Systems market is to address the complexities associated with modern electrical and data infrastructure. With the increasing demand for high-speed internet, advanced telecommunications, and sophisticated electrical systems, the need for effective cable management solutions has never been more critical. This market encompasses a wide range of products and solutions, including cable trays, conduits, raceways, cable ties, and labeling systems, each tailored to meet specific industry requirements.

A significant aspect of the Global Wire & Cable Management Systems market is its focus on safety and compliance with regulatory standards. Electrical and data cables, when improperly managed, can pose serious hazards such as fire risks and electrical faults. This market aims to mitigate these risks by providing robust management systems that ensure cables are securely and neatly arranged, reducing the likelihood of accidents and system failures. Additionally, adherence to industry standards and regulations is a key consideration, ensuring that installations meet the necessary safety and performance criteria.

The industry is also driven by the need for efficiency and cost-effectiveness. Proper cable management can significantly reduce installation and maintenance costs by simplifying the process of identifying and accessing cables. This is particularly important in large-scale industrial and commercial projects where extensive cabling is required. By streamlining the management of cables, businesses can minimize downtime, enhance operational efficiency, and ultimately achieve cost savings.

Technological advancements will continue to shape the Global Wire & Cable Management Systems market. Innovations in materials, such as the development of fire-resistant and environmentally friendly cable management products, will cater to the growing demand for sustainable solutions. Furthermore, the integration of smart technologies, such as sensors and automation, will enhance the functionality of cable management systems, allowing for real-time monitoring and maintenance. This will lead to improved performance and reliability, addressing the increasing complexity of modern electrical and data networks.

The market will also respond to the evolving needs of various industries, including construction, IT and telecommunications, healthcare, and manufacturing. Each of these sectors presents unique challenges and requirements for cable management. For instance, the healthcare industry demands stringent hygiene standards and reliable data transmission, while the construction industry prioritizes durability and ease of installation. The Global Wire & Cable Management Systems market will continue to develop specialized solutions to meet these diverse needs.

The Global Wire & Cable Management Systems market is integral to the efficient and safe distribution of electrical power and data. By addressing the challenges associated with cable and wire management, this industry will enhance the reliability and performance of modern infrastructure. As technological advancements and industry requirements evolve, the market will adapt and innovate, providing cutting-edge solutions that meet the demands of an increasingly complex world. The future of this market will be marked by a commitment to safety, efficiency, and sustainability, ensuring that it remains a vital component of global infrastructure development.

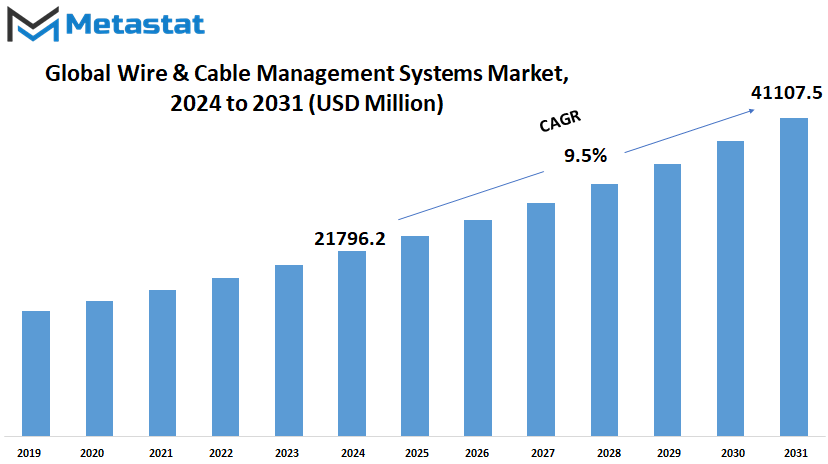

Global Wire & Cable Management Systems market is estimated to reach $41107.5 Million by 2031; growing at a CAGR of 9.5% from 2024 to 2031.

GROWTH FACTORS

The Global Wire & Cable Management Systems market is witnessing significant growth, driven primarily by factors such as rapid industrialization and urbanization. As industries expand and cities develop, the demand for wire and cable management systems increases, fueling market growth. Additionally, the adoption of advanced technologies in various sectors further propels the market forward. Companies are increasingly investing in wire and cable management solutions to enhance operational efficiency and ensure safety.

Furthermore, the growing emphasis on renewable energy sources like solar and wind power is boosting the demand for wire and cable management systems. These systems are crucial for efficiently transmitting electricity generated from renewable sources, thereby supporting the transition towards a more sustainable energy landscape. Moreover, the rising need for upgrading and modernizing existing infrastructure in both developed and developing regions contributes to the expansion of the market.

However, certain challenges such as volatile raw material prices and fluctuations in currency exchange rates might hinder the market's growth trajectory. Additionally, stringent regulations pertaining to environmental sustainability and safety standards pose challenges for market players. Addressing these challenges effectively will be crucial for sustaining growth and profitability in the wire and cable management systems market.

Looking ahead, technological advancements such as the integration of IoT (Internet of Things) and AI (Artificial Intelligence) will play a pivotal role in shaping the future of the wire and cable management systems market. IoT-enabled devices can provide real-time data on the condition of cables and wires, enabling proactive maintenance and reducing downtime. Similarly, AI-powered analytics can optimize cable routing and distribution, maximizing efficiency and minimizing energy losses.

Furthermore, the increasing focus on smart cities and digital infrastructure will create lucrative opportunities for market expansion. Smart city projects necessitate robust wire and cable management systems to support the deployment of various technologies such as sensors, surveillance cameras, and communication networks. As governments and municipalities worldwide invest in transforming their urban landscapes, the demand for advanced wire and cable management solutions will continue to rise.

The Global Wire & Cable Management Systems market is poised for significant growth driven by various factors including rapid urbanization, technological advancements, and the transition towards renewable energy sources. While challenges such as volatile raw material prices and regulatory pressures may pose obstacles, opportunities abound in the form of emerging technologies and the development of smart infrastructure. By leveraging innovation and adapting to changing market dynamics, industry players can capitalize on these trends and secure long-term success.

MARKET SEGMENTATION

By Cable Type

In the dynamic landscape of technology and connectivity, the Global Wire & Cable Management Systems market stands as a crucial player in facilitating the seamless flow of power and communication. This market encompasses various segments, each playing a vital role in ensuring efficient wire and cable management across industries.

One of the key segments within this market is the Cable Type division, which further breaks down into Power Cable and Communication Wire & Cable. Each of these subcategories serves distinct purposes, addressing the diverse needs of industries and consumers worldwide.

The Communication Wire & Cable segment, in particular, emerges as a significant contributor within the market. Valued at 7756.6 USD Million in 2023, it signifies the substantial demand for communication infrastructure to support the ever-expanding network of digital connectivity

Looking ahead, the trajectory of this segment is poised for continued growth and innovation. As technology continues to advance, the need for robust communication networks will only intensify. From fiber optics to high-speed internet cables, the Communication Wire & Cable segment will witness an influx of new technologies and solutions designed to meet the evolving demands of the digital age.

Moreover, the increasing integration of IoT (Internet of Things) devices, 5G networks, and smart technologies will further propel the demand for advanced communication wire and cable solutions. These developments will not only enhance the efficiency and reliability of communication networks but also pave the way for new opportunities and applications across various industries.

Furthermore, factors such as urbanization, industrialization, and the growing adoption of renewable energy sources will drive the demand for Power Cable solutions. As societies become increasingly reliant on electricity to power homes, businesses, and infrastructure, the importance of efficient power cable management cannot be overstated.

In response to these trends, manufacturers and stakeholders within the Global Wire & Cable Management Systems market will continue to invest in research and development to innovate and enhance their product offerings. From improved materials and designs to enhanced durability and sustainability, the future of wire and cable management systems holds promise for greater efficiency, reliability, and performance.

The Communication Wire & Cable segment, along with its counterpart, the Power Cable segment, plays a pivotal role in shaping the Global Wire & Cable Management Systems market. As we look ahead, the continued advancements in technology and the growing demand for connectivity will drive innovation and growth within this dynamic industry.

By Product

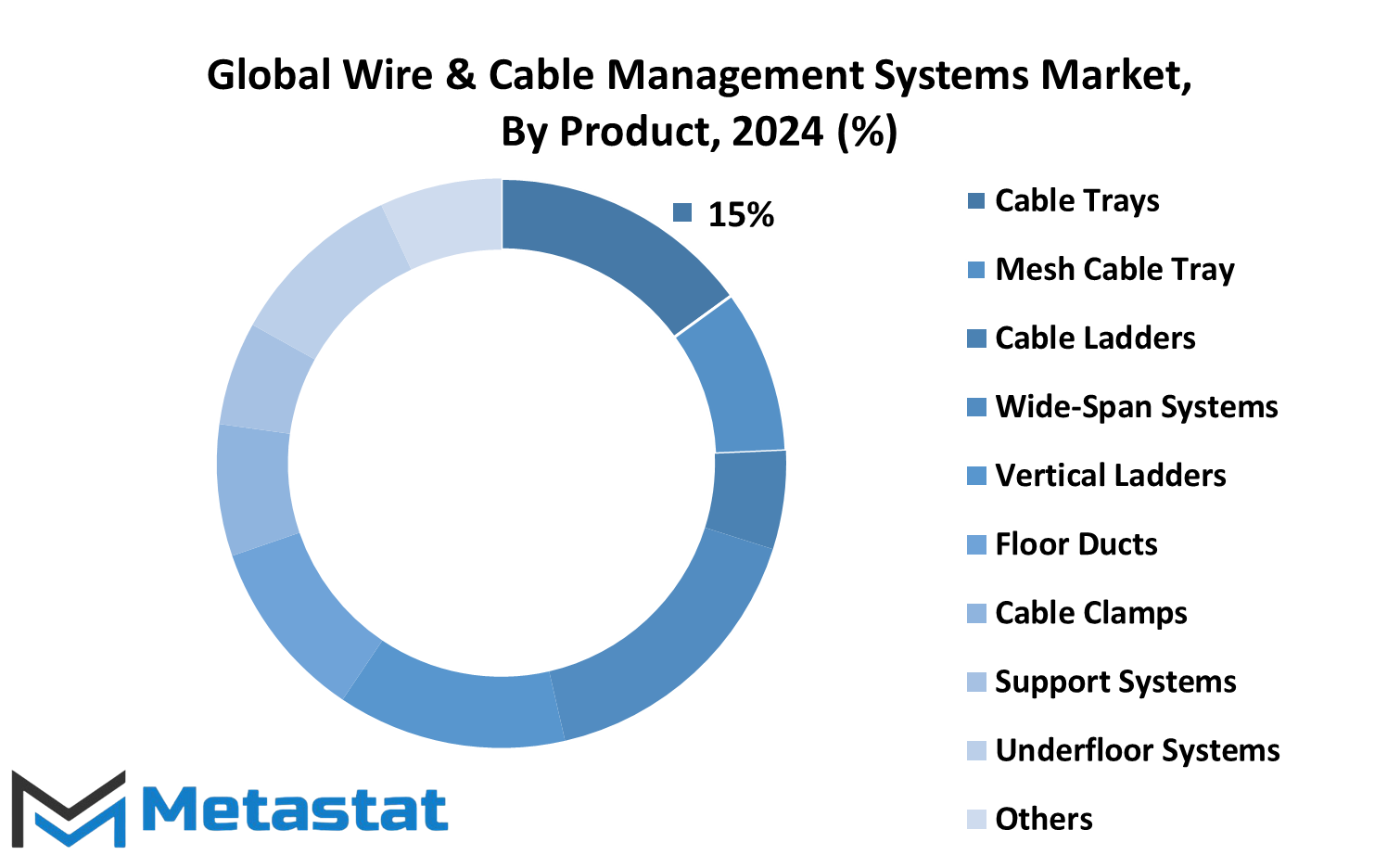

The Global Wire & Cable Management Systems market encompasses various products catering to different needs and requirements. These products include Cable Trays, Mesh Cable Trays, Cable Ladders, Wide-Span Systems, Vertical Ladders, Floor Ducts, Cable Clamps, Support Systems, Underfloor Systems, and Others.

Among these, the Cable Trays segment recorded a value of 2998.7 USD Million in 2023. Cable Trays offer a structured pathway for cables, ensuring organized and efficient cable management. Mesh Cable Trays, another segment in this market, provide similar functionality but with a different design suited for specific applications.

The Wide-Span Systems segment, valued at 3306.2 USD Million in 2023, offers solutions for supporting cables over longer distances, catering to scenarios where traditional cable trays might not suffice. These systems are designed to handle heavier loads and cover larger spans, thus providing flexibility and adaptability in cable management setups.

Floor Ducts, with a value of 2078.1 USD Million in 2023, present an alternative approach to cable management, especially in environments where overhead cable routing is not feasible. Floor Ducts are installed beneath the flooring, offering a concealed pathway for cables while maintaining accessibility for maintenance and upgrades.

Other segments in the market include Cable Clamps, Support Systems, Underfloor Systems, and miscellaneous products catering to specific needs and niche applications within the wire and cable management domain. These segments address various challenges such as cable organization, support, and protection, ensuring smooth operations of electrical and data systems across different industries and environments.

The Wire & Cable Management Systems market offers a diverse range of products catering to the needs of modern infrastructure and technology. As the market continues to evolve, innovation and technological advancements will play a crucial role in shaping the future landscape of wire and cable management solutions.

By Material

In the expansive world of wire and cable management systems, one of the key factors that define the market landscape is the materials used in their construction. The Global Wire & Cable Management Systems market is divided into two primary segments based on materials: Metallic and Non-Metallic.

The Metallic segment of the market refers to wire and cable management systems that are constructed using various metals. These metals could include steel, aluminum, copper, or alloys thereof. In 2023, this segment boasted a significant valuation, reaching 11609.3 USD Million. This substantial figure underscores the widespread use and demand for metallic wire and cable management solutions across industries worldwide.

On the other hand, the Non-Metallic segment encompasses wire and cable management systems made from materials other than metal. These materials might include plastics, composites, or other synthetic substances. While the precise valuation of this segment isn't explicitly mentioned, it's evident that it constitutes a notable portion of the market share.

By End User

The Global Wire & Cable Management Systems market is categorized based on its end users, which include Residential, Commercial, and Industrial sectors. Understanding these segments is crucial for grasping the dynamics of the market.

Residential end users encompass households and living spaces. In this domain, wire and cable management systems are essential for ensuring safety, organization, and aesthetics. With the increasing integration of technology into homes, such as smart devices and entertainment systems, the demand for efficient wire and cable management solutions will continue to rise. Homeowners seek systems that not only conceal wires but also provide easy access for maintenance and upgrades.

Moving on to the Commercial sector, this category encompasses various establishments such as offices, retail stores, and public buildings. In commercial settings, wire and cable management systems play a vital role in maintaining a neat and professional appearance while also adhering to safety regulations. With the growing reliance on technology in business operations, there is a constant need for efficient cable management solutions that facilitate connectivity and flexibility. Businesses will prioritize systems that offer scalability and adaptability to accommodate evolving technological requirements.

The Industrial segment represents manufacturing facilities, warehouses, and other industrial settings. In these environments, wire and cable management systems are crucial for optimizing workflow, ensuring worker safety, and minimizing downtime. Industrial operations often involve heavy machinery and complex electrical systems, making effective cable management essential for preventing accidents and maintaining productivity. Industrial users will seek robust and durable solutions capable of withstanding harsh conditions and supporting heavy-duty applications.

REGIONAL ANALYSIS

The global Wire & Cable Management Systems market is analyzed based on various regions across the world. These regions include North America, Europe, Asia-Pacific, South America, and Middle East & Africa.

In North America, the market is further segmented into the United States, Canada, and Mexico. Similarly, Europe comprises the United Kingdom, Germany, France, Italy, and the Rest of Europe. Moving to Asia-Pacific, this region is divided into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

Furthermore, South America includes Brazil, Argentina, and the Rest of South America. Lastly, the Middle East & Africa region is categorized into GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa.

Analyzing the market based on these regions provides valuable insights into regional trends, preferences, and factors influencing the Wire & Cable Management Systems market. Understanding regional dynamics is crucial for businesses operating in this market, as it helps them tailor their strategies according to specific regional requirements and demands.

For instance, different regions may have varying regulations, infrastructural capabilities, and customer preferences, all of which can significantly impact the demand for wire and cable management systems. By closely examining regional nuances, businesses can identify growth opportunities, mitigate risks, and optimize their market penetration strategies.

Moreover, regional analysis enables companies to adapt their product offerings and marketing strategies to resonate with the unique needs of customers in each region. This may involve customizing product features, pricing strategies, and distribution channels to better align with local market conditions and consumer preferences.

In the ever-evolving global marketplace, understanding regional dynamics is essential for businesses to stay competitive and sustain long-term growth. By leveraging insights from regional analysis, companies can make informed decisions and navigate the complexities of the Wire & Cable Management Systems market more effectively.

Examining the Wire & Cable Management Systems market through a regional lens provides valuable insights that can guide businesses in optimizing their strategies and capitalizing on emerging opportunities across different geographical areas. By embracing regional diversity and tailoring their approaches accordingly, companies will be better positioned to thrive in the dynamic landscape of the global market.

COMPETITIVE PLAYERS

In the realm of the Global Wire & Cable Management Systems market, several companies stand out as significant players. These companies are pivotal in shaping the direction and dynamics of the industry. Understanding who these key players are and what they bring to the table is essential for anyone involved or interested in this sector.

OBO Bettermann Holding GmbH & Co. KG, Hubbell Incorporated, Panduit Corp., TE Connectivity, Legrand S.A., Eaton Corporation, Niedax Group, Hellermann Tyton, ABB Group, Storskogen Group AB, nVent Electric plc, Chatsworth Products, Phoenix Contact GmbH & Co. KG, Hager Group, PohlCon international, Baks Kazimierz Sielski, Pemsa Cable Management, S.A., Basor Electric S.A., Trayco NV, Atkore International, Inc., Oglaend System Group, DKC Group, Daqo Group, Automated Systems Design, Inc., Huapeng Group Co., Ltd., Korvest Ltd (EzyStrut Cable & Pipe Supports), and IEK Group are among the notable players in this field.

Each of these companies brings its unique strengths, whether it's innovative technologies, extensive market reach, or a strong focus on customer satisfaction. For instance, companies like TE Connectivity and Panduit Corp. are known for their cutting-edge solutions and advanced product offerings. On the other hand, companies like Legrand S.A. and Eaton Corporation have established themselves as leaders through their broad range of products and global presence.

In a rapidly evolving market landscape, competition among these players will likely intensify. As new technologies emerge and customer demands continue to evolve, companies will need to stay agile and adaptive to maintain their competitive edge. This could mean investing in research and development to drive innovation, expanding into new markets to capture growth opportunities, or enhancing operational efficiencies to streamline processes and reduce costs.

Moreover, as sustainability becomes increasingly important, we can expect to see a greater emphasis on eco-friendly practices and solutions within the industry. Companies that demonstrate a commitment to environmental responsibility and corporate social responsibility are likely to gain favor among consumers and investors alike.

Overall, the presence of these key players underscores the vibrancy and competitiveness of the Global Wire & Cable Management Systems market. As they continue to vie for market share and leadership positions, their actions and strategies will shape the future trajectory of the industry. In this dynamic landscape, only those companies that can innovate, adapt, and deliver value consistently will thrive.

Wire & Cable Management Systems Market Key Segments:

By Cable Type

- Power Cable

- Communication Wire & Cable

By Product

- Cable Trays

- Mesh Cable Tray

- Cable Ladders

- Wide-Span Systems

- Vertical Ladders

- Floor Ducts

- Cable Clamps

- Support Systems

- Underfloor Systems

- Others

By Material

- Metallic

- Non-Metallic

By End User

- Residential

- Commercial

- Industrial

Key Global Wire & Cable Management Systems Industry Players

- OBO Bettermann Holding GmbH & Co. KG

- Hubbell Incorporated

- Panduit Corp.

- TE Connectivity

- Legrand S.A.

- Eaton Corporation

- Niedax Group

- Hellermann Tyton

- ABB Group

- Storskogen Group AB

- nVent Electric plc

- Chatsworth Products

- Phoenix Contact GmbH & Co. KG

- Hager Group

- PohlCon international

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252