MARKET OVERVIEW

The US Large Consumer Home Good Retailers market is a very significant part of the larger retail sector in the United States and specializes in the sale of products that are used daily in the home. A market of this nature encompasses such a wide array of household supplies, including furniture, kitchen equipment, clean-up supplies, and decorative items, to name just a few examples. The market includes both online retailers and brick-and-mortar destinations that give many buyers their choice of both online and physical options in retail settings. These retailers look forward to offering quality products at cheap prices hence making them meet the demand in home improvement, renovation, and lifestyle upgrades that have become the hallmark of modern living.

The USA Large Consumer Home Good Retailers market has evolved over time with developments in years witnessed in the alterations of consumer behavior and technological innovations. Today, retailers are emphasizing convenience in shopping by combining e-commerce platforms with store services to meet the tastes of the customers. The growth of mobile shopping and online retail has transformed the dynamics through which such products are accessed, and therefore bigger players in the market have sought to expand their digital footprint. The fact that consumers can now compare prices and product details in a few clicks over the internet means that retailers must maintain a strong presence online as well as offline.

The USA Large Consumer Home Good Retailers market will adapt to consumer demand for convenience and value. Retailers will need to integrate those high-tech innovations, such as augmented reality, within their operations to offer virtual experiences in stores or upgrade in-store experiences through better service and personalization. As technology advances, those companies will definitely be able to think of new ways of making the consumer see how products would fit into a home. It will therefore enhance consumer satisfaction and decrease return rates, one of the paramount problems in the home goods industry.

One trend defining the market is sustainability. Increasingly more American consumers are now environmentally conscious while making their purchases, which means that big retailers should catch up with this where they have to offer products that fall within the sustainability bracket and have a low carbon footprint. Sustainable materials, energy-efficient appliances, and ethically sourced goods will become more prevalent in the USA Large Consumer Home Good Retailers market. These factors will determine consumer preference in the market as the necessity to be involved in environmental issues becomes glaring to consumers.

The other trend that has also hindered the USA Large Consumer Home Good Retailers market is third factor: emphasis on product affordability, considering their sensitivity to economic pressure. The rising cost of living, inflation, and changing disposable income levels may thrust consumers to the hunt for the right mix of affordability and quality home goods. Retailers will respond with promotions, discounts, or special offers because they would have to earn the loyalty of the customer by making them wish they did not have to go elsewhere. In addition, loyalty programs and membership benefits will derive value based on consumer desire to acquire more value from their purchase.

Given the evolving nature of customer expectations, this USA Large Consumer Home Good Retailers market will increasingly be competitive and diversified as retailers are constantly innovating. This market will still be one where brick-and-mortar traditional retail blends with digital retail as the product offerings shift towards sustainability and affordability. Any retailer’s success will depend on the most important keys: understanding consumer needs and acting promptly on changes in demand.

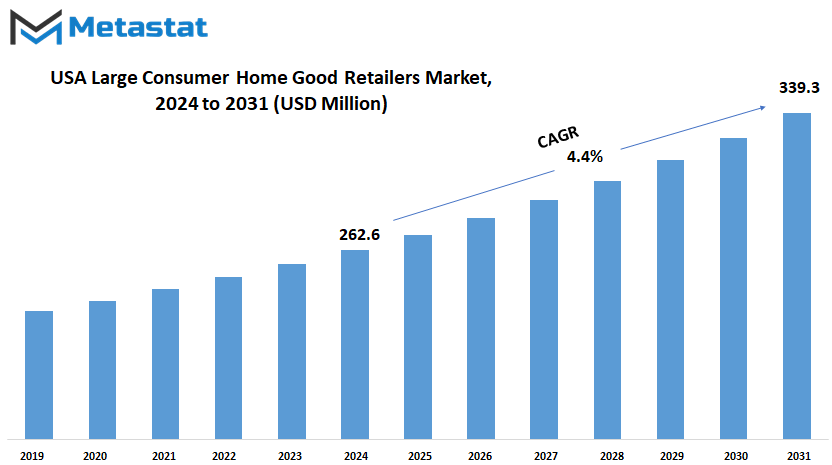

USA Large Consumer Home Good Retailers market is estimated to reach $339.3 Million by 2031; growing at a CAGR of 4.4% from 2024 to 2031.

GROWTH FACTORS

The USA Large Consumer Home Goods Retailers market will expand in an extremely significant way in the near future years. Several factors will drive the market growth, including technological advancements. Because the need to enhance consumer convenience and efficiency will continue to rise, retailers will be challenged to adopt even more innovative solutions-possibly even artificial intelligence and automation-while renovating the shopping experience. These will come to streamline operations, reduce costs, and create space for value-added services to customers. This will attract a large section of consumers. Online shopping, on its own, is not going away anytime soon either as consumer behavior shifts towards online shopping, which is convenient and quick. Retailers that embrace this new trend will see increased sales.

However, there may also be barriers that will limit growth of the USA Large Consumer Home Goods Retailers market. Probably, it is disruption to supply chains, which has actually proven to be one of the most common causes during global events. Its very existence could bring a product's availability forward, bringing irritation amongst consumers and pushing them to other competitors' services. Apart from this, uncertainty in the economy and inflation may reduce disposable income among consumers, and this could lead to decreased expenditure on home goods. The retailers will have to be agile and responsive to these potential stumbling blocks to remain competitive.

However, despite these challenges, there are also opportunities for growth in the market. One such area is where the rising demand for sustainability will create an opportunity area for retailers to obtain remarkable benefits from. Conscious consumers are growingly aware of the environment. As such, the demand for products which will meet their eco-friendly or sustainably made requirement is growing. Those retailers who focus on offering such products, or who at least attempt to make less of an environmental footprint themselves, are likely to attract an increasingly large segment of market. This shall be supported by the rise of urbanization and smart homes, which shall lead to the need for home goods integrating new technologies.

While there are factors that will probably constrain the USA Large Consumer Home Goods Retailers market growth, for example, supply chains and economic instability, prospects look bright. The future seems quite favorable when retailers take technological innovations and changes in consumer preferences into account. Those who can handle the challenges with flexibility on board will be quite successful in this growing market.

MARKET SEGMENTATION

By Type

The USA Large Consumer Home Goods Retailers market is an integral part of the retail industry of the country. Its various segments help drive the growth in the sector. Each category plays a vital role in determining consumer preference and, thus, drives demand in the market. By 2021, the different categories had generated enviable valuations. Bedding products, for instance, accounted for 9.56 billion USD, a reflection of the high demand being driven by consumer interest in comfort and relaxation at home. Bath products are valued at 4.43 billion USD in the same year and continue to expand as families try to make their rooms attractive with good-quality products. Window treatments valued at 5.33 billion USD also continue an upward trend as people seek to design homes that are functional but styled.

The large segment in 2021 was home décor at 26.4 billion USD, or 11.5% in the total Large Consumer Home Goods Retailers market. Such growth, however indicates the extent to which consumers will go along in making their homes look presentable to everybody but themselves. As people spend most of their time inside, they indeed spend more on décor that not only provides comfort but also beauty for their living spaces.

Kitchen and dining furniture, another critical segment, was at 7.48 billion USD in 2021. This has been growing with increasing households focusing on home cooking; the need for usable and aesthetically pleasing furniture in the dining spaces has increased. The increasing practice of remote work also increased home office furniture demand as the same consumers adapted to living space arrangements that balance between comfort and productivity.

Looking forward, growth in the bedroom furniture segment, as well as in the living room furniture and even lamps/ lighting segments, is likely to continue in this USA Large Consumer Home Goods Retailers market. Companies in the market will have to innovate, offering products that combine functionality with glamour. As homes become multifunctional, there will be a continued call for bedroom furniture, living room furniture, lamps, and lighting. The altered lifestyle will determine further changes needed from retailers- not just providing run-of-mill ware, but something that improves the entire home experience. With a solid foundation already laid and consumers looking to improve their living environments, this market is by no chance slowing down.

By Sales Channel

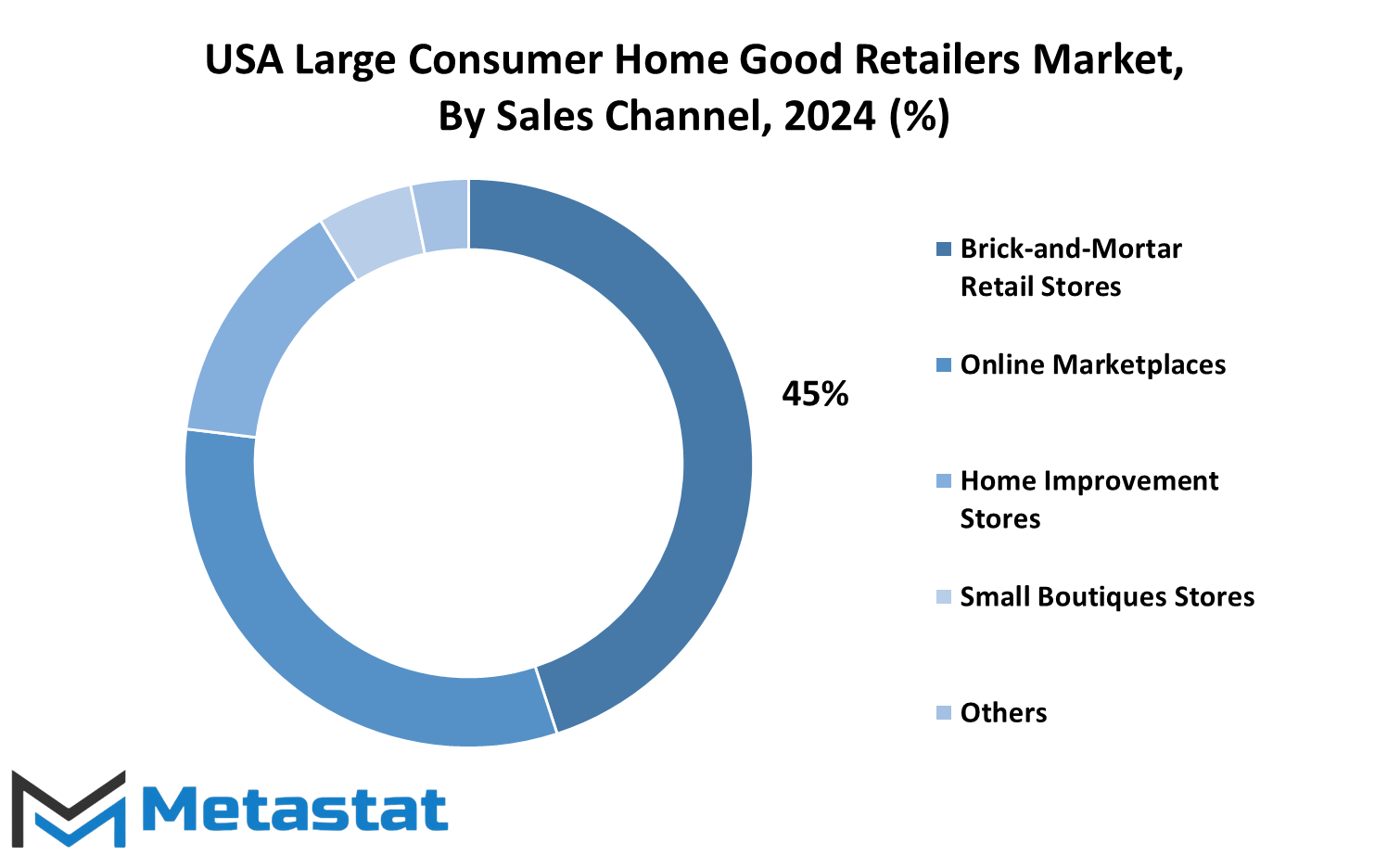

The market for USA large consumer home good retailers has grown at an increasing rate over the past few years. It is more influenced by changes in consumer behavior and an increased impact of technology. This market is therefore expected to continue undergoing changes as both channels of sales and consumers' preferences continue changing. The market can be segmented into brick-and-mortar retail stores, online markets, home improvement stores, small boutique outlets, and other specialty outlets. Each channel provides some variety of benefits and challenges making the home goods retail landscape a pretty diverse place.

Brick-and-mortar has been in the USA Large Consumer Home Good Retailers market for decades; consumers touched and feel the product before buying it. In the future, these stores will form a huge part of the future, only maybe with more technology, such as augmented reality, to make shopping better for its consumers. In physical aspects, they may be directed on providing more individualized and interactive environment for consumers who want to achieve in-person experiences.

Online marketplaces are blowing up and are expected to continue along an upward trajectory. The convenience and different assortments of e-commerce platforms make them more likely to attract consumers. Innovation areas are huge in the future and can include new and more complex product recommendation systems, speedier modes of delivery, and better virtual shopping experiences. Online shopping is bound to attract consumers, and making it an indispensable channel for the USA Large Consumer Home Good Retailers market will remain intact.

There is also an important home improvement retail segment serving customers who want specialized products and expert advice on their do-it-yourself projects. As more people undertake home improvement, these stores are likely to continue growing. They will add more services, such as online tutorials or virtual consultations, to capture the needs of the modern tech-savvy buyer.

The small boutiques will remain much more curated, often with many more local home goods offerings. As large retailers compete head-to-head, those unique offerings and specific customer service will keep the boutiques near and dear to a niche. The better that consumers see the value in sustainability and community, then the more growth opportunities small boutiques may find.

Overall, the USA Large Consumer Home Good Retailers market will continue changing with current consumer demands, and each sales channel will continue evolving in its own unique manner to suit the customer needs of the future.

By Class Demographics

This USA Large Consumer Home Good Retailers market is on the cusp of major change, effectively driven by the changing demographics of class. When consumer habit landscapes change, corresponding changes will have to be made in consumer home good retailers’ services to suit different socio-economic classes. The market can be classified into three classes, which will suit the upper class, middle class, and lower class, respectively. The expectations of each class and their purchasing power also vary.

There is a shift among upper-class consumers toward more customized and premium products. The disposable income of this group is still increasing, and they are going to be looking for premium products that characterize their lifestyle and class status. Thus, retailers targeting this target category should highlight luxury products, superior quality material, and exclusive brands. They tend to focus much more on design, innovation, and a smooth shopping experience. As technology progresses, this will probably translate into even more virtual reality and AI-based propositions that the retailers who target such a segment design to offer an extremely customized and engaging shopping experience to such customers.

The middle class-the oft-called back of the USA Large Consumer Home Good Retailers market-is also here to stay but changing. Since middle-class consumers now value sustainability and ethical production as much as affordability, demand is shifting toward more eco-friendly products. Retailers with such an aim will need to offer more eco-friendly products and environmental responsibility if they wish to be loyal. This group would definitely appreciate smart home technologies and multi-functional furniture as they would seek simple yet stylish solutions for their homes.

The bottom class will also decide the future of the market. This group, characterized by a preference for affordability over everything else, will continue to look for affordable solutions as income inequality holds its stand. Thus, the retail players catering to this segment will have to offer affordable products without compromising on quality. Additionally, when an increasing number of consumer base from this segment comes online, marketers have to make sure that the digital offer is accessible and affordable modes of delivery are offered to make themselves competitive.

As these demographic groups continue to shape its trajectory, USA Large Consumer Home Good Retailers will continue to evolve over the coming years. Relatively more responsive retailers to the changes of each class will likely achieve higher success in this dynamic environment.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$262.6 Billion |

|

Market Size by 2031 |

$339.3 Billion |

|

Growth Rate from 2024 to 2031 |

4.4% |

|

Base Year |

2022 |

COMPETITIVE PLAYERS

The USA Large Consumer Home Good Retailers market is still widely dynamic and continues to grow in this regard. Indeed, QVC, Inc., The TJX Companies, Inc., Walmart Inc., and Target Corporation are some of the major players shaping this market while trying to keep up with ever-changing consumer expectations. All these companies have established their brands by offering a wide range of home goods and furniture. Home Depot, Lowe's Companies, Inc., and Wayfair LLC have established not only a physical retail store presence but also its availability online which can be easily accessed to a wide customers.

The shopping patterns in the home goods market will remain on this trajectory as we move forward in the future. Since the consumers become more reliant on e-commerce sites headlined by Amazon.com, Inc. and Wayfair LLC, there will obviously remain a significant driving force to define purchasing behavior. This means that the management focus areas of the traditional retailers like Macy's, Kohl's, and Crate & Barrel will shift toward building infrastructures in the online arena as well for survival in the race. On the other hand, companies such as Walmart and Costco already have such powerful e-commerce models in place, which in their natural course guarantee them to be significant market players.

The USA Large Consumer Home Good Retailers market will likely have some sustainability focus. Consumers are slowly becoming more aware of the environmental impact of their purchases. That will be to the benefit of companies like IKEA Systems B.V., which markets itself as adopting an eco-friendly policy, and Restoration Hardware (RH), whose product line stresses sustainability. These companies are ahead of the others as consumers continue to be sensitized to eco-friendly products.

Technology is also an advancing factor shaping the future of this market, as well. Companies like Lowe's and Home Depot quickly capitalized on the shift and started moving toward a variety of tech-driven products-from smart lighting to home security systems. The trend is to grow further where more consumers are turning to improve their homes' convenience, efficiency, and safety with the latest technology.

For the USA Large Consumer Home Good Retailers market, the future is likely to be one of both innovation in the digital space and sustainability, personalization, and growth for the larger retailers. Major retailers will focus on readjustment toward integration with new technology as well as consumer preference to maintain or gain market momentum. As such trends emerge in the market, companies are sure to alter to keep pace with the changing needs of their customers and shape the market for years ahead.

USA Large Consumer Home Good Retailers Market Key Segments:

By Type

- Bedding Products

- Bath Products

- Window Treatments

- Bedroom Furniture

- Home Décor

- Home Office Furniture

- Kitchen & Dining Furniture

- Lamps & Lighting

- Living Room Furniture

- Others

By Sales Channel

- Brick-and-Mortar Retail Stores

- Online Marketplaces

- Home Improvement Stores

- Small Boutiques Stores

- Others

By Class Demographics

- Upper Class

- Middle Class

- Lower Class

By Demographics

- Male

- Female

Key USA Large Consumer Home Good Retailers Industry Players

- QVC, Inc.

- The TJX Companies, Inc.

- IKEA Systems B.V.

- Walmart Inc.

- Target Corporation

- Home Depot

- Lowe's Companies, Inc.

- Pier 1 Imports

- Wayfair LLC

- Costco Wholesale Corporation

- Williams-Sonoma Inc.

- Macy's

- Kohl’s, Inc.

- Crate & Barrel

- Dollar General Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383