MARKET OVERVIEW

Styrene-Isoprene-Styrene, abbreviated as SIS, is one type of thermoplastic elastomer. It has alternating blocks of styrene and isoprene. This type of elastomer is widely used in adhesives, sealants, coatings, and elastic films. SIS makes its way into such application areas due to the perfect blend of elasticity, strength, and adhesive properties that it displays.

The material is prepared by the arrangement of styrene and isoprene in a block structure. It is styrene, which gives hardness and strength, and isoprene that provides flexibility and extensibility characteristic of elastomers. This special arrangement gives SIS the ability to hold shape even at stress, and with this balance of flexibility and durability, it finds its best applications where a product needs adhesion with elastic properties.

High elasticity is one of the significant advantages of SIS. This allows the material to stretch and deform without losing its original look, thereby making it applicable to products that are subjected to repeated movement or deformation. In adhesives and sealants, it makes for bonds that can be very strong and long-lived, which would otherwise be broken by the temperature and pressure changes that affect it.

Additionally, SIS has a higher level of strength. It has enough strength to withstand any mechanical stress and is wear-and-tear resistant, thus excellent in providing coatings and films with sufficient time durability. With both strength and elasticity, SIS can be used in automotive, construction, or several more industries where reliable, non-degradable materials are used.

The other significant property of SIS is adhesiveness. It has such a structure that it forms good adhesion with numerous surfaces, hence applicable in numerous applications wherein adhesion plays an important role. Whether applied as adhesive in the packaging or used as coatings for protective films, the SIS can provide adequate strength and reliable adhesion to withstand forces from external sources.

Overall, SIS is an all-purpose and highly effective material used in a very broad range of industries. It can combine flexibility, strength, and adhesive power, which explains why it is preferred for so many applications, from the daily products to the more specialized industrial uses.

Global Styrene Isoprene Styrene (SIS) market is estimated to reach $3051.5 Million by 2031; growing at a CAGR of 10.2% from 2024 to 2031.

MARKET DETERMINANTS

The Styrene Isoprene Styrene (SIS) market is determined by various factors that govern its growth and development. The material, which has an elastic property, is highly used in adhesives, sealants, coatings, and packaging industries. Its flexibility, durability, and bonding properties make it a favorite for use in these applications. Growth in industries and changing consumer demands determine the factors driving the SIS market.

One of the significant factors here is the rising demand in construction and packaging for adhesives and sealants. SIS is an indispensable component of pressure-sensitive adhesives, applied in labelling, tapes, as well as protective films. Because of the growing e-commerce industry, packing requirements have risen, adding to the demand for SIS-based adhesives, while the growth in the construction industry in regions has escalated the demand for high performance sealants that further pushes the market.

Yet another driver is the growing importance of sustainability and eco-friendly products. Manufacturers are working to produce SIS materials with low environmental impact, which opened up new avenues for innovation. This is a result of consumer preference as well as tougher environmental regulations. Products that balance performance with sustainability are expected to find a competitive edge in the market.

Advances in technology also play an important role in the SIS market. Advances in the processes of production and the development of new material formulations have significantly improved the efficiency and quality of SIS. As such, manufacturers are in a position to produce to suit diverse industry-specific needs. To wit, there is an increased emphasis on medical applications for SIS. These include elastic bands and films where precision and reliability come into play.

Economic factors comprise availability and fluctuations in price, which are also influencing factors for the SIS market. The production of SIS depends on raw materials like styrene and isoprene, which are derived from petroleum. Variations in crude oil prices and supply chain interruptions can influence production cost and market dynamics.

It will be industrial demand, the rise of technological progress, and economic conditions that shape this Styrene Isoprene Styrene market. With this expansion of industries to confront the new challenges, the application of SIS will further remain a key factor by which it offers solutions meeting requirements based both on performance and sustainability. With versatility and functionality, this one is an essential part in many industries.

REPORT SCOPE

By Type

There are two types of block copolymers SIS: LMW (low molecular weight) SIS and HMW (high molecular weight) SIS. Polymers of such variety are applied in various usages, which ranges from adhesive, sealant, to coating. The differences between them can be mostly observed in molecular weights, where molecular weights define properties and performances for different usage purposes.

Low Molecular Weight SIS, as the name indicates, has a lower molecular weight, meaning that the polymer chains are shorter. This tends to result in a softer material that flows easily with low viscosity. These properties make LMW SIS extremely useful in applications where high flowability and ease of spreading are important. For instance, low molecular weight SIS can achieve strong adhesion while providing a fast tackiness and easy application. Its relatively low viscosity makes it good for products that need to be dried quickly or have a thin coating layer.

High Molecular Weight SIS has longer polymer chains; hence, it has a greater viscosity and strength. This type of SIS is more rigid and exhibits superior durability under stress, making it suitable for applications requiring more robust performance. In coatings and sealants, for example, HMW SIS is more often used because it can build up a thicker, more resistant layer that provides more effective resistance to wear and environmental factors. This gives an improved thermal stability to the products, which may be significant in cases of products being used in high-temperature conditions.

The two types of SIS have their benefits; therefore, one of the two is selected depending on the requirement of the end product. Based on the factors like the flexibility, viscosity, strength, and durability of the products, LMW and HMW SIS is selected. HMW SIS is usually preferred over LMW SIS to get more strength and resistance under other ambient conditions for products that may require more strength. As a result, the different types of SIS offered allow manufacturers to tailor the requirements of their products to individual businesses; for example, automotive industries, construction industries, or indeed any other industry.

All of the previously said differences in Low Molecular Weight SIS and High Molecular Weight SIS are due to the varying molecular structure, leading towards distinguished properties like flexibility, viscosity, strength, and toughness. These differences need to be understood for selecting which particular type of SIS could be used for a required application; otherwise, the performance or lifecycle might not be satisfactory.

By Application

An application of the product is essential in determining the market divisions and usage in different industries. In this regard, there are several segments of the market divided according to types of products and their applications as follows: Adhesives & Sealants; Elastomers; Tires & Rubber Products; Personal Care Products; Packaging; Medical & Healthcare; Coatings; and Others.

Adhesives and sealants play an essential role in many industries. They are very important in building materials, especially in automobile and other general household products manufacturing. Adhesives and sealants must be able to provide powerful bond strength that can resist all forms of water, air, and other environmental substances.

Another very important commodity in the market are elastomers. These have been used in applications such as from parts of the auto world to consumer goods since it has the property to stretch and compress, therefore is termed as an elastomer. This elasticity will qualify it for use in most applications, especially for manufacture processes.

The Tires & Rubber Products segment is involved with the use of rubber to manufacture tyres for automobiles and many other products from rubber. Rubber is highly used in the auto industry to make tyres, but it has many industrial and consumer product applications as well. It is therefore very robust and strong and lends itself perfectly to such usage.

Another high majority in the industry consist of Personal Care Products. This includes a series of lotions, shampoos, deodorants as well as all raw materials that are required for this product's manufacture. Gradually, demands for the personal care product increased even with an ongoing demand on new inventions and developments involving hygiene, beauty products as well as skincare products.

Another critical area where these materials are used is in packaging. Packaging materials must be tough, flexible, and capable of protecting products during shipping and handling. This is particularly important in the food and beverage industry, where packaging must meet specific safety and durability standards.

It finds significant usage in the Medical & Healthcare field in designing equipment, goods, and other medical tools. To design such products as gloves for surgical application, dressings, or medical-related products, adhesives and coatings along with elastomers are the most suitable ones.

Coatings are applied in different applications, which help to give protective layers to surfaces. This helps extend the life of surfaces. Coatings are applied to items such as metals, plastics, and many other materials to protect them against corrosion, wear, and tear.

The Others category includes any other applications that do not fall within the categories mentioned above. These are usually a mix of niche applications in which these materials are used in novel solutions for different applications.

The market is varied, and each of the segments feeds into an array of industries. In their everyday products, bonding, protection, flexibility, and performance make them indispensable to modern society.

By End-User

The market can be divided into many important sectors with their own distinct needs and demands in each. The automotive, packaging, construction, consumer goods, medical and healthcare, personal care and cosmetics, industrial manufacturing, and textiles and apparel sectors would be some of the ones that could be considered. These have different characteristics, drivers, and growth opportunities.

There is growth in the automotive industry over the demand of advanced materials, manufacturing processes, and technology. The primary focus area of attention would include performance, safety, and efficiency for fuel. Competition has surged through growing the adoption of new approaches, as manufacturers are responding to changing consumer preferences and also regulatory standards.

On the other hand, tremendous growth is seen in the packaging industry due to increased demand for sustainable packaging and eco-friendly solutions in this industry. As customer awareness about environmental issues improves, companies seek alternatives from the usual packaging methods that lessen the waste generated and recycle them better. Innovations in the materials and technologies pertaining to packaging help businesses here reach sustainability goals.

Other substantial market sectors include construction. Urbanization and infrastructural projects fuel demands for material and technologies in this area, not to mention energy efficiency. Construction is also becoming smart through materials and building methods that are not only effective but also sustainable. The growing population in the world entails new necessities for housing as well as commercial spaces, which in turn need development.

Consumer goods industries offer vast ranges of articles from food and beverages to household requirements. Consumer behavior has been altered; consumers have been shifting away from the traditional and have started making choices for healthy, organic, and eco-friendly products. Manufacturers are working on personalizing their products to get more consumer-specific options toward the clients as well.

Technological advancement and an ever-aging population are the key drivers in the medical and healthcare sector. It seeks to innovate more effective treatments, improvement in delivering healthcare, and enhanced access towards medical services. There would be continued growth in the market with superior patient care with advancement in new medical devices, pharmaceuticals, and healthcare technologies.

Personal care and cosmetics are industries led by shifting consumer fads, especially the desire for natural organic beauty products. The consumers are looking for products that promote their well-being and sustainability, which is a reason why there are now cleaner beauty lines.

Industrial manufacturing is a key component in most industries' production of products, and there is more demand for more efficient processes, automation, and usage of advanced materials. This is why the development of industries such as robotics, 3D printing, and artificial intelligence will drive this market.

Textiles and apparels are always on the move with consumer taste change, fashion, and concern for sustainability. Businesses now have to think of very creative ways of remaining profitable while still dealing with all these concerns.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$ 1911.2 million |

|

Market Size by 2031 |

$3051.5 Million |

|

Growth Rate from 2024 to 2031 |

10.2% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL SEGEMENTATION

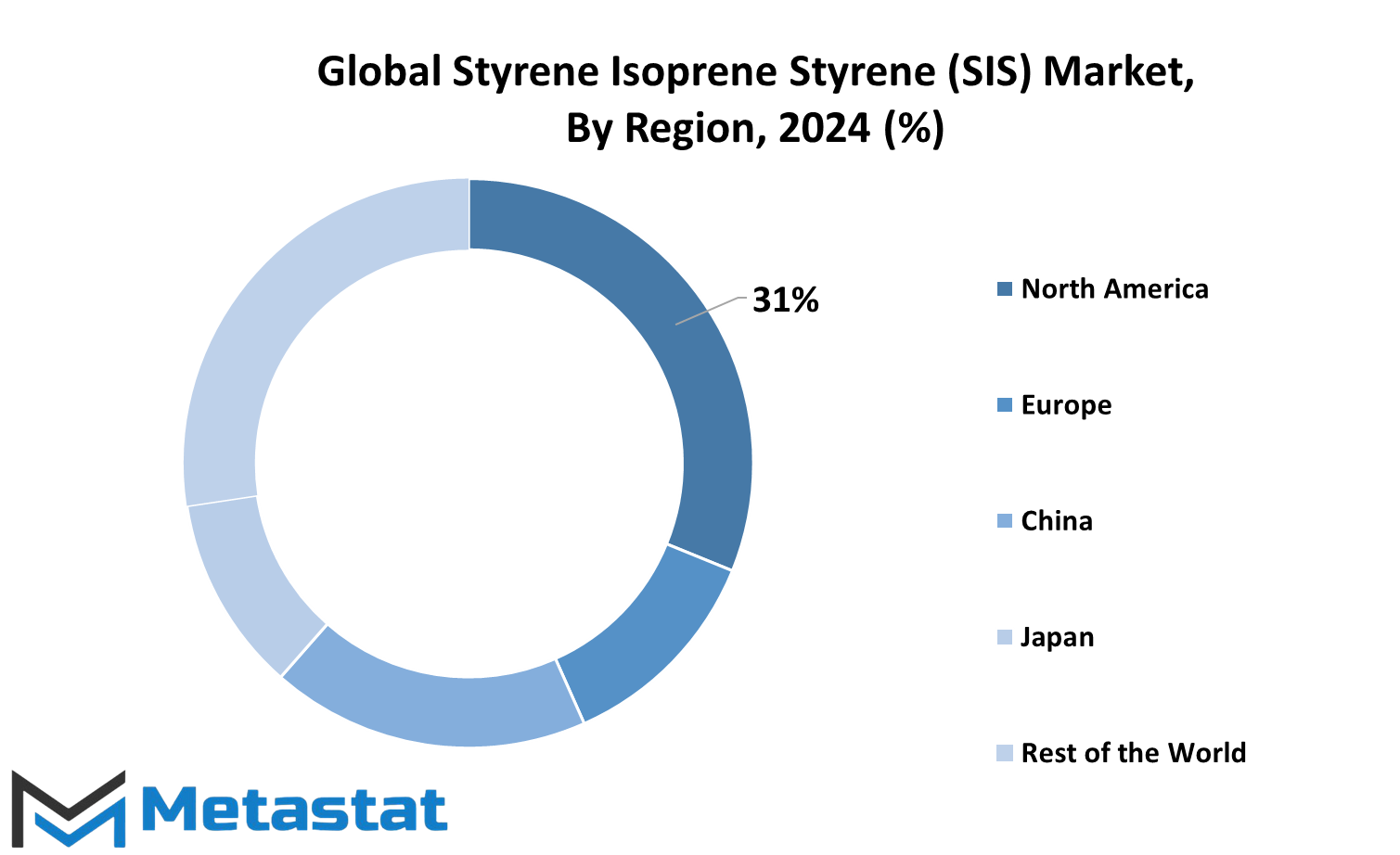

Global Styrene Isoprene Styrene (SIS) Market segmentation: There are several distinct regions, along with their market dynamics in the global Styrene Isoprene Styrene market. Some of these regions are North America, Europe, Asia-Pacific, South America, and Middle East & Africa.

Further segmentation of North America region involves three main countries such as U.S., Canada, and Mexico. These three countries are essential to the total market in this region. The U.S. is the largest market in North America, driven by its advanced manufacturing sector and strong demand for SIS in various applications. Canada and Mexico also contribute significantly, with Mexico serving as an important manufacturing hub due to its competitive labor costs and proximity to the U.S. market.

Another primary region is Europe, whose market is divided into different countries of the UK, Germany, France, Italy, and the Rest of Europe. Germany is in a league of its own when it comes to Europe, in terms of being a huge producer and consumer of SIS, thanks to its huge automotive and industrial sectors. Strong demand from the manufacturing and construction industries also comes in from the UK and France for the region. Rest of Europe - This includes the rest of Europe countries, where the emerging markets for SIS have increased the region's reach.

Asia-Pacific is the largest and the fastest-growing region for the SIS market, and includes India, China, Japan, South Korea, and the Rest of Asia-Pacific. Major players in this region are China and Japan, wherein the rapidly growing industrial sector in China drives the demand for SIS, mainly in automotive and construction industries. There are huge demand growths in Asia-Pacific, especially in South Korea, which has an enormous industrial base, and also in India, which supports this growth with the growth of infrastructure and manufacturing.

The market in South America is mainly driven by countries like Brazil, Argentina, and the Rest of South America. The Brazil segment has the largest market share here, with a very healthy demand from the automobile and construction industries. Argentina also ranks next in the market; SIS consumption has grown alongside the increasing industrial activities there.

The Middle East & Africa is further segmented into GCC countries, Egypt, South Africa, and the Rest of the region. The GCC countries, including Saudi Arabia and the UAE, are dominating the market due to large-scale industrial and construction projects. South Africa also constitutes a major share of the market in the region, with increasing demand in various industrial applications.

These regional divisions are important because they depict the different demand and growth opportunities for SIS around the world. Each region's uniqueness and economic activities help shape the overall dynamics of the global SIS market.

MARKET LEADERS

The Styrene Isoprene Styrene industry is of great importance in the global market of chemicals, with several key leaders in production and innovation at the helm. These firms are shaping the future of a versatile polymer called SIS applied in various applications, starting from adhesives to coatings. Qingdao ECHEMI Digital Technology Co., Ltd. - the company, which leads the list and, at the same time, is significant for the spread of the SIS product. Another prominent player in this industry WEGO CHEMICAL GROUP - with an excellent logistics chain and, of course, high quality of manufactured goods.

Among the world's largest producers of the SIS belongs Kraton Polymers LLC: high-performance products. They have an excellent track record for providing innovative solutions in polymer technology. Eastman Chemical Company is a leading producer of specialty chemicals globally, with strong research and development activities to keep up with the demand from the markets. ExxonMobil Chemical Company is another big player in the market providing a diverse array of materials, such as SIS, to fulfill market demands while concentrating on sustainability solutions.

Sinopec Limited is another major Chinese oil and gas company that dominates the SIS market. Its production capabilities enable it to offer a range of SIS grades that cater to different industrial needs. Versalis (Eni S.p.A.) is another significant player, focusing on the production of high-performance polymers, including SIS, to meet the needs of various industries. Another important chemical-producing company in Brazil is Braskem S.A., which has also been a key entity in the distribution of SIS worldwide.

PolyOne Corporation, with its innovative polymer solutions, is one of the essential contributors to the growth of the SIS market. Their products are being used across a number of sectors. LCY Chemical Corp. is another significant contributor with its high-quality SIS products for a variety of applications and markets.

Together, these companies will determine the future of the Styrene Isoprene Styrene industry. They offer a whole range of products that serve different industries in their time of need. They are continually working to better their manufacturing process and to produce new solutions to address changes in the needs of the market. Then, as demand for high-quality SIS products keeps on growing, these companies will remain always at the lead in the industry, keeping market conditions competitive and innovative.

Styrene Isoprene Styrene (SIS) Market Key Segments:

By Type

- Low Molecular Weight SIS

- High Molecular Weight SIS

By Application

- Adhesives & Sealants

- Elastomers

- Tires & Rubber Products

- Personal Care Products

- Packaging

- Medical & Healthcare

- Coatings

- Others

By End-User

- Automotive Industry

- Packaging Industry

- Construction Industry

- Consumer Goods Industry

- Medical & Healthcare

- Personal Care & Cosmetics

- Industrial Manufacturing

- Textiles & Apparel

Key Global Styrene Isoprene Styrene (SIS) Industry Players

- Qingdao ECHEMI Digital Technology Co., Ltd.

- WEGO CHEMICAL GROUP

- Kraton Polymers LLC

- Eastman Chemical Company

- ExxonMobil Chemical Company

- Sinopec Limited

- Versalis (Eni S.p.A.)

- Braskem S.A.

- PolyOne Corporation

- LCY Chemical Corp.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252