MARKET OVERVIEW

The US molecular diagnostics market, a dynamic sector inside the broader healthcare enterprise, performs a critical role in diagnosing diseases, guiding remedy selections, and tracking affected person responses to remedy. This niche section encompasses various strategies and technology aimed at studying organic markers on the molecular degree, providing insights into an man or woman's genetic make-up, gene expression styles, and biochemical procedures.

The US molecular diagnostics market lies innovation and advancement in genetic checking out, polymerase chain reaction (PCR), sequencing technologies, and other molecular techniques. These methodologies permit healthcare experts to detect and signify various illnesses, including infectious diseases, genetic issues, most cancers, and cardiovascular conditions, with heightened precision and accuracy.

One of the prominent factors defining the panorama of the US molecular diagnostics market is the sizeable adoption of next-era sequencing (NGS) platforms. NGS has revolutionized genomic analysis by using permitting excessive-throughput sequencing of DNA and RNA, facilitating comprehensive genetic profiling and personalized medication processes. As NGS technology grow to be extra on hand and price-powerful, they may be an increasing number of integrated into clinical workflows, using the expansion of molecular diagnostics programs across diverse medical specialties.

Furthermore, the marketplace is witnessing amazing growth in point-of-care testing (POCT) answers, which provide speedy and decentralized molecular diagnostic talents. POCT devices empower healthcare vendors to supply timely diagnoses and provoke appropriate interventions at the bedside or in non-conventional healthcare settings, improving patient results and healthcare efficiency.

In modern-day years, the US molecular diagnostics market has professional widespread advancements in partner diagnostics, wherein molecular checks are paired with particular recuperation pills to optimize treatment preference and dosage for character patients. This paradigm shift in the direction of precision remedy underscores the significance of molecular diagnostics in facilitating custom designed healthcare techniques and enhancing affected person results all through illness regions.

Additionally, the convergence of molecular diagnostics with other disciplines, along with bioinformatics, synthetic intelligence (AI), and digital fitness, is reshaping the panorama of healthcare shipping and medical decision-making. Integrated structures and software program application answers are leveraging molecular records to generate actionable insights, assist medical selection help systems, and decorate patient manage strategies, thereby driving overall performance and efficacy in healthcare shipping.

Moreover, the US molecular diagnostics market is characterized through a sturdy regulatory landscape and stringent remarkable requirements to make sure the protection, accuracy, and reliability of diagnostic assessments. Regulatory businesses, which encompass the Food and Drug Administration (FDA), play a pivotal feature in overseeing the approval and clearance of molecular diagnostic products, fostering innovation on the same time as upholding affected person safety and public health. The market represents a dynamic and transformative vicinity in the healthcare industry, driven by way of innovation, technological upgrades, and a determination to improving affected individual care.

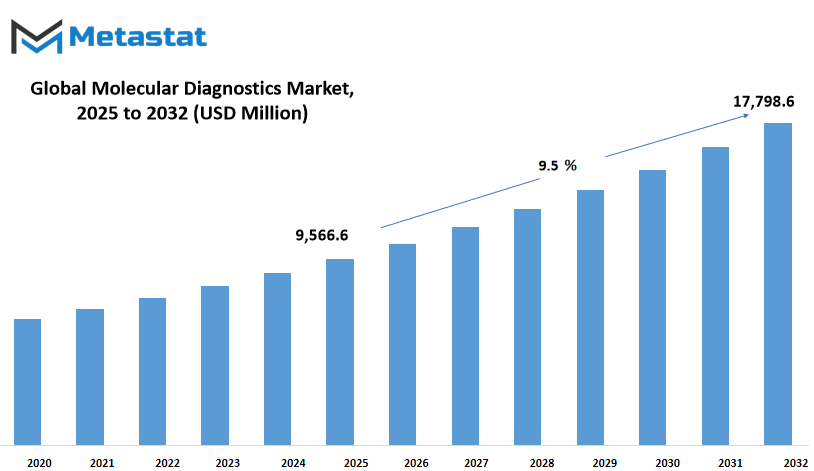

The US molecular diagnostics market is anticipated to attain $17,798.6 Million by 2032; developing at a CAGR of 9.5% from 2025 to 2032.

GROWTH FACTORS

The US molecular diagnostics market is experiencing huge growth, driven with the aid of several key factors. One essential factor is the growing demand for personalized medicine. As people become greater aware of the advantages of tailor-made treatments that take into account individual genetic makeup and other elements, the call for for molecular diagnostic assessments has been steadily growing.

Advancements in technology have moreover performed a crucial function in fueling the boom of the molecular diagnostics market. These upgrades have led to the development of quicker and more accurate diagnostic exams, enhancing both efficiency and effectiveness in diagnosing numerous illnesses and situations. This has more desirable the overall great of healthcare by using permitting in advance detection and more particular remedy strategies.

However, no matter the promising increase potentialities, the marketplace faces certain challenges. One such task is the excessive charges associated with molecular diagnostics. These checks often contain complex methods and specialized gadget, leading to extensive expenses for healthcare companies and patients alike. Additionally, regulatory demanding situations and stringent approval tactics can create limitations to market entry for groups developing new diagnostic technology.

Despite those demanding situations, there are possibilities for increase in the molecular diagnostics market. One such possibility lies inside the developing adoption of point-of-care molecular diagnostic devices for decentralized testing. These gadgets permit for fast checking out and evaluation of samples at or near the patient's vicinity, doing away with the want for time-consuming laboratory processing. As healthcare systems an increasing number of prioritize efficiency and accessibility, the call for for point-of-care testing solutions is predicted to upward thrust, developing rewarding opportunities for market players.

The US molecular diagnostics market is pushed by means of increasing call for for personalized remedy and improvements in era. While challenges which include high fees and regulatory hurdles exist, opportunities for growth, especially within the adoption of factor-of-care testing devices, are on the horizon. By addressing those challenges and capitalizing on rising opportunities, the molecular diagnostics marketplace is poised for persevered expansion inside the coming years.

MARKET SEGMENTATION

By Product and Service

The US molecular diagnostics market is a dynamic and crucial sector inside the healthcare enterprise. It plays a crucial function in disorder detection, monitoring, and treatment. This marketplace encompasses diverse services and products geared toward studying organic markers on the molecular level to diagnose sicknesses as it should be.

One good sized aspect of the USA molecular diagnostics market is its segmentation by product and provider. This segmentation gives a clean understanding of the specific additives contributing to the market’s increase and improvement. Within this segmentation, the market is split into three main categories: reagents and kits, units, and offerings/software program.

The reagents and kits segment is an crucial issue of the molecular diagnostics market, worth 5,760.1 USD million in 2025. Reagents and kits are essential for accomplishing numerous assessments, including polymerase chain response (PCR), nucleic acid amplification, and sequencing. These merchandise contain specific chemical substances and materials necessary for appearing molecular assays accurately. They allow healthcare professionals to discover and take a look at genetic mutations, infectious retailers, and other biomarkers related to diseases.

Alongside reagents and kits, gadgets moreover play a critical characteristic in molecular diagnostics. The devices section emerge as well worth 2,286.4 USD million in 2025. These devices encompass a big variety of gadgets used for sample guidance, nucleic acid extraction, amplification, and detection. Examples encompass PCR machines, nucleic acid sequencers, and microarray scanners. These devices are designed to automate and streamline the molecular trying out method, improving efficiency and accuracy in ailment analysis.

The boom of the US molecular diagnostics market is pushed through various factors, such as technological advancements, increasing incidence of infectious diseases and most cancers, and the growing demand for personalized medication. Technological innovations, inclusive of next-era sequencing and digital PCR, maintain to beautify the accuracy, velocity, and scalability of molecular checking out techniques. Moreover, the rising adoption of factor-of-care testing and partner diagnostics further speeds up market growth, allowing well timed and centered treatment interventions.

The market is a multifaceted and dynamic sector that performs a pivotal function in current healthcare. Through its segmentation by way of product and provider, including reagents and kits, gadgets, and offerings/software, this market offers a comprehensive range of equipment and answers for disorder analysis and management. With ongoing technological improvements and increasing call for for precision medicinal drug, the future of molecular diagnostics holds promising opportunities for innovation and growth.

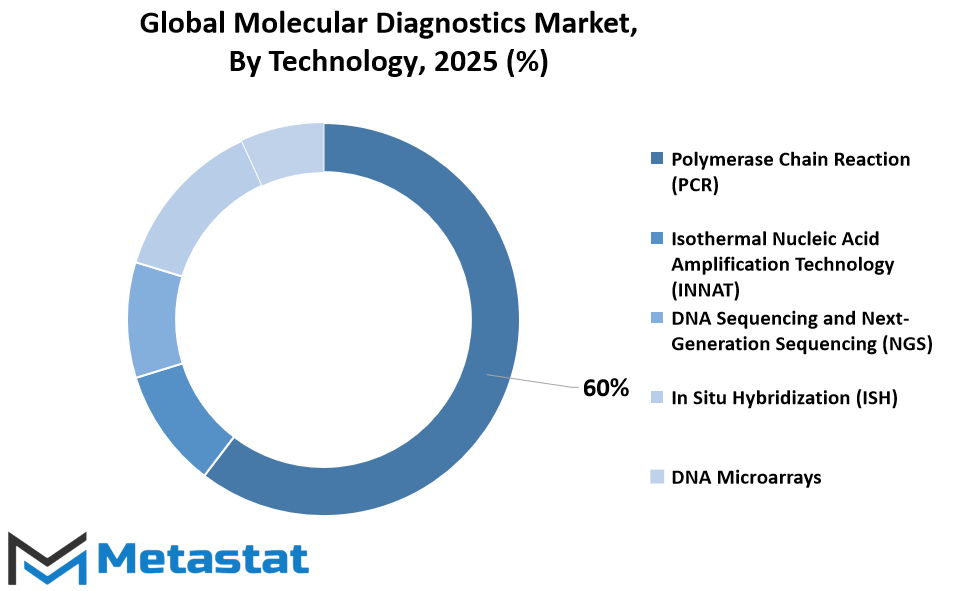

By Technology

The US molecular diagnostics market encompasses diverse technology aimed at detecting and reading genetic material for scientific functions. These technology play a important function in diagnosing sicknesses, tracking remedy responses, and predicting patient effects.

One of the important thing technology driving this marketplace is Polymerase Chain Reaction (PCR). PCR is a extensively used approach for amplifying small segments of DNA, allowing researchers to come across and analyze genetic versions related to diseases consisting of most cancers, infectious diseases, and genetic disorders. Its efficiency and sensitivity make it a cornerstone in molecular diagnostics.

Another good sized era in this discipline is Isothermal Nucleic Acid Amplification Technology (INNAT). INNAT gives benefits over PCR, along with less difficult instrumentation and faster turnaround times. It enables the amplification of nucleic acids at a regular temperature, making it appropriate for factor-of-care trying out and resource-limited settings.

DNA Sequencing and Next-Generation Sequencing (NGS) have revolutionized molecular diagnostics with the aid of presenting comprehensive records about an person’s genetic makeup. These technology allow for the analysis of whole genomes or targeted regions, facilitating the identification of genetic mutations, biomarkers, and personalized treatment options.

In Situ Hybridization (ISH) is another technique utilized in molecular diagnostics. It enables the visualization and localization of precise nucleic acid sequences inside cells or tissue samples. ISH is in particular treasured in cancer prognosis and research, taking into consideration the detection of gene amplifications, deletions, and translocations.

DNA Microarrays are effective gear that permit the simultaneous analysis of lots of genes or genetic versions. They have applications in gene expression profiling, mutation detection, and pharmacogenomics. DNA microarrays facilitate excessive-throughput screening and customized medication methods in molecular diagnostics.

Apart from these primary technology, the market consists of numerous other molecular diagnostic methods catering to unique desires and applications. These may additionally consist of strategies like loop-mediated isothermal amplification (LAMP), virtual PCR, and mass spectrometry-primarily based assays. These opportunity methods offer various answers for detecting and studying genetic material in special clinical eventualities.

The US molecular diagnostics market is pushed via factors together with the increasing incidence of infectious illnesses, most cancers, and genetic problems, coupled with the developing call for personalized medicinal drug and precision diagnostics. Technological advancements, including automation, miniaturization, and multiplexing, in addition propel market boom through improving the velocity, accuracy, and efficiency of molecular diagnostic exams.

By Application

The US molecular diagnostics market encompasses various programs, with one big segment being infectious ailment diagnostics. In 2025, this segment by myself turned into valued at 7 million USD. This shows the crucial role molecular diagnostics play in figuring out and managing infectious sicknesses, a crucial aspect of public fitness.

Another important utility inside this marketplace is oncology checking out, which specializes in diagnosing and monitoring numerous types of cancer. In 2025, the oncology finding out phase modified into worth 1,269.5 million USD. This underscores the importance of molecular diagnostics in oncology, in which early detection and correct tracking are pivotal for improving affected character outcomes.

Genetic trying out is also a superb element of the US molecular diagnostics market. This sort of finding out consists of reading an man or woman’s DNA to grow to be privy to genetic variations related to inherited problems or susceptibility to certain ailments. While the right cost of the genetic finding out phase in 2025 is not provided, its inclusion shows the developing significance of customized remedy and the function of molecular diagnostics in tailoring clinical treatments to man or woman genetic profiles.

Additionally, the market encompasses diverse other packages beyond infectious sickness diagnostics, oncology checking out, and genetic trying out. These other programs may additionally consist of testing for metabolic problems, cardiovascular diseases, neurological issues, and extra. While specific values for those segments are not supplied, their inclusion highlights the diverse range of scientific conditions that can be identified and controlled thru molecular diagnostics.

Overall, the US molecular diagnostics market is characterized with the aid of its multifaceted nature, addressing a big range of healthcare wishes through superior molecular trying out technologies. The full-size marketplace values for infectious disorder diagnostics and oncology checking out underscore the essential function of molecular diagnostics in fighting infectious sicknesses and improving cancer care. Moreover, the inclusion of genetic trying out displays the growing fashion in the direction of customized remedy, where remedies are tailored to person genetic profiles for better efficacy and patient outcomes. As clinical science continues to increase, the position of molecular diagnostics is probably to enlarge similarly, riding improvements in sickness prognosis, treatment choice, and affected person care.

By End User

The US molecular diagnostics market is segmented by quit customers into Diagnostic Laboratories, Hospitals and Clinics, and Others. Each section performs a crucial position within the utilization and development of molecular diagnostics in the healthcare landscape.

Diagnostic Laboratories function the cornerstone of molecular diagnostics, imparting many exams and services to resource in disorder detection, prognosis, and remedy monitoring. These laboratories hire advanced technologies and expert employees to make sure correct and timely outcomes. Their complete trying out abilities cause them to critical in the diagnosis and control of various diseases, consisting of infectious illnesses, genetic disorders, and cancer.

Hospitals and Clinics additionally play a essential position within the adoption of molecular diagnostics, integrating those innovative techniques into their medical practice to beautify patient care. With molecular diagnostic equipment with ease available onsite, healthcare vendors can expedite the diagnostic technique, main to more efficient remedy decisions and progressed patient effects. Additionally, hospitals and clinics regularly collaborate with diagnostic laboratories to enlarge their checking out capabilities and provide a broader variety of services to their sufferers.

Furthermore, Other end users, inclusive of research establishments and educational centers, make contributions to the development of molecular diagnostics through their medical inquiry and innovation. These entities conduct cutting-edge studies to develop new diagnostic assessments, enhance present technology, and discover novel packages of molecular biology in healthcare. By fostering collaboration among academia and enterprise, these end customers drive progress in molecular diagnostics, paving the way for future advancements in precision remedy and personalized healthcare.

Overall, the numerous stop-consumer panorama of the United States Molecular Diagnostics market reflects the enormous adoption and integration of molecular diagnostic technologies across various healthcare settings. Diagnostic Laboratories, Hospitals and Clinics, and Other give up users each play a unique role in advancing the field of molecular diagnostics, contributing to improved affected person care, and using innovation in healthcare delivery. As technology keeps to adapt and new discoveries emerge, those stakeholders will remain at the leading edge of shaping the destiny of molecular diagnostics, ushering in a brand new technology of precision medicinal drug and personalized healthcare.

COMPETITIVE PLAYERS

The US molecular diagnostics market boasts numerous aggressive players vying for prominence. Among those key gamers are Qiagen, Inc., Agilent Technologies Inc, and bioMerieux SA.

Qiagen, Inc. Stands as a stalwart in the discipline, renowned for its progressive molecular diagnostic answers. With a focus on supplying modern-day technology for sample and assay technologies, Qiagen has carved out a huge presence within the marketplace. Their numerous portfolio encompasses a variety of products designed to satisfy the evolving wishes of the diagnostic enterprise.

Agilent Technologies Inc. Is another distinguished player, leveraging its knowledge in existence sciences and diagnostics to make substantial strides in the molecular diagnostics zone. Renowned for its precision units and software program solutions, Agilent Technologies caters to the needs of medical laboratories and research institutions alike. Their commitment to handing over remarkable merchandise has solidified their role as a powerful competitor within the market.

BioMerieux SA rounds out the trio of key players, prominent for its complete variety of molecular diagnostics solutions. Specializing in infectious illnesses, bioMerieux offers a big range of molecular diagnostic assays designed to discover and screen diverse pathogens. Their consciousness on accuracy and reliability has earned them a recognition for excellence in molecular diagnostics.

These key gamers carry specific strengths and talents to the table, contributing to the dynamic panorama of the molecular diagnostics industry. While each organization pursues its personal strategic goals, they together pressure innovation and progress within the market. As opposition intensifies, clients stand to gain from a non-stop flow of improvements and upgrades in molecular diagnostic technologies.

In addition to these primary gamers, the molecular diagnostics marketplace functions a various array of smaller businesses and startups. These rising players inject sparkling perspectives and ideas into the enterprise, hard mounted norms and driving in addition innovation. While they may no longer but wield the equal stage of affect as their larger opposite numbers, their contributions are despite the fact that precious in shaping the destiny of molecular diagnostics.

Overall, the aggressive landscape of the US molecular diagnostics market is characterized by way of a mixture of hooked up leaders and up-and-coming challengers. This variety fosters wholesome competition and spurs ongoing innovation, in the end benefiting patients, healthcare carriers, and stakeholders throughout the board. As technology continues to increase and new opportunities emerge, the molecular diagnostics market is poised for further boom and evolution inside the future years.

US Molecular Diagnostics Market Key Segments:

By Product and Service

- Reagents and Kits

- Instruments

- Service and Software

By Technology

- Polymerase Chain Reaction (PCR)

- Isothermal Nucleic Acid Amplification Technology (INNAT)

- DNA Sequencing and Next-Generation Sequencing (NGS)

- In Situ Hybridization (ISH)

- DNA Microarrays

- Others

By Application

- Infectious Disease Diagnostics

- Oncology Testing

- Genetic Testing

- Others

By End User

- Diagnostic Laboratories

- Hospitals and Clinics

- Others

Key US Molecular Diagnostics Industry Players

- Qiagen, Inc.

- Agilent Technologies Inc

- bioMerieux SA

- Quidel Corporation

- Biocartis NV

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche AG

- Danaher Corporation

- Hologic, Inc.

- Becton, Dickinson, and Company (BD)

- Illumina, Inc.

- Sysmex Corporation

- Siemens Healthineers

- Abbott Laboratories

- Thermo Fisher Scientific Inc

- Grifols, S.A.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383