MARKET OVERVIEW

The US construction spending market is an integral part of the country's economic landscape during this period of continued growth and change in the construction industry. The market includes funds and investments on construction activities of the residences, commercial places, and infrastructures within the United States. A domestic analysis of trends and patterns in this market tells not only about the nation being in economic strides but also gives quite a few insights into its wider family socio-economic context.

Thus, construction spending becomes a critical determinant of the allocation and investment of resources and capital within the sector concerning the health of the economy overall. Construction spending is not limited to the manifestations of the obvious and visible matte structures dotting the skyline; it also delves deeply into the foundations of economic development, job creation, and technological advancement. It manifests a nation's commitment to progress and a strategic vision regarding sustainable growth.

Once again this figure represents a simple, absolutely multi-faceted approach to understanding the US construction spending market: Residential construction mirrors people's housing needs and desires, while commercial construction shows just what the businesses want in modern, functional spaces. Infrastructure spending underlies the connectivity and accessibility essential for developing regionalism and, consequently, the economy-wide integration of those regions.

In the complex and interwoven leaps of market forces, the US construction spending market is a barometer of economic vitalities. It sways with the current and changes in the demographic situation and technology advances, and shifts in policy. When construction spending goes up or down, it also becomes a projection or a combination of the vision of the nation, crystallized into concrete and steel.

Another complication would be the cyclical nature of this industry. Hence, in the downturn, spending on construction would decrease as projects are deferred or halted, while high investment occurs in strikes during boom periods, signifying optimism among investors regarding future growth. As is always the case, this combination results in a very dynamic environment filled with expected and unexpected things that stakeholders have to juggle with when it comes to spotting action.

As the US construction spending market continues to undergo changes, it is necessary to comprehend its repercussions within these connected industries and the entire economic ecosystem. From the raw materials required in making structures to the skilled labor needed to drive projects forward, the market creates a fabric of these linkages. Government policies and regulations, too, are the ones determining the fate of construction spending toward project timelines and even environmental sustainability aspects.

And that is the US construction spending market: rather than a ledger of entries and exits within a defined accounting period, it is a very long tale of a nation's aspirations, resilience, and adaptability to the changing times. Just numbers and statistics do not define it; rather, it forms part of the collective effort to build a future that is structurally sound while socially and economically vibrant. Construction spending is the story of growth, development, and the interminable chase behind a better tomorrow.

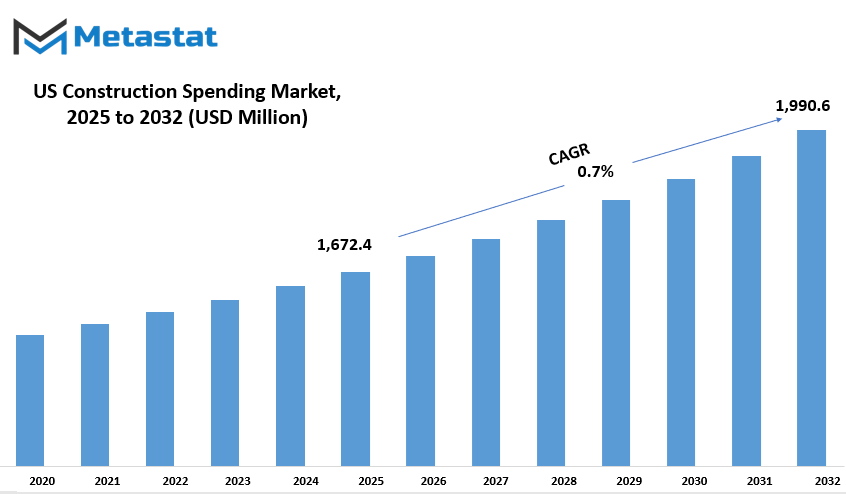

US construction spending market is estimated to reach $1,990.6 Million by 2032; growing at a CAGR of 0.7% from 2025 to 2032.

GROWTH FACTORS

A variety of factors that drive the growth of the US construction spending market stand opposed to several challenges posed against such growth by themselves. Major factors driving growth include population increase and urbanization, where more people coming into urban areas will have more requirements of space, residential areas, and commercial areas that require the construction industry to provide such answers.

Another major driver of the market is the economic growth conducive to increased disposable income. A viable economy leads to investments in construction projects to build new structures and infrastructure and, therefore, serves as a catalyst for expansion in the sector.

Nonetheless, challenges also abound in the market. With unforeseen economic changes come fluctuations, which impact investment considerations in the construction industry. Economic uncertainties can, indeed, be potential obstacles to the steady growth of this market.

And yet, the ever-escalating costs associated with construction become a great issue. Factors such as varying prices for raw materials and increasing labor costs are inhibiting construction spending market growth. This further illustrates the susceptibility of the industry to outside economic factors and cost pressures.

Contrary to these challenges, emphasis on sustainable building and green practices has increased. The importance of environmentally friendly approaches is now being recognized by the construction sector with increasing urgency. While the integration of such practices is well justified by global environmental concerns, it also establishes the foundation for further growth in the market.

Furthermore, infrastructure modernization and renovation projects provide much opportunity for the construction spending market. As existing structures have to be updated and improved, the need for construction services to carry out these projects would remain constant. This would add to the market's resilience and adaptability against economic uncertainty.

A dynamic interplay of factors are at work and affect the US construction spending market. Growth is propelled by factors like population expansion and urbanization, economic prosperity, and disposable income. Conversely, some challenges, such as economic fluctuations and rising construction costs, put forth increasing demand for adaptability from the industry. Adoption of sustainable practices and seizing opportunities in infrastructure work are two paramount ways for sustaining growth and vibrancy of the construction spending market in the years ahead.

MARKET SEGMENTATION

By Type

The US construction spending market have two primary divisions based on funding, namely Private Construction and Public Construction. This division shows the clear distinction in two major components that together make up the overall field of construction spending in the United States.

In a Private Construction state, the project has a principal and funding through private sources, such as individuals, corporations, or private organizations. Large residential, commercial, and industrial-type developments are typically included. Private funding for the construction is one of the major considerations in the entire picture of construction spending.

However, Public Construction has to do with the projects that are executed and funded by government authorities in all its forms, that is, federal, state, and local governments. A public construction project could be specifically an assortment of activities ranging from infrastructure developments such as highways, bridges, and public buildings to park and recreation places. This activity has funding from public coffers, thus indicating a slightly different dimension of overall construction spending together with private construction.

Private Construction and Public Construction provide a practical framework of understanding US construction spending market. It tells us about the various actors and funding sources that pose influence on the construction activities in the country. This classification allows finer trend analysis and helps stakeholders understand what varies on accounting construction spending in either sector.

The US construction spending market is categorized into Private Construction and Public Construction for a broader understanding of the various development projects happening in the country. The segmentation aids in the thorough examination of the construction landscape, allowing stakeholders to make informed decisions and understand each category's conflicting dynamics.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,672.4 million |

|

Market Size by 2032 |

$1,990.6 Million |

|

Growth Rate from 2024 to 2031 |

0.7% |

|

Base Year |

2024 |

By Application

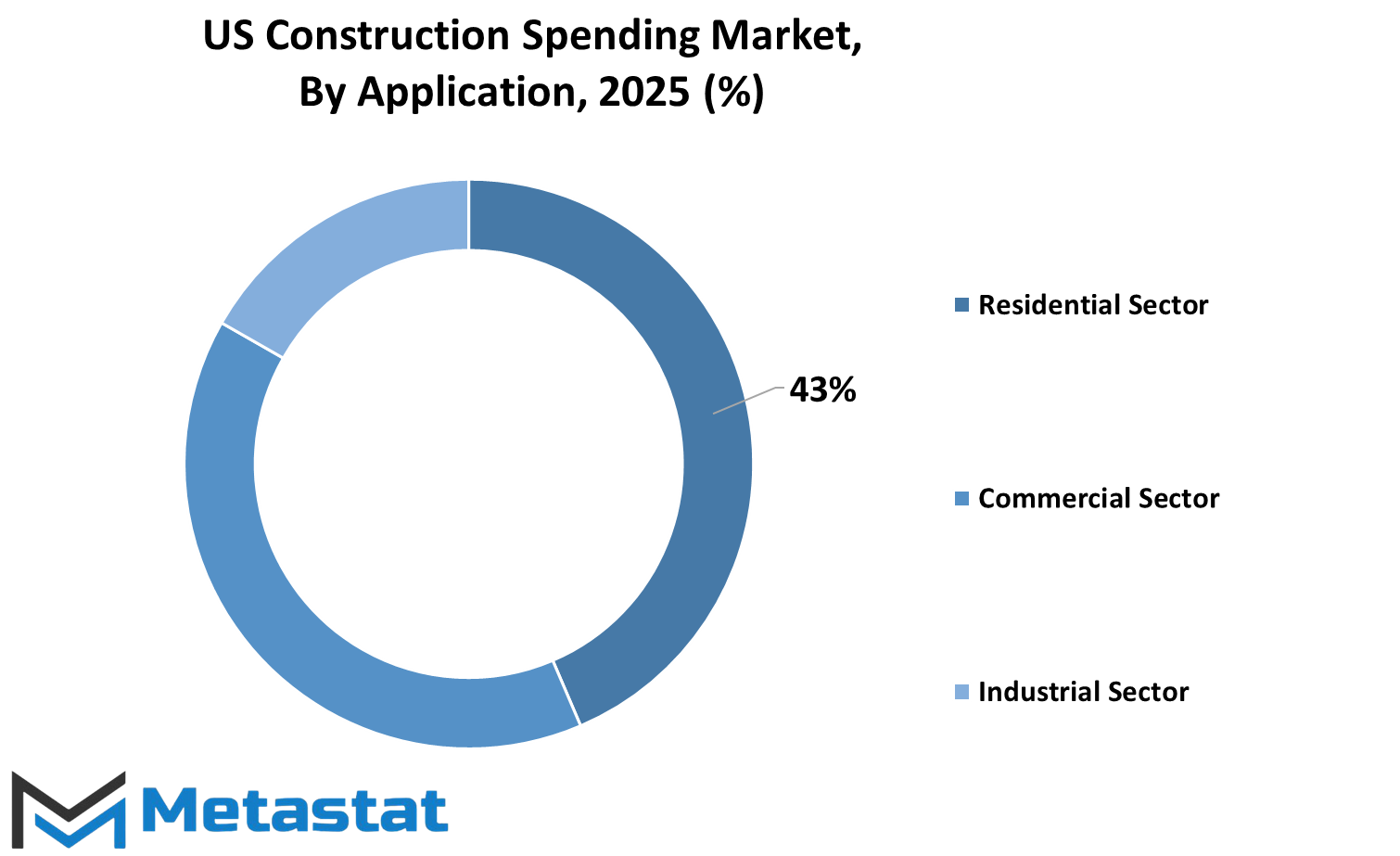

On the basis of application, the US construction spending market mainly comes under three heads, namely Residential, Commercial, and Industrial. It is through these areas that the different expenditures in the construction industry can actually be understood and analyzed.

The Residential Sector covers construction activities concerning housing space in which residential homes, apartments, or other types of buildings with residential spaces are built. Expenditure on this sector would represent current demand for housing as well as urban and suburban sprawl.

Construction expenses in this Commercial Sector designate expenditures for building structures for office, retail, and public institution uses for non-residential development. Spending in this sector elucidates the liveliness of all business and commerce, thus showcasing trends in the economy and the subsequent need for modern infrastructure functionalities to support commercial activities.

The Industrial Sector is for all construction within manufacturing facilities, warehouses, and industrial complexes. Allocations in this sector depict investments in production and logistics, which correspond to the needs of the industrial landscape and are adaptable to the evolving nature of various sectors.

The three application-based sectors through which the US construction spending market is broken down would indicate very clearly where the funds are poured into. This can also give an idea of the heartbeat of the economy in relation to societal movements and improved decision making regarding investments and allocation of resources in the construction industry. Such segmentation improves the accuracy of market analysis to give more insightful dynamics of what shapes US construction spending market.

COMPETITIVE PLAYERS

With the US construction spending market flourishing, it houses many influential major players, such as the overleaders AECOM and Balfour Beatty US, in its ranks. These pivotal players have an important influence over the dynamics and course of the industry.

AECOM happens to be among significant contributors within this US construction spending market, thus holding the credits for lending its expertise and capabilities. The company fully involves itself with almost all angles within construction; thus it is known as multiple and capable marketplace player. Strategic initiatives and projects of AECOM are among those responsible for the whole industry dynamic's vibrancy and competitiveness.

Quite the same, Balfour Beatty US is another prominent company worth reminding in this US construction spending market. The activities and projects of this firm generally add value to the industry's overall development and growth. Balfour Beatty US, like AECOM, plays a significant role in framing the contour of the market through its wealth of experience and resources towards progress.

In Construction Spending, the presence and influence of these key players apparently go beyond mere participation; their strategies, execution of projects, and market insights build competitiveness in the industry. AECOM and Balfour Beatty US are just some who leave a footprint in the narrative of construction spending in the United States.

As the industry adapts to changes, these key players remain changeling and still hold the market with their transformation effects in Construction Spending. Their impact reveals the importance of established players concerning market growth, innovation, and direction. In other words, you can say that competitive players in the US construction spending market will drive the industry into where it is now and where it is headed in the future.

US Construction Spending Market Key Segments:

By Type

- Private Construction

- Public Construction

By Application

- Residential Sector

- Commercial Sector

- Industrial Sector

Key Global Construction Spending Industry Players

- AECOM

- Balfour Beatty US

- Bechtel Corporation

- Black & Veatch

- BrandSafway

- Clark Construction Group

- DPR Construction

- EMCOR Group, Inc.

- Fluor Corporation

- Gilbane Building Company

- Granite Construction Inc.

- Kiewit Corporation

- Mastec, Inc.

- McCarthy Holdings, Inc.

- Michels Corporation

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252