MARKET OVERVIEW

The Global Sun Protection Products market and its industry is a niche area that deals with products intended to protect individuals from the harmful effects of ultraviolet (UV) radiation. This market is characterized by its focus on catering to the needs of a diverse consumer base seeking advanced solutions for skin health and protection. The focus in this field is on the development, innovation, and availability of formulations that meet different stages of UV exposure and serve regional preferences and regulatory requirements.

This sunscreen market surrounds sunscreen lotions, sprays, creams, and allied products acting as UV barriers. Beyond that, though, it embraces cosmetic products having sunscreen properties and even foundations, lip balms, and moisturisers having SPF content. More so, the industry offers clothes, hats, and sunglasses for UV protection which suggests a wide array of items made available for the demands of contemporary consumers.

Further advance with respect to scientific research will provide it a greater emphasis on putting forth products that prevent only the kind of sunburn but in effect will combat premature aging or can help reduce the risk posed by serious skin conditions. The market will be driven through science and technology innovation that will enable it in terms of efficacy, wherein awareness about long-term benefit pertaining to sun protection is surging among consumers. The future is characterized by more customization, such as products addressing specific skin types, tones, and unique geographical challenges. The dynamic nature of the market will force businesses to expand their product lines and adjust their approach to the specific needs of regions around the world. Areas with high sun exposure will spur the development of high-SPF products, while other regions will focus on multifunctional products that combine sun protection with skincare benefits. This adaptability will enable the Global Sun Protection Products market to remain relevant and appealing to an increasingly well-informed consumer base.

Consumer behavior will be a game-changer in the market path. The industry will experience a shift towards online sale channels as people increasingly rely more on digital platforms. New marketing strategies will be applied by businesses, and instead of traditional marketing, organizations will adopt digital campaigns and collaborations with social media influencers educating consumers on the need to protect themselves from the sun. Ingredient transparency and sustainable packaging shall also be the way ahead for gaining consumer trust and preference.

The regulatory landscape will be the determinant of the future of the Global Sun Protection Products market. Manufacturers will move in accordance with stringent safety standards so that the product is effective and friendly to the skin. Countries with specific regulations will encourage companies to invest in localized research and development, thereby fostering innovation tailor-made for a particular market.

The research and sustainability aspect will be the driving force behind the Global Sun Protection Products market as it evolves. The industry will, therefore, incorporate environmentally conscious practices by prioritizing reef-safe formulations and minimizing the ecological impact of production processes. The market will focus on effective sun protection without compromise in environmental integrity as sustainability becomes a global priority.

The Global Sun Protection Products market and industry will be forever changing. Changing consumer awareness, emerging technological advancements, and sustainable thinking will always drive them towards this sector. And once the diversified needs of customers and regional regulatory compliance are considered, it will gain an indispensable place in the landscape of skincare and personal care products

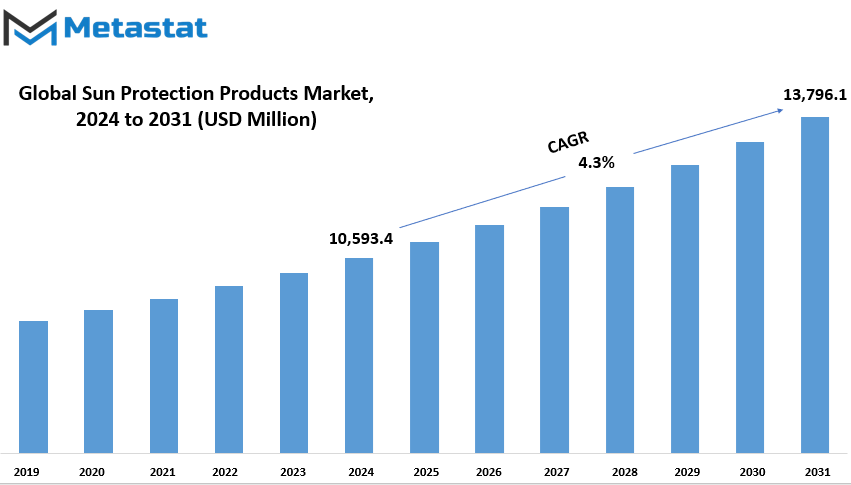

Global Sun Protection Products market is estimated to reach $13,796.1 Million by 2031; growing at a CAGR of 4.3% from 2024 to 2031.

GROWTH FACTORS

The global sun protection products market has witnessed a significant increase with the rising awareness of harmful effects of UV radiation on the skin. Consumers are getting more aware of the need to protect their skin from damage that could eventually lead to premature aging, discoloration, or even worse health issues like skin cancer. This increasing awareness has raised a demand for products that effectively offer protection against damaging UV radiation. Additionally, there is an increase in the preference of people for organic and natural products due to a need for healthier, greener options.

But on the other hand, there are also some challenges in this market that could restrict it to reach its full potential. One of the major challenges is that premium sun protection products are expensive. Although these products usually have advanced formulations and added benefits, their price makes them inaccessible to a wider audience. Furthermore, in most developing regions, awareness of sun protection and its importance is still low. This lack of awareness can deter the adoption of such products, especially in areas where UV-related skin health education is not widespread.

Despite these challenges, there are significant opportunities for growth in this market. The rise of e-commerce has brought sun protection products closer to the consumer, who can then make choices from the comfort of their homes. Also, it allows companies to communicate more with people in distant or deprived locations that cannot reach shops at close or distant locations. Moreover, innovations in sun protection involve more and more multi-functional products by addressing the needs of busy and value-conscious consumers that they are looking for easier alternatives like easy hydration, antiaging and light finish suitable for a lifetime usage.

The future of this market will be driven by the interplay of growing awareness, shifting consumer preferences, and innovative methods of distribution. Tapping into growing demand will not only help overcome cost-related challenges but also improve presence across diverse regions as companies overcome education-related challenges. Growing demand for the products as consumers make skin health and sustainability their top priorities will depend on further development of accessible, effective, and eco-friendly sun protection solutions.

MARKET SEGMENTATION

Type

The global Sun Protection Products market is characterized by various types of products, which are sought by different consumers for different preferences and needs. In 2020, the market share of the gel type was 28.3%. It is the most commonly sought after product type due to its light and easy-absorbing properties, as gels are less greasy, which makes them convenient for people with oily or combination skin. They also have a cooling action, which is a plus and really attractive, especially to use in hot climates.

While the lotion segment led with a 50.1 percent share in the same year and is expected to be valued at a compound annual growth rate of 4.5 percent. This tremendous share is a result of massive usage as they are versatile in applications and ensure uniform coverage. Lotions are suitable for a wide range of skin types and are often enriched with moisturizing ingredients that help in maintaining skin hydration while offering protection against harmful UV rays. Other formats besides gels and lotions include powders and miscellaneous products.

These cater to niche requirements, offering alternative options for consumers who may prefer different applications or textures. For example, powder sun-protection products are popular in providing the user with a feel of convenience as they also control shine and can make them desirable. The others include sprays, sticks, and hybrids which can combine the sunscreen effect with another benefit related to skin care to match other specific demands from the consumer. The growth of the market is based on increased awareness over adverse sun exposure effects, like the occurrence of premature aging and also a risk of skin cancer, hence more consumers opting to include daily sun protection regimens, which contributes significantly to the demand for varied forms. Each segment remains essential for the overall development in this market, catering for a variety of life-style options and preferences in gel and lotions and other types of forms.

Over the long term, companies are bound to center their focus on innovation and sustainability, using environmentally-friendly ingredients and packaging to increase market demand for responsible products. This will ensure that sun protection continues to be successful into the future, providing superior solutions to a wide variety of consumers.

By Application

It has been common to break the market of numerous products and services based on who would be their target audiences. Classifications by application are usually categorized into products for both males and females. This type of segmentation enables businesses to differentiate the goods that they sell based on preferences and needs in line with their specified groups, ensuring to respond to the different requirements that each category might present. Through these specific applications, companies can design niche products that are likely to appeal to their target market.

Products targeting men are usually designed with an eye toward functionality and utility. For example, in the grooming and personal care sectors, items are developed based on men's preferences, emphasizing aspects such as ease of use, effectiveness, and masculine fragrances. Similarly, the clothing and footwear for men are designed keeping in mind durability, comfort, and style that goes along with their lifestyle choices. These products are aimed to provide utility while aligning with the tastes and habits typically associated with male consumers.

Conversely, products for women focus on a wide range of factors, such as beauty, innovation, and customization. For instance, in the beauty industry, products for women often include choices for different types of skin, tones, and personal styles to make the product feel inclusive and personalized. Likewise, fashion for women usually celebrates diversity in design, providing a wide range of options for various occasions and personal tastes.

This division by application is not limited to personal care or fashion; it extends to other sectors, such as fitness equipment, health products, and even technology. By identifying the specific needs of men and women in these areas, businesses can develop solutions that enhance the user experience. For example, fitness brands may create exercise equipment tailored to different strength levels or body structures, while health-focused companies might offer supplements that address varying nutritional requirements.

This categorization ensures that the market remains responsive to its diverse audience, and people can find the products they prefer and need. A balance between functionality and appeal can satisfy the expectations of both men and women while fostering loyalty and satisfaction among customers. This thoughtfulness benefits consumers and helps companies fortify their market presence and sustain growth.

By Sales Channel

There are two main distribution and sales channels in the market. These include online and offline. The two channels play a critical role in the mode of sale or distribution of products depending on the needs and preferences of each customer group. Online sales channel has recently become very popular. This is because technological advancement has been providing ease for growth. With the facility to browse through thousands of products, compare prices, and make purchases from their homes, customers have greatly benefited from online platforms. They not only offer detailed descriptions and reviews of products but also have the means of fast delivery and apps for mobile devices. However, offline sales remain quite robust in markets for those people who like shopping more personally and with senses.

There are some products that involve seeing, touching, and sometimes trying out before purchase. Most people would prefer having the product instantly available to them when shopping off line. They also get an opportunity to seek advice or help from the people selling it in a shop. Moreover, there is always that sense of trust and dependability attached to off-line channels as a customer interacts directly with the seller. Though online shopping is easy and efficient, it lacks the kind of connection and immediacy that offline channels provide. Both channels have strengths and challenges, and most businesses use a combination of both to reach a wider market. For example, while some companies focus on their online presence to expand the customer base, others maintain offline outlets to enhance brand loyalty and provide a physical space for customer engagement.

It also reflects how businesses change based on consumer preferences and the trend in the market between online and offline sales channels. The companies that will manage to balance the two channels well are more likely to achieve their diverse customer expectations.

Whether it is through the comfort of shopping online or the trust associated with a face-to-face encounter, the choice of sales channel makes a huge difference in terms of customer experience and purchase behavior. As the dynamics of business continue to evolve, they will probably come up with new ways of enhancing their online and offline sales approach to stay relevant in an ever-changing marketplace.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$10,593.4 million |

|

Market Size by 2031 |

$13,796.1 Million |

|

Growth Rate from 2024 to 2031 |

4.3% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

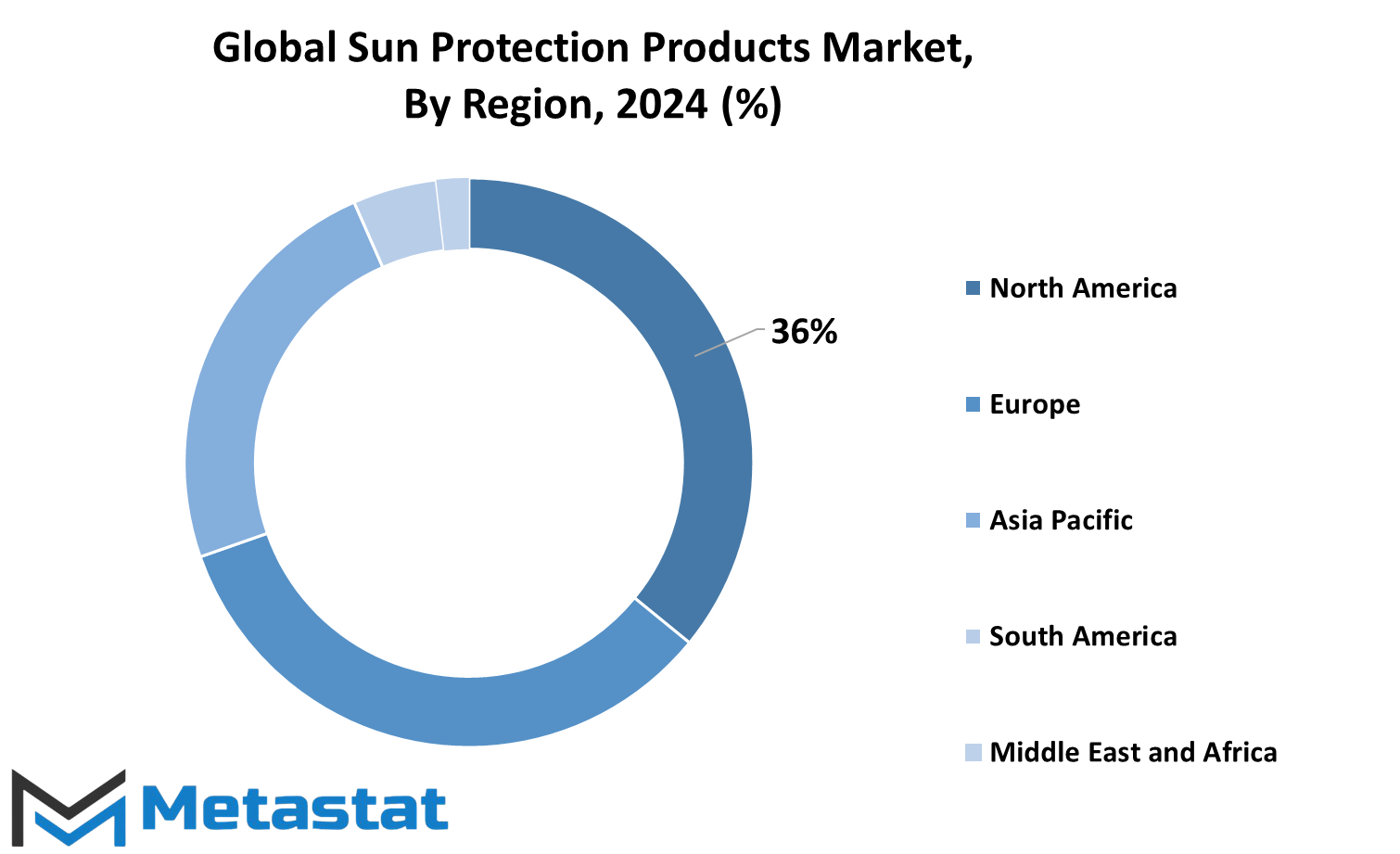

The global market for sun protection products is segmented on the basis of geography into several key regions: North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. In North America, the market is further bifurcated into the U.S., Canada, and Mexico. Europe comprises of major countries such as the UK, Germany, France, Italy, along with other parts of Europe that fall into the "Rest of Europe" category. India, China, Japan, South Korea, and the rest of Asia-Pacific, which comprises the rest of countries in this region, not specified. South America market covers Brazil, Argentina, and the rest of South America. Finally, the Middle East & Africa is divided into GCC countries, Egypt, South Africa, and the rest of the countries in the region, falling under the "Rest of Middle East & Africa" category.

Each region has its characteristics, which have an influence on demand for sun protection products. North America, with more developed markets, is mainly a consumer of these products, by virtue of a high awareness of the potential risks of skin care and sun exposure. In Europe, there is a focus particularly on sunscreen and related products in a country with high sun-exposure levels. The Asia-Pacific region is the largest market for growing fast, especially focusing more on skincare and sun protection products because countries like Japan and South Korea have always focused on their beauty and skincare cultures. South America and Middle East & Africa is a new-emerging market with ever-expanding demand for sun protection products with awareness of people on skin care and their health.

The sun protection products market overall is diverse, where every region has its specific requirements and pattern of consumer behavior. The geographic segmentation helps businesses determine the precise areas to focus their marketing activities on as well as how to adapt their products for regional-specific preferences and needs. This variance in products that exists throughout these regions further exemplifies the global necessity for efficacious sun protection through both sunscreens and after-sun care.

COMPETITIVE PLAYERS

Key players operating in the Sun Protection Products industry include Amway, Avon Products, Beiersdorf, Clarins, Coty Inc., Edgewell Personal Care, Estee Lauder, Johnson & Johnson, L'Oreal, Lotus Herbals, Proctor & Gamble, Revlon, Shiseido, and Unilever.

Sun Protection Products Market Key Segments:

By Type

- Gel

- Lotion

- Powder

- Others

By Application

- Men

- Women

By Sales Channel

- Online

- Offline

Key Global Sun Protection Products Industry Players

- Amway

- Avon Products

- Beiersdorf

- Clarins

- Coty Inc.

- Edgewell Personal Care

- Estee Lauder

- Johnson & Johnson

- L'Oreal

- Lotus Herbals

- Proctor & Gamble

- Revlon

- Shiseido

- Unilever

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383