MARKET OVERVIEW

The global semiconductor advanced electronics test & repair services market is a niche but strategic segment in the overall electronics and semiconductor industry. This specialized sector will play an important role in the operation and reliability of leading-edge electronic components that are the backbone of present-day high-performance equipment. As electronics are becoming increasingly dense and functional, their manufacturers will be under heightened pressure to see that each microcomponent runs at its best. This demand will propel requirements for meticulous testing and very skilled repair services to detect and correct even infinitesimal faults.

The depth of the global semiconductor advanced electronics test & repair services market reaches beyond basic diagnostics or skin-deep repairs. It will entail a multi-tiered process of fault isolation, functional verification, component-level troubleshooting, and sophisticated rework capability. With increasingly layered semiconductor technologies and advanced interconnects, testing and repair procedures will need to be supported by tools and environments with equal levels of sophistication. Chip design, fabrication, and system integration enterprises will not be in a position to tolerate functional downtime or performance degradation. They will therefore rely more and more on service providers who can produce customized test protocols and precise repair procedures for every product cycle.

What sets the global semiconductor advanced electronics test & repair services market apart from the traditional electronics servicing is the level of precision involved. These services are not intended for end-user devices or consumer-level repairs. Rather, they are aimed at high-end fabrication facilities, aerospace systems, automotive control platforms, and industrial automation systems where failure rates need to be close to nil. These conditions will require ultra-clean handling systems, non-destructive test mechanisms, and micro-level defect analysis. The testing process shall frequently involve thermal cycling, parametric testing, burn-in analysis, and occasionally even quantum-level signal tracing based on the technology node involved.

Additionally, repair facilities will no longer involve just replacement of faulty components. Rather, next-generation service models will incorporate sophisticated micro-soldering, laser rework, material deposition for trace recovery, and even AI-augmented diagnostic algorithms to identify performance anomalies. This level of capability will make this segment an operational safety net for makers working on deadline-sensitive projects or narrowly timed production cycles. It will prove particularly useful when production faults happen in high-value prototype stages or legacy systems that are not readily replaceable.

This global semiconductor advanced electronics test & repair services market existence will expand in regions where semiconductor manufacturing is confronted with regionalization because of geopolitical forces and supply chain diversification. While chipmakers are spreading out their operations to multiple geographies, localized testing and repair services will keep the quality consistent without the necessity for central processing centers. This change will foster new collaborations between fabrication labs, design houses, and third-party service providers who focus on this very niche area.

Finally, the global semiconductor advanced electronics test & repair services market will develop as a function of support that is an indispensable cog in a very fragmented but highly interdependent industry. As this industry continues to innovate architecture and design, these services will closely track them, accommodating new material, standards, and processes. It will no longer be a matter of periodic maintenance but of precision engineering, response speed, and long-term functional integrity.

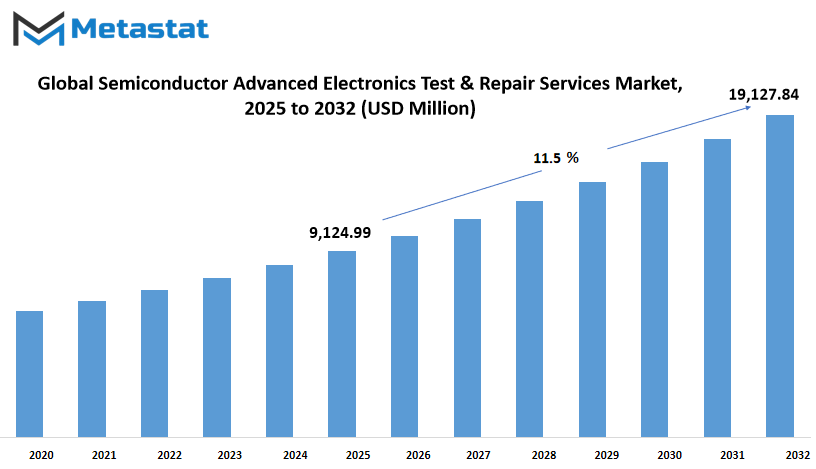

Global semiconductor advanced electronics test & repair services market is estimated to reach $19,127.84 Million by 2032; growing at a CAGR of 11.5% from 2025 to 2032.

GROWTH FACTORS

The global semiconductor advanced electronics test & repair services market is heading towards a future where efficiency, accuracy, and adaptability are more crucial than ever before. As semiconductor technology gets increasingly complex, the demand for accurate testing and repair services becomes a must. Gadgets today are smaller, faster, and stronger, compelling manufacturers and service providers to embrace more superior methods to make them function efficiently. This escalating sophistication implies even the smallest flaw can have serious performance consequences, and this necessitates the need for expert services able to diagnose and resolve such issues in a timely manner.

The other major driver of this market is the increasing application of electronics in various sectors such as automotive systems, medical devices, and consumer electronics. Vehicles today have an extensive array of electronic components that range from safety features to navigation systems. In the field of medicine, equipment that monitors patients or aids in diagnosis relies significantly on semiconductor components to operate properly. As electronics become increasingly a part of everyday objects, demand for services that can repair and maintain these systems should skyrocket. The challenges to the growth of the global semiconductor advanced electronics test & repair services market, though, are present. The biggest challenge is a high price for testing equipment and the requirement for highly technical-styled manpower.

These aspects create it difficult for small companies to get entry into the market or to compete against large companies. In addition to this, the rapid rate of change in electronics technology requires that service providers regularly change their equipment and processes, adding to the pressure on both costs and planning. Nevertheless, there are compelling reasons to expect that this market will continue to grow. One of the most exciting sectors is the development of semiconductor fabrication plants in emerging areas. These new factories hold a lot of potential for creating alliances among service providers and manufacturers. As production moves into new nations, local service networks must increase to service them. This will probably create new business opportunities and bring services closer to more people around the globe. Looking forward, the need for advanced testing and repair services shall be in steady growth. The dependence of humanity on electronics isn't slowing down, with the parts used in those electronics getting only advanced day after day. Companies that can keep this rhythm with an offer of reliable, efficient, and cost-effective services shall be in high demand in the global semiconductor advanced electronics test & repair services market.

MARKET SEGMENTATION

By Type

The global semiconductor advanced electronics test & repair services market is picking up steady momentum, buoyed by the continued increase in demand for electronic systems from different industries. With an increasing number of devices being created to respond to contemporary needs, the need for precise testing and dependable repair services is increasing rapidly. This industry guarantees electronic systems functional and reliable, which is essential as industries keep developing smarter, more integrated technologies. From electric cars and cell phones to manufacturing equipment, every device relies on electronic components that need to be tested and serviced in order to run correctly. Segmented by type, the market has a number of categories, each of which holds potential for future development.

Semiconductor Device Test Services, comprising of Device-Level Test and System-Level Test, have attained a worth of USD 5,854.59 million. This indicates the extent to which it has become crucial to test each part of a chip prior to usage. System-level testing ensures that complete units interact as expected, thereby preventing expensive failures in the future. With chips being made smaller yet more powerful, the accuracy of testing them becomes more critical. Wireless Product Test & Calibration Services, such as Module Test, are worth USD 1,131.50 million. Wireless communication makes a gigantic contribution to our lives, and all devices that transmit or receive data must be tested for accuracy.

Since more and more devices rely on wireless aspects, these services will keep increasing in significance. Advanced Electronic System Test Services worth USD 1,122.37 million emphasize Sub-System Tests. These services verify that parts of larger systems function properly on their own as well as when combined with others and are, therefore, critical for industries such as defense, aerospace, and medicine, where failure is unacceptable. Robotics Testing and Repair Services represent another important segment of the market, with a value of USD 406.06 million. As automation is becoming increasingly prevalent in factories and day-to-day processes, robots need to be repaired and serviced promptly in order to maintain continuity. Testing of robotic systems serves to catch potential issues ahead of time, cutting down on downtime and improving productivity. Other services in the global semiconductor advanced electronics test & repair services market, worth USD 610.46 million, provide a broad spectrum of solutions supporting and enhancing overall system performance. Moving forward, this market will serve an increasing role in maintaining pace with future advancements. With more industries employing sophisticated electronics, the need for sophisticated test and repair services will continue to grow, and it will become a vital assistance in the expansion of technology in the future.

By End User

The global semiconductor advanced electronics test & repair services market is headed in a direction where accuracy, time, and dependability will become increasingly important than ever before. As electronic systems become increasingly more complicated and the need for higher performance and smaller size increases, testing and repair services will become critically important in ensuring products are of high quality and perform as designed. This market not only will enable product development but also will enable devices to be longer-lasting and with less waste, which is particularly relevant in a world that desires sustainability and efficiency.

In the future, businesses across industries will increasingly depend on these services. Semiconductor makers and foundries will continue to turn to test and repair suppliers in order to sustain production yields and catch any defects early on in the process. Electronics OEMs and ODMs will require quick and accurate testing technology in order to remain competitive as they bring new devices to market faster than ever before. Device makers will also rely on precise inspection to provide signal reliability and performance, which is critical in devices such as smartphones, routers, and wearables. Industrial robotics producers and integrators will gain even greater value from high-end test and repair services. Robots in factories cannot afford to break down, and rapid repair or calibration can avoid significant delays. Auto electronics makers will be heavy users too, particularly as cars have more and more sensors, chips, and software-based features. Given the importance of safety as a factor in automotive design, testing each item of hardware will remain at the top of the list.

Consumer electronic firms will also depend on this market to test for defects in devices such as tablets, laptops, and smart household devices. With these becoming increasingly complex and networked, demand for deep testing increases. Electronics manufacturing services (EMS) will seek these services to meet sharp deadlines and tight expectations from customers. This demand will continue to increase as more businesses outsource the electronics manufacturing.

Others in the manufacturing sector, including defense contract firms or medical device companies, will also be aided by these services. Their products frequently must adhere to rigorous standards, and highly advanced testing will assist them in identifying issues before they turn into major issues.

In the future, with ongoing pressure to make devices smarter, faster, and smaller, the global semiconductor advanced electronics test & repair services market will continue to be a necessity. It will play an increasing role in making devices perform better, as well as determining the way technology is constructed, supported, and relied upon by customers globally.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$9,124.99 million |

|

Market Size by 2032 |

$19,127.84 Million |

|

Growth Rate from 2025 to 2032 |

11.5% |

|

Base Year |

2024 |

|

Regions Covered |

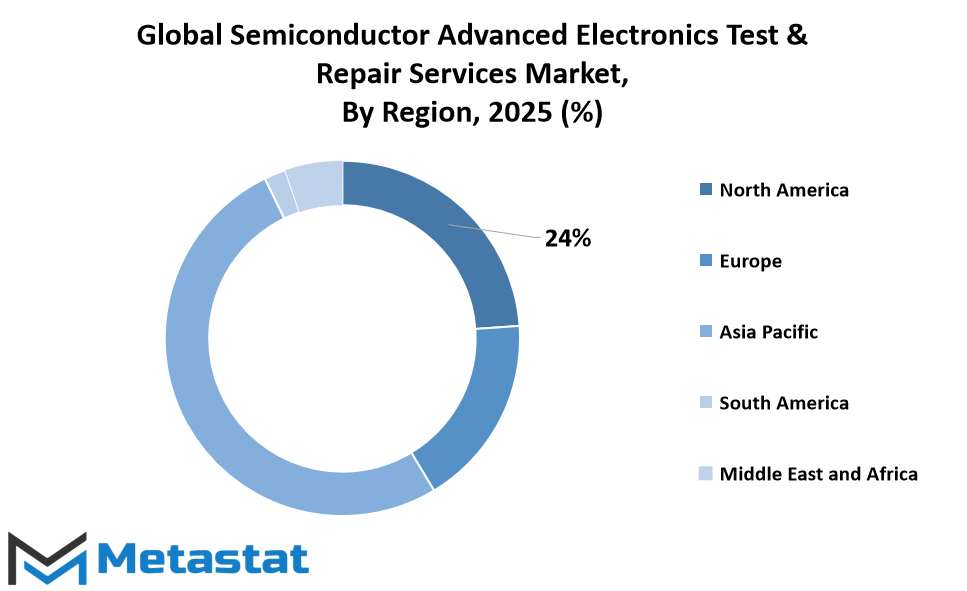

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global semiconductor advanced electronics test & repair services market is poised for steady growth in the years ahead as the demand for electronic products continues to grow. With technology advancing, the demand for proper testing and safe repair services will grow accordingly. From handheld devices to industrial machinery, semiconductors are critical to ensuring systems stay up and running. With increasing numbers of industries dependent on these parts, service providers that can guarantee the quality and functionality of semiconductors will continue to be vital. This industry aids makers by catching defects early, prolonging the life of parts, and minimizing downtime. In the future, more automation and intelligent tools will come into play to inspect and repair semiconductors even more quickly and accurately.

Worldwide, the development of this market will differ by region based on economic growth, consumer electronics demand, and investment in technology infrastructure. In North America, particularly the U.S., the well-established base of technology firms and research institutions enables constant innovation. Canada and Mexico also add with expanding electronics production. Europe, including Germany, France, Italy, and the UK, exhibits consistent interest in preserving the performance of electronic systems, especially in automotive and healthcare equipment. Europe appreciates quality assurance, which prompts the demand for these services.

Asia-Pacific is also likely to experience the highest growth, spearheaded by nations such as China, Japan, South Korea, and India. These countries have a robust electronics sector, and the greater the production, the greater the demand for sophisticated test and repair services.

In China, the drive towards self-sufficiency in chip production will likely ensure greater demand for quality control measures. Japan and South Korea, which are famous for precision manufacturing, will keep seeking dependable testing means. India is investing increasingly in electronics manufacturing, which will foster service development in the region. In South America, Brazil and Argentina are beginning to build out their electronics industries, and this will lead to an increased focus on quality testing and repair. While smaller in size, this market segment is promising.

The Middle East & Africa region, whose countries include the GCC members, Egypt, and South Africa, is slowly establishing its tech sectors. With an increase in local production, so will there be an increased demand for reliable test and repair services. Over time, as more and more regions invest in electronics, the global semiconductor advanced electronics test & repair services market will be even more crucial in aiding innovation and maintaining the smooth functionality of contemporary devices.

COMPETITIVE PLAYERS

The global semiconductor advanced electronics test & repair services market will be one of the most critical sectors in the future of technology and electronics. As electronics continue to get smaller but more powerful, their demand for testing and repair services that are precise, honest, and rapid will keep on rising. This sector is significant in ensuring that advanced electronic components satisfy demanding quality and performance requirements before they are incorporated into anything from consumer electronics to vehicle systems and industrial equipment.

The gradual move toward digital transformation across industries is driving consistent demand for increasingly sophisticated semiconductors. With increased usage of automation, artificial intelligence, and future-generation communication systems, components are becoming increasingly sophisticated and need to be tested precisely. This increasing complexity will compel firms to increasingly depend on professional test and repair services to minimize production defects and prevent costly delays. As this space evolves, firms will seek to remain competitive by frequently upgrading their testing processes and equipment. They are Advantest Corporation, Cohu, Inc., Test Research, Inc. (TRI), AEM Holdings Ltd., ViTrox Corporation, Keysight Technologies, Rohde & Schwarz, Yokogawa Test & Measurement, ASMPT Limited, Sanmina Corporation, Teradyne Inc., STAr Technologies Inc., QES Group Berhad, Tessolve Semiconductor, Johnstech, Aehr Test Systems, and ASE Technology Holding.

These firms are investing in technology to create quicker and more precise testing instruments, as well as emphasizing sustainability and affordability. As electric cars, 5G, and smart infrastructure become more prevalent, more stringent quality checks will be necessary. Test and fix services will play an important role in controlling the speed and volume of chip manufacture. Automated and artificial intelligence-driven test platforms will become the norm in manufacturing plants over the next few years. These technologies will enable firms to eliminate errors, decrease costs, and streamline turnarounds.

Also, as green issues increase, there will be increased pressure to keep electronics in use longer through improved repair practices. In place of trashing malfunctioning parts, most companies will look to trusted service providers who can restore broken units to full operation. This practice not only conserves resources but also encourages more sustainable production practices.

The global semiconductor advanced electronics test & repair services market will continue to play an integral part in enabling innovation while guiding industries toward more efficient and sustainable manufacturing systems.

Semiconductor Advanced Electronics Test & Repair Services Market Key Segments:

By Type

- Semiconductor Device Test Services (Device-Level Test, System-Level Test)

- Wireless Product Test & Calibration Services (Module Test)

- Complex Electronic System Test Services (Sub-System Test)

- Robotics Repair and Testing Services

- Others

By End User

- Semiconductor Manufacturers & Foundries

- Electronics OEMs & ODMs

- Wireless Device Manufacturers

- Industrial Robotics Manufacturers & Integrators

- Automotive Electronics Producers

- Consumer Electronics Companies

- Electronics Contract Manufacturers (EMS)

- Others

Key Global Semiconductor Advanced Electronics Test & Repair Services Industry Players

- Advantest Corporation

- Cohu, Inc.

- Test Research, Inc. (TRI)

- AEM Holdings Ltd.

- ViTrox Corporation

- Keysight Technologies

- Rohde & Schwarz

- Yokogawa Test & Measurement

- ASMPT Limited

- Sanmina Corporation

- Teradyne Inc.

- STAr Technologies Inc.

- QES Group Berhad

- Tessolve Semiconductor

- Johnstech

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252