MARKET OVERVIEW

The global machine vision and rfid in logistics automation market is on the verge of a phase when its reach will not be limited to warehouse productivity and real-time location. This market, which is renowned for redesigning supply chain transparency, is set to go beyond conventional logistics domains and become part of more vibrant, multi-purpose ecosystems. What started out as a solution for practical use in sorting, scanning, and authenticating shipments is gradually transforming into a base technology for more extensive operational intelligence, informing the way companies will comprehend, forecast, and respond to supply and demand.

As logistics increasingly relies on data, the application of machine vision and RFID will go beyond identification and automation functions. In the next few years, this market will enable the emergence of predictive logistics, in which historical and live data are crunched with machine accuracy to predict disruptions ahead of time. This change will not only be cost-saving but also redefine responsiveness, making sure that logistical choices are pre-emptive rather than reactive. The technology will adapt to interact with outside variables such as weather patterns, geopolitical events, and traffic patterns in a way that aids companies in planning logistics with a level of preternatural insight previously unimaginable.

Another shift is in the convergence of physical and digital identities. The global machine vision and rfid in logistics automation market will trend toward supporting digital twins real-time, virtual replicas of supply chain assets that update in real-time. These digital twins will enable more intelligent asset maintenance and inventory management, modeling potential bottlenecks and revealing invisible inefficiencies. Predictive visibility will become critical not just in distribution centers but in industries like aerospace, pharmaceuticals, and food distribution, where traceability and quality control are absolute.

Moreover, the use of machine vision and RFID will evolve into sustainability auditing. These technologies will begin to aid in carbon footprint tracking, temperature-controlled product monitoring to reduce spoilage, and outright elimination of paper-based documentation. In an ever more environmentally accountable world, the market will assist companies in bringing logistics operations into line with worldwide sustainability objectives. What was a voluntary add-on will soon become an integral compliance requirement for worldwide trading partners and environmentally aware consumers.

The impact on education cannot be ignored. With machine vision and RFID technologies becoming increasingly pertinent, these will become a part of vocational courses and degree programs, developing a new class of people skilled in automation processes. Logistics employees will become analysts and automation supervisors in the future, better at deciphering streams of data than controlling manual processes.

Essentially, the global machine vision and rfid in logistics automation market is poised to move towards the direction of becoming its core to business intelligence, strategic foresight, and global efforts towards sustainability. This will not only be about the adaptation of operating flow; This will determine the method in which companies connect with their environment, resources and consumers. This change would be a reflection of a deep change - which will be an infection for automation for automation for automation for automation and automation for automation, a one that will re -define the meaning of logistics in a interconnected world.

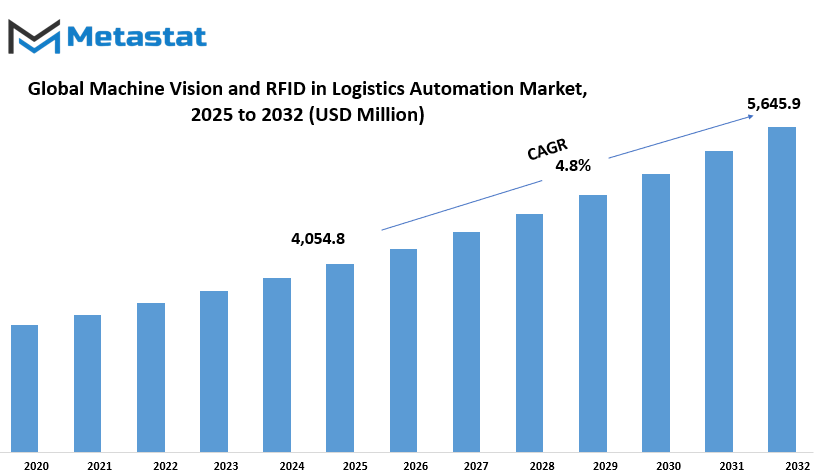

Global machine vision and rfid in logistics automation market is estimated to reach $5,645.9 Million by 2032; growing at a CAGR of 4.8% from 2025 to 2032.

GROWTH FACTORS

The global machine vision and rfid in logistics automation market is going through a time of extreme change as companies seek to develop faster, more efficient, and less expensive operations. Perhaps the primary driver of this innings is an increase in e-commerce. With millions of packages flowing through supply chains and warehouses every day, business feels pressure to deliver within compressed windows. This has created the need to monitor, inspect and certify the products with the minimum amount of human intervention automatically the need of the system. The machine enables identification and inspection of products with vision accuracy, while RFID enables real-time tracking without line-off-vision scanning. Both technologies simultaneously enable companies to process more orders in a short time, which is today an important aspect in the fast -book retail world.

Speed and accuracy are no longer alternatives, but requirements. Distribution centers and godowns do not have time for delays or mistakes. Whether they are scanning the barcode, verifying the position of the package, or looking for stocks, the automation system operated by the machine vision and RFID makes it easier and sharp. Companies are now able to spot weaknesses in their logistics stream and are immediately correct, which was impossible only under manual labor. Nevertheless, the direction of the implementation of these technologies is not always a smooth, especially for small and medium -sized enterprises.

Cost is one of the largest hurdles. The development cost of creating machine vision systems and RFID facilities may be prohibitive. In addition to the hardware, firms have to replace or upgrade components of their current software and train personnel to operate new systems. For most smaller players, such costs are difficult to justify, particularly if the returns are not instant. Then there is the matter of compatibility. Older logistics infrastructures, still prevalent in most facilities, tend not to interface well with newer digital technologies. This complicates full integration, and firms sometimes experience unwelcome downtime or glitches in the process.

Aside from price and integration, security of the data is also a factor. These systems gather and analyze a lot of data, from inventory information to location monitoring. If not protected well, this data will be vulnerable. Companies already know they need to secure their systems, particularly as they become more integrated. Nevertheless, concerns about the safety and dependability of these arrangements might make some companies wait and implement them partially.

In spite of these issues, the global machine vision and rfid in logistics automation market is full of opportunity that might outweigh the constraints. Trend towards more intelligent, network warehouses means that automation will remain an important part of logistics. AI and IOT are being included in the machine vision and RFID systems, making them intelligent equipment that do not only process data, but also learn from it. For example, the future stating maintenance and real -time notification is now possible, enables companies to prevent delays before it is. Such developments make logistics active rather than reactive, which can place companies in an infallible leadership on their rivals.

As more companies infection in industry 4.0, the use of automation in logistics will be not only an option, but will be a requirement. Innovative businesses are already spending money on AI-Saksham Machine Vision System and RFID technology that enables them to lead the pack. Although the cost and difficulty of implementation may withdraw to some companies, long-term paybacks will promote enhancement, low errors, and improvement in customers' satisfaction-will propagate overall adoption. This change will create new opportunities for innovation and provide space to suppliers to create a more economical, skill able solution that will allow technology to reach wide number of businesses.

MARKET SEGMENTATION

By Type

The global machine vision and rfid in logistics automation market is experiencing a significant transformation as logistics organizations focus on speed, accuracy, and visibility. With rapid complex supply chains, organization will rely rapidly on automation technologies to reduce errors and maximize workflows. Machine vision and RFID systems are at the forefront of this change, allowing organizations to track, scan and validate products in delivery containums. These technologies are not only about customizing processes - they also enable future maintenance, quality control and more stability in inventory checks.

Within this market, the type segment covers Machine Vision Systems, which are worth $1,036.7 million, in addition to RFID Systems and Integrated Systems that incorporate both. Machine Vision Systems will remain essential for use in functions like reading barcodes, object identification, and robotic arm guidance in warehouses and sorting centers. While this is going on, RFID Systems provide contactless tracking that reduces delays in scanning and improves stock control. The advent of Integrated Systems combining the best of both indicates the intention of the industry to integrate data collection and real-time tracking into one building and therefore have a more reactive supply chain.

While global demand continues to increase, especially in manufacturing and e-commerce, automation will become rapidly prominent. The firms will use these systems not only to expand operations, but also to meet the customer's demands for rapid and error-free delivery. Investment in end-to-end logistics solutions will increase, which will be affected by the pressure of being competitive and responsible. The global machine vision and rfid in logistics automation market is not just riding a trend - it is moving towards an era where data, accuracy and smart automation defines the movement of goods from Point A to Point B.

By Application

The global machine vision and rfid in logistics automation market is headed towards a future where logistics operations will be much more streamlined and sophisticated. As business wants quickly, more accurate ways to control supply chains, are spreading in the implementation of machine vision and RFID technologies. These technologies are changing in the way the goods have been obtained, tracked, and sent-streamline the activities and reduce dependence on manual labor.

Perhaps the most visible change in inventory management will be. Instead of traditional barcode, RFID tag will mean that each product will have a unique code that can be read from a distance. This will significantly reduce the consumption time in stock-counter and eliminate errors that often crawl with human inputs. Concurrently, the machine vision solution will enable the warehouses to scan and certify the item in terms of seconds, providing real-time insight into the stock level and movement.

Warehouse automation is another sector where this industry will take a sizeable role. Robotic and automated systems driven by machine vision will take, place, and sort products with increased precision. RFID technology will accompany this by verifying the identity and positioning of items, allowing the systems to function without delays. This combination will decrease reliance on human intervention and decrease the risk of accidents or inefficiencies that commonly occur in massive storage areas.

In transport and fleet management, RFID will be a major force in enabling vehicle routes and businesses to track time. Using real-time information, companies will re -determinate on the fly, eliminate the delay, and put more control over their supply chain. Machine vision systems, mounted on trucks or loading bays, will read the items automatically or unloaded items to ensure that everything will be finished at the right place.

In packaging and pruning, speed and accuracy will be increased as visual-guided robots are capable of rapidly identifying the shape, size and label. With RFID, the system item will be able to assign its proper destination. This reduces the possibility of wrong routing shipment and enables rapid product distribution.

Inspection and quality control will also experience significant improvements. Machine vision will identify packaging defects or product damage in a matter of milliseconds. This minimizes waste and makes sure that only perfect products are shipped from the warehouse. As RFID tracks the entire path of each item, it is easier to trace when and where a problem developed if a complaint is lodged by a customer.

Tracking and tracing will no longer be dependent on manual scanning. RFID systems will continuously record movement of goods through checkpoints without impairing the process. The outcome is an open chain to the advantage of everyone from manufacturers to retailers to customers. In case something goes missing, it will be simpler to find and correct the issue.

Automated Guided Vehicles (AGVs) will travel through vast warehouse areas by utilizing a combination of RFID signals and machine vision sensors. The vehicles will carry materials without the need for human intervention, dodging objects and adjusting to changes in layout in real time. This will accelerate the flow of goods and maintain operations even during staff shortages.

As the global machine vision and rfid in logistics automation market keeps expanding, it's obvious that logistics won't remain the same. With quicker identification, better accuracy, and intelligence, companies will enjoy lower costs and increased efficiency. The combination of machine vision and RFID technologies will serve to create a logistics system prepared for the future fast, reliable, and capable of keeping pace with world demand.

By End User

The global machine vision and rfid in logistics automation market are watching significant changes as industries try for sharp, clever and more accurate operations. This change is mainly being given fuel from the increasing requirement of greater visibility and control on the supply chain. The two technologies contributing significantly are machine visions, which appoint cameras and computer software to scan and inspect objects, and RFID, which enables radio waves to track the item in real time. They are being integrated into logistics and the way the goods are sorted, stored, and transported. Technologies themselves are not new, but their adoption between logistics activities has increased significantly in recent times, and it is likely to continue in the coming years.

From industry to industry, the movement of goods from points is no longer about speed - it is about accurate and intelligence. For e-commerce enterprises, where working with large number of small, high-speed products is about transferring all large versions, machine visions and RFID systems, which bring the ability to reduce human errors and speed up order. These systems enable automation of packaging, sorting and stock monitoring, resulting in delivery accuracy and increase in customer satisfaction. Similarly, third-party logistics companies are embracing these devices to increase operation transparency and to streamline warehouses, so that they can provide quality services to many customers.

Retailers are also reaping the rewards. Through the use of RFID, they will be able to manage their stock more precisely and eliminate stockouts. The machine vision enables them to monitor the shelf space and product placement, to run the in-store experience smoothly. The manufacturers, however, are using the production level and beyond these devices. When the goods are packed and the production line is sent down, the machine vision confirms quality, while the RFID tag starts tracking each item in the supply chain. This will reduce the waste, recall Curtel, and it will provide assurance that the products are up to the standards before being distributed to consumers.

Distribution centers are becoming automated nodes where speed and accuracy go hand-in-hand. These centers will increasingly implement machine vision systems for package scanning and identification at high speed, while RFID will assist in the movement of goods in and out with minimal intervention. For transport companies, these technologies are enabling improved fleet management. RFID tag enables the real -time monitoring of shipments, while the machine vision software can aid in vehicle inspection and license plate reading. The result is low delay, better tracking and more reliable distribution program.

The global machine vision and rfid in logistics automation market is particularly notable that these techniques are not so much than increasing, but the way they are creating new expectations around the logistics. This is no longer acceptable for the goods lost in delay or transit in shipment. Companies that cannot be met with these expectations will be rapidly threatened by companies that embrace automation to provide frequent, reliable service.

As all this takes place, the global machine vision and rfid in logistics automation market will increasingly witness investments in technology enhancements, employee training, and system integration. Firms that embrace machine vision and RFID will most probably derive a competitive advantage, particularly in industries requiring high precision and quick turnaround. The integration of these tools will be at the heart of logistics management with every end user be it an e-commerce company or a transport firm gaining in some manner.

Briefly speaking, the logistics future will no longer lie in more trucks, bigger warehouses, or quicker routes. Rather, it will be based on how intelligent and networked the systems are. The global machine vision and rfid in logistics automation market will be setting the standard for that.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$4,054.8 million |

|

Market Size by 2032 |

$5,645.9 Million |

|

Growth Rate from 2025 to 2032 |

4.8% |

|

Base Year |

2024 |

|

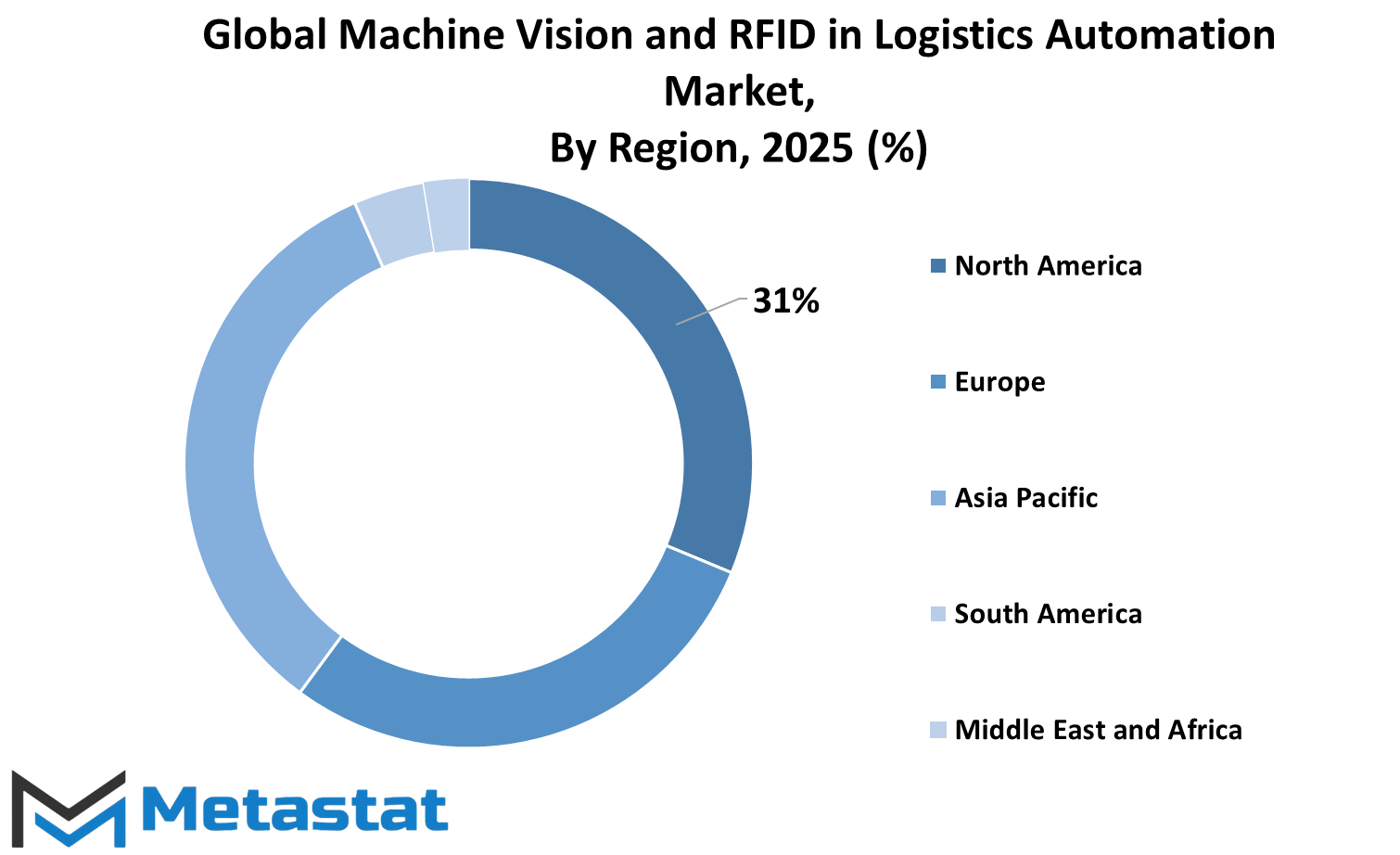

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

REGIONAL ANALYSIS

The global machine vision and rfid in logistics automation market continues to expand in power as companies look for quicker, wiser, and more effective supply chains. Perhaps the most significant factor driving this expansion is regional demand and innovation distribution. Geographically, the market splits into various dominant regions, each with its own dynamics and technological agendas.

North America, that is divided into the U.S., Canada, and Mexico, is a key motive force of the route of this market. The U.S., specifically, is a leader, fueled with the aid of a extensive presence of automation manufacturers and early embracers of smart logistics systems. Canada and Mexico additionally make contributions to standard regional improvement because of increasing infrastructure funding and pass-border alternate projects that require progressed tracking and control abilities.

In Europe, nations together with the UK, Germany, France, and Italy, at the side of the rest of Europe, are targeting high-efficiency warehouse operations in addition to sustainability. Germany, being a manufacturing country, is still adopting device imaginative and prescient technologies for multiplied accuracy, whilst France and the UK are looking toward RFID for more efficient logistics coordination and intelligent stock control. Throughout Europe, logistics vendors are joining virtual transformation priorities, that's riding consistent adoption.

Asia-Pacific is the second sizable contributor, further divided into India, China, Japan, South Korea, and the relaxation of Asia-Pacific. Smart logistics enlargement hinges on China and Japan, as they host some of the world's main manufacturing and export industries. India is speedy catching up, with increasing funding in computerized structures and help from the government for modernization in freight dealing with and warehousing. South Korea, known for its electronics and generation sectors, is applying those innovations to logistics infrastructure as nicely, boosting demand for device vision and RFID programs.

South America, including Brazil, Argentina and the surrounding countries, is demonstrating stable development. Brazilian infection is leading, especially in areas such as agriculture and retail which are extended by tracking systems and warehousing automation. Although issues about cost and access to efficient labor in parts of the region continue, the demand for real -time tracking and increased efficiency will demand the global machine vision and rfid in logistics automation market forward.

The Middle East and Africa region is divided into GCC countries, Egypt, South Africa and the rest. GCC nations, especially UAE and Saudi Arabia, are making significant investments in smart infrastructure projects. Such projects include logistics centers that require strong automation, in which RFID and machine visions are important for adaptation of their operations. Egypt and South Africa are also revealing slow adoption, there is a recognition associated with regional trade expansion and increasing recognition to help the regional trade expansion and supply chains delay and reduce human mistakes.

As operations in each of these segments increasingly go towards faster and clearer operations, machine vision and RFID in logistics automation will increasingly find more applications. Firms across various industries are realizing they need to update systems not only to fulfill the demand of customers, but also to save costs and remain competitive in an environment where every second and every delivery makes a difference.

COMPETITIVE PLAYERS

The global machine vision and rfid in logistics automation market will become a critical component of the way supply chains operate in the future. With companies seeking methods to accelerate speed, accuracy, and efficiency, machine vision and RFID technology will fill long-standing holes within logistics. Machine vision assists in detecting, inspecting, and directing products in real-time, while RFID tags provide rapid tracking without contact or line-of-sight requirements. Used in combination, these technologies are transforming the ways in which warehouses, distribution facilities, and freight networks function.

Part of the reason this marketplace will continue to grow is the intensifying pressure on businesses to minimize human error and maximize transparency throughout supply chains. From sorting and tagging to inventory verification and tracking shipments, the marrying of these technologies will add more form and regulation to day-to-day operations. With increasing numbers of organizations struggling with human staffing shortages or peak demand surges, particularly during holiday seasons, automated systems fueled by machine vision and RFID will fill in and take over. These technologies won't just make tracking a product quicker but will also pick up errors or misplacements that go undetected.

Industrywide, adoption will increase as businesses branch into traceability and predictive logistics. In e-commerce to pharmaceuticals, where accuracy can be a matter of life and death, the combination of these technologies will propel more intelligent systems. What once was labor-intensive to scan and key in will be seamless and nearly transparent, done behind the scenes without slowing down. As calls for speedier shipments and real-time visibility increase, systems designed with machine vision and RFID will gain a distinct advantage.

A number of players are already well down this road. Major players in the global machine vision and rfid in logistics automation market are Cognex Corporation, Zebra Technologies Corp., Honeywell International Inc., Datalogic S.p.A., SICK AG, Keyence Corporation, Omron Corporation, Impinj, Inc., Alien Technology, LLC, Basler AG, Teledyne Technologies Inc., and Novanta Inc. (JADAK). All of these players contribute unique strengths from imaging hardware to RFID chip design and integration software. With their innovations, the logistics industry will determine the way its system modernize its system and manages everything from pruning in warehouses to global shipping lanes.

The destiny of this market will be determined how fast companies move away from ancient systems and embrace technology that enables making more intelligent decisions. With more emphasis on speed, accuracy and traceability, machine vision and RFID will no longer be rebuilt for top applications. Instead, they will be central how the global logistics engine runs. Whether to scan the barcode in a warehouse or keep an eye on the palette in the continents, these tools will help companies to reduce waste, avoid damage, and do better service to customers in the world where expectations increase.

Machine Vision and RFID in Logistics Automation Market Key Segments:

By Type

- Machine Vision Systems

- RFID Systems

- Integrated Systems (Machine Vision + RFID)

By Application

- Inventory Management

- Warehouse Automation

- Transportation and Fleet Management

- Sorting and Packaging

- Quality Control and Inspection

- Tracking and Tracing

- Automated Guided Vehicles (AGVs)

By End User

- E-commerce Companies

- Third-Party Logistics (3PL) Providers

- Retailers

- Manufacturers

- Distribution Centers

- Transportation Companies

Key Global Machine Vision and RFID in Logistics Automation Industry Players

- Cognex Corporation

- Zebra Technologies Corp.

- Honeywell International Inc.

- Datalogic S.p.A.

- SICK AG

- Keyence Corporation

- Omron Corporation

- Impinj, Inc.

- Alien Technology, LLC

- Basler AG

- Teledyne Technologies Inc.

- Novanta Inc. (JADAK)

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252