Global Seed Coating Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global seed coating market has dramatically developed from a simple farming technique to a principal part of modern seed technology and crop management. The early stage of the industry taking its shape can be traced back to the twentieth century when the farmers and seed developers started experimenting with the natural coatings composed of clay, lime, and plant extracts. The initial purpose of those operations was mainly to provide a barrier against various insects and facilitate planting. In the course of time, though, the evolving scientific and structured farming practices resulted in the transformation of the process from a basic on-farm method to one of specialized industries.

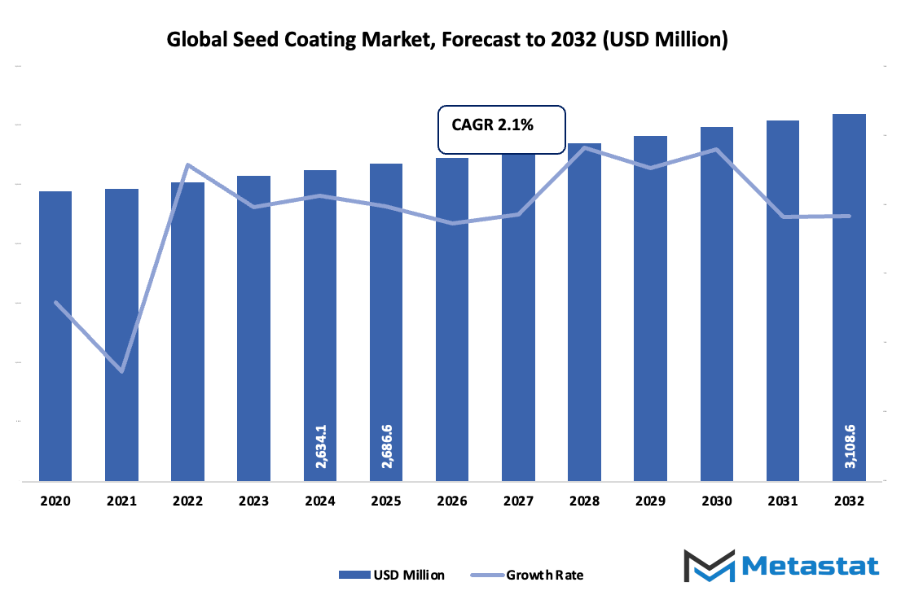

- The global seed-coating market is valued almost at USD 2686.6 million in 2025, with a CAGR of approximately 2.1% till 2032, thereby pushing the market's potential to over USD 3108.6 million.

- Powders are responsible for approximately 36.4% of the overall market share, this portion being one of the main reasons for the continuous research to bring about innovations and expanding applications.

- Among the key factors responsible for the growth are: The use of sophisticated agricultural methods for growing crops is increasing, the demand for seeds with better protection and performance is also rising,

- The focus on developing biodegradable and eco-friendly seed coating materials is one of the opportunities in this market.

- A major takeaway is that the market valuation will increase very rapidly over the coming decade, thus unearthing a lot of growth avenues.

The global seed coating market had taken a new turn by the 1960s when synthetic polymers and colorants were introduced, which not only made the seeds look better but also helped in better seed identification and uniform distribution. This period was one of the most important changes in the market, as seed companies started integrating coating technologies into their commercial footprints. The 1980s and 1990s were marked by the emergence of precision agriculture and biotechnology, both of which had a major impact on market trends. Protective measures were all that coating materials could do they also became carriers for micronutrients, inoculants, and biological agents, thus assisting seeds in taking stronger roots and withstanding environmental stress.

In the last couple of years, the trend in the global seed coating market has been sustainability and ecological responsibility. More stringent regulations in agriculture have resulted in the decreased use of chemical treatments, thereby pushing manufacturers to come up with coatings that are made from biodegradable polymers and natural bio-stimulants. Farmers, who are becoming more knowledgeable about soil health and ecological impact, are asking for products that not only perform well but also are safe for the environment. This trend is likely to persist as global food production is going to be challenged by climate change, land degradation, and the need for higher yields with reduced inputs.

In the next few years, technology will remain a driving force behind this industry. The development of nanomaterials, smart polymers, and microbial formulations will make it possible to have very specific and precise seed treatments that are based on the particular climate and crop type. The global seed coating market will not only be transformed in terms of deepening of research and expansion of agricultural networks but also be the connecting point between science, sustainability, and innovation to cater to the changing expectations of both farmers and consumers across the globe.

Market Segments

The global seed coating market is mainly classified based on Form, Additive, Crop Type, Process.

By Form is further segmented into:

- Powder: The coating in the powder form is very popular because of great ease of use and being economically priced. Powder coatings contribute to the enhancement of seed flow and also offer seeds protection from mechanical damage during the handling process. The form allows for evenly spreading the protective agents around the seeds, thereby providing better storage and planting performance. Powder coatings are not restricted to specific crops and they also offer long-term stability during the transportation period.

- Liquid: The liquid form of seed dressing gives the best adhesion of the additives to the seed surface and also provides a uniform coating thickness. In the case of very expensive seeds, this form is preferred as it allows for the precise application of the active ingredients. Liquid dressings, on the other hand, cure seed germination and they also protect the seeds from fungal and bacterial infections. The liquid coating process is not only fast but also creates less dust when compared to the powder form thereby assuring a cleaner and safer working environment.

By Additive the market is divided into:

- Polymers: Polymers play a key role in forming protective layers around seeds, improving durability and handling properties. They help in controlling the release of active substances and enhance the mechanical strength of coated seeds. The use of biodegradable polymers is increasing due to growing environmental concerns and sustainable farming practices.

- Colorants: Colorants are used mainly for identification and branding purposes. They help in distinguishing different seed varieties and ensure uniformity during planting. Apart from aesthetics, colorants also provide light protection and prevent the degradation of sensitive seed components. Safe and non-toxic colorants are preferred for agricultural use.

- Binders: Binders are essential in maintaining the adhesion between the seed surface and coating materials. They improve coating strength and prevent cracking or peeling during storage and planting. The right selection of binders ensures even distribution of protective agents and prolongs seed shelf life. Water-based binders are becoming popular due to their eco-friendly nature.

- Minerals: Minerals are added to improve seed weight and enhance coating texture. They provide better protection against external stress and help in maintaining seed integrity. Common minerals used include talc and clay, which support better handling and flow during planting. Mineral coatings also contribute to moisture control and storage stability.

- Active Ingredients: Active ingredients such as fungicides, insecticides, and micronutrients are used to enhance seed protection and growth potential. These ingredients safeguard seeds against soil-borne pathogens and pest attacks. Controlled-release formulations of active ingredients ensure prolonged protection and reduce the need for additional chemical treatments during early plant growth.

- Other Additives: Other additives include wetting agents, anti-foaming agents, and dispersants that enhance coating performance. These substances improve coating uniformity and ensure smooth application. Additives help in maintaining the physical and chemical stability of the coating material, leading to better germination rates and field performance.

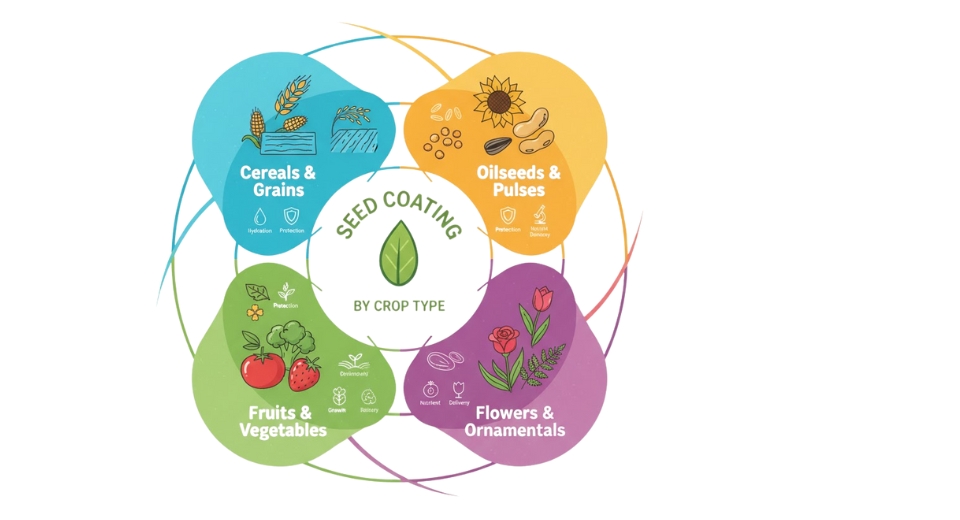

By Crop Type the market is further divided into:

- Cereals & Grains: Cereals and grains are major segments where seed coating is widely applied. Coated seeds provide better disease resistance and uniform germination. The adoption of coated seeds in crops like wheat, rice, and corn is increasing due to rising global food demand and the need for higher productivity.

- Oilseeds & Pulses: Seed coating in oilseeds and pulses helps in improving plant vigor and protecting seeds from fungal infections. Coated seeds ensure better nutrient uptake and root development. The process supports better yield and quality in crops such as soybeans, peanuts, and lentils, which are vital for edible oil and protein production.

- Fruits & Vegetables: The use of coated seeds in fruits and vegetables ensures improved germination rates and early growth. Coating protects delicate seeds from mechanical stress and environmental factors. It also provides essential nutrients during initial growth, supporting better plant establishment and higher-quality produce.

- Flowers & Ornamentals: Seed coating in flowers and ornamentals enhances germination consistency and appearance. Coated seeds offer better storage stability and protect against diseases. The process also allows easier handling of small or irregularly shaped seeds, making sowing more efficient and cost-effective for commercial growers.

- Other Crop Types: Other crop types include forage, turf, and specialty crops that benefit from coating technologies. Coated seeds in these categories promote uniform growth and disease resistance. They ensure better stand establishment and help farmers achieve improved yield and field performance even in challenging soil conditions.

By Process the global seed coating market is divided as:

- Film Coating: Film coating is the process of laying over seeds a very thin and even layer of polymer or other materials. It does not change the seed size or shape; it only enhances the protection of the seeds. The process works like a very effective barrier against pests and diseases but at the same time seed breathability is maintained which basically means that germination and growth are healthy.

- Encrusting: Encrusting puts seeds in a protective material layer and this adds moderate weight to the seeds. The technique makes the seed size even more uniform which, in turn, makes planting easier and more precise. Encrusted seeds are also more easily handled and less likely to break. The method is frequently applied to medium seeds needing moderate protection.

- Pelleting: Pelleting results in the complete covering of seeds with a round and smooth layer, thus increasing their size and weight for more accurate sowing. This technique is particularly advantageous for small or non-uniformly shaped seeds as it helps to rectify planting accuracy. Pelleted seeds are normally enriched with nutrients and active agents that not only support but also accelerate germination and at the same time reduce crop losses during the early stages.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2686.6 Million |

|

Market Size by 2032 |

$3108.6 Million |

|

Growth Rate from 2025 to 2032 |

2.1% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

By Region:

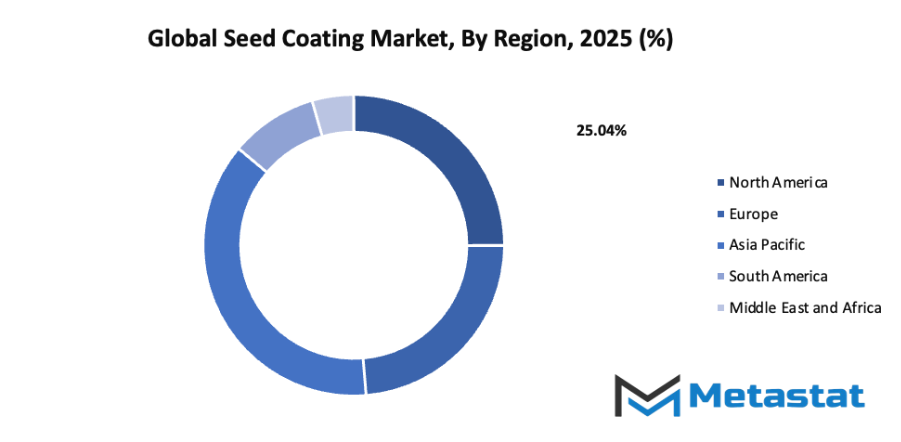

- Based on geography, the global seed coating market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

Rising adoption of advanced agricultural practices to improve crop yield:

The global seed coating market is supported by the growing shift toward modern farming methods designed to boost productivity and crop performance. Farmers are moving toward practices that maximize seed potential while minimizing input costs. Seed coating technology allows for precise delivery of nutrients, fertilizers, and pesticides directly to the seed, improving germination rates and early plant development. With the pressure to meet food security needs and optimize land use, agricultural producers are adopting coated seeds to achieve better yield outcomes. Government support and technological innovations also play a key role in accelerating this transition.

Increasing demand for high-quality seeds with enhanced protection and performance:

Another major driver for the global seed coating market is the rising need for superior-quality seeds that offer improved resistance against diseases, pests, and adverse climatic conditions. Coated seeds provide a controlled release of active ingredients, ensuring longer protection and healthier plant growth. The use of such seeds reduces the dependence on additional crop protection measures during cultivation. As farming becomes more data-driven and focused on efficiency, the importance of seed quality is increasing. This trend encourages more investment in seed coating technologies that ensure better crop establishment and consistent results.

Challenges and Opportunities

High cost of coated seeds compared to untreated ones:

One of the major challenges faced by the global seed coating market is the higher cost associated with coated seeds. The production process involves advanced materials and technology, which increases the overall price compared to untreated seeds. This can discourage farmers with limited resources, especially in price-sensitive regions. While coated seeds provide long-term benefits such as better yield and reduced pesticide use, the initial investment remains a concern. Balancing affordability with innovation is a challenge for manufacturers aiming to expand their market presence among all categories of farmers.

Limited awareness among small-scale farmers in developing regions:

Another key challenge for the global seed coating market is the lack of awareness among small-scale farmers about the benefits of using coated seeds. In several developing regions, traditional farming methods still dominate, and knowledge about new agricultural technologies is limited. Many farmers remain hesitant to adopt seed coating due to unfamiliarity with its benefits or misconceptions about cost and effectiveness. Expanding educational programs, government support, and agricultural extension services can help increase acceptance. Improved awareness will encourage wider use, leading to better productivity and profitability for farmers in these areas.

Opportunities

Growing focus on biodegradable and eco-friendly seed coating materials:

Sustainability trends present significant opportunities for the global seed coating market. With increasing concerns about environmental impact, there is a growing demand for biodegradable and eco-friendly coating materials. Manufacturers are developing coatings made from natural polymers and renewable sources that decompose safely in the soil without harming the ecosystem. Such innovations not only meet environmental standards but also attract farmers and companies looking to adopt sustainable farming practices. The shift toward green solutions will likely open new avenues for growth and enhance the market’s long-term viability.

Competitive Landscape & Strategic Insights

The global seed coating market continues to grow as agriculture adopts new technologies to improve crop yield, protection, and performance. The market is driven by the rising demand for sustainable farming methods and the need to increase food production for a growing population. Seed coating improves germination, protects against pests and diseases, and enhances overall plant development. Coating materials are designed to provide better handling and planting efficiency, helping farmers achieve stronger and more uniform crop stands. The increasing awareness of modern agricultural techniques has encouraged the use of coated seeds across various regions, especially in developing economies that are focusing on agricultural productivity.

The industry is a mix of both international industry leaders and emerging regional competitors. Important competitors include Solvay, BASF SE, Croda International Plc, Clariant, DSM, Precision Laboratories LLC, Chromatech Incorporated, Germains Seed Technology, Universal Coating Systems, Michelman Inc., Summit Seed Coatings, Lanxess AG, and Cistronics Innovations Pvt. Ltd. Each company plays a key role in providing innovative coating materials and technologies that meet the specific needs of different crops and climates. Research and development activities are focused on improving coating formulations that are more environmentally friendly and capable of delivering nutrients and protectants directly to the seed.

Market size is forecast to rise from USD 2686.6 million in 2025 to over USD 3108.6 million by 2032. Seed Coating will maintain dominance but face growing competition from emerging formats.

Growth in the global seed coating market is supported by government initiatives promoting advanced agricultural practices and by investments in biotechnology. Increasing demand for hybrid and genetically modified seeds also strengthens market expansion. Companies are working to create coatings that reduce environmental impact while improving seed performance. The market is expected to continue developing as more farmers recognize the economic and agricultural benefits of coated seeds. With a combination of scientific progress, environmental awareness, and competitive innovation, the global seed coating market will remain a vital part of agricultural advancement.

Report Coverage

This research report categorizes the global seed coating market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global seed coating market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global seed coating market.

Seed Coating Market Key Segments:

By Form

- Powder

- Liquid

By Additive

- Polymers

- Colorants

- Binders

- Minerals

- Active Ingredients

- Other Additives

By Crop Type

- Cereals & Grains

- Oilseeds & Pulses

- Fruits & Vegetables

- Flowers & Ornamentals

- Other Crop Types

By Process

- Film Coating

- Encrusting

- Pelleting

Key Global Seed Coating Industry Players

- Solvay

- BASF SE

- Croda International Plc

- Clariant

- DSM

- Precision Laboratories LLC

- Chromatech Incorporated

- Germains Seed Technology

- Universal Coating Systems

- Michelman Inc.

- Summit Seed Coatings

- Lanxess AG

- Cistronics Innovations Pvt. Ltd.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252