MARKET OVERVIEW

The global shortwave infrared (SWIR) market is a specialized business in the broader electro-optics and imaging market. SWIR market deals with technologies operating within the shortwave infrared band, usually ranging from 0.9 to 1.7 microns in wavelength. Unlike visible light imagery, SWIR imagery allows for the observation of information inaccessible to the human eye, such as moisture levels, thermal properties, and subtle differences in material composition. These unique abilities will keep driving industrial monitoring, defense, scientific investigation, and quality control procedures across various industries.

During the next several years, the market will be shaped by shifting needs in precision sensing and imaging. SWIR cameras and sensors are not standard optical tools; they are precision tools that give insights from non-visible spectrums. These discoveries will play an increasing part in revealing hidden defects in production lines, finding counterfeit materials, and improving vision systems in shadowy or low-light conditions. The versatility of SWIR imaging will lead it into uses outside of typical applications, as industries such as agriculture and pharmaceuticals discover more accurate and non-destructive analytical methods.

Although the global shortwave infrared (SWIR) market involves many decades-old technologies, innovation will never cease. Miniaturization of sensors, cooling technology, and artificial intelligence integration will propel more advanced and smaller systems. Such systems will reduce overheads during operation and boost applications, especially field-based and handheld. With increasing specialism in imaging needs, the market itself will need to change with more tailored solutions, especially in application-specific sensors and bespoke optics.

Another aspect of this market is the material and design complexities required. Indium gallium arsenide (InGaAs) sensor utilization is still at the heart of the majority of SWIR systems, but alternatives will begin to emerge as cost and availability concerns prompt firms to diversify. Developers and producers will need to reassess performance versus economic and logistical factors. Beyond the sensors themselves, the enabling software environment for SWIR imaging must receive more attention. As data captured with SWIR grows larger and more complex, software utilities to interpret and visualize it will need enhancement to meet expectations of end users.

Geopolitical and regulatory elements will similarly influence the global shortwave infrared (SWIR) market. With bans on the export of certain image-forming technologies and components, companies working in this industry must forecast compliance requirements by jurisdictions. This will certainly induce additional local production, partnerships, and intellectual property advancements to avoid dependency on slim supply chains.

Although still considered by most to be a niche, the global shortwave infrared (SWIR) market is making its presence felt quietly in applications with high accuracy that need higher precision than vision. It will not follow the path of conventional imaging technologies. Instead, it will create its own niche by addressing problems that relate to viewing what conventional cameras cannot. So, the market will continue to grow with applications that stretch today's limits on optical sensing and imaging.

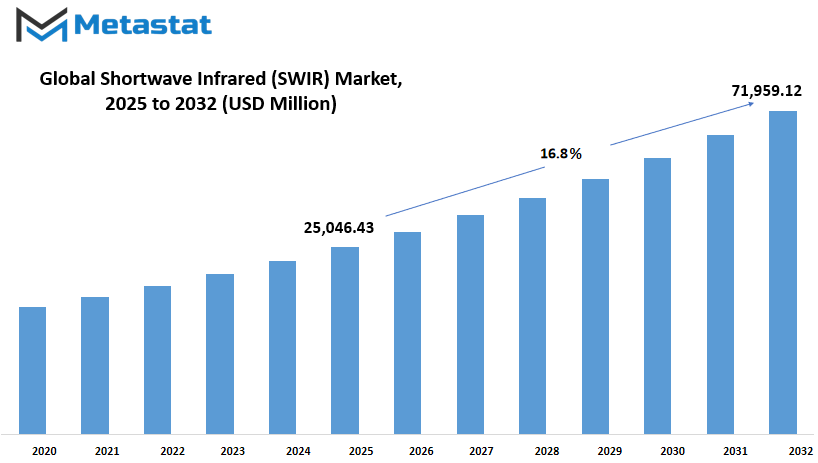

Global shortwave infrared (SWIR) market is estimated to reach $71,959.12 Million by 2032; growing at a CAGR of 16.8% from 2025 to 2032.

GROWTH FACTORS

The global shortwave infrared (SWIR) market is gradually gaining momentum as industries look for more precise and dependable imaging technologies. One of the main reasons for this growth is the rising need for advanced imaging in areas such as defense, aerospace, and industrial inspection. These fields rely on clear visibility in conditions where standard imaging tools often fall short. SWIR cameras offer a unique ability to capture images through smoke, fog, and even under low-light conditions, making them valuable for military and surveillance applications. In industrial settings, they help detect defects that are otherwise invisible, improving the overall quality of inspections and reducing errors.

Another area that is pushing the market forward is the increasing use of SWIR cameras in the inspection of semiconductors and solar cells. These components need to be checked with great precision to ensure they meet high-quality standards. SWIR technology allows for quick and accurate inspection, helping to spot internal cracks or defects that could affect performance. As the demand for electronics and renewable energy sources continues to grow, so will the need for these inspection tools.

However, despite these benefits, some challenges remain. One of the biggest issues is the high cost of SWIR sensors. These sensors are not widely available in the commercial space, making them less accessible to smaller companies or startups. Additionally, they often require special materials like Indium Gallium Arsenide (InGaAs) during production, which not only adds to the expense but also makes the manufacturing process more complex. These factors may limit wider adoption in the near term.

Looking ahead, though, there are promising opportunities that could shift the market. A major development on the horizon is the creation of more affordable SWIR solutions. As research progresses, companies are working on ways to reduce production costs without lowering the quality of the sensors. Another exciting possibility is the integration of SWIR cameras into smartphones and autonomous systems. Imagine a future where everyday devices are equipped with SWIR capabilities, allowing for better facial recognition, night vision, or even medical imaging. Autonomous vehicles could also benefit, as SWIR sensors would help them see better in difficult conditions, improving safety.

Overall, while the global shortwave infrared (SWIR) market faces some hurdles, its potential is strong. As technology advances and costs begin to drop, SWIR could move from a specialized tool to a standard feature in many industries, changing the way we see and interact with the world.

MARKET SEGMENTATION

By Type

The global shortwave infrared (SWIR) market is expected to grow steadily as industries find new ways to use this advanced imaging technology. SWIR cameras have the ability to capture images in low light or even through fog and smoke, making them highly useful across various fields. In the future, more sectors will turn to SWIR for precise monitoring and inspection. This shift will come not only from military and defense applications but also from areas like agriculture, electronics, and healthcare, where detailed observation is becoming more important.

By type, the global shortwave infrared (SWIR) market is further segmented into Area Scan and Line Scan systems. Area Scan cameras are used for capturing wide images in a single frame. These are helpful when the entire scene needs to be recorded at once, such as in quality checks during manufacturing or in security monitoring. Line Scan cameras, on the other hand, are ideal for situations where items are moving on a conveyor belt. They scan one line at a time and create full images as the object passes through. As automation spreads further into factories, Line Scan technology will play a larger role in keeping production efficient and accurate.

Over the next few years, we will likely see improvements in both image quality and sensor technology. The demand for higher-resolution images will push manufacturers to invest in better lenses and smaller, more sensitive sensors. These improvements will make SWIR cameras more affordable and available to mid-size companies, not just large enterprises or government agencies.

There is also a rising interest in combining SWIR with artificial intelligence. Smart imaging systems that can learn from the data they collect will make it easier to detect problems early, saving both time and money. For example, in agriculture, these systems can monitor plant health by identifying moisture levels or detecting diseases before they spread. In electronics, SWIR can help identify defects that are not visible to the human eye, improving product reliability.

As research continues and technology gets more refined, the global shortwave infrared (SWIR) market will likely become a standard part of tools used in many industries. The move toward smarter, faster, and more accurate imaging tools shows that SWIR is not just a passing trend. Its importance will only grow as more practical uses are discovered and developed over time.

By Technology

The global shortwave infrared (SWIR) market is expected to grow steadily in the coming years, especially with advances in imaging technologies. The market is divided by technology into two key categories: Cooled Infrared Imaging and Uncooled Infrared Imaging. Both of these types are shaping the future of imaging applications across various industries, from security and surveillance to agriculture and manufacturing. With better sensors and more compact designs, SWIR technology is becoming more accessible and useful for many tasks that require clear vision in low-light or harsh conditions.

Cooled Infrared Imaging uses cryogenic cooling to reduce noise in the image and increase sensitivity. This type is highly effective in situations that demand accurate detail, such as identifying materials, detecting temperature changes, or tracking heat loss. Though it tends to be more expensive due to the cooling equipment, its performance is hard to match. In industries like defense and aerospace, this level of precision will remain necessary for early warning systems and advanced surveillance tools.

Uncooled Infrared Imaging, on the other hand, does not require such cooling systems. This makes it more affordable and easier to handle. These systems are lighter and better suited for portable or hand-held devices. As production costs drop and sensors improve, more businesses will turn to uncooled options for monitoring processes, inspecting equipment, and detecting faults. Uncooled imaging will likely become more common in day-to-day commercial use, including machine vision in smart factories and environmental monitoring.

Looking forward, the global shortwave infrared (SWIR) market will benefit from improvements in artificial intelligence and machine learning. These tools will allow SWIR systems to analyze images in real time and recognize patterns faster than before. This will be useful not only in industrial settings but also in search and rescue operations, border protection, and precision farming. As automation increases, the need for reliable imaging that works regardless of lighting conditions will continue to rise.

Materials and sensor technology are also expected to evolve, leading to better image quality and broader application. The cost of producing SWIR sensors is slowly coming down, which will make them more attractive to mid-size and smaller companies as well. This growth in demand will push manufacturers to develop even more efficient and user-friendly systems. In the coming years, the global shortwave infrared (SWIR) market will likely see more innovation, driven by the demand for smarter, faster, and more flexible imaging solutions.

By End-User

The global shortwave infrared (SWIR) market is expected to grow steadily across various sectors due to its growing use in applications that demand precision, visibility in low light, and non-invasive inspection methods. By looking ahead, it becomes clear that the demand for SWIR technology will continue to increase as industries seek more accurate and efficient tools for observation and analysis. Each end-user segment will play a key role in shaping how this market moves forward. In the military and defense sector, for example, SWIR is being used for surveillance, target recognition, and navigation, especially in low-visibility conditions. This technology allows for better decision-making in real time, which can save lives and improve the success of operations. As global security needs evolve, more countries will likely invest in these systems.

In the food and beverage industry, SWIR is being used to inspect quality, detect foreign objects, and even monitor moisture content. The ability to inspect without contact is especially helpful for keeping food safe while keeping processes clean and efficient. As food safety regulations become stricter, and companies aim to reduce waste, more food producers will likely adopt this technology. In the electronics and communication sector, SWIR plays a role in inspecting components that are not visible to the human eye. It can check for cracks, ensure proper assembly, and help during manufacturing by spotting issues early. As devices become smaller and more complex, this kind of detailed inspection will be even more valuable.

The medical and healthcare fields are also expected to benefit from this technology. SWIR imaging is being explored for its ability to see under the skin or through tissues, which could help doctors diagnose conditions faster and with greater accuracy. This non-invasive method has potential in both diagnosis and surgery. Over time, as research continues, hospitals and clinics may turn to SWIR as a safer and more effective tool. Lastly, the aerospace industry will likely use SWIR to inspect materials and components in aircraft, both during production and maintenance. Its ability to detect small faults without damaging the surface is critical for safety.

With ongoing advancements and the push for smarter, more reliable technology across all sectors, the global shortwave infrared (SWIR) market is positioned for long-term growth. Each of these industries will help drive the adoption of SWIR, leading to broader innovation and practical improvements in everyday operations.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$25,046.43 million |

|

Market Size by 2032 |

$71,959.12 Million |

|

Growth Rate from 2025 to 2032 |

16.8% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

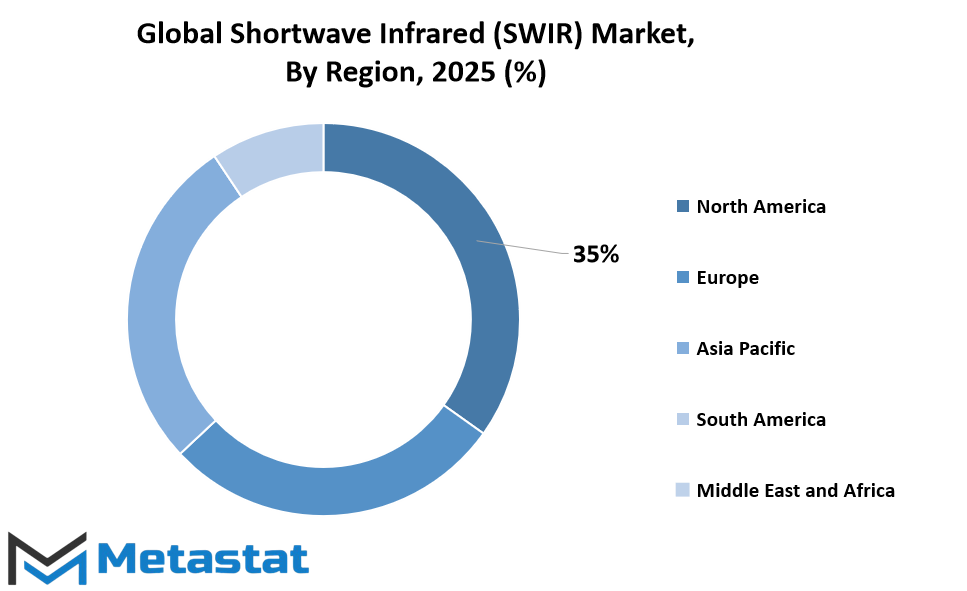

The global shortwave infrared (SWIR) market is expected to grow steadily in the coming years, driven by increasing demand across various regions. Based on geography, the market is categorized into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each of these regions has its own factors that will likely influence future developments, with technology advancements and increased research playing a key role in shaping the market’s direction.

In North America, the U.S., Canada, and Mexico are likely to see more investment in defense and industrial sectors where SWIR technology can offer sharper imaging and enhanced performance. The U.S., in particular, will continue to lead due to its established infrastructure and government funding. Canada and Mexico are also expected to grow, but at a steadier pace as they adopt SWIR applications in energy and agriculture.

Europe, which includes the UK, Germany, France, Italy, and the rest of Europe, will see growth through greater emphasis on surveillance, automotive innovations, and machine vision. Countries like Germany and the UK are moving towards smart manufacturing, and SWIR is likely to play a part in making these systems more reliable and efficient. The region's focus on environmental monitoring will also push the adoption of SWIR in remote sensing tasks.

Asia-Pacific, consisting of India, China, Japan, South Korea, and the remaining countries in the region, is poised for rapid expansion. China and Japan, known for their strong electronics and semiconductor industries, will likely lead in integrating SWIR into consumer technology. South Korea and India are emerging players that will contribute through their investments in security, industrial automation, and research. As technology becomes more affordable, smaller countries in the region are also expected to follow suit.

In South America, Brazil and Argentina will continue exploring SWIR uses in agriculture and mining, fields that benefit from accurate imaging and material identification. These countries are likely to adopt SWIR more widely as awareness grows and the need for efficiency becomes more critical. The rest of South America is expected to progress at a slower pace but will still play a part in the overall growth.

The Middle East & Africa, covering GCC Countries, Egypt, South Africa, and others, is expected to see more interest in SWIR through its use in oil exploration, security, and infrastructure projects. While still developing, this region has the potential to grow significantly as industries begin to recognize the benefits of SWIR. As all these regions continue to adapt and evolve, the future of the global shortwave infrared (SWIR) market looks promising.

COMPETITIVE PLAYERS

The global shortwave infrared (SWIR) market is expected to play a growing role in shaping modern imaging and sensing technologies. This growth is driven by the expanding demand for better visibility across various fields, such as surveillance, industrial inspection, and scientific research. Unlike traditional imaging methods, SWIR technology can detect wavelengths that are invisible to the human eye, which helps identify details that would otherwise go unnoticed. Because of this advantage, companies across the globe are beginning to integrate SWIR sensors into their operations to improve accuracy, safety, and efficiency.

As technology continues to move forward, the use of SWIR cameras and sensors will likely become even more common. Their ability to work effectively in low-light conditions and through materials such as fog or plastic gives them an edge in many settings. Whether used in agriculture to monitor crops or in defense to enhance vision during nighttime operations, SWIR imaging holds practical value across different sectors. One of the most promising aspects of this technology is its potential to support automation in manufacturing. For example, SWIR sensors can spot defects in materials that are not visible under standard lighting, helping companies maintain high-quality production standards.

Several key players are helping to drive this progress. Companies like Sensor Unlimited Inc., Princeton Instruments, Inc., InfraTec Infrared LLC, Xenix, Intevac, Inc., FluxData, Inc., HGH Infrared Systems, and Photonic Science & Engineering Limited are all contributing through innovation and product development. Others, such as New Imaging Technologies (NIT), Sofradir, Hamamatsu Photonics K.K., Raptor Photonics Limited, and Allied Vision Technologies GmbH, are also investing in new features that make SWIR devices more adaptable and cost-effective. As these companies push forward, the technology is expected to become more accessible, not only for large industries but also for smaller firms looking to improve their operations.

Looking ahead, the global shortwave infrared (SWIR) market will likely continue growing as newer applications emerge and older systems get replaced. The blend of improved performance, lower costs, and wider use cases is setting the stage for long-term demand. Companies investing in SWIR today may find themselves ahead in a future where precision imaging is no longer a luxury but a necessity. As advancements continue, SWIR technology is set to become a quiet yet powerful tool in shaping how industries work and how problems are solved with greater clarity and speed.

Shortwave Infrared (SWIR) Market Key Segments:

By Type

- Area Scan

- Line Scan

By Technology

- Cooled Infrared Imaging

- Uncooled Infrared Imaging

By End-User

- Military and Defense

- Food and Beverage

- Electronics and Communication

- Medical and Healthcare

- Aerospace

Key global shortwave infrared (SWIR) market Industry Players

- Sensor Unlimited In

- Princeton Instruments, Inc

- InfraTec Infrared LLC

- Xenix

- Intevac, Inc.

- FluxData, Inc.

- HGH Infrared Systems

- Photonic Science & Engineering Limited

- New Imaging Technologies (NIT)

- Sofradir

- Hamamatsu Photonics K.K

- Raptor Photonics Limited

- Allied Vision Technologies GmbH

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252