MARKET OVERVIEW

The global travel insurance market primarily specialized in offering monetary protection as well as assistance to such visitors against unexpected incidents during the tour. These markets have primarily focused on the offer of insurance products that are going to provide protection against undesired situations like a scenario where tours are going to be cancelled, health cases, losses of baggage, delay in flights, among others that may disrupt traveling. With the global facilitation of international travel, entire travel insurance policies will be sought after in huge volumes for a tremendous amount of travelers globally. The global travel insurance market provides a foundation for travelling overseas for tourism, business, or studies.

It fills the chasm between the risks of travel and the tranquility of mind of a traveler; therefore, it guarantees that unforeseen events do not lead to significant financial or logistical hassle. Single trip, multi-trip, and long-stay coverages are offered by the market for different customer choices. Specialized products that target particular segments will be a characteristic of the industry-senior citizens, students, and corporate travelers. Technology will be a key component of the future global travel insurance market. Through digital platforms, mobile applications, and artificial intelligence, the sale, claiming, and management of travel insurance policies will all be transformed.

The customer experience will keep getting better with real-time alerts, online filing of claims, and customized suggestions. This will enable insurance companies to look at the data of travelers better, hence delivering more accurate and tailored solutions. The global travel insurance market coverage extends beyond policy level. Travel insurance policies for corporate and group groups will hold a more significant role with growing interest of businesses towards safety of employees on business trips.

Moreover, collaboration among insurers and tour operators, airlines, and banking institutions will play vital roles in promoting innovative products and routes of distribution. Thus, travel insurance will enter the mindset and consideration of tourists across the globe. Geographical diversification will remain the signature of the Global Travel Insurance industry as an increasing number of developing countries experience outbound tourism. Asian-Pacific, Middle Eastern, and Latin American nations will be the hubs in the development of the sector, with rising disposable incomes and a huge middle class eager to explore the world.

Existing markets in North America and Europe will shift towards new customer demands of green and environmentally sustainable travel insurance products that are on the same level as international trends.

The global travel insurance market will face the issues of frequency of climate-related interruptions and geopolitical tensions and world health in the future, so their insurance companies innovate towards creating policies that resonate with contemporary travel and incorporating policy coverage for contemporary risk and uncertainties. The policy will look to promote transparency and consumer awareness wherein travelers can make an informed decision about the optimal policy for their needs. The global travel insurance market will be the center of the travel ecosystem, evolving with technology, demographics, and new travel tendencies. Its capacity to give travelers financial protection and assurance will propel its growth to create a future where travel insurance is omnipresent and unavoidable in global traveling planning.

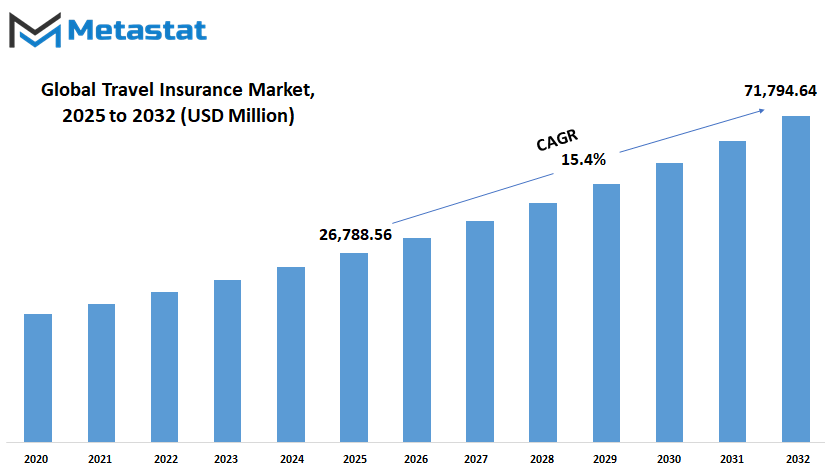

Global travel insurance market is estimated to reach $71,794.64 Million by 2032; growing at a CAGR of 15.4% from 2025 to 2032.

GROWTH FACTORS

In the near term, the global travel insurance market is likely to witness fantastic growth with the influx of international travel alongside growing financial security against unforeseen events. The world has witnessed tremendous increases in individuals traveling across borders because of numerous leisure, business, as well as personal reasons. This growth comes with a corresponding surge in demand for travel insurance as people try to protect themselves against unforeseen interruptions like medical crises, trip cancellations, or lost luggage. In addition, increased concern regarding the need for travel insurance is rising as a result of unstable global events like pandemics and political turbulence. These issues highlight the need to protect one's travel plans and thus insurance becomes an important component of worldwide travel. In spite of all these favorable factors, the market does have some challenges that will slow down its progress.

Top among these is the premium cost, which is extremely steep for full-value policies with extensive coverage of various risks. Such expenses will make many shun buying, particularly individuals who travel on limited budgets. The ignorance about the benefits of travel insurance or the hesitation to pay for coverage is another cause of resistance among some travelers. All these obstacles need more education and awareness campaigns by insurance companies to demonstrate the usefulness of spending money on such policies. Technological innovations will be revolutionary in restructuring the global travel insurance market in the future. Integration with travel booking websites and apps will simplify and make it more convenient for users to carry insurance.

Innovations with instant coverage choices provided directly at the point of booking can simplify the buying experience and thereby lead to more travelers buying protection. Mobile apps, with the ability to provide real-time updates, policy management, and claims support, will increase user interaction and confidence in travel insurance services. Emerging consumer expectations and preferences will also have a bearing on the future of the global travel insurance market. Consumers are now demanding tailor-made, flexible policies that cater to their individual requirements.

Once businesses and insurers start to cater to such demands, the market will continue to grow even larger, enabling current players as well as entrants to flourish in the business. While challenges have continued, the growing emphasis on risk management, in addition to the improvements in technology, would further set the stage for its robust growth in the years ahead.

MARKET SEGMENTATION

By Type

The global travel insurance market is slowly becoming extremely prominent as global travel continues to cost less and get more diversified. Travelers are becoming more aware of the numerous threats of unforeseen incidents or medical issues, cancellation of the trip, or loss of some of their possessions. With a growing demand, henceforth, travel insurance has emerged as a sought-after field of innovation in offering policies catering to diverse requirements. The prospects of this market are high in terms of growth, largely due to technological development and growing awareness towards personalized coverage. Single-Trip Travel Insurance that offers insurance cover to the traveler for a single trip is one of the leading segments of the global travel insurance market. This kind of insurance is particularly appealing to the occasional traveler who wants financial security for a specific trip.

Whether for travel on business or pleasure, single-trip policies are a reassurance without the need for long-term commitment. Future innovations in this category will involve personalized plans that can be designed for the destination or nature of travel so that the coverage is as close to individual needs as possible. Alternatively, Annual Multi-Trip Travel Insurance is targeted at frequent travelers and offers protection for several trips within a year.

This is an affordable as well as convenient option. It does not need an individual to purchase a new policy for each trip. With more individuals embracing lifestyles of frequent travel for business or pleasure, the need for these policies will keep increasing. Technology is most likely to be at the forefront here, making handling multiple trips and claims easier through easy-to-use apps or platforms. Last but not least, Long-Stay Travel Insurance protects individuals going abroad for longer durations of time.

Such coverage is appropriate for expatriates, students going abroad to study, or individuals traveling for extended vacations. Such a policy will expand with the increasing mobility of the global workforce and increasing educational opportunities internationally. Some future innovations could be complete health, legal assistance, and even remote work-related risks coverage. Artificial intelligence and data analysis will get better with time and make insurers more adept at determining risks and providing bespoke solutions. In the future, market growth will be reliant on how much it can adapt to the changing nature of international travel, making coverage relevant and available to everyone. This ability to adapt will be central to its future growth and success.

By Coverage

With regard to the plans for traveling outside the country, the global travel insurance industry is on the verge of massive expansion in the next few years. Growing globalization is prompting more and more individuals to realize how important it is to buy travel insurance. Travel insurance is intended to maintain different uncertainties and risks during a trip under control.

Some of the perils associated with traveling are medical emergencies or being in a cancelled flight, e.g., lost luggage; and all these accidents fall under various types of coverage. Travel insurance falls under product lines across the world by coverage areas, and each peril corresponds to a particular type of coverage.

One of the most common is medical expense coverage. This form of coverage will remain significant for travelers, particularly those visiting countries whose healthcare is very costly. The more that the world travels from country to country, the more diverse forms of health care systems they encounter, the greater the need for medical cost coverage will be.

This is necessary because such travelers are protected financially in the event that they require any medical care abroad. Since the medical expenses are on the rise in the world, medical coverage will be a component of travel insurance that will give peace of mind to the travelers. The second big category in global travel insurance market is trip cancellation. Travelers' plans could be disrupted by family crises or unexpected work obligations. This protection would become more significant as individuals travel for longer periods or reserve bookings in advance. It protects the travelers to the extent that their costs could be reimbursed when trips are cancelled for genuine reasons. The enhanced booking processes and non-refundable tickets will render trip cancellation insurance a necessity not to incur losses from finance. Lost luggage is another common occurrence that a traveler faces, and the travel insurance will still be important in that.

With increased air traffic and the massive amount of luggage, then there will be an even greater number of lost or misplaced luggage. Lost luggage cover is where it is needed. This kind of coverage will pay travelers back over the disruption of misplaced baggage and can assist in replacing items that are crucial to finishing the trip. One of the most significant aspects of international travel insurance is flight accident insurance. Air travel's safety record is impeccable, but accidents happen. Flight accident insurance will ensure travelers do not incur severe economic loss when an accident is experienced on a flight. The insurance would evolve with emerging safety standards and technologies in the airline industry.

Other types of losses such as natural disasters or terrorist attacks can disrupt travel schedules. This policy, which will cover the uncertainty of such an occurrence, will be vital to the traveler seeking protection from the shock of an occurrence. Global travels will drive the need for these other types of covers, which will offer security against all risks on the traveling person. In summary, the global travel insurance industry will keep on growing and evolving to cope with the rising needs of travelers globally.

By Distribution Channel

The global travel insurance market is a significant segment of the insurance sector, offering protection to people traveling domestically or internationally. The globe is getting more and more interconnected, and traveling is on the rise.

Consequently, there will be a rise in demand for travel insurance. People want to be secured from a variety of unforeseen circumstances, including the cancellation of trips, medical issues, or misplaced luggage. With this increasing demand for insurance, the market is evolving and growing. One of the most important drivers behind this growth is the range of distribution channels that are on offer to customers.

The current and future the global travel insurance market can be grouped along the distribution channel into four primary channels: Insurance Companies, Banks, Online Platforms, and Insurance Brokers. All of these channels have a function in the way consumers buy travel insurance and meet various needs and desires of the consumer. The channels of distribution will change with some being more prevalent than others depending on the developing consumer habits and growth of technology in the future.

A predominant position in the global travel insurance market has until now been held by travel insurance companies. They have an extensive range of products in travel insurance and the market is highly dependent on them due to their widespread reputation and trustworthiness. However, as more customers will look for convenience through an online portal for comparison or purchase, the function may change over time.

Technology will be invested in over the coming years by the insurance companies in order to make it easy and user-friendly in buying travel insurance. The second important distribution channel will be banks. Banks are likely to go on continuing to sell travel insurance as part of their future product offerings, directed primarily towards credit card holders or customers who organize their travels through the bank. Financial organizations increasingly embrace mobile services and digital banking; travel insurance products are going to be easily packaged into their current offerings, thus providing higher convenience to the consumers. Online platforms have already begun to make their presence felt in the market.

The future belongs to online platforms since they can serve as a one-stop destination for travelers to compare and purchase various travel insurance policies provided by various companies. This trend is bound to gain additional strength since it is fueled by online travel agencies and niche insurance comparison websites that resonate with the aspirations of the contemporary traveler for convenience and efficiency.

Insurance brokers, even if fewer in number than the other channels, will still exist. More and more, possibly in the next few years, brokers will turn to niche markets. This will mean product development and marketing niche travel insurance products for specific groups, e.g., business travelers or adventure tourists. Personalized service will continue to be an added value for individuals looking for expert advice on these products in a global travel insurance market.

With an expanding global travel market and a more evolving consumer preference, there is no doubt that the travel insurance industry will experience change. Growth in every channel of distribution will be affected by technology as it continues to evolve, driven toward greater ease of access and more customized service. Thus, the future of the global travel insurance market will largely depend on how effective and efficient these channels are at satisfying the needs of the travelers, making their traveling easy and convenient as they get the coverage needed.

By End-Users

The global travel insurance market is growing at a fast pace and is being fueled by the constantly changing needs of tourists around the world. It is gradually becoming a part of the trip planning process, providing security against unforeseen circumstances like medical emergencies or cancellations, loss of luggage, etc. So, travel industry growth results in more demand for travel insurance, which is sure to change due to changed travel behavior and user needs.

Another cause for this growth is the segmentation of the market based on the end-users. In the future, the different travelers will always need customized packages of insurance that cater to whatever need they have. Business travelers, especially, will continue to demand coverage that ensures one is covered during work-related travel. This segment very frequently needs insurance to cover the likes of trip delays, medical emergencies, or even business equipment coverage.

The higher the number of individuals traveling for work reasons, the higher the demand for such types of insurance products will be. Leisure travelers constitute another important market segment within the global travel insurance market. They usually go for coverage of trip interruption and cancellation and other safeguarding against loss of baggage and flight delays. With more people traveling for recreational purposes and the world getting closer and closer, full travel insurance coverage is going to be in greater demand. Most tourists also nowadays seek a package that includes coverage for adventure sports like hiking, skiing, or scuba diving.

Travel will become increasingly adventurous and diverse. The senior citizens' segment will continue to be a key market player. Older individuals will travel more frequently, particularly post-retirement. Therefore, there will be increasing demand for health and travel insurance products for them. Medical coverage, trip cancellation, and repatriation benefits will be critical for this group. Insurance companies will consider offering packages that can be able to cover all the risks of older tourists, so they can enjoy a more serene trip.

Students form another increasing segment in the global travel insurance market. More students going abroad for study will make insurance products providing coverage against health problems, trip delays, and personal effects highly sought after. This segment will demand affordable but full-coverage policies to cover their unique requirements while traveling overseas. Third. And above all, families are going to be a crucial segment of the travel insurance sector.

As family vacations and group travel are increasing, insurance coverage for the entire family as part of the insurance will become essential. Families will seek flexible coverage with benefits for all its members during the tour. As travel insurance demand increases, the global travel insurance market will become more specialized in serving the interest of these differentiated end-user segments. The future of this market will be based on how travel trends evolve and what type of need is created for personalized insurance solutions.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$26,788.56 million |

|

Market Size by 2032 |

$71,794.64 Million |

|

Growth Rate from 2025 to 2032 |

15.4% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

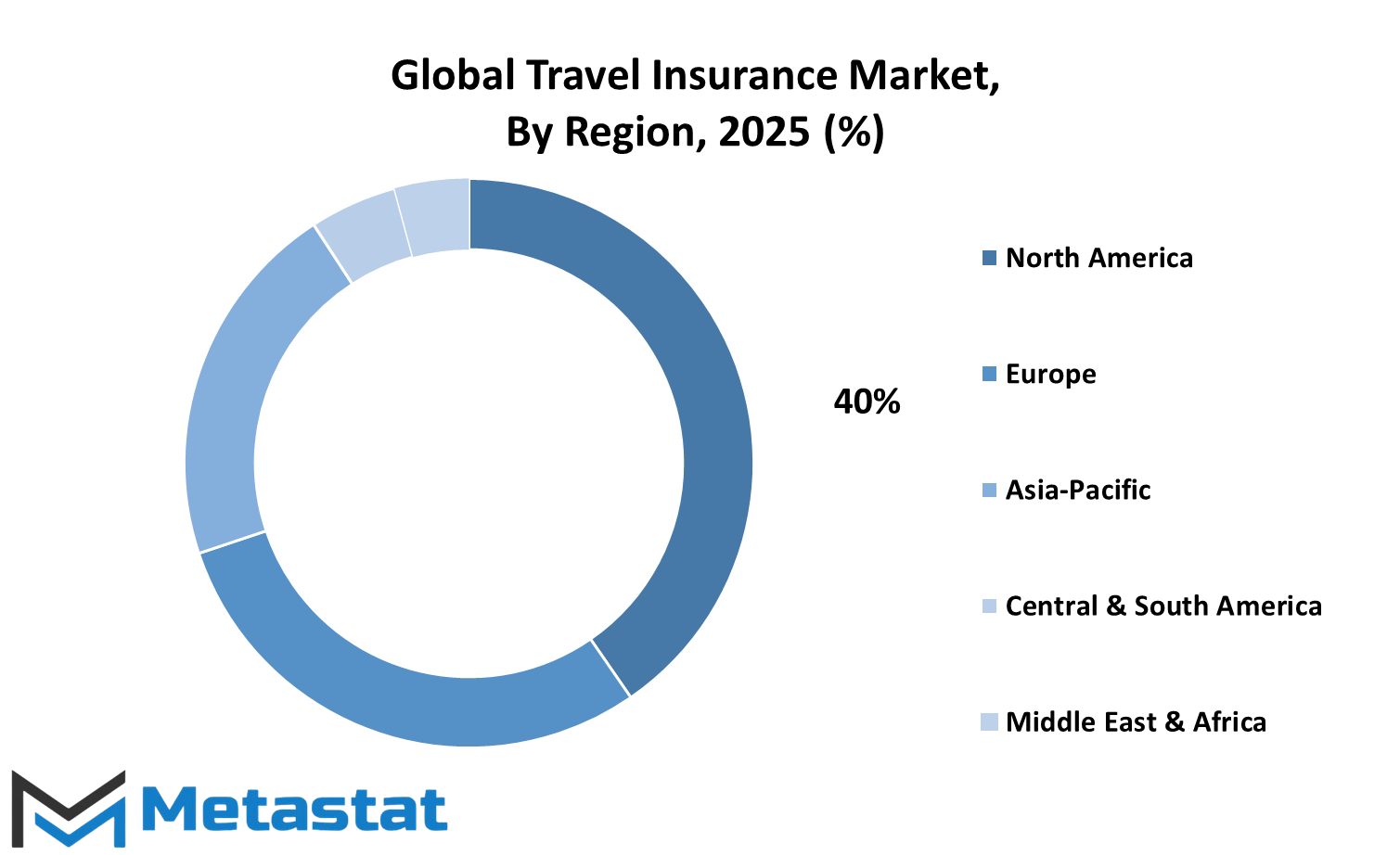

In the past few years, the global travel insurance market has witnessed vast growth, and its growth is also expected to be driven by regional factors. Geographically, the market is divided into five key regions: North America, Europe, Asia-Pacific, South America, and the Middle East and Africa. The travel insurance demand in each of these regions varies with unique characteristics that drive demand through the impact of economic climates, regulatory landscapes, and changing consumer behavior.

The North American market is dominated by the U.S., Canada, and Mexico. The United States, as a heavy contributor of global tourism, will remain the country to lead the region's travel insurance market. High rates of international travel, coupled with mounting consciousness of the risks inherent in travel, will propel demand for products related to travel insurance. Furthermore, as tourist behaviors shift, US travelers will seek more extensive coverage, such as emergency medical care and trip cancellations. In Mexico and Canada, with growing tourism, the market should trend similarly, with greater demand for travel protection, particularly among international travelers. Europe is another significant region where the global travel insurance market is expected to increase substantially.

Major nations like the UK, Germany, France, and Italy are going to contribute heavily towards demand for travel insurance. The region's strong travel market, as well as variations in national policies and increasing awareness of the insurance products available, will drive market growth. As European tourists travel to distant places, demand for customized insurance products will increase. The remainder of Europe, including the Eastern European nations, will also witness a steady boost in demand owing to enhancing economic status and increased access to travel means.

The Asia-Pacific region, comprising India, China, Japan, and South Korea, is likely to witness high growth in the market for travel insurance. With the increasing disposable incomes, expanding middle-class populations, and outbound tourism growth, the products of travel insurance will be influenced by these trends.

Increased number of travelers from these nations will begin to look for international destinations, and insurance companies will make corresponding adjustments to provide policies reflecting the special characteristics of these nations. Although mature markets like Japan and South Korea will remain stable, the growth story will largely be with emerging markets like China and India for insurers.

In South America, Brazil and Argentina are dominating the travel insurance sector. International travel, along with international disposable incomes, is on the rise, and this will definitely fuel demand further. As travel on the continent grows, South America will see a slow transition toward more insurance uptake.

Likewise, the Middle East & Africa, including regions like the GCC nations, Egypt, and South Africa, will also feel an expansion of travel insurance. As tourism keeps expanding in these regions, travel insurance will become a standard component of the travel sector for international tourists as well as domestic travelers. In the future, the global travel insurance market will continue to evolve as nations change with shifting economic, societal, and travel patterns. As growing awareness and demand for protection on all continents, travel insurance will become a fundamental aspect of international travel. With an increasing number of travelers seeking peace of mind when traveling, the market will grow, and insurers will have new business opportunities to meet various consumer needs.

COMPETITIVE PLAYERS

The global travel insurance market has witnessed a high growth in recent years, primarily as a result of increasing tourists who desire coverage against any unpredictable incidents that might arise during their voyages. The global travel insurance market is likely to maintain its rise as more travelers are looking for protection and peace of mind facilitated through insurance. With this competitive landscape, different key players are deciding how the future of the business will be driven by creating a range of travel insurance products to meet the diverse needs of clients. Firms such as Allianz Global Assistance, Travel Insured International, and WorldTrips are taking the lead in providing end-to-end travel insurance plans.

These firms provide insurance against typical travel hazards, such as trip cancellations, lost baggage, health emergencies, and delays in travel. Their extensive exposure and high customer confidence have enabled them to lead the market. For example, Allianz Global Assistance enjoys a global presence and is thus considered among the leading options for tourists looking for secure and readily accessible insurance coverage. TravelSafe, Nationwide, and Travel Guard are also significant players in the Global Travel Insurance industry, each of whom offers something distinct to appeal to a range of consumers.

TravelSafe, as a consumer-focused company, enables customers to tailor their insurance plans to the particular facts of their travel. Nationwide, with a long tradition in the insurance business, continues to build up its travel insurance operation while keeping expenses low and policies straightforward. Travel Guard, which is owned by AIG, is also a market leader because it has high coverage for medical conditions, travel aid, and 24/7 assistance, all of which the traveler appreciates when they are at a point of need. The other large players are Seven Corners, AXA Assistance USA, and Generali Global Assistance, which are major in shaping the competitive market. Seven Corners, for instance, provides some of the most inclusive coverages for global travelers and some of the plans aimed at people with pre-existing medical conditions.

AXA Assistance USA has positioned itself as a world leader in offering innovative insurance products through technology-based solutions for improving customer service and claims handling. Generali Global Assistance, with its international network, aims to provide customized service and customer support, guiding travelers through unexpected situations on the road. Similarly, small but significant players like Travelex Insurance Services, HTH Worldwide, Berkshire Hathaway Travel Protection, and Tin Leg Travel Insurance contribute to the Global Travel Insurance industry and provide affordable flexible travel insurance for price-sensitive travelers.

Going ahead, the global travel insurance market will definitely become increasingly competitive. With technology expanding, it is probable that these companies will employ digital platforms to simplify the buying process, enhance claims processing, and make customized recommendations. In such a situation, with travelers opting for customized insurance products and an expanding market, the competition between these prominent players will only rise, with innovation and better services for international consumers being the outcome.

Travel Insurance Market Key Segments:

By Type

- Single-Trip Travel Insurance

- Annual Multi-Trip Travel Insurance

- Long-Stay Travel Insurance

By Coverage

- Medical Expenses

- Trip Cancellation

- Lost Baggage

- Flight Accident

- Other Losses

By Distribution Channel

- Insurance Companies

- Banks

- Online Platforms

- Insurance Brokers

By End-Users

- Business Travelers

- Leisure Travelers

- Senior Citizens

- Students

- Families

Key Global Travel Insurance Industry Players

- Allianz Global Assistance

- Travel Insured International

- WorldTrips

- TravelSafe

- Nationwide

- Travel Guard

- Seven Corners

- AXA Assistance USA

- Generali Global Assistance

- Travelex Insurance Services

- HTH Worldwide

- Berkshire Hathaway Travel Protection

- Tin Leg Travel Insurance

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252