Global Voluntary Carbon Offsets for Forestry Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

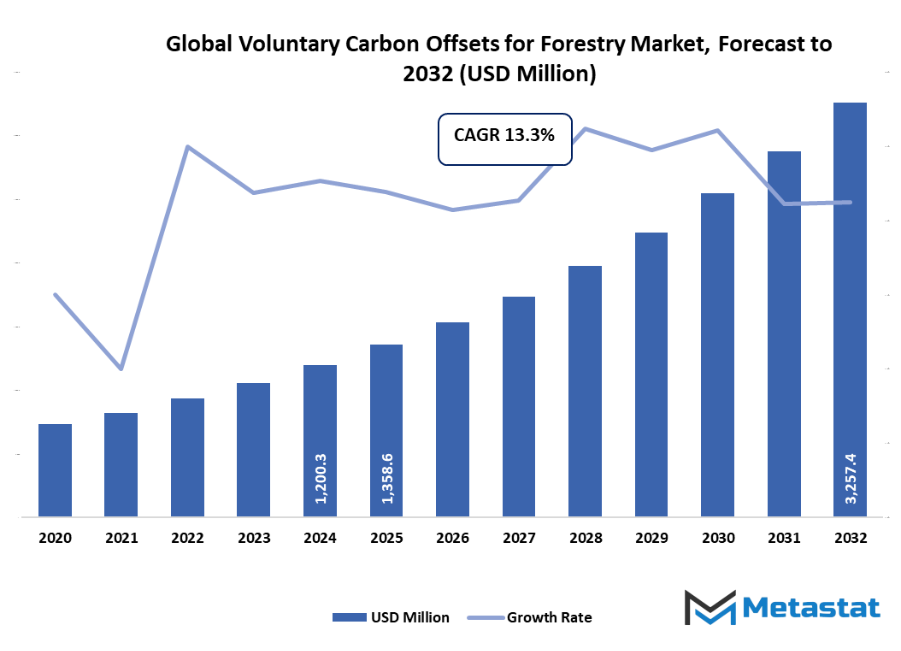

- The global voluntary carbon offsets for forestry market valued at approximately USD 1358.6 million in 2025, growing at a CAGR of around 13.3% through 2032, with potential to exceed USD 3257.4 million.

- Reforestation Projects account for a market share of 22.7% in 2024, driving innovation and expanding applications through intense research.

- Key trends driving growth: Growing corporate commitments toward carbon neutrality and sustainability goals, Rising consumer and investor pressure for environmentally responsible practices

- Opportunities include: Advancements in monitoring and verification technologies create new opportunities

- Key insight: The market is set to grow exponentially in value over the next decade, highlighting significant growth opportunities.

Market Background & Overview

The global voluntary carbon offsets for forestry market involves the buying and selling of carbon credits that are created from forestry-based treatments involving afforestation, reforestation, and forest conservation treatments. In this market, companies and individuals elect to voluntarily offset their greenhouse gas emissions by funding climate projects that contribute to carbon sequestration in forest ecosystems. Over time, we expect that the market will develop to meet the interest and demand from companies, and the environmental community, for legitimate approaches to reduce their carbon footprint and demonstrate climate accountability.

The operation of the market will use a regulated system that brings transparency, measurement, and verification to carbon offset projects. Market standards, including the Verified Carbon Standard (VCS), Gold Standard, and Climate, Community & Biodiversity Standards (CCBS) will serve fundamental related to ensuring project credibility. For example, offsets based on forestry will be valued not only for contributing carbon sequestered trees to a carbon project, but for the double green benefits representing biodiversity conservation, improving soil quality, and conserving water bodies to support carbon sequestration activities. The market will then consist of project developers, corporate buyers, and private sector investors as engaged participants that wish to engage sustainably to help accomplish the carbon neutral goal.

Financial tools will involve directly purchasing carbon credits as well as engaging in voluntary carbon trading exchanges. Participants in the market will also implement sophisticated monitoring, reporting, and verification technologies, like satellite imaging, drones, and analytics that leverage artificial intelligence (AI), to verify carbon accounting. As a result, the global voluntary carbon offsets for forestry market will evolve into a mature marketplace that gets the economic value of protecting the environment, while amplifying the ability of forests to function as natural climate solutions, and providing a reputable way for organizations to feel that they are taking responsibility for offsetting the impact they have on the environment.

Market Segmentation Analysis

The global voluntary carbon offsets for forestry market is mainly classified based on Project Type, Carbon Offset Methodology, Tree Species Used, Stakeholders Involved.

By Project Type is further segmented into:

- Reforestation Projects

Reforestation is the planting of trees in cleared forests, to rejuvenate ecosystems, increase biodiversity and sequester carbon from the atmosphere. These projects are more and more appealing to corporations focused on achieving sustainability goals and carbon offsets. Future growth will be supported by global focus on climate action and carbon neutrality initiatives. - Afforestation Projects

Afforestation is creating forests where none existed before, and is also a strategy for carbon sequestration that also improves soils and enhances ecosystem restoration. Afforestation will also grow as governments and private industry reposition to address climate change. - Forest Management Projects

Sustainable forest management aims to maximize carbon storage while protecting forest health. This can include selective logging, fire prevention, and ecosystem restoration. Sustainable forest management strategies will gain traction, as awareness of the dual benefits - environment and economic - will enhance product acceptance. - Agroforestry Projects

Agroforestry practices include the integration of trees into agricultural systems with crops and animals, providing carbon storage benefits and rural resilience. Agroforestry also has ecological benefits and income opportunities for rural people. It is anticipated that as global interest in sustainable agricultural practices continues to increase so too will interest in agroforestry systems. - Conservation Projects

Conservation projects aim to locate and protect remaining forests and to stop deforestation. The purpose is to conserve biodiversity, reduce carbon emissions from deforested forests, and protect forest ecosystem function. The growing global awareness of the importance of forest conservation will increase the funding of conservation projects.

By Carbon Offset Methodology the market is divided into:

- Verified Carbon Standard (VCS)

Projects certified by VCS demonstrate credibility and quantifiable carbon reductions. There is a growing interest from companies looking for reliable sustainability credentials to indicate verification of carbon reductions signified by VCS certification. - Climate Action Reserve (CAR)

The CAR methodology offers credible, verified North American-based projects with an added level of rigor that increases confidence among buyers in voluntary carbon markets. - Gold Standard

Gold Standard not only emphasizes carbon reductions, it also places a strong emphasis on sustainable development impact, making it attractive to socially-minded investors. - American Carbon Registry (ACR)

ACR methodology provides transparent carbon accounting and project verification-facilitating both compliance and voluntary offset carbon markets. - International Carbon Reduction and Offset Alliance (ICROA)

ICROA creates an international standard for high-quality carbon offset project verification to guide multinational corporations toward measuring quality climate action.

By Tree Species Used the market is further divided into:

- Native Tree Species

Planting native species enhances biodiversity and ecological resilience and can provide long-duration carbon storage. - Commercial Tree Species

Fast-growing species are planted for wood production and are capable of sequestering carbon in the short-term to provide sustainable economic opportunities. - Fast-Growing Species

Fast-growing tree species support sequestered carbon quickly, while providing the basic different climate mitigation and private investment incentives quickly. - Endangered Species

The addition of vulnerable species enhances restoration ecology and biodiversity conservation, as well as the opportunity for carbon offsets. - Mixed-Species Plantations

Planting diversity will support structural stability, create ecological balances, and provide additional climate benefits in terms of carbon- capturing efficiency.

By Stakeholders Involved the global voluntary carbon offsets for forestry market is divided as:

- Non-Governmental Organizations (NGOs)

NGOs are mainly involved in executing projects, financing projects, and community outreach in forestry carbon offsets. - Private Corporations

Companies invest in forest projects for carbon neutrality and ESG objectives. - Government Agencies

Government sector involvement ensures projects comply with regulations, funding, and policy support for forestry projects. - Local Communities

Local communities offer labour, indigenous knowledge, and stewardship, and ensure projects are carried out in an environmentally responsible manner. - International Environmental Organizations

International organizations facilitate the sharing of knowledge, certification, and financing for forestry carbon offset projects.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1358.6 Million |

|

Market Size by 2032 |

$3257.4 Million |

|

Growth Rate from 2025 to 2032 |

13.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

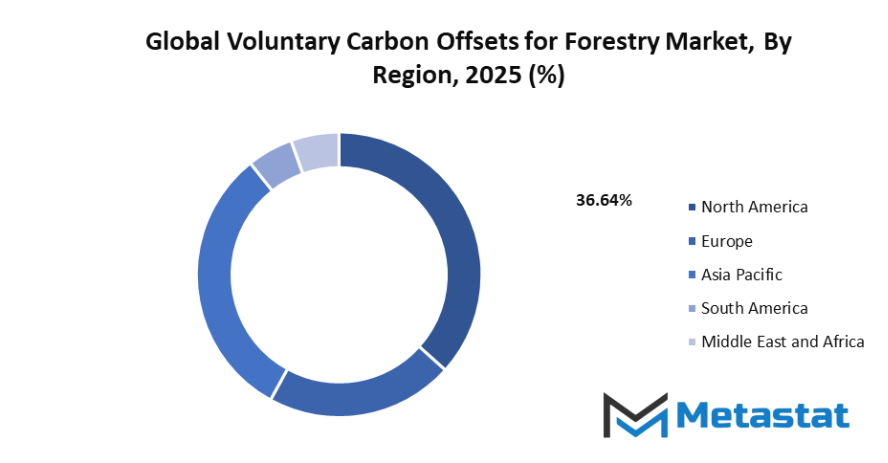

By Region:

Across North America, the participants of the sector - the U.S., Canada, and Mexico - will proceed with individual initiatives such as a nationally defined forestry offset program that factors in the possible connections between carbon credits. Both public policy frameworks and private corporate sustainability programs are expected to play an important role in establishing the voluntary carbon offsets industry in the region; as such, all stakeholders will help this effort to ensure buyers have delivered on their intention of using such credits for offsetting purposes (e.g. net-zero emissions).

Across Europe, there will be a similarly strong decision-support framework including existing carbon trading systems already in place (e.g. the UK, Germany, France, and Italy) that will likely shape the way in which forestry offsets are used and accepted in voluntary carbon offset purchases. Countries in this region are likely to consider transparency, adherence to international carbon standards, and applicability to sustainability programs of corporates and governments.

Asia-Pacific will be inclusive of India, China, Japan, South Korea, and other countries in the region, which will promote carbon credit generation utilizing large-scale reforestation and afforestation initiatives. South America, specifically Brazil and Argentina, will implement sequestration projects applying to their extensive forest resources. The Middle East & Africa include GCC countries, Egypt, and South Africa which will explore innovative forestry solutions and accommodate the adoption of forestry offsets into the global carbon markets by ecosystem.

Market Dynamics

Growth Drivers:

Growing corporate commitments toward carbon neutrality and sustainability goals

More and more companies in different industries are making commitments to carbon neutrality, and actively looking for credible solutions for carbon offsets. Forestry-based voluntary carbon offsets are a credible way to sequester CO₂ while providing benefits to restoring the environment. The global voluntary carbon offsets for forestry market will continue to expand as companies incorporate forestry projects into ESG strategies, ensuring compliance with regulatory initiatives and proving accountability to shareholders, customers and stakeholders in carbon neutrality commitments. As corporate sustainability commitments increase, forestry carbon offsets will gain traction around the world.

Rising consumer and investor pressure for environmentally responsible practices

More consumers and investors want to make environmentally conscious choices, which manifests itself in requiring transparency in environmental and sustainability practices from companies. As a result of this pressure, companies must demonstrate that they actively participate in carbon emission reductions, which is leading to increased investment in forestry offset projects. The global voluntary carbon offsets for forestry market stands to gain as stakeholders increasingly give preference to organizations that engage in tangible, measurable opportunities for environmental initiatives which will in turn encourage companies to adopt forestry-based carbon offsets globally due to reputational and financial benefits and globally.

Restraints & Challenges:

Concerns over credibility and transparency in carbon offset projects

Forestry-based carbon offsets usually involve substantial up-front investment and long maturation timelines before verifiable carbon sequestration takes place. High costs and long timelines may deter smaller organizations and or organizations focused on immediate impact. In order to navigate these issues and support sustainable growth across regions, the market will need new financing modality, public-private partnerships, and frameworks for scalable projects.

High costs and long timelines for forestry project implementation

While carbon offsets indeed offer potential benefits, certain initiatives and methodologies are questioned as to their credibility or verification. Non-equivalent measurements and generally inconsistent measurement standards and reporting practices undermine investor and company confidence in forestry carbon offsets. Consequently, in order to sustain trust and encourage widespread participation in supporting forestry projects, the global voluntary carbon offsets for forestry market must work to create standardized ways to measure offsets, as well as implement strong monitoring practices and third-party certification of carbon offset projects.

Opportunities:

Advancements in monitoring and verification technologies create new opportunities

Novel tools such as satellite imaging, drones, and AI-based monitoring, are making carbon offset projects more accurate and transparent. The tools, especially drones and satellite imaging, allow for real-time monitoring of tree growth, carbon sequestration, and ecosystem health. The global voluntary carbon offsets for forestry market will be greatly advanced through technology developments that contribute credibility to the offsetting process, lower operational costs, and entice more corporations and investor activity focused on legitimate forestry offset projects that become verified high-quality approaches.

Competitive Landscape & Strategic Insights

The industry presents a mix of established international brands and newer regional operators, within the global voluntary carbon offsets for forestry market. Major companies, such as South Pole Group, 3Degrees, First Climate Markets AG, and NatureOffice GmbH, will continue to characterize the market through their project development and carbon credit certification work. Increased opportunities for these organizations will focus on transparency, credibility, and sustainability of forestry based carbon offset projects.

Regional operators, including Allcot Group, Forliance, Swiss Climate, and Ecotierra, will build capacity through focusing on local thematics. These companies will focus on elements such as community engagement, biodiversity, and ecosystem restoration to support and achieve the overarching goals of climate mitigation. Their efforts will serve as a complement to global efforts while also introducing creativity and innovation to projects by introducing their respective approaches to project monitoring and carbon verification.

Companies in this market, which include EcoAct, GreenTrees, Forest Carbon, ClimatePartner GmbH, Carbon Credit Capital, Bluesource, Biofílica, L&C Carbon, and Bioassets, will all emphasize utilizing innovative analytics, remote sensing technology, and traditional blockchain tracking systems. By doing so, efficiency, traceability, and reliability of the carbon offset program will be achieved. Collectively, the global voluntary carbon offsets for forestry market will offer a global mix of strategic direction from international companies and fast, nimble practices from regional players.

Forecast & Future Outlook

- Short-Term (1-2 Years): Recovery from COVID-19 disruptions with renewed testing demand as healthcare providers emphasize metabolic risk monitoring.

- Mid-Term (3-5 Years): Greater automation and multiplex assay adoption improve throughput and cost efficiency, increasing clinical adoption.

- Long-Term (6-10 Years): Potential integration into routine metabolic screening programs globally, supported by replacement of conventional tests with advanced biomarker panels.

Market size is forecast to rise from USD 1358.6 million in 2025 to over USD 3257.4 million by 2032. Voluntary Carbon Offsets for Forestry will maintain dominance but face growing competition from emerging formats.

In summary, the global voluntary carbon offsets for forestry market represents an ongoing source of revenues or funding for companies or organizations that want to offset their carbon emissions through sustainable forestry. The market, with robust verification, implementation of sophisticated monitoring systems, and open trading, will generate carbon credits that are accountability and provide meaningful connections to forest preservation, biodiversity, and nature restoration. Overall, it will connect environmental obligation with economic value in a more meaningful way that will propel forestry carbon credits as a prominent component of the global effort to address climate change.

Report Coverage

This research report categorizes the global voluntary carbon offsets for forestry market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global voluntary carbon offsets for forestry market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global voluntary carbon offsets for forestry market.

Voluntary Carbon Offsets for Forestry Market Key Segments:

By Project Type

- Reforestation Projects

- Afforestation Projects

- Forest Management Projects

- Agroforestry Projects

- Conservation Projects

By Carbon Offset Methodology

- Verified Carbon Standard (VCS)

- Climate Action Reserve (CAR)

- Gold Standard

- American Carbon Registry (ACR)

- International Carbon Reduction and Offset Alliance (ICROA)

By Tree Species Used

- Native Tree Species

- Commercial Tree Species

- Fast-Growing Species

- Endangered Species

- Mixed-Species Plantations

By Stakeholders Involved

- Non-Governmental Organizations (NGOs)

- Private Corporations

- Government Agencies

- Local Communities

- International Environmental Organizations

Key Global Voluntary Carbon Offsets for Forestry Industry Players

- South Pole Group

- 3Degrees

- First Climate Markets AG

- NatureOffice GmbH

- Allcot Group

- Forliance

- Swiss Climate

- Ecotierra

- EcoAct

- GreenTrees

- Forest Carbon

- ClimatePartner GmbH

- Bioassets

- Carbon Credit Capital

- Bluesource

- BiofÃ-lica

- L&C Carbon

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383