MARKET OVERVIEW

The Global Takaful market ranks among the prime ethical financial instruments in ensuring conformity to Islamic regulations by providing parallel financial protection. The market participants pool together contributions whereby the policyholders share the risks collectively, as opposed to another party taking responsibility for the entire loss. This far-reaching distinction from conventional insurance has led to a unique operational structure that needs to maintain a fine balance between transparency, financial sustainability, and Shariah compliance. Growing demand for such offerings may be expected in the foreseeable future as more people become aware of other options that express their beliefs.

Takaful or Islamic insurance is essentially a part of the wider Islamic finance industry; Shariah-compliant insurance solutions are offered to cater to the individual and corporate needs of customers. With the changing face of finance that are becoming more ethical and shying away from interest-based transactions, the evolution of this insurance arm would continue to track the vaguely defined parameters far beyond conventional risk-sharing. Takaful is founded on mutual cooperation and collective responsibility while traditional insurance is identified with the demonization of risk transfer. Regulatory frameworks have since been reshaped to accommodate Islamic financial principles, and the sector is poised to innovate within the boundaries of such religious commitments, having considered modern financial demands.

Global Takaful Market, distinguished from conventional forms of insurance primarily concerned with profit maximization, creates an environment conducive to community solidarity and social responsibility. The Takaful Operator, on the other hand, views themselves more as managers of the representatives than bearers of risk. Excess funds may consequently be returned to policyholders or channeled toward charitable activities, adding to the ethical orientation of this system. This is a two-fold avenue for establishing fairness in transactions while building a sustainable circle of financial cooperation that, in turn, undergirds economic stability in regional markets.

The next innovation during the Global Takaful market will determine the direction in which Shariah-compliant insurance will move. Under increased digital technological advancement and automation, the operation of Takaful products will be made simpler and quicker. Blockchain and AI must improve efficiency across operations while also ensuring regulatory compliance. Online Takaful approaches will widely bring the market into the fold as financial institutions figure out a way to marry Islamic finance with digital solutions.

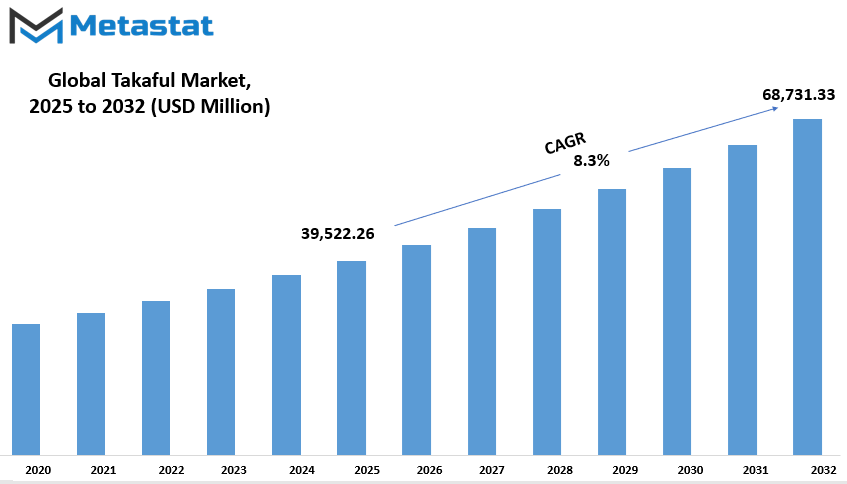

Global Takaful market is estimated to reach $68,731.33 Million by 2032; growing at a CAGR of 8.3% from 2025 to 2032.

GROWTH FACTORS

Multiple factors make up the growth-inducing landscape for the Global Takaful market. Two key aspects that are triggering the market are the rising Muslim population coupled with the increasing awareness of financial services in the light of Shariah principles. People are now searching for alternative insurance options considered ethical and interest-free, and Takaful fits that bill. Governments in some countries have also plowed considerable efforts into fostering Islamic finance through the setting up of acts and regulations that are designed to provide support in creating a structured environment for encouraging participation in Shariah-compliant financial services.

To date, the market is indeed growing, and yet some challenges still prevail that hinder its furtherance. A major impediment has been the limited awareness of and understanding of Takaful in regions where the Muslim population is not the majority. The foundation of Takaful in the minds of the greater public and its principles and benefits for achieving these benevolent ends remain largely unfamiliar to many a potential customer. This results in sluggish adoption rates. Furthermore, its unique risk-sharing model does offer operational challenges for Takaful, constraining profitability and long-term sustainability. Actually, while in conventional insurance the risks are transferred to the insurer, Takaful, on the other hand, is based on a shared-risk mechanism that equally shares potential benefits and losses between the parties involved.

To overcome these challenges, companies are working on innovative methods that will augment accessibility and market reach. The advent of digital platforms creates a bunch of opportunities for the Takaful industry thanks to the convenience and enhanced reach it offers. Takaful plans can be bought, compared, and managed with great ease through online platforms and mobile applications. This digital revolution is expected to facilitate market penetration and attract a wider segment of the population, including the youth, who mostly prefer easy and technology-driven financial solutions.

In the future, the Global Takaful market stands to gain from the rapid advancement of digital solutions and continued government support. With the provision of addressing the shortcomings on the consumer awareness side and the enhancement of the risk-sharing mechanism, the industry is propelled up for sustainable growth. Takaful service providers will probably, with further improvement on financial technology, avail modern tools for improving customer experience and internal business operations. The Takaful market is set for steady growth in the coming years owing to regulation, demand, and digitalization..

MARKET SEGMENTATION

By Type

There are now a large number of potential clients for Global Takaful-the preferred alternative to the conventional insurance-among increasing awareness on Sharia-compliant financial services. The mutual cooperation and shared responsibility between the policyholders ensure that the clients pay to a common fund, which serves as support for those in need. It has gained popularity in an area where Islamic finance is not necessarily the major influence, and it is now appealing to some markets that are non-Muslims because of principles of ethical investment.

Takaful is differentiated into various categories, whereby Family Takaful or Life Takaful is contributed the most amount, standing at $26,045.23 million. Such a division provides financial protection to families during unforeseen situations accompanied by plans for long-term savings and investments. General Takaful, which ranges from motor insurance to property and health insurance, has also seen a steady demand among businesses and individuals seeking respectable alternatives to conventional insurance products. Companies that offer these services have concentrated on making it easily accessible, improving their digital platforms, and providing customized solutions to the needs of consumers.

Regulatory support in many countries coupled with consumer awareness will be a significant driver toward taking the growth of the market. This has now made it possible to create a structured platform for Takaful operators to provide these services. Government and financial institutions work towards clear-cut guidelines that make sure they comply with Islamic financial principles, while innovation within the sector continues. Technology integration is part and parcel of making this market transformational. The access of Takaful to customers has been widened through online and mobile applications.

The change in expectations and preferences among consumers has driven demand toward ethical financial products aligned with Takaful in their demands of transparency and benefits to beneficiaries; insurance companies have been innovating products targeted at the different market segments, such as low-income earners and small businesses, in terms of coverage. To further strengthen the industry, strategic partnerships between financial institutions and Takaful operators continue to thrive as avenues for Sharia-compliant broader investment options.

Awareness and the growth of financial technologies will still drive the expansion of the Global Takaful market. Companies will be as busy as ever in making efforts to streamline service delivery, improve their product offerings, and forge partnerships to reach out to the mass audience. The unmet growing demand by the public for ethical and reliable insurance services will continue to pave the way for sustained growth making Takaful among the dominant players in the global financial landscape.

By Distribution Channel

The growth and development of the Global Takaful market have been affected by various factors. Takaful, an Islamic insurance model based on shared responsibility and mutual cooperation, is becoming attractive to individuals and businesses in their search for ethical solutions that are Shari'ah-compliant. The market is expanding because more people are starting to appreciate the risk-sharing mechanism that guarantees financial security in a manner whose principles and teachings are the basis of their values.

By the channel of distribution, the market is segmented into Agents & Brokers and Direct Response. Agents and brokers are an essential resource for a client in understanding policy options so that he can make a knowledgeable decision. They communicate the specifics of eligible benefits under coverage so that the client can weigh his or her options and choose the plan that best meets his or her needs. Clients are comfortable with this kind of engagement and truly appreciate being able to get answers to their questions through tailored advice. Direct response is for those who want self-service—website, call center, or direct sales: a great convenience for policyholders who want to shop for their options without being influenced by a salesperson.

Building Takaful providers are at the forefront of digital innovation in service delivery to maximize customer experience. Policyholders can now gain access to Takaful products more easily and efficiently through their mobile applications, AI-supported chat functionality, and simplified online claim submission processes. Another avenue of outreach is now being considered, particularly in association with banks and financial institutions, putting the Takaful product to a wide range of audiences. Hence, the ongoing growth of Takaful—where both traditional and novel styles are being integrated toward activity—would continue to complement and facilitate the growth of the Takaful market.

Sustainability and ethical issues are among the foremost reasons for Takaful's rising popularity. Many are seeking insurance solutions compatible with their philosophy, for instance: against interest-based transactions and uncertainty. Thus, its cooperative attribute encourages Takaful policyholders to support one another, creating a network of financial security and a sense of community. This is gradually penetrating into most people's consciousness, and more and more people are looking at these options over conventional insurance.

In its wake, a variety of government initiatives and regulatory backing are further entrenching the growth of the Takaful industry. Takaful is suffering under a scenario where some regions are setting up policy frameworks that create an enabling environment for its promotion while ensuring adherence to Islamic financial tenets and transparent ways of doing business. Hence, with more customers being attracted, the Global Takaful market is above a state of upward drive with continuous improvements in service delivery. Takaful providers will continually find ways to change the products on offer to fit changing consumer preferences regarding ethical and sustainable financial solutions.

By Application

Ever since the Global Takaful market began attracting the prospective attention of men and women seeking some form of financial protection that exists along the channels of ethics and various religious beliefs, the uptake of Takaful- which is an insurance type based on the collectivity of responsibility-has steadily grown due to the rising awareness and demand of Sharia-compliant financial mechanisms. The market segmentation faces a wide array of policyholders who uphold the tenets of transparency and risk-sharing into personal and commercial applications.

In personal applications, Takaful covers health, life, and educational maintenance. Takaful has an appeal among individuals since its essence is based on mutual support, whereby all participants contribute to a pool fund of resources which attempts to assist and compensate a member with a loss or damage. This enables social cohesion, thus attracting many customers as an alternative to traditional insurance. We envisage pronounced increased adoption of Takaful policies as public awareness keeps increasing, particularly in regions where Islamic finance is trending.

Commercial Takaful services cover business insurance products covering risks related to property and liability and employee benefits. Companies seeking ethical insurance options prefer Takaful as it ensures compliance with religious principles while providing financial security. Takaful is one of the most common risk management tools for businesses operating in industries ranging from healthcare to real estate to manufacturing to protect their assets and operations. Thus, the increasing participation of businesses in Takaful programs reflects a growing trend to embrace responsible financial practices.

Supportive regulations, technological advancement, and strategic alliances between financial institutions determine the rapid expansion of the Global Takaful market. Digital platforms serve to facilitate the entry of policies and processing of claims, making it more viable Takaful to a wider audience. Besides, the fast-evolving nature of customer demand has seen financial institutions teaming together to formulate innovative products, all of which maintain ethical responsibility.

Increased awareness among the populace shall soon lead individuals and businesses to make investigations into the various Takaful products available. Consumer trust, supporting regulatory frameworks, and providers' capability to change with the evolving demands shape market development. Hence, with continuous advancement and acceptance, steady growth in the Global Takaful market is forecasted to happen, supporting its visions of being a credible and principled means for financial protection.

By Region

The Global Takaful market is gaining momentum currently with many consumers looking for financial products compatible with their ethical and religious principles. Takaful, or Islamic insurance based upon the principle of mutual cooperation, lends itself to a new paradigm from conventional insurance in that it prohibits interest and uncertainty. Risks and profits are, in the end, decided upon by members of one community-stringing together a moral fiber of trust amongst policyholders. Clearly, the rising demand for Shari'ah-compliant financial solutions is enhancing participation and investment in the Takaful marketplace.

The global Takaful market has been regionally divided into the Gulf Cooperation Council (GCC), Southeast Asia, Africa, and Others. While still an important player, the GCC is supported by a strong local foundation with an established Islamic finance ecosystem. In Takaful across Saudi Arabia, the United Arab Emirates, and Bahrain, growth regulations have been laid down within the financial sectors of these countries. With an increase in the demand for products of family and general Takaful, the region proves its commitment toward ethical financing.

On the opposite side, Southeast Asia is another major market with Malaysia leading in the regulatory framework and product innovations. The government of Malaysia has taken a leading role in the setting of industry standards and also incentives while promoting awareness. Along with the increasing percentage of Muslim population and growing levels of disposable income, Takaful is gaining steady traction in its services provided. Takaful, with its cover in health and business protection, has proven to be an ideal choice for many users.

The largest potential for Takaful is expected to exist in Africa with Nigeria, Egypt, and Sudan being the pre-eminent examples, with huge Muslim populations. This market is still in its infancy, while the regulatory frameworks will slowly become properly established. Awareness campaigns and strategic partnerships with already accepted Islamic financial institutions are easing the way for consumers toward acceptance and usage. With even more African countries beginning to embrace the idea of Takaful, the industry will potentially see growth and offer financial inclusion to underserved communities.

Interest in Takaful is also growing in other regions, including parts of Europe and South Asia. Financial hubs like the UK are investigating ways to fit Islamic insurance into their financial landscapes. As Takaful gains acceptance, more institutions are looking at it as an alternative to their conventional insurance products, thus opening more avenues for further growth.

With advancing trends, support from the regulatory regime, and increasing awareness among consumers, the Global Takaful market is expected to continue on the up and up. To address the changing profile of its consumers, companies are engaged in digital transformation, innovative product development, and strategic alliances.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$39,522.26 million |

|

Market Size by 2032 |

$68,731.33 Million |

|

Growth Rate from 2025 to 2032 |

8.3% |

|

Base Year |

2025 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

Ethics has become the main driver of growth in the Takaful market. The greater demand for Islamic financial products by the general public continues to grow from most regions. The structural arrangement of the Takaful market allows its policyholders to share losses among themselves, distancing it from the conventional insurance models. The concept of Takaful has found acceptance with both Muslims and non-Muslims, hence leaving its footprints on the soil of multiple nations.

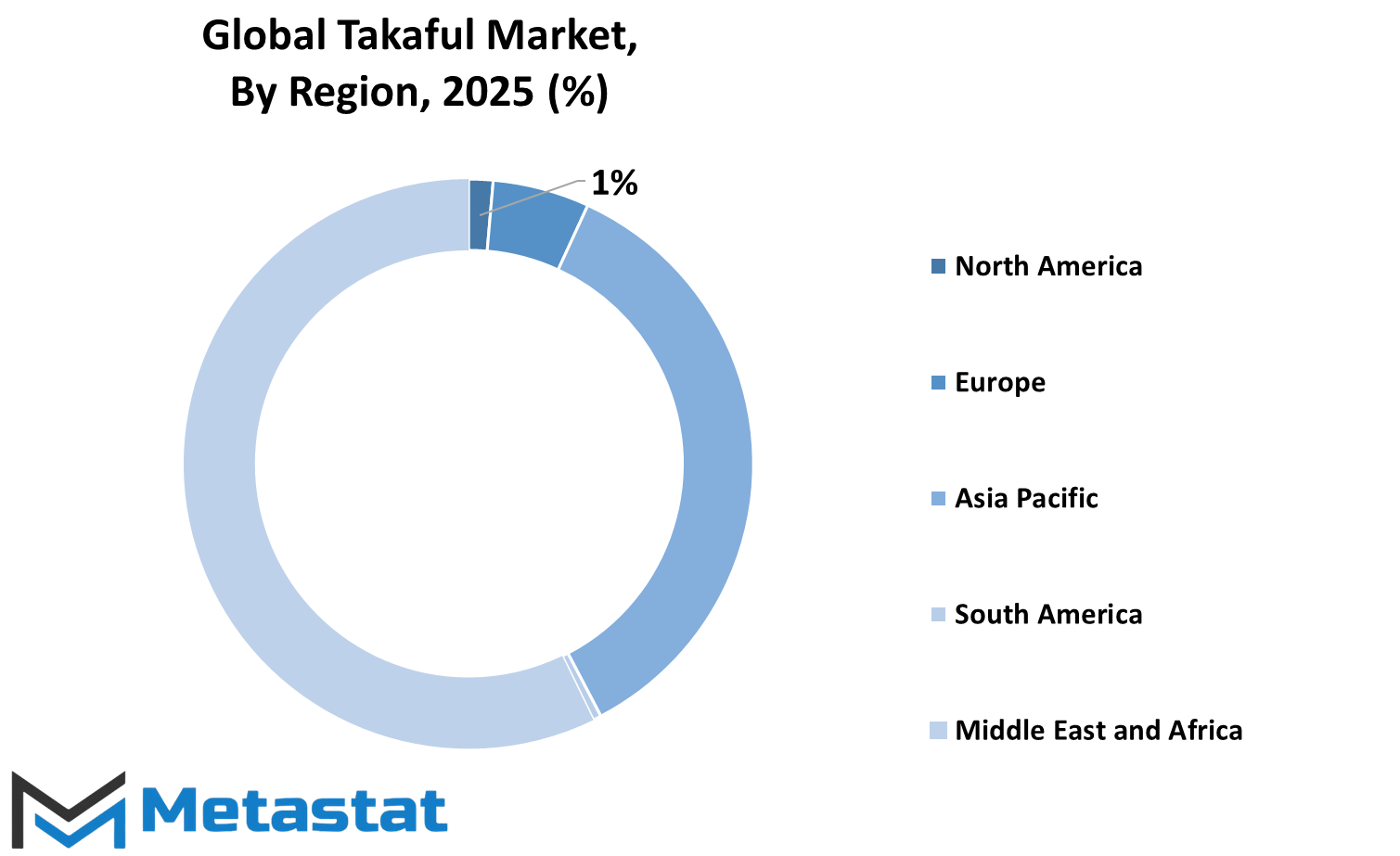

Geographically, the market is spread across North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. North America includes all countries of the U.S., Canada, and Mexico. The European market would constitute countries like UK, Germany, France, Italy among other countries in that region. The Asia-Pacific covers India, China, Japan, South Korea, and further countries, whereas South America incorporates Brazil, Argentina, and other adjacent markets. The Middle East & Africa region comprises GCC Countries, Egypt, South Africa, and further territories. The existence of diverse customer bases spread throughout these regions is a positive attribute in ensuring the growth of the market by influencing the various economic and strategic regulation environments.

Gaining more visibility regarding ethical and Shari'ah-compliant financial products has nudged the growing acceptance of Takaful services. Several governments and financial institutions are striving to propagate the sector through specific regulatory frameworks that facilitate its growth. This witnessed developing and creating more ground-breaking policies directed towards businesses and persons who require alternatives to conventional insurance policies.

The presence of technology in today's world has also set an impact on this market. With the new online portals and mobile applications, customers can now easily access Takaful for securing their coverage. Technology has resulted in better transparency and efficiency in operations, which can further build customer trust and engagement. This will eventually further increase the number of accessible consumers when the industry has most digitalized insurance.

Sustainability fashions various spheres of the industry. Most providers are leaning towards socially responsible investments to achieve their ethical value. This attracts consumers interested in financial products that benefit the broader community while securing their future. Therefore, enterprises are rising to the occasion with products that meet economic and demographic variations to ensure continuous growth in the market.

The perpetuity of the Global Takaful market would show the emphasis on three thingsm that is ethical financial services within and beyond borders, technological advancement, and support in regulation in order to continue its existence. Companies will therefore cater to this increased diversification with products acceptable to all, thereby growing the client base in terms of numbers and diversity.

COMPETITIVE PLAYERS

Takaful is in demand as an increasing number of people and businesses seek Sharia-compliant insurance solutions, driving the growth of the Global Takaful market. Mutual cooperation and shared responsibility are the tenets of Takaful, and these have gained favor with many who seek ethical and interest-free alternatives to conventional insurance. The model assures that participants donate to a mutual fund that will help support those members that find themselves in financial difficulty. This model promotes community building while grounding itself in Islamic financial principles.

Companies like Abu Dhabi National Takaful Company (ADNTC), Allianz Group, Dubai Islamic Insurance & Reinsurance Company (AMAN), and Al Rajhi Takaful are some of those leading the way in the industry. These organizations are continuously refining their portfolios to suit the variated likings of the customers, ensuring their policies remain competitive yet compliant. Others in the industry making inroads to extend their reach and enhance product offerings are Prudential BSN Takaful Berhad, Qatar Islamic Bank (QIB), and Salama Islamic Arab Insurance Company.

The market itself is benefitting from digital transformation. Firms have begun to harness technology to ensure smooth policy management, customer engagement, and claims settlement. Platforms with easy online enrollment and mobile app services give Takaful products an upper hand through the rising demand for digital financial solutions. This has helped the likes of Syarikat Takaful Brunei Darussalam Sdn Bhd, Takaful International Company B.S.C., and Zurich Malaysia strengthen their market presence with seamless user-friendly services.

Sustainability and ethical investing are also trends impacting the industry's growth. The efforts to integrate environmental, social, and governance (ESG) principles into business models by Etiqa General Takaful Berhad, Takaful Ikhlas, and Great Eastern Takaful Berhad are in line with the values of socially responsible consumers, which, in turn, boosts their trust in the Takaful system. Innovative risk-sharing schemes providing extra financial security while adhering to Islamic finance regulations are being developed by other institutions like HSBC Amanah Malaysia Berhad and AIA PUBLIC Takaful Berhad.

The Global Takaful market is evolving, driven by demand for ethical financial solutions, digital innovations, and development strategies. With the demand for Sharia-compliant coverage increasing, leading companies in this sector are enhancing their services while ensuring accessibility and sustainability. This developed industry is expected to grow steadily, providing further impetus and awareness of Takaful benefits in attracting a broader customer base.

Takaful Market Key Segments:

By Type

- Family Takaful (Life Takaful)

- General Takaful

By Distribution Channel

- Agents & Brokers

- Direct Response

By Application

- Personal

- Commercial

By Region

- Gulf Cooperation Council (GCC)

- Southeast Asia

- Africa

- Others

Key Global Takaful Industry Players

- Abu Dhabi National Takaful Company (ADNTC)

- Allianz Group

- Dubai Islamc Insurance & Reinsurance Company (AMAN)

- Al Rajhi Takaful

- Prudential BSN Takaful Berhad

- Qatar Islamic Bank (QIB)

- Salama Islamic Arab Insurance Company

- Syarikat Takaful Brunei Darussalam Sdn Bhd

- Takaful International Company B.S.C.

- Zurich Malaysia

- Etiqa General Takaful Berhad

- Takaful Ikhlas

- Great Eastern Takaful Berhad

- HSBC Amanah Malaysia Berhad

- AIA PUBLIC Takaful Berhad

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252