Market Overview

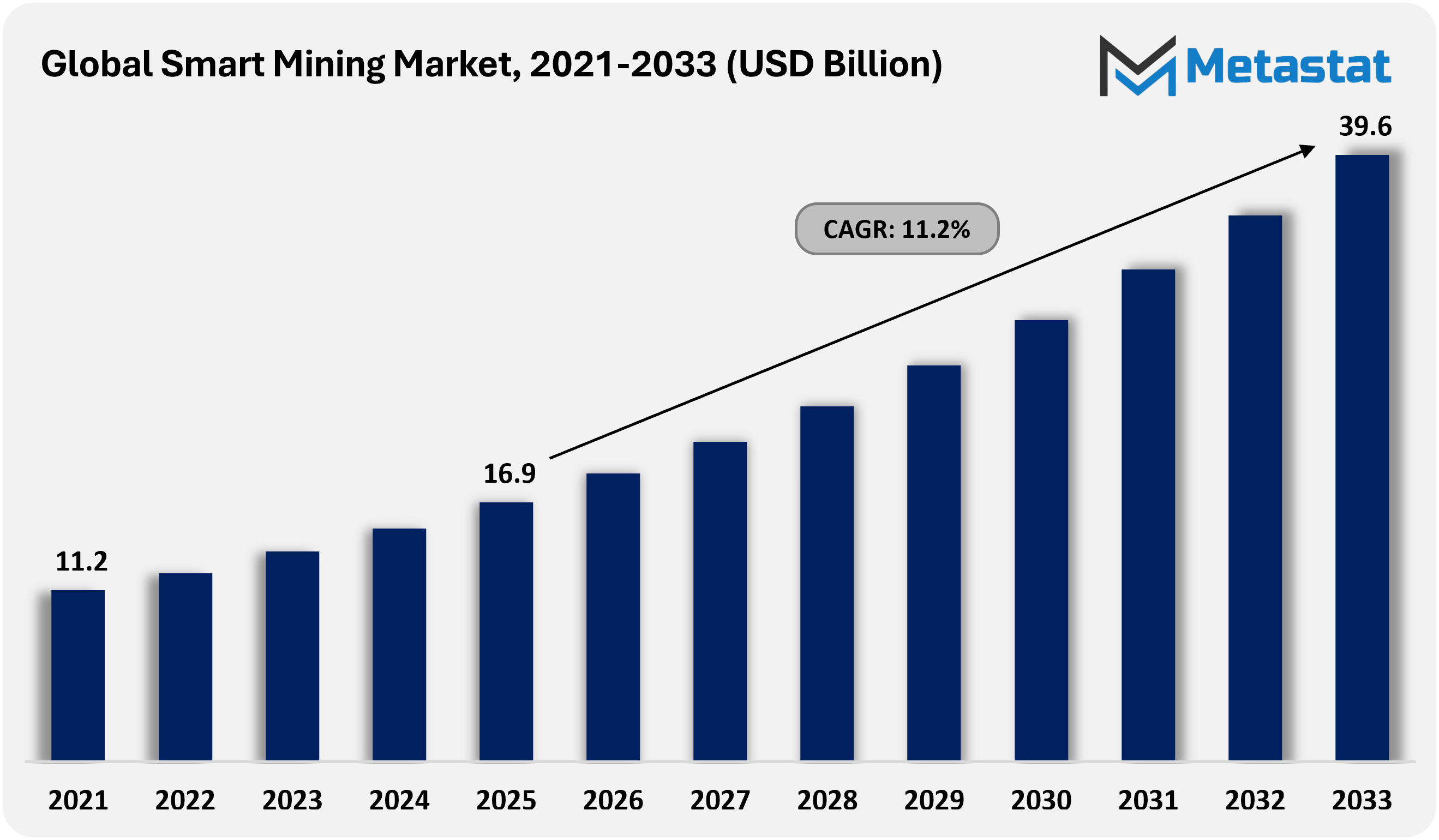

The global Smart Mining market size was valued at USD 16.9 billion in 2025. The market is projected to grow from USD 18.8 billion in 2026 to USD 39.6 billion by 2033, exhibiting a CAGR of 11.2% during the forecast period.

The Smart Mining market is undergoing a fast development phase owing to OEM and government moves from isolated pilots to site-wide digital ecosystems that combine autonomous haulage, remote equipment, IoT sensors, edge analytics and automation. The International Labour Organization states that mining employs less than 1% of the world's workforce while it produces about 8% of all workplace deaths. The alarming statistic forces governments to back up worker safety through automation and remote operations. Digital safety systems are also being implemented. Environmental performance benchmarks are also influencing the mining industry's shift towards sustainable practices. The International Energy Agency reports that the mining and metals value chain consumes up to 7% of worldwide energy usage. The operators now use energy-saving autonomous equipment with real-time monitoring systems, and data-based process optimization to reduce their environmental effects. The data from national geological surveys demonstrates the important patterns in extraction intensity. For instance, the U.S. Geological Survey notes a consistent rise in the demand for critical minerals, prompting the mining operations to incorporate precision drilling, fleet optimization, and sensor-based ore characterization to sustain productivity levels.

As sustainability regulations expand across regions such as Asia-Pacific, Europe, and the Americas, government mandates concerning air quality and tailings safety are driving the increased utilization of IoT sensors, automated monitoring stations, and AI-based risk detection technologies. Furthermore, the push for decarbonization is encouraging large-scale trials of electric and hybrid mining vehicles, supported by public innovation funds.

Collectively, these developments indicate a market trajectory that favours highly automated, data-centric mining operations. By adopting these advancements, mining companies can significantly improve safety, enhance energy efficiency, ensure compliance with environmental regulations, and boost extraction performance. This transition is essential for staying competitive and addressing the growing demands of a rapidly changing industry landscape.

Global Smart Mining Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

- Global Smart Mining market valued at USD 16.9 billion in 2025, growing at a CAGR of around 11.2% through 2033, with potential to exceed USD 39.6 billion.

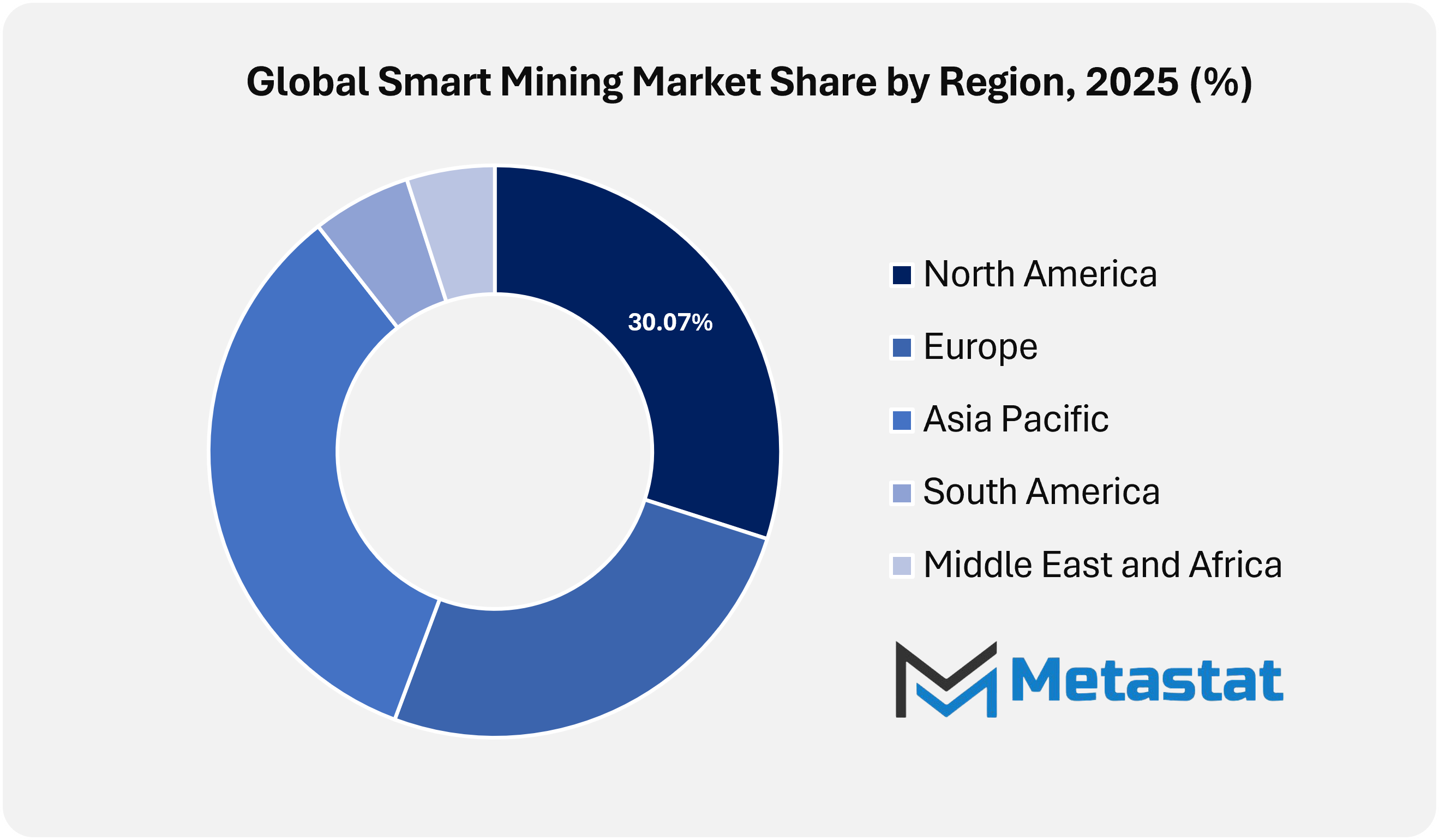

- North America holds 30.07% in 2025 with US leading the market share in 2026.

- Underground Mining segment account for a market share of 58.5% in 2025, driving innovation and expanding applications through intense research.

- Key trends driving growth: Growing adoption of automation and autonomous equipment to improve efficiency and worker safety and Increasing demand for real-time data analytics and IoT connectivity for operational optimization and cost reduction.

- Opportunities include the expansion of AI-driven predictive maintenance and operational intelligence across mineral exploration and production workflows.

Market Dynamics

Growth Drivers:

Growing adoption of automation and autonomous equipment to improve efficiency and worker safety.

Mining companies are increasingly deploying autonomous haul trucks, drills, and loaders, thereby reducing human exposure to hazardous environments and minimizing operational accidents. These systems also enable round-the-clock operations, improving overall productivity and throughput while maintaining consistent safety standards across sites. Automation reduces human error and enhances precision in material handling and extraction processes.

Increasing demand for real-time data analytics and IoT connectivity for operational optimization and cost reduction.

Real-time monitoring of equipment, ore quality, and environmental conditions allows operators to make informed decisions instantly. IoT-enabled sensors and cloud-based analytics platforms help detect inefficiencies, predict failures, and optimize energy usage. This reduces operational downtime, maintenance costs, and waste, while ensuring compliance with safety and environmental regulations.

Restraints & Challenges:

High capital investment required for deploying advanced digital and autonomous technologies:

Implementing smart mining solutions involves substantial upfront costs for autonomous vehicles, sensors, data infrastructure, and software platforms. Smaller mining operators may struggle to finance these systems, delaying adoption. The return on investment is long-term, making it a barrier for companies with limited budgets or short-term operational priorities.

Limited digital skills and slow technology adoption in traditional mining environments:

Mining has historically relied on manual processes, and a lack of trained personnel capable of managing complex digital systems can slow adoption. Resistance to change, workforce skill gaps, and insufficient training programs hinder the integration of new technologies, reducing operational efficiency gains in the short term.

Opportunities:

Expansion of AI-driven predictive maintenance and operational intelligence across mineral exploration and production workflows:

Artificial intelligence can analyze massive volumes of operational data to predict equipment failures before they occur, reducing unplanned downtime. AI also optimizes drilling, hauling, and processing workflows by providing actionable insights. Adoption of these systems allows mines to enhance productivity, reduce maintenance costs, and increase overall operational efficiency while supporting safer and more sustainable mining practices.

Market Segmentation Analysis

The global Smart Mining market is mainly classified based on Mining Type, Solution, Service Type, and Technology.

By Mining Type, the market is further segmented into:

- Underground Mining

Underground mining uses advanced automation such as autonomous loaders, remote-operated drilling, and sensor-based ventilation control. These technologies improve safety in confined environments and enhance ore recovery. The growing push for deeper mineral extraction is driving the expansion of smart underground solutions.

- Surface Mining

Surface mining benefits from large-scale automation, including autonomous haul trucks, fleet management platforms, and drone-based terrain mapping. These systems help increase productivity, reduce fuel use, and optimize blasting operations. The segment grows as mines focus on cost efficiency and operational visibility.

By Solution the market is divided into:

- Smart Control System

Smart control systems integrate real-time equipment coordination, centralized command centers, and automated process regulation. They minimize human error, improve response time, and streamline mine-wide workflows. The need for greater operational precision drives adoption for smart control system within global smart mining market.

- Smart Asset Management

Smart Asset Management includes predictive maintenance, remote diagnostics, and digital twins that track equipment health across the mine lifecycle. It reduces unplanned downtime and improves asset reliability. Mining companies rely on these tools to cut maintenance costs and extend machinery life.

- Safety and Security System

Safety and Security System use worker tracking, hazard alerts, collision avoidance, and automated emergency responses. They significantly reduce accident risks and support regulatory compliance. Rising global focus on miner safety strengthens this segment.

- Data Management and Analytics Software

Analytics platforms process geological, operational, and equipment data to guide mine planning and production decisions. AI-driven tools help optimize resource allocation and cost control. The segment expands rapidly as mines transition to data-centric operations.

- Monitoring System

Monitoring systems include drones, remote sensors, and condition-monitoring devices that track environmental and equipment parameters in real time. They enhance transparency, ensure compliance, and support proactive maintenance. Their adoption grows as environmental standards become stricter.

- Others

The other category includes energy management tools, connectivity solutions, and advanced automation add-ons. These technologies complement core innovative mining systems and support overall digital transformation. Demand grows as mines adopt integrated digital ecosystems.

By Service Type the market is further divided into:

- System Integration

System Integration involves integrating automation hardware, IoT networks, and software platforms into existing mining infrastructure. It ensures seamless interoperability and optimized workflows. Rising digitalisation projects across new and existing mines drive growth.

- Consulting Service

Consulting Service Covers technology assessment, digital roadmap development, workforce training, and sustainability consulting. These services help mining firms navigate complex transformation processes. Demand rises due to the skill gap in mining digitalisation.

- Others

Others include managed digital services, long-term maintenance, and technology upgrade support. These services ensure continuous system performance and reduce operational disruptions. They are increasingly valued as mining companies outsource technical workloads.

By Technology the global Smart Mining market is divided as:

- Internet of Things (IoT)

IoT connects sensors and equipment to gather real-time operational, environmental, and safety data. This improves decision-making and enhances predictive operations. Growing sensor affordability accelerates adoption across mine sites.

- Artificial Intelligence and Analytics

AI enables predictive maintenance, autonomous navigation, ore-grade prediction, and intelligent scheduling. It enhances efficiency and reduces energy waste. The segment grows as mines shift from automation to full intelligent systems.

- Others

The other category includes robotics, 5G, augmented reality, and advanced automation hardware. These technologies support remote operations, high-speed connectivity, and workforce assistance. Their integration strengthens the overall mine automation capability.

By Region:

Based on geography, the global Smart Mining market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

North America Smart Mining Market is set to expand at a CAGR of 11.2% within the forecast period, reaching a market size (TAM) of USD 11.8 billion by the end of 2033.

Strong federal initiatives in North America strengthen the domestic critical-minerals supply chains are driving an acceleration in investments in automation, remote operations, and digital mining technologies to improve productivity and reduce reliance on imports. The growing demand for minerals not only used in batteries but also in grid infrastructure and clean-energy manufacturing is accelerating advanced data analytics, precision extraction, and predictive maintenance to improve throughputs and operational efficiencies, thus driving the growth of Smart Mining Market in North America region.

Large mineral reserves within the Asia Pacific, supplemented by rapid industrial policy support, lays the foundation for tremendous prospects for the expanded deployment of integrated automation, mine electrification, and digital processing systems in Australia and China, and among other emerging Southeast Asian producers. Intense demand in the region for lithium, nickel, and copper, underpinning fast-growing EV, electronics, and renewable-energy sectors, continues to propel the wider adoption of high-precision ore imaging, IoT-based monitoring, and real-time production optimization technologies.

Europe's push for secure and sustainable raw-materials supply is driving modernization of mines with digital monitoring, low-emission equipment, and stricter operational oversight. Interest in Africa's critical minerals, especially cobalt and copper, is growing fast. This factor has led the investments in monitoring systems, traceability tools, and better extraction efficiency. The countries of the Middle East are capitalizing on their diversification strategies to establish themselves as mineral-processing hubs underpinned by advanced automation. South America's major copper and lithium producers are increasingly faced with global demand. This factor has propelled the establishment of digital grid control, water-efficient processing, and predictive maintenance to help achieve them the global demand targets.

Competitive Landscape & Strategic Insights

Competition within the Smart Mining market is increasingly characterized by a convergence of OEMs, technology providers, software firms, and leading mining operators. The key players are driving the shift from isolated automation trials to fully integrated, technology-driven mining ecosystems. Autonomous equipment players like Caterpillar, Komatsu, Epiroc, and Sandvik have firm control over the smart mining industry, currently supplying autonomous haul trucks, high-precision drills, and remotely operated underground loaders. These systems have, to date, together shown the capability to move billions of tons of material globally, driving demonstrable gains across productivity, efficiency of operations, and safety of workers. Key players like ABB, Siemens, and Schneider Electric in electrification and industrial automation provide the power infrastructure, microgrids, and control systems needed for battery-electric fleets and low-emission mining operations.

Software and technology providers such as Hexagon, Microsoft, SAP, AVEVA, and Trimble drives the digital transformation and predictive analytics to enable real-time monitoring, centralized operations centers, data-driven decision-making, and predictive maintenance. Miners benefit from decreased unplanned downtime, optimized fleet performance, and higher mine-wide operational efficiency with these solutions. Connectivity and industrial networking providers include Cisco and Phoenix Contact, whose products ensure reliable and secure communications for autonomous operations and remote-control systems.

Major mining companies such as Rio Tinto, BHP, and Anglo American are acting as innovation leaders, piloting autonomous and battery-electric equipment, AI-driven decision support systems, and connected sensor networks. Strategic partnerships among OEMs, miners, and technology providers expedite the uptake of integrated solutions across surface and underground operations in smart mining industry.

Key developments such as large-scale deployment of autonomous haulage systems, various electrification initiatives, and the establishment of centralized digital command centres, all of which together position the market toward safer, more productive, environmentally sustainable mining operations worldwide.

Forecast & Outlook

Market size is forecast to rise from USD 16.9 billion in 2025 to over USD 39.6 billion by 2033.

The Smart Mining market is poised for sustained growth as global miners increasingly adopt automation, IoT, and AI-driven analytics to enhance productivity, safety, and operational efficiency. Rising demand for low-emission and battery-electric mining equipment, supported by government electrification initiatives, is driving technology adoption. Real-time data integration, predictive maintenance, and centralized operations centers enable optimized fleet management and reduced downtime. Advances in autonomous haulage, high-precision drilling, and remote-operated underground machinery further accelerate digital transformation.

Over the next decade, the market is expected to expand as operators prioritize sustainable, tech-enabled mining ecosystems, creating opportunities for OEMs, software providers, and service integrators worldwide.

Smart Mining Market Key Segments:

By Mining Type:

- Underground Mining

- Surface Mining

By Solution:

- Smart Control System

- Smart Asset Management

- Safety and Security System

- Data Management and Analytics Software

- Monitoring System

- Others (Energy Management Tools, Connectivity Solutions, etc)

By Service Type:

- System Integration

- Consulting Service

- Others (Digital Services, Long-term Maintenance, etc)

By Technology:

- Internet of Things (IoT)

- Artificial Intelligence and Analytics

- Others (Robotics, 5G, Augmented Reality, etc)

Key Global Smart Mining Industry Players

- ABB Ltd.

- Atlas Copco AB

- Robert Bosch GmbH

- Caterpillar Inc.

- Cisco Systems, Inc.

- Hexagon AB

- Hitachi Construction Machinery Co., Ltd.

- Komatsu Ltd.

- Rio Tinto Group

- Rockwell Automation, Inc.

- SAP SE

- Siemens AG

- Epiroc AB

- Sandvik AB

- Schneider Electric SE

- Metso Corporation

- FLSmidth & Co. A/S

- Wenco International Mining Systems Ltd.

- Microsoft Corporation

- Trimble Inc.

- Wipro Limited

- AVEVA Group plc

- Yilmaden

- Anglo American

- Phoenix Contact

- Micromine Pty Ltd.

Report Coverage

This research report categorizes the Smart Mining market based on key segments and regions, forecasts revenue growth, and analyses trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the Smart Mining market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market.

The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the Smart Mining market.

|

Report Attributes |

Details |

|

Study Period |

2021-2033 |

|

Base Year |

2025 |

|

Estimated Year |

2026 |

|

Forecast Period |

2026-2033 |

|

Historical Period |

2021-2025 |

|

Growth Rate |

CAGR 11.2% from 2026 to 2033 |

|

Revenue Unit |

USD billion |

|

Segmentation |

By Mining Type, Solution, Service Type, Technology, and Region |

|

By Mining Type |

Underground Mining |

|

Surface Mining |

|

|

By Solution |

Smart Control System |

|

Smart Asset Management |

|

|

Safety and Security System |

|

|

Data Management and Analytics Software |

|

|

Monitoring System |

|

|

Others |

|

|

By Service Type |

System Integration |

|

Consulting Service |

|

|

Others |

|

|

By Technology |

Internet of Things (IoT) |

|

Artificial Intelligence and Analytics |

|

|

Others |

|

|

By Region |

North America (By Mining Type, Solution, Service Type, Technology, and Country) |

|

|

|

|

|

|

|

Europe (By Mining Type, Solution, Service Type, Technology, and Country) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Asia Pacific (By Mining Type, Solution, Service Type, Technology, and Country) |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

South America (By Mining Type, Solution, Service Type, Technology, and Country) |

|

|

|

|

|

|

|

|

Middle East and Africa (By Mining Type, Solution, Service Type, Technology, and Country) |

|

|

|

|

|

|

|

|

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383