MARKET OVERVIEW

The Global Stainless Powder market will be one of the prominent players in the global materials industry. With industries innovating further and with the growing demand for advanced manufacturing methods, stainless powders will be at the forefront of meeting those needs. The market for stainless powder will flourish due to its versatile applications across a wide range of sectors such as automotive, aerospace, energy, and more. Stainless powders will be critical in the production of high-performance parts and components through cost-effective and efficient production processes. This trend will enhance the growth of the market and change the way materials are used in advanced manufacturing processes.

Stainless powders will become highly known for their use in powder metallurgy processes. These processes, MIM and additive manufacturing, will be more in demand by companies that are looking for precision, durability, and customization. The ability to form complex shapes with minimal waste will make stainless powders attractive to industries that demand high precision, such as medical devices and electronics. These materials will offer solutions to industries facing a problem in the traditional methods applied to produce stainless steel components while providing more sustainable and cost-efficient alternatives. The Global Stainless Powder market will continue to advance as new manufacturing technologies and techniques are developed.

The Additive manufacturing, 3D printing of parts in stainless steel, revolutionizes the way products are now designed and created. Printing of stainless steel parts with fine details will make the process of manufacturing more personalized, thereby contributing to the evolution of the market. The use of metal injection molding will also make production easier and reduce time and costs associated with traditional processes, giving companies an edge in producing small yet highly intricate parts. Sustainability would play a very significant role in the future of the Global Stainless Powder market.

Reducing environmental footprint will now become a focus for all businesses and industries. Therefore, there will be more demands on the use of environment-friendly, energy-efficient materials. And because stainless powders can be recycled and have lower energy use during manufacturing, it fits perfectly in this demand. Companies will continue to seek sustainable solutions within their supply chains, which means the demand for stainless powders will rise as a resourceful and green alternative to other materials. The main driver of change in the Global Stainless Powder market will be towards automation and digitalization of manufacturing processes. As the technologies related to digital technology and robotics continue to advance, manufacturers will utilize these innovations to enhance powder production and processing.

This will, in turn, increase the efficiency and consistency of stainless powders, which will open new applications and fuel further market growth. In addition, global standards and regulations will increasingly influence how stainless powders are manufactured and used, ensuring that only the highest-quality materials are being produced and supplied. The Global Stainless Powder market would continue to grow as this industry serves all the requirements and needs of those industries looking for reliable, sustainable, and more advanced materials for production. From the aerospace industry to aerospace, components in medical equipment, and more, opportunities for stainless powders abound. And as the product is continuing to evolve, innovations from around the world will turn towards incorporating stainless powder into their manufacturing processes and thus increase the quality, performance, and efficiency of their products.

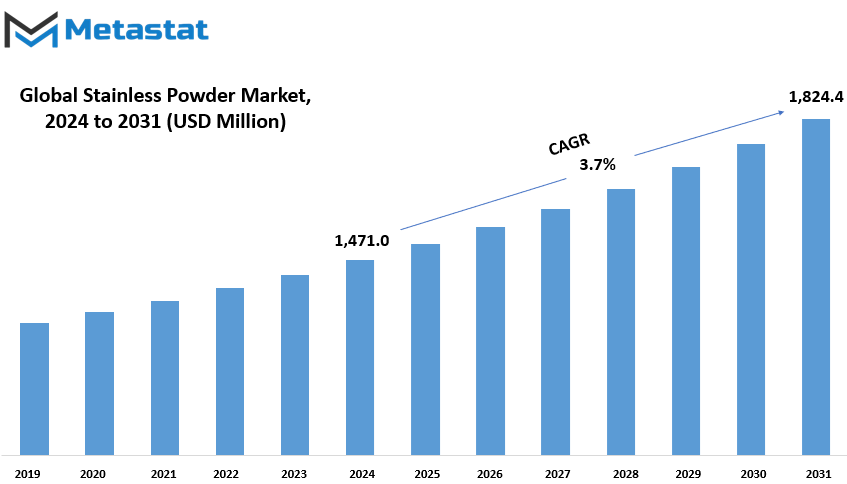

Global Stainless Powder market is expected to be $1,824.4 Million by 2031; growing at a CAGR of 3.7% from 2024 to 2031.

GROWTH FACTORS

Increased application of additive manufacturing, also known as 3D printing in the aerospace, automotive, and medical sectors is a prime growth factor for the market. Such technologies provide flexibility along with accuracy and allow manufacturers to create designs which earlier were not achievable or challenging to create. Rising application of 3D printing in more companies is expected to increase the demand for stainless steel powder, thus making this market grow further in the near future. In addition, growing demand for highly efficient properties stainless steel components via powder metallurgy supports the said trend in the market. Powder metallurgy grants a favorable opportunity to producers of producing parts with particular desired characteristics like increased strength or wear resistance, for instance. Such considerations play an important role for the performance and durability-critical aerospace and automotive industries, respectively.

The challenges that the market faces in light of these driving factors include its very high production costs. Powder from stainless steel is much costlier than the conventional form of stainless steel. Manufacturing stainless steel powder requires the usage of high-tech techniques, which results in higher costs than regular methods. This may reduce the use of stainless steel powder on a large scale in the industries that have a budget constraint or where cost effectiveness is needed.

Another challenge in the market is the lack of knowledge and experience regarding advanced manufacturing applications, especially in some regions. Many companies will not fully understand the advantages of using stainless steel powder or lack the skills needed to implement advanced manufacturing techniques. This gap in knowledge would slow down the adoption of new technologies, thus affecting market growth in some areas.

However, there are still promising opportunities for the market in the coming years. Such opportunities include increasingly greater emphasis on sustainable manufacturing processes. As companies try to reduce environmental impacts, there will be demand for stainless steel powder in sustainable manufacturing methods of production. Lighterweight components, that help provide fuel efficiency for aerospace as well as the automotive industry are also likely to drive it. With growing needs for the lightest, strongest component, stainless steel powder would likely be in line with future potential. Thus, as the trends progress, the demand for stainless steel powder would increase and drive the market with efficient, durable, and environmentally friendly manufacturing solutions.

MARKET SEGMENTATION

Type

The different kinds of stainless steel powder vary by the composition, through which it is classified into a wide group; some fall in Austenitic Stainless Steel Powder, while others may be Martensitic Stainless Steel Powder, Ferritic Stainless Steel Powder, Duplex Stainless Steel Powder, and Precipitation Hardening Stainless Steel Powder. Each has characteristics that could suit certain applications across various industrial lines.

Austenitic stainless steel powder is most frequently used. It has corrosion resistance along with excellent formability. It is commonly used for products where a more extreme condition is foreseen-the kitchen appliances, medical instrumentations, etc. The product is nonmagnetic, yet highly equilibrated in between strength and ductility.

The martensitic stainless steel powder has a very high hardness and strength. It is ferromagnetic and thus usually applied in applications where wear resistance and strength are needed. This makes it ideal for tools, knives, and other heavy equipment. It also exhibits its hardenability by heat treatment that further strengthens it to function well under stressful conditions.

The powder made of ferritic stainless steel offers very high resistance to stress corrosion cracking. At high temperatures, the same can also perform well. Comparing to the austenitic and martensitic stainless steel, it is less ductile but more resistant to corrosion. Ferritic stainless steel usually is applied in automotive exhaust systems along with other applications where the system's oxidation needs to be resisted.

Duplex stainless steel powder is an amalgamation of both austenitic and ferritic stainless steel in developing a stainless steel of two characteristics which include being of the highest strength material, having an excellent resistance to stress corrosion cracking. It is frequently used in industrial sectors such as oil-gas wherein the materials used are corrosive in nature and also quite harsh to be expressed.

Precipitation hardening stainless steel powder is a high-performance powder that can precipitate harden. This enhances the strength while keeping the corrosion resistance of the material. It is applied in areas where high strength is needed, such as aerospace and high-performance engineering components.

Every kind of stainless steel powder is created with specific applications in mind to be used in the respective industries and their demands. These might range from wear resistance, heat resistance, corrosion resistance, or stress resistance.

By Process Type

The market is divided into several process types, which include Gas Atomization, Water Atomization, Plasma Atomization, Mechanical Alloying, and other processes such as Electrodeposition and Rotary Atomization. Each of these plays a key role in the production of metal powders used in various industries, ranging from manufacturing to advanced materials.

Gas atomization is one of the most important techniques used for fine metal powders production. In gas atomization, a stream of gas is fed onto molten metal. Upon impingement of gas onto molten metal, the molten metal breaks up into small drops that harden into powdered metal. The technique, being widely used due to its benefits in creating powder with desired particle size distribution and high purity, is widely known for precise quality material preparation, for instance, to aerospace and automotive companies.

Another widely used technique is water atomization, similar to gas atomization but using high-pressure water instead of gas for breaking up the molten metal. This process is often economical and is preferred for a high rate of powder production. It is very commonly utilized in the industries of powder metallurgy and in making parts for the automotive and energy sector.

Plasma atomization utilizes the plasma torch to melt and atomize the metal. Such a method ensures high quality powders with very fine uniform particle sizes. Plasma atomization is most helpful when producing powders that go into advanced applications such as metal 3D printing or additive manufacturing where finer control over the characteristics of the powder is crucial.

Mechanical alloying is different since it uses high-energy ball mills for mixing and grinding metal powders. This alloy is created using a process common when making alloys that are complicated by other methods. Therefore, the process allows specific types of powders with various properties and compositions to meet specified requirements for specialized purposes like high-performance coatings and advanced materials.

Electrodeposition and Rotary Atomization are also processes that produce metal powders. Electrodeposition is the process by which a metal is electrochemically deposited onto a surface, whereas Rotary Atomization employs a rotating disk to break up molten metal into powder. These are selected based on the application where the characteristics of the powder become essential for coatings or specialty materials.

These different processes offer flexibility and innovation in the production of metal powders, with each process offering unique advantages according to the needs of the end product.

By End-Use Industry

The market is further sub-classified based on the end-use industries, which include automotive, aerospace, medical devices and implants, industrial equipment, consumer goods, additive manufacturing, also known as 3D printing, and others. These categories reflect the varied uses of the products or materials from the market across sectors. In the automotive industry, demand for advanced materials and components is required to improve vehicle performance, safety, and fuel efficiency. Similarly, in aerospace, the use of lightweight, high-strength materials is a critical aspect of ensuring that aircraft are safe and efficient.

In medical devices and implants, the precision materials are significantly used, as they will be utilized in life-saving applications. Therefore, such materials have to fulfill rigorous requirements on biocompatibility and durability. In industrial equipment, it is emphasized that the material must be strong to endure harsh conditions and exhibit performance over time, especially for heavy machinery and manufacturing processes.

Consumer goods range from electronics, through household items, so on and so forth that have to be made of effective material for functionality and durability, respectively. Additive Manufacturing also known as 3-D Printing is a rapidly-emerging field where materials are accumulated to create custom parts and products by layering, which supports flexibility in design and provides little or no waste byproduct. Lastly, other industries not mentioned in the categories above still participate in the market, using materials for the construction industry, packaging industry, and energy production industries, among others.

These various industries prove that the diversity of application for the materials in the market is enormous. Different sectors have their own needs and requirements, thus materials have to be selected and processed for the specific need of each end-use. With changing needs, industries continue growing and evolving along with such emerging industries, and the need for sophisticated materials will grow in these sectors as well. So this demand for developed materials may be for newly developed consumer products, newly developed medicines, or sophisticated manufacturing technology.

By Application

The global stainless powder market can be segmented based on various applications, each of which plays a significant role in how the powder is used across different industries. One of the major applications is Metal Injection Molding (MIM), which is a process that involves injecting metal powders into molds to create complex parts with high precision. This method is widely used in automotive and electronics industries, among others, where there are demands for small, intricately designed components. The MIM process enables the manufacturer to produce parts that would be difficult or even very costly to make using the traditional machining methods, and thus it is an important technique in the stainless powder market.

Another important application area is Powder Metallurgy which includes pressing and sintering metal powders to provide solid materials. This process finds significant use in the development of parts that are characterized by strength, durability, and resistance to wear for such applications as gears and bearings. Powder metallurgy finds significant application in fields such as automotive, aerospace, and industrial machinery, all of which require high performance for the proper functioning of such complex systems.

Additive Manufacturing, also known as 3D printing, is another growing application for stainless powder. This technology involves melting metal powder in layers to build up a three-dimensional object. With the use of this technology for making custom parts, prototypes, and tools, industries such as aerospace, medical devices, and defense are becoming more demanding. Flexibility and design freedom are some of the important reasons why 3D printing offers great value to industries requiring very specialized or low-volume parts.

Hot Isostatic Pressing (HIP) is another area where stainless powder makes all the difference. This is a method that uses hot and pressure to bond metal powders into solid parts, having a uniform density, and having minimal porosity. HIP is used for the creation of high quality components, especially in areas such as aerospace, strength, and reliability being an issue of utmost importance.

Lastly, Cold Isostatic Pressing (CIP) is a process that compacts stainless powder at room temperature to form a dense, uniform shape before further processing. This technique is usually applied in producing components that require high precision, such as in the production of medical implants or automotive parts.

Each of these applications utilizes stainless powder differently and with unique techniques suitable for specific industries. Stainless powder is thus likely to be of the core production methods throughout the world as the need for more advanced manufacturing techniques remains.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$1,471.0 million |

|

Market Size by 2031 |

$1,824.4 Million |

|

Growth Rate from 2024 to 2031 |

3.7% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

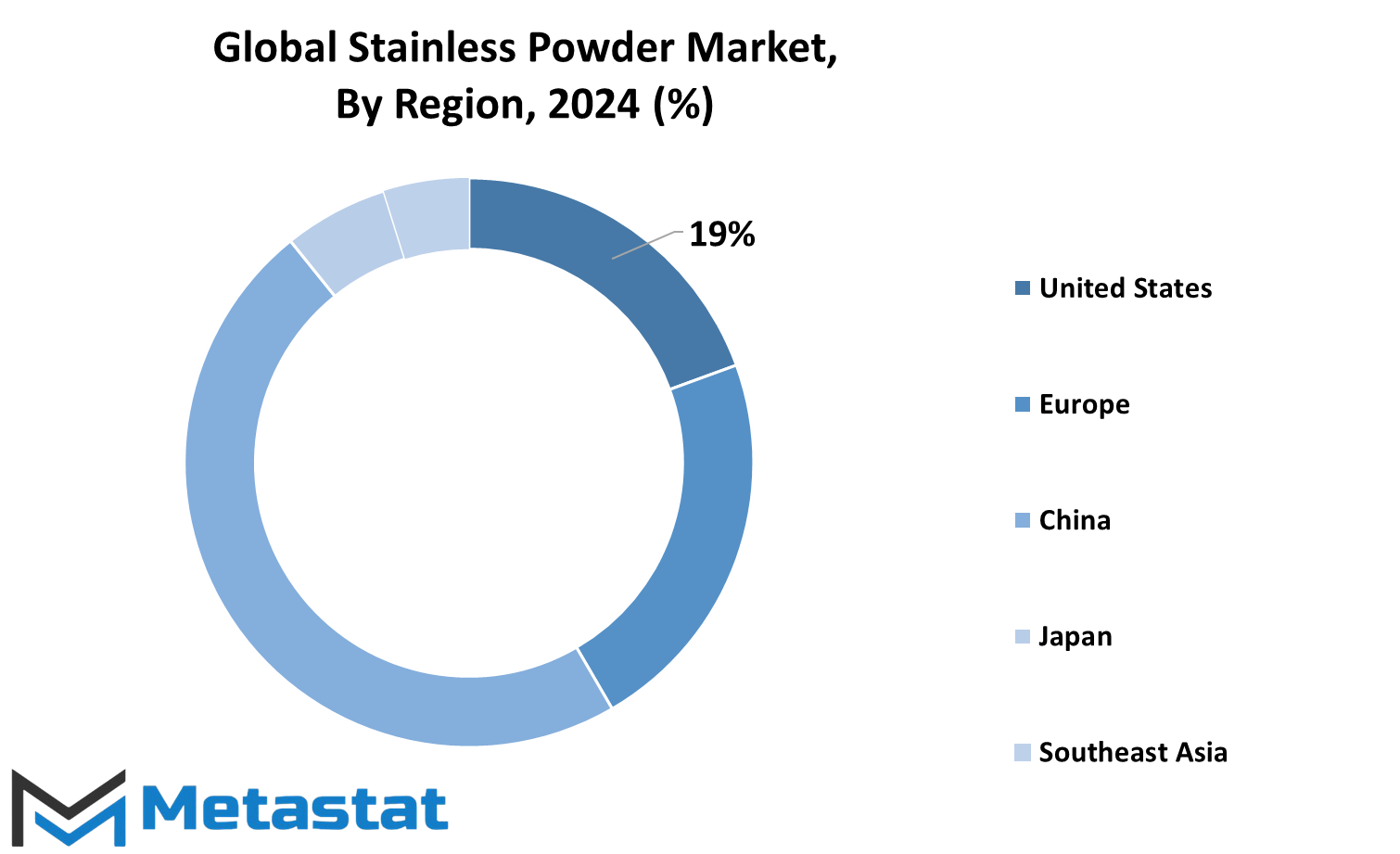

The global stainless powder market is segmented by geography into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. North America encompasses the United States, Canada, and Mexico, while Europe consists of the United Kingdom, Germany, France, Italy, and the rest of Europe. In Asia-Pacific, the market is segmented into India, China, Japan, South Korea, and the rest of the region. South America includes Brazil, Argentina, and the rest of the South American countries. In the Middle East & Africa region, there is separation into GCC countries, Egypt, South Africa, and all other countries in the Middle East and Africa. Regional diversification helps in grasping the various dynamics, preferences, and growth opportunities of every region.

With such segmentation, firms can effectively design their market actions according to specific regional requirements and trends. Each region has its unique set of challenges and opportunities, shaped by different elements, including growth in economy, industrial demand, and the overall regulations within the region. The North America market, for instance, is influenced by high-end manufacturing technologies and demand for stainless powder across a wide array of industries such as the automotive and aerospace sectors.

On the other hand, Asia-Pacific has a strong growing manufacturing base that has resulted in increased demand for applications in the sectors of electronics and construction. Segmentation also reveals the difference in approach among regions in terms of how stainless powder is utilized due to local industries using it for specific applications, such as metal fabrication, coatings, or 3D printing. With South America and the Middle East & Africa emerging as significant markets, it is obvious that international demand for stainless powder depends on everything from local economic conditions to international trade.

As these regions continue to develop, their contribution to the global market will probably grow and offer more opportunities for growth and innovation in the stainless powder industry. In a nutshell, knowledge of geographical segmentation of the stainless powder market is necessary for any business that intends to cash in on the varied needs and opportunities that exist in different parts of the world. Each region will thus have its peculiar characteristics that shape its role in the broader market.

COMPETITIVE PLAYERS

The stainless powder industry has significant influence from a few major players that drive its growth and development. Some of the notable players in this industry are Sandvik AB, Hoeganaes Corporation, Carpenter Technology Corporation, and ATI Powder Metals. These companies are very important in the production of stainless steel powders, which play a significant role in various applications across industries such as automotive, aerospace, and manufacturing.

GKN Powder Metallurgy, Evonik Industries AG, and Praxair S.T. Tech, Inc. are among the other leading companies providing special stainless steel powders for high-end manufacturing applications. Such companies have garnered considerable reputation based on their delivery of quality products suitable for advanced industrial applications.

Mitsubishi Corporation RtM Japan Ltd. and BASF SE are also significant players in the stainless powder industry, with a focus on innovation and new material development. They continue to innovate stainless steel powder technology, keeping the industry competitive and meeting the needs of a changing global market.

Other companies, including H.C. Starck GmbH, Fine Sinter Co., Ltd., and Advanced Metal Powders Pvt. Ltd., make the market even stronger as they provide a wide range of stainless powders for different applications. Their products contribute to the increasing demand for lightweight, durable, and cost-effective materials in manufacturing processes.

The Linde Group and Oerlikon Metco are more prominent names in the industry but also offer high-quality stainless steel powders, along with specialized services catering to specific sectors, such as electronics, healthcare, and automotive.

These key players are at the forefront of shaping the future for the stainless powder industry by bringing new technologies and solutions into place to meet the needs that are constantly evolving among customers. With the increased demand for stainless steel powder, the companies will be at the leading edge of this dynamic and highly competitive industry.

Stainless Powder Market Key Segments:

By Type

- Austenitic Stainless Steel Powder

- Martensitic Stainless Steel Powder

- Ferritic Stainless Steel Powder

- Duplex Stainless Steel Powder

- Precipitation Hardening Stainless Steel Powder

By Process Type

- Gas Atomization

- Water Atomization

- Plasma Atomization

- Mechanical Alloying

- Other Processes (e.g., Electrodeposition, Rotary Atomization)

By End-Use Industry

- Automotive

- Aerospace

- Medical Devices and Implants

- Industrial Equipment

- Consumer Goods

- Additive Manufacturing (3D Printing)

- Other End-Use Industries

By Application

- Metal Injection Molding (MIM)

- Powder Metallurgy

- Additive Manufacturing (3D Printing)

- Hot Isostatic Pressing (HIP)

- Cold Isostatic Pressing (CIP)

Key Global Stainless Powder Industry Players

- Sandvik AB

- Hoeganaes Corporation

- Carpenter Technology Corporation

- ATI Powder Metals

- GKN Powder Metallurgy

- Evonik Industries AG

- Praxair S.T. Tech, Inc.

- Mitsubishi Corporation RtM Japan Ltd.

- BASF SE

- H.C. Starck GmbH

- Fine Sinter Co., Ltd.

- Advanced Metal Powders Pvt. Ltd.

- Linde Group

- Oerlikon Metco

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383