MARKET OVERVIEW

The newly launched report by Metastat Insight provides valuable insights into the global medical device testing services market, presenting a comprehensive insight into its existing landscape and subtle developments. This report presents an insightful view of how the industry is evolving, influenced by a matrix of factors that keep shaping the direction and demands of medical device testing beyond geographical boundaries. It presents a reflective image of an industry that is having to move through tiers of hopes, norms, and technological ambitions, influenced by the diverse regional traditions and institutional directives.

Medical device testing has evolved from a standaradized checkpoint into a highly technical specialty requiring rigorous accuracy and strict regulation. The development of this sector is as much about product safety as it is about compliance with the multifarious regulatory environments found worldwide. Producers and service providers must adhere to strict specifications, set not by a singular governing authority but by a patchwork of policy, each demanding unique protocols and documentation. The market, as it is today, is a manifestation of this increasing sophistication and is increasingly characterized by the capabilities of service providers to predict and respond to these sophisticated demands.

Service providers in the global medical device testing services market now face mounting pressure to prove capabilities that extend far beyond traditional laboratory testing. They need to be prepared to deal with the differing certification procedures prevalent in each jurisdiction, with their own jargon, test regimes, and deadlines for compliance. It is this cross-border dilemma that has made partnership and regional bases more popular, where smoother integration between product development and market entry can be achieved, despite the processes of compliance attracting greater attention in certain geographies. One expanding aspect of this market's environment is the function of innovation not only in the equipment itself but in the technologies employed to test it.

As medical technology extends the limits of what can be done, the technologies employed to assess their safety and performance need to change in a similar fashion. From biocompatibility to electromagnetic compatibility, the range of testing technologies continues to expand. Here, the worth of a test partner is no longer assessed by infrastructure but by how well it can integrate into a manufacturer's development cycle and deliver valuable insights at an early stage of the cycle.

The drivers behind this industry are also directly related to the growth of medical technologies into less conventional niches. Home healthcare devices, wearable technology, and remote monitoring networks add other levels of complexity. They require novel types of validation beyond the laboratory, into the settings in which the devices will be deployed. Service providers must recreate real-world scenarios, not only delivering evidence of function, but of reliability in real-world constraints. This transition quietly realigns the burden of expectation assigned to the global medical device testing services market, enacting a wider scale of responsibility.

This more holistic process also addresses the manner in which coalescence is reconfiguring the structure of the market. The historical boundary between device creation and quality assurance is being eroded. Customers now demand their testing allies to function as an integral part of their own organizations. This promise is accompanied by new stresses, especially around confidentiality, pace, and responsiveness. The success of these collaborations relies largely on mutual comprehension, not just of technical requirements but also of the commercial and regulatory stresses that define a product's path from conception to clinic.

Notwithstanding the professional and logistical challenges encountered, the market still expands in depth and applicability. This growth is not uniform, however. Various regions have their own requirements and destinies. Emerging markets, for example, bring both new opportunity and increased caution, as national regulations can be less established or in flux. Service providers are forced to be flexible, adapting their methods to accommodate both worldwide standards and national expectations. It is a complex balancing act, and it remains a dominant feature of much activity in the global medical device testing services market today.

There is also increased focus on sustainability, both in terms of the methods used to test devices and the overall lifecycle effect of testing activities. This development encourages increased innovation in the tools and materials utilized during the validation process. As businesses start to quantify not just the efficiency but the environmental cost of their testing activities, services are increasingly being drawn into broader discussions about corporate responsibility and long-term effect.

The report presented by Metastat Insight ultimately offers a considered window into the trends and alliances defining this market. Instead of providing broad-brush generalizations, it indicates particular operational issues and nuanced changes in stakeholder expectations. From this perspective, the global medical device testing services market does not appear as a fixed industry but as an adaptive ecosystem influenced by interdependencies that extend across technical, regulatory, and strategic dimensions. With the medical technology industry always evolving, the market for testing services will continue to be an essential component of its base, constantly evolving to address the requirements of a world that values both innovation and guarantee.

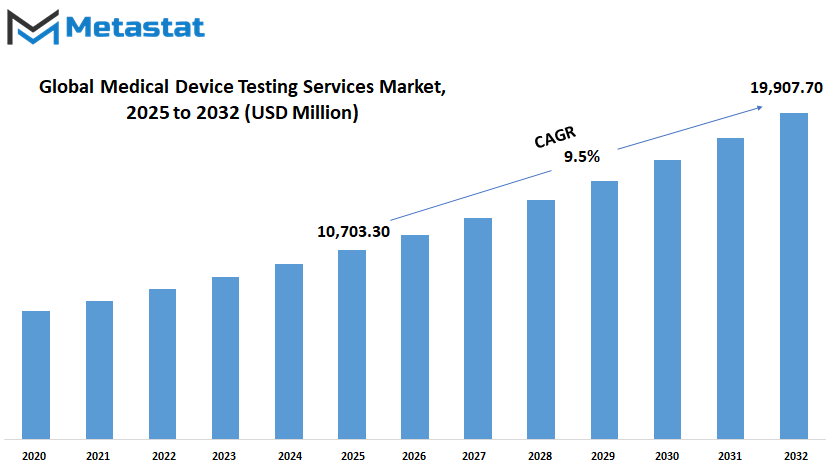

Global medical device testing services market is estimated to reach $19,907.70 Million by 2032; growing at a CAGR of 9.5% from 2025 to 2032.

GROWTH FACTORS

The global medical device testing services market is expected to witness consistent growth for the coming years. With the medical sector evolving, it has become increasingly important to provide safety and reliability of medical devices. Health authorities and governments around the world are now placing more emphasis on rules and regulations to ensure patient protection. This has led to more tests needing to be done before a medical device can be applied. These are not only in a few countries but are snowballing globally, and this will continue to fuel demand for expert testing services. In the meantime, more manufacturers are turning to outsourcing testing operations instead of performing them themselves. This is all because outsourcing allows one to get results quicker and save money.

The smaller companies, in particular, benefit from this tactic, since they don't necessarily have elaborate labs or qualified technical staff. The test service providers do have both, so this presents a stronger and cost-saving option. This outsourcing trend will also ensure the growth of the global medical device testing services market in the foreseeable future. While the prospect is promising, there are issues that could undermine the pace of this growth. One key deterrent is the complexity of the regulatory requirements, which might vary from country to country.

This not only delays product to market but is more expensive. Additionally, specialist testing, particularly for more sophisticated technologies like AI-based or implant devices, generally involves the use of high-end equipment and specialist knowledge, both of which command a premium. Despite all these challenges, there are also some areas that would be promising in the future. Wearable medical technology is one of them. This technology is fast gaining popularity with both doctors and patients due to its capability to monitor health real-time. As the devices gain wider usage, proper and regular testing will also see heightened demand. Further, connected devices that transmit patient data will have additional levels of verification to offer assurance in terms of performance and cybersecurity. The increasing demand should offer fair chances for providers of testing services to test themselves and eventually decide the future course of the global medical device testing services market.

MARKET SEGMENTATION

By Service

The global medical device testing services market will continue to develop steadily as the healthcare sector keeps evolving and the need for quality medical equipment rises. The future of the industry is bright, primarily due to the increasing demand for safe and efficient devices. The technological advancement of the medical industry implies that medical equipment is becoming more sophisticated, thereby requiring testing services to adapt to new challenges. When governments and health organizations increase their safety requirements, businesses will require improved test solutions to serve those demands. The future will see tougher laws that will encourage manufacturers to increasingly use professional test services to comply with legal and safety standards. In the future, the market will grow further as an increasing number of people demand higher medical standards and new equipment is created.

One significant reason for this expansion is the increased utilization of medical devices in day-to-day care, particularly with an aging population. The devices need to be tested so they can function properly within the body and do not lead to dangerous reactions. Biocompatibility tests come into play here. These tests examine the extent to which a device can function without harming adjacent tissue or leading to side effects. With more technologically advanced devices being developed, this type of testing will be crucial even more so. Chemistry tests will also become crucial in future medical device testing. These tests identify any toxic chemicals or materials that may be harmful to patients.

As medical devices get smaller and technologically advanced, even a small piece of material can harm a person's health. It is for this reason that chemistry testing will still be an integral component of the industry. The emphasis will not only be placed on what is contained in the device, but how those materials degrade over time or how they affect the human body. Sterility tests and microbiology will remain an essential component of the service. Since instruments and implants are inserted into the body, even a minute amount of bacteria can lead to infection. Sterility testing ensures that the device is free from any kind of germs when it arrives at a hospital. With more procedures being performed through minimally invasive techniques, maintaining devices as sterile as possible will be more critical than ever. Package testing will become increasingly important as well. It's not sufficient that a device is safe when it leaves the plant; it needs to remain so until it is employed. This service ensures the packaging keeps the device safe while traveling and sitting in storage. Over the next few years, as devices travel farther distances and through numerous hands, this type of testing will increase in frequency and necessity.

By Phase

The global medical device testing services market is likely to keep expanding steadily as medical technology continues to progress. As human beings live longer and expect quality healthcare, the need for safe and quality medical devices increases. Testing services play an integral role in this. They ensure that every device is credible prior to reaching patients. These services will become even more critical as businesses struggle to keep pace with tighter regulations and the increasing demand for quality assurance throughout the healthcare sector. Testing of medical devices is usually split into two broad phases preclinical and clinical.

During the preclinical phase, there is an emphasis on ensuring that the device functions as required in a controlled environment before it is actually tested in human subjects. This stage will usually involve mechanical checks, biocompatibility tests, and electrical safety tests. These processes enable companies to identify potential issues early. In the future, advanced tools such as digital twins and AI simulations could be applied in this stage to model how a device will work, which could conserve time and resources. Preclinical testing will persist in providing the basis for ensuring devices are safe before proceeding. After a device clears preclinical testing, it enters the clinical stage. This is where it is tested on humans under close observation.

This process is designed to ensure the device is not only functional but also safe for use in actual conditions. With advancing technology, clinical testing may also be aided by wearable sensors and mobile monitoring, which could provide quicker and more detailed feedback. These improvements would allow for issues to be identified sooner and enhance patient safety. Over the next few years, both phases will probably be employing smarter, data-based systems that streamline the process. The global medical device testing services market isn't merely expanding it's evolving. Businesses will have to adapt to new approaches, tools, and expectations. This shift is not only about following regulations but also about being ready for what’s next in medical care.

Faster approvals, better testing methods, and smarter use of data will shape how devices are tested and approved. As healthcare keeps evolving, testing services will remain a key support system in bringing safe and effective devices to patients around the world. The emphasis will remain on safety, precision, and confidence, particularly as innovation continues to challenge the limits of what medical devices can accomplish.

By Device Class

The global medical device testing services market is continuously expanding, fueled by increasing demand for effective and safe healthcare solutions. With the development of medical technology and the shift towards patient-centric healthcare, making medical devices more reliable and safe is increasingly important. The market is instrumental in supporting manufacturers in conforming to regulatory requirements and enhancing the quality of devices utilized in hospitals, clinics, and home care facilities. With increased focus on patient safety, the value of high-quality testing increases, affecting innovation and compliance within the medical industry. In the future, the necessity of device testing will continue to grow.

As medical devices become more interconnected, digital, and data-intensive, businesses will be required to demonstrate their safety and efficacy under even more stringent regulations. Healthcare agencies and governments are laying greater emphasis on making sure that every device, ranging from the most mundane tools to the most sophisticated implants, is put through intense testing before it reaches patients. This will make sure that the performance of every device meets safety standards in actual use conditions. This in turn will urge manufacturers to depend even more on testing service providers to help the approval process. By device class, the global medical device testing services market is divided into three: Class I, Class II, and Class III Medical Devices. Class I Medical Devices, which are typically of least risk, nevertheless need precise testing to confirm their quality and operation.

These can be things like bandages or hand instruments. They may not appear complicated, but any failure would cause problems, so careful examination is critical. Class II Medical Devices, which present a greater risk than Class I, require more comprehensive assessments. These devices may be such things as infusion pumps or power wheelchairs. Testing here not only ensures quality but also considers safety in more complex use-cases. Last, Class III Medical Devices are the most-risky category. These are devices that aid or sustain life, for example, pacemakers or implantable defibrillators. They are thoroughly tested and are required to demonstrate that the device will safely function over an extended period, usually through both laboratory and practical simulations. In the near future, automation, artificial intelligence, and connected diagnostics will be part of device testing on a regular basis. This transition will enable service providers to accelerate the process without compromising on accuracy. Therefore, the global medical device testing services market is likely to remain crucial not only in fulfilling current requirements but also in defining tomorrow's healthcare solutions.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$10,703.30 million |

|

Market Size by 2032 |

$19,907.70 Million |

|

Growth Rate from 2025 to 2032 |

9.5% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global medical device testing services market is gradually transforming as the healthcare sector moves toward more advanced solutions for quality, safety, and regulatory compliance. As technology becomes more integrated into healthcare, the importance of rigorous testing grows. Manufacturers must meet high standards to bring their devices to patients safely. This demand for accuracy and safety is shaping the direction of the market and will continue to do so in the years ahead. The future will likely see more automated and real-time testing tools being adopted to reduce risks, speed up approval times, and improve patient outcomes.

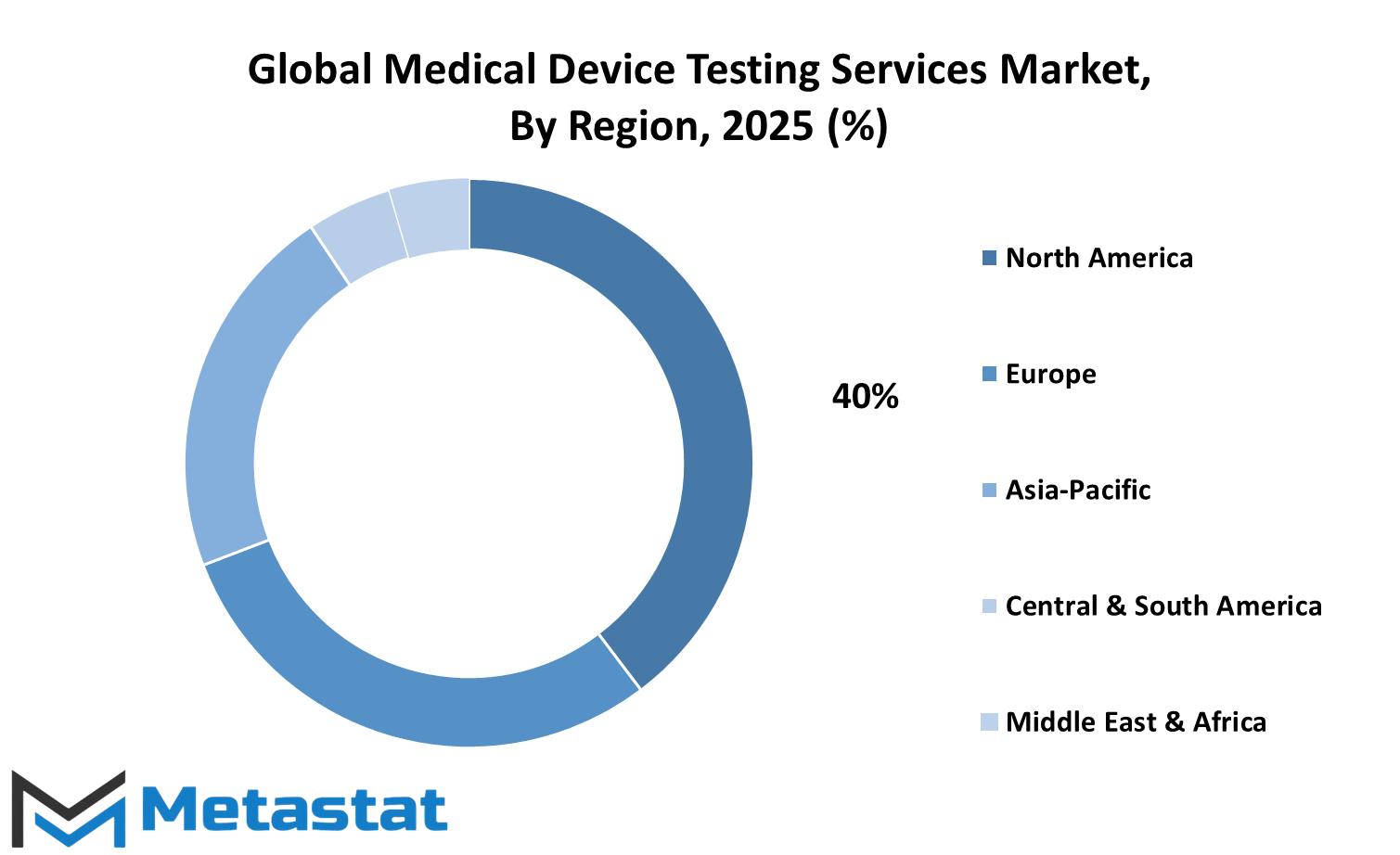

From a geographical standpoint, the global medical device testing services market shows different growth patterns across regions. North America holds a strong position, mainly because of ongoing innovations and well-established healthcare systems in the U.S., Canada, and Mexico. The U.S., in particular, is investing heavily in research and regulatory improvements, which will support long-term growth in the medical device sector. Europe, with countries like the UK, Germany, France, and Italy leading the way, is also investing in testing infrastructure. This region is expected to continue playing a major role in raising safety standards and introducing stricter compliance processes.

In the Asia-Pacific region, nations such as India, China, Japan, and South Korea are quickly building their presence in the global medical device testing services market. With growing populations and rising healthcare needs, there is pressure to produce safe, reliable medical equipment. These countries are likely to focus more on domestic production backed by local testing services, cutting down on dependence on foreign verification. As the demand for healthcare devices rises, this region is set to become a key area for future market expansion.

South America, with Brazil and Argentina at the front, is gradually catching up. While growth is slower compared to other regions, increased government spending and interest from foreign investors could improve testing capabilities there. Similarly, the Middle East & Africa, particularly the GCC countries, Egypt, and South Africa, are expected to make slow but steady progress. As healthcare awareness rises and infrastructure improves, these regions will likely play a bigger part in global developments.

Looking ahead, the global medical device testing services market will depend not just on technological progress, but also on global cooperation, regulation alignment, and the ability to adapt quickly to changing healthcare needs. The goal will always be the same: ensuring every device is safe, reliable, and ready to improve lives.

COMPETITIVE PLAYERS

The global medical device testing services market is expected to play an increasingly important role in shaping the future of healthcare. With the growing demand for safe and effective medical devices, the need for reliable testing services is only becoming more critical. This industry supports the development and approval of a wide range of devices used for diagnostics, treatment, and patient monitoring. Testing services ensure that devices meet strict safety and performance standards before they reach the hands of healthcare providers and patients. As innovation continues to grow in medical technology, the importance of thorough and precise testing will grow with it.

Looking ahead, the global medical device testing services market will likely see greater involvement from both established firms and emerging companies that bring fresh methods and technologies. The key players in this field have already built strong reputations for providing high-quality testing and validation services. These companies include SGS SA, Laboratory Corporation of America Holdings, Nelson Laboratories, LLC, TÜV SÜD, Charles River Laboratories, and Element Minnetonka, among others. Their experience and deep understanding of regulatory guidelines help medical device manufacturers navigate the approval process smoothly.

More companies are beginning to rely on these services, not just to meet regulatory requirements, but also to build trust with users. As patient safety and performance reliability remain at the forefront, testing providers are investing in better facilities and more advanced testing methods. This includes simulation tools, faster turnaround times, and stronger data analysis. In the future, we may also see increased use of automation and artificial intelligence to handle large volumes of testing data more accurately and efficiently. However, even with automation, human oversight will still be key to ensuring that every step meets the right standards.

Competition among service providers will also push the industry forward. As more players enter the global medical device testing services market, those that can offer faster results, better customer service, and more flexible solutions will likely gain an advantage. Established companies like Intertek Group Plc, Eurofins Scientific, and WuXi AppTec will continue to refine their offerings to stay ahead. At the same time, companies such as PPD Inc., BSI Group, UL LLC, and NSF International will focus on expanding their capabilities to handle new types of medical devices.

With rapid advances in wearable health tech, implants, and smart diagnostic tools, the global medical device testing services market is set to expand steadily. Companies that stay committed to quality, speed, and innovation will shape the way medical devices are tested and trusted in the years to come.

Medical Device Testing Services Market Key Segments:

By Service

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Package Validation

By Phase

- Preclinical

- Clinical

By Device Class

- Class I Medical Devices

- Class II Medical Devices

- Class III Medical Devices

Key Global Medical Device Testing Services Industry Players

- SGS SA

- Laboratory Corporation of America Holdings

- Nelson Laboratories, LLC

- TÜV SÜD

- Charles River Laboratories

- Element Minnetonka

- North America Science Associates Inc. (NAMSA)

- Eurofins Scientific

- Pace Analytical Services LLC

- Intertek Group Plc

- WuXi AppTec

- PPD Inc.

- Sterigenics International LLC

- BSI Group

- UL LLC

- NSF International

- Medistri SA

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252