MARKET OVERVIEW

The global smart labels market is a fastgrowing and dynamic section within the labeling industry, in that it is a market characterized by incorporating highly advanced technologies into more classic labeling systems. Defined generally by the increasing application of labels embedded with digital content, such as RFID tags, QR codes, NFC chips, and sensors, for better communication, tracking, and data retrieval abilities. Smart labels have gone beyond mere identification purposes to become an important instrument for supply chain efficiency improvement, authenticity of products, and a more enriched customer experience.

Smart labels are very versatile and have applications in retail, healthcare, logistics, food and beverages, and electronics. Such industries use smart labels for various applications, from inventory management and anti-counterfeiting measures to temperature monitoring and interactive consumer engagement. The technological backbone of the global smart labels market is in its capability to bridge physical products with digital ecosystems. This ensures that there is transparency, accuracy, and real-time data sharing, all of which are increasingly important in today's data-driven world.

The market is on the way to growth due to businesses around the globe investing in smart labeling solutions aimed at streamlining their operations. The greater tracking and monitoring capabilities promised by smart labels are forecasted to redefine supply chain practices as businesses can make quick responses to disruptions or changes in demand. The store and transfer of data about a product's location, condition, and history on smart labels will continue attracting industries looking for greater efficiency in operations.

In addition, the shift in the expectations of consumers is bound to impact the global smart labels market. Today, people want to know more about what they are buying-from its origin to how it has been treated. Smart labels offer that information in an accessible and engaging way, which fosters trust and loyalty. A simple scan of a QR code can deliver extensive insights into a product's sustainability practices, safety certifications, and usage instructions.

The global smart labels market's competitive landscape is likely to grow with advancements in new technology solutions through collaborative efforts among technology providers and manufacturers. Innovation in labelling materials, sensor incorporation, and data management system development will remain key sources of investment into research and development. Moreover, this would propel the power of IoT frameworks that make the use of smart labels interconnective for all products and users as well as other information networks without interruption.

As regulatory frameworks on traceability and consumer safety continue to become more stringent, industries will increasingly rely on smart labeling technologies to remain compliant. The healthcare sector will benefit greatly because smart labels allow for precise tracking of medical devices and pharmaceuticals, ensuring authenticity and proper handling.

Coming years would, therefore, observe technological improvements but also access because of a reduction in production costs and ease of application. The feasibility for small and medium enterprises will also open up in smart labeling, further expanding the landscape of the market. In the long run, the global smart labels market is going to play a transformational role in the way products are identified, tracked, and experienced in the industries of today and discerning consumers.

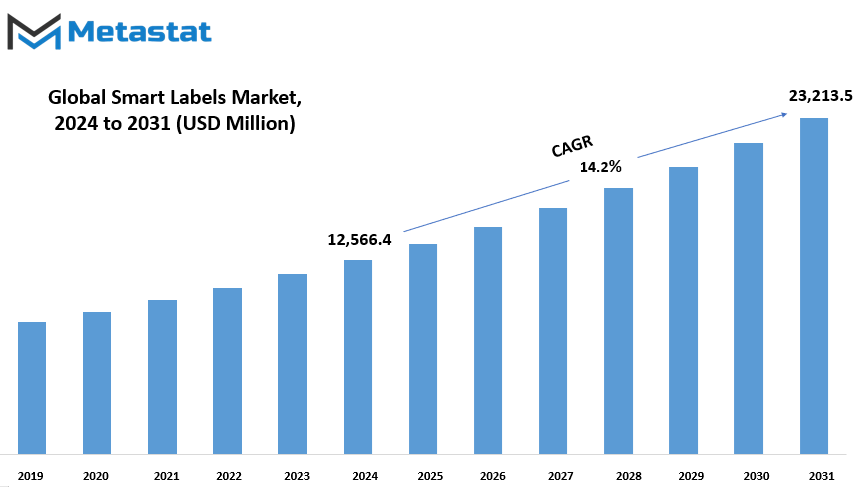

Global smart labels market is estimated to reach $23,213.5 Million by 2031; growing at a CAGR of 14.2% from 2024 to 2031.

MARKET DETERMINANTS

Several key factors are driving the rapidly growing global smart labels market for supply chain transparency and inventory management solutions. One of the major driving forces is the increasing demand for more transparent and efficient tracking of goods throughout the supply chain. The solutions provide the necessary tools for better oversight and control as businesses strive to improve their operations and meet consumer expectations. Companies are recognizing the value of clear, real-time data on their products, helping them minimize losses, enhance efficiency, and improve customer satisfaction.

In addition, smart packaging and Internet of Things (IoT) are increasingly being adopted in consumer goods and logistics industries. The integration of these advanced technologies allows companies to monitor products more closely from the manufacturing process until delivery. Smart packaging, integrated with sensors, can deliver critical information such as temperature, humidity, or location, which enhances product quality and provides a higher level of assurance to customers.

Despite these benefits, there are challenges that may limit market growth. One major concern is the increased production costs of smart labels compared with traditional methods of labeling. These are high costs for some and may be impossible to accommodate for smaller businesses or industries where margins are slim. Technologies behind smart labels, like embedded sensors and connectivity, require more investments, making some companies hesitant in adopting these fully.

Another challenge is that of increasing concern about data privacy and security. The collection and sharing of sensitive information by smart labels and IoT devices risk unauthorized access or cyberattacks that compromise business operations and consumer trust. Such issues have caused alarms, especially in industries such as healthcare and food safety, where the protection of data is very important.

Yet, it has a prospective prospect to grow in future: that of smart labels merging with blockchain. In areas of food safety and pharmaceutical use, Blockchain's ability may strengthen the system to be trustworthy for product traceability and product authenticity due to its assured security-tamper system. Consumer concerns over origination and quality of consumed goods ensure transparency and an increment of trust across those chains. It is highly likely that those businesses embracing this combination will then be well-positioned to capture the growing demand for secure and transparent product tracking through the coming years.

REPORT SCOPE

By Technology

EAS Labels held a sizeable share of 13.97% in the global smart labels market in 2018. The product segment is expected to experience huge growth, reaching 1,931.1 million US dollars by 2025, from 802.9 million US dollars in 2018. The global smart labels market is increasing at a rapid rate because of rapid technological advancements and more demands for efficient and interactive solutions.

The global smart labels market is further segmented into categories with their respective growth potentials. One of the important segments is RFID labels, widely used due to their capabilities in storing and transmitting data wirelessly. RFID labels are highly adopted in inventory management, logistics, and retailing, which offers benefits like real-time tracking and automation. They are a key element of the smart label industry.

Another significant category is sensing labels, which are intended to monitor environmental conditions, such as temperature, humidity, or pressure. These labels provide valuable information for industries like food, pharmaceuticals, and logistics, where the quality and safety of products are critical. Sensing labels can track the condition of products throughout the supply chain, helping ensure they reach consumers in optimal condition.

Electronic shelf or dynamic display labels are also gaining popularity. Retailers use these labels as a means of displaying product details, prices, and campaigns. They can be conveniently updated remotely, giving retailers the right to change pricing and product-related information in real-time, thus improving business operational efficiency and customer service.

Another popular factor in the smart label market is that of Near Field Communication (NFC) tags. NFC tags allow consumers to interact with products using any smartphone or other NFC-enabled equipment. This technology allows for seamless entry into product information, enhancing customer engagement and providing brands with new ways in which they can connect with their audience.

The global smart labels market is poised to grow further as the requirement for new innovative solutions that provide improvements in operational efficiency, product traceability, and customer interaction continues to increase. In turn, these technologies will open new avenues, and with these developments, the smart label market is sure to continue its expansion over the coming years.

By Component

The global smart labels market is categorized into a number of key components, which make up the overall industry. These key components include transceivers, memories, batteries, microprocessors, and others, with each being used for a different function that supports the growth and development of the market.

Transceivers are vital components within communication systems. They assist in the transmission and reception of signals, therefore allowing devices to connect and communicate. These components apply in a wide range of applications that include telecommunications and networking with the aim of ensuring smooth data interchange between different systems. The progress of technology increases the need for efficient and high-performing transceivers, hence increasing the market's growth.

Memories are also fundamental components that are used in storing data. They are in the form of RAM, flash memory, and hard drives, among others, which serve different purposes based on the speed and volume of data they process. With the increase in the production of data worldwide, demand for faster and more reliable memory solutions is growing. This trend makes it imperative to develop new memory technologies that will be applicable in businesses and to consumers.

Batteries, in fact, the power driver of these electronic devices are another major category in the market. Increasingly dependent upon mobile phones, electric vehicles, and other portable technologies mean that batteries have become vital than ever. Therefore, the attention has been there to create more enduring, faster-charging, and environmental-friendly ones, resulting in new battery technologies such as lithium-ion or solid-state batteries.

Microprocessors are the most important element of any computing tool, determining the system's operations and tasks. They are crucial in everything from phones to computers to embedded systems. As technology advances, these microprocessors are becoming more energy-efficient while being more potent, thereby allowing devices to perform more with less power. Because of artificial intelligence and the increasing trends of machine learning, these high-performance microprocessors become more and more in demand.

Other components have specific, niche roles within certain industries. Examples include sensors and specialized chips tailored for certain applications. Various markets with their differing needs have given rise to many custom components designed to meet the specific needs of a particular application.

Each of these components is vital for the functioning of the more extended market and the innovation that would be realized from such continuities in each of the components. Therefore, this market continues to expand due to increasing consumer demand as well as the rapid advancement in technology, providing an opportunity for expansion and development.

By Application

The global smart labels market has been segmented into different categories on the basis of its applications. These categories include Retail Inventory, Perishable Goods, Electronic & IT Assets, Equipment, Pallets Tracking, and others. Each of these categories serves a different purpose, addressing different needs and providing solutions in unique ways. For example, Retail Inventory is very important for businesses that need to have an effective stock level. Tracking these items ensures that products are available when needed, reducing the risk of shortages or overstocking. This helps retailers maintain smooth operations and meet customer demand.

Another similar aspect of such items is that perishable goods demand special care due to their short shelf life. Businesses monitor these products, thus ensuring that they consume such goods before they get spoilt and reduce waste while making maximum efficiency. Handling and monitoring such perishable goods is essential in the industries dealing with food and medicines.

Electronic & IT Assets is the other significant segment. With such fast technological developments, companies should track their electronic devices, computers, and IT infrastructure for proper usage and maintenance. By tracking these assets, businesses avoid losses resulting from theft, damage, or loss and ensure that upgrades or replacements are timely.

Equipment tracking is equally essential, particularly in industries where machinery is the primary equipment used daily. With this, a business will know the usage and maintenance of the equipment so that everything is running smoothly, and there will be proper planning for repair or replacement when necessary. This avoids unexpected downtime and increases productivity.

Pallets Tracking is also one of the key applications in industries such as logistics and warehousing. Pallets are used in transporting goods, and their tracking helps streamline the supply chain, ensuring that goods are moved efficiently and securely without delays and to a minimum risk of loss during transport.

Finally, the "Others" category covers any other applications that do not fit into the predefined categories but are still important for tracking and managing goods, assets, or equipment. Such a broad classification is useful to handle specific business needs that are not covered under the common applications.

In conclusion, there is a significant role in each segment of the market that helps in maximizing efficiency, minimizing waste, and ensuring proper resource management. By addressing the specific requirements of each category, companies can optimize their operations and manage to stay competitive in their field.

By End-user

The global smart labels market is growing and is fragmented into several key sectors like automotive, fast-moving consumer goods (FMCG), healthcare and pharmaceuticals, logistics, retail, manufacturing, and others. Each one of these sectors has distinctive needs and applications for smart labels, driving demand and innovation in this space.

Smart labels can be used in the automobile industry to track parts for better inventory management. In this case, real-time data is offered, ensuring that manufacturers and suppliers track each component from production to delivery. This increases efficiency with reduced errors, thereby lowering the cost and managing resources.

Smart labels benefit the FMCG sector in several ways. Most FMCG products have a short shelf life, and smart labels monitor the expiration date, temperature, and storage conditions. This ensures that the products are in the best possible condition at all stages of the supply chain, hence ensuring customer satisfaction and minimizing waste. Smart labels can also give consumers more information about the product, thus increasing transparency and trust.

The use of smart labels in healthcare and pharmaceuticals is rapidly expanding. It is used in the medicine and medical appliances industry, where the most important task is to ensure that the medicine and medical devices are safe and authentic. It may store critical information regarding batch number and date of expiration. It can be scanned for real-time updates. It helps in lowering the risks of counterfeit drugs and maintains compliance with severe regulations.

Logistics companies rely on smart labels for better tracking and delivery services. The labels enable a business to track products throughout the stages of transportation. Real-time data helps to optimize routes, reduce delays, and improve customer service.

Retailers also adopt smart labels to improve inventory management and customer experience. With the increase in online shopping and a need for faster delivery times, retailers are using smart labels to streamline their supply chains and keep customers informed of product availability and delivery times.

The other sector that has been highly influenced by smart labels is manufacturing. Here, they have been assisting with asset tracking, quality control, and supply chain management. Easy monitoring of equipment, parts, and materials enables smooth production processes.

Finally, the "Others" category comprises such a broad array of businesses, from food and beverages to electronics, that all are looking to embrace smart labels benefits in improving efficiency and management of products.

In conclusion, the global smart labels market is soon going to be a crucial tool within most industries. It serves as a means of providing more reliable tracking, increasing efficiency, and opening up more transparent levels of productivity.

|

Report Coverage |

Details |

|

Forecast Period |

2024-2031 |

|

Market Size in 2024 |

$12,566.4 million |

|

Market Size by 2031 |

$23,213.5 Million |

|

Growth Rate from 2024 to 2031 |

14.2% |

|

Base Year |

2022 |

|

Regions Covered |

North America, Europe, Asia-Pacific Green, South America, Middle East & Africa |

REGIONAL ANALYSIS

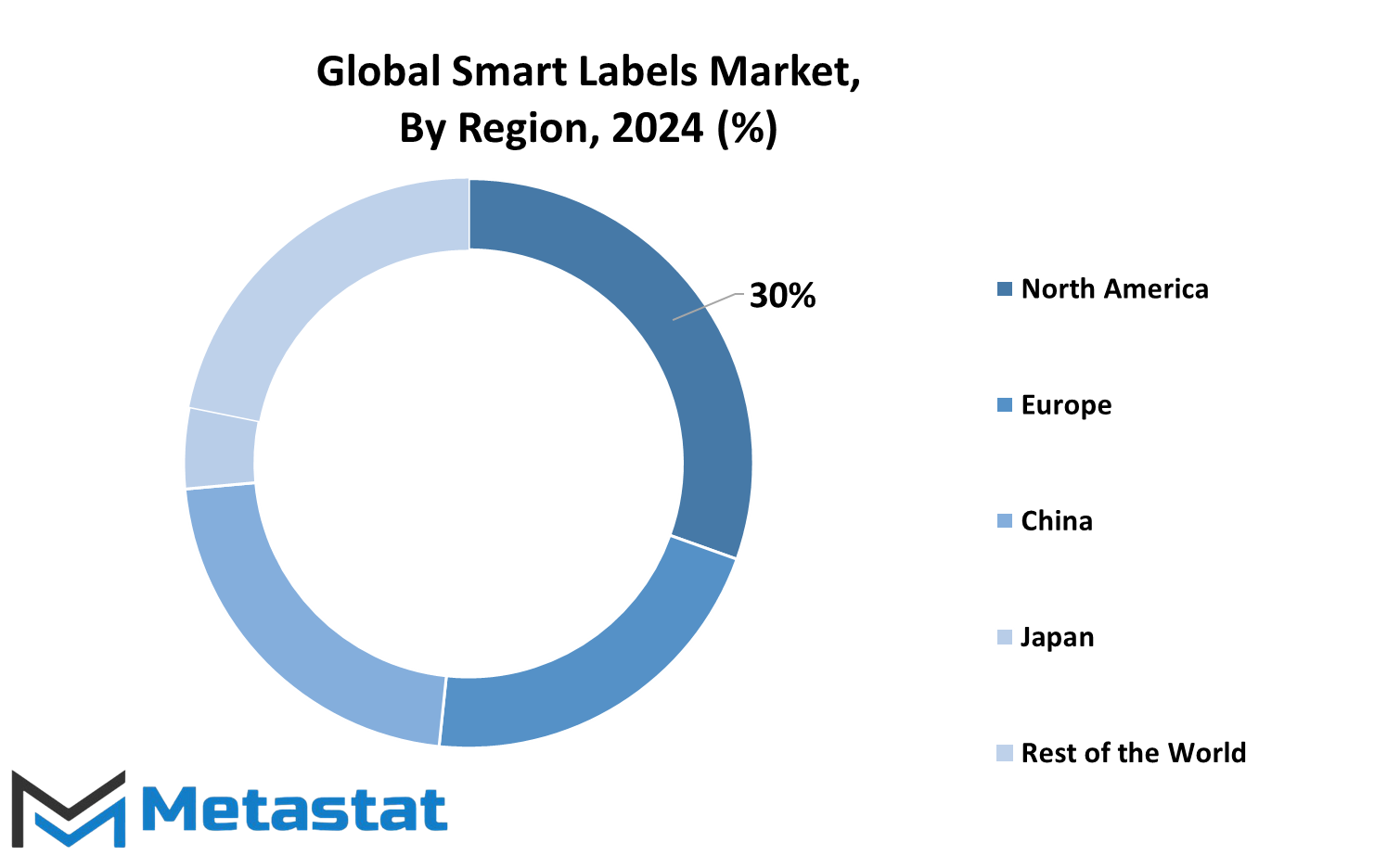

The global smart labels market is segmented based on geography, which includes regions such as North America, Europe, Asia-Pacific, South America, and the Middle East & Africa. North America comprises the U.S., Canada, and Mexico, which reflects the diversity of the market dynamics in the region. Europe consists of major countries like the UK, Germany, France, Italy, and other countries in the Rest of Europe. Asia-Pacific is known for a rapid adoption of technology; the region is divided into major markets such as India, China, Japan, and South Korea, while other countries are categorized under Rest of Asia-Pacific. In South America, the market is divided between Brazil, Argentina, and the Rest of South America, showcasing the region's growing interest in smart labeling technologies. The Middle East & Africa market is further segmented as GCC Countries, Egypt, South Africa, and the Rest of Middle East & Africa, showing different levels of demand across this diverse geography.

Each of these markets is significant for the global smart labels market, driven by advancements in technology, economic conditions, and the local industry's requirement. The strongest contender in terms of demand, however, is North America, established with infrastructural and consumer bases; there is increasing demand from almost all segments, starting with retail, logistics, etc. Europe takes the next place with growing needs for smart labels from sustainability-oriented and legally demanding environments.

Asia-Pacific represents a developing market mainly through a large base of manufacturers adopting the latest technology. This growth is highly contributed by countries like China, India, and Japan, where these countries continue to grow their smart label adoption in areas such as e-commerce, pharmaceuticals, and food & beverage. South America and the Middle East & Africa also are gradually moving into using these technologies due to an increase in industries in the area of retail, logistics, and healthcare. These regions will thus continue to experience steady growth as demand for smarter and more efficient labeling solutions rises; however, growth rates in these markets will be much slower compared to North America and Europe. The global smart labels market will, therefore, be driven by regional factors and, more specifically, by the particular needs and challenges in each region.

COMPETITIVE PLAYERS

The global smart labels market has been gaining traction at a rapid pace. Increasing demand for more efficient tracking, inventory management, and enhanced customer experiences has added fuel to the growth story of the industry. Smart labels are a powerful tool to streamline processes across a gamut of industries, which includes retail, logistics, and healthcare. They provide benefits such as improved product tracking, reduced errors, and better data management. Consequently, the industry attracted several key players who were actively driving innovation and growth.

Alien Technology, LLC., the leader in the global smart labels market is known for expertise in the radio frequency identification (RFID) technology. This company specializes in developing real-time data-based solutions for businesses to enable them to optimize their operations. One of the prominent names here is Avery Denison Corporation, which is an established brand offering a whole range of smart labeling solutions for the retail, logistics, and healthcare sectors. These products reduce operational costs while improving efficiency by automating data collection and tracking.

CCL Industries Inc. specializes in smart labeling with solid market presence and RFID-innovative solutions. In terms of the company products, they have enhanced their visibility and supply chain management. Checkpoint Systems Inc. offers the latest advanced RFID-based solutions for effective tracking of business products.

Honeywell International Inc., known for its technological developments, has made considerable advancements in the global smart labels market. Its solutions concentrate on enhancing security and traceability. These solutions find their application in healthcare and retail. Another important company that is engaged in smart label solutions integrating RFID technology is Invengo Technology Pte. Ltd.

Others in the industry include MPI Label Systems, Muehlbauer Holding AG, and OPRFID Technologies, with their advanced solutions targeting data accuracy enhancement and cost reduction. SATO Holdings Corporation helps distribute range versions of smart labeling products throughout various sectors, designed for efficiency and tracking improvement.

Zebra Technologies Corporation is another major company that concentrates on offering real-time tracking and monitoring by RFID solutions. Its products are commonly used in retail, manufacturing, and logistics. Among the many firms that have emerged to support businesses to better their operations through smart labeling solutions, William Frick & Company, Scanbuy Inc., and Schreiner Group stand out.

R.R. Donnelley & Sons Company and smart-TEC GmbH & Co. have also strengthened their product portfolios to provide businesses with more advanced solutions for labeling and tracking applications. These companies are making the future of the global smart labels market while contributing toward its fast growth by giving cutting-edge products and services around the world.

Smart Labels Market Key Segments:

By Technology

- EAS Labels

- RFID Labels

- Sensing Labels

- Electronic Shelf/Dynamic Display Labels

- Near Field Communication (NFC) Tags

By Component

- Transceivers

- Memories

- Batteries

- Microprocessors

- Others

By Application

- Retail Inventory

- Perishable Goods

- Electronic & IT Assets

- Equipment

- Pallets Tracking

- Others

By End-user

- Automotive

- Fast Moving Consumer Goods (FMCG)

- Healthcare & Pharmaceutical

- Logistic

- Retail

- Manufacturing

- Others

Key Global Smart Labels Industry Players

- Alien Technology, LLC.

- Avery Denison Corporation

- CCL Industries Inc.

- Checkpoint Systems Inc.

- Honeywell International Inc.

- Invengo Technology Pte. Ltd.

- MPI Label Systems

- Muehlbauer Holding AG

- OPRFID Technologies

- SATO Holdings Corporation

- Zebra Technologies Corporation

- William Frick & Company

- Scanbuy Inc.

- Schreiner Group

- R.R. Donnelley & Sons Company

- smart-TEC GmbH & Co.

WHAT REPORT PROVIDES

- Full in-depth analysis of the parent Industry

- Important changes in market and its dynamics

- Segmentation details of the market

- Former, on-going, and projected market analysis in terms of volume and value

- Assessment of niche industry developments

- Market share analysis

- Key strategies of major players

- Emerging segments and regional growth potential

US: +1 3023308252

US: +1 3023308252