MARKET OVERVIEW

The global industrial hoists market is at the focal point of the heavy machinery industry, providing the essential lifting technology to factories, construction sites, automobile plants, and warehouses across the world. Industrial hoists are not devices; they are an integral part of the material handling processes that demand safety and precision. As global operations get more mechanical and there is increased demand for efficient load transportation, the application of these systems will increase extensively. They will be key factors in streamlining operations where manual work cannot meet performance or safety standards.

This business will not become stagnant; it will expand and develop based on operational needs, technology advances, and evolving industrial procedures. Varying hoist systems electric, pneumatic, hydraulic, and manual will be appropriate according to usage intensity, weight-bearing capacity, and environmental restriction. Clean-room applications will attract certain industries to the electric hoists, while others will continue with the use of air-powered units in explosive atmospheres. This category of product utility will still influence the way the market addresses specific industrial issues without succumbing to the single-size-fits-all strategy.

An understanding of the global industrial hoists market also involves looking beyond the item itself. The dialogue between end-users, system integrators, producers, and maintenance experts creates a supply network that hangs on dependability and effectiveness. A collapse of an assembly line or a failed load move can result in losses many times greater than the cost of the hoist. Uptime and efficiency will thus be at the forefront of both operators' and buyers' minds. In the long term, the suppliers will not only be selling equipment but also extended service contracts, data management services, and predictive maintenance strategies. This shift from a mechanical-only to a technology-facilitated service model will ultimately redefine the market's operational paradigm.

The regional requirements for this market will still be heterogeneous. North American and European industrial regions will emphasize regulatory compliance, compatibility with automation, and lifecycle reliability. Conversely, areas of high infrastructure development like the Middle East and parts of Asia will remain to emphasize scalability and solid load capacities in unstable circumstances. These differences will ensure that the market will have the same technology platforms but will differ as much as what those platforms will appear like in terms of implementation, marketing, and support.

Critically, the global industrial hoists market cannot be viewed in product manuals or tonnage of shipments alone. Its scope extends to workplace safety policy, staff training, and energy management methods. The final success of the hoist systems will not only depend on the machine itself but also on how it interacted with digital systems, adapted to local requirements, and fulfilled evolving operating goals.

While most industrial sectors rely on top-level automation, hoist systems remain inherently physical equipment that must function sturdily in challenging conditions. The global industrial hoists market will in the future continue to support the bedrock of worldwide manufacturing and shipping operations, evolving not through carte blanche transformation, but through targeted innovation driven by the day-to-day industrial requirements.

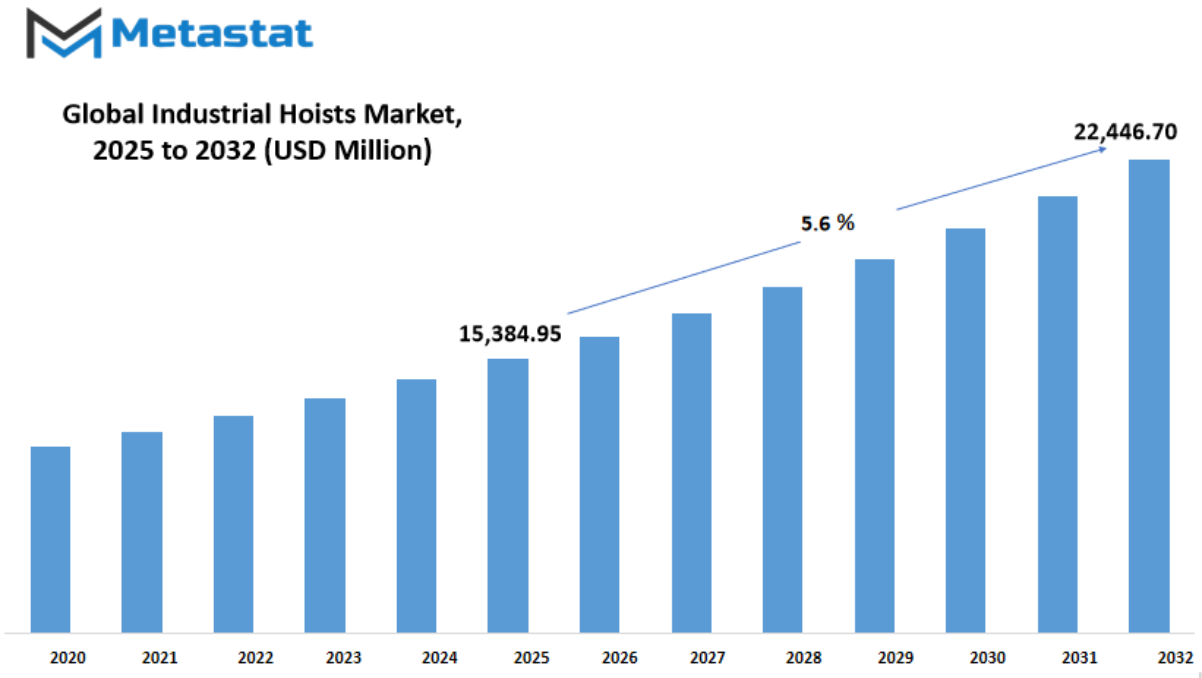

Global industrial hoists market is estimated to reach $22,446.70 Million by 2032; growing at a CAGR of 5.6% from 2025 to 2032.

GROWTH FACTORS

The global industrial hoists market is expected to see significant changes in the years ahead as industries continue to modernize. As the manufacturing and construction sectors grow, the need for better ways to move heavy loads becomes more important. Hoists are tools that help lift and position materials safely and quickly, making them a valuable part of many industrial setups. With more factories aiming to improve how they handle materials, the demand for hoists will continue to rise.

One of the biggest reasons for this growth is the push for automation. Many industries want to speed up operations while reducing the need for manual labor. Hoists that are part of automated systems make it easier to complete tasks without as much physical effort. Alongside this, there is a growing focus on worker safety. Companies are looking for equipment that not only gets the job done but also reduces risks. Hoists that meet strict safety standards are more likely to be used, especially in places where workers often deal with heavy lifting.

Still, there are a few things that make it harder for the global industrial hoists market to grow quickly. Smaller companies often struggle with the high cost of buying and maintaining this equipment. For them, the upfront price can be a challenge, and keeping the equipment in good shape also requires regular attention and spending. Another problem is the risk involved when hoists are not used properly. If they are overloaded or handled without care, they can cause accidents. This makes some companies think twice before investing in them.

Despite these challenges, the future of the global industrial hoists market holds a lot of promise. More companies are beginning to use smart hoists that connect to the internet and other systems. These hoists can help track performance and send alerts when something is wrong. This kind of real-time monitoring makes it easier to fix problems before they lead to bigger issues. It also supports better planning for maintenance, which helps avoid sudden breakdowns. As technology keeps improving, more businesses will see the benefits of these smart systems, opening new doors for growth and innovation in the market. With the right balance of safety, cost, and efficiency, industrial hoists will remain a key part of future industrial operations.

MARKET SEGMENTATION

By Type

The global industrial hoists market is expected to see gradual but consistent growth in the coming years, as industries continue to focus on improving efficiency, safety, and lifting capacities across different sectors. Industrial hoists are lifting devices that help handle heavy loads in factories, warehouses, construction sites, and other industrial areas. The market, by type, is broken down into electric hoists, pneumatic hoists, manual hoists, chain hoists, and wire rope hoists. Each type serves specific needs and is chosen based on the weight, speed, and frequency of lifting required in a particular setting.

Electric hoists are likely to become even more common as industries shift toward automation and smart systems. These hoists offer faster operations, less physical strain, and are ideal for environments where lifting tasks happen frequently. As more businesses install automated systems, electric hoists will fit in easily and boost overall productivity. Pneumatic hoists, powered by compressed air, are often used in areas where fire hazards are a concern. In the future, as safety standards rise, these hoists might see more use in sectors like oil and gas, or any environment where sparks could be dangerous.

Manual hoists will continue to serve in locations where power sources are limited or where lifting tasks are occasional and don’t require much speed. They are cost-effective and easy to maintain, making them suitable for smaller operations. Although they may not be the top choice for large-scale operations, their role in the market will remain steady. Chain hoists are known for their strength and are useful in settings where heavy loads need to be lifted with precision. These are expected to see steady use in mechanical workshops and assembly lines. Wire rope hoists, on the other hand, offer high lifting speeds and are preferred for very heavy loads and high-frequency use. They are likely to remain popular in large-scale production plants, especially those working with steel, construction equipment, or heavy parts.

Looking ahead, the global industrial hoists market will likely grow not just in size but also in how advanced and reliable these systems become. With smart manufacturing gaining more attention, hoists could be integrated with monitoring tools, sensors, and remote operation systems. The focus will stay on making lifting processes safer, quicker, and more cost-effective. As industries keep evolving, the demand for the right type of hoist for each task will shape how the market moves forward.

By Load Capacity

The global industrial hoists market is expected to see significant progress in the coming years, largely driven by growing demand across various industries. These hoists are used to lift or lower heavy materials with the help of drums or lift-wheels and are often powered by electricity, hydraulics, or air. Their application is wide-ranging, from warehouses and factories to construction and logistics. As industries become more focused on increasing productivity and safety, the need for reliable and efficient lifting equipment will continue to grow.

Looking at future trends, the demand for hoists with smarter features and better control systems is rising. Many manufacturers are investing in automation and remote operation technologies to make industrial hoists more efficient. This shift will likely lead to increased adoption across sectors, particularly in areas where precision and worker safety are critical. The inclusion of sensors and monitoring systems will help detect potential issues early, reducing downtime and maintenance costs. As technology continues to improve, hoists will become more advanced, allowing for better performance even under demanding conditions.

When considering load capacity, the global industrial hoists market is divided into five segments: Under 1 ton, 1 to 5 tons, 5 to 10 tons, 10 to 20 tons, and Above 20 tons. Each of these categories serves different needs. For instance, hoists under 1 ton are often used in smaller workshops or for lighter tasks. The 1 to 5 tons segment is popular in general manufacturing and repair settings. Hoists in the 5 to 10 tons and 10 to 20 tons ranges are more common in heavy-duty industries like steel, automotive, and machinery. Equipment above 20 tons is mostly used in very heavy operations such as shipbuilding or mining, where the scale of materials handled is much larger.

As infrastructure development and industrial projects increase across the globe, particularly in emerging economies, the demand for hoists across all load categories will likely increase. With rising investments in energy, transport, and construction sectors, the need for safe and efficient lifting solutions will become more important. Manufacturers will also need to keep up with environmental standards, pushing them to develop energy-efficient and low-noise models.

In the future, the global industrial hoists market will not only grow in size but also in complexity. Companies that stay ahead by adopting new technologies and offering customized solutions will likely lead this transformation.

By Mechanism Type

The global industrial hoists market is expected to witness noticeable changes in the coming years, especially when looking at it through the lens of mechanism types. As industries continue to focus on efficiency, safety, and automation, the demand for reliable lifting solutions is expected to grow. Different mechanism types serve unique roles, and each one is likely to see specific improvements based on the needs of the industries that use them. Gear drive hoists, for example, are popular for their strong power transmission and durability. Over time, these hoists will likely become more compact and energy-efficient, offering better load control while keeping operational noise low. As manufacturers push for greener alternatives, gear systems may also include smarter technology that helps reduce unnecessary wear and tear.

Direct drive hoists are gaining interest because of their simple structure and lower maintenance needs. These are expected to become even more important in modern workplaces where downtime is costly. By reducing the number of moving parts, future versions of these hoists could increase reliability while decreasing the chances of malfunction. Chain driven hoists are already well-known for their toughness in heavy-duty settings. Future updates may include features like remote operation or built-in sensors that monitor load weight and position, allowing for safer and more precise handling.

Cable driven hoists are often chosen for operations that require long lifting distances or vertical reach. In the future, these may include improved cable materials that are lighter but still strong, reducing the strain on motors while increasing overall safety. With the advancement of smart manufacturing, these hoists may also come equipped with data-sharing capabilities, making it easier to schedule maintenance or adjust settings based on workload.

Hydraulic hoists will likely continue to be used in environments where high lifting power is needed. However, newer models may focus on reducing oil leaks and improving energy use. Some could even shift towards hybrid systems that use a combination of electric and hydraulic power to get the best of both worlds.

As industries such as construction, mining, and manufacturing grow and evolve, the global industrial hoists market will keep adapting. Each mechanism type brings its own strengths, and future versions are expected to offer even greater performance, lower energy use, and safer operations. By combining strength with smart technology, industrial hoists will become a more important part of modern production systems.

By Application

The global industrial hoists market is expected to grow steadily in the coming years due to the rising demand across several industries. These hoists play a key role in handling heavy loads efficiently and safely. Their use is expanding not only in traditional sectors but also in newer areas where automation and better safety practices are becoming important. As industries look for ways to improve workflow and reduce manual effort, hoists offer a practical solution. They help in lifting and moving materials that would otherwise require large amounts of human labor, reducing the risk of injury and increasing productivity.

When looking at the market by application, manufacturing continues to lead. In this sector, hoists are essential for moving materials through different stages of production. Whether it is raw materials being lifted onto machines or finished products being moved to storage, hoists are used throughout the process. With many factories upgrading their facilities to match global standards, the demand for modern, durable hoists is expected to increase.

The construction industry also contributes significantly to this market. Construction sites often deal with heavy equipment, steel parts, and concrete. Hoists are used to lift these materials to different levels of a building, especially in high-rise projects. As urban areas expand and the number of infrastructure projects rises, the need for reliable lifting tools will grow as well.

The aerospace sector uses hoists in both aircraft assembly and maintenance. The precision and safety requirements in aerospace are very high. Hoists are used to handle parts like engines, wings, and other large components that require careful placement. As the aviation industry prepares for more advanced aircraft and larger fleets, hoist systems will become even more important.

In the marine sector, hoists are used for shipbuilding, maintenance, and port activities. These tasks often involve moving very large and heavy items. With global trade increasing and the need for larger cargo ships rising, hoists that can handle massive loads are in greater demand.

The automotive industry depends on hoists for assembly lines, repair shops, and testing areas. Cars and trucks are made of many parts that need to be lifted and placed accurately. As electric vehicles and automation change how cars are made, the tools needed, including hoists, will also need to adapt.

Finally, other industries such as mining, energy, and warehouses are also starting to use industrial hoists more often. Their focus on safety, speed, and reducing labor costs will likely drive future growth.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$15,384.95 million |

|

Market Size by 2032 |

$22,446.70 Million |

|

Growth Rate from 2025 to 2032 |

5.6% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

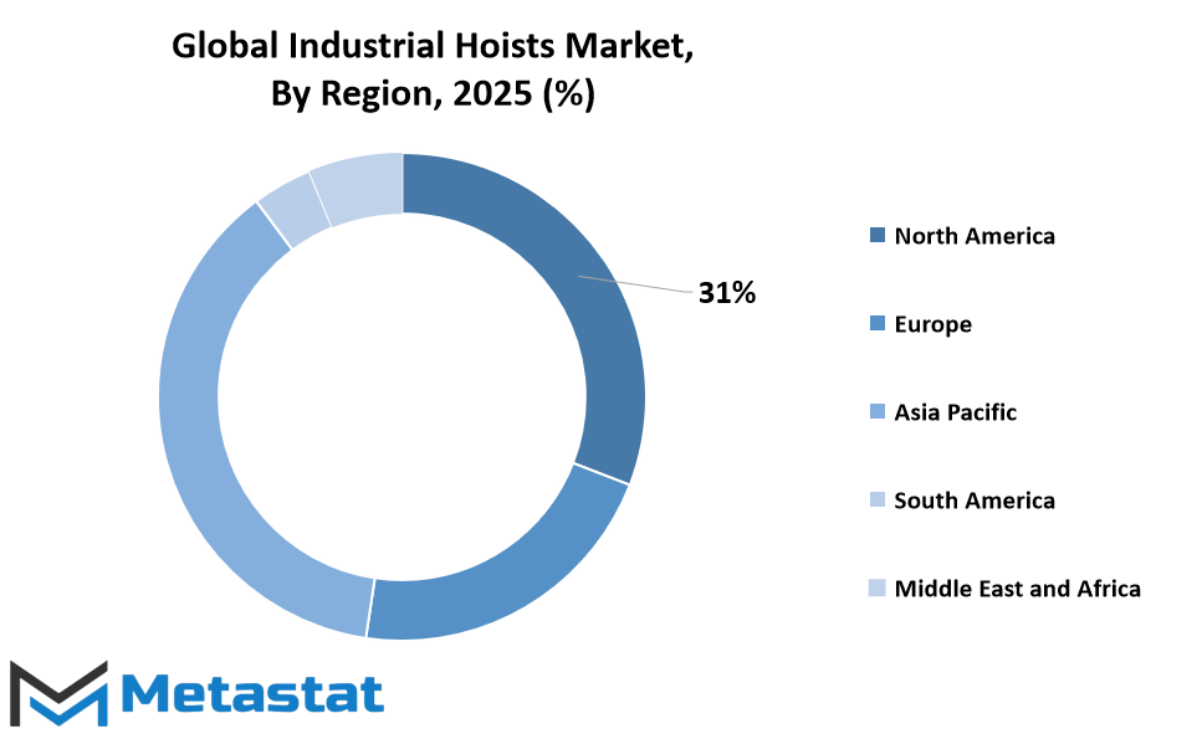

The global industrial hoists market is growing steadily across different regions, and its future looks promising as industries continue to expand and modernize their operations. When we look at the geographic breakdown, each region plays a unique role in shaping the current trends and future direction of this market. North America remains one of the most advanced regions, with countries like the U.S., Canada, and Mexico investing in infrastructure upgrades and automation. These developments support the wider use of industrial hoists across sectors such as construction, manufacturing, and warehousing. The growing need for efficient material handling will continue to drive demand in this region.

Europe also holds a significant place in the industrial hoists market. The UK, Germany, France, and Italy are among the leading countries that contribute to the market’s stability and growth. These countries are focusing more on energy efficiency and safety, which encourages businesses to adopt better hoisting systems. As companies look for ways to improve productivity and reduce labor risks, the demand for advanced hoist solutions will increase. Technological improvements and stricter safety regulations will likely push more companies to modernize their lifting equipment, creating steady growth across the European market.

Asia-Pacific is expected to experience the fastest growth in the coming years. Nations like India, China, Japan, and South Korea are industrializing rapidly, with major investments in manufacturing, transportation, and logistics. The expansion of e-commerce and the need for faster delivery services are also pushing the demand for reliable hoisting systems. As companies aim to meet higher production demands, industrial hoists will become more essential in helping them manage heavy loads with ease. The region’s cost-effective manufacturing and growing exports make it a strong force in this market.

South America, including countries such as Brazil and Argentina, is gradually expanding its industrial base. While the pace is slower compared to other regions, government efforts to improve infrastructure and attract foreign investment are expected to support growth. Meanwhile, the Middle East & Africa is showing steady development, especially in GCC countries, Egypt, and South Africa. With ongoing construction projects and a growing emphasis on economic diversification, industrial hoists are becoming increasingly important.

Looking ahead, all these regions are expected to play important roles in shaping the future of the global industrial hoists market. As the need for efficiency, safety, and automation rises, hoisting systems will be key tools in the ongoing transformation of industries worldwide.

COMPETITIVE PLAYERS

The global industrial hoists market is steadily moving toward a future shaped by innovation, automation, and strategic expansion. Many well-established companies are driving this shift, each aiming to strengthen their presence through technology integration, improved product design, and greater customer focus. As industries worldwide continue to seek efficient lifting solutions, manufacturers in this market are expected to play an even more central role. With growing demand from sectors such as construction, manufacturing, and logistics, companies are prioritizing research and development to stay ahead in a space that values reliability and performance.

Leading manufacturers like Kito Corporation, Demag (Konecranes), and Columbus McKinnon Corporation are investing in smart hoisting systems that are safer and easier to operate. These systems are expected to rely heavily on sensor technology and remote monitoring to reduce human error and equipment failure. Others, like Ingersoll Rand and ABUS Kransysteme GmbH, are focusing on increasing energy efficiency and reducing maintenance needs, recognizing that users want solutions that are cost-effective over the long run. Firms such as GH Cranes and Street Crane Co Ltd are also expanding globally, forming local partnerships or setting up regional hubs to ensure better service support.

Smaller but fast-growing players like Apollo Hoist, Tiger Lifting, and World Hoist are becoming more competitive by introducing niche products and targeting underserved markets. Their flexibility allows them to respond quickly to market trends and customer needs, which is increasingly valuable as industries shift towards leaner operations. Meanwhile, companies like Hitachi, Ltd. and Able Forge are using their long-standing industry experience to refine their products for high-demand environments, ensuring they meet strict safety standards while boosting performance.

Future developments in this market are likely to be shaped by automation and data integration. Predictive maintenance, driven by real-time data, will become more common as hoists become part of connected systems. Firms such as DELTA Hoisting Equipment and Donati Cranes may soon focus on user-friendly software interfaces that allow easier operation and troubleshooting. Sustainability is another growing factor, with companies exploring materials and technologies that reduce environmental impact.

As competition grows, innovation and adaptability will decide which companies lead and which follow. This push will benefit users, who will have access to safer, smarter, and more durable hoists. Over time, the global industrial hoists market will not only grow in size but also in capability, offering solutions that meet the future demands of a changing industrial world.

Industrial Hoists Market Key Segments:

By Type

- Electric Hoists

- Pneumatic Hoists

- Manual Hoists

- Chain Hoists

- Wire Rope Hoists

By Load Capacity

- Under 1 ton

- 1 to 5 tons

- 5 to 10 tons

- 10 to 20 tons

- Above 20 tons

By Mechanism Type

- Gear Drive Hoists

- Direct Drive Hoists

- Chain Driven Hoists

- Cable Driven Hoists

- Hydraulic Hoists

By Application

- Manufacturing

- Construction

- Aerospace

- Marine

- Automotive

- Others

Key Global Industrial Hoists Industry Players

- Able Forge

- ABUS Kransysteme GmbH

- Alimak Group (TRACTEL)

- Apollo Hoist

- Beijing Lieying Hoisting Machinery Equipment Group Co., Ltd.

- Columbus McKinnon Corporation

- DAESAN Inotech

- DELTA Hoisting Equipment

- Demag (Konecranes)

- Donati Cranes

- eepos GmbH

- Endo Kogyo Co.Ltd

- GH Cranes

- GIS AG

- HADEF

- Hitachi, Ltd.

- Imer International S.P.A

- Ingersoll Rand

- J.D. Neuhaus GmbH & Co. KG

- Kito Corporation

- Konecranes

- LIFTKET Hoffmann GmbH

- NIKO HELM HELLAS SA

- Novocrane

- PLANETA-Hebetechnik GmbH

- R&M Materials Handling Inc.

- Rema (Axel Johnson International)

- RWM Srl

- Street Crane Co Ltd

- SWF Krantechnik

- Tianjin Kunda Hoisting Equipment Co., Ltd.

- Tiger Lifting

- Verlinde SA

- William Hackett

- World Hoist

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252