MARKET OVERVIEW

The global surety market will continue to evolve in the next few years because it is indispensable to a multitude of industries including construction, finance, and insurance. Its significance is based on the guarantee and bonds extended by it to meet commitments, guaranteeing finance against loss, and trust between business transaction parties. As governments and corporations look for ways to secure transactions and contain risks, the need for surety bonds will continue, determining the future of this industry.

The Global Surety companies will, in the next few years, transform under the pressures of emerging technologies and changing economic conditions. Digitalization will drive the development of more sophisticated tools for estimating ever more accurate levels of risk and quicker processing of bonds. Development of artificial intelligence and machine learning will enable underwriters to better screen bond applications, precisely predicting potential risk. Computer software will likely replace the current manual system, providing businesses and the public faster, more efficient service.

Greater business globalization will also affect the market, especially as operations extend further overseas. This expansion creates a demand for surety bonds that support the performance of contracts and agreements, securing domestic and foreign stakeholders. The global surety market will increasingly experience more cross-border transactions, which in itself will call for greater coordination and cooperation among surety providers across different regions. These partnerships will have to deliver the convenience of business growth and reduced international trade complexity.

The expansion of infrastructure development across the globe will be another impetus to the global surety market future. Large-ticket projects in sectors like construction and energy will require improved bonding solutions, which will drive projects to completion on schedule and to spec. Governments and private institutions will make greater use of surety bonds to secure successfully completed construction projects, saving costs and time.

The regulatory climate of the market will also shift. The regulating bodies will further clarify their policies so that responsible surety bonds are issued. Changes can be more stringent monitoring of the issuers of the bonds to ensure that they adopt sensible financial processes. Governments in the quest to assist consumers and enterprises will result in new laws and policies, regulating the issuance, enforcement, and regulation of surety bonds. These regulatory reforms will influence the way surety providers function, requiring them to modify their strategies to maintain compliance and competitiveness.

In the next few years, the global surety market can anticipate seeing an increased focus on sustainability and the environment. As the global focus shifts towards green projects and eco-friendly initiatives, the demand for surety bonds that support such principles will rise. Businesses that conduct sustainable businesses may have surety bonds that guarantee environmental regulated practices to ensure the businesses do not degrade the ecosystem. This will compel the market to find innovative solutions for addressing the distinct requirements of business ventures that conduct sustainability.

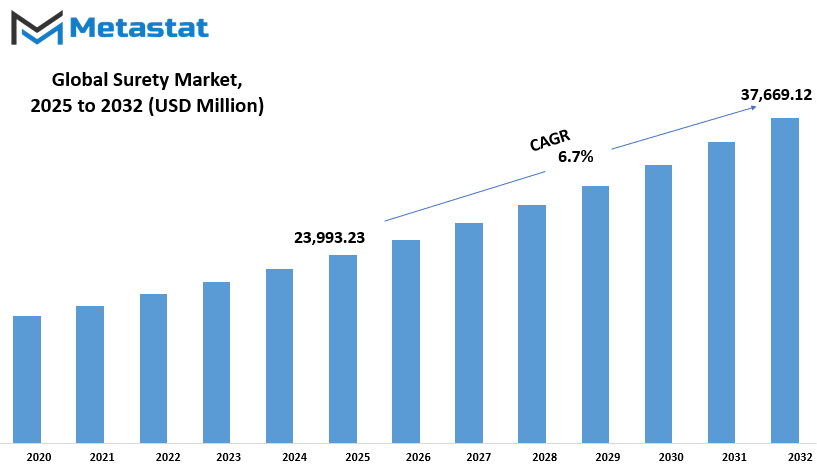

Global surety market is estimated to reach $37,669.12 Million by 2032; growing at a CAGR of 6.7% from 2025 to 2032.

GROWTH FACTORS

The global surety market is rising, supported majorly by rising numbers of building and infrastructural projects that call for guarantees on performance as well as payments worldwide. They call for the guarantors to ensure compliance in both terms given by the contractors in their terms of either private or public agreements. Rising demands for these forms of project request calls the requirement for the same to ever keep on escalating. In addition, stricter regulatory conditions for surety bonds in these contracts are certainly driving the market forward. Private sector organizations and providers of government contracts are more and more insisting that contractors provide surety bonds to ensure their performance and safeguard against failure to complete, fueling the demand for such financial tools higher.

Various issues that can affect the growth of the global surety market do exist, though. One of the most applicable is the multi-step process of underwriting that is needed to acquire a surety bond. Such processes are time-consuming and can quite possibly be cumbersome for small enterprises. Moreover, the stringent eligibility criteria employed by the majority of surety firms restrict access to such bonds, especially among small and medium enterprises. This will make it even more difficult for such companies to accept high-profile projects, and they will be deterred from expanding their growth prospects.

The second most important disincentive for market growth is poor awareness among small and medium-sized companies regarding surety bonds and their utility. Most companies are unaware of the process of surety bonds or lack confidence regarding the services provided by them, e.g., increasing an additional cover and generating confidence among business partners and customers. This lack of awareness will discourage firms from approaching surety bonds, closing them out from options that could be available otherwise.

In spite of all these challenges, there are promising opportunities for the surety industry in the future. One of these opportunities is the development of internet-based surety platforms. These platforms are meant to automate the process of issuing bonds so that it is simpler and quicker for businesses to obtain surety bonds. Through reducing the process complexity and paperwork, digital platforms are also assisting in expanding the scope of the market to more businesses, especially small businesses that otherwise might have grappled with conventional processes. This move toward digitalization will be a big market growth driver in the forthcoming years, facilitating more businesses access surety bonds and enhancing industry efficiency.

Finally, the surety market is likely to expand further with construction and infrastructure activities on the rise and regulatory requirements becoming more stringent. Nevertheless, addressing underwriting, eligibility, and awareness issues will unlock its full potential. Further innovation in digital surety platforms is sure to create tremendous opportunity for growth in the global surety market.

MARKET SEGMENTATION

By Type

The global surety market is a large and dynamic industry that provides different types of bonds with crucial functions across different industries. Bid bonds are one of the most important parts of this market, and they alone account for around $4,167.44 million. These bonds are necessary for companies undertaking project bidding because they give assurance to the project owners that the bidding company is serious and is capable of carrying out the project in case they win. A bid bond is an undertaking, which guarantees the bidding company to undertake its proposal and execute the contract within the terms agreed upon.

Besides bid bonds, the market is also filled with other forms of surety bonds. The performance bonds are the other key section, ensuring a contractor executes the work as per the terms of the agreement. When the contractor is unable to adhere to the terms or conducts work in a below-par way, the performance bond guarantees financial restitution to the project owner so he can cover himself against the risk of delayed project or poor work quality.

Payment bonds, however, ensure subcontractors and suppliers are paid for labor and materials they contribute to a project. The bond also gives assurance to everyone involved since they ensure laborers on the project shall never be unpaid in the event the main contractor fails to. Payment bonds also build trust among suppliers in the supply chain and eliminate financial imbalances that occur as a result of unpaid labor.

Maintenance bonds are a niche product within the global surety market, and they are employed to guarantee that the contractor will repair any flaws that do occur once the project is finished, usually within a period of time. Bonds give the owner of the project confidence that if something turns out to be faulty once it is built, the contractor will be obliged to repair the flaw at no extra cost to the owner.

Customs bonds are a necessity for companies that engage in international business. Customs bonds ensure that there is compliance with regulation and timely payment of import duties, tax, and regulatory charges for the facilitation of admission of imported goods into a country. Customs bonds provide a vehicle of ease of passage in transferring commodities from one location to another with less room for delay with respect to regulation.

Lastly, other types of surety bonds cover other requirements not included in the mentioned categories. Such types of bonds can be applied for other purposes according to the requirements of a particular project or business and offer a wide variety of coverage options for businesses and individuals looking for financial protection.

Collectively, these segments create the global surety market, which is instrumental to the successful completion of projects, with proper financial security in place. The size and variety of the marketplace illustrate its significance across various industries where trust, security, and accountability are essential.

By Application

The global surety market is a key driver in many industries across the globe through the offer of financial cover against risk, guaranteeing that commitments are honored. The market is segmented into a number of key areas of use, each serving distinct industries that need guarantees and bonds to guarantee easy operations and conformity. The most prominent uses are construction and infrastructural projects, trade and commerce, financial guarantees, public procurement contracts, and energy and utilities.

In construction and infrastructure projects, surety bonds are usually demanded to make contractors finish work on time and to satisfactory standards. These bonds act as insurance for the owners of projects against loss in the event of default by contractors to fulfill their commitment. In big projects, where risk is high and stakes are also high, this comes in very handy. Surety bonds are used by construction companies to establish their credibility and financial status with customers and investors and are a critical part of the construction sector.

Trade and commerce also contribute a significant portion to the global surety market. Businesses that deal in international trade often need bonds to guarantee fulfillment of contractual terms, such as payment for goods and services or compliance with trade regulations. Such bonds help build trust between parties and reduce default or failure to perform, which is risky in foreign markets. Trade and commerce surety bonds provide some form of protection that can be relied on by businesses while trading.

Financial guarantees is another important arena where surety bonds are in widespread use. Guarantees in this sector are an undertaking that a financial obligation will be met, and serve to ensure investors, creditors, and others. In finance, such bonds have a highly important function of creating stability and confidence, particularly when transactions are being conducted involving huge loans or investments of great risk.

Public sector contracts is another area in which the global surety market has an important function. Governments and public authorities tend to insist on contractors furnishing surety bonds when they are tendering contracts. The bonds ensure that the contractor fulfills obligations as agreed, to protect public money and guarantee successful completion of the project. Without the use of surety bonds, financial loss would be more likely within the public sector.

Finally, in the energy and utilities industry, surety bonds play a critical role in construction and maintenance of infrastructure such as power plants, pipelines, and electric grids. The bonds serve as a buffer to stakeholders since it is assured that projects are completed and obligations met, particularly in such capital-intensive sectors where failure would result in long-term impacts.

All of these applications point to the importance of the global surety market in different sectors. As governments and companies rely on these financial guarantees to manage risk, the market will be a major component in providing stability and confidence in industries.

By End User

The global surety market is divided by end user, which further splits into three broad categories: large businesses, small and medium businesses (SMEs), and government. These segments help to gain a better understanding of the demand and specific requirements within each category, giving a clearer picture of how the market operates across different sizes and types of organizations.

Big companies dominate a significant portion of the global surety market. These firms will probably require more valuable surety bonds since their operations are larger in size and their projects more complicated. These firms will probably be engaged in large-scale construction, infrastructure, and commercial projects, and they require financial guarantees to secure that obligations are met. Big company surety bonds typically guarantee a wide range of risk, from the performance of contracts to payment guarantees for subcontractors and workers. Big companies are incentivized to demand surety bonds by project size and the regulatory requirements to which they are subject.

On the other hand, small and medium businesses (SMEs) also play a critical part in the surety industry, though their required bonds are dissimilar from that of big companies. SMEs typically require surety bonds for smaller capacity jobs or compliance requirements for their business. While financial risks involving SMEs are possibly lower compared to big business, they too have the protection of surety bonds. They allow SMEs to establish creditworthiness and credibility with customers, suppliers, and contractors. Greater awareness in other regions of the world about the importance of bonding to SMEs has contributed immensely to driving demand within this marketplace.

Government authorities constitute another highly important segment within the global surety market. Such entities require surety bonds to govern risks of public works projects and prompt contractors to adhere to the terms of their contracts. Government contracts, especially in areas like construction and infrastructure, usually require bonds to ensure projects are completed on time and within budget as set forth. The bonds also ensure payment to subcontractors and suppliers according to contract. Government requirement for surety bonds has also remained high due to the persistent need for infrastructure development and increased complexity of public sector projects.

In short, the global surety market is driven by the needs of large companies, SMEs, and government agencies. Each of these markets will have specific needs for surety bonds, but all are addressed by the financial security and protection against risk that these bonds provide. As the market grows, understanding the needs and character of each end user will be critical to firms that want to succeed in this market.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$23,993.23 million |

|

Market Size by 2032 |

$37,669.12 Million |

|

Growth Rate from 2025 to 2032 |

6.7% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

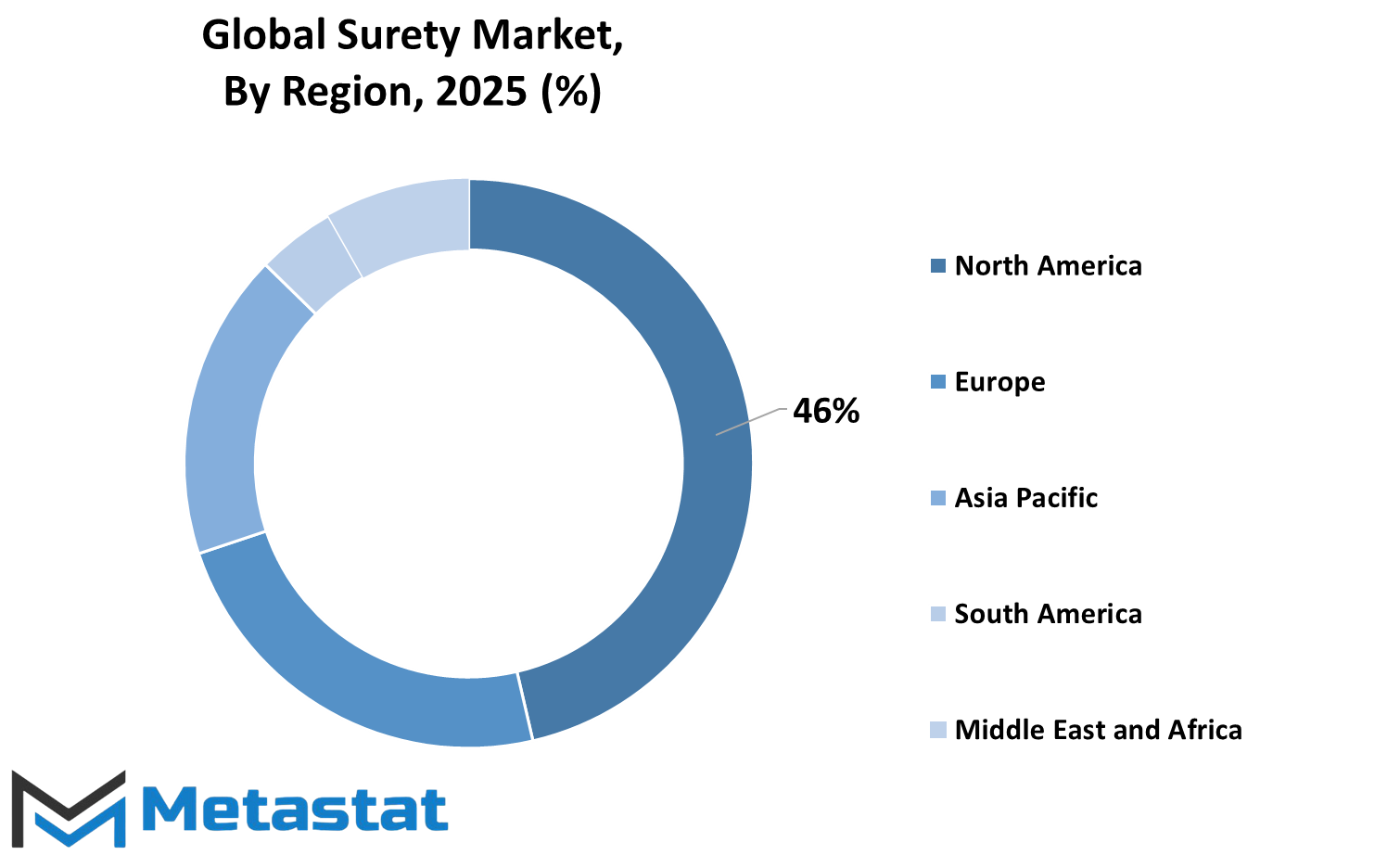

The global surety market is bifurcated on the basis of geographical areas into different segments with their unique market dynamics and characteristics. They include North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. Each geographical region has different segments, and these segments are bifurcated further to provide a more effective understanding of market trends and opportunities.

In North America, the global surety market is typically divided into three countries: the United States, Canada, and Mexico. The U.S. dominates this market, with a large number of companies and a highly developed regulatory framework for surety bonds. Canada and Mexico have large markets, but they are smaller than the U.S. Every nation has its own rules and needs for surety services, which might influence the aggregate request for surety items.

Europe, then again, incorporates nations such as the United Kingdom, Germany, France, Italy, and the remainder of Europe. The UK and Germany are notably significant contributors to the European surety market because of their strong economies and robust business communities. France and Italy, with their large construction and manufacturing industries, also play their part in growing the global surety market. The remaining countries in Europe also have a share, although some of them have been climbing to be big markets for surety bonds over the last few years.

Asia-Pacific is another big region and consists of nations like India, China, Japan, South Korea, and the remaining Asia-Pacific countries. India and China are among the largest emerging markets for surety bonds with increasing infrastructure development and demand for construction work. Japan and South Korea have robust markets and play a considerable role in total growth in the region. The remaining Asia-Pacific countries also show potential, driven by emerging economies and infrastructure growth.

South America includes Brazil, Argentina, and the rest of South America. The biggest economy in South America is Brazil, and it is the primary contributor to the surety market in South America. Argentina also makes contributions, with the demand for surety services increasing due to the growth of its construction and development sectors. Other countries in South America are increasingly requiring surety bonds as their economies grow.

Finally, the Middle East & Africa is divided into the GCC countries, Egypt, South Africa, and the remainder of the region. The GCC countries, including Saudi Arabia, the UAE, and Qatar, control the surety market due to their perpetual infrastructure development projects. Egypt and South Africa contribute as well, with South Africa controlling the African surety market. Other areas in the region are constructing their markets due to various construction and development plans.

All of these areas are significant components of the global surety market, with broad ranges of demand and expansion possibilities based on their individual economic and industry conditions.

COMPETITIVE PLAYERS

The global surety market is a backbone to the world of risk management and insurance. A surety bond guarantees that a specified task or enterprise will be performed as agreed upon, typically being present in areas of finance, construction, and the legal practice. As enterprises stretch and outreach themselves, so has the demand for surety bonds. Leading players of the surety business provide these services and have dominated the marketplace because of their experience and global presence. Some of the largest brands are Zurich Insurance Group, Allianz SE, Atradius, Coface, London Surety & Financial Risks, Swiss Re, Chubb Limited, Munich Re, Tokio Marine HCC, Liberty Mutual Insurance Company, and QBE Insurance Group Plc.

Zurich Insurance Group is one of the industry leaders, well known for offering a range of surety products that are tailored to the requirements of various industries. Allianz SE, another leader, has a good reputation for its commitment to financial security and providing prudent surety bonds. Atradius and Coface, two specialized credit insurance providers, also contribute to the global surety market by providing services aimed at protecting business against risks in international trade.

In addition to these, London Surety & Financial Risks offers unique financial solutions that address clients' needs in the home market as well as in foreign markets. Swiss Re and Chubb Limited are also as powerful in their line of business as they provide the best surety solutions while remaining at the top in risk minimization for their clients. Munich Re also has a global reach, stretching its wings as far as it needs to in order to provide access to support services for companies, no matter their size. Similarly, Tokio Marine HCC offers varying surety solutions, working to help companies with effective risk management.

Liberty Mutual Insurance Company is a critical market player with flexible and full-range surety services to customers across the world. QBE Insurance Group Plc, however, prides itself on customer-centricity and its ability to offer products that adapt to the evolving requirements of businesses. They complement each other in the sense that they cover a broad range of industries to ensure companies can make their payments and thrive in their respective markets.

Finally, the global surety market is one that is driven by a mixed bag of participants who are focused on delivering fundamental services that assist companies in the management of risk and the performance of their contracts. Through the efforts of entities such as Zurich Insurance Group, Allianz SE, and others, businesses across the globe can obtain the financial support needed to conduct their affairs with confidence.

Surety Market Key Segments:

By Type

- Bid Bonds

- Performance Bonds

- Payment Bonds

- Maintenance Bonds

- Customs Bonds

- Other Surety Bonds

By Application

- Construction and Infrastructure Projects

- Trade and Commerce

- Financial Guarantees

- Public Sector Contracts

- Energy and Utilities

By End User

- Large Enterprises

- Small and Medium Enterprises (SMEs)

- Government Entities

Key Global Surety Industry Players

- Zurich Insurance Group

- Allianz SE

- Atradius

- Coface

- London Surety & Financial Risks

- Swiss Re

- Chubb Limited

- Munich Re

- Tokio Marine HCC

- Liberty Mutual Insurance Company

- QBE Insurance Group Plc

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252