MARKET OVERVIEW

The Global Event Insurance market is present in a niche segment of the insurance industry that specializes in managing financial risks associated with events of all types and sizes-from global summits to multitudes of people thronging large music festivals. All these situations require cover against unforeseeable occurrences that can lead to severe financial losses. Whether it is a natural disaster, liability, or an unexpected cancellation, its work cannot be limited to only risk management.

With so many logistics, attendance, and regulatory requirements still subject to change, event organizers take more risk than ever before. Thus, insurance in this relatively emerging market does not serve as a mere safety net but actually as a strategic component of planning an event. Ensures that businesses, sponsors, and other stakeholders within an event are protected from financial stresses and strains resulting from an unpredictable disruption. Events get bigger and bigger, but so do the complexities of the risk involved, requiring coverage tailored to new emerging challenges. The policies designed for the sector range broadly from very extreme weather conditions to protection against cyber threats in the case of virtual events.

This market is hardly the same, and one important difference here lies in the continuous re-evaluation of risk assessment methods. Gradually parting ways with the conventional process of evaluating historical data with a view to future liabilities are the technology-driven approaches. Through advanced analytics, artificial intelligence, and predictive modeling, much of the development in underwriting policy will come from these innovations. The likely end result of real-time data will be that organizers receive personalized coverage, tailored to meet their own requirements rather than serving them with generic installations. With greater emphasis on personalized offerings, the shape of a policy will differ according to the nature of the event rather than using a one size-fits-all template.

The legal and regulatory environment will continue to steer this market. The extent of coverage will depend heavily on government policies about public gatherings, data privacy, and health issues. While holding up the exceptionally intricate global and regional frameworks and mandates, insurers must also navigate successfully to remain compliant while providing flexible solutions. Legal rights around pandemic disruptions have already altered contract forms, mandating inclusions of clauses dealing with previously unknown events. As international provisions are amended, insurers will continue to adjust their requirements to keep up with these developing legal frameworks.

Technology's integration will extend beyond policy customization to claims processing and fraud detection. Automated claims systems reduce turnaround time and ultimately improve customer satisfaction through streamlining. Blockchain applications may eventually prove to be a trusted method for verifying claims, reducing fraud, and improving transparency between insurers and policyholders. Beyond that, digitalization will change the vision of efficiency and set a new standard in customer expectation, shifting demand to tech-enabled, seamless solutions in the insurance sector.

Traditional event risks-such as damages to venues and loss of equipment-while still having their prominence, are soon to be demanded by new emerging threats with unique risk characteristics to require development of innovative coverage models. It is the requirement of these virtual and hybrid events that is creating multiple paths of liability-from technical failure to data breach. Digital conference organizers, online concerts, esports tournaments, and events of this nature will need these new policies that address coverage of digital interruptions. This change will bring into question many traditional coverage constructs and determine policy relevancy into this increasingly digitized world.

The Global Event Insurance market will keep on morphing in pace with the new business environment and changing regulatory scenarios, alongside improvements in technology. The emergence of the market will also see the path that demands personalized solutions and faster, less expensive risk assessment methods. The emerging ways in which this industry adopts technology will change how insurance providers redefine their risk management strategies for events, setting new standards in a world where uncertainty will always remain the strongest challenge.

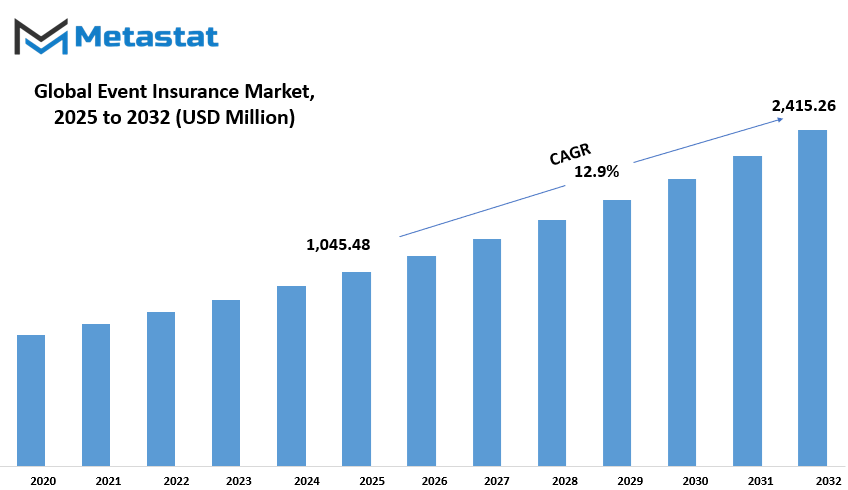

Global Event Insurance market is estimated to reach $2,415.26 Million by 2032; growing at a CAGR of 12.9% from 2025 to 2032.

GROWTH FACTORS

Rising demand for protection against multiple events has significantly boosted growth in the Global Event Insurance market. Increasing numbers of concerts, corporate events, sports tournaments, and festivals have increased the possibility of financial protection from risks. In terms of the uncertainties that an event organizer might have to face, these could include; property damage, injuries, cancellations, and extreme weather conditions caused by natural events. Without insurance, the above risks can turn into very heavy monetary losses. The number of high-profile events where large amounts of investments are made is increasing rapidly, which leads to more requirements for insurance policies with comprehensive cover.

Another contributor to the long-standing evolution of the market rests on the growing legal and financial liabilities in organizing events. An uptick in regulations coupled with favorable prospects for lawsuits have prompted event organizers to seek insurance policies against unforeseen events that might occur. Nevertheless, event insurance mainly provides peace of mind through coverage, including the legal fees, damage to property, or even reputational risks. Many governments and regulatory bodies have also set a requirement for compulsory insurance for large public events, thereby increasing demand for the policies even further.

Despite the growth of the market, a number of challenges could impede the growth of the market. One main challenge would pertain to the increasingly high premium rates charged in policies. Organizers with a relatively small scale and poor budgets might find it difficult to purchase the requirement for comprehensive insurance. Most event planners do not realize the great benefits derived from event insurance compared to above-average adoption rates by smaller and medium companies. Limited awareness of different policy options and coverage benefits holds the hands of many prospective investors from investing in event insurance.

However, the market is predicted to have its share in profiting from the coming expansion of online insurance platforms. The flourishing online platforms now have made it even easier for an event organizer to compare different policies, learn their alternatives, and ultimately purchase insurance in utmost convenience. Customized plans, instant quote reports, and easy claims processing through online platforms will make insurance more available to both large and small event organizers. Further advancement in technology is likely to see online platforms play a significant role in pushing market penetration numbers.

Going forward, the event insurance market will likely experience progressive growth on the backdrop of increasing demands for large events coverage combined with new stricter legal requirements. In as much as high costs and limited awareness could pose some challenges, the provisions created by the increasing availability of online platforms will open up new avenues. As long as event organizers continue to focus their efforts on risk management, the market shall continue to grow by having better and broader coverage options within the affordability scope for all sorts of event planners.

MARKET SEGMENTATION

By Type

The global market for event insurance serves an important purpose by providing financial protection against unexpected risks arising from many events. The continuous and steady growing demand for coverage across various industries, including entertainment, corporate functions, and sports, is a demand generator for the event insurance market. Event organizers face various uncertainties, such as calamities, cancellations, property damage, or legal liabilities, which is why insurances become vital in protection.

The other prominent reason for market growth can be said to be the increase in the number of open-air events across the world. Such events could be music festivals and sports tournaments on one hand, and corporate conferences and weddings on the other. All organizers are understandably interested in insurance coverage to ensure they are financially prepared for any unforeseen expenses aroused, for lack of coverage of an incident might expose them to financial ruin. Therefore, more businesses and individuals have begun to engage in event insurance, a strategy that in itself helps to combat potential risks.

The industry is segmented into various kinds of coverages that serve its special purpose. Of these, general liability insurance is the most prominent, accounting for $452.35 million given that it provides coverage against third-party bodily injury and property damage claims. Professional liability coverage is quite popular too, especially among event planners and service providers, since it protects against claims pertaining to negligence or errors in professional service.

Event cancellation insurance has, however, grown in relevance with unpredictable disasters and global crises that could prompt spur-of-the-moment cancellations. At the same time, property coverage protects equipment, venues, and other tangible assets so that its damage does not become an impossible hindrance in financing events. The other big one would be prize indemnity insurance covering contests and promotions where rewards of great worth are at stake.

As the market for event insurance grows, companies and individuals realize what financial security it gives them. Also, insurers have started adjusting their policies to fit such changing needs with more flexibility and comprehensiveness. Digital platforms have simplified the comparison and customization of plans and the purchasing of policies by customers online. Together, these trends serve to streamline the entire process.

However, challenges persist in the areas of premiums and claims. Some event planners are dutifully marketed for insurance by its high premium, while others are turned off by the difficulty of filing claims. But awareness is encouraging most companies to fight for a clear and fair insurance process so that event planners can access protection without a burden.

Insurance will continue to become an increasing core component, ensuring a clear path for the integrity of managing risk in any large-scale event. With the customized coverage of policies offered, the market can really be expected to flourish further, comforting the shoulders of event organizers so that they can fully concentrate on executing a successful experience.

By Application

Thus, the Global Event Insurance market is growing due to the emerging need for providing monetary cover for unexpected situations. Couples and businesses spend enormous time and money on event planning and hence insurance becomes the most valuable ornament in the crown of possible safeguards through which more event organizers choose to afford protection against unpredictable factors and ensure their investments are safe. Extreme weather, accidents, and even cancellations can cause these unexpected events to major financial losses. Thus, many event owners choose insurance policies to break the risk factors and provide assurance against losing investments.

Event insurance is particularly relevant for very large gatherings where stakes are high. The market can be segmented as per application into Weddings, Community Events, Sports Events, Corporate Events, Festivals and Concerts, and Theater Performances. For example, wedding venues require cancellation coverage, vendors problems, or even unforeseen situations, such as bad weather. Sponsorship and ticket sales usually are community events, so insurance is needed in order to mitigate losses in the event that the plan does not work. Such last-minute cancellations or equipment failures will make a show impossible. Most companies attach very high budgets to events, most are linked to venues, catering, and speakers. Insurance ensures businesses are not shortchanged in any way due to sudden cancellations or liability claims.

Festivals and concerts polarize huge crowds and come with difficulty-rich risk-replete penalties for liability arising from injuries, property damage, or even event cancellations. Proper coverage voids the serious consequences associated with financially damaging event organizers. All sports, whether local or professional, need insurance to pay the risk for injuries, accidents, or unexpected disruptions. Because sports are very physical, coverage is needed for the protection of organizers, participants, and spectators.

This ever-increasing awareness of financial loss has made the demand for event insurance shoot up rapidly. Therefore, the market will ensure continued growth as more people understand risk management as a mitigation measure. Growth is also attributed to an increase in massive events around the globe. Insurance delivers such comfort that both hosts and guests at large public events receive it as if it were a private gathering.

The event insurance market has been undergoing changes owing to advances in technology. There are companies that provide tailored-to-fit policies based on particular needs, thereby enhancing customer experience in sourcing policies. Quick and convenient policy purchase is an online trend that minimizes the headache of the old paper pursuit. More individuals and businesses are expected to seek protection from unforeseen incidents, resulting in continued growth of the industry. It is often an unwanted but inevitable aspect of our world: uncertainty can derail, manifestly or not, even the best-laid plans, which is why event insurance remains essential for stability and protection.

By End User

Every year, millions of dollars move through event insurance markets around the globe to ensure those who organize and host events will be reimbursed in the event of any form of disappointment or misfortune occurring at the time--be it a corporate gathering, concert, wedding, or sports event. This risk can take several forms and can include cancellation of the event, property damage, accidents, or external liability claims. As the number of big events witnessed worldwide keeps growing, so too has the increasing demand for an all-encompassing insurance policy.

Event insurance is also taken by many people to cover their financial investment for private occasions like weddings, birthdays, and private parties. In such cases, associated risks are unexpected weather, vendor cancellations, or unfortunate accidents that interrupt the event planning. Most importantly, event insurance can be the umbrella under which the heavy financial burden of nonrefundable deposits and last-minute changes can be avoided. That is to say; event insurance will ensure that people breathe easy by not bearing the full brunt of inevitable disruptions.

Enterprises also depend on event insurance when organizing conferences, product launches, and business meetings. Such events often entail high budgets, involved vendors, as well as considerable logistics planning. Some common potential problems that companies should account for include venue problems, technical failures, and cancellations by speakers or presenters. Then, insurance will support businesses in recovering these losses, preventing long-term impact on finances. Thus, the need for reliable insurance policies remains strong as more companies see events become platforms for branding and networking.

Risk is inherent in the life of event organizers responsible for the management and execution of events. From securing venues, handling vendors, to ensuring guest safety, this job responsibility entails many tasks; thus, with every task comes the risk of equipment failure, an unavailability of venue at the last moment, or medical emergencies, which can put an unexpected bill on the organizer's plate. The organizer tackles these situations in comfort using this coverage, as it will not cause severe financial impact. As event organization becomes more complex by the day, securing more comprehensive insurance policies is one area becoming important for many of them.

Event venues that host different events also enjoy benefits from event insurance coverage. Damage to property, legal issues, or accidents happening within the event add up a heavy financial liability. Most venues will require the host to acquire event insurance before confirming booking the venue to avoid exposure for the two sides in the long run. With proper insurance protection, venues are able to function well without fear against any probable claims and damages.

Henceforth, as the event industry expands globally, increases in demand for insurance coverage will continue to increase. It will always be an incidence in the world where people, enterprises, event organizers, and venues look toward safeguarding themselves against uncertainties; hence, the event insurance market will remain a must-have towards ensuring smooth and secure events within operations.

By Sales Channel

The global event insurance market has exhibited growth as more individuals and organizations realize that financial protection is vital for unforeseen circumstances. Events, whether big or small, come with their associated risks, one of which is cancellations, property damage, accidents, or liabilities. This has encouraged the increasing demand for com-prehensive insurance solutions against loss. The market trends in relation to increasing event-related costs, risk management perspectives, and external uncertainties, such as weather or economic events, shaping demand.

Diverting what the biggest influence is an array of contests needing coverage. From weddings to concerts, corporate events to sports competitions, they all have their own issues attached to them that may make insurance service all the more necessary. Organizers and stakeholders will always look to find policies that cover unexpected conditions interrupting the event and costing them money. In addition, the tendency toward organizing larger public events has resulted in increasing importance of requiring liability-associated coverages. This offers protection from claims of accidents or property damage during an event.

Three major sales categories: brokers, direct and web resources, are used for the distribution of event insurance policies. Brokers have the most important role further on advising the client and, accordingly, finding the best policy corresponding to the specific needs. Most event organizers prefer going through brokerages because of the complexity of understanding most of the terms and conditions in the general insurance. Direct sales, meanwhile, are all about purchasing direct insurance through providers.

It allows consumers to sell directly to insurers without intermediaries and at times resulting in personalized policies. Meanwhile, online platforms gained popularity due to being accessible and convenient. Most of these insurance providers have embraced online solutions where a customer would compare policies, get instant quotations, and even finalize their purchase in minutes. This has seemingly made it attractive to many people and businesses to seek event insurance.

There are many factors contributing to the expansion of an event insurance market worldwide. More awareness about the risks of events has provoked organizers into action. Growth in the entertainment and corporate sectors has also contributed to an increase in higher investments by companies in such large-scale functions that cove trespass with all-inclusives. Moreover, now with the digital solutions, accessibility has improved to a lot more people being insured without hassle.

As the demand for event insurance keeps on increasing, it's expected that the insurers keep developing their offerings to cater to the wide needs of customers. Policies may become more flexible now as they will include emerging risks that accompany technological advances and developments in trends of events. Innovation will probably shape the market's future; it will ensure that organisers have the right financial resources to be successful events.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$1,045.48 million |

|

Market Size by 2032 |

$2,415.26 Million |

|

Growth Rate from 2024 to 2031 |

12.9% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

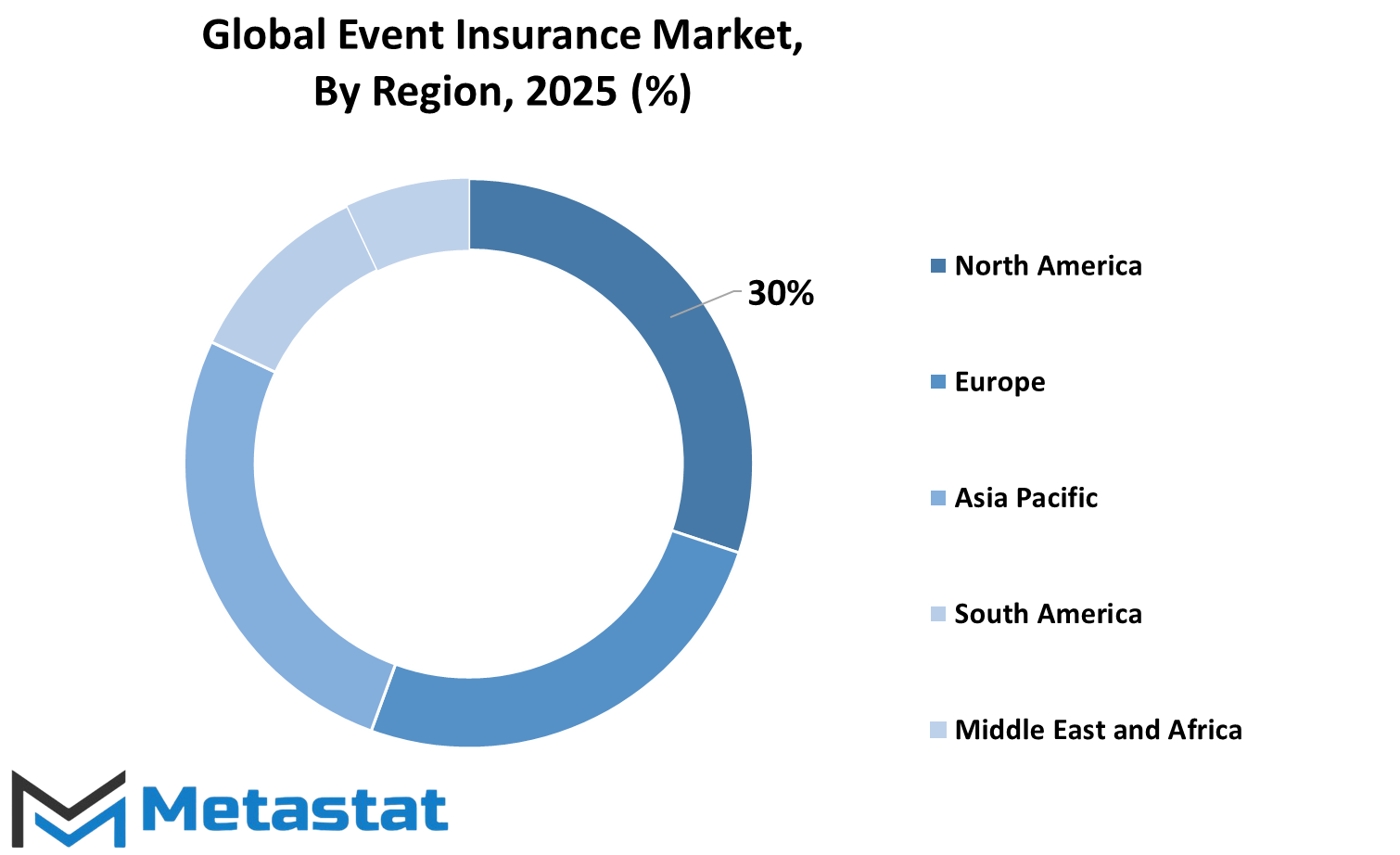

The global event insurance market is influenced by many factors, with geography acting as a key factor for the wide segmentation of the market. The market is generally segmented into five main regions: North America, Europe, Asia-Pacific, South America, and Middle East and Africa. The market dynamics in these areas are influenced by various factors, including economic conditions, regulatory policies, and the frequency of events requiring insurance cover.

The North American regional market is one of the major markets for event insurance; in fact, the U.S., Canada, and Mexico contribute mainly to the growth of this market. There is a huge demand for event insurance coverage in this region, driven mostly by the large number of corporate events, concerts, and sporting events there. Moreover, well-established insurance companies operate within a tight regulatory framework; therefore, event organizers seek comprehensive policies in order to contain their financial risks. That is why the U.S. enjoys the biggest share of this market, given its well-established entertainment and sports industries.

Europe also encompasses markets like the UK, Germany, France, Italy, and Rest of Europe. A well-known cultural scene, international exhibitions, and vast amounts of sporting events all influence the demand. In Germany and France, a proper insurance industry is enabling trustful coverage for all event organizers. The UK's one of the most diverse entertainment industries, and this directly impacts the significant growth of event insurance in the region. As the region plays host to internationally recognized events, insurers have increased their offerings to cover varying needs.

Asia-Pacific covers India, China, Japan, South Korea, and the rest of Asia-Pacific. The market has expanded massively because of the high rate of urbanization and an increased interest in large-scale events. With buoyant economies, China and India host numerous corporate events, weddings, and cultural festivals, thereby pushing up the demand for event insurance. Japan and South Korea bolster the market with sophisticated insurance products, as they have a developed financial sector offering comprehensive insurance options for various event types.

South America, which incorporates Brazil, Argentina, and the rest of South America, is another emerging market. Brazil, with its carnival festivities and international sports events, is opening windows for insurers. Argentina also counts in with growing needs for coverage, especially regarding business events and entertainment shows. Though the market is still at its infancy in this region, the heightened awareness of risk management should stimulate demand over the coming years.

In the Middle East and Africa region, classification is done taking into consideration the GCC Countries, Egypt, South Africa, and the rest of Middle East and Africa. The GCC countries in the UAE and Saudi Arabia are key contributors, thanks to increasing tourism and entertainment industries. To add on, South Africa, also hosting international sporting events, boosts the market. With the ongoing development of the region's event sector, demand for specialized insurance policies is also expected to rise.

COMPETITIVE PLAYERS

Emerging market for event insurance globally has largely etched itself into safeguarding event planners from a horde of unforeseen financial disadvantages. Corporate gatherings, music festivals, sports events, and private functions are examples of events under this umbrella, to name a few. Cancellation, property damage, or liability claims usually lead to many considerable expenses, which can be minimized with event insurance.

The increasing size of events is directly proportional to the increase in hauler requirements for event event insurance. Extreme weather conditions; accident cases related to the event and legal liabilities all are the different types of risks that event organizers come across. The financial burden, in case of a single incident Event insurance policies cover different aspects of coverage, such as general liability, cancellation, property damage, and even unexpected interruptions. Depending on the type of event, location, number of attendees, and associated risks, coverage levels will vary.

Protecting such organizations and individuals against cancellations is one of the main reasons they buy event insurance. The cause of cancellation of an event can be owing to natural disasters, unexpected incidents, and failure of suppliers. Cancellations of events usually create great financial loss for the planners. The insurance ensures they will be able to recover some or not all of their costs, thus preventing the damage from being too severe. Liability insurance is also important because, during events, people can be involved in accidents and damage to their properties, as both can lead to lawsuits and claims for compensation. Therefore, having adequate insurance helps minimize financial exposure and the legal aspect.

The market has been flooded with increased demand as a result of the growing numbers of mega events. Corporate conferences, international sporting competitions, and high-profile entertainment events rely on strong insurance policies for their protection against unforeseen risk. This increased participation has attracted various key players into the industry who specialize in different segments of insurance coverage for events. Some of the key companies participating in the event insurance industry include Aon plc; Allstate Insurance Company; American International Group, Inc.; Chubb Limited; Hiscox Ltd; GEICO; InEvexco Ltd.; Marsh LLC; and R.V. Nuccio & Associates Insurance Brokers, Inc. While numerous companies like these are in the market to design options meeting specific event needs, The Hartford, nevertheless, stands found in the listed companies.

Increased incidence is the event industry's calling. With the ongoing demand for a well-structured insurance policy, all organizers clearly know the importance of shielding finances against worse unforeseen eventualities. As risks change, insurance companies continue to fine-tune products addressing emerging issues. Proper insurance will provide an opportunity for many event organizers to worry more about delivering successful experiences than financial failures in the unforeseeable future against which they have not planned.

Event Insurance Market Key Segments:

By Type

- General Liability Insurance

- Professional Liability Insurance

- Event Cancellation Insurance

- Property Insurance

- Prize Indemnity Insurance

By Application

- Weddings

- Community Events

- Theater Performances

- Corporate Events

- Festivals and Concerts

- Sports Events

By End User

- Individuals

- Enterprises

- Event Organizers

- Venues

By Sales Channel

- Brokers

- Direct Sales

- Online Platforms

Key Global Event Insurance Industry Players

- Aon plc

- Allstate Insurance Company

- American International Group, Inc.

- Chubb Limited

- Hiscox LtdGEICO

- InEvexco Ltd.

- Marsh LLC

- R.V. Nuccio & Associates Insurance Brokers, Inc.

- The Hartford

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252