MARKET OVERVIEW

The Asia-Pacific facility management market is at an interesting juncture, not only as a commercial industry but as a quiet agent capable of influencing the future of how buildings operate and develop. Although it has been the physical foundation of commercial and industrial spaces for years, the sector is poised to redefine operational success across industries. Beyond the everyday maintenance and upkeep, this market will also start to drive larger decisions on sustainability, technology integration, and space optimization to become a transformation driver in ways yet to be realized.

In the coming decade, the sector will slowly transition from being service-oriented to becoming highly data-driven. Buildings won't merely be operated they will be instinctively known. A building will not wait for defects to be manually identified; instead, embedded systems will pre-empt problems, indicate inefficiencies, and direct energy consumption. This transition will be characterized not by abrupt disruption but by steady, intentional transformation. While stakeholders perceive the transition from customary to technology-enabled models, the very notion of facility management will experience a quiet transformation, transforming it into a strategic contributor rather than a cost centre.

What's beyond the present reach of the Asia-Pacific facility management market is its ability to work with upcoming urban trends. Smart cities will necessitate smart buildings, but above all, they will need smart management of said buildings. Facility managers will not only manage day-to-day operations they will integrate physical infrastructures with digital ecosystems. These experts will have to know everything from cyber threats in building automation systems to sustainable material selection that meets long-term climate objectives. The discipline, previously operational in orientation, will have more power in boardroom discussions of environmental footprint and long-term value of assets.

This change will also redefine employment and talent expectations. Conventional job positions will combine with newer profiles that require digital literacy, predictive maintenance analytics, and strategic planning. Training institutions will step by step align their curriculum to accommodate these future roles. Fresh entrants in the field will no longer be plain troubleshooters; they will become consultants, system designers, and policy advisors. The industry of facility management will start to receive the type of professional respect that reflects its real contribution to business resilience and effectiveness.

With the regulatory environment and tenant demands both set to increase, the industry will be at the crossroads of compliance and innovation. Firms will increasingly rely on facility management not only for business continuity, but to ensure their ESG performance, privacy obligations, and user satisfaction targets. It will no longer be an unnoticeable layer of support but a perceptible framework of reliability and advancement.

In this new era, the Asia-Pacific facility management market will continue to shape the built environment, not just by keeping it maintained, but by redefining what it can be. This path suggests a future in which the market is an overriding influence on how humans engage with their environment organized, intuitive, and dramatically more intelligent than current norm.

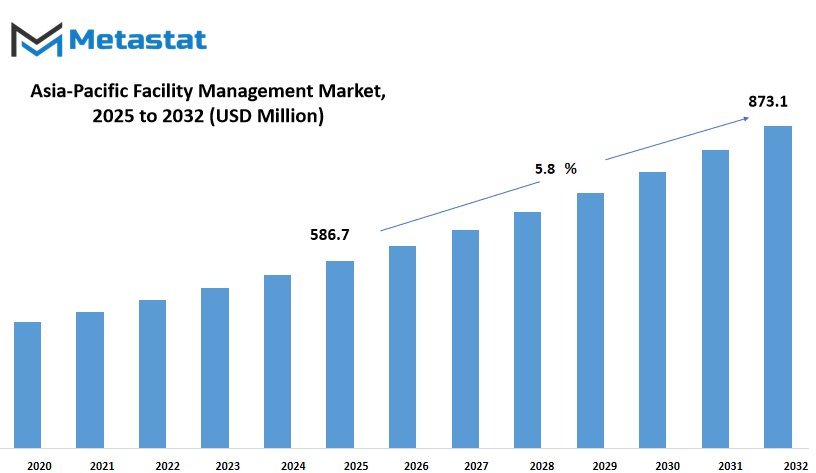

Asia-Pacific facility management market is estimated to reach $873.1 Million by 2032; growing at a CAGR of 5.8% from 2025 to 2032.

GROWTH FACTORS

The Asia-Pacific facility management market is slowly transforming the way organizations consider operational efficiency and building upkeep. One of the number one drivers of this variation is the increasing hobby in sustainable and energy-efficient answers. Businesses want to see how they are able to decrease their effect at the environment even as saving on operational costs. This exchange isn't always a fashion it is turning into a want. From heating and cooling structures to lighting and refuse, groups will go out of their way to operate in an environmentally pleasant manner for both internal goals and external guidelines. With environmental needs turning into greater stringent, provider companies with green offerings will simply revel in a greater call for.

An additional key impetus is the developing trend toward outsourcing non-middle features. Companies are increasingly more figuring out that services which includes janitorial work, renovation, and security do no longer always should be done in-house. Rather, having those duties outsourced enables agencies to concentrate on their strengths at the same time as specialists deal with specialised responsibilities. This technique now not handiest taps into expertise but also higher manages prices. With additional industries embracing this model, the demand for reliable and adaptable facility management providers will continue to grow.

That being said, the Asia-Pacific facility management market is not without challenges. One significant obstacle is the excessive expense of establishing sophisticated systems. Adopting contemporary solutions tends to be very costly in the initial stages, particularly when they are incorporated into older, antiquated systems. These integration issues tend to impede digital adoption and put off the benefits businesses desire. Furthermore, numerous locations maintain to grapple with no longer having ok skilled employees who can function and manage those sophisticated systems efficaciously. Without standard regulations and right schooling, it's miles tough to hold regular provider high-quality, specially in larger or multi-region operations.

Despite those barriers, the Asia-Pacific facility management market guarantees giant capacity. Intelligent era is unlocking new opportunities. IoT and AI are increasingly contributing to facility control, rendering operations more responsive and facts-driven. Occupancy sensors, temperature manage that automatically adjusts, and predictive upkeep notifications will power centers to emerge as more green and cheap. This clever management shift might not simplest improve performance it will trade expectancies. Organizations will require real-time visibility and control, and those providers who can provide it will be a standout.

Concurrently, pushing services into emerging markets and rising urban centers presents new possibilities. Governments investing in smart cities are laying the foundation for cutting-edge infrastructure that is greatly reliant on effective facility management. As cities expand and infrastructure grows more intricate, the need for structured, scalable, and technology-enabled solutions will be there to follow. Companies moving into these markets will require service providers who grasp local issues but have the capacity to introduce international standards.

The Asia-Pacific facility management market will keep evolving as companies look for more efficient, technology-based, and sustainable solutions. With doors opening in both developed and emerging economies, and technologies revolutionizing the way facilities are managed, this industry is headed towards radical transformation.

MARKET SEGMENTATION

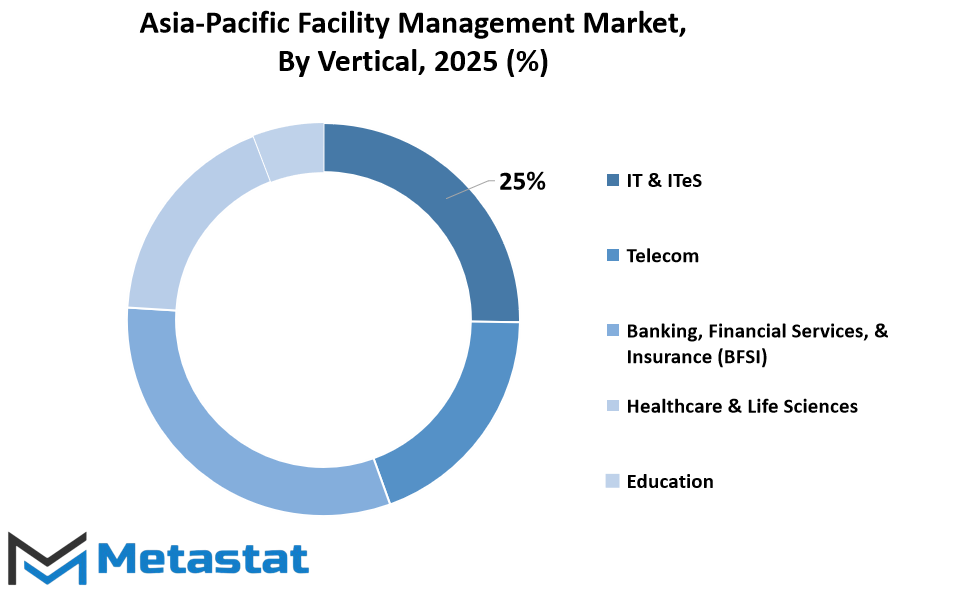

By Vertical

The Asia-Pacific facility management market is going through fuel by increasing the development of infrastructure and increasing demand for effective construction services in areas. Increasing dependence on convenience management services, with organizations to streamline operations and reduce costs will help not only for day-to-day maintenance but also for long-term strategy. Such services help maintain workplaces as safe, functional and durable places-especially in large-scale commercial and industrial establishments.

The Asia-Pacific facility management market is organized around a number of primary verticals with unique demand cycles and service needs. For IT & ITeS, with its pervasive 24/7 operations, facilities must operate continuously. Energy management, data center support, and security are among the top services. For telecom as well, the need to provide seamless connectivity creates pressure for solid infrastructure maintenance and emergency response systems.

Banking, Financial Services, and Insurance (BFSI) is another major vertical where rigid compliance and risk management dictate facility strategy. Here, digital monitoring, space optimization, and secure document handling are focusing more attention. The life sciences and healthcare require a different degree of accuracy. Cleanliness, waste management, temperature-controlled zones, and on-time maintenance become the essentials here, with lives at stake depending on the facility's reliability.

The education sector continues to grow as both private and public investments fuel demand for clean campuses that foster learning and safety. Facility management providers are anticipated to keep classrooms, dorms, labs, and sports facilities in pristine condition while adhering to hygiene requirements. Retail establishments, on the other hand, demand facility services that increase consumer experience. Such services involve lighting, temperature regulation, cleanliness, and even fragrance marketing. As the in-store experience becomes more considered and curated, facilities management will align accordingly.

The "Other Verticals" category combines several businesses with unique but occasionally more unsystematic requirements, ranging from manufacturing to logistics. This section of the report indicates the agile character of facility services and how they respond to various operational conditions.

With increasing consciousness regarding energy efficiency, green buildings, and smart technology, the Asia-Pacific facility management market is not just reacting to the functional requirements of various industries but also gearing up for a future that will be based on sustainability and automation. As every vertical keeps developing with its own challenges, the role of facility management will continue to be critical centering on getting spaces to function better, safer, and smarter.

By Service Type

The Asia-Pacific facility management market is poised to represent not only a change in the way buildings are serviced but also the way environments are constructed in order to increase efficiency, comfort, and safety across all industry sectors. As companies continue to grow and new infrastructure emerges Asia-Pacificly, the need for intelligent and dependable services in this field will keep getting more intense.

By type of service, the Asia-Pacific facility management market is decidedly divided into segments based on the type of support provided. One of the most redoubtable divisions is Hard Services, which currently sits at $245.1 million. These usually encompass critical maintenance work pertaining to physical infrastructure be it electrical work to plumbing and fire safety installations. Because these functions are central to the physical function of a building, their relevance will continue to be high as more spaces require sustainable and technically augmented infrastructure.

Complementary to Hard Services are the Soft Services, which deal greater with enhancing the every day revel in for customers. These encompass cleansing, waste control, pest manage, landscaping, and even security offerings. Although they don't require machinery or engineering, Soft Services are vital to how people engage with their environment. A easy, well-prepared environment is what makes a big difference in workplace productivity and task pride. As individuals grow to be more and more aware of hygiene levels and environmental situations, there can be greater emphasis placed on preserving those offerings consistent and high in first-class.

Together, those two organizations replicate the manner the Asia-Pacific facility management market is turning into greater prepared however resilient in adapting to the desires of the present day Asia-Pacific. It's now not approximately repairing what's defective or sanitizing what's unclean; it is approximately constructing environments in which people can paintings, examine, or heal more productively. Whether the building in query is a health center, workplace complex, university, or manufacturing facility, each place has its own set of expectancies and facility management may be tasked with meeting them. With cities developing and era nonetheless dictating how areas are applied, the important thing to Hard and Soft Service balance will decide the future increase phase for the marketplace.

Thus, the Asia-Pacific facility management market is moving toward a future that requires more than conventional maintenance. It requires careful management of space, service, and strategy an approach not only meeting current requirements, but also anticipating the way buildings and their purposes will evolve over time.

By Model

The Asia-Pacific facility management market will continue to grow as organizations want efficient ways to manage their buildings, services and operations. -As the demand for better cost control and well -organized management increases, businesses are searching for both internal and external models to handle these responsibilities throughout the region. By the model, the Asia-Pacific facility management market is divided into outsourcing facilities management and management of in-house features.

Outsourcing facilities mean management to hire third -party providers to handle the responsibilities such as cleanliness, maintenance, security and energy management. This model appeals to businesses who are seeking to reduce operational expenses, reach special expertise and attention more on predominant enterprise features. In markets inclusive of Japan, South Korea and Singapore, where labor costs and fine general are excessive, outsourcing presents a sensible solution that lets in companies to meet both economic and regulator expectations. This enables groups to stay bendy, help speedy undertake new technology or carrier requirements with out inner training or recruitment burden.

On the other hand, management of in-house features is often preferred by organizations that prefer complete control over their infrastructure and daily operations. This model allows for tight oversite, sewn workflow and direct communication between departments. Large public institutions, government buildings, and some multinational firms rely on in-house teams to ensure consistent standards of performance in all functions. Although this option may demand more internal resources, it offers high levels of adaptation and can sometimes result in rapid response time during important conditions.

As the infrastructure in the Asia-Pacific region becomes more advanced and the expectations around stability, technology integration and workforce efficiency increase, both models will play an important role. The choice between outsourcing and in-house solutions often depends on the size, industry, budget and strategic goals of the company. It is clear that convenience management is no longer seen as only a support ceremony - it is now part of widespread discussion about productivity, energy use and employee experience.

By Region

The Asia-Pacific facility management market will preserve to enlarge as nations in this place shift in the direction of based carrier models and advanced infrastructure. This a part of the arena includes dynamic economies such as Hong Kong, Singapore, Japan, Malaysia, Indonesia, and Thailand, with the relaxation of Asia-Pacific also contributing to the location’s increase. Each of these areas performs a wonderful position in shaping how facility control services could be adopted and optimized in the destiny.

Singapore and Hong Kong will in all likelihood stay frontrunners, given their recognition on cleanliness, sustainability, and operational performance. Their compact city layouts make them extra willing to adopt clever centers that rely on automation and records-driven insights. Japan’s growing old populace and choice for high-tech solutions will cause a growing need for facility support offerings that are not just efficient however also aligned with accessibility and user comfort. Meanwhile, nations like Indonesia, Malaysia, and Thailand will lean on facility control as an answer for enhancing urban infrastructure and commercial areas, mainly in hastily growing cities. These areas are anticipated to transition from traditional in-house structures to outsourced, tech-supported offerings that better deal with current-day needs.

The Asia-Pacific facility management market will see rising hobby in incorporated solutions, specially in industrial homes, hospitals, and educational establishments. While the adoption rate may also vary throughout nations due to differences in monetary maturity, rules, and cognizance, the fashion will flow in a single route toward smarter, greater responsive facility management. In the Rest of Asia-Pacific, smaller economies will slowly comply with in shape, fashioned by the examples set with the aid of their extra evolved neighbors.

This shift within the Asia-Pacific facility management market displays not only a local trend however a broader Asia-Pacific transition in how buildings and offerings are maintained, secured, and optimized for overall performance.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$586.7 million |

|

Market Size by 2032 |

$873.1 Million |

|

Growth Rate from 2025 to 2032 |

5.8% |

|

Base Year |

2024 |

COMPETITIVE PLAYERS

The Asia-Pacific facility management market is on the brink of change, fueled by changing business demands, urban development at a breakneck pace, and accelerating technological integration. Whereas facility management in the region used to revolve around run-of-the-mill operations such as cleaning, maintenance, and security, it has gradually evolved into a more strategic role. Organizations are now realizing the long-term gains of adding services to professional firms bringing order, efficiency, and digital tools into asset and building operations. That increasing awareness is ushering companies further into intelligent, sustainable practices in both public and private sectors.

An observable change is taking place among nations such as India, China, Japan, and Australia, where they are making investments in facility solutions beyond cost cutting. The emphasis is broadening to enhancing workplace spaces, energy management, and data-driven planning. With hybrid work as the new norm, commercial properties are being revamped to accommodate physical and virtual workspaces, and such change is fueling the demand for end-to-end services. That is, providers are no longer simply handling space they are now anticipated to provide technology-enabled insights and strategies that facilitate safety, productivity, and business resilience.

Digital transformation is also at the core of this shift. Technologies such as IoT sensors, cloud platforms, and AI systems are making it possible to monitor building performance in real-time, perform predictive maintenance, and optimize space. Vendors such as IBM Corporation and Oracle Corporation are providing cloud solutions that facilitate centralized management and analytics. These technologies are not only contributing to lower downtime and energy usage but are also allowing more informed decision-making. As facilities become increasingly networked, managers will look to digital platforms to see what's happening and respond more quickly and intelligently.

Competitive dynamics in the Asia-Pacific facility management market are influenced by a combination of Asia-Pacific players and robust regional operators. Operators like ISS Facility Services AG, Sodexo, and Johnson Controls are maintaining strong presence in many Asian nations through extensive service provision and long-standing client relationships. While that is happening, companies such as Dussman Services AG, Honegger AG, and Apleona GmbH are growing footprints by responding to local market needs and making strategic alliances. Local understanding and tailoring are still paramount, and operators who can match their offerings to country-specific standards and cultures will be most likely to dominate.

Yet another important layer of change is sustainability. Clients are becoming more conscious about the green surroundings and impact of their buildings and operations. Energy-efficient lighting fixtures, water-conserving installations, and waste management measures are no longer discretionary they're mandatory. Facility managers will be required to minimize carbon footprints and weigh cost against compliance. Companies such as Bouygues E\\&S InTec Switzerland Ltd. and CBRE Group, Inc. are making a serious effort in this direction by adopting green building practices and providing measuring and reporting tools for sustainability performance. With regulations becoming stricter and stakeholder pressure building, sustainable facility solutions will become the default norm.

Simultaneously, the software aspect of the Asia-Pacific facility management market is also becoming just as critical. Solutions provided by MRI Software LLC, Planon, Infor, and the Nemetschek Group are increasingly being used to manage the complicated coordination of facility operations. These software systems enable anything from asset tracking through maintenance scheduling, and real-time dashboards simplify the management of big properties with less manual intervention. Integration of these solutions into current IT infrastructures will give facility management more agility, visibility, and responsiveness.

Each year, the market will draw closer to end-to-end automation and forecast-based service models. Companies will increasingly depend on outside expertise to control their spaces but with greater urgency for customized services aligned with business objectives. The Asia-Pacific facility management market will not just continue to expand it will be a fundamental driver of operational excellence, fueled by technology, human capability, and the increasing need for more intelligent workplaces.

In this cutting-edge ecosystem, the coexistence of established brands such as Jones Lang LaSalle IP, Inc., CBRE Group, Inc., and new entrants operating on niche tech platforms will keep things competitive. They are transforming the way buildings are managed not only physically but strategically. With more Asia-Pacific businesses looking for agile, scalable, and technology-savvy partners, the Facility Management sector will continue to evolve to address those needs.

Asia-Pacific facility management market Key Segments:

By Vertical

- IT & ITeS

- Telecom

- Banking, Financial Services, & Insurance (BFSI)

- Healthcare & Life Sciences

- Education

- Retail

- Other Verticals

By Service Type

- Hard Services

- Soft Services

By Model

- Outsourcing Facilities Management

- In-House Facilities Management

By Region

- Hong Kong

- Singapore

- Japan

- Malaysia

- Indonesia

- Thailand

- Rest of Asia Pacific

Key Asia-Pacific Facility Management Industry Players

- ISS Facility Services AG

- Johnson Controls

- Bouygues E&S InTec Switzerland Ltd.

- Dussman Services AG

- Honegger AG

- Sodexo

- IBM Corporation

- Oracle Corporation

- CBRE Group, Inc.

- Jones Lang LaSalle IP, Inc.

- Nemetschek Group

- Infor

- MRI Software LLC

- Planon

- Apleona GmbH

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252