Global Energy Transition Market - Comprehensive Data-Driven Market Analysis & Strategic Outlook

The global energy transition market and its related sectors will undergo major transformations as part of the long-lasting change in the energy systems of countries that differ in the way electricity is produced, transported, and consumed.

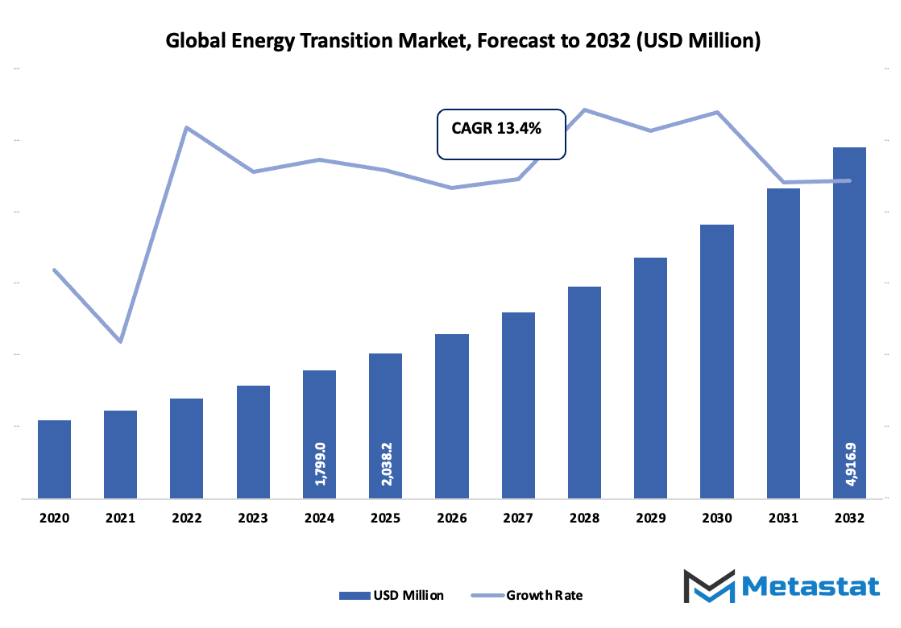

- The global energy transition market is projected to be about USD 2438.7 million by 2025 with a CAGR of nearly 15.3% up to 2032 and the figure of USD 6608.8 million is even in the ballpark.

- The segment of Renewable Energy which account for about 48.2% of the total reverberating market, stands out as the most significant among others since it not only drives the innovation but also expands the use of the energy source through research.

- The overriding trend factors for growth are - the increasing significance of reaching net-zero emissions and the related goals set by the countries; and government backing and funds coming into the renewable sector for infrastructure development.

- The areas of energy storage and green hydrogen technology breakthroughs are some of the ones that will make large-scale renewable energy use possible in the future.

The tale of these changes began in the late 20th century when a combination of the oil crises, the desire for cleaner air, and climate change studies prompted the governments to rethink their dependency on fossil fuels. Initially, there was not much to see, but then the substantial actions like the establishment of the United Nations Framework Convention on Climate Change in 1992 and the Kyoto Protocol in 1997 slowly guided the countries' energy policies toward the use of cleaner sources. In the beginning, there were very few solar and wind technology projects that gradually turned into a huge number due to the falling manufacturing costs, the modernized power grid, and the growing public demand for cleaner air.

The start of the 21st century saw the introduction of more efficient solar cells, gigantic wind turbines, and sophisticated power network control systems, allowing the energy sector to discuss real changes instead of theoretical ones. The consumers not only wanted green power as a novelty but also demanded it as a standard product and thus power companies along with tech suppliers were obliged to provide state-of-the-art infrastructure. The International Energy Agency reports that over the mentioned period, the total global renewable power generation increased from around 3,800 TWh in 2010 to over 8,400 TWh in 2022, with the solar energy market gaining a large share and fast-growing battery storage capacity being the main driving forces. Besides these factors, industry studies noted that solar module prices, on average, dropped more than 80% from 2010 to 2021 which led to both the developing and developed regions widely adopting the cleaner technologies.

The 2020s commenced with governments tightening regulations, as many countries proclaimed legally binding targets for emission reductions. The transition to electric vehicles was hastened, with global EV sales exceeding 10 million units in 2022, as per the International Energy Agency's reports. Alongside this trend, which not only cut gas emissions and transformed the grid's expectations but also opened up new areas such as supply chain transparency and low-carbon manufacturing, hydrogen plants, carbon-capture projects, and long-duration storage tests were the most visible; however, the market was already heading towards the non-renewables phase, identifying and accepting a broad spectrum of interconnected technologies.

Market Segments

The global energy transition market is mainly classified based on Type, Sector, Application.

By Type is further segmented into:

- Renewable Energy:

Growing demand for clean sources encourages stronger use of renewable systems within the global energy transition market. Increased adoption of wind, solar, and biomass projects supports steady integration of advanced steam generation units. Rising environmental targets across many regions strengthens investment flow and drives broader acceptance in new power-focused developments. - Electrification:

Electrification efforts across numerous countries support stronger need for efficient thermal systems linked with the global energy transition market. Expansion of electric networks, charging facilities, and industrial electrified processes encourages steady placement of compact steam units. Broader movement toward reduced fuel dependence creates a consistent push for upgraded operational performance. - Energy Efficiency:

Energy-saving goals encourage wider interest in efficient steam solutions within the global energy transition market. Many facilities focus on lowering energy waste, improving heat transfer, and cutting operating costs through improved generator designs. Strong pressure to meet environmental guidelines increases adoption of systems built for long-term, dependable performance with reduced energy strain. - Others:

Additional categories linked with the global energy transition market include emerging technologies, hybrid setups, and supportive engineering services. Continuous improvements in monitoring tools, material strength, and installation methods provide steady value. Growing interest in flexible power solutions increases attention toward diverse applications outside the main segments listed above.

By Sector the market is divided into:

- Power & Utility:

Power and utility activities create a steady foundation for the global energy transition market, with frequent installation in large plants seeking stable output. Many regions expand grid capacity, encouraging greater demand for reliable steam systems. Strong emphasis on dependable service strengthens long-term investment and operational confidence in major facilities. - Transportation:

Transportation-linked energy systems form another active area for the global energy transition market. Growth in advanced engines, heavy-duty systems, and supporting infrastructure encourages adoption of compact steam units. Cleaner operation, reduced fuel waste, and stronger process control contribute to steady use within technologically driven mobility sectors. - Others:

Additional sectors influencing the global energy transition market include mining operations, construction activities, and specialized engineering projects. Many projects require dependable steam support for controlled heating or scaled-up processes. Broader industrial expansion combined with modernization strategies encourages ongoing interest across varied operational environments.

By Application the market is further divided into:

- Power Generation:

Power generation remains a major driver for the global energy transition market, with growing focus on stable output and flexible thermal handling. Many plants expand capacity using systems designed for quick response and consistent heat exchange. Reliable performance encourages long-term integration across new and upgraded energy facilities. - Transportation:

Transportation applications linked with the global energy transition market benefit from compact design, improved fuel handling, and stable thermal support. Advanced mobility systems require dependable steam functions for controlled operations. Broader modernization of transport networks sustains interest in units suited for efficient, scalable, and responsive energy needs. - Industrial:

Industrial facilities support continued growth of the global energy transition market by using steam for heating, processing, and production tasks. Many factories seek improved efficiency, dependable output, and lower fuel use. Upgraded generator systems offer strong value for expanding industrial bases focused on reliable and predictable performance. - Residential:

Residential participation in the global energy transition market remains limited but gradually expands within specialized heating applications. Increased interest in compact thermal units encourages attention from builders and property developers. Demand for stable heat supply and low-maintenance operation supports small-scale adoption in select housing projects. - Commercial:

Commercial facilities contribute to steady advancement of the global energy transition market by using efficient steam support for climate control, cleaning, and operational tasks. Hotels, offices, and service centers require reliable heating functions with reduced energy cost. Improved system designs encourage greater acceptance across modern commercial developments.

|

Forecast Period |

2025-2032 |

|

Market Size in 2025 |

$2438.7 Million |

|

Market Size by 2032 |

$6608.8 Million |

|

Growth Rate from 2025 to 2032 |

15.3% |

|

Base Year |

2024 |

|

Regions Covered |

North America, Europe, Asia-Pacific, South America, Middle East & Africa |

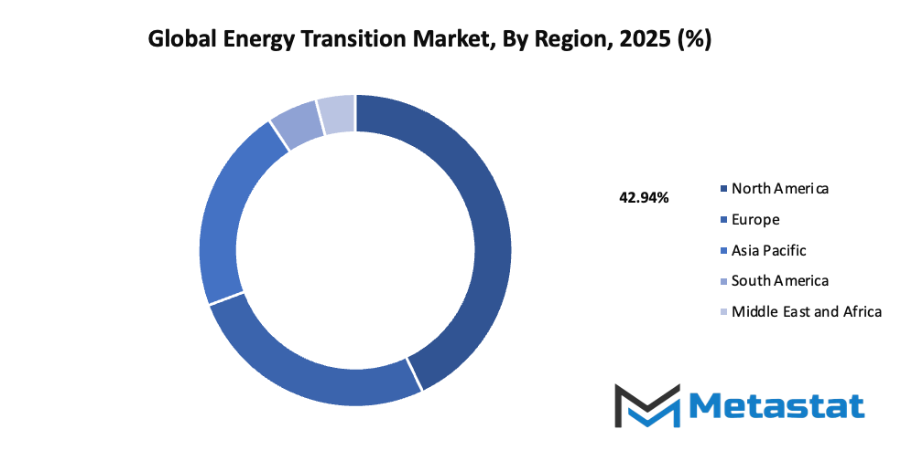

By Region:

- Based on geography, the global energy transition market is divided into North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

- North America is further divided into the U.S., Canada, and Mexico, whereas Europe consists of the UK, Germany, France, Italy, and the Rest of Europe.

- Asia-Pacific is segmented into India, China, Japan, South Korea, and the Rest of Asia-Pacific.

- The South America region includes Brazil, Argentina, and the Rest of South America, while the Middle East & Africa is categorized into GCC Countries, Egypt, South Africa, and the Rest of the Middle East & Africa.

Growth Drivers

Rising global focus on decarbonization and net-zero emission targets continues to guide long-term planning within the global energy transition market. Strong climate commitments encourage cleaner production methods, lower-carbon systems, and sustainable development pathways. Clear goals from public and private sectors create steady momentum, supporting wider acceptance of alternative energy sources and improved environmental practices.

Increasing investments and government incentives for renewable energy infrastructure:

Growing financial support from public programs and private funds strengthens renewable deployment across multiple regions. Subsidies, tax benefits, and low-interest financing encourage broader construction of solar, wind, and related facilities. Supportive frameworks reduce financial risks, attract new participants, and promote steady expansion of modern energy networks focused on cleaner and more reliable power generation.

Challenges and Opportunities

High initial capital costs for renewable energy technologies:

Large upfront spending for equipment, installation, and supporting systems often slows project planning. Long payback periods create hesitation among investors, especially in regions with limited funding options. Cost reductions continue gradually, but many developers still require stable policies, predictable revenue streams, and accessible financing tools to maintain confidence during early development stages.

Intermittency issues and lack of efficient energy storage solutions:

Variable energy output from wind and solar sources places pressure on grid stability. Limited storage capacity restricts smooth power delivery during peak demand or low-generation periods. Stronger grids, better forecasting, and expanded buffering systems are essential for reliable performance and for encouraging broader participation in renewable-based power structures.

Opportunities

Advancements in energy storage and green hydrogen technologies enabling large-scale renewable adoption: Rapid progress in batteries, long-duration storage, and hydrogen production supports flexible and dependable clean-energy systems. Improved efficiency and falling costs open pathways for broader industrial use, heavy transport support, and large-scale integration of variable sources. Strong technological growth encourages wider confidence in sustainable energy expansion across global markets.

Competitive Landscape & Strategic Insights

The global energy transition market shows strong momentum as demand grows for cleaner power and efficient technology. The industry brings together long-established international corporations and fast-growing regional firms, creating steady competition and constant improvement. Major companies shape overall progress through new technology, expanded manufacturing capacity, and large-scale project investment. ABB Ltd., Ameresco Inc., BP plc, Brookfield Renewable Partners L.P., Canadian Solar Inc., Constellation, Daikin Industries Ltd., Danfoss, Dongfang Electric Corporation, Duke Energy Corporation, EDF Group, Enel S.p.A., Enel X S.r.l., Enphase Energy, Inc., First Solar, Inc., GE Vernova, General Electric Company, Iberdrola, S.A., NextEra Energy, Inc., Orion Energy Systems, Inc., Schneider Electric SE, Siemens AG, SunPower Corporation, Tesla, Inc., and Vestas Wind Systems A/S stand out as influential competitors in this expanding market.

Strong pressure for reduced emissions encourages steady innovation in renewable power, storage solutions, and energy-efficient equipment. Each organization listed above adds a different strength, whether through advanced solar modules, large wind installations, modern grid systems, or improved energy-saving technology for commercial and industrial use. Growing investment from both public and private sources supports new projects that bring clean power to more communities, while updated policies in many countries help companies introduce new systems at a faster pace.

Market size is forecast to rise from USD 2438.7 million in 2025 to over USD 6608.8 million by 2032. Energy Transition will maintain dominance but face growing competition from emerging formats.

Rising demand for solar power encourages Canadian Solar Inc., First Solar, Inc., and SunPower Corporation to increase production and improve product performance. Expanding wind projects keep Vestas Wind Systems A/S and GE Vernova active in many regions as governments seek large renewable capacity. Broader energy management needs also guide companies such as Schneider Electric SE, Danfoss, and Orion Energy Systems, Inc., which focus on efficient distribution and reduced waste. Large utilities including Enel S.p.A., Iberdrola, S.A., Duke Energy Corporation, and EDF Group continue to build renewable portfolios that support long-term market growth. The combined activity of these organizations sets a steady path toward cleaner power generation and more resilient global infrastructure.

Report Coverage

This research report categorizes the global energy transition market based on various segments and regions, forecasts revenue growth, and analyzes trends in each submarket. The report analyses the key growth drivers, opportunities, and challenges influencing the global energy transition market. Recent market developments and competitive strategies such as expansion, type launch, development, partnership, merger, and acquisition have been included to draw the competitive landscape in the market. The report strategically identifies and profiles the key market players and analyses their core competencies in each sub-segment of the global energy transition market.

Energy Transition Market Key Segments:

By Type

- Renewable Energy

- Electrification

- Energy Efficiency

- Others

By Sector

- Power & Utility

- Transportation

- Others

By Application

- Power Generation

- Transportation

- Industrial

- Residential

- Commercial

Key Global Energy Transition Industry Players

- ABB Ltd.

- Ameresco Inc.

- BP plc

- Brookfield Renewable Partners L.P.

- Canadian Solar Inc.

- Constellation

- Daikin Industries Ltd.

- Danfoss

- Dongfang Electric Corporation

- Duke Energy Corporation

- EDF Group

- Enel S.p.A.

- Enel X S.r.l.

- Enphase Energy, Inc.

- First Solar, Inc.

- GE Vernova

- General Electric Company

- Iberdrola, S.A.

- NextEra Energy, Inc.

- Orion Energy Systems, Inc.

- Schneider Electric SE

- Siemens AG

- SunPower Corporation

- Tesla, Inc.

- Vestas Wind Systems A/S

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1-(714)-364-8383

US: +1-(714)-364-8383